Europe Safety Systems Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.38 Billion

USD

2.25 Billion

2024

2032

USD

1.38 Billion

USD

2.25 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 2.25 Billion | |

|

|

|

|

Segmentação do mercado de sistemas de segurança na Europa, por tipo (controladores e relés de segurança, visão de máquina de segurança, sensores de segurança e interruptores de segurança), tecnologia (sensor digital, sensor inteligente e sensor analógico), função (proteção de máquinas, monitoramento de processos, gerenciamento de energia, assistência de estacionamento, prevenção de colisões, sistemas de monitoramento de vibração, sistemas de parada de emergência e outros), tamanho da organização (organização de grande porte e organização de pequeno e médio porte), usuário final (automotivo, aeroespacial e defesa, saúde, petróleo e gás, transporte e logística, eletrônicos de consumo, alimentos e bebidas, indústria da construção e outros), canal de distribuição (vendas diretas e vendas indiretas) - tendências e previsões do setor até 2032

Tamanho do mercado de sistemas de segurança na Europa

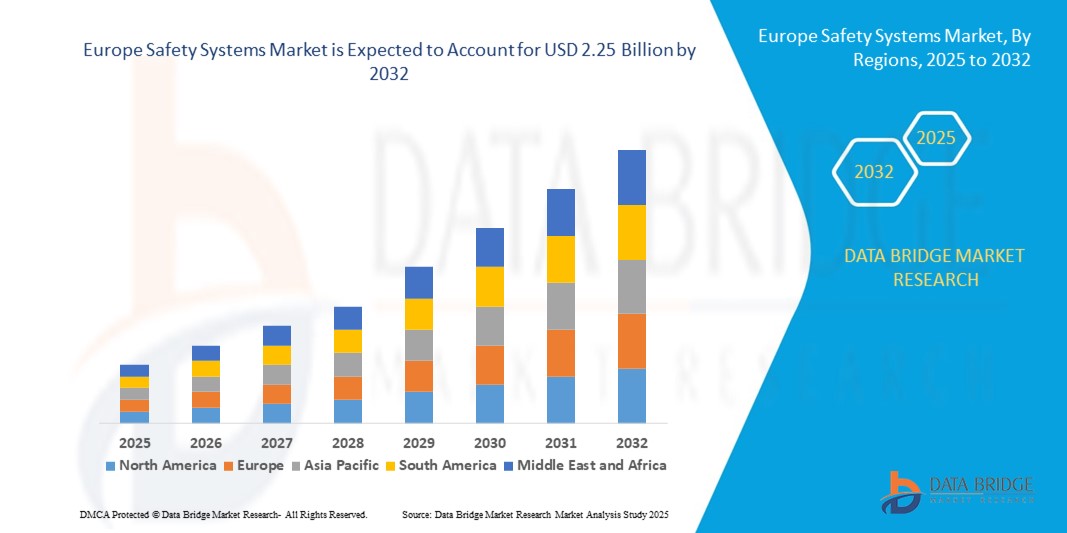

- O tamanho do mercado de sistemas de segurança da Europa foi avaliado em US$ 1,38 bilhão em 2024 e deve atingir US$ 2,25 bilhões até 2032 , com um CAGR de 6,3% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente implementação de automação e regulamentações rigorosas de segurança no local de trabalho em todos os setores, aumentando a demanda por sistemas de segurança avançados para proteger máquinas, trabalhadores e operações.

- Além disso, a crescente adoção de sensores inteligentes, visão de máquina e soluções de monitoramento habilitadas para IoT está permitindo o gerenciamento de segurança em tempo real, manutenção preditiva e conformidade, acelerando assim a adoção de sistemas de segurança e impulsionando significativamente a expansão do mercado.

Análise de Mercado de Sistemas de Segurança na Europa

- Os sistemas de segurança são soluções integradas que incluem sensores, controladores, relés e dispositivos de monitoramento projetados para proteger equipamentos, processos e operadores humanos de condições perigosas em setores como automotivo, petróleo e gás, manufatura e saúde.

- A crescente demanda por sistemas de segurança é impulsionada principalmente por estruturas regulatórias mais rígidas, foco crescente na eficiência operacional e a crescente necessidade de minimizar o tempo de inatividade e os acidentes de trabalho por meio de tecnologias de segurança automatizadas e inteligentes.

- O Reino Unido dominou o mercado de sistemas de segurança em 2024, devido à sua forte base industrial, setor de manufatura avançado e regulamentações rigorosas de segurança no local de trabalho em setores como automotivo, aeroespacial e petróleo e gás.

- Espera-se que a Alemanha seja o país com crescimento mais rápido no mercado de sistemas de segurança durante o período previsto devido à rápida expansão das práticas da Indústria 4.0, à adoção de robótica avançada e à crescente dependência de máquinas automatizadas em seus centros de fabricação.

- O segmento de sensores inteligentes dominou o mercado, com uma participação de mercado de 42% em 2024, devido à sua capacidade de fornecer dados precisos, conectividade com plataformas de IoT e recursos de monitoramento em tempo real. Esses sensores são amplamente preferidos para manutenção preditiva e aprimoramento da eficiência operacional em setores como aeroespacial, saúde e automotivo. Sua adaptabilidade a sistemas de automação avançados e integração com análises baseadas em nuvem garantem proteção confiável e processos otimizados. A crescente demanda por interpretação inteligente de dados e autodiagnóstico em sistemas de segurança reforça ainda mais sua liderança.

Escopo do Relatório e Segmentação do Mercado de Sistemas de Segurança

|

Atributos |

Principais insights do mercado de sistemas de segurança |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, produção e capacidade de empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas de tendências de preços e análises de déficit da cadeia de suprimentos e demanda. |

Tendências do mercado de sistemas de segurança na Europa

Adoção crescente de máquinas inteligentes e indústria 4.0

- O mercado de sistemas de segurança está testemunhando um crescimento significativo com a crescente adoção da Indústria 4.0 e das tecnologias de máquinas inteligentes. A automação e a digitalização avançadas exigem mecanismos de segurança integrados para garantir uma operação perfeita em ambientes industriais cada vez mais complexos.

- Por exemplo, a Rockwell Automation vem incorporando tecnologias de segurança inteligentes em suas soluções de automação industrial. Seus sistemas são projetados para integrar a segurança às operações digitais, fornecendo análises preditivas que melhoram a proteção dos trabalhadores e reduzem o tempo de inatividade nas fábricas.

- A combinação de sensores inteligentes, conectividade IoT e aprendizado de máquina está aprimorando os sistemas de segurança, tornando-os mais proativos. Esses avanços permitem monitoramento em tempo real, manutenção preditiva e desligamentos automatizados em ambientes perigosos, o que melhora significativamente a segurança no local de trabalho.

- Além disso, a demanda por robótica colaborativa e equipamentos industriais autônomos pressiona por uma integração avançada de segurança. Os sistemas de segurança são essenciais para permitir que máquinas e humanos trabalhem lado a lado sem acidentes, promovendo a produtividade e a resiliência operacional.

- A crescente importância da tomada de decisões baseada em dados nas fábricas destaca a necessidade de sistemas de segurança que se conectem a plataformas centralizadas. Esses sistemas fornecem relatórios de incidentes e dados de conformidade em tempo real, alinhando a segurança industrial com as estratégias de transformação digital.

- Em suma, a adoção da Indústria 4.0 está colocando os sistemas de segurança na vanguarda da produção e das operações modernas. Sua integração com tecnologias inteligentes garante que o avanço industrial seja equilibrado com maior proteção de ativos, processos e capital humano.

Dinâmica do mercado de sistemas de segurança na Europa

Motorista

Avanços na tecnologia de sistemas de segurança

- Os avanços tecnológicos em sistemas de segurança estão impulsionando significativamente o crescimento do mercado, à medida que os fabricantes incorporam soluções inovadoras para atender às necessidades industriais modernas. Maior eficiência, conectividade digital e automação inteligente estão se tornando características definidoras das soluções de segurança de última geração.

- Por exemplo, a Siemens desenvolveu sistemas de automação com segurança integrada que combinam produtividade com camadas de segurança avançadas. Essas plataformas permitem que as empresas atendam a padrões rigorosos, ao mesmo tempo em que aumentam a flexibilidade e reduzem o tempo de lançamento de novos produtos no mercado.

- Novas tecnologias de sistemas de segurança, como controladores de segurança programáveis, visão computacional avançada e redes de comunicação à prova de falhas, estão garantindo maior capacidade de resposta e precisão. Essas inovações minimizam riscos e proporcionam segurança personalizada para diferentes operações industriais.

- Além disso, a integração com plataformas IIoT aprimora as capacidades de análise de dados, permitindo que as empresas detectem riscos proativamente. Os sistemas de segurança agora funcionam não apenas como medidas reativas, mas também como ferramentas preditivas e preventivas, tornando-os essenciais para a excelência operacional.

- Esses avanços tecnológicos demonstram a inovação contínua do setor. Ao alinhar a segurança à modernização digital, as organizações garantem maior confiabilidade, conformidade e eficiência em ambientes industriais, reforçando os sistemas de segurança como um impulsionador de crescimento a longo prazo.

Restrição/Desafio

Aumento dos requisitos regulatórios e padrões de conformidade

- O mercado de sistemas de segurança enfrenta desafios decorrentes de estruturas regulatórias em constante evolução e rigorosos requisitos de conformidade em todos os setores. As empresas precisam atualizar seus sistemas regularmente para atender a diversos padrões regionais, o que aumenta os custos e a complexidade operacional.

- Por exemplo, empresas como a ABB e a Honeywell enfrentam pressão contínua para alinhar suas soluções de segurança a diversas diretrizes de segurança, como a ISO 13849 e os regulamentos da OSHA. A conformidade com essas normas internacionais e nacionais frequentemente exige investimentos substanciais em projeto e certificação de sistemas.

- O ritmo da evolução regulatória ultrapassa a capacidade de adaptação das empresas menores, criando disparidades na adoção pelo setor. Para muitas empresas, os custos associados às atualizações contínuas dificultam a implementação generalizada de tecnologias de segurança avançadas.

- Além disso, regulamentações de segurança fragmentadas nos mercados globais levam a complicações no desenvolvimento e na implantação de produtos. As empresas precisam lidar com requisitos sobrepostos, prolongando o lançamento de produtos e desacelerando as taxas de adoção em determinadas regiões.

- Enfrentar esses desafios de conformidade exige uma colaboração mais estreita entre empresas e órgãos reguladores, bem como investimentos em soluções de segurança flexíveis e escaláveis. Desenvolver sistemas adaptáveis a diversas condições regulatórias será essencial para sustentar o crescimento do mercado de sistemas de segurança.

Escopo do mercado de sistemas de segurança na Europa

O mercado é segmentado com base no tipo, tecnologia, função, tamanho da organização, usuário final e canal de distribuição.

- Por tipo

Com base no tipo, o mercado de sistemas de segurança é segmentado em controladores e relés de segurança, sistemas de visão de máquina de segurança, sensores de segurança e interruptores de segurança. O segmento de controladores e relés de segurança dominou a maior fatia de mercado em 2024, impulsionado por seu papel central no gerenciamento e coordenação de operações de segurança em máquinas industriais e linhas de produção. Esses dispositivos garantem a conformidade com rigorosos padrões internacionais de segurança, especialmente em setores como a indústria automotiva e a engenharia pesada. Sua facilidade de integração à infraestrutura de automação existente, combinada com sua comprovada confiabilidade na minimização de riscos no local de trabalho, reforça sua dominância. A crescente demanda por certificações de segurança funcional e o foco crescente na proteção de operadores humanos impulsionam ainda mais a adoção.

Prevê-se que o segmento de visão computacional de segurança apresentará a maior taxa de crescimento entre 2025 e 2032, impulsionado pelos rápidos avanços em reconhecimento de imagens e automação baseados em IA. Sistemas de visão computacional são cada vez mais utilizados para monitoramento em tempo real, detecção de defeitos e inspeção automatizada, a fim de prevenir mau funcionamento e acidentes em equipamentos. A crescente adoção de práticas da Indústria 4.0 e fábricas inteligentes amplia o uso de visão computacional de segurança para análise preditiva e otimização de processos. Além disso, sua escalabilidade em diversas aplicações, incluindo farmacêutica, processamento de alimentos e montagem de eletrônicos, posiciona esse segmento para um crescimento acelerado.

- Por Tecnologia

Com base na tecnologia, o mercado de sistemas de segurança é segmentado em sensores digitais, sensores inteligentes e sensores analógicos. O segmento de sensores inteligentes dominou o mercado com uma participação de 42% em 2024, devido à sua capacidade de fornecer dados precisos, conectividade com plataformas de IoT e recursos de monitoramento em tempo real. Esses sensores são amplamente preferidos para manutenção preditiva e aprimoramento da eficiência operacional em setores como aeroespacial, saúde e automotivo. Sua adaptabilidade a sistemas de automação avançados e integração com análises baseadas em nuvem garantem proteção confiável e processos simplificados. A crescente demanda por interpretação inteligente de dados e autodiagnóstico em sistemas de segurança reforça ainda mais sua liderança.

Espera-se que o segmento de sensores digitais apresente o CAGR mais rápido entre 2025 e 2032, apoiado por sua relação custo-benefício, design compacto e operação com eficiência energética. Sensores digitais estão sendo cada vez mais utilizados para monitorar temperatura, vibração e pressão em ambientes industriais, onde respostas rápidas são essenciais para evitar falhas. Sua facilidade de integração em sistemas de controle automatizados e compatibilidade com tecnologias embarcadas os tornam altamente atraentes para PMEs. A crescente adoção de gêmeos digitais e simulação em tempo real acelera ainda mais a demanda por sensores digitais em sistemas de segurança modernos.

- Por função

Com base na função, o mercado é segmentado em proteção de máquinas, monitoramento de processos, gerenciamento de energia, assistência ao estacionamento, prevenção de colisões, sistemas de monitoramento de vibração, sistemas de parada de emergência e outros. O segmento de proteção de máquinas dominou o mercado em 2024, apoiado por seu papel crítico na proteção de máquinas industriais de alto valor contra falhas mecânicas e erros humanos. Os fabricantes priorizam os sistemas de proteção de máquinas devido à sua capacidade de reduzir o tempo de inatividade, melhorar a eficiência operacional e estender a vida útil dos equipamentos. A adoção é forte nas indústrias automotiva, aeroespacial e pesada, onde a confiabilidade dos equipamentos impacta diretamente a produtividade. A aplicação de regulamentações internacionais de segurança e o aumento do custo dos acidentes de trabalho fortalecem ainda mais a demanda.

O segmento de prevenção de colisões deverá crescer ao ritmo mais acelerado entre 2025 e 2032, impulsionado pela crescente implantação em veículos autônomos, robótica de armazéns e aplicações de aviação. Sistemas de prevenção de colisões utilizam sensores avançados, LiDAR e algoritmos de IA para detectar perigos potenciais e prevenir acidentes em tempo real. A crescente adoção de sistemas de assistência ao motorista nos setores automotivo e de logística contribui significativamente para seu crescimento. Com os governos exigindo recursos avançados de segurança em veículos e as indústrias adotando a automação, os sistemas de prevenção de colisões estão se tornando um componente essencial na redução de riscos operacionais.

- Por tamanho da organização

Com base no porte da organização, o mercado é segmentado em organizações de pequeno e médio porte e organizações de grande porte. As organizações de grande porte dominaram o mercado em 2024, impulsionadas por sua maior capacidade de investimento, ampla adoção de automação e rigoroso cumprimento das normas de segurança. Empresas em setores como petróleo e gás, automotivo e aeroespacial priorizam sistemas de segurança avançados para proteger ativos, funcionários e garantir operações ininterruptas. A implantação em larga escala de robótica e máquinas conectadas exige soluções de segurança sofisticadas e integradas, fortalecendo a participação de mercado desse segmento.

O segmento de pequenas e médias empresas deverá registrar o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente conscientização sobre segurança no trabalho, soluções econômicas e requisitos de conformidade regulatória. As PMEs estão adotando cada vez mais sistemas de segurança modulares e escaláveis que se adaptam aos seus orçamentos e permitem atualizações graduais. Os incentivos governamentais para a adoção de soluções de segurança e a disponibilidade de tecnologias acessíveis e fáceis de instalar incentivam ainda mais a adoção. Essa mudança é particularmente visível em economias emergentes, onde as PMEs constituem a espinha dorsal da atividade industrial.

- Por usuário final

Com base no usuário final, o mercado é segmentado em automotivo, aeroespacial e defesa, saúde, petróleo e gás, transporte e logística, eletrônicos de consumo, alimentos e bebidas, construção civil e outros. O segmento automotivo dominou o mercado em 2024, devido à crescente ênfase na segurança do motorista e dos passageiros, aliada à crescente adoção de sistemas avançados de assistência ao motorista (ADAS). Os fabricantes automotivos estão investindo pesadamente na integração de sensores de segurança, visão computacional e sistemas de prevenção de colisões para atender às normas de segurança e aumentar a confiabilidade dos veículos. O crescente setor de veículos elétricos impulsiona ainda mais a demanda por sistemas avançados de segurança.

Prevê-se que o segmento de saúde apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela necessidade de precisão, monitoramento em tempo real e segurança do paciente em ambientes de cuidados intensivos. Os sistemas de segurança em ambientes de saúde são vitais para garantir diagnósticos precisos, monitorar a saúde dos equipamentos e proteger a equipe médica contra exposições perigosas. A rápida digitalização dos hospitais, a adoção de sistemas de monitoramento habilitados para IoT e o aumento do investimento em infraestrutura inteligente de saúde amplificam o crescimento. A demanda é ainda sustentada pelo foco regulatório na segurança de dispositivos médicos e na prevenção de erros.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em vendas diretas e vendas indiretas. O segmento de vendas diretas dominou o mercado em 2024, apoiado pela preferência dos fabricantes pelo engajamento direto com os clientes para fornecer soluções personalizadas, serviços pós-venda e contratos de longo prazo. Os canais de vendas diretas são especialmente proeminentes em setores como aeroespacial, automotivo e petróleo e gás, onde são implantadas soluções de segurança personalizadas de alto valor. A força desse canal reside na construção de relacionamentos sólidos com os clientes e na oferta de expertise técnica completa.

Espera-se que o segmento de vendas indiretas cresça no ritmo mais acelerado entre 2025 e 2032, impulsionado pelo papel crescente de distribuidores, integradores de sistemas e plataformas de e-commerce. Os canais indiretos proporcionam um alcance de mercado mais amplo, especialmente para PMEs e mercados emergentes, onde os clientes dependem de fornecedores terceirizados para soluções econômicas. A crescente demanda por dispositivos de segurança modulares plug-and-play e a expansão das plataformas de distribuição digital aumentam ainda mais o potencial de crescimento do canal de vendas indiretas.

Análise regional do mercado de sistemas de segurança na Europa

- O Reino Unido dominou o mercado de sistemas de segurança com a maior participação na receita em 2024, impulsionado por sua forte base industrial, setor de manufatura avançado e regulamentações rigorosas de segurança no local de trabalho em setores como automotivo, aeroespacial e petróleo e gás.

- A liderança do país é reforçada pela ampla adoção da automação, integração de sensores inteligentes e tecnologias de visão computacional e investimentos contínuos na atualização da infraestrutura de segurança industrial

- O foco crescente na conformidade com os padrões internacionais de segurança, juntamente com a crescente demanda por soluções de manutenção preditiva e proteção ao trabalhador, fortalece ainda mais a posição do Reino Unido

Visão do mercado de sistemas de segurança na Alemanha

A Alemanha deverá registrar o CAGR mais rápido da Europa entre 2025 e 2032, impulsionado pela rápida expansão das práticas da Indústria 4.0, pela adoção de robótica avançada e pela crescente dependência de máquinas automatizadas em seus centros de produção. O crescimento é sustentado por iniciativas governamentais que promovem a segurança industrial, investimentos pesados em fábricas inteligentes e pela forte demanda por sistemas de monitoramento habilitados para IoT. A liderança do país nos setores automotivo, de engenharia e de automação industrial cria oportunidades substanciais para tecnologias de segurança de última geração. A ênfase da Alemanha na integração de visão computacional orientada por IA, sistemas de prevenção de colisões e sensores digitais em processos industriais está acelerando a adoção e impulsionando uma forte expansão do mercado.

Visão do mercado de sistemas de segurança na França

A França deverá apresentar um crescimento constante entre 2025 e 2032, apoiado por seu setor industrial consolidado, pela crescente adoção da automação na construção e no transporte e pelo foco crescente na conformidade com a segurança no local de trabalho. A crescente demanda por sensores de segurança, sistemas de parada de emergência e tecnologias de proteção de máquinas nos setores de alimentos e bebidas e eletrônicos de consumo está impulsionando a adoção. A colaboração entre empresas nacionais e fabricantes internacionais de sistemas de segurança melhora a acessibilidade, a inovação de produtos e a penetração no mercado. O foco do país em operações sustentáveis, alinhamento regulatório e adoção de tecnologias de segurança digital continua a fortalecer as perspectivas de mercado da França.

Participação no mercado de sistemas de segurança na Europa

O setor de sistemas de segurança é liderado principalmente por empresas bem estabelecidas, incluindo:

- Siemens (Alemanha)

- Panasonic Corporation (Japão)

- ABB (Suíça)

- Honeywell International Inc. (EUA)

- Rockwell Automation (EUA)

- Festo SE & Co. KG (Alemanha)

- Schneider Electric (França)

- SICK AG (Alemanha)

- KEYENCE CORPORATION (Japão)

- OMRON Corporation (Japão)

- Sensata Technologies, Inc. (EUA)

- Pepperl+Fuchs SE (Alemanha)

- Balluff GmbH (Alemanha)

- TankScan (EUA)

- Autonics Corporation (Coreia do Sul)

- Hans Turck GmbH & Co. KG (Alemanha)

Últimos desenvolvimentos no mercado de sistemas de segurança na Europa

- Em agosto de 2024, a Siemens Smart Infrastructure lançou o SICAM Enhanced Grid Sensor (EGS), avançando significativamente na digitalização das redes de distribuição. Ao fornecer monitoramento contínuo e evitar sobrecargas, esta solução plug-and-play permite que as operadoras de rede maximizem o uso da infraestrutura existente, garantindo maior eficiência e estabilidade. A inovação apoia a integração de fontes de energia renováveis na rede, uma necessidade crescente na transição energética global. Este lançamento fortaleceu a liderança da Siemens no mercado de soluções de energia inteligente, posicionando-a como parceira preferencial para concessionárias de serviços públicos que buscam transformação digital e infraestrutura resiliente.

- Em dezembro de 2023, a Panasonic Holdings Corporation revelou um sensor inercial 6 em 1 projetado para aumentar a segurança e o desempenho automotivo. Ao combinar múltiplas funcionalidades de detecção em uma única unidade compacta, a inovação aprimora a estabilidade do veículo e os sistemas de assistência ao motorista, atendendo à crescente demanda por tecnologias avançadas de segurança automotiva. Este desenvolvimento reforçou a posição da Panasonic no mercado de sensores automotivos, permitindo à empresa expandir sua participação de mercado e fortalecer colaborações com montadoras focadas em soluções de mobilidade inteligente.

- Em maio de 2023, a ABB concluiu a aquisição da unidade de motores NEMA de baixa tensão da Siemens, um movimento estratégico que ampliou o portfólio de motores industriais da ABB. Com essa aquisição, a ABB reforçou sua capacidade de fabricação e ampliou seu alcance de serviços para clientes globais em setores como automação, energia e manufatura. Esse desenvolvimento reforçou a liderança da ABB no mercado de motores industriais, permitindo que a empresa atendesse à crescente demanda por soluções de motores confiáveis e com eficiência energética em mercados desenvolvidos e emergentes.

- Em janeiro de 2023, a Honeywell International Inc. aprofundou sua parceria com a Nexceris para fornecer soluções de segurança aprimoradas para veículos elétricos. Ao integrar a tecnologia de sensores de bateria da Honeywell com o sistema de detecção de gás Li-Ion Tamer da Nexceris, a colaboração se concentrou na mitigação dos riscos de descontrole térmico que levam a incêndios em baterias de veículos elétricos. Isso fortaleceu a posição de mercado da Honeywell no segmento de soluções de segurança automotiva, especialmente no setor de veículos elétricos em rápido crescimento, e demonstrou sua capacidade de fornecer tecnologias inovadoras que salvam vidas e atendem às crescentes demandas de segurança do setor.

- Em agosto de 2022, a Rockwell Automation lançou seus sensores fotoelétricos Allen-Bradley 42EA RightSight S18 e 42JA VisiSight M20A, atendendo a indústrias que exigem soluções de detecção compactas, confiáveis e versáteis. Esses sensores econômicos simplificam a instalação e a manutenção, ao mesmo tempo em que oferecem alto desempenho em ambientes com espaço limitado. O lançamento reforçou a posição da Rockwell nos mercados de automação industrial e sensores, atendendo à demanda por tecnologias de detecção avançadas e com boa relação custo-benefício, expandindo assim sua base de clientes em diversas aplicações industriais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.