Europe Refractive Surgery Devices Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

422.98 Million

USD

746.40 Million

2021

2029

USD

422.98 Million

USD

746.40 Million

2021

2029

| 2022 –2029 | |

| USD 422.98 Million | |

| USD 746.40 Million | |

|

|

|

Mercado de dispositivos de cirurgia refrativa na Europa , por tipo de produto (laser, lente intraocular fácica (LIO), aberrómetro/aberrometria de frente de onda, instrumentos cirúrgicos e acessórios, kits de cirurgia refrativa, medidores de diâmetro pupilar, epicerátomos, microcerátomos, termoceratoplastia, kits de incisão de relaxamento limbar e outros) , Tipo de cirurgia (LASIK (ceratomileusis in situ a laser, ceratectomia fotorrefrativa (PRK), lentes intraoculares fácicas (LIO), ceratotomia astigmática (AK), ceratoplastia lamelar automatizada (ALK), anel intracorneano (INTACS), ceratoplastia térmica a laser (LTK) , Ceratoplastia Condutiva (CK), Ceratotomia Radial (RK) e Outros), Aplicação (Miopia, Hipermetropia, Astigmatismo e Presbiopia), Utilizador Final (Hospitais, Clínicas Especializadas, Blocos Operatórios Ambulatório e Outros), Canal de Distribuição (Licitação direta, distribuidores terceirizados e outros) Tendências e previsões do setor até 2029.

Definição e Insights de Mercado

Os dispositivos de cirurgia refrativa são utilizados para melhorar ou corrigir erros de refração, como a miopia, a hipermetropia, a presbiopia ou o astigmatismo. Estes dispositivos incluem lasers excimer, lasers YAG, microcerátomos e lasers de femtossegundos. As cirurgias refrativas reduzem muito a dependência de óculos ou lentes de contacto. Vários dispositivos refrativos são utilizados no mercado para tratar defeitos de visão.

Os erros de refração são causados pelo formato inadequado da córnea ou do globo ocular. O procedimento de cirurgia refrativa inclui a remodelação dos globos oculares ou da córnea utilizando vários dispositivos de cirurgia refrativa, como lasers avançados, tratamentos LASIK, ceratectomia fotorrefrativa e várias lentes, como lentes intraoculares fácicas e lentes intraoculares tóricas.

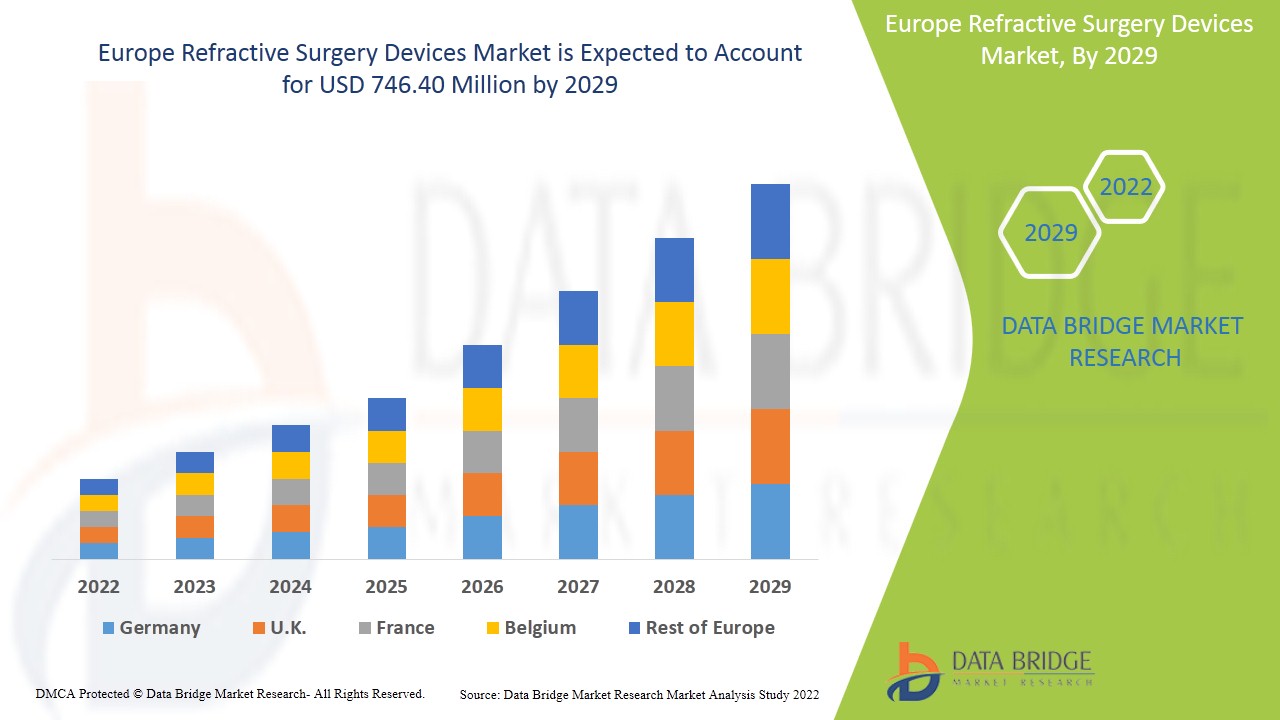

Espera-se que o mercado de dispositivos de cirurgia refrativa ganhe crescimento de mercado no período previsto de 2022 a 2029. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 7,6% no período previsto de 2022 a 2029 e deverá atingir os 746,40 milhões de USD até 2029, face aos 422,98 milhões de dólares em 2021.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2019 - 2014) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos |

|

Segmentos abrangidos |

Por tipo de produto (laser, lente intraocular fácica (LIO), aberrómetros/aberrometria de frente de onda, instrumentos cirúrgicos e acessórios, kits de cirurgia refrativa, medidores de diâmetro pupilar, epicerátomos, microcerátomos, termoceratoplastia, kits de incisão de relaxamento limbar e outros), tipo de cirurgia (LASIK ( Ceratomileusis laser in situ, ceratectomia fotorrefrativa (PRK), lentes intraoculares fácicas (LIO), ceratotomia astigmática (AK), ceratoplastia lamelar automatizada (ALK), anel intracorneano (INTACS), ceratoplastia térmica a laser (LTK), queratoplastia condutiva (CK) , Ceratotomia Radial (RK) e Outros), Aplicação (Miopia, Hipermetropia, Astigmatismo e Presbiopia), Utilizador Final (Hospitais, Clínicas Especializadas, Centros Cirúrgicos Ambulatório e Outros), Canal de Distribuição ( Concurso Direto, Terceiros Distribuidores e Outros) |

|

Países abrangidos |

Alemanha, França, Reino Unido, Itália, Espanha, Países Baixos, Rússia, Suíça, Bélgica, Turquia, Áustria, Noruega, Hungria, Lituânia, Irlanda, Polónia Resto da Europa |

|

Atores do mercado abrangidos |

Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc. (uma subsidiária da Topcon Corporation), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon entre outros |

A dinâmica de mercado do mercado de dispositivos de cirurgia refrativa inclui

Motoristas

- Aumento do avanço tecnológico

A aceleração no desenvolvimento tecnológico no setor da saúde aumentou tremendamente nos últimos anos. O avanço na tecnologia dos dispositivos de cirurgia refrativa proporciona um tratamento indolor e descomplicado durante o tratamento de uma doença. Além disso, a inovação e a atualização em vários dispositivos de cirurgia refrativa auxiliam num resultado preciso e rápido do diagnóstico da doença. A inovação em dispositivos de cirurgia refrativa também proporciona a relação custo-benefício das ferramentas terapêuticas baseadas em tecnologia durante o tratamento de doenças.

Por exemplo,

- De acordo com a Contoura Vision India, descobriu-se que a cirurgia de visão Contoura é a mais recente cirurgia ocular avançada na remoção de óculos. É um dos avanços tecnológicos mais seguros na cirurgia ocular, que não só corrige a potência dos óculos, como também atua nas irregularidades da córnea

- De acordo com a Eye and Laser Centre Organisation, em maio de 2017, descobriu-se que a tecnologia do laser de femtosegundo Visumax é um dos tratamentos cirúrgicos refrativos mais avançados. É capaz de realizar defeitos visuais dos olhos

Espera-se que os crescentes avanços tecnológicos em vários dispositivos de cirurgia refrativa, como os avanços na varredura de pontos variáveis a laser, impulsionem o mercado de dispositivos de cirurgia refrativa. Assim sendo, espera-se que a crescente inovação e o avanço tecnológico nos dispositivos de cirurgia refrativa impulsionem o crescimento do mercado durante o período previsto.

- Aumento das despesas com a saúde

Na última década, os gastos com a saúde aumentaram drasticamente para melhorar os cuidados prestados aos doentes. Os EUA são o maior mercado de cuidados de saúde, onde o gasto total em cuidados de saúde aumentou drasticamente nos últimos anos. O objetivo fundamental por detrás do aumento dos gastos é fornecer dispositivos de cirurgia refrativa apropriados, acessíveis e de alta qualidade. Para promover uma população mais saudável e lidar com emergências de saúde nos países desenvolvidos e em desenvolvimento, os respetivos organismos governamentais e organizações de saúde estão a tomar a iniciativa de acelerar os gastos em saúde.

Por exemplo,

- De acordo com a Organização para os Assuntos de Saúde, os gastos com a saúde nos EUA aumentaram 9,7%, atingindo os 4,1 biliões de dólares em 2020, uma taxa muito mais rápida do que a observada em 2019.

- De acordo com o governo do Reino Unido, em 2020, o governo disponibilizou quase 250 milhões de libras, o que equivale a cerca de 300 milhões de dólares, para digitalizar e promover os cuidados de diagnóstico em todo o NHS (Serviço Nacional de Saúde) utilizando o tecnologia mais recente. Este financiamento foi atribuído especificamente para melhorias tecnológicas nos serviços de diagnóstico do NHS, para detetar e iniciar o tratamento de problemas de saúde o mais cedo possível.

- A Iniciativa Nacional de Serviço de Diagnóstico Gratuito foi lançada como parte da Missão Nacional de Saúde pelo Governo da Índia. Isto era importante para prestar cuidados médicos abrangentes e de qualidade, sem custos, num só local. Com esta iniciativa do governo indiano, vários estados tentaram vários modelos para garantir a disponibilidade de diagnósticos nas unidades de saúde públicas

O aumento dos gastos em saúde é também benéfico para o crescimento económico e para o crescimento do sector da saúde. Afeta significativamente o desenvolvimento de novos testes de diagnóstico e de novas ferramentas cirúrgicas. Por conseguinte, os grandes gastos em saúde são um fator favorável ao crescimento do mercado.

Oportunidade

- Conquistas em cirurgias LASIK

A taxa de sucesso do LASIK ou os resultados do LASIK são bem compreendidos, com milhares de estudos clínicos a analisar a acuidade visual e a satisfação do paciente. Pesquisas recentes referiram que 99% dos pacientes alcançam uma visão melhor que 20/40, e mais de 90% alcançam 20/20 ou melhor. Além disso, o LASIK tem uma taxa de satisfação do paciente sem precedentes de 96%, a mais elevada de qualquer procedimento eletivo.

Por exemplo,

- Um estudo de 2016 no Journal of Cataract & Refractive Surgery descobriu que o LASIK tem uma taxa de satisfação dos pacientes de 96%

De acordo com o artigo "LASIK: Conheça as recompensas e os riscos", 2018

- Eric Donnenfeld, MD, ex-presidente da Sociedade Americana de Catarata e Cirurgia Refrativa, concluiu cerca de 85.000 procedimentos ao longo da sua carreira de 28 anos

- De acordo com o Market Scope, cerca de 10 milhões de americanos fizeram cirurgia LASIK desde que a FDA a aprovou pela primeira vez em 1999. Cerca de 700.000 cirurgias LASIK são feitas a cada ano, mas isto é inferior ao pico de 1, 4 milhões em 2000.

Doravante, o número crescente de cirurgias LASIK bem-sucedidas em todo o mundo está positivamente associado ao desenvolvimento, registo e lançamento de produtos. Assim, espera-se que isto impulsione o mercado de dispositivos de cirurgia refrativa nos próximos anos.

- Iniciativas estratégicas dos participantes no mercado

O aumento da carga de erros refrativos em todo o mundo criou mais procura pelo mercado de dispositivos de cirurgia refrativa. O principal objetivo é melhorar a gestão da saúde com o desenvolvimento de produtos inovadores e tipos de cirurgia para cuidados de qualidade com aplicação conveniente. Os principais participantes do mercado de dispositivos de cirurgia refrativa tomaram iniciativas estratégicas, que incluem lançamentos de produtos, aquisições e muito mais, e espera-se que liderem e criem mais oportunidades no mercado de dispositivos de cirurgia refrativa.

Por exemplo,

- Em junho de 2021, a Glaukos Corporation recebeu a aprovação regulamentar da Therapeutic Goods Administration (TGA) da Austrália para o PRESERFLO MicroShunt. O PRESERFLO MicroShunt teve como objetivo diminuir a pressão intraocular (PIO) nos olhos de doentes com glaucoma primário de ângulo aberto, onde a PIO permaneceria incontrolável, para além de ser a terapêutica médica máxima tolerada e/ou onde a progressão do glaucoma requer cirurgia

- Em junho de 2021: a Bausch & Lomb Incorporated assinou um acordo com a Lochan, uma empresa do setor dos serviços de tecnologias de informação. Estas empresas tinham como objetivo desenvolver a próxima geração do software de apoio à decisão clínica eyeTELLIGENCE da Bausch & Lomb Incorporated. Ao utilizar a infraestrutura predominante baseada na nuvem do eyeTELLIGENCE, este software seria desenvolvido para permitir aos cirurgiões combinar sem esforço todos os fatores dos procedimentos de cirurgia de catarata, retina e refrativa para aumentar a eficiência total da sua prática.

- Em março de 2021, a NIDEK revelou o RT-6100 CB para Windows, software de controlo opcional para o RT-6100 Intelligent Refractor e o TS-610 Tabletop Refraction System. Este software adapta-se às necessidades específicas dos pacientes e operadores. Além disso, o software permite refrações, que atendem aos requisitos de distanciamento social

Estes muitos produtos estratégicos lançados e aquisições por parte de grandes empresas no mercado dos dispositivos de cirurgia refrativa abriram uma oportunidade para as empresas de todo o mundo. Estas estratégias estão a permitir às empresas reforçar a sua presença no mercado. Assim sendo, prevê-se que a iniciativa estratégica seja uma oportunidade de ouro para os participantes do mercado acelerarem o crescimento das suas receitas no mercado.

Desafios/Restrições

- Falta de sensibilização e confiança das pessoas quanto aos benefícios do procedimento

Em muitos países, a população em geral desconhece a cirurgia refrativa ou os seus diversos benefícios para os erros refrativos, como a miopia, o astigmatismo, a presbiopia e outros. As pessoas têm receio de cirurgias que possam causar efeitos secundários graves, o que pode representar um grande desafio para o mercado.

Por exemplo,

- De acordo com o estudo do Instituto Nacional de Saúde (NIH) de 2021, foi declarado que as pessoas se recusavam a submeter à cirurgia porque estavam preocupadas com as complicações e não tinham informações sobre o procedimento. Além disso, o estudo mostrou que 82,5% dos participantes desconheciam que a cirurgia refrativa poderia melhorar a sua acuidade visual devido à falta de sensibilização

- De acordo com o estudo do International Journal of Medicine in Developing Countries em 2019, foi afirmado que:

- 32,2% do total de participantes achavam que a cirurgia refrativa era perigosa e 9,5% achavam que causava complicações avançadas

- Além disso, o estudo da Índia mostrou que 64% dos participantes não sabiam que a cirurgia refrativa era capaz de melhorar a sua visão

Espera-se que a falta de sensibilização para os benefícios da cirurgia refrativa e o medo das pessoas de complicações cirúrgicas criem um grande desafio para o crescimento do mercado.

- Falta de instalações de saúde para tratamento ocular

A população pobre dos países de baixo e médio rendimento sofre mais de cegueira e de distúrbios oftalmológicos do que a população mais rica. Os planos de avanço e estratégicos adotados nos países desenvolvidos não são igualmente iniciados nos países de baixo rendimento. Muitos países de baixo rendimento contam frequentemente com agentes de saúde comunitários, assistentes médicos e cirurgiões de catarata para os seus cuidados oftalmológicos primários iniciais. A oftalmologia nos países de baixo rendimento (LIC) é muito desafiante devido às suas complexidades, tais como climas tropicais, redes eléctricas frágeis, infra-estruturas rodoviárias e hídricas deficientes, capacidade de diagnóstico limitada e opções de tratamento limitadas.

Por exemplo,

- De acordo com o artigo "Ferramentas de diagnóstico inovadoras para oftalmologia em países de baixo rendimento", o relatório de 2020 refere que a prevalência de cegueira e distúrbios oculares em países de alto rendimento é de 0,3 por 1.000 pessoas, mas em países de baixo rendimento, a estimativa é de 1,5 por 1.000. Isto mostra a necessidade não satisfeita de cuidados oftalmológicos em países de baixo

Outro grande problema nos países de baixo rendimento é a falta de sensibilização entre as pessoas sobre a dor ocular e outros distúrbios. Muitos estudos de investigação relatam a elevada procura de cuidados de saúde ocular em países de baixo rendimento, e as suas necessidades não satisfeitas ainda estão a ganhar atenção entre muitas organizações de saúde.

Por exemplo,

- Em 2014, o British Journal of Ophthalmology informou que o plano Vision 2020 iniciado pelo governo ainda está longe de ser alcançado devido à falta de iniciativas tomadas que visem os países de rendimentos médios e baixos.

Por conseguinte, a precariedade das instalações de saúde para tratamentos oculares em países de baixo e médio rendimento é considerada o maior desafio para o crescimento do mercado de dispositivos de cirurgia refrativa.

Impacto pós-COVID-19 no mercado de dispositivos de cirurgia refrativa

A COVID-19 afetou o mercado. Os bloqueios e o isolamento durante as pandemias restringiram a movimentação das massas. Como resultado, as datas e os horários das cirurgias foram adiados. Portanto, a pandemia afetou negativamente este mercado

Desenvolvimento recente

- Em julho de 2021, a Johnson & Johnson Vision lançou o VERITAS Vision System, um sistema de facoemulsificação (faco) de última geração. Este sistema foi desenvolvido para cuidar de três áreas importantes: eficiência do cirurgião, segurança do paciente e conforto. Isto aumentou o portfólio de produtos da empresa

Âmbito de mercado dos dispositivos de cirurgia refrativa

O mercado de dispositivos de cirurgia refrativa está segmentado em tipo de produto, tipo de cirurgia, aplicação, utilizador final e canal de distribuição. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecer aos utilizadores uma visão geral e informações valiosas do mercado para tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo de produto

- Laser

- Lente Intra-Ocular Fácica (LIO)

- Aberrómetros / Aberrometria de frente de onda

- Instrumentos Cirúrgicos e Acessórios

- Kits de cirurgia refrativa

- Medidores de Diâmetro Pupilar

- Epicerátomos

- Microcerátomos

- Termoceratoplastia

- Kits de incisão relaxante limbar

- Outros

Com base no tipo de produto, o mercado de dispositivos de cirurgia refrativa está segmentado em laser, lente intraocular fácica (LIO), aberrómetro/aberrometria de frente de onda, instrumentos cirúrgicos e acessórios, kits de cirurgia refrativa, medidores de diâmetro pupilar, epicerátomos , microcerátomos, termoceratoplastia, limbo kits de incisão relaxante e outros.

Tipo de cirurgia

- Lasik (Ceratomileusis in situ a laser)

- Ceratectomia Fotorrefrativa (PRK)

- Lentes Intraoculares Fácicas (LIO)

- Ceratotomia Astigmática (AK)

- Ceratoplastia Lamelar Automatizada (ALK)

- Anel Intracorneano (INTACS)

- Ceratoplastia Térmica Laser (LTK)

- Ceratoplastia Condutiva (CK)

- Ceratotomia radial (RK)

- Outros

Com base no tipo de cirurgia, o mercado dos dispositivos de cirurgia refrativa está segmentado em LASIK (ceratomileusis in situ a laser), ceratectomia fotorrefrativa (PRK), lentes intraoculares fácicas (LIO), ceratotomia astigmática (AK), ceratoplastia lamelar automatizada (ALK ), anel intracorneano (INTACS), ceratoplastia térmica a laser (LTK), ceratoplastia condutiva (CK), ceratotomia radial (RK) e outras.

Aplicação

- Miopia

- Hipermetropia (hipermetropia)

- Astigmatismo

- Presbiopia

Com base na aplicação, o mercado dos dispositivos de cirurgia refrativa está segmentado em miopia, hipermetropia, astigmatismo e presbiopia.

Utilizador final

- Hospitais

- Clínicas especializadas

- Centros Cirúrgicos Ambulatoriais

- Outros

Com base no utilizador final, o mercado de dispositivos de cirurgia refrativa está segmentado em hospitais, clínicas especializadas, centros de cirurgia ambulatória e outros.

Canal de Distribuição

- Licitação Direta

- Distribuidores Terceirizados

- Outros

On the basis of distribution channel, the refractive surgery devices market is segmented into direct tender, third party distributors, and others.

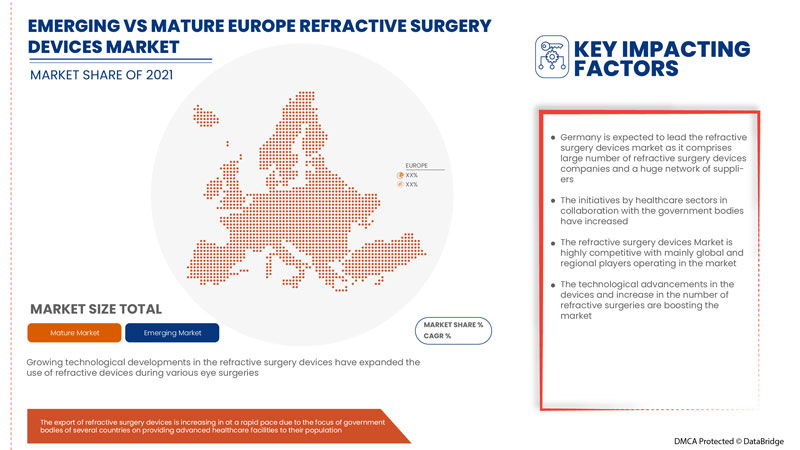

Refractive Surgery Devices Market Regional Analysis/Insights

The refractive surgery devices market is analysed and market size insights and trends are provided by country, product type, surgery type, application, end user, and distribution channel as referenced above.

The countries covered in the refractive surgery devices market report are the Germany, France, U.K., Italy, Spain, Netherlands, Russia Switzerland, Belgium, Turkey, Austria, Norway, Hungary, Lithuania, Ireland, Poland Rest of Europe.

Germany is expected to dominate the market due to the rising adoption of minimal invasive surgeries.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Refractive Surgery Devices Market Share Analysis

The refractive surgery devices market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on refractive surgery devices market.

Some of the major companies dealing in the refractive surgery devices market are Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc. (A subsidiary of Topcon Corporation), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analysed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global vs. Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analysed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Factbook) or can assist you in creating presentations from the data sets available in the report

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE REFRACTIVE SURGERY DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 EUROPE REFRACTIVE SURGERY DEVICES MARKET: REGULATIONS

4.3.1 REGULATION IN THE U.S.

4.3.2 REGULATIONS IN EUROPE

4.3.3 REGULATIONS IN SINGAPORE

4.3.4 REGULATIONS IN AUSTRALIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING TECHNOLOGICAL ADVANCEMENT

5.1.2 RISE IN HEALTHCARE EXPENDITURE

5.1.3 INCREASE IN POPULATION WITH MACULAR DEGENERATION

5.1.4 RISE IN ADOPTION OF MINIMALLY INVASIVE SURGERIES

5.2 RESTRAINTS

5.2.1 STRINGENT RULES AND REGULATIONS

5.2.2 HIGH COST ASSOCIATED WITH REFRACTIVE SURGERY DEVICES

5.2.3 SIDE EFFECTS OF SURGERY

5.3 OPPORTUNITIES

5.3.1 ACHIEVEMENTS IN LASIK SURGERIES

5.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.3 INCREASING GERIATRIC POPULATION

5.3.4 EXCESSIVE USAGE OF DIGITAL DEVICES

5.4 CHALLENGES

5.4.1 DEARTH OF SKILLED PROFESSIONALS

5.4.2 LACK OF HEALTHCARE FACILITIES FOR EYE TREATMENT

6 COVID-19 IMPACT ON EUROPE REFRACTIVE SURGERY DEVICES MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY

6.4 STRATEGIC DECISIONS BY MANUFACTURERS

6.5 CONCLUSION

7 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 LASER

7.2.1 EXCIMER LASERS

7.2.2 FEMTOSECOND LASER/ULTRASHORT PULSE LASER

7.2.3 OTHERS

7.3 PHAKIC INTRAOCULAR LENS (IOL)

7.4 ABERROMETERS / WAVEFRONT ABERROMETRY

7.5 SURGICAL INSTRUMENTS & ACCESSORIES

7.6 REFRACTIVE SURGERY KITS

7.7 PUPILLARY DIAMETER METERS

7.8 EPIKERATOMES

7.9 MICROKERATOMES

7.1 THERMOKERATOPLASTY

7.11 LIMBAL RELAXING INCISION KITS

7.12 OTHERS

8 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY SURGERY TYPE

8.1 OVERVIEW

8.2 LASIK (LASER IN-SITU KERATOMILEUSIS)

8.3 PHOTOREFRACTIVE KERATECTOMY (PRK)

8.4 PHAKIC INTRAOCULAR LENSES (IOL)

8.5 ASTIGMATIC KERATOTOMY (AK)

8.6 AUTOMATED LAMELLAR KERATOPLASTY (ALK)

8.7 INTRACORNEAL RING (INTACS)

8.8 LASER THERMAL KERATOPLASTY (LTK)

8.9 CONDUCTIVE KERATOPLASTY (CK)

8.1 RADIAL KERATOTOMY (RK)

8.11 OTHERS

9 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NEARSIGHTEDNESS (MYOPIA)

9.3 FARSIGHTEDNESS (HYPEROPIA)

9.4 PRESBYOPIA

9.5 ASTIGMATISM

10 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITAL

10.3 SPECIALTY CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 OTHERS

11 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 THIRD PARTY DISTRIBUTORS

11.4 OTHERS

12 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 FRANCE

12.1.3 U.K.

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 NETHERLANDS

12.1.7 RUSSIA

12.1.8 SWITZERLAND

12.1.9 BELGIUM

12.1.10 TURKEY

12.1.11 AUSTRIA

12.1.12 NORWAY

12.1.13 HUNGARY

12.1.14 LITHUANIA

12.1.15 IRELAND

12.1.16 POLAND

12.1.17 REST OF EUROPE

13 EUROPE REFRACTIVE SURGERY DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 JOHNSON AND JOHNSON SERVICES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.1.5.1 PRODUCT LAUNCH

15.2 ALCON INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.2.5.1 ACQUISITION

15.2.5.2 PRODUCT LAUNCH

15.3 STAAR SURGICAL

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BAUSCH + LOMB INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.4.5.1 ACQUISITION

15.4.5.2 CE APPROVAL

15.5 TOPCON CANADA INC., (A SUBSIDIARY OF TOPCON CORPORATION)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 PARTNERSHIP

15.5.5.2 ACQUISITION

15.6 AAREN SCIENTIFIC INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AMPLITUDE LASER

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.7.3.1 PARTNERSHIP

15.8 BD

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.8.4.1 CONFERENCE

15.8.4.2 PRODUCT LAUNCH

15.9 GLAUKOS CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 PRODUCT LAUNCH

15.9.4.2 ACQUISITION

15.1 HOYA SURGICAL OPTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 CONFERENCE

15.11 IVIS TECHNOLOGIES

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LENSAR INC. (A SUBSDIARY OF PDL BIOPHARMA, INC.)

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 MORIA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 NIDEK CO., LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 WEBSITE LAUNCH

15.15 OPHTEC BV

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 PRODUCT LAUNCH

15.16 RAYNER INTRAOCULAR LENSES LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.16.3.1 NEW DISTRIBUTION UNIT

15.16.3.2 ACQUISITION

15.16.3.3 ACQUISITION

15.17 REICHERT, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.17.3.1 CONFERENCE

15.18 ROWIAK GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.18.3.1 R&D FACILITY

15.19 SCHWIND EYE-TECH-SOLUTIONS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TRACEY TECHNOLOGIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 R&D FACILITY

15.21 ZIEMER OPHTHALMIC SYSTEMS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.21.3.1 AGREEMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE PHAKIC INTRAOCULAR LENS (IOL) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ABBEROMETERS/WAFEFRONT ABERROMETRY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE SURGICAL INSTRUMENT & ACCESSORIES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE REFRACTIVE SURGERY KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE PUPILLARY DIAMETER METERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE EPIKERATOMES IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE MICROKERATOMES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE THERMOKERATOPLASTY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE LIMBAL RELAXING INCISION KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE LASIK (LASER IN-SITU KERATOMILEUSIS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PHOTOREFRACTIVE KERATECTOMY (PRK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE PHAKIC INTRAOCULAR LENSES (IOL) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ASTIGMATIC KERATOTOMY (AK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE AUTOMATED LAMELLAR KERATOPLASTY (ALK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE INTRACORNEAL RING (INTACS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE LASER THERMAL KERATOPLASTY (LTK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE CONDUCTIVE KERATOPLASTY (CK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE RADIAL KERATOTOMY (RK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE NEARSIGHTEDNESS (MYOPIA) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE FARSIGHTEDNESS (HYPEROPIA) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE PRESBYOPIA IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE ASTIGMATISM IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 EUROPE HOSPITALS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE SPECIALTY CLINICS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE AMBULATORY SURGICAL CENTERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 36 EUROPE DIRECT TENDER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE THIRD PARTY DISTRIBUTORS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 GERMANY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 49 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 FRANCE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 55 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 ITALY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 67 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 SPAIN LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 NETHERLANDS LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 RUSSIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 85 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 SWITZERLAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 91 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 BELGIUM LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 97 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 TURKEY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 103 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 AUSTRIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 109 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 NORWAY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 115 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 118 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 119 HUNGARY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 121 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 124 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 LITHUANIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 127 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 IRELAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 133 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 135 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 POLAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 139 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 REST OF EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 EUROPE REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE REFRACTIVE SURGERY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE REFRACTIVE SURGERY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE REFRACTIVE SURGERY DEVICES MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE REFRACTIVE SURGERY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE REFRACTIVE SURGERY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE REFRACTIVE SURGERY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE REFRACTIVE SURGERY DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE REFRACTIVE SURGERY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASING TECHNOLOGICAL ADVANCEMENTS IN THE REFRACTIVE SURGERY DEVICES ARE EXPECTED TO DRIVE THE EUROPE REFRACTIVE SURGERY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE REFRACTIVE SURGERY DEVICES MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE REFRACTIVE SURGERY DEVICES MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGES FOR EUROPE REFRACTIVE SURGERY DEVICES MARKET

FIGURE 15 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 17 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2021

FIGURE 20 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2020-2029 (USD MILLION)

FIGURE 21 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 22 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 23 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2021

FIGURE 24 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 25 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2021

FIGURE 28 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 29 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 33 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 EUROPE REFRACTIVE SURGERY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 36 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 37 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 EUROPE REFRACTIVE SURGERY DEVICES MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.