Mercado europeu de serviços de comprimento de onda ótico, por largura de banda (100 GBPS, inferior e igual a 10 GBPS, mais de 100 GBPS e 40 GBPS), interface (OTN, Ethernet , SONET), por dimensão da organização (pequenas e médias empresas e grandes empresas) ), Por aplicação (longa distância, metro e curta distância), país (Reino Unido, Alemanha, Espanha, Itália, França, Rússia, Bélgica, Turquia, Eslováquia, Holanda, Roménia, Hungria, República Checa, Polónia, Suíça e resto da Europa), Tendências da Indústria e Previsões para 2028

Análise de mercado e insights: Mercado europeu de serviços de comprimento de onda ótico

Análise de mercado e insights: Mercado europeu de serviços de comprimento de onda ótico

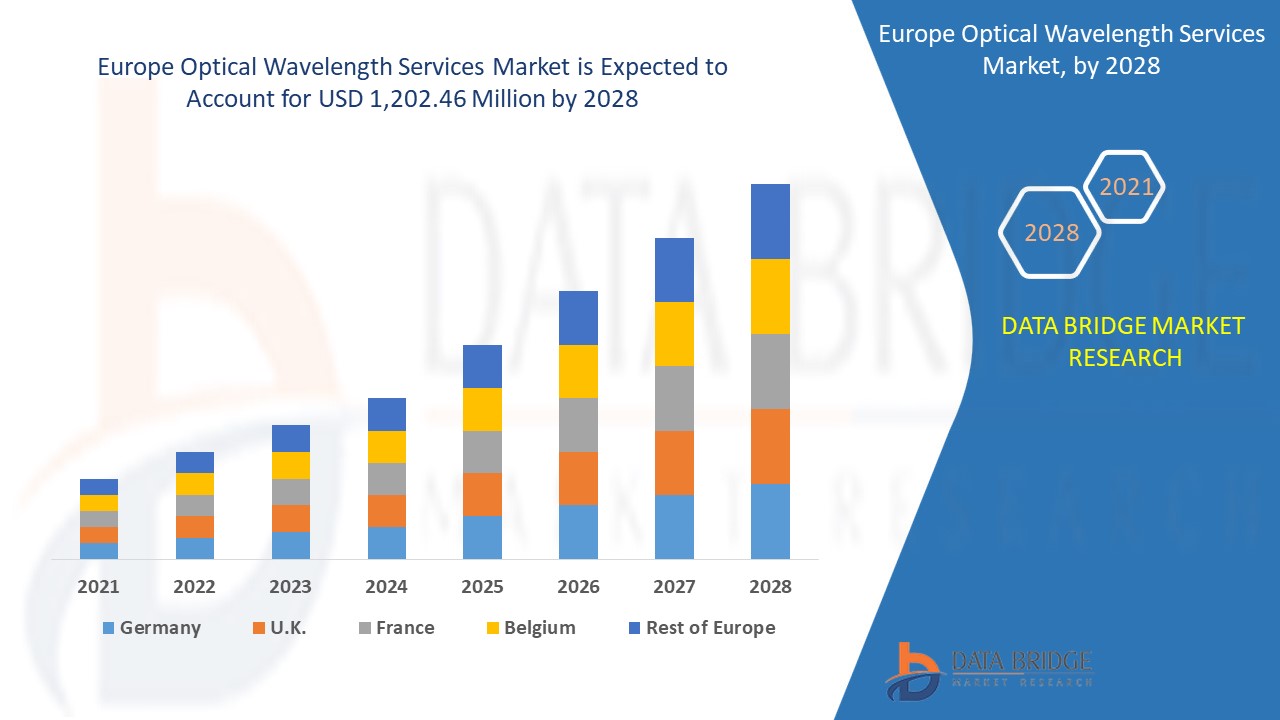

Espera-se que o mercado europeu de serviços de comprimento de onda ótico ganhe crescimento de mercado no período de previsão de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 9,6% no período de previsão de 2021 a 2028 e deverá atingir os 1.202,46 milhões de dólares até 2028. O crescimento da procura de internet de alta velocidade está a atuar como um fator importante para o crescimento do mercado.

Verifica-se um aumento da procura no setor das telecomunicações por elevada largura de banda entre as empresas e também entre os clientes individuais. A comunicação de alta largura de banda permite às organizações abrir o fluxo de tráfego, reduz os investimentos de tempo e os custos dos projetos, tornando mais simples para as empresas mudarem as suas atividades, operações e processos para a tecnologia cloud. Através da comunicação de elevada largura de banda , os sinais de elevada largura de banda são transferidos a uma maior distância, auxiliando a indústria das telecomunicações na transmissão de voz, vídeo e telemetria para diversas fontes. A procura dos consumidores por serviços de dados de alta velocidade para sinais telefónicos, sinais de televisão por cabo, comunicações pela Internet e outros serviços está a aumentar ao longo dos anos, o que resultou num aumento da procura de melhores serviços e qualidade por parte da indústria das telecomunicações.

Este relatório de mercado de serviços de comprimento de onda ótico fornece detalhes de quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos , expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado contacte-nos para um Analyst Brief, a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir o objetivo desejado.

Âmbito do mercado de serviços de comprimento de onda ótico da Europa e dimensão do mercado

Âmbito do mercado de serviços de comprimento de onda ótico da Europa e dimensão do mercado

O mercado europeu de serviços de comprimento de onda ótico é segmentado com base na largura de banda, tamanho da organização, interface e aplicação. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

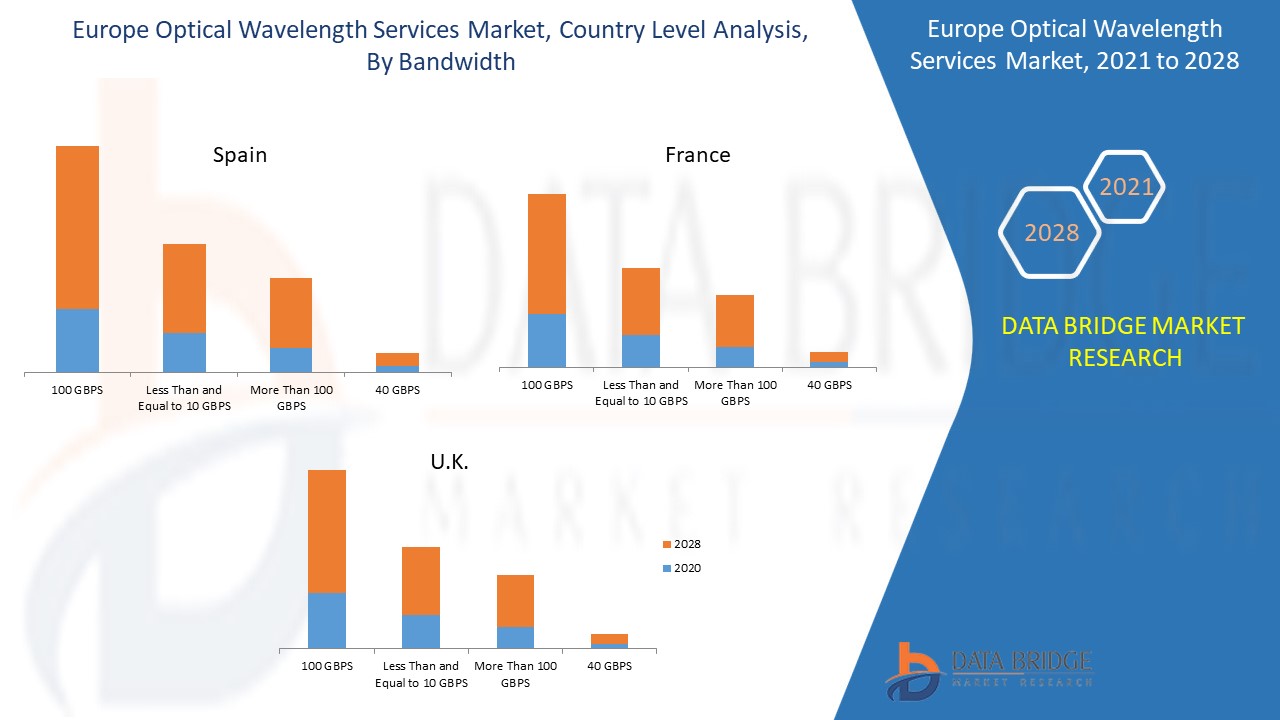

- Com base na largura de banda, o mercado europeu de serviços de comprimento de onda ótico foi segmentado em 100 GBPS, mais pequeno e igual a 10 GBPS, mais de 100 GBPS e 40 GBPS. Em 2021, prevê-se que 100 GBPS dominem o mercado europeu de serviços de comprimento de onda ótico, devido à crescente procura de elevada transmissão de dados, crescentes oportunidades no ambiente de aplicação, crescentes requisitos de capacidade, rápida necessidade de elevada largura de banda dos data centers e mudança para a rede 5G .

- Com base na interface, o mercado europeu de serviços de comprimento de onda ótico foi segmentado em OTN, Ethernet e SONET. Em 2021, prevê-se que a OTN domine o mercado europeu de serviços de comprimento de onda ótico, devido a razões como a escalabilidade para além dos 100 GBPS, a capacidade de transportar vários clientes num comprimento de onda único, a elevada fiabilidade relativa às capacidades de monitorização de ligação, otimização de custos, entre outros.

- Com base na dimensão da organização, o mercado europeu de serviços de comprimento de onda ótico foi segmentado em grandes empresas e pequenas e médias empresas. Em 2021, prevê-se que as pequenas e médias empresas dominem o mercado, atribuído à adoção de iniciativas empresariais digitais, à forte dependência das PME nos EUA e nos países europeus, e que se liguem fortemente com as partes interessadas, de forma a têm uma vantagem sobre os concorrentes

- Com base na aplicação, o mercado europeu de serviços de comprimento de onda ótico foi segmentado em longa distância, metro e curta distância. Em 2021, prevê-se que o longo curso domine o mercado europeu de serviços de comprimento de onda ótico, uma vez que oferece comodidade na ligação de longas distâncias entre diferentes estados dos EUA e países europeus, melhora o desempenho da rede e reduz o custo da rede , e ampla disponibilidade de produtos de comprimento de onda ótico de longo curso

Análise ao nível do país do mercado de serviços de comprimento de onda ótico da Europa

Análise ao nível do país do mercado de serviços de comprimento de onda ótico da Europa

O mercado europeu de serviços de comprimento de onda ótico é analisado e são fornecidas informações sobre o tamanho do mercado por país, largura de banda, tamanho da organização, interface e aplicação

Os países abrangidos no relatório de mercado de serviços de comprimento de onda ótico da Europa são o Reino Unido, Alemanha, Espanha, Itália, França, Rússia, Bélgica, Turquia, Eslováquia, Países Baixos, Roménia, Hungria, República Checa, Polónia, Suíça e Resto da Europa

Espanha domina o mercado europeu de serviços de comprimento de onda óptico devido a factores como a rápida procura de conectividade de alta largura de banda, maior foco na adopção de redes ópticas, maior apoio governamental relativo a iniciativas digitais e investigação e desenvolvimento contínuos para a rede 5G.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado interno que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade das marcas europeias e os desafios enfrentados devido à grande ou escassa concorrência das marcas locais e nacionais, o impacto dos canais de vendas são considerados, ao mesmo tempo que se fornecem uma análise de previsão dos dados do país.

O crescimento da utilização da conectividade LAN e WAN

O mercado europeu de serviços de comprimento de onda ótico também fornece análises de mercado detalhadas para o crescimento da indústria de cada país com vendas, vendas de componentes, impacto do desenvolvimento tecnológico nos serviços de comprimento de onda ótico e mudanças nos cenários regulamentares com o seu apoio ao mercado europeu de serviços de comprimento de onda ótico. Os dados estão disponíveis para o período histórico de 2019.

Análise do panorama competitivo e da quota de mercado dos serviços de comprimento de onda ótico da Europa

O panorama competitivo do mercado europeu de serviços de comprimento de onda ótico fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes, largura e amplitude do produto, domínio de aplicação, curva de segurança da tecnologia. Os dados acima fornecidos estão apenas relacionados com o foco das empresas relacionado com o mercado europeu de serviços de comprimento de onda ótico. Os principais players abordados no relatório são a Lumen Technologies, Charter Communications Inc., Colt Technology Services Group Limited, Comcast Corporation, COX ENTERPRISES, INC., Crown Castle, GTT Communications, Inc., Nokia, T-Mobile USA, Inc., Verizon , Windstream Intellectual Property Services, LLC, Zayo Group, LLC, Huawei Technologies Co., Ltd., ADTRAN, Inc., TDS Telecommunications LLC, Neos Networks, Xeta Group, LLC, Jaguar Network SAS, BCE Global e AT&T Intellectual Property, entre outros. Os analistas DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos desenvolvimentos de produtos são também iniciados por empresas de todo o mundo que estão também a acelerar o crescimento do mercado europeu de serviços de comprimento de onda ótico. As parcerias, joint ventures e outras estratégias aumentam a quota de mercado da empresa com maior cobertura e presença. Oferece também o benefício para as organizações melhorarem a sua oferta de serviços de comprimento de onda ótico através de uma gama alargada de tamanhos.

Por exemplo,

- Em junho, a Windstream Intellectual Property Services, LLC anunciou o lançamento do ICON, Intelligent Converged Optical Network. Este recém-lançado ICON oferece novas funcionalidades e melhorias aos serviços óticos e fornece uma arquitetura eficiente entre redes locais e de longa distância. Isto ajudará a empresa a melhorar as suas ofertas e a crescer no mercado.

- Em fevereiro de 2021, a Nokia estabeleceu uma parceria com a Vodafone para o teste bem-sucedido de uma nova tecnologia de rede ótica passiva (PON) . Esta tecnologia de rede ótica (PON) é capaz de fornecer velocidades até 100 gigabits por segundo (Gb/s) num único comprimento de onda. Isso ajudará a empresa a crescer no mercado.

As parcerias, joint ventures e outras estratégias aumentam a quota de mercado da empresa com maior cobertura e presença. Oferece também o benefício para as organizações melhorarem a sua oferta de serviços de comprimento de onda ótico através de uma gama alargada de tamanhos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE OPTICAL WAVELENGTH SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 BANDWIDTH TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH RATE OF ADOPTION OF OPTICAL WAVELENGTH SERVICES TO MINIMIZE THE BUSINESS EXPENDITURE

5.1.2 EXPAND IN DEMAND FOR HIGH BANDWIDTH COMMUNICATION

5.1.3 GROW IN DEMAND FOR HIGH-SPEED INTERNET

5.1.4 THE GROWTH IN USAGE OF LAN & WAN CONNECTIVITY

5.1.5 INCREASE IN REMOTE WORK AND LEARNING APPLICATIONS

5.2 RESTRAINT

5.2.1 COMPLICATIONS IN REPLACING THE PRE-EXISTING NETWORK INFRASTRUCTURE

5.3 OPPORTUNITIES

5.3.1 INTRODUCTION OF 5G TECHNOLOGY

5.3.2 ADVANCES IN TECHNOLOGIES SUCH AS IOT, AI, AND OTHERS

5.3.3 INCREASE IN ADOPTION OF AUTOMATION ACROSS VARIOUS INDUSTRIES

5.3.4 INCREASE IN EMPHASIS ON RESEARCH AND DEVELOPMENT ACTIVITIES

5.3.5 GROW IN INCLINATION TOWARDS DIGITALIZATION

5.4 CHALLENGES

5.4.1 LACK OF TECHNICAL KNOWLEDGE

5.4.2 LIMITED AVAILABILITY OF INCREMENTAL BANDWIDTH OF OPTICAL WAVELENGTHS

6 IMPACT ANALYSIS OF COVID-19 ON EUROPE OPTICAL WAVELENGTH SERVICES MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE EUROPE OPTICAL WAVELENGTH SERVICES MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND AND SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH

7.1 OVERVIEW

7.2 GBPS

7.3 LESS THAN AND EQUAL TO 10 GBPS

7.4 MORE THAN 100 GBPS

7.5 GBPS

8 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE

8.1 OVERVIEW

8.2 OTN

8.3 ETHERNET

8.4 SONET

9 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 SMALL AND MEDIUM ENTERPRISES

9.2.1 OTN

9.2.2 ETHERNET

9.2.3 SONET

9.3 LARGE ENTERPRISES

9.3.1 OTN

9.3.2 ETHERNET

9.3.3 SONET

10 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 LONG HAUL

10.3 METRO

10.4 SHORT HAUL

11 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY COUNTRY

11.1 EUROPE

11.1.1 SPAIN

11.1.2 FRANCE

11.1.3 U.K.

11.1.4 RUSSIA

11.1.5 ITALY

11.1.6 BELGIUM

11.1.7 TURKEY

11.1.8 GERMANY

11.1.9 SLOVAKIA

11.1.10 NETHERLANDS

11.1.11 ROMANIA

11.1.12 HUNGARY

11.1.13 CZECH REPUBLIC

11.1.14 POLAND

11.1.15 SWITZERLAND

11.1.16 REST OF EUROPE

12 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 AT&T INTELLECTUAL PROPERTY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 SERVICES PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 COMCAST CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 T MOBILE USA, INC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 SOLUTION PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 VERIZON

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 LUMEN TECHNOLOGIES

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 ADTRAN, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 BCE GLOBAL

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCTS & SERVICES PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 CHARTER COMMUNICATIONS INC

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 SERVICE PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 COLT TECHNOLOGY SERVICES GROUP LIMITED

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 COX ENTERPRISES, INC

14.10.1 COMPANY SNAPSHOT

14.10.2 BUSINESS PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 CROWN CASTLE

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 SOLUTION PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 GTT COMMUNICATIONS, INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SERVICE PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 HUAWEI TECHNOLOGIES CO., LTD

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 JAGUAR NETWORK SAS

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 SOLUTION PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 NEOS NETWORKS

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCTS & SERVICES PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 NOKIA

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 SOLUTION PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 TDS TELECOMMUNICATIONS LLC

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SERVICES PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 WINDSTREAM INTELLECTUAL PROPERTY SERVICES, LLC

14.18.1 COMPANY SNAPSHOT

14.18.2 BUSINESS PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 XETA GROUP, LLC

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 ZAYO GROUP, LLC

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 2 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 3 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 4 EUROPE SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 5 EUROPE LARGE ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 6 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, MARKET FORECAST 2019-2028 (USD MILLION)

TABLE 7 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 8 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 9 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 10 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 11 EUROPE SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 12 EUROPE LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 13 EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 14 SPAIN OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 15 SPAIN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 16 SPAIN OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 17 SPAIN SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 18 SPAIN LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 19 SPAIN OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 20 FRANCE OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 21 FRANCE OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 22 FRANCE OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 23 FRANCE SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 24 FRANCE LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 25 FRANCE OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 26 U.K. OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 27 U.K. OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 28 U.K. OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 29 U.K. SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 30 U.K. LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 31 U.K. OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 32 RUSSIA OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 33 RUSSIA OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 34 RUSSIA OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 35 RUSSIA SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 36 RUSSIA LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 37 RUSSIA OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 38 ITALY OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 39 ITALY OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 40 ITALY OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 41 ITALY SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 42 ITALY LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 43 ITALY OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 44 BELGIUM OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 45 BELGIUM OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 46 BELGIUM OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 47 BELGIUM SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 48 BELGIUM LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 49 BELGIUM OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 50 TURKEY OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 51 TURKEY OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 52 TURKEY OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 53 TURKEY SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 54 TURKEY LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 55 TURKEY OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 56 GERMANY OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 57 GERMANY OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 58 GERMANY OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 59 GERMANY SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 60 GERMANY LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 61 GERMANY OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 62 SLOVAKIA OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 63 SLOVAKIA OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 64 SLOVAKIA OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 65 SLOVAKIA SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 66 SLOVAKIA LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 67 SLOVAKIA OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 68 NETHERLANDS OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 69 NETHERLANDS OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 70 NETHERLANDS OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 71 NETHERLANDS SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 72 NETHERLANDS LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 73 NETHERLANDS OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 74 ROMANIA OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 75 ROMANIA OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 76 ROMANIA OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 77 ROMANIA SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 78 ROMANIA LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 79 ROMANIA OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 80 HUNGARY OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 81 HUNGARY OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 82 HUNGARY OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 83 HUNGARY SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 84 HUNGARY LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 85 HUNGARY OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 86 CZECH REPUBLIC OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 87 CZECH REPUBLIC OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 88 CZECH REPUBLIC OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 89 CZECH REPUBLIC SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 90 CZECH REPUBLIC LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 91 CZECH REPUBLIC OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 92 POLAND OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 93 POLAND OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 94 POLAND OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 95 POLAND SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 96 POLAND LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 97 POLAND OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 98 SWITZERLAND OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

TABLE 99 SWITZERLAND OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 100 SWITZERLAND OPTICAL WAVELENGTH SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 101 SWITZERLAND SMALL & MEDIUM ENTERPRISES IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 102 SWITZERLAND LARGE ENTERPRISE IN OPTICAL WAVELENGTH SERVICES MARKET, BY INTERFACE, 2019-2028 (USD MILLION)

TABLE 103 SWITZERLAND OPTICAL WAVELENGTH SERVICES MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 104 REST OF EUROPE OPTICAL WAVELENGTH SERVICES MARKET, BY BANDWIDTH, 2019-2028 (USD MILLION)

Lista de Figura

FIGURE 1 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: U.S. VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: SEGMENTATION

FIGURE 11 HIGH RATE OF ADOPTION OF OPTICAL WAVELENGTH SERVICES TO MINIMIZE THE BUSINESS EXPENDITURE IS EXPECTED TO DRIVE EUROPE OPTICAL WAVELENGTH SERVICES MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 GBPS BANDWIDTH SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE OPTICAL WAVELENGTH SERVICES MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE OPTICAL WAVELENGTH SERVICES MARKET

FIGURE 14 INTERNET PENETRATION RATES IN THE WORLD, BY GEOGRAPHIC REGION, 2021

FIGURE 15 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: BY BANDWIDTH, 2020

FIGURE 16 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: BY INTERFACE, 2020

FIGURE 17 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: BY ORGANIZATION SIZE, 2020

FIGURE 18 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: BY APPLICATION, 2020

FIGURE 19 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: SNAPSHOT (2020)

FIGURE 20 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: BY COUNTRY (2020)

FIGURE 21 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 22 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: BY COUNTRY (2020 & 2028)

FIGURE 23 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: BY BANDWIDTH (2021-2028)

FIGURE 24 EUROPE OPTICAL WAVELENGTH SERVICES MARKET: COMPANY SHARE 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.