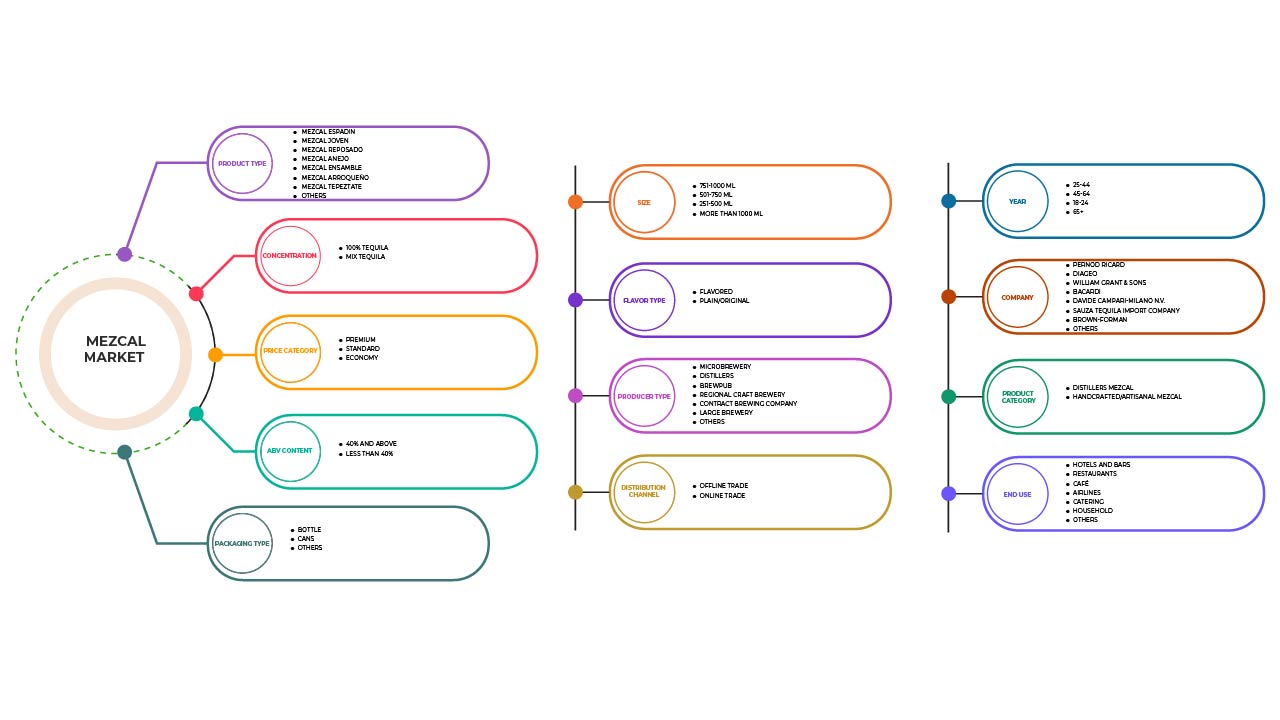

Mercado Europeu de Mezcal, Por Tipo de Produto (Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Espadin, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble e Outros), Concentrado (100% Tequila e Mix Tequila), Categoria de Preço (Premium, Standard e Economia), Teor ABV (40% e acima e inferior a 40%), Ano (18-24 anos, 25-44 anos, 45-64 anos, 65+ anos), Tipo de embalagem (garrafa, latas e outros ), Tamanho (251-500 ml, 501-750 ml, 751-1000 ml e mais de 100 ml), tipo de sabor (simples/original e com sabor), tipo de produtor (microcervejaria, destilaria , cervejaria artesanal, empresa de fabrico de cerveja contratada, cervejaria artesanal regional) , Grande Cervejaria e Outros), Categoria de Produto (Destilarias Mezcan e Mezcan Artesanal/Mezcan Artesanal), Utilizador Final (Restaurantes, Hotéis e Bares, Cafés, Buffet, Companhias Aéreas, Domésticos e Outros) , Canal de Distribuição (Comércio Off-line e Comércio Online ) – Tendências e previsões do setor até 2029.

Análise e dimensão do mercado de mezcal na Europa

As diferentes espécies de agave utilizadas, que possuem uma grande variedade de compostos terpênicos, a capacidade de utilizar folhas de agave na fermentação do mezcal, variações no estado de maturação do agave, cozedura do agave que pode ser feita em buracos no solo com madeira queimada e pedras aquecidas que produzem furanos e voláteis fumados e são retidos no agave, e algumas ervas ou outros materiais naturais (como minhocas) podem contribuir para as diferenças de sabor entre os mezcal.

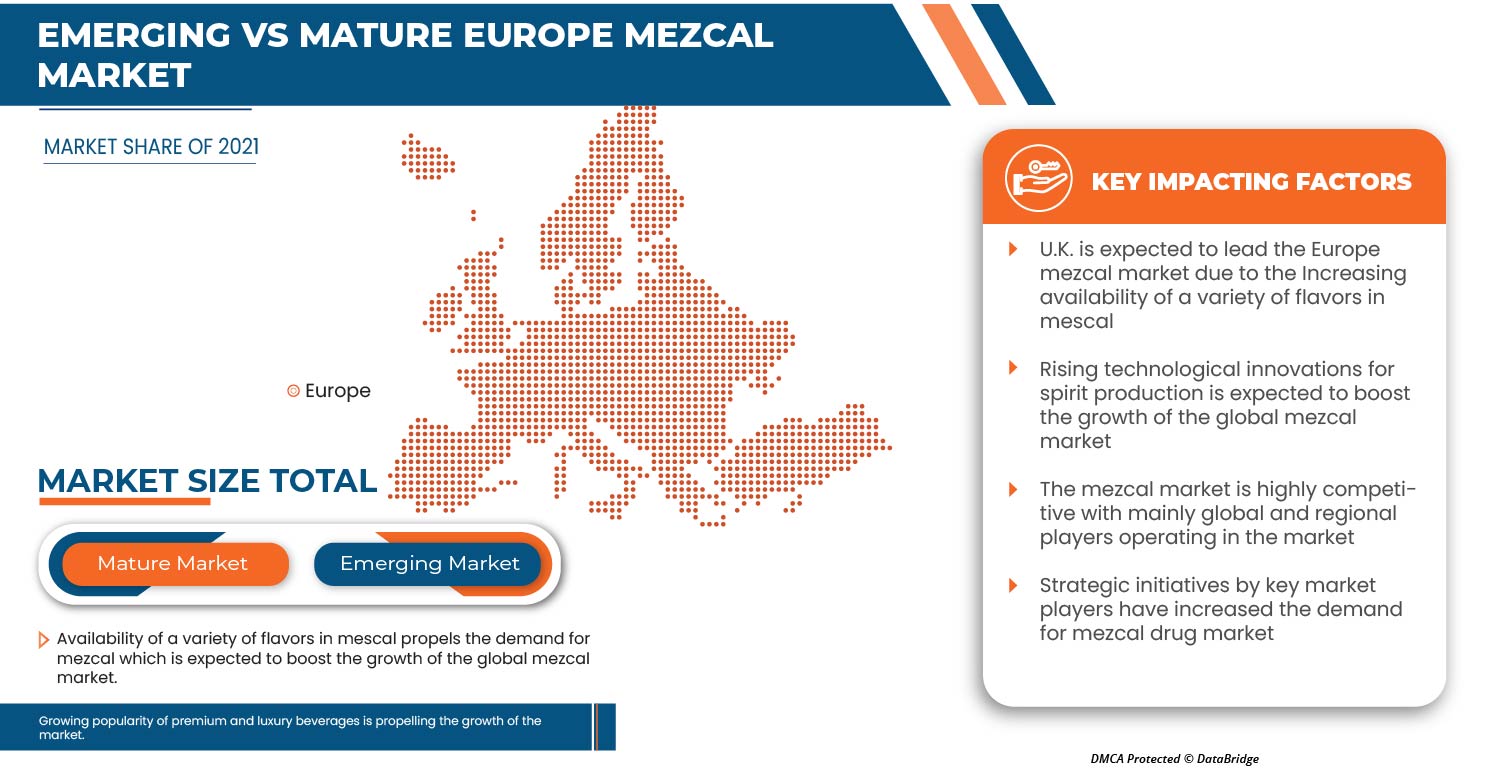

A crescente procura dos consumidores pela bebida mezcal, a perspetiva positiva em relação a soluções de embalagens avançadas e inteligentes e o aumento do número de unidades de produção estão a impulsionar a procura do mercado de mezcal no período previsto. No entanto, espera-se que os elevados impostos e taxas, para além das regras e regulamentos rigorosos, dificultem o crescimento do mercado do mezcal no período previsto.

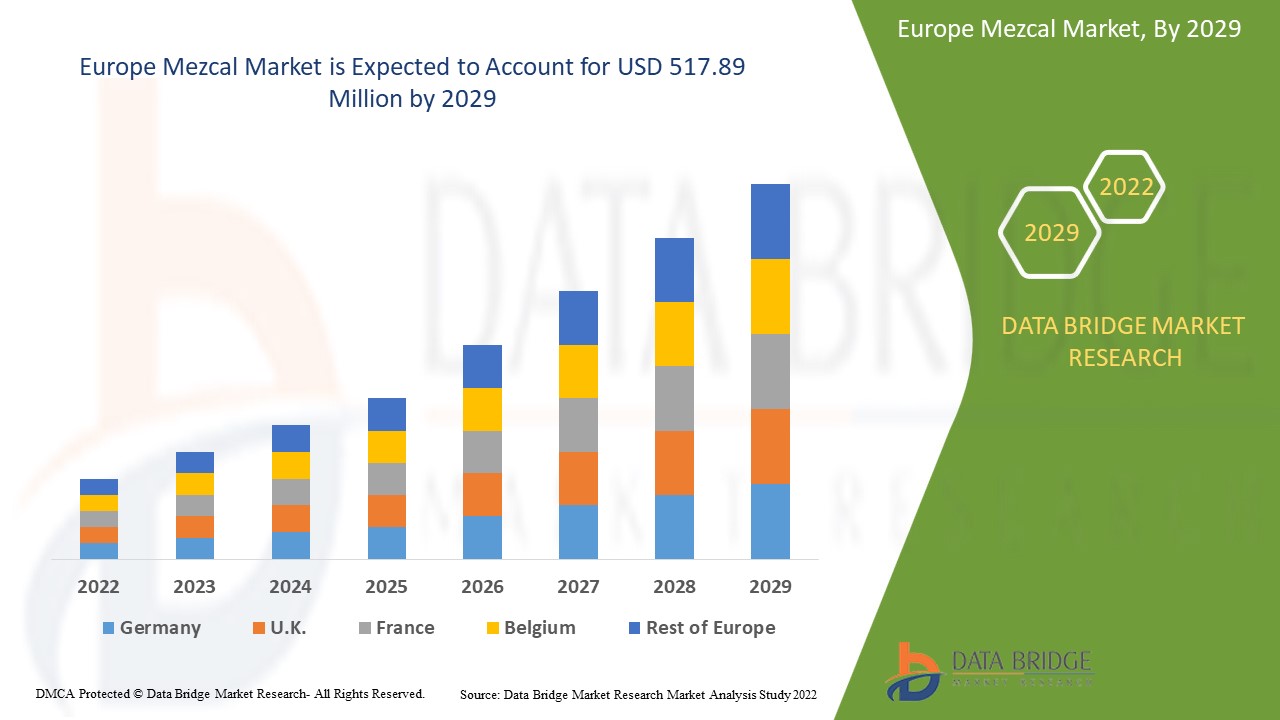

A Data Bridge Market Research analisa que o mercado do mezcal deverá atingir um valor de 517,89 milhões de dólares até 2029, com um CAGR de 23,7% durante o período previsto. A crescente procura dos consumidores pela bebida mezcal, a perspetiva positiva em relação a soluções de embalagens avançadas e inteligentes e o aumento do número de unidades de produção estão a impulsionar a procura do mercado de mezcal. O relatório de mercado do mezcal também abrange análises de preços, análises de patentes e avanços tecnológicos em profundidade.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2019-2014) |

|

Unidades quantitativas |

Receita em milhões de dólares, volumes em quilolitros |

|

Segmentos abrangidos |

Por tipo de produto (Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Espadin, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble e outros), concentrado (100% Tequila e Mix Tequila), categoria de preço (Premium, Standard e Economy), ABV Conteúdo (40% e acima e menos de 40%), Ano (18-24 anos, 25-44 anos, 45-64 anos, 65+ anos), Tipo de embalagem (garrafa, latas e outros), Tamanho (251 - 500 ml, 501-750 ml, 751-1000 ml e mais de 100 ml), tipo de sabor (simples/original e aromatizado), tipo de produtor (microcervejaria, destilaria , cervejaria artesanal regional, cervejaria grande, E outros), categoria de produto (destilarias Mezcan e Mezcan artesanal/Artesanal Mezcan), utilizador final (restaurantes, hotéis e bares, cafés, serviços de catering, companhias aéreas, residências e outros), canal de distribuição (comércio offline e comércio online ) |

|

Países abrangidos |

Reino Unido, Alemanha, França, Espanha, Itália, Holanda, Suíça, Rússia, Bélgica, Turquia, Resto da Europa |

|

Atores do mercado abrangidos |

As principais empresas que operam no mercado são a Davide Campari-Milano NV, BACARDI, Craft Distillers, MADRE MEZCAL, Familia Camarena, Brown-Forman, Diageo, Pernod Ricard, WILLIAM GRANT & SONS LTD, entre outras. |

Definição de Mercado

Mezcal é o nome dado às bebidas alcoólicas destiladas tradicionais feitas em várias zonas rurais do México, desde certos estados do norte até aos estados do sul, que é em nahuatl mexcalli, "agave assado". Estas bebidas alcoólicas são feitas a partir de caules cozidos de espécies do género Agave, também conhecidas por "maguey", que possuem açúcares fermentados. É uma bebida destilada tradicional mexicana produzida a partir de sucos fermentados do miolo cozido da planta agave. É um tipo de bebida alcoólica destilada feita a partir de corações cozidos e fermentados, ou piñas, de plantas de agave.

Dinâmica do Mercado do Mezcal

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

- DISPONIBILIDADE DE VARIEDADE DE SABORES EM MEZCAL

A qualidade e autenticidade do mezcal são altamente cruciais devido ao sabor alcoólico único da bebida, que resulta dos compostos voláteis e não voláteis, cujos precursores diretos provêm do próprio agave cru. Isto inclui ácidos gordos, que vão do cáprico ao lignocérico, ácidos gordos livres, β-sitosterol e grupos de mono-, di- e triacilgliceróis, bem como frutanos, o principal hidrato de carbono da Agave. Devido às temperaturas mais elevadas e ao pH mais baixo no processo de cozedura do agave, os frutanos podem formar compostos de Maillard, como furanos, piranos e cetonas.

Além disso, o parâmetro importante que define a qualidade das bebidas de agave é o sistema de destilação utilizado. A composição do aroma do mezcal é extremamente complexa. As semelhanças e diferenças entre amostras de mezcal podem ser atribuídas às condições e às matérias-primas utilizadas, para além da origem e da época de produção.

Devido à disponibilidade de vários sabores no mezcal, os consumidores preferem-no a outras bebidas artesanais. Além disso, espera-se que o crescente interesse dos consumidores por produtos de origem ética e a tendência para promover bebidas como a cerveja artesanal, os sumos prensados a frio e os batidos com ingredientes naturais como o premium impulsionem o crescimento do mercado no período previsto.

- INOVAÇÕES TECNOLÓGICAS CRESCENTES PARA A PRODUÇÃO DE BEBIDAS ALCOÓLICAS

A planta agave é extraída e utilizada na produção de bebidas alcoólicas, enriquecendo o perfil volátil do mezcal. O processo de extração tradicional leva frequentemente a um maior consumo de solvente, tempos de extração mais longos, rendimentos mais baixos e pior qualidade de extração. A destilação do maguey fermentado é necessária para produzir diversas bebidas alcoólicas destiladas, como a bacanora, a tequila e o mezcal. Assim, os avanços tecnológicos criaram uma oportunidade para a produção sustentável de extratos e bebidas espirituosas. Os fabricantes estão envolvidos em inovações tecnológicas e de produtos para reduzir os custos de extração e fabrico. As empresas podem melhorar a rastreabilidade dos produtos utilizando tecnologias inovadoras que podem aumentar consideravelmente a eficácia e a eficiência das cadeias de abastecimento, particularmente em setores como o alimentar e bebidas, farmacêutico e da saúde.

O processo de fermentação gera etanol, álcoois superiores, ésteres, ácidos orgânicos e outros. Alguns destes compostos voláteis são de maior importância que outros devido às suas concentrações ou características aromáticas; algumas podem ser específicas da espécie agave. Desta forma, espera-se que a crescente tecnologia avançada de produção impulsione o mercado europeu de mezcal.

- PERSPECTIVA POSITIVA PARA SOLUÇÕES DE EMBALAMENTO AVANÇADAS E INTELIGENTES

O setor das embalagens de vinho está a adotar soluções inteligentes e sustentáveis para tornar a embalagem dos produtos mais orientada para o consumidor e amiga do ambiente. A premiumização torna uma marca ou produto mais atraente para os consumidores ao enfatizar a sua qualidade superior e exclusividade na categoria de bebidas à base de agave, tornando a marca mais atraente e, portanto, mais cara. Isto pode advir de novas embalagens, produção artesanal, ingredientes de maior qualidade, novos sabores e mensagens sociais/ambientais.

Além disso, as embalagens impressas digitalmente oferecem um potencial de poupança considerável em relação a outros processos de impressão e baixos custos de configuração. Os fabricantes podem dispensar encomendas em grandes quantidades com grandes tiragens e stock. As empresas de design de marcas populares preferem garrafas de vidro para embalagens de Mezcal. Os benefícios da impressão digital são essenciais para o setor atual da embalagem. A impressão digital é o processo ideal para tiragens pequenas e médias e permite a criação de impressões personalizadas para embalagens e expositores. Além disso, a maior parte do mezcal disponível online é embalado em garrafas de vidro.

Assim, devido aos lançamentos e desenvolvimentos de novos produtos, espera-se que um aumento da procura de embalagens avançadas e inteligentes atue como um impulsionador para o mercado europeu de mezcal.

Restrições

- PESADOS IMPOSTOS E TAXAS

A crescente procura de bebidas alcoólicas em todo o mundo aumentou as importações no mercado em crescimento. Mas espera-se que os impostos e as pesadas taxas alfandegárias restrinjam este mercado, pois limitam o seu crescimento e encarecem o custo do produto. Espera-se, portanto, que isto restrinja a procura pelos produtos.

Desta forma, os impostos pesados e os impostos especiais de consumo aumentam automaticamente os preços dos produtos e tornam o álcool mais caro, o que diminui a procura do produto. Isto resulta mesmo na perda de clientes, o que prejudica diretamente o mercado em geral e deverá restringir o seu crescimento.

Oportunidades/ Desafios

- POPULARIDADE CRESCENTE DE BEBIDAS PREMIUM E DE LUXO

A capacidade de monitorizar os níveis de colesterol e os níveis de açúcar no sangue. O crescimento do mercado é ainda impulsionado pelo aumento do rendimento disponível e do poder de compra do consumidor, factores que aumentam a procura dos consumidores por uma variedade de bens. A procura de mezcal está a aumentar devido à tendência de premiumização, incentivando o consumo de bebidas alcoólicas e não alcoólicas de alto padrão. Mais do que beber álcool faz parte da tendência de premiumização. Entre os clientes da geração Y, existe uma procura crescente por produtos de mezcal premium. Devido ao aumento do rendimento disponível nos países desenvolvidos, como a América do Norte e a Europa Ocidental, estão dispostos a gastar muito dinheiro em produtos de alta qualidade e superpremium. Devido ao aumento do rendimento disponível do consumidor por pessoa e à contínua expansão da economia, o mercado de bebidas destiladas premium de alta qualidade aumentou 5% a 6% por ano em volume de 2019 a 2021.

Prevê-se que o mercado se expanda ao longo do período previsto, uma vez que a procura de mezcal cresceu drasticamente nos últimos anos. A crescente procura de mezcal premium é uma oportunidade para o crescimento do mercado europeu de mezcal.

- CRESCENTE POPULARIDADE DE BEBIDAS SAUDÁVEIS E NÃO ALCOÓLICAS

Uma das indústrias que mais se desenvolve é a das bebidas, que envolve a produção de diversas bebidas, como o mezcal. A crescente consciencialização do consumidor sobre a utilização de componentes naturais e orgânicos em alimentos e bebidas deverá criar um desafio na taxa de crescimento da indústria do mezcal no futuro.

Muitos alimentos e bebidas fermentados contêm carbamato de etilo (EC), um conhecido carcinogéneo genotóxico. O carbamato de etilo não é apenas cancerígeno, mas também um conhecido agente tóxico para o fígado humano. Além disso, o consumo de bebidas gaseificadas tem sido associado a cálculos renais, todos eles fatores de risco para a doença renal crónica. O número crescente de doenças crónicas do fígado e dos rins faz com que os consumidores se consciencializem da necessidade de beber de forma saudável. Hoje em dia, as pessoas preferem mais as bebidas não alcoólicas devido a estas condições de saúde.

Desta forma, o aumento das condições de saúde crónicas está a sensibilizar os consumidores para o uso de bebidas não alcoólicas, o que pode representar um desafio ao crescimento do mercado.

Impacto pós-COVID-19 no mercado do mezcal

O surto de COVID-19 teve um impacto significativo na indústria do mezcal. O bloqueio prejudicou a produção europeia e irá agravar a incerteza comercial e a actual crise industrial. Comparativamente falando, a pandemia teve pouco efeito nas operações do sector alimentar e das bebidas, mas a sua cadeia de abastecimento na Europa foi gravemente interrompida, o que impediu um maior crescimento. A mudança do consumidor impactou negativamente o comportamento de compra do consumidor. O sector sofreu efeitos a curto e longo prazo devido ao surgimento de muitos obstáculos, incluindo a suspensão de inúmeras operações, o crescimento empresarial prejudicado e outros problemas. Estas questões tiveram um impacto significativo na oferta e na procura. O setor alimentar e das bebidas foi um dos afetados pelas interrupções na produção e no fornecimento de matéria-prima.

As cadeias de abastecimento mundiais foram prejudicadas pelo encerramento de muitas indústrias, o que interrompeu as atividades industriais, os calendários de entrega e a venda de vários produtos. Várias empresas já alertaram que qualquer atraso nas entregas de produtos pode prejudicar as vendas futuras dos seus produtos. A interrupção de viagens afeta o setor industrial, uma vez que interfere com o planeamento da empresa e com o trabalho em equipa. Tanto os retalhistas online como os offline fornecem mezcal; o setor offline sofreu perdas significativas devido aos encerramentos e alertas contra saídas para diminuir o efeito da COVID-19, mas o setor online tem registado um maior crescimento. Além disso, as coisas estão a melhorar porque há menos casos de COVID em todo o mundo, e o mercado está a crescer rapidamente e continuará a crescer durante o período de projeção. Como resultado, prevê-se que o mercado se expanda significativamente após a COVID-19.

Desenvolvimentos recentes

- Em janeiro de 2022, a Diageo PLC adquiriu a Mezcal Union através da aquisição da Casa UM. A Mezcal Union é uma das marcas líderes na produção de mezcal. A empresa utilizou esta aquisição para expandir o seu negócio de bebidas mezcal

- Em abril de 2021, a Madre Mezcal, uma das marcas de mezcal de crescimento mais rápido na América, angariou 3 milhões de dólares para aplicar a estratégia de crescimento bem-sucedida da marca a novos produtos e mercados. A ronda Série A foi liderada pela Room 9, um estúdio de capital de risco sediado em Nova Iorque, especializado em investimentos no setor do consumo

Âmbito do mercado de mezcal na Europa

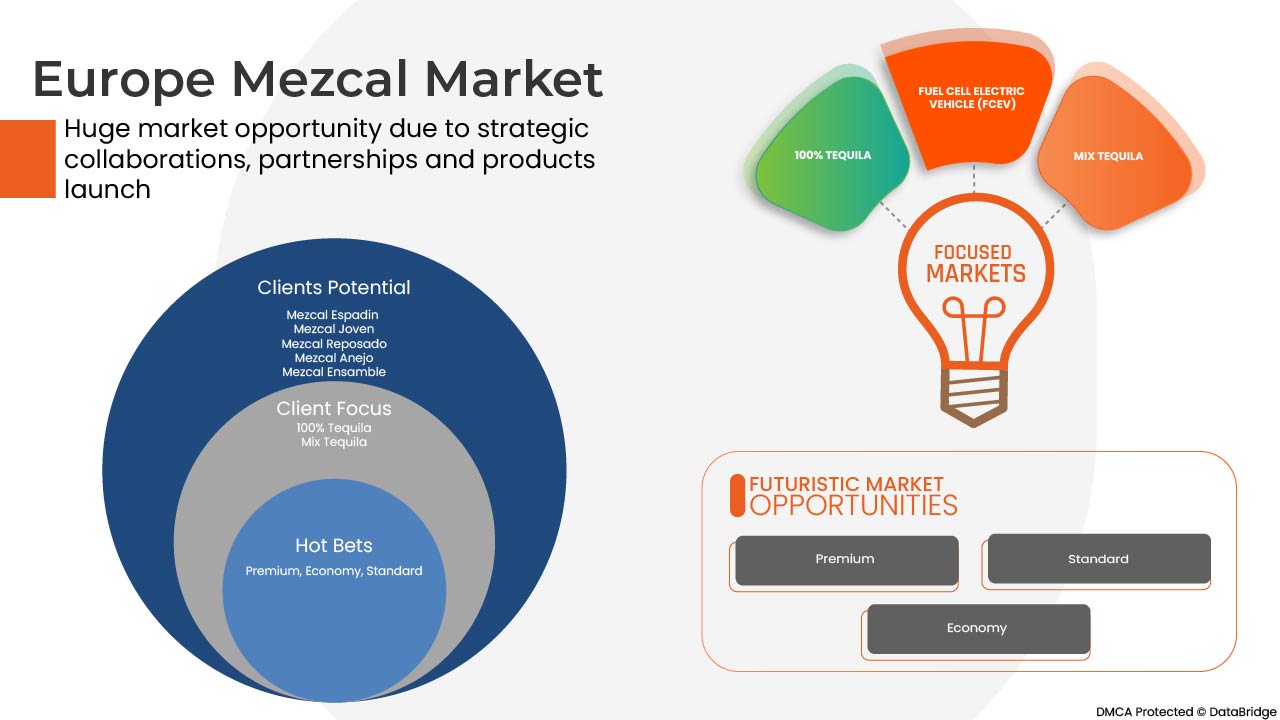

O mercado europeu de mezcal é segmentado com base no tipo de produto, concentrado, categoria de preço, teor de ABV, ano, tipo de embalagem, tamanho, tipo de sabor, tipo de produtor, categoria de produto, utilizador final e canal de distribuição . O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo de produto

- Mezcal Espadin

- Mezcal Jovem

- Mezcal Reposado

- Mezcal Anejo

- Conjunto de Mezcal

- Mezcal Arroqueño

- Mezcal Tepeztate

- Outros

Com base no tipo de produto, o mercado europeu de mezcal está segmentado em mezcal joven, mezcal reposado, mezcal anejo, mezcal espadin, mezcal tepztate, mezcal arroqueño, mezcal ensamble e outros.

CONCENTRADO

- 100% Tequila

- Misture Tequila

Com base no concentrado, o mercado europeu de mezcal foi segmentado em tequila 100% e tequila mista.

CATEGORIA DE PREÇO

- Prémio

- Padrão

- Economia

Com base na categoria de preço, o mercado europeu de mezcal foi segmentado em premium, standard e económico.

TEOR ABV

- 40% e acima

- Menos de 40%

Com base no teor de álcool, o mercado europeu de mezcal foi segmentado em abaixo de 40% e acima e menos de 40%.

ANO

- 18-24

- 25-44

- 45-64

- 65+

Com base no ano, o mercado europeu de mezcal foi segmentado em 18-24 anos, 25-44 anos, 45-64 anos e 65+ anos

TIPO DE EMBALAGEM

- Garrafa

- Latas

- Outros

Com base no tipo de embalagem, o mercado europeu de mezcal foi segmentado em garrafas, latas e outros.

TAMANHO

- 251-500 ml

- 501-750 ml

- 751-1000 ml

- mais de 100 ml

Com base no tamanho, o mercado europeu de mezcal foi segmentado em 251-500 ml, 501-750 ml, 751-1000 ml, mais de 100 ml

TIPO DE SABOR

- Simples/Original

- Saborizado

Com base no tipo de sabor, o mercado europeu de mezcal foi segmentado em simples/original e aromatizado.

TIPO DE PRODUTOR

- Microcervejaria

- Destiladores

- Cervejaria

- Empresa de fabrico de cerveja contratada

- Cervejaria artesanal regional

- Grande cervejaria

- Outros

Com base no tipo de produtor, o mercado europeu de mezcal foi segmentado em microcervejarias, destilarias, cervejarias artesanais, empresas de fabrico de cerveja por contrato, cervejarias artesanais regionais, grandes cervejarias e outras.

CATEGORIA DE PRODUTO

- Destiladores mezcan

- Mezcan artesanal/ mezcan artesanal

Com base na categoria de produto, o mercado europeu de mezcal foi segmentado em mezcan de destilaria e mezcan artesanal.

USO FINAL

- Restaurantes

- Hotéis e bares

- Café

- Restauração

- Companhias aéreas

- Agregado familiar

- Outros

Com base no utilizador final, o mercado europeu de mezcal foi segmentado em restaurantes, hotéis e bares, cafés, buffet, companhias aéreas, residências e outros.

CANAL DE DISTRIBUIÇÃO

- Comércio offline

- Comércio online

Com base no canal de distribuição, o mercado europeu de mezcal foi segmentado em comércio offline e comércio online.

Análise/Insights Regionais do Mercado de Mezcal

O mercado de mezcal é analisado, e são fornecidos insights e tendências de tamanho de mercado por país, tipo de produto, concentrado, categoria de preço, conteúdo ABV, ano, tipo de embalagem, tamanho, tipo de sabor, tipo de produtor, categoria de produto, utilizador final e canal de distribuição.

Os países abrangidos pelo relatório do mercado de mezcal na Europa são o Reino Unido, Alemanha, França, Espanha, Itália, Países Baixos, Suíça, Rússia, Bélgica, Turquia e Resto da Europa.

O Reino Unido está a dominar o mercado europeu de mezcal com um CAGR de cerca de 26,9%. A ampla base da indústria de bebidas no país deverá impulsionar o crescimento do mercado.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas europeias e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado do mezcal

O cenário competitivo do mercado do mezcal fornece detalhes dos concorrentes. Os detalhes incluem a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na Europa, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento do produto, amplitude e amplitude do produto e aplicação domínio. Os pontos de dados acima estão apenas relacionados com o foco das empresas no mercado do mezcal.

Alguns dos principais players que operam no mercado do mezcal são Davide Campari-Milano NV, BACARDI, Craft Distillers, MADRE MEZCAL, Familia Camarena, Brown-Forman, Diageo, Pernod Ricard, WILLIAM GRANT & SONS LTD, Rey Campero, Tequila & Mezcal Private Marcas SA de CV, Destilería Tlacolula, El Silencio Holdings, INC., Sauza Tequila Import Company, Dos Hombres LLC. , Del Maguey, Wahaka Mezcal., BOZAL MEZCAL Sombra, Pensador Mezcal, Ilegal Mezcal entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE MEZCAL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKETING STRATEGY OPTED BY MICROBREWERIES

4.1.1 CREATING CUSTOM PACKAGING

4.1.2 PROVIDING BUSINESS PERSPECTIVES

4.1.3 SOCIAL MEDIA USE

4.1.4 DESIGNING CUSTOMER LOYALTY INITIATIVES

4.1.5 GETTING INVOLVED WITH THE COMMUNITY

4.2 KEY TRENDS SCENARIO

4.2.1 PREMIUMISATION

4.2.2 VALUE FOR MONEY

4.2.3 HEALTH AND WELL BEING

4.2.4 CONSUMER AWARENESS

4.2.5 PRODUCT INNOVATION

4.2.6 AVAILABILITY OF LOCAL PRODUCTS

4.2.7 OTHERS

4.3 FACTORS INFLUENCING PURCHASE DECISION

4.4 KEY DEMOGRAPHIC CONSUMER BASE INCLUDE:

4.5 PRICE ANALYSIS

4.6 PROMOTIONAL ACTIVITIES ADOPTED BY KEY MARKET PLAYERS

4.7 PRIVATE LABEL VS BRAND LABEL

4.8 TAXATION AND DUTY LEVIES

5 SUPPLY CHAIN OF EUROPE MEZCAL MARKET

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

5.5 LOGISTIC COST SCENARIO

5.6 IMPORTANCE OF LOGISTIC SERVICE PROVIDER

6 EUROPE MEZCAL MARKET: SHOPPING BEHAVIOUR

6.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

6.2 RESEARCH

6.3 IMPULSIVE

6.4 ADVERTISEMENT:

6.4.1 TELEVISION ADVERTISEMENT

6.4.2 ONLINE ADVERTISEMENT

6.4.3 IN-STORE ADVERTISEMENT

7 EUROPE MEZCAL MARKET: REGULATIONS

7.1 REGULATION IN U.S

7.2 REGULATION IN EUROPE

7.3 REGULATION IN AUSTRALIA

8 EUROPE MEZCAL MARKET, NEW PRODUCT LAUNCH STRATEGY

8.1 OVERVIEW

8.2 NUMBER OF PRODUCT LAUNCHES

8.2.1 LINE EXTENSION

8.2.2 NEW PACKAGING

8.2.3 RE-LAUNCHED

8.2.4 NEW FORMULATION

8.3 DIFFERENTIAL PRODUCT OFFERING

8.4 MEETING CONSUMER REQUIREMENT

8.5 PACKAGE DESIGNING

8.6 PRICING ANALYSIS

8.7 PRODUCT POSITIONING

8.8 CONCLUSION

9 EXPORT AND IMPORT TRADE ANALYSIS

9.1 EXPORT ANALYSIS OF SPIRIT DRINKS

9.2 IMPORT ANALYSIS OF SPIRIT DRINKS

10 EUROPE MEZCAL MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

10.1 OVERVIEW

10.2 SOCIAL FACTORS

10.3 CULTURAL FACTORS

10.4 PSYCHOLOGICAL FACTORS

10.5 PERSONAL FACTORS

10.6 ECONOMIC FACTORS

10.7 PRODUCT TRAITS

10.8 MARKET ATTRIBUTES

10.9 EUROPE CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

10.1 CONCLUSION

11 MARKET OVERVIEW

11.1 DRIVERS

11.1.1 AVAILABILITY OF A VARIETY OF FLAVORS IN MEZCAL

11.1.2 RISING TECHNOLOGICAL INNOVATIONS FOR SPIRIT PRODUCTION

11.1.3 POSITIVE OUTLOOK TOWARDS ADVANCED AND SMART PACKAGING SOLUTIONS

11.1.4 RISING INITIATIVE OF COMPANIES TO EXPAND THEIR BUSINESS EUROPELY

11.2 RESTRAINTS

11.2.1 HEAVY TAXATION AND DUTIES

11.2.2 STRINGENT RULES AND REGULATIONS

11.3 OPPORTUNITIES

11.3.1 GROWING POPULARITY OF PREMIUM AND LUXURY BEVERAGES

11.3.2 INCREASING CUSTOMERS FOR MEZCAL PRODUCTS

11.3.3 INCREASED AVAILABILITY OF MEZCAL ON E-COMMERCE PLATFORMS

11.4 CHALLENGES

11.4.1 RISING POPULARITY OF DRINKING HEALTHFUL, NON-ALCOHOLIC BEVERAGES

11.4.2 HIGH COST OF MEZCAL

12 EUROPE MEZCAL MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 MEZCAL ESPADIN

12.2.1 BY CONCENTRATION

12.2.1.1 100% TEQUILA

12.2.1.2 MIX TEQUILA

12.2.2 BY ABV CONTENT

12.2.2.1 40% AND ABOVE

12.2.2.2 LESS THAN 40%

12.3 MEZCAL JOVEN

12.3.1 BY CONCENTRATION

12.3.1.1 100% TEQUILA

12.3.1.2 MIX TEQUILA

12.3.2 BY ABV CONTENT

12.3.2.1 40% AND ABOVE

12.3.2.2 LESS THAN 40%

12.3.3 BY DISTILLATION

12.3.3.1 COPPER

12.3.3.2 STEEL

12.4 MEZCAL REPOSADO

12.4.1 BY CONCENTRATION

12.4.1.1 100% TEQUILA

12.4.1.2 MIX TEQUILA

12.4.2 BY ABV CONTENT

12.4.2.1 40% AND ABOVE

12.4.2.2 LESS THAN 40%

12.4.3 BY DISTILLATION

12.4.3.1 COPPER

12.4.3.2 STEEL

12.5 MEZCAL ANEJO

12.5.1 BY CONCENTRATION

12.5.1.1 100% TEQUILA

12.5.1.2 MIX TEQUILA

12.5.2 BY ABV CONTENT

12.5.2.1 40% AND ABOVE

12.5.2.2 LESS THAN 40%

12.5.3 BY DISTILLATION

12.5.3.1 COPPER

12.5.3.2 STEEL

12.6 MEZCAL ENSAMBLE

12.6.1 BY CONCENTRATION

12.6.1.1 100% TEQUILA

12.6.1.2 MIX TEQUILA

12.6.2 BY ABV CONTENT

12.6.2.1 40% AND ABOVE

12.6.2.2 LESS THAN 40%

12.7 MEZCAL ARROQUEÑO

12.7.1 BY CONCENTRATION

12.7.1.1 100% TEQUILA

12.7.1.2 MIX TEQUILA

12.7.2 BY ABV CONTENT

12.7.2.1 40% AND ABOVE

12.7.2.2 LESS THAN 40%

12.8 MEZCAL TEPEZTATE

12.8.1 BY CONCENTRATION

12.8.1.1 100% TEQUILA

12.8.1.2 MIX TEQUILA

12.8.2 BY ABV CONTENT

12.8.2.1 40% AND ABOVE

12.8.2.2 LESS THAN 40%

12.9 OTHERS

12.9.1 BY CONCENTRATION

12.9.1.1 100% TEQUILA

12.9.1.2 MIX TEQUILA

12.9.2 BY ABV CONTENT

12.9.2.1 40% AND ABOVE

12.9.2.2 LESS THAN 40%

13 EUROPE MEZCAL MARKET, BY CONCENTRATION

13.1 OVERVIEW

13.2 100% TEQUILA

13.3 MIX TEQUILA

14 EUROPE MEZCAL MARKET, BY PRICE CATEGORY

14.1 OVERVIEW

14.2 PREMIUM

14.3 STANDARD

14.4 ECONOMY

15 EUROPE MEZCAL MARKET, BY ABV CONTENT

15.1 OVERVIEW

15.2 40% AND ABOVE

15.3 LESS THAN 40%

16 EUROPE MEZCAL MARKET, BY YEAR

16.1 OVERVIEW

16.2 25-44

16.3 45-64

16.4 18-24

16.5 65+

17 EUROPE MEZCAL MARKET, BY PACKAGING TYPE

17.1 OVERVIEW

17.2 BOTTLE

17.3 CANS

17.4 OTHERS

18 EUROPE MEZCAL MARKET, BY SIZE

18.1 OVERVIEW

18.2 751-1000 ML

18.3 501-750 ML

18.4 251-500 ML

18.5 MORE THAN 1000 ML

19 EUROPE MEZCAL MARKET, BY FLAVOR TYPE

19.1 OVERVIEW

19.2 FLAVORED

19.2.1 CITRUS FRUITS

19.2.1.1 ORANGE

19.2.1.2 LEMON

19.2.1.3 GRAPE FRUIT

19.2.1.4 OTHERS

19.2.2 FLORALS

19.2.3 SMOKED

19.2.4 GREEN PEPPER

19.2.5 OTHERS

19.3 PLAIN/ORIGINAL

20 EUROPE MEZCAL MARKET, BY PRODUCER TYPE

20.1 OVERVIEW

20.2 MICROBREWERY

20.3 DISTILLERS

20.4 BREWPUB

20.5 REGIONAL CRAFT BREWERY

20.6 CONTRACT BREWING COMPANY

20.7 LARGE BREWERY

20.8 OTHERS

21 EUROPE MEZCAL MARKET, BY PRODUCT CATEGORY

21.1 OVERVIEW

21.2 DISTILLERS MEZCAL

21.3 HANDCRAFTED/ARTISANAL MEZCAL

22 EUROPE MEZCAL MARKET, BY END USE

22.1 OVERVIEW

22.2 HOTELS AND BARS

22.3 RESTAURANTS

22.3.1 RESTAURANTS, BY TYPE

22.3.1.1 CHAIN RESTAURANTS

22.3.1.2 INDEPENDENT RESTAURANTS

22.3.2 RESTAURANTS, BY SERVICE CATEGORY

22.3.2.1 FULL SERVICE RESTAURANTS

22.3.2.2 QUICK SERVICE RESTAURANTS

22.4 CAFE

22.4.1 AIRLINES

22.4.2 CATERING

22.4.3 HOUSEHOLD

22.4.4 OTHERS

23 EUROPE MEZCAL MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 OFFLINE TRADE

23.2.1 NON-STORE BASED RETAILERS

23.2.1.1 VENDING MACHINE

23.2.1.2 OTHERS

23.2.2 STORE BASED RETAILER

23.2.2.1 HYPERMARKET/SUPERMARKET

23.2.2.2 CONVENIENCE STORES

23.2.2.3 SPECIALTY STORES

23.2.2.4 GROCERY STORES

23.2.2.5 OTHERS

23.3 ONLINE TRADE

23.4 COMPANY OWNED WEBSITE

23.5 E-COMMERCE

24 EUROPE MEZCAL MARKET, BY REGION

24.1 EUROPE

24.1.1 U.K.

24.1.2 FRANCE

24.1.3 GERMANY

24.1.4 SPAIN

24.1.5 ITALY

24.1.6 RUSSIA

24.1.7 NETHERLANDS

24.1.8 SWITZERLAND

24.1.9 TURKEY

24.1.10 BELGIUM

24.1.11 REST OF EUROPE

25 EUROPE MEZCAL MARKET: COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: EUROPE

26 SWOT ANALYSIS

27 COMPANY PROFILE

27.1 PERNOD RICARD

27.1.1 COMPANY SNAPSHOT

27.1.2 REVENUE ANALYSIS

27.1.3 COMPANY SHARE ANALYSIS

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENT

27.2 DIAGEO

27.2.1 COMPANY SNAPSHOT

27.2.2 REVENUE ANALYSIS

27.2.3 COMPANY SHARE ANALYSIS

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 WILLIAM GRANT & SONS

27.3.1 COMPANY SNAPSHOT

27.3.2 COMPANY SHARE ANALYSIS

27.3.3 PRODUCT PORTFOLIO

27.3.4 RECENT DEVELOPMENTS

27.4 BACARDI

27.4.1 COMPANY SNAPSHOT

27.4.2 COMPANY SHARE ANALYSIS

27.4.3 PRODUCT PORTFOLIO

27.4.4 RECENT DEVELOPMENT

27.5 DAVIDE CAMPARI-MILANO N.V.

27.5.1 COMPANY SNAPSHOT

27.5.2 REVENUE ANALYSIS

27.5.3 COMPANY SHARE ANALYSIS

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENT

27.6 BROWN-FORMAN

27.6.1 COMPANY SNAPSHOT

27.6.2 REVENUE ANALYSIS

27.6.3 PRODUCT PORTFOLIO

27.6.4 RECENT DEVELOPMENT

27.7 BOZAL MEZCAL

27.7.1 COMPANY SNAPSHOT

27.7.2 PRODUCT PORTFOLIO

27.7.3 RECENT DEVELOPMENT

27.8 CRAFT DISTILLERS

27.8.1 COMPANY SNAPSHOT

27.8.2 PRODUCT PORTFOLIO

27.8.3 RECENT DEVELOPMENTS

27.9 DOS HOMBRES LLC.

27.9.1 COMPANY SNAPSHOT

27.9.2 PRODUCT PORTFOLIO

27.9.3 RECENT DEVELOPMENTS

27.1 DEL MAGUEY SINGLE VILLAGE MEZCAL

27.10.1 COMPANY SNAPSHOT

27.10.2 PRODUCT PORTFOLIO

27.10.3 RECENT DEVELOPMENTS

27.11 DESTILERÍA TLACOLULA

27.11.1 COMPANY SNAPSHOT

27.11.2 PRODUCT PORTFOLIO

27.11.3 RECENT DEVELOPMENT

27.12 EL SILENCIO HOLDINGS, INC.

27.12.1 COMPANY SNAPSHOT

27.12.2 PRODUCT PORTFOLIO

27.12.3 RECENT DEVELOPMENTS

27.13 FAMILIA CAMARENA

27.13.1 COMPANY SNAPSHOT

27.13.2 PRODUCT PORTFOLIO

27.13.3 RECENT DEVELOPMENTS

27.14 ILEGAL MEZCAL

27.14.1 COMPANY SNAPSHOT

27.14.2 PRODUCT PORTFOLIO

27.14.3 RECENT DEVELOPMENTS

27.15 KING CAMPERO

27.15.1 COMPANY SNAPSHOT

27.15.2 PRODUCT PORTFOLIO

27.15.3 RECENT DEVELOPMENTS

27.16 MADRE MEZCAL

27.16.1 COMPANY SNAPSHOT

27.16.2 PRODUCT PORTFOLIO

27.16.3 RECENT DEVELOPMENTS

27.17 MEZCAL SOMBRA

27.17.1 COMPANY SNAPSHOT

27.17.2 PRODUCT PORTFOLIO

27.17.3 RECENT DEVELOPMENT

27.18 PENSADOR MEZCAL

27.18.1 COMPANY SNAPSHOT

27.18.2 PRODUCT PORTFOLIO

27.18.3 RECENT DEVELOPMENTS

27.19 SAUZA TEQUILA IMPORT COMPANY

27.19.1 COMPANY SNAPSHOT

27.19.2 PRODUCT PORTFOLIO

27.19.3 RECENT DEVELOPMENTS

27.2 TEQUILA & MEZCAL PRIVATE BRANDS S.A. DE C.V.

27.20.1 COMPANY SNAPSHOT

27.20.2 PRODUCT PORTFOLIO

27.20.3 RECENT DEVELOPMENTS

27.21 WAHAKA MEZCAL

27.21.1 COMPANY SNAPSHOT

27.21.2 PRODUCT PORTFOLIO

27.21.3 RECENT DEVELOPMENT

28 QUESTIONNAIRE

29 RELATED REPORTS

Lista de Tabela

TABLE 1 THE FOLLOWING ARE THE DIFFERENT PRICES OF DIFFERENT BRANDS.

TABLE 2 EUROPE MEZCAL MARKET, BY PRODUCT TYPE, 2020- 2029 (USD MILLION)

TABLE 3 EUROPE MEZCAL MARKET, BY PRODUCT TYPE, 2020- 2029, VOLUME (KILO LITERS)

TABLE 4 EUROPE MEZCAL ESPADIN IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 5 EUROPE MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 6 EUROPE MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 7 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 8 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 9 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 10 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 11 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 12 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 13 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 14 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 15 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 16 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 17 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 18 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 19 EUROPE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 20 EUROPE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 21 EUROPE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 22 EUROPE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 23 EUROPE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 24 EUROPE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 25 EUROPE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 26 EUROPE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 27 EUROPE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 28 EUROPE OTHERS IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 29 EUROPE OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 30 EUROPE OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 31 EUROPE MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE 100% TEQUILA IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE MIX TEQUILA IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 EUROPE PREMIUM IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE STANDARD IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE ECONOMY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 39 EUROPE 40% AND ABOVE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE LESS THAN 40% IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 42 EUROPE 25-44 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE 45-64 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE 18-24 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE 65+ IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE BOTTLES IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE CANS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 EUROPE OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 EUROPE MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE 751-1000 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE 501-750 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 EUROPE 251-500 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 EUROPE MORE THAN 1000 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 EUROPE MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 56 EUROPE FLAVORED IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 57 EUROPE FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 58 EUROPE CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 59 EUROPE PLAIN/ORIGINAL IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 60 EUROPE MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 61 EUROPE MICROBREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 EUROPE DISTILLERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 EUROPE BREWPUB IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 EUROPE REGIONAL CRAFT BREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 EUROPE CONTRACT BREWING COMPANY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 EUROPE LARGE BREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 EUROPE OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 68 EUROPE MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 69 EUROPE DISTILLERS MEZCAL IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 70 EUROPE HANDCRAFTED/ARTISANAL MEZCAL IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 EUROPE MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 72 EUROPE HOTELS AND BARS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 EUROPE RESTAURANTS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 EUROPE RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 EUROPE RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 76 EUROPE CAFÉ IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 EUROPE AIRLINES IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 EUROPE CATERING IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 EUROPE HOUSEHOLD IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 EUROPE OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 81 EUROPE MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 82 EUROPE OFFLINE TRADE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 83 EUROPE OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 84 EUROPE NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 85 EUROPE STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 86 EUROPE ONLINE TRADE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 EUROPE ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 88 EUROPE MEZCAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 89 EUROPE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 EUROPE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 91 EUROPE MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 92 EUROPE MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 93 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 94 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 95 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 96 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 97 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 98 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 99 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 100 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 101 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 102 EUROPE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 103 EUROPE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 104 EUROPE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 105 EUROPE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 106 EUROPE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 107 EUROPE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 108 EUROPE OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 109 EUROPE OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 110 EUROPE MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 111 EUROPE MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 112 EUROPE MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 113 EUROPE MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 114 EUROPE MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 115 EUROPE MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 116 EUROPE MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 117 EUROPE FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 118 EUROPE CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 EUROPE MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 120 EUROPE MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 121 EUROPE MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 122 EUROPE RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 EUROPE RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 124 EUROPE MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 EUROPE OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 EUROPE NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 EUROPE STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 128 EUROPE ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 U.K. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 U.K. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 131 U.K. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 132 U.K. MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 133 U.K. MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 134 U.K. MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 135 U.K. MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 136 U.K. MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 137 U.K. MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 138 U.K. MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 139 U.K. MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 140 U.K. MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 141 U.K. MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 142 U.K. MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 143 U.K. MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 144 U.K. MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 145 U.K. MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 146 U.K. MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 147 U.K. MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 148 U.K. MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 149 U.K. OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 150 U.K. OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 151 U.K. MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 152 U.K. MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 153 U.K. MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 154 U.K. MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 155 U.K. MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 156 U.K. MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 157 U.K. MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 158 U.K. FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 159 U.K. CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 U.K. MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 161 U.K. MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 162 U.K. MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 163 U.K. RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 U.K. RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 165 U.K. MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 166 U.K. OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 167 U.K. NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 168 U.K. STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 169 U.K. ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 FRANCE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 FRANCE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 172 FRANCE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 173 FRANCE MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 174 FRANCE MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 175 FRANCE MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 176 FRANCE MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 177 FRANCE MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 178 FRANCE MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 179 FRANCE MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 180 FRANCE MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 181 FRANCE MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 182 FRANCE MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 183 FRANCE MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 184 FRANCE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 185 FRANCE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 186 FRANCE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 187 FRANCE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 188 FRANCE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 189 FRANCE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 190 FRANCE OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 191 FRANCE OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 192 FRANCE MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 193 FRANCE MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 194 FRANCE MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 195 FRANCE MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 196 FRANCE MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 197 FRANCE MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 198 FRANCE MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 199 FRANCE FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 200 FRANCE CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 FRANCE MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 202 FRANCE MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 203 FRANCE MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 204 FRANCE RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 FRANCE RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 206 FRANCE MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 207 FRANCE OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 208 FRANCE NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 209 FRANCE STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 210 FRANCE ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 211 GERMANY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 212 GERMANY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 213 GERMANY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 214 GERMANY MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 215 GERMANY MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 216 GERMANY MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 217 GERMANY MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 218 GERMANY MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 219 GERMANY MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 220 GERMANY MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 221 GERMANY MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 222 GERMANY MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 223 GERMANY MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 224 GERMANY MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 225 GERMANY MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 226 GERMANY MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 227 GERMANY MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 228 GERMANY MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 229 GERMANY MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 230 GERMANY MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 231 GERMANY OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 232 GERMANY OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 233 GERMANY MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 234 GERMANY MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 235 GERMANY MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 236 GERMANY MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 237 GERMANY MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 238 GERMANY MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 239 GERMANY MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 240 GERMANY FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 241 GERMANY CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 GERMANY MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 243 GERMANY MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 244 GERMANY MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 245 GERMANY RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 GERMANY RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 247 GERMANY MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 248 GERMANY OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 249 GERMANY NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 250 GERMANY STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 251 GERMANY ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 252 SPAIN MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 253 SPAIN MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 254 SPAIN MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 255 SPAIN MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 256 SPAIN MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 257 SPAIN MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 258 SPAIN MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 259 SPAIN MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 260 SPAIN MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 261 SPAIN MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 262 SPAIN MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 263 SPAIN MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 264 SPAIN MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 265 SPAIN MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 266 SPAIN MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 267 SPAIN MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 268 SPAIN MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 269 SPAIN MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 270 SPAIN MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 271 SPAIN MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 272 SPAIN OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 273 SPAIN OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 274 SPAIN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 275 SPAIN MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 276 SPAIN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 277 SPAIN MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 278 SPAIN MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 279 SPAIN MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 280 SPAIN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 281 SPAIN FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 282 SPAIN CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 SPAIN MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 284 SPAIN MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 285 SPAIN MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 286 SPAIN RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 SPAIN RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 288 SPAIN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 289 SPAIN OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 290 SPAIN NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 291 SPAIN STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 292 SPAIN ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 293 ITALY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 294 ITALY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 295 ITALY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 296 ITALY MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 297 ITALY MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 298 ITALY MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 299 ITALY MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 300 ITALY MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 301 ITALY MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 302 ITALY MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 303 ITALY MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 304 ITALY MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 305 ITALY MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 306 ITALY MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 307 ITALY MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 308 ITALY MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 309 ITALY MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 310 ITALY MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 311 ITALY MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 312 ITALY MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 313 ITALY OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 314 ITALY OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 315 ITALY MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 316 ITALY MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 317 ITALY MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 318 ITALY MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 319 ITALY MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 320 ITALY MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 321 ITALY MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 322 ITALY FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 323 ITALY CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 324 ITALY MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 325 ITALY MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 326 ITALY MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 327 ITALY RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 328 ITALY RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 329 ITALY MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 330 ITALY OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 331 ITALY NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 332 ITALY STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 333 ITALY ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 334 RUSSIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 335 RUSSIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 336 RUSSIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 337 RUSSIA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 338 RUSSIA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 339 RUSSIA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 340 RUSSIA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 341 RUSSIA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 342 RUSSIA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 343 RUSSIA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 344 RUSSIA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 345 RUSSIA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 346 RUSSIA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 347 RUSSIA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 348 RUSSIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 349 RUSSIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 350 RUSSIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 351 RUSSIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 352 RUSSIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 353 RUSSIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 354 RUSSIA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 355 RUSSIA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 356 RUSSIA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 357 RUSSIA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 358 RUSSIA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 359 RUSSIA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 360 RUSSIA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 361 RUSSIA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 362 RUSSIA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 363 RUSSIA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 364 RUSSIA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 365 RUSSIA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 366 RUSSIA MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 367 RUSSIA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 368 RUSSIA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 369 RUSSIA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 370 RUSSIA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 371 RUSSIA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 372 RUSSIA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 373 RUSSIA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 374 RUSSIA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 375 NETHERLANDS MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 376 NETHERLANDS MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 377 NETHERLANDS MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 378 NETHERLANDS MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 379 NETHERLANDS MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 380 NETHERLANDS MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 381 NETHERLANDS MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 382 NETHERLANDS MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 383 NETHERLANDS MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 384 NETHERLANDS MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 385 NETHERLANDS MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 386 NETHERLANDS MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 387 NETHERLANDS MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 388 NETHERLANDS MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 389 NETHERLANDS MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 390 NETHERLANDS MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 391 NETHERLANDS MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 392 NETHERLANDS MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 393 NETHERLANDS MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 394 NETHERLANDS MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 395 NETHERLANDS OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 396 NETHERLANDS OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 397 NETHERLANDS MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 398 NETHERLANDS MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 399 NETHERLANDS MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 400 NETHERLANDS MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 401 NETHERLANDS MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 402 NETHERLANDS MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 403 NETHERLANDS MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 404 NETHERLANDS FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 405 NETHERLANDS CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 406 NETHERLANDS MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 407 NETHERLANDS MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 408 NETHERLANDS MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 409 NETHERLANDS RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 410 NETHERLANDS RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 411 NETHERLANDS MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 412 NETHERLANDS OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 413 NETHERLANDS NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 414 NETHERLANDS STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 415 NETHERLANDS ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 416 SWITZERLAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 417 SWITZERLAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 418 SWITZERLAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 419 SWITZERLAND MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 420 SWITZERLAND MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 421 SWITZERLAND MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 422 SWITZERLAND MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 423 SWITZERLAND MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 424 SWITZERLAND MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 425 SWITZERLAND MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 426 SWITZERLAND MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 427 SWITZERLAND MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 428 SWITZERLAND MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 429 SWITZERLAND MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 430 SWITZERLAND MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 431 SWITZERLAND MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 432 SWITZERLAND MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 433 SWITZERLAND MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 434 SWITZERLAND MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 435 SWITZERLAND MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 436 SWITZERLAND OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 437 SWITZERLAND OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 438 SWITZERLAND MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 439 SWITZERLAND MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 440 SWITZERLAND MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 441 SWITZERLAND MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 442 SWITZERLAND MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 443 SWITZERLAND MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 444 SWITZERLAND MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 445 SWITZERLAND FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 446 SWITZERLAND CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 447 SWITZERLAND MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 448 SWITZERLAND MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 449 SWITZERLAND MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 450 SWITZERLAND RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 451 SWITZERLAND RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 452 SWITZERLAND MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 453 SWITZERLAND OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 454 SWITZERLAND NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 455 SWITZERLAND STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 456 SWITZERLAND ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 457 TURKEY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 458 TURKEY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 459 TURKEY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 460 TURKEY MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 461 TURKEY MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 462 TURKEY MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 463 TURKEY MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 464 TURKEY MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 465 TURKEY MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 466 TURKEY MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 467 TURKEY MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 468 TURKEY MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 469 TURKEY MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 470 TURKEY MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 471 TURKEY MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 472 TURKEY MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 473 TURKEY MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 474 TURKEY MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 475 TURKEY MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 476 TURKEY MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 477 TURKEY OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 478 TURKEY OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 479 TURKEY MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 480 TURKEY MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 481 TURKEY MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 482 TURKEY MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 483 TURKEY MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 484 TURKEY MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 485 TURKEY MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 486 TURKEY FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 487 TURKEY CITRUS FRUITS IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 488 TURKEY MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 489 TURKEY MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 490 TURKEY MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 491 TURKEY RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 492 TURKEY RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 493 TURKEY MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 494 TURKEY OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 495 TURKEY NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 496 TURKEY STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 497 TURKEY ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 498 BELGIUM MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 499 BELGIUM MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 500 BELGIUM MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 501 BELGIUM MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 502 BELGIUM MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 503 BELGIUM MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 504 BELGIUM MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 505 BELGIUM MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 506 BELGIUM MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 507 BELGIUM MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 508 BELGIUM MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 509 BELGIUM MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 510 BELGIUM MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 511 BELGIUM MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 512 BELGIUM MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 513 BELGIUM MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)