Europe Foot And Ankle Devices Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

973.60 Million

USD

1,749.70 Million

2024

2032

USD

973.60 Million

USD

1,749.70 Million

2024

2032

| 2025 –2032 | |

| USD 973.60 Million | |

| USD 1,749.70 Million | |

|

|

|

|

Segmentação do mercado de dispositivos para pé e tornozelo na Europa, por tipo de produto (implantes e dispositivos ortopédicos, dispositivos de suporte e órteses, próteses), aplicação (trauma, dedo em martelo, osteoartrite, artrite reumatoide, joanetes, distúrbios neurológicos, osteoporose, outros), usuário final (hospitais, centros de trauma, centros cirúrgicos ambulatoriais, clínicas especializadas, outros) - Tendências do setor e previsão até 2032

Tamanho do mercado de dispositivos para pé e tornozelo

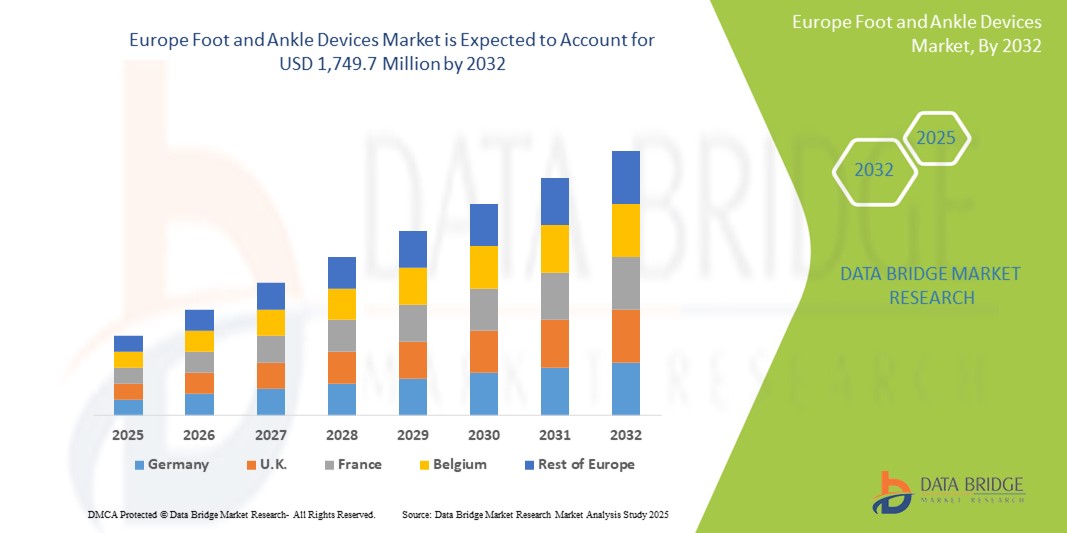

- O tamanho do mercado europeu de dispositivos para pé e tornozelo foi avaliado em US$ 973,6 milhões em 2024 e deve atingir US$ 1.749,7 milhões até 2032 , com um CAGR de 7,6% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente prevalência de distúrbios nos pés e tornozelos, pelo número crescente de lesões no trânsito e esportivas relacionadas a acidentes e pela crescente população geriátrica em toda a Europa.

- Além disso, os avanços tecnológicos em dispositivos para pé e tornozelo, como biomateriais aprimorados, técnicas cirúrgicas minimamente invasivas e órteses e próteses personalizadas impressas em 3D, estão impulsionando a expansão do mercado. Esses fatores convergentes estão acelerando a adoção de dispositivos para pé e tornozelo, impulsionando significativamente o crescimento do setor.

Análise de mercado de dispositivos para pé e tornozelo

- O mercado de Dispositivos para Pé e Tornozelo abrange uma ampla gama de dispositivos médicos projetados para o diagnóstico, tratamento e reabilitação de condições que afetam o pé e o tornozelo. Isso inclui implantes e dispositivos ortopédicos (como implantes articulares e dispositivos de fixação), dispositivos de suporte e órteses, e próteses. Esses dispositivos são cruciais para tratar uma variedade de problemas, incluindo traumas, lesões esportivas, complicações do pé diabético, artrite (osteoartrite e artrite reumatoide) e diversas deformidades. O mercado é impulsionado pela crescente incidência dessas condições, pelo envelhecimento da população e pelos avanços contínuos em técnicas cirúrgicas e tecnologia de dispositivos.

- A crescente demanda por dispositivos para pés e tornozelos é alimentada principalmente pela conscientização crescente sobre a saúde dos pés e tornozelos, pela crescente demanda por reabilitação e cuidados preventivos eficazes e pelo aumento dos gastos com saúde na região.

- A Alemanha domina o mercado de dispositivos para pé e tornozelo na Europa, detendo a maior fatia da receita, de 26,7% em 2025, apoiada por uma robusta infraestrutura de atendimento ortopédico, altos volumes cirúrgicos e forte demanda por implantes e dispositivos de fixação tecnologicamente avançados. O sistema de reembolso bem estabelecido do país e a adoção precoce de procedimentos minimamente invasivos para pé e tornozelo contribuíram para a crescente utilização de placas, parafusos e sistemas de substituição articular em hospitais públicos e privados.

- A Alemanha também deverá ser o país com crescimento mais rápido no mercado europeu de dispositivos para pé e tornozelo durante o período previsto, impulsionada pelo envelhecimento da população, pelo aumento da prevalência de osteoartrite e lesões esportivas e pela forte ênfase na reabilitação pós-trauma. O investimento contínuo em inovação ortopédica e a expansão de centros ortopédicos especializados impulsionam ainda mais o crescimento do mercado, juntamente com as colaborações entre instituições de pesquisa e fabricantes de tecnologia médica.

- Implantes e dispositivos ortopédicos, incluindo placas, parafusos e hastes intramedulares, devem dominar o mercado europeu de dispositivos para pé e tornozelo, com uma participação de mercado de 39,2% em 2025, devido ao seu amplo uso no tratamento de fraturas, deformidades e procedimentos reconstrutivos complexos. O segmento se beneficia dos avanços contínuos em biomateriais, incluindo titânio e polímeros bioabsorvíveis, e da crescente adoção de ferramentas de planejamento cirúrgico específicas para cada paciente, que melhoram os resultados dos procedimentos e reduzem o tempo de recuperação.

Escopo do relatório e segmentação do mercado de dispositivos para pé e tornozelo

|

Atributos |

Principais insights de mercado sobre dispositivos para pé e tornozelo |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de dispositivos para pé e tornozelo

“Avanços em técnicas cirúrgicas minimamente invasivas ”

- Avanços Tecnológicos em Procedimentos Minimamente Invasivos e Dispositivos Personalizados: Uma tendência significativa e crescente no mercado europeu de dispositivos para pé e tornozelo é o contínuo avanço tecnológico, particularmente em técnicas cirúrgicas minimamente invasivas e no desenvolvimento de dispositivos personalizados. Essa evolução está melhorando significativamente os resultados dos pacientes, reduzindo os tempos de recuperação e melhorando a eficácia geral do tratamento.

- Por exemplo, inovações em implantes ortopédicos e dispositivos de fixação permitem que cirurgiões realizem procedimentos complexos com menos complicações e recuperação mais rápida. A crescente adoção de procedimentos minimamente invasivos, que oferecem benefícios como redução da dor e da formação de cicatrizes, está expandindo o uso de dispositivos especializados para pé e tornozelo.

- O mercado também observa uma tendência crescente para dispositivos personalizados, impulsionada pela tecnologia de impressão 3D. Isso permite a criação de órteses e próteses personalizadas, adaptadas às necessidades específicas de cada paciente, oferecendo melhor ajuste, suporte e funcionalidade.

- Além disso, há um foco crescente em reabilitação e cuidados preventivos, o que leva à demanda por dispositivos ortopédicos, aparelhos ortopédicos e ferramentas inteligentes de reabilitação que auxiliam na recuperação e previnem lesões futuras. A tecnologia vestível está desempenhando um papel significativo nessa área, fornecendo feedback e monitoramento em tempo real.

- Esta tendência para soluções mais precisas, menos invasivas e específicas para cada paciente está a remodelar fundamentalmente o panorama do tratamento para doenças dos pés e tornozelos na Europa.

Dinâmica do mercado de dispositivos para pé e tornozelo

Motorista

“Aumento da prevalência de doenças nos pés e tornozelos (trauma, diabetes, artrite)”

- Aumento da incidência de distúrbios nos pés e tornozelos e envelhecimento da população: O aumento da prevalência de distúrbios nos pés e tornozelos, incluindo aqueles causados por traumas, diabetes e condições relacionadas à idade, como artrite e osteoporose, é um dos principais impulsionadores do crescimento do mercado de dispositivos para pés e tornozelos na Europa.

- Por exemplo, a crescente população geriátrica na região europeia é mais propensa a sofrer de problemas relacionados com os pés e tornozelos, como artrite e fraturas, o que aumenta diretamente a procura destes dispositivos.

- O número crescente de lesões esportivas e acidentes de trânsito também contribui significativamente para a demanda por dispositivos para pés e tornozelos para tratamento e reabilitação.

- Além disso, a crescente conscientização sobre a saúde dos pés e tornozelos entre a população em geral e os profissionais de saúde está levando ao diagnóstico e à intervenção mais precoces, impulsionando ainda mais o crescimento do mercado.

- Os avanços tecnológicos que tornam os dispositivos mais eficazes, confortáveis e fáceis de usar, juntamente com o aumento das despesas com cuidados de saúde, também atuam como impulsionadores principais

Restrição/Desafio

“ Alto custo de dispositivos avançados para pé e tornozelo ”

- Alto custo dos dispositivos e regulamentações rigorosas: o alto custo de alguns dispositivos avançados para pé e tornozelo, juntamente com diretrizes regulatórias rigorosas, representa um desafio significativo para a ampla adoção do mercado na Europa.

- Por exemplo, a fabricação de diversos produtos para pés e tornozelos pode aumentar significativamente o custo de capital para empresas de dispositivos médicos. O alto investimento inicial em implantes e próteses avançados pode limitar sua acessibilidade, especialmente em sistemas de saúde com financiamento público ou para pacientes sem cobertura de seguro abrangente.

- Estruturas regulatórias rígidas, como o Regulamento de Dispositivos Médicos da UE (MDR), estão substituindo diretivas mais antigas, levando a grandes mudanças no acesso ao mercado e exigindo ampla validação e documentação, o que aumenta o tempo e o custo para os fabricantes.

- Além disso, a escassez de profissionais qualificados em cirurgia e reabilitação de pé e tornozelo pode dificultar a utilização e adoção eficazes desses dispositivos avançados. Preocupações com o afrouxamento das placas ósseas ao longo do tempo, exigindo substituição, também representam um desafio.

Escopo de mercado de dispositivos para pé e tornozelo

O mercado é segmentado com base no tipo de produto, aplicação e usuário final.

- Por produto

Com base no produto, o mercado de Dispositivos para Pé e Tornozelo abrange Dispositivos de Fixação Ortopédica, Implantes Articulares, Dispositivos Ortopédicos de Tecidos Moles, Dispositivos de Suporte e Órteses e Próteses. Espera-se que o segmento de Dispositivos de Fixação Ortopédica domine o mercado, com a maior participação na receita, de 39,2%, até 2025, impulsionado por seu amplo uso em reparo de fraturas, correção de deformidades e cirurgias reconstrutivas. Esses dispositivos — incluindo placas, parafusos, fios e hastes intramedulares — são frequentemente utilizados em procedimentos eletivos e de trauma. Avanços tecnológicos, como implantes anatomicamente moldados e materiais bioabsorvíveis, melhoraram os resultados clínicos e a recuperação dos pacientes, reforçando a liderança deste segmento.

Prevê-se que o segmento de Dispositivos de Suporte e Órteses (Bracing & Support Devices) apresente a maior taxa de crescimento, de 5,2%, entre 2025 e 2032, impulsionado pela crescente incidência de osteoartrite e artrite reumatoide na população idosa. A crescente demanda por próteses totais de tornozelo e os avanços no design de implantes — como componentes impressos em 3D e soluções personalizadas — estão impulsionando a adoção em centros cirúrgicos na Alemanha, Reino Unido e França.

- Por aplicação

Com base na aplicação, o mercado de Dispositivos para Pé e Tornozelo é segmentado em Trauma, Osteoartrite, Correção de Deformidades, Artrite Reumatoide e Outros. O setor de Trauma deteve a maior fatia de mercado em 2025, devido ao alto número de lesões no pé e tornozelo associadas a esportes, acidentes de trânsito e incidentes no local de trabalho. A intervenção cirúrgica rápida com dispositivos de fixação e implantes é fundamental para a recuperação e mobilidade ideais, tornando o trauma a área de aplicação dominante em toda a Europa.

A osteoartrite deverá apresentar a taxa composta de crescimento anual (CAGR) mais rápida entre 2025 e 2032, impulsionada pelo envelhecimento da população europeia e pelo aumento da prevalência de doenças articulares degenerativas. Técnicas cirúrgicas minimamente invasivas e inovações em dispositivos de substituição articular estão apoiando a adoção de soluções para pé e tornozelo adaptadas à mobilidade a longo prazo e ao controle da dor.

- Por usuários finais

Com base nos usuários finais, o mercado de Dispositivos para Pé e Tornozelo é segmentado em Hospitais, Centros Cirúrgicos Ambulatoriais (CCAs) e Clínicas Ortopédicas. O segmento de Hospitais foi responsável pela maior fatia da receita de mercado em 2024, impulsionado por altos volumes de procedimentos, ambientes de atendimento multidisciplinar e acesso a ferramentas avançadas de imagem e navegação cirúrgica. Hospitais públicos em países como Alemanha, Itália e Holanda se beneficiam de políticas de compras centralizadas e investimentos governamentais em infraestrutura ortopédica.

Espera-se que o segmento de Centros Cirúrgicos Ambulatoriais (CACS) apresente o CAGR mais rápido entre 2025 e 2032, com a crescente prevalência de cirurgias no mesmo dia em toda a Europa. Os CACS estão cada vez mais equipados para realizar procedimentos minimamente invasivos no pé e tornozelo, oferecendo atendimento com boa relação custo-benefício, menor tempo de recuperação do paciente e eficiência operacional. A mudança para cirurgias ortopédicas ambulatoriais é particularmente notável no Reino Unido, Espanha e países nórdicos.

Análise regional do mercado de dispositivos para pé e tornozelo

- A Alemanha domina o mercado europeu de dispositivos para pé e tornozelo, capturando a maior fatia da receita, de 26,7% em 2025, devido à sua avançada infraestrutura de atendimento ortopédico, ao alto volume de cirurgias de trauma e reconstrução e ao sólido cenário de reembolso para implantes articulares e dispositivos de fixação. O país lidera na adoção de soluções ortopédicas inovadoras, incluindo implantes específicos para cada paciente e tecnologias de fixação minimamente invasivas.

- A excelência ortopédica da Alemanha é respaldada por uma rede robusta de centros cirúrgicos especializados, hospitais acadêmicos e colaborações com fabricantes globais de tecnologia médica, como Zimmer Biomet, Stryker e Waldemar Link. Essas parcerias garantem acesso consistente a dispositivos e sistemas cirúrgicos de ponta.

- Além disso, o envelhecimento da população e a crescente prevalência de osteoartrite e complicações no pé diabético estão impulsionando o crescimento dos procedimentos. A ênfase da Alemanha na reabilitação pós-operatória e na preservação da mobilidade também está fomentando a demanda por implantes de alto desempenho para pé e tornozelo.

Visão geral do mercado de dispositivos para pé e tornozelo na França

O mercado francês de dispositivos para pé e tornozelo deverá crescer a uma taxa composta de crescimento anual (CAGR) significativa durante o período previsto, apoiado por um sistema público de saúde bem estabelecido e estratégias nacionais voltadas para a melhoria da saúde musculoesquelética. A França está observando uma demanda crescente por intervenções cirúrgicas em traumas, lesões esportivas e doenças degenerativas do pé e tornozelo, especialmente entre idosos. Hospitais públicos e unidades ortopédicas na França estão integrando cada vez mais imagens 3D e navegação cirúrgica para a colocação precisa de implantes e melhores resultados em procedimentos de correção de deformidades e reconstrução articular. O apoio regulatório da Agência Nacional Francesa para a Segurança de Medicamentos e Produtos de Saúde (ANSM) e projetos colaborativos de P&D entre cirurgiões ortopédicos e fabricantes locais estão permitindo um acesso mais rápido ao mercado para dispositivos e implantes avançados.

Visão geral do mercado de dispositivos para pé e tornozelo no Reino Unido

O mercado de dispositivos para pé e tornozelo do Reino Unido está pronto para um crescimento robusto, impulsionado por iniciativas do NHS focadas na redução de atrasos cirúrgicos, na melhoria dos tempos de espera ortopédica e na melhoria do acesso a cirurgias minimamente invasivas em ambientes de saúde públicos e privados. A crescente incidência de complicações nos pés relacionadas ao diabetes, lesões esportivas e osteoartrite está aumentando significativamente a demanda por implantes, dispositivos de fixação e sistemas de órteses. Procedimentos para pé e tornozelo são cada vez mais realizados em centros cirúrgicos ambulatoriais e clínicas ambulatoriais, apoiando a adoção de instrumentos cirúrgicos compactos e eficientes. A British Orthopaedic Foot & Ankle Society (BOFAS) e órgãos profissionais relacionados estão desempenhando um papel fundamental na promoção de melhores práticas, treinamento cirúrgico e adoção de tecnologias inovadoras, como implantes personalizados, sistemas de navegação e produtos ortopédicos regenerativos.

Participação no mercado de dispositivos para pé e tornozelo

O setor de dispositivos para pé e tornozelo é liderado principalmente por empresas bem estabelecidas, incluindo:

- Stryker Corporation (EUA)

- Johnson & Johnson (DePuy Synthes) (EUA)

- Zimmer Biomet Holdings, Inc. (EUA)

- Smith & Nephew plc (Reino Unido)

- Enovis Corporation (EUA)

- Acumed, LLC (EUA)

- Arthrex, Inc. (EUA)

- Paragon 28 Inc. (EUA)

- Orthofix Medical Inc. (EUA)

- Medtronic plc (Irlanda)

- DJO LLC (EUA)

- Össur hf. (Islândia)

- B.Braun Melsungen AG (Alemanha)

- Bauerfeind AG (Alemanha)

- Otto Bock Healthcare GmbH (Alemanha)

- Grupo Thuasne (França)

- Fillauer LLC (EUA)

Últimos desenvolvimentos no mercado europeu de dispositivos para pé e tornozelo

- Em maio de 2023, a Paragon 28 lançou sua placa de osteotomia supramaleolar (SMO) Gorilla e o sistema de aloenxerto PRESERVE SMO, oferecendo aos cirurgiões configurações de placas personalizáveis e opções de enxerto para melhorar os resultados e a flexibilidade em osteotomias supramaleolares para correções complexas de deformidades do pé e tornozelo.

- Em dezembro de 2022, a Enovis Corporation recebeu a aprovação do FDA para seu sistema STAR PSI, permitindo que os cirurgiões criem planos pré-operatórios 3D personalizados para substituições totais de tornozelo, melhorando a precisão do posicionamento do implante, a eficiência cirúrgica e os resultados específicos do paciente em procedimentos ortopédicos.

- Em fevereiro de 2022, a DePuy Synthes, parte da Johnson & Johnson, adquiriu a CrossRoads Extremity Systems para expandir seu portfólio de produtos para pé e tornozelo. A aquisição fortalece sua posição em cuidados ortopédicos com tecnologias avançadas para fusão articular, correção de joanetes e reconstrução de tecidos moles.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.