Europe Encapsulated Calcium Propionate Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

102.90 Million

USD

174.18 Million

2024

2032

USD

102.90 Million

USD

174.18 Million

2024

2032

| 2025 –2032 | |

| USD 102.90 Million | |

| USD 174.18 Million | |

|

|

|

|

Segmentação do mercado europeu de propionato de cálcio encapsulado, por grau (grau alimentício e grau de ração), forma (pó e granulado), aplicação (alimentos, bebidas e ração) - Tendências da indústria e previsão até 2032

Tamanho do mercado de propionato de cálcio encapsulado na Europa

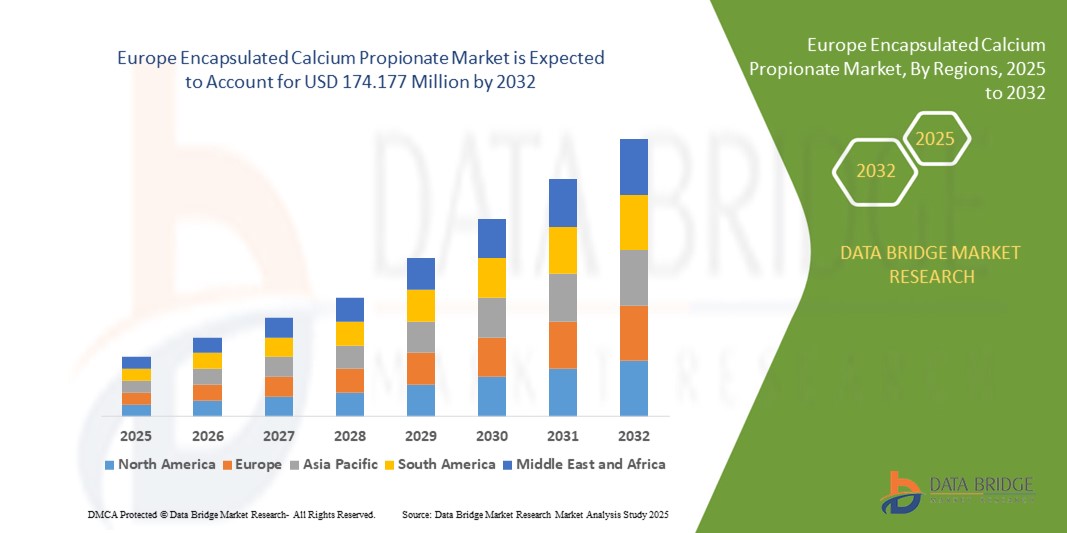

- O tamanho do mercado de propionato de cálcio encapsulado na Europa foi avaliado em US$ 102,90 milhões em 2024 e deve atingir US$ 174,177 milhões em 2032 , com um CAGR de 6,80% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por produtos de panificação e confeitaria com prazo de validade prolongado, impulsionado pela crescente preferência do consumidor por soluções conservantes com propriedades de liberação controlada.

- O foco crescente na redução do desperdício de alimentos e na manutenção do frescor dos produtos em todas as cadeias de suprimentos está acelerando ainda mais a adoção do propionato de cálcio encapsulado na Europa entre os fabricantes de alimentos

Análise do Mercado de Propionato de Cálcio Encapsulado na Europa

- O mercado está testemunhando um crescimento constante à medida que os fabricantes de alimentos buscam maneiras mais seguras e eficazes de controlar a deterioração microbiana sem comprometer a qualidade do produto

- A crescente conscientização sobre saúde e as rigorosas regulamentações de segurança alimentar estão incentivando o uso de conservantes encapsulados que garantem liberação controlada e interação química mínima com componentes alimentares.

- A projeção é que o Reino Unido domine o mercado europeu de propionato de cálcio encapsulado de 2025 a 2032, impulsionado por sua infraestrutura avançada de processamento de alimentos, altos padrões regulatórios de segurança alimentar e forte demanda por conservantes de rótulo limpo.

- Espera-se que a Alemanha testemunhe a maior taxa de crescimento anual composta (CAGR) no mercado europeu de propionato de cálcio encapsulado devido aos rápidos avanços tecnológicos na preservação de alimentos, à crescente preferência do consumidor por alimentos embalados de alta qualidade e aos crescentes investimentos em soluções inovadoras de encapsulamento.

- O segmento de grau alimentício deteve a maior fatia de mercado em 2024, impulsionado pela crescente demanda por produtos de panificação e laticínios embalados, que exigem maior prazo de validade e padrões de segurança aprimorados. A crescente ênfase regulatória na qualidade dos alimentos e a preferência do consumidor por conservantes seguros e de rótulo limpo reforçam ainda mais o domínio deste segmento.

Escopo do Relatório e Segmentação do Mercado de Propionato de Cálcio Encapsulado na Europa

|

Atributos |

Principais insights do mercado de propionato de cálcio encapsulado na Europa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de propionato de cálcio encapsulado na Europa

Adoção crescente da tecnologia de encapsulamento na preservação de alimentos

• O uso crescente de técnicas de encapsulamento na conservação de alimentos está transformando o mercado de propionato de cálcio, permitindo a liberação controlada e melhorando a estabilidade dos conservantes. Isso garante maior vida útil para produtos de panificação e laticínios, mantendo a qualidade do sabor e da textura. A tecnologia também reduz a interação química direta com ingredientes alimentares, aumentando a segurança do produto e a aceitação do consumidor. Como resultado, mais fabricantes estão integrando soluções encapsuladas em linhas de produção em larga escala para atender às crescentes demandas de qualidade.

• A demanda por produtos alimentícios com rótulos limpos e minimamente processados está impulsionando a inovação em tecnologias de encapsulamento. Os fabricantes estão adotando a microencapsulação para reduzir a interação química direta com ingredientes alimentícios, alinhando-se às preferências dos consumidores por aditivos alimentares naturais e seguros. Essa tendência é apoiada pela crescente conscientização sobre a saúde, à medida que os consumidores buscam cada vez mais soluções de conservantes com menos componentes sintéticos, mantendo o frescor dos alimentos. Investimentos em pesquisa e desenvolvimento estão impulsionando a criação de materiais de encapsulamento ecologicamente corretos para atender aos padrões regulatórios e de sustentabilidade.

• O encapsulamento também ajuda a mascarar o odor e o sabor do propionato de cálcio, tornando-o mais adequado para uma gama mais ampla de aplicações alimentícias. Isso está incentivando sua adoção por redes de padarias, processadores de laticínios e fabricantes de alimentos embalados que buscam melhor qualidade do produto. Além disso, o encapsulamento permite a liberação controlada dos ingredientes, preservando os perfis de sabor durante o armazenamento e o transporte. Seu papel na melhoria da satisfação do consumidor está se tornando central para estratégias de diferenciação de produtos na competitiva indústria alimentícia.

• Por exemplo, em 2023, vários produtores de panificação na Europa introduziram formulações de propionato de cálcio encapsulado que mantiveram o frescor do produto por mais tempo, reduzindo o desperdício de alimentos e os custos de produção. Essas iniciativas também ajudaram os fabricantes a cumprir as rigorosas normas de segurança alimentar, otimizando os sistemas de gestão de estoque. A capacidade de estender a vida útil dos produtos contribuiu para a redução das despesas logísticas e para a melhoria das margens de lucro das empresas alimentícias.

• Embora a tecnologia de encapsulamento esteja expandindo o escopo de aplicação, pesquisa contínua, otimização de custos e sistemas avançados de entrega são essenciais para alcançar o máximo de benefícios comerciais. A colaboração entre cientistas de alimentos, inovadores em embalagens e fornecedores de ingredientes é fundamental para liberar todo o seu potencial. Além disso, programas de treinamento para fabricantes podem acelerar a adoção e a padronização em mercados desenvolvidos e emergentes.

Dinâmica do mercado de propionato de cálcio encapsulado na Europa

Motorista

Crescente demanda por maior prazo de validade e segurança alimentar

• As crescentes preocupações com a deterioração dos alimentos e a contaminação microbiana estão levando os fabricantes de alimentos a adotar conservantes que garantam segurança e qualidade. O propionato de cálcio encapsulado na Europa oferece liberação direcionada, reduzindo o uso excessivo e mantendo a eficácia. Ele oferece uma solução mais segura e limpa, alinhada às preferências dos consumidores por produtos alimentícios minimamente processados. As marcas de alimentos estão cada vez mais destacando o encapsulamento nos rótulos dos produtos como uma marca de qualidade e inovação.

• O crescimento da indústria de panificação, aliado à mudança de hábitos alimentares e à expansão da população urbana, está impulsionando significativamente a demanda por conservantes encapsulados que aumentam a vida útil dos produtos sem comprometer o sabor. Estilos de vida agitados e a maior demanda por alimentos de conveniência estão aumentando a necessidade de produtos com maior estabilidade de armazenamento. A tecnologia de encapsulamento garante frescor sem depender de tratamentos químicos excessivos, atraindo consumidores preocupados com a saúde.

• Iniciativas governamentais que promovem a segurança alimentar e regulamentações rigorosas sobre contaminação microbiana estão impulsionando os processadores de alimentos a adotar métodos de preservação mais seguros e eficazes. A conformidade regulatória está se tornando um fator importante nas decisões de compra em fábricas de alimentos. O encapsulamento oferece uma solução que atende aos padrões internacionais de qualidade e às crescentes expectativas dos consumidores por transparência nos ingredientes.

• Por exemplo, em 2022, autoridades reguladoras em toda a Europa introduziram diretrizes mais rigorosas, promovendo o uso de conservantes encapsulados em alimentos processados para aumentar o frescor e reduzir a exposição química direta. Essa iniciativa acelerou a adoção entre cadeias de padarias, fabricantes de laticínios e produtores de alimentos embalados europeus, com o objetivo de cumprir os requisitos de rótulos limpos e prolongar a vida útil dos produtos, ao mesmo tempo em que apoiava as metas mais amplas de sustentabilidade e segurança alimentar da região.

• Embora as preocupações com a segurança alimentar estejam acelerando a demanda, garantir acessibilidade e disponibilidade em larga escala continua sendo uma área de foco para as partes interessadas do setor. Aumentar a produção e aprimorar as redes de distribuição será crucial para alcançar pequenas e médias empresas. Parcerias entre fornecedores de tecnologia e empresas alimentícias podem ajudar a reduzir custos e expandir a penetração no mercado.

Restrição/Desafio

Altos custos de produção e conscientização limitada em mercados emergentes

• A produção de propionato de cálcio encapsulado na Europa envolve tecnologias avançadas de processamento, o que eleva os custos de fabricação em comparação com os conservantes convencionais. Essa diferença de preço frequentemente limita a adoção em regiões sensíveis a custos. Padarias e laticínios menores têm dificuldade em justificar o investimento, especialmente quando as margens de lucro são apertadas. Subsídios ou modelos de financiamento colaborativo podem ser necessários para preencher a lacuna de acessibilidade.

• Em muitos mercados em desenvolvimento, os processadores de alimentos não têm conhecimento sobre os benefícios dos conservantes encapsulados, continuando a depender de aditivos químicos tradicionais, que são mais baratos, mas menos eficazes. Esforços limitados de marketing e educação retardam a aceitação da tecnologia, apesar de suas vantagens comprovadas. Campanhas de conscientização por meio de associações comerciais e agências governamentais podem desempenhar um papel vital na mudança de percepções.

• A infraestrutura limitada de P&D em economias emergentes retarda ainda mais a adoção de tecnologias de encapsulamento, visto que os fabricantes locais enfrentam barreiras para expandir métodos avançados de preservação. A ausência de profissionais qualificados e de conhecimento técnico dificulta a inovação e o controle de qualidade nas instalações de produção. Joint ventures com empresas de tecnologia de alimentos podem ajudar a transferir conhecimento e desenvolver capacidades locais.

• Por exemplo, em 2023, padarias de pequeno porte em toda a Europa relataram hesitação em adotar conservantes encapsulados devido ao aumento dos custos de produção e à limitada expertise técnica. Essa dependência de métodos convencionais de preservação continua a limitar a otimização da vida útil e a competitividade no mercado, destacando a necessidade de iniciativas apoiadas por governos e colaborações da indústria para demonstrar as vantagens econômicas e de qualidade a longo prazo das soluções encapsuladas.

• Para superar esses desafios, os participantes do setor precisam se concentrar na otimização de custos, em programas de treinamento e em campanhas de conscientização para impulsionar a adoção em mercados com alto potencial de crescimento. A introdução de unidades de encapsulamento modular e sistemas de entrega de baixo custo pode tornar a tecnologia mais acessível. Parcerias regionais também podem facilitar o compartilhamento de recursos e a troca de conhecimento para apoiar fabricantes de pequena escala.

Escopo do mercado de propionato de cálcio encapsulado na Europa

O mercado é segmentado com base em grau, forma e aplicação.

- Por grau

Com base na classificação, o mercado europeu de propionato de cálcio encapsulado é segmentado em grau alimentício e grau de ração. O segmento de grau alimentício deteve a maior participação de mercado na receita em 2024, impulsionado pela crescente demanda por produtos de panificação e laticínios embalados, que exigem maior prazo de validade e padrões de segurança aprimorados. A crescente ênfase regulatória na qualidade dos alimentos e a preferência do consumidor por conservantes seguros e de rótulo limpo reforçam ainda mais o domínio deste segmento.

Espera-se que o segmento de rações para animais apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente necessidade de prevenir a deterioração microbiana na ração animal e manter a qualidade nutricional. O aumento da população pecuária e a conscientização sobre o manejo da saúde animal estão acelerando a adoção dessa categoria.

- Por Formulário

Com base na forma, o mercado de propionato de cálcio encapsulado é segmentado em pó e granulado. O segmento de pó foi responsável pela maior fatia da receita em 2024, pois oferece facilidade de mistura, distribuição uniforme em produtos alimentícios e custo-benefício na produção em larga escala. O propionato de cálcio encapsulado em pó da Europa é amplamente utilizado por fabricantes de panificação devido à sua solubilidade superior e desempenho de preservação consistente.

Espera-se que o segmento granular apresente a maior taxa de crescimento entre 2025 e 2032, devido às suas vantagens em liberação controlada, melhores propriedades de manuseio e menor formação de poeira. Essa forma está ganhando força em aplicações especializadas de processamento de alimentos, onde dosagem precisa e segurança são essenciais.

- Por aplicação

Com base na aplicação, o mercado europeu de propionato de cálcio encapsulado é segmentado em alimentos e bebidas e ração animal. O segmento de alimentos e bebidas deteve a maior fatia da receita em 2024, impulsionado pelo crescente consumo de produtos de panificação, laticínios e refeições prontas, onde prazo de validade prolongado e frescor são essenciais. A crescente urbanização e a demanda por alimentos de conveniência contribuem ainda mais para o crescimento do segmento.

Espera-se que o segmento de rações apresente a maior taxa de crescimento entre 2025 e 2032, devido ao aumento da produção pecuária e à necessidade de evitar a deterioração da ração durante o armazenamento e o transporte. O Propionato de Cálcio Encapsulado Europeu ajuda a manter a qualidade da ração, reduzindo perdas econômicas para os produtores e garantindo os padrões de saúde animal.

Análise regional do mercado europeu de propionato de cálcio encapsulado

- O mercado de propionato de cálcio encapsulado no Reino Unido e na Europa deverá dominar o mercado regional de 2025 a 2032, impulsionado por sua infraestrutura avançada de processamento de alimentos, altos padrões regulatórios para segurança alimentar e forte demanda por conservantes de rótulo limpo.

- A presença dos principais fabricantes de panificação e confeitaria, juntamente com os crescentes investimentos em tecnologias inovadoras de encapsulamento, posiciona o Reino Unido como um contribuidor fundamental para a quota de mercado da Europa.

Visão geral do mercado de propionato de cálcio encapsulado na Alemanha

Espera-se que o mercado alemão de propionato de cálcio encapsulado apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pelos rápidos avanços tecnológicos na conservação de alimentos e pela crescente demanda dos consumidores por produtos de panificação e laticínios de alta qualidade e longa vida útil. A ênfase alemã em inovações baseadas em pesquisa e aditivos alimentares sustentáveis acelera ainda mais a adoção do propionato de cálcio encapsulado na indústria de processamento de alimentos.

Participação no mercado de propionato de cálcio encapsulado na Europa

A indústria europeia de propionato de cálcio encapsulado é liderada principalmente por empresas bem estabelecidas, incluindo:

- Ingrizo NV (Bélgica)

- Glanbia plc (Irlanda)

- TasteTech (Reino Unido)

- Glanbia plc (Irlanda)

- ADDCON GmbH (Alemanha)

- AB Mauri (Reino Unido)

- Perstorp (Suécia)

- TasteTech (Reino Unido)

Últimos desenvolvimentos no mercado europeu de propionato de cálcio encapsulado

- Em agosto de 2022, a Balchem Corporation anunciou a aquisição da Cardinal Associates Inc., que operava como "Bergstrom Nutrition". A aquisição da Bergstrom Nutrition pela Balchem Corporation traz diversas vantagens estratégicas. A expansão da linha de produtos proporciona novas oportunidades de crescimento, fortalece a presença no mercado e complementa a expertise da Balchem em produtos minerais com respaldo científico, contribuindo para o desenvolvimento e o sucesso geral dos negócios.

- Em junho de 2022, a Balchem Corporation concluiu com sucesso a aquisição da Kappa Bioscience AS, uma importante fabricante com foco em ciência, sediada em Oslo, Noruega, especializada em vitamina K2 para a indústria de nutrição humana. Esta aquisição aprimora a oferta de produtos da empresa, amplia suas capacidades e abre novos caminhos para o crescimento. A aquisição está alinhada ao compromisso da Balchem com a inovação e a liderança de mercado, fornecendo um ativo valioso para atender às crescentes demandas dos consumidores no setor de nutrição e contribuindo para a expansão e o sucesso geral dos negócios.

- Em setembro de 2022, a Ingrizo NV anunciou que a Korys decidiu investir na Ingrizo para permitir que ela continuasse sua trajetória de crescimento e o desenvolvimento de seus portfólios de produtos atuais e futuros. A participação da Korys teve um efeito positivo, visto que ambas as partes tinham uma forte ambição de expandir significativamente o faturamento.

- Em novembro de 2023, na IBA Munique, renomada feira de panificação e confeitaria, a Llopartec apresentou sua expertise em soluções alimentares personalizadas, posicionando-se como líder no mercado internacional. O evento, um polo de intercomunicação e inovação, recebeu 1.073 expositores de 46 países e atraiu um público recorde de 57.000 visitantes de 150 nações. A Llopartec, com seu estande, apresentou novos produtos e inovações voltados principalmente para os setores de panificação, confeitaria e microencapsulação. Esta exposição ajudou a empresa a apresentar seu portfólio de produtos e inovação, além de expandir seu alcance de mercado.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.