Mercado europeu de embalagens de cartão canelado, por matéria-prima (Linerboard & Medium), estilo (caixa com fenda, telescópios, pastas, tabuleiros, folhas, fanfold, Die Cut Bliss & Die Cut Interiors), grau (Testliner não branqueado, Testliner de topo branco, não branqueado Kraftliner, Kraftliner de topo branco, caneluras à base de resíduos e caneluras semiquímicas), utilização final (alimentos processados, cuidados de saúde, bebidas, produtos químicos, têxteis, cuidados pessoais, produtos elétricos, peças de veículos, artigos de vidro e cerâmica, madeira e produtos de madeira , Cuidados Domésticos, Frutas e Legumes, Produtos de Papel, Tabaco e Outros), País (Alemanha, Reino Unido, França, Itália, Espanha, Holanda, Bélgica, Rússia, Turquia, Suíça , Polónia, Finlândia, Suécia, Noruega, Lituânia, Letónia, Estónia e Resto da Europa) Tendências e previsões da indústria para 2029

Análise de mercado e insights : Mercado europeu de embalagens de cartão canelado

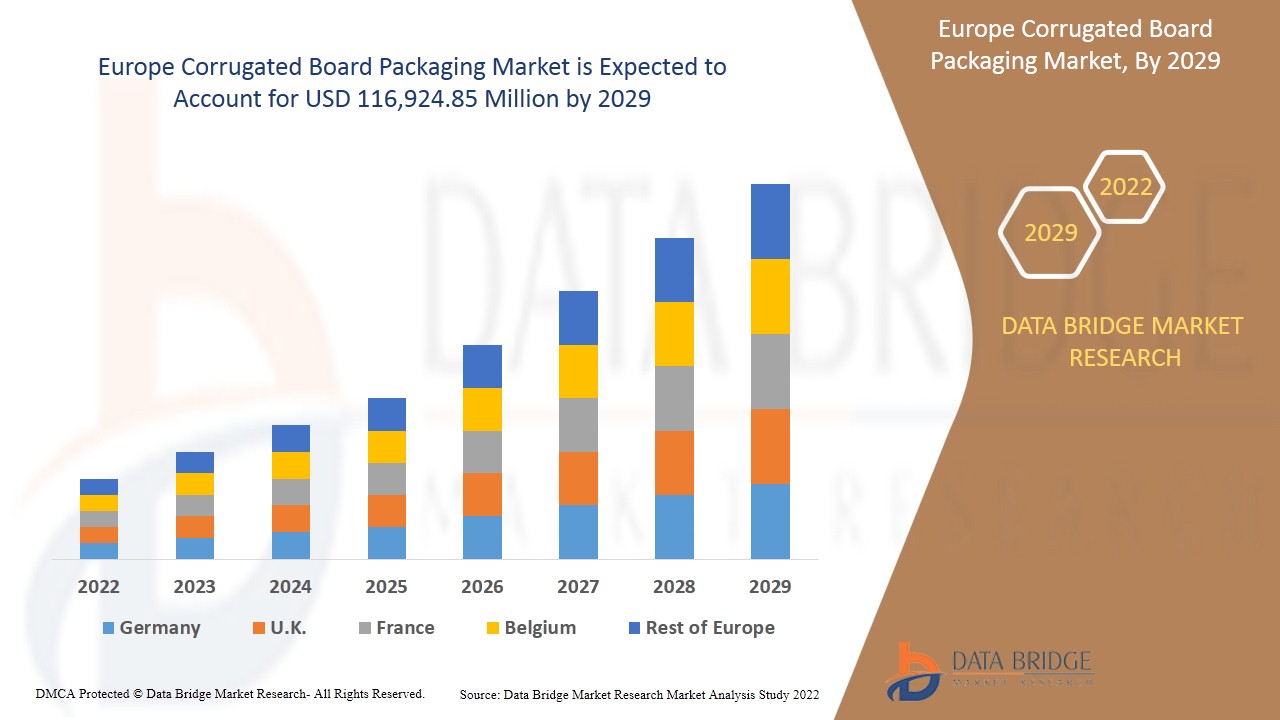

Espera-se que o mercado europeu de embalagens de cartão canelado ganhe crescimento de mercado no período de previsão de 2022 a 2029. A Data Bridge Market Research analisa que o mercado está a crescer com o CAGR de 5,9% no período de previsão de 2022 a 2029 e prevê-se que atinja os 116.924,85 milhões de dólares até 2029. Crescimento das embalagens de cartão canelado de pequena e média dimensão na indústria de embalagens para alimentos e bebidas e aumento das preferências por produtos de cartão canelado reciclados na indústria de embalagens. A fim de satisfazer a crescente procura de produtos de embalagem de cartão canelado na indústria da construção civil e da indústria eletrónica, algumas empresas estão a expandir as suas capacidades de produção através de aquisições, joint ventures e lançamento de produtos em diferentes regiões.

As embalagens de cartão canelado são concebidas para oferecer uma proteção extrema a produtos frágeis, pesados, volumosos ou de elevado valor em armazenamento e trânsito. Uma embalagem de cartão canelado com diversas camadas confere resistência ao produto embalado e torna-o mais resistente do que o cartão normal. Diferentes tipos de revestimentos são utilizados no cartão canelado para fornecer resistência, tais como revestimentos kraft, revestimentos de teste e chips lineares. O cartão canelado também atua como almofada para o produto em trânsito. Os produtos de embalagens de cartão canelado são 100% renováveis e de natureza económica e são utilizados para substituir as embalagens de madeira e metal. Existem diversos tipos de embalagens de cartão canelado como monofásica, parede simples, wallboard duplo, wallboard triplo, entre outras. A embalagem monofásica de cartão canelado inclui uma única ranhura e uma ou duas folhas de cartão linear. A embalagem de cartão canelado de parede única envolve uma folha do meio ondulado colada e colocada entre duas folhas do cartão do forro. O wallboard duplo refere-se ao tipo de embalagem de cartão canelado que consiste em duas camadas de meio canelado coladas entre três camadas do liner. O wallboard triplo refere-se ao tipo de embalagem de cartão canelado, que é considerada a mais forte de todos os tipos de embalagem de cartão canelado, uma vez que consiste em três camadas de meio canelado e quatro camadas de cartão forro.

Espera-se que o aumento das compras de caixas de cartão canelado leves em todos os setores impulsione o crescimento do mercado, no entanto, espera-se que as regulamentações governamentais rigorosas para as embalagens de produtos restrinjam o mercado de embalagens de cartão canelado da Ásia-Pacífico . Espera-se que o aumento da aquisição e colaboração entre empresas crie oportunidades para o crescimento do mercado, mas a falta de sensibilização para a sustentabilidade das embalagens está a causar um grande desafio para o crescimento do mercado.

O relatório do mercado de embalagens de cartão canelado fornece detalhes da quota de mercado, novos desenvolvimentos e análise do pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos , expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado de embalagens de cartão canelado, contacte a Data Bridge Market Research para obter um resumo do analista, a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir o objetivo desejado.

Âmbito do mercado de embalagens de cartão canelado e tamanho do mercado

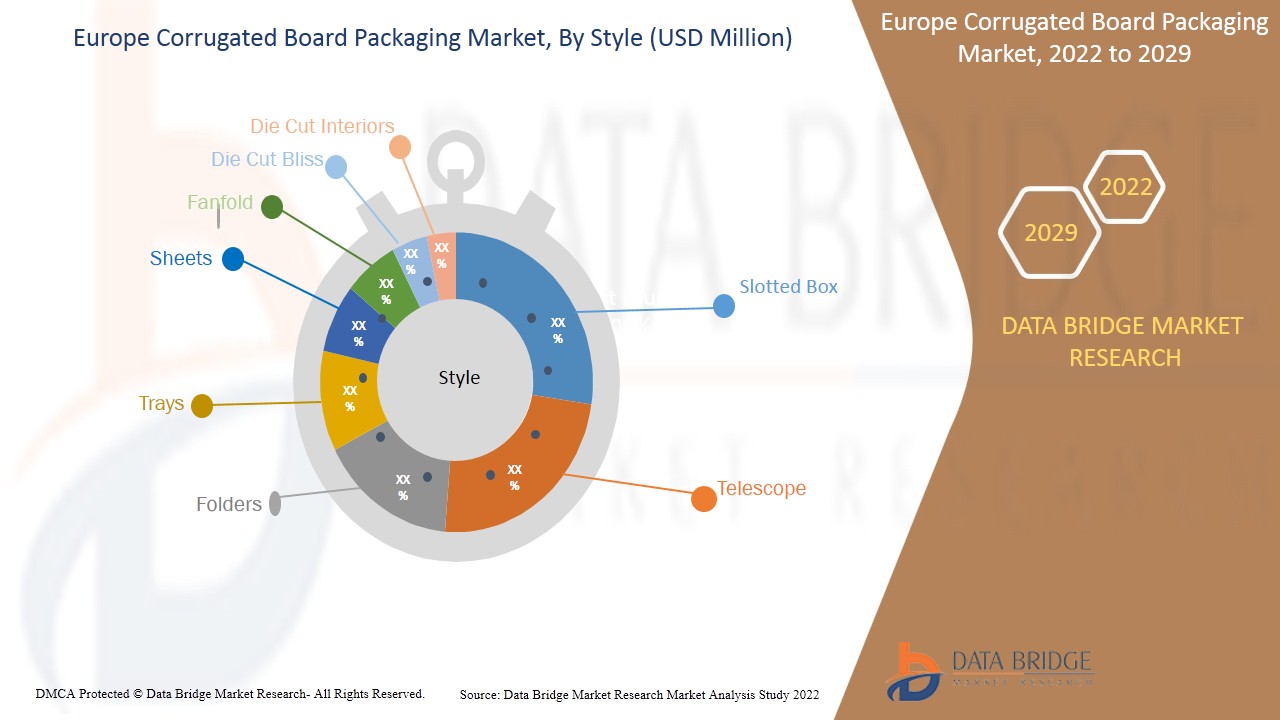

O mercado europeu de embalagens de cartão canelado está segmentado em quatro segmentos notáveis que se baseiam na qualidade, matéria-prima, estilo e utilização final. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base na matéria-prima, o mercado europeu de embalagens de cartão canelado está segmentado em linerboard e médio. Em 2022, espera-se que o segmento de linerboard domine o mercado europeu de embalagens de cartão canelado devido às técnicas de processamento fáceis, à eficiência melhorada e à utilização mais fácil. No entanto, a quantidade limitada de força restringe o consumo no mercado.

- Com base no segmento de estilo, o mercado europeu de embalagens de cartão canelado está segmentado em caixa com fenda, telescópios, pastas, tabuleiros, felicidade cortada, interiores cortados, folhas e fanfold. Em 2022, prevê-se que o segmento das caixas com ranhura domine o mercado devido à sua crescente aplicação na indústria alimentar e de bebidas no mercado europeu. A fácil disponibilidade no mercado impulsiona o segmento das caixas com ranhura no mercado europeu.

- Com base no segmento de qualidade, o mercado europeu de embalagens de cartão canelado está segmentado em kraftliner de topo branco, kraftliner não branqueado, testliner de topo branco, testliner não branqueado, caneluras à base de resíduos e caneluras semi-químicas. Em 2022, prevê-se que o segmento do testliner não branqueado domine o mercado devido à disponibilidade em abundância, o que maximiza o consumo no mercado europeu. As propriedades de resistência da força maximizam a aplicação em diversas áreas que impulsionam o segmento do testliner não branqueado no mercado europeu.

- Com base no segmento de utilização final, o mercado europeu de embalagens de cartão canelado está segmentado em alimentos processados, frutas e legumes, bebidas, cuidados pessoais, cuidados de saúde, cuidados domésticos, produtos químicos , produtos de papel, produtos elétricos, vidros e cerâmica , madeira e madeira produtos, têxteis , tabaco, peças de veículos, entre outros. Em 2022, prevê-se que o segmento dos alimentos processados domine o mercado devido à crescente procura de alimentos embalados nos países em desenvolvimento. As propriedades de fácil transporte impulsionam o segmento alimentar e das bebidas no mercado europeu.

Análise a nível de país do mercado de embalagens de cartão canelado

O mercado de embalagens de cartão canelado é analisado e são fornecidas informações sobre o tamanho do mercado por país, matéria-prima, estilo, grau e utilização final, conforme mencionado acima.

Os países abrangidos no relatório de mercado de embalagens de cartão canelado são Alemanha, Reino Unido, França, Itália, Espanha, Países Baixos, Bélgica, Rússia, Turquia, Suíça, Polónia, Finlândia, Suécia, Noruega, Lituânia, Letónia, Estónia e Resto da Europa.

Espera-se que a Alemanha domine a região europeia devido à crescente procura de alimentos e bebidas frescos, produtos domésticos e pessoais, aplicações logísticas, produtos eletrónicos, à sensibilização dos consumidores para embalagens sustentáveis e ao crescimento da indústria do comércio eletrónico que levou a uma progressão regular.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade das marcas europeias e os desafios enfrentados devido à concorrência grande ou escassa das marcas locais e nacionais, o impacto dos canais de vendas são considerados, ao mesmo tempo que fornecem uma análise de previsão dos dados do país.

Espera-se que a crescente inclinação das compras para caixas de cartão canelado leves em toda a indústria impulsione o crescimento do mercado

O mercado de embalagens de cartão canelado também fornece análises de mercado detalhadas para o crescimento de cada país num mercado específico. Além disso, fornece informações detalhadas sobre a estratégia dos intervenientes no mercado e a sua presença geográfica. Os dados estão disponíveis para o período histórico de 2020.

Análise do cenário competitivo e da quota de mercado das embalagens de cartão canelado

O panorama competitivo do mercado de embalagens de cartão canelado fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes, largura e amplitude do produto, domínio de aplicação, curva de segurança da tecnologia. Os dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de embalagens de cartão canelado.

Alguns dos principais players que operam no mercado de embalagens de cartão canelado são a Packaging Corporation of America, WestRock Company, International Paper, DS Smith, Rengo, Cascades Inc., Mondi, NEFAB GROUP, NIPPON PAPER INDUSTRIES CO., LTD, Sealed Air e Smurfit Kappa entre outros.

Muitos contratos e acordos são também iniciados pelas empresas da Europa que também estão a acelerar o mercado das embalagens de cartão canelado.

Por exemplo,

- Em 2021, o GRUPO NEFAB adquiriu o grupo Reflex Packaging, empresa líder mundial em amortecimento termoformado sustentável, para reforçar ainda mais o seu compromisso de poupar recursos nas cadeias de abastecimento. Para reduzir custos e impacto ambiental à escala global esta decisão foi tomada.

- Em agosto de 2021, a NIPPON PAPER INDUSTRIES CO., LTD. adquiriu duas certificações eco rail para os seus produtos ecológicos. A certificação foi obtida pelo ministério e infraestruturas do Japão. O produto foi reconhecido pelas empresas e foi elogiado. Mercado vai ter nova gama de produtos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE CORRUGATED BOARD PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 RAW MATERIAL TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVER

5.1.1 GROWING INCLINATION OF PURCHASES TOWARD LIGHT WEIGHT CORRUGATED BOXES ACROSS THE INDUSTRY

5.1.2 CONTINUED INDUSTRIALIZATION ACROSS EUROPELY FOR UNIQUE CARTONS AND MATERIALS

5.1.3 RISING DEMAND FOR SUSTAINABLE AND AESTHETIC PACKAGING IN THE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGHER COST OF CORRUGATED BOARD FOR PACKAGING

5.2.2 STRINGENT GOVERNMENT REGULATIONS FOR PACKAGING OF PRODUCTS

5.3 OPPORTUNITIES

5.3.1 RISE IN THE ACQUISITIONS & COLLABORATIONS BETWEEN THE COMPANIES

5.3.2 BAN ON PLASTIC PACKAGING PRODUCTS ON THE EUROPE MARKET

5.3.3 SURGING E-COMMERCE & COURIER SECTOR ACROSS DEVELOPED COUNTRIES

5.4 CHALLENGES

5.4.1 LACK OF AWARNESS ABOUT SUSTAINABLE PACKAGING

5.4.2 IMPACT OF HUMID AND MOIST WEATHER ON THE FIRMNESS OF CORRUGATED BOX

6 ANALYSIS ON IMPACT OF COVID 19 ON THE MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST MARKET GROWTH

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE & DEMAND

6.4 IMPACT ON SUPPLY CHAIN

6.5 CONCLUSION

7 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 LINERBOARD

7.2.1 RECYCLED RESOURCES

7.2.1.1 OCC

7.2.1.2 RECOVERY PAPER

7.2.1.3 MIXED PAPER

7.2.1.4 OFFICE PAPER

7.2.2 NATURAL RESOURCES

7.3 MEDIUM

7.3.1 RECYCLED RESOURCES

7.3.1.1 OCC

7.3.1.2 RECOVERY PAPER

7.3.1.3 MIXED PAPER

7.3.1.4 OFFICE PAPER

7.3.2 NATURAL RESOURCES

8 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY STYLE

8.1 OVERVIEW

8.2 SLOTTED BOX

8.3 TELESCOPES

8.4 FOLDERS

8.5 TRAYS

8.6 SHEETS

8.7 FANFOLD

8.8 DIE CUT BLISS

8.9 DIE CUT INTERIORS

9 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY GRADE

9.1 OVERVIEW

9.2 UNBLEACHED TESTILINER

9.3 WHITE-TOP TESTILINER

9.4 UNBLEACHED KRAFTLINER

9.5 WHITE-TOP KRAFTLINER

9.6 WASTE-BASED FLUTING

9.7 SEMI-CHEMICAL FLUTING

10 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY END-USE

10.1 OVERVIEW

10.2 PROCESSED FOODS

10.3 HEALTHCARE

10.4 BEVERAGES

10.5 CHEMICALS

10.6 TEXTILES

10.7 PERSONAL CARE

10.8 ELECTRICAL GOODS

10.9 VEHICLE PARTS

10.1 GLASSWARE AND CERAMICS

10.11 WOOD AND TIMBER PRODUCTS

10.12 HOUSEHOLD CARE

10.13 FRUITS AND VEGETABLES

10.14 PAPER PRODUCTS

10.15 TOBACCO

10.16 OTHER

11 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 NETHERLANDS

11.1.7 BELGIUM

11.1.8 RUSSIA

11.1.9 TURKEY

11.1.10 SWITZERLAND

11.1.11 POLAND

11.1.12 FINLAND

11.1.13 SWEDEN

11.1.14 NORWAY

11.1.15 LITHUANIA

11.1.16 LATVIA

11.1.17 ESTONIA

11.1.18 REST OF EUROPE

12 EUROPE CORRUGATED BOARD PACKAGING MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY SHARE ANALYSIS

14.1 WESTROCK COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 INTERNATIONAL PAPER

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 PACKAGING CORPORATION OF AMERICA

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 DS SMITH

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 RENGO CO, LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ARABIAN PACKAGING CO, LLC

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 B SMITH PACKAGING LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CASCADE INC

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 GEORGIA PACIFIC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 JONSAC AB

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 KLABIN S.A.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 KLINGELE PAPIERWERKE GMBH & CO.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MONDI

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 NEFAB GROUP

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NEWAY PACKAGING

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 NIPPON

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 OJI HOLDING CORPORATION

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 SMURFIT KAPPA

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 SEALED AIR

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 WERTHEIMER BOX CORPORATION

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 BASIC RULES TO CONSIDER FOR SINGLE WALL CORRUGATED FIBERBOARD BOXES:

TABLE 2 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 3 EUROPE LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 EUROPE RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE SLOTTED BOX IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE TELESCOPE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE FOLDERS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE TRAYS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE SHEETS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE FANFOLD IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE DIE CUT BLISS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE DIE CUT INTERIORS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 19 EUROPE UNBLEACHED TESTILINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE WHITE-TOP TESTILINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE UNBLEACHED KRAFTLINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE WHITE-TOP KRAFTLINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE WASTE-BASED FLUTING IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE SEMI-CHEMICAL FLUTING IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE PROCESSED FOODS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE HEALTHCARE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 28 EUROPE BEVERAGES IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE CHEMICALS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE TEXTILES IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE PERSONAL CARE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE ELECTRICAL GOODS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE VEHICLE PARTS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE GLASSWARE AND CERAMICS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE WOOD AND TIMBER PRODUCTS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE HOUSEHOLD CARE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE FRUITS AND VEGETABLES IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE PAPER PRODUCTS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE TOBACCO IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE OTHER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 42 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 43 EUROPE LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 EUROPE RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 EUROPE MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 EUROPE RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 48 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 50 GERMANY CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 51 GERMANY LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 GERMANY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 GERMANY MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 GERMANY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 GERMANY CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 56 GERMANY CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 57 GERMANY CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 U.K. CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 59 U.K. LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.K. RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.K. RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.K. CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 64 U.K. CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 65 U.K. CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 66 FRANCE CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 67 FRANCE LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 FRANCE RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 FRANCE MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 FRANCE RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 FRANCE CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 72 FRANCE CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 73 FRANCE CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 74 ITALY CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 75 ITALY LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ITALY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 ITALY MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 ITALY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 ITALY CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 80 ITALY CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 81 ITALY CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 82 SPAIN CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 83 SPAIN LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SPAIN RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 SPAIN MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 SPAIN RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SPAIN CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 88 SPAIN CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 89 SPAIN CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 90 NETHERLANDS CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 91 NETHERLANDS LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 NETHERLANDS RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 NETHERLANDS MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 NETHERLANDS RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 NETHERLANDS CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 96 NETHERLANDS CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 97 NETHERLANDS CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 98 BELGIUM CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 BELGIUM LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 BELGIUM RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 BELGIUM MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 BELGIUM RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 BELGIUM CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 104 BELGIUM CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 105 BELGIUM CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 106 RUSSIA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 107 RUSSIA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 RUSSIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 RUSSIA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 RUSSIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 RUSSIA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 112 RUSSIA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 113 RUSSIA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 114 TURKEY CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 115 TURKEY LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 TURKEY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 TURKEY MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 TURKEY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 TURKEY CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 120 TURKEY CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 121 TURKEY CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 130 POLAND CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 131 POLAND LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 POLAND RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 POLAND MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 POLAND RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 POLAND CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 136 POLAND CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 137 POLAND CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 138 FINLAND CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 139 FINLAND LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 FINLAND RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 FINLAND MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 FINLAND RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 FINLAND CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 144 FINLAND CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 145 FINLAND CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 146 SWEDEN CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 147 SWEDEN LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 SWEDEN RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 SWEDEN MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 SWEDEN RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 SWEDEN CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 152 SWEDEN CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 153 SWEDEN CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 154 NORWAY CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 155 NORWAY LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 NORWAY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 NORWAY MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 NORWAY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 NORWAY CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 160 NORWAY CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 161 NORWAY CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 162 LITHUANIA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 163 LITHUANIA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 LITHUANIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 LITHUANIA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 LITHUANIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 LITHUANIA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 168 LITHUANIA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 169 LITHUANIA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 170 LATVIA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 171 LATVIA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 LATVIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 LATVIA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 LATVIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 LATVIA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 176 LATVIA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 177 LATVIA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 178 ESTONIA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 179 ESTONIA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 ESTONIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 ESTONIA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 ESTONIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 ESTONIA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 184 ESTONIA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 185 ESTONIA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 186 REST OF EUROPE CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 EUROPE CORRUGATED BOARD PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE CORRUGATED BOARD PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE CORRUGATED BOARD PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE CORRUGATED BOARD PACKAGING MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE CORRUGATED BOARD PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE CORRUGATED BOARD PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE CORRUGATED BOARD PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE CORRUGATED BOARD PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE CORRUGATED BOARD PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE CORRUGATED BOARD PACKAGING MARKET: SEGMENTATION

FIGURE 11 GROWING INCLINATION OF PURCHASES TOWARD LIGHT WEIGHT CORRUGATED BOXES ACROSS THE INDUSTRY IS EXPECTED TO DRIVE EUROPE CORRUGATED BOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 RAW MATERIAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE CORRUGATED BOARD PACKAGING MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND ALSO THE FASTEST GROWING REGION IN THE EUROPE CORRUGATED BOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVER, RESTRAINTS, OPPORTUNITIES, CHALLENGES FOR EUROPE CORRUGATED BOARD PACKAGING MARKET

FIGURE 15 BELOW FIGURE DEPICTS THE EARNING REVENUE FROM DIFFERENT TYPE OF PACKAGING IN U.S. PACKAGING INDUSTRY IN 2016 (IN %)

FIGURE 16 U.S RETAIL SALES VIA E-COMMERCE IN 2019

FIGURE 17 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY RAW MATERIAL, 2021

FIGURE 18 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY STYLE, 2021

FIGURE 19 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY GRADE, 2021

FIGURE 20 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY END-USE, 2021

FIGURE 21 EUROPE CORRUGATED BOARD PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY RAW MATERIAL (2022-2029)

FIGURE 26 EUROPE CORRUGATED BOARD PACKAGING MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.