Europe Biodegradable Paper and Plastic Packaging Market, By Packaging Type (Plastic and Paper), Product (Bags, Baking Sheets, Paper Plates, Clamshell Sandwich Containers, Portion Cups, Trays, Cutlery, Bowls, Pouches and Sachets, Lidded, and Others), Usage (Single-Use, and Reusable), Distribution Channel (E-Commerce, Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, and Others), Application (Food Packaging, Beverage Packaging, Pharmaceuticals Packaging, Personal & Home Care Packaging, Electronic Appliance Packaging, and Others), Packaging Layer (Primary Packaging, Secondary Packaging, and Tertiary Packaging), End-User (Restaurants, Hotels, Tea and Coffee Shops, Sweets & Snacks Stores, Cafeteria, and Others), Country (Germany, U.K., Italy, France, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, and Rest of Europe), Industry Trends and Forecast to 2029.

Market Analysis and Insights: Europe Biodegradable Paper and Plastic Packaging Market

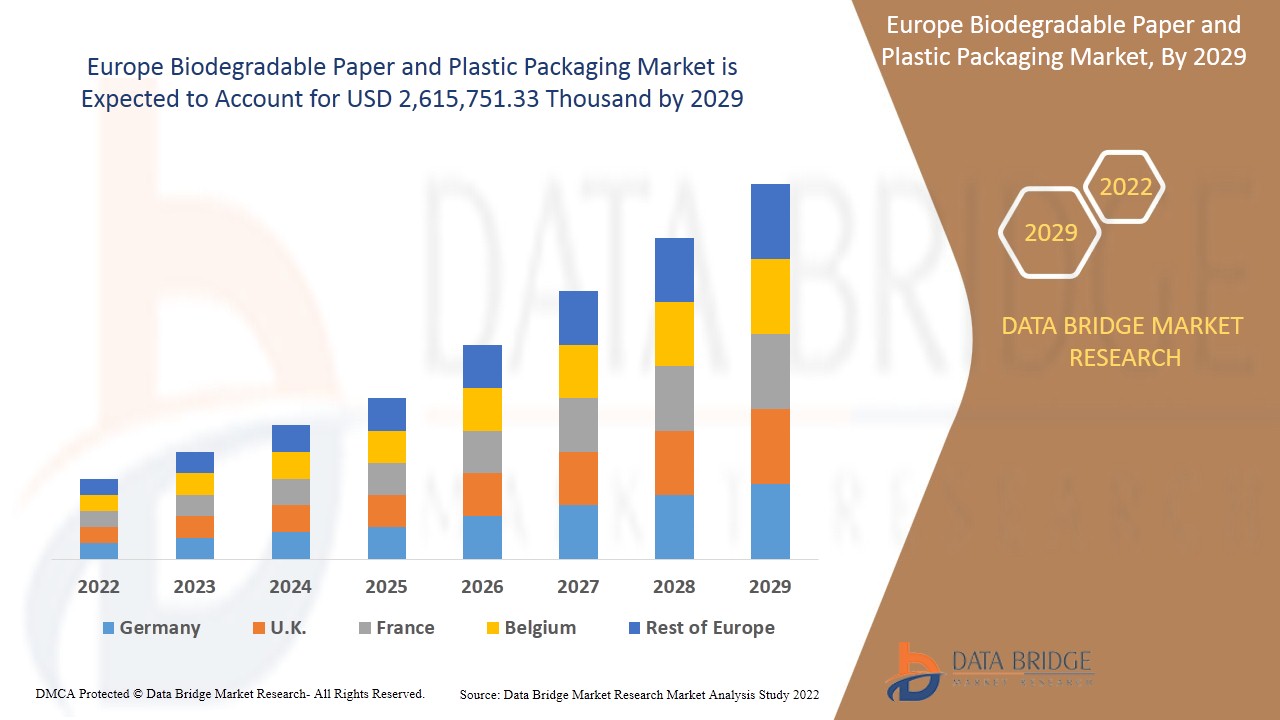

Europe biodegradable paper and plastic packaging market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing at a CAGR of 7.8% in the forecast period of 2022 to 2029 and is expected to reach USD 2,615,751.33 thousand by 2029. One of the significant drivers associated with the Europe biodegradable paper and plastic packaging market could be strengthening government regulations related to packaging.

Biodegradable paper and plastic packaging is an environmentally friendly commodity that does not emit any carbon during the production process. Due to the rising awareness among the population about eco-friendly packaging, the demand for biodegradable paper and plastic packaging has increased. It applies to several industries such as pharmaceutical, food, healthcare, and environmental industries. With various types of plastics, the food and beverage industry is highly dependent on packaging materials.

Growing consumer awareness related to eco-friendly packaging is expected to drive market growth. The need for lower carbon footprint materials may act as a potential market driver for the market. Also, phase-out of single-use plastics, increasing the sales and profit of the players operating in the market.

The major restraint impacting the Europe biodegradable paper and plastic packaging market is the limited investment in biodegradable plastic production. Further, a high focus on recyclable and bio-based non-biodegradable plastic production can also restrain the market growth. The production of polylactic acid (PLA) from sugarcane and corn is expected to create opportunities for the Europe biodegradable paper and plastic packaging market. Limited availability of machines and equipment for bio-based materials is likely to act as a challenge for the market growth.

This Europe biodegradable paper and plastic packaging market report provide details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Europe Biodegradable Paper and Plastic Packaging Market Scope and Market Size

Europe biodegradable paper and plastic packaging market is segmented based on packaging type, product, usage, distribution channel, application, packaging layer and end-user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

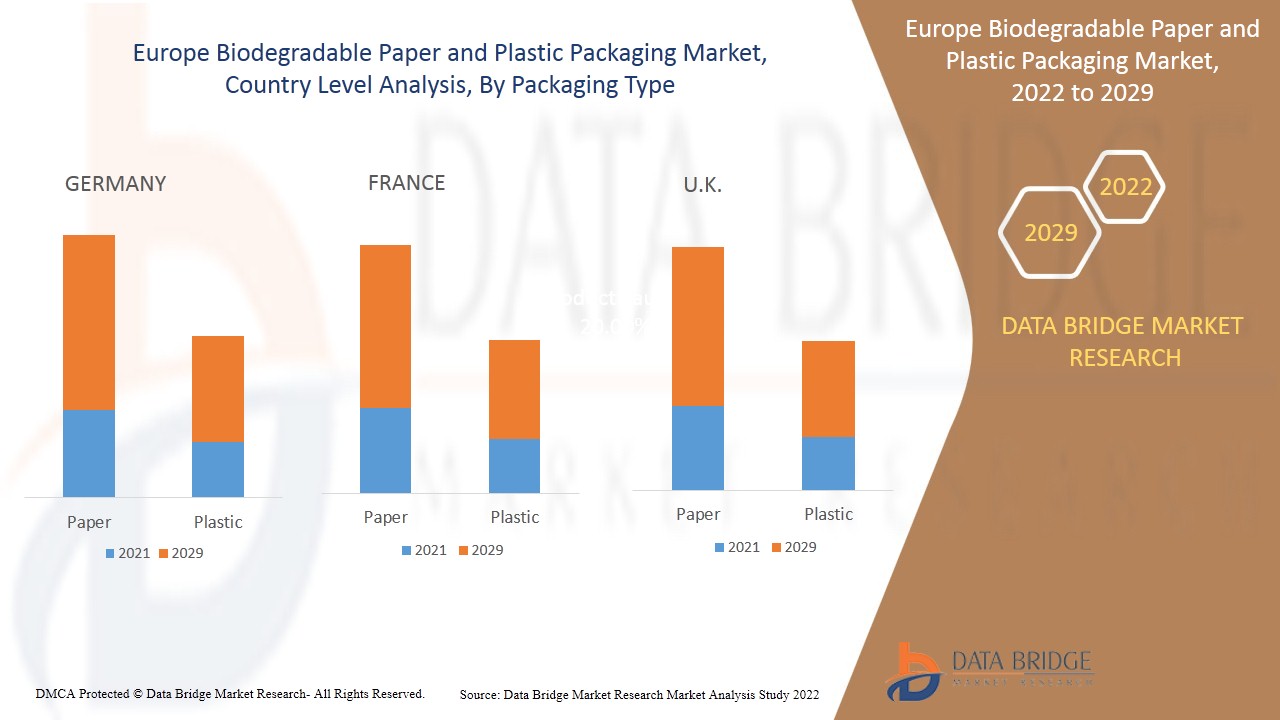

- On the basis of packaging type, the Europe biodegradable paper and plastic packaging market is segmented into paper and plastics. In 2022, the paper segment is expected to dominate the Europe biodegradable paper and plastic packaging market as the manufacturing process of paper requires less skilled laborers with easy availability of resources or raw material, which increases its demand.

- On the basis of product, the Europe biodegradable paper and plastic packaging market is segmented into straws, bags, baking sheets, paper plates, clamshell sandwich containers, portion cups, trays, cutlery, bowls, pouches and sachets, lidded, and others. In 2022, the bags segment is expected to dominate the Europe biodegradable paper and plastic packaging market as it is durable and can be used for multipurpose, which increases its demand.

- On the basis of usage, the Europe biodegradable paper and plastic packaging market is segmented into single-use and reusable. In 2022, the reusable segment is expected to dominate the Europe biodegradable paper and plastic packaging market as it prevents unnecessary exploitation of resources and prevents littering, thus increasing its demand in the forecast period.

- On the basis of distribution channel, the Europe biodegradable paper and plastic packaging market is segmented into e-commerce, supermarkets/hypermarkets, convenience stores, specialty stores, and others. In 2022, the supermarkets/hypermarkets segment is expected to dominate the Europe biodegradable paper and plastic packaging market as customers can enjoy full freedom of selection, which increases its demand in the forecast period.

- On the basis of application, the Europe biodegradable paper and plastic packaging market is segmented into food packaging, beverage packaging, pharmaceuticals packaging, personal & home care packaging, electronic appliance packaging, and others. In 2022, the food packaging segment is expected to dominate the Europe biodegradable paper and plastic packaging market as it makes food safer and less vulnerable to contamination which increases its demand.

- On the basis of packaging layer, the Europe biodegradable paper and plastic packaging market is segmented into primary packaging, secondary packaging, and tertiary packaging. In 2022, the primary packaging segment is expected to dominate the Europe biodegradable paper and plastic packaging market as it is low cost and designed for end-users who have printed information of the product, thus increasing its demand in the forecast period.

- On the basis of end-user, the Europe biodegradable paper and plastic packaging market is segmented into restaurants, hotels, tea and coffee shops, sweets & snacks stores, cafeteria and others. In 2022, the restaurants segment is expected to dominate the Europe biodegradable paper and plastic packaging market as it introduces diners to different cultures through food and its packaging, which increases its demand in the forecast period.

Europe Biodegradable Paper and Plastic Packaging Market, Country Level Analysis

Europe biodegradable paper and plastic packaging market is segmented based on packaging type, product, usage, distribution channel, application, packaging layer and end-user.

The countries covered in the Europe biodegradable paper and plastic packaging market report are Germany, U.K., Italy, France, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, and the Rest of Europe.

Germany is expected to dominate the Europe biodegradable paper and plastic packaging market due to the increasing need for lower carbon footprint materials. In France, growing consumer awareness related to eco-friendly packaging is proven to boost the demand for biodegradable paper and plastic packaging in every sector. Whereas in the U.K., strengthening government regulations related to packaging is expected to boost the biodegradable paper and plastic packaging demand among end-users.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of European brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growth in the Biodegradable Paper and Plastic Packaging Industry

Europe biodegradable paper and plastic packaging market also provide you with detailed market analysis for every country growth in an installed base of different kind of products for the biodegradable paper and plastic packaging market, the impact of technology using lifeline curves, and changes in infant formula regulatory scenarios and their impact on the Europe biodegradable paper and plastic packaging market. The data is available for the historical period 2012 to 2020.

Competitive Landscape and Europe Biodegradable Paper and Plastic Packaging Market Share Analysis

The Europe biodegradable paper and plastic packaging market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the company’s focus on the Europe biodegradable paper and plastic packaging market.

Some of the major players covered in the report are Smurfit Kappa, DS Smith, Tetra Pak, Mondi, International Paper, VPK Group, Sonoco Products Company, STOROPACK HANS REICHENECKER GMBH, WestRock Company, Stora Enso, Eurocell srl, Novamont S.p.A., OSQ, BIO-LUTIONS International AG, TIPA LTD, Robert Cullen Ltd., BioApply, CPS Paper Products, The Biodegradable Bag Company Ltd., Hosgör Plastik are among other players domestic and regional. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

For instance,

- In October 2021, VPK Group launched the DA Alizay industrial site, located in the Normandy region, into a hub for sustainable development in the circular economy. VPK Group announces to carry out the rebuilding of the paper machine with Valmet Oyj

- In November 2021, Mondi invested €20 million to improve the sustainability of its pulp production at the Frantschach mill in Austria. This new plant equipment will make Mondi’s pulp production even more efficient and sustainable. This will further help to gain a customer base

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 USAGE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 CUSTOMER BARGAINING POWER

4.1.4 SUPPLIER BARGAINING POWER

4.1.5 INTERNAL COMPETITION (RIVALRY)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 NEED FOR LOWER CARBON FOOTPRINT MATERIALS

5.1.2 GROWING CONSUMER AWARENESS RELATED TO ECO-FRIENDLY PACKAGING

5.1.3 STRENGHTHENING OF GOVERNMENT REGULATIONS RELATED TO PACKAGING

5.1.4 PHASE OUT OF SINGLE USE PLASTICS

5.2 RESTRAINTS

5.2.1 HIGH COST OF BIODEGRADABLE PACKAGING PRODUCTS

5.2.2 LOW PRODUCTION OF POLYHYDROXYBUTYRATE ACID (PHB)

5.2.3 LIMITED INVESTMENT IN BIODEGRADABLE PLASTIC PRODUCTION

5.2.4 HIGH FOCUS ON RECYCLABLE AND BIO-BASED NON-BIODEGRADABLE PLASTIC PRODUCTION

5.3 OPPORTUNITIES

5.3.1 PRODUCTION OF COST-EFFECTIVE BIODEGRADABLE PACKAGING PRODUCTS

5.3.2 PRODUCTION OF POLYLACTIC ACID (PLA) FROM SUGARCANE AND CORN

5.3.3 BIODEGRADABLE PACKAGING PRODUCTION FOR HEALTHCARE INDUSTRY

5.4 CHALLENGES

5.4.1 HIGH FLUCTUATION IN RAW MATERIAL PRICES

5.4.2 LIMITED AVAILABILITY OF MACHINES AND EQUIPMENT FOR PRODUCTION OF BIO-BASED MATERIALS

5.4.3 LOW YIELD IN PRODUCTION OF BIO-BASED PLASTIC RESINS

6 IMPACT OF COVID-19 ON EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE EUROPE BIODEGRADABLE PLASTIC & PAPER PACKAGING MARKET

6.2 STRATERGIC DECISIONS BY MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 PRICE IMPACT

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 BAGS

7.2.1 STANDARD CARRY BAGS

7.2.2 STAND UP BAGS

7.2.2.1 ROUND BOTTOM GUSSET TYPE

7.2.2.2 SEAL BOTTOM TYPE

7.2.2.3 PLOW BOTTOM TYPE

7.2.2.4 SIDE GUSSET TYPE

7.2.2.5 THREE SIDE SEALED

7.2.2.6 FOUR SIDE SEALED

7.2.2.7 OTHERS

7.2.3 T-SHIRT PLASTIC BAGS

7.2.4 SELF-OPENING STYLE BAGS

7.2.5 ZIPPER BAGS

7.2.6 FOOD SAFE BARRIER BAGS

7.2.7 SMELL PROOF BAGS

7.2.8 PINCH BOTTOM BAGS

7.2.9 OTHERS

7.3 TRAYS

7.4 PAPER PLATES

7.5 BOWLS

7.6 CLAMSHELL SANDWICH CONTAINERS

7.7 POUCHES AND SACHETS

7.8 PORTION CUPS

7.9 STRAWS

7.1 CUTLERY

7.11 LIDDED

7.12 BAKING SHEETS

7.13 OTHERS

8 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE

8.1 OVERVIEW

8.2 PAPER

8.2.1 CORRUGATED BOARD

8.2.2 BOXBOARD

8.2.3 FLEXIBLE PAPER

8.2.4 OTHERS

8.3 PLASTIC

8.3.1 PLA

8.3.2 STARCH BASED PLASTIC

8.3.3 PBS

8.3.4 PHA

8.3.5 PCL

8.3.6 OTHERS

9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE

9.1 OVERVIEW

9.2 REUSABLE

9.3 SINGLE-USE

10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SUPERMARKETS/HYPERMARKETS

10.3 CONVENIENCE STORES

10.4 SPECIALTY STORES

10.5 E-COMMERCE

10.6 OTHERS

11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER

11.1 OVERVIEW

11.2 PRIMARY PACKAGING

11.3 SECONDARY PACKAGING

11.4 TERTIARY PACKAGING

12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD PACKAGING

12.2.1 FOOD PACKAGING, BY APPLICATION

12.2.1.1 FRUITS

12.2.1.2 VEGETABLE

12.2.1.3 BAKERY PRODUCTS

12.2.1.3.1 CAKES

12.2.1.3.2 PASTRIES

12.2.1.3.3 BISCUITS

12.2.1.3.4 BREAD

12.2.1.3.5 OTHERS

12.2.1.4 COOKED FOOD

12.2.1.4.1 PIZZA

12.2.1.4.2 SANDWICH

12.2.1.4.3 BURGER

12.2.1.4.4 OTHERS

12.2.1.5 MEAT, SEAFOOD AND POULTRY

12.2.1.6 DAIRY PRODUCTS

12.2.1.6.1 EGGS

12.2.1.6.2 CHEESE

12.2.1.6.3 OTHERS

12.2.1.7 OTHERS

12.3 BEVERAGE PACKAGING

12.4 ELECTRONIC APPLIANCE PACKAGING

12.5 PERSONAL & HOME CARE PACKAGING

12.6 PHARMACEUTICALS PACKAGING

12.7 OTHERS

13 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER

13.1 OVERVIEW

13.2 RESTAURANTS

13.2.1 RESTAURANTS, BY PRODUCT

13.2.1.1 BAGS

13.2.1.2 TRAYS

13.2.1.3 PAPER PLATES

13.2.1.4 BOWLS

13.2.1.5 CLAMSHELL SANDWICH CONTAINERS

13.2.1.6 POUCHES AND SACHETS

13.2.1.7 PORTION CUPS

13.2.1.8 STRAWS

13.2.1.9 CUTLERY

13.2.1.10 LIDDED

13.2.1.11 BAKING SHEETS

13.2.1.12 OTHERS

13.3 SWEETS & SNACKS STORES

13.3.1 SWEETS & SNACKS STORES, BY PRODUCT

13.3.1.1 BAGS

13.3.1.2 TRAYS

13.3.1.3 PAPER PLATES

13.3.1.4 BOWLS

13.3.1.5 CLAMSHELL SANDWICH CONTAINERS

13.3.1.6 POUCHES AND SACHETS

13.3.1.7 PORTION CUPS

13.3.1.8 STRAWS

13.3.1.9 CUTLERY

13.3.1.10 LIDDED

13.3.1.11 BAKING SHEETS

13.3.1.12 OTHERS

13.4 CAFETERIA

13.4.1 CAFETERIA, BY PRODUCT

13.4.1.1 BAGS

13.4.1.2 TRAYS

13.4.1.3 PAPER PLATES

13.4.1.4 BOWLS

13.4.1.5 CLAMSHELL SANDWICH CONTAINERS

13.4.1.6 POUCHES AND SACHETS

13.4.1.7 PORTION CUPS

13.4.1.8 STRAWS

13.4.1.9 CUTLERY

13.4.1.10 LIDDED

13.4.1.11 BAKING SHEETS

13.4.1.12 OTHERS

13.5 TEA AND COFFEE SHOPS

13.5.1 TEA AND COFFEE SHOPS, BY PRODUCT

13.5.1.1 BAGS

13.5.1.2 TRAYS

13.5.1.3 PAPER PLATES

13.5.1.4 BOWLS

13.5.1.5 CLAMSHELL SANDWICH CONTAINERS

13.5.1.6 POUCHES AND SACHETS

13.5.1.7 PORTION CUPS

13.5.1.8 STRAWS

13.5.1.9 CUTLERY

13.5.1.10 LIDDED

13.5.1.11 BAKING SHEETS

13.5.1.12 OTHERS

13.6 HOTELS

13.6.1 HOTELS, BY PRODUCT

13.6.1.1 BAGS

13.6.1.2 TRAYS

13.6.1.3 PAPER PLATES

13.6.1.4 BOWLS

13.6.1.5 CLAMSHELL SANDWICH CONTAINERS

13.6.1.6 POUCHES AND SACHETS

13.6.1.7 PORTION CUPS

13.6.1.8 STRAWS

13.6.1.9 CUTLERY

13.6.1.10 LIDDED

13.6.1.11 BAKING SHEETS

13.6.1.12 OTHERS

13.7 OTHERS

13.7.1 OTHERS, BY PRODUCT

13.7.1.1 BAGS

13.7.1.2 TRAYS

13.7.1.3 PAPER PLATES

13.7.1.4 BOWLS

13.7.1.5 CLAMSHELL SANDWICH CONTAINERS

13.7.1.6 POUCHES AND SACHETS

13.7.1.7 PORTION CUPS

13.7.1.8 STRAWS

13.7.1.9 CUTLERY

13.7.1.10 LIDDED

13.7.1.11 BAKING SHEETS

13.7.1.12 OTHERS

14 EUROPE

14.1 GERMANY

14.2 FRANCE

14.3 U.K.

14.4 ITALY

14.5 SPAIN

14.6 RUSSIA

14.7 BELGIUM

14.8 NETHERLANDS

14.9 SWITZERLAND

14.1 TURKEY

14.11 REST OF EUROPE

15 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 MERGERS & ACQUISITIONS

15.3 EXPANSIONS

15.4 NEW PRODUCT DEVELOPMENT

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SMURFIT KAPPA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATES

17.2 DS SMITH

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 TETRA PAK

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT UPDATES

17.4 MONDI

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 INTERNATIONAL PAPER

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 VPK GROUP

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 SONOCO PRODUCTS COMPANY

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT UPDATE

17.8 STOROPACK HANS REICHENECKER GMBH

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATES

17.9 BIOAPPLY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT UPDATE

17.1 BIO-LUTIONS INTERNATIONAL AG

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT UPDATES

17.11 CPS PAPER PRODUCTS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATE

17.12 EUROCELL SRL

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT UPDATE

17.13 HOŞGÖR PLASTIK

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 NOVAMONT S.P.A.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT UPDATE

17.15 OSQ

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT UPDATE

17.16 ROBERT CULLEN LTD

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATE

17.17 STORA ENZO

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT UPDATE

17.18 THE BIODEGRADABLE BAG COMPANY LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT UPDATE

17.19 TIPA LTD

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT UPDATES

17.2 WEST ROCK COMPANY

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT UPDATES

18 QUESTIONNAIRES

19 RELATED REPORTS

Lista de Tabela

TABLE 1 IMPORT DATA OF ARTICLES FOR CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS AND OTHER CLOSURE OF PLASTICS.; HS CODE - 3923 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES FOR CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS AND OTHER CLOSURE OF PLASTICS .; HS CODE - 3923 (USD THOUSAND)

TABLE 3 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND )

TABLE 13 EUROPE FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE DAIRY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 26 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 28 GERMANY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 29 GERMANY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 30 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 GERMANY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 32 GERMANY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 34 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 35 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 36 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 GERMANY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 38 GERMANY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 GERMANY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 GERMANY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 42 GERMANY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 GERMANY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 44 GERMANY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 GERMANY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 46 GERMANY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 GERMANY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 48 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 50 FRANCE BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 51 FRANCE STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 FRANCE PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 FRANCE PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 56 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 57 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 58 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 FRANCE FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 60 FRANCE BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 FRANCE COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 FRANCE DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 64 FRANCE RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 65 FRANCE SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 66 FRANCE CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 FRANCE TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 68 FRANCE HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 FRANCE OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 70 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 72 U.K. BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 U.K. STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 74 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 U.K. PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 U.K. PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 78 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 79 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 80 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 U.K. FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 82 U.K. BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 83 U.K. COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 U.K. DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 86 U.K. RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 U.K. SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 88 U.K. CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 U.K. TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 90 U.K. HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 91 U.K. OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 92 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 93 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 94 ITALY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 95 ITALY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 96 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 ITALY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 ITALY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 100 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 101 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 102 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 103 ITALY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 104 ITALY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 105 ITALY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 ITALY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 108 ITALY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 109 ITALY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 110 ITALY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 111 ITALY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 112 ITALY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 113 ITALY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 114 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 116 SPAIN BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 117 SPAIN STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 118 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 SPAIN PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 SPAIN PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 122 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 123 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 124 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 SPAIN FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 126 SPAIN BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 127 SPAIN COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 128 SPAIN DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 130 SPAIN RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 131 SPAIN SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 132 SPAIN CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 133 SPAIN TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 134 SPAIN HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 135 SPAIN OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 136 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 137 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 138 RUSSIA BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 139 RUSSIA STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 140 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 RUSSIA PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 RUSSIA PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 144 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 145 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 146 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 RUSSIA FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 148 RUSSIA BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 RUSSIA COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 150 RUSSIA DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 152 RUSSIA RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 153 RUSSIA SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 154 RUSSIA CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 155 RUSSIA TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 156 RUSSIA HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 157 RUSSIA OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 158 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 159 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 160 BELGIUM BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 161 BELGIUM STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 162 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 BELGIUM PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 BELGIUM PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 166 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 167 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 168 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 169 BELGIUM FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 170 BELGIUM BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 171 BELGIUM COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 172 BELGIUM DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 173 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 174 BELGIUM RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 175 BELGIUM SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 176 BELGIUM CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 177 BELGIUM TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 178 BELGIUM HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 179 BELGIUM OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 180 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 181 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 182 NETHERLANDS BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 183 NETHERLANDS STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 184 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 NETHERLANDS PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 NETHERLANDS PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 188 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 189 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 190 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 191 NETHERLANDS FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 192 NETHERLANDS BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 193 NETHERLANDS COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 194 NETHERLANDS DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 196 NETHERLANDS RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 197 NETHERLANDS SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 198 NETHERLANDS CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 199 NETHERLANDS TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 200 NETHERLANDS HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 201 NETHERLANDS OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 202 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 203 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 204 SWITZERLAND BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 205 SWITZERLAND STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 206 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 207 SWITZERLAND PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 208 SWITZERLAND PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 210 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 211 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 212 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 213 SWITZERLAND FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 214 SWITZERLAND BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 215 SWITZERLAND COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 216 SWITZERLAND DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 217 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 218 SWITZERLAND RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 219 SWITZERLAND SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 220 SWITZERLAND CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 221 SWITZERLAND TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 222 SWITZERLAND HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 223 SWITZERLAND OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 224 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 225 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 226 TURKEY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 227 TURKEY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 228 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 229 TURKEY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 230 TURKEY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 231 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 232 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 233 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 234 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 235 TURKEY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 236 TURKEY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 237 TURKEY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 238 TURKEY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 239 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 240 TURKEY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 241 TURKEY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 242 TURKEY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 243 TURKEY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 244 TURKEY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 245 TURKEY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 246 REST OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 247 REST OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

Lista de Figura

FIGURE 1 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: GLOBAL VS. REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: THE USAGE LIFE LINE CURVE

FIGURE 7 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 14 GROWING CONSUMER AWARENESS RELATED TO ECOFRIENDLY PACKAGING IS DRIVING THE EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET IN 2022 TO 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

FIGURE 17 VOLUME OF PLASTIC POLYMERS USE IN THE EUROPEAN UNION (MILLION TONS), 2018

FIGURE 18 EUROPE BIOPLASTICS MARKET, BY TYPE (IN EUROPE), 2018

FIGURE 19 PRODUCTION CAPACITY OF BIOPLASTICS, BY MATERIAL TYPE, 2019

FIGURE 20 TYPES OF NATIONAL RESTRICTIONS OR BANS IN THE WORLD (%)

FIGURE 21 BANS ON SPECIFIC PRODUCTS (N) ASSOCIATED WITH FOOD SERVICE AND DELIVERY

FIGURE 22 PRODUCTION COST OF PLA, BY OPERATING EXPENDITURE (%)

FIGURE 23 FEEDSTOCK EFFICIENCY SCORE, 2016

FIGURE 24 LAND USE PER TON OF BIOBASED PLA, BIOBASED PE AND BIOETHANOL

FIGURE 25 PRODUCER PRICE INDEX BY INDUSTRY: PLASTICS MATERIAL AND RESINS MANUFACTURING

FIGURE 26 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2021

FIGURE 27 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2021

FIGURE 28 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2021

FIGURE 29 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 30 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2021

FIGURE 31 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2021

FIGURE 32 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2021

FIGURE 33 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 34 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 35 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 36 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 37 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY PRODUCT (2022-2029)

FIGURE 38 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY SHARE 2021(%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.