Europe Bioactive Ingredient Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

10.34 Billion

USD

17.90 Billion

2025

2033

USD

10.34 Billion

USD

17.90 Billion

2025

2033

| 2026 –2033 | |

| USD 10.34 Billion | |

| USD 17.90 Billion | |

|

|

|

|

O mercado europeu de revestimentos hidrofóbicos está segmentado por tipo de ingrediente (prebióticos, probióticos, aminoácidos, peptídeos, ómega 3 e lípidos estruturados, fitoquímicos e extratos vegetais, minerais, vitaminas, fibras e hidratos de carbono especiais, carotenoides e antioxidantes e outros), aplicação ( funcional Alimentos, suplementos alimentares, suplementos de goma, nutrição animal, cuidados pessoais e outros) e fonte (vegetal, animal e microbiana), país (Alemanha, Reino Unido, França, Itália, Espanha, Holanda, Bélgica, Rússia, Turquia, Suíça , Dinamarca , Suécia, Polónia, resto da Europa), tendências e previsões do setor até 2028.

Análise de Mercado e Insights: Mercado de Ingredientes Bioativos na Europa

Análise de Mercado e Insights: Mercado de Ingredientes Bioativos na Europa

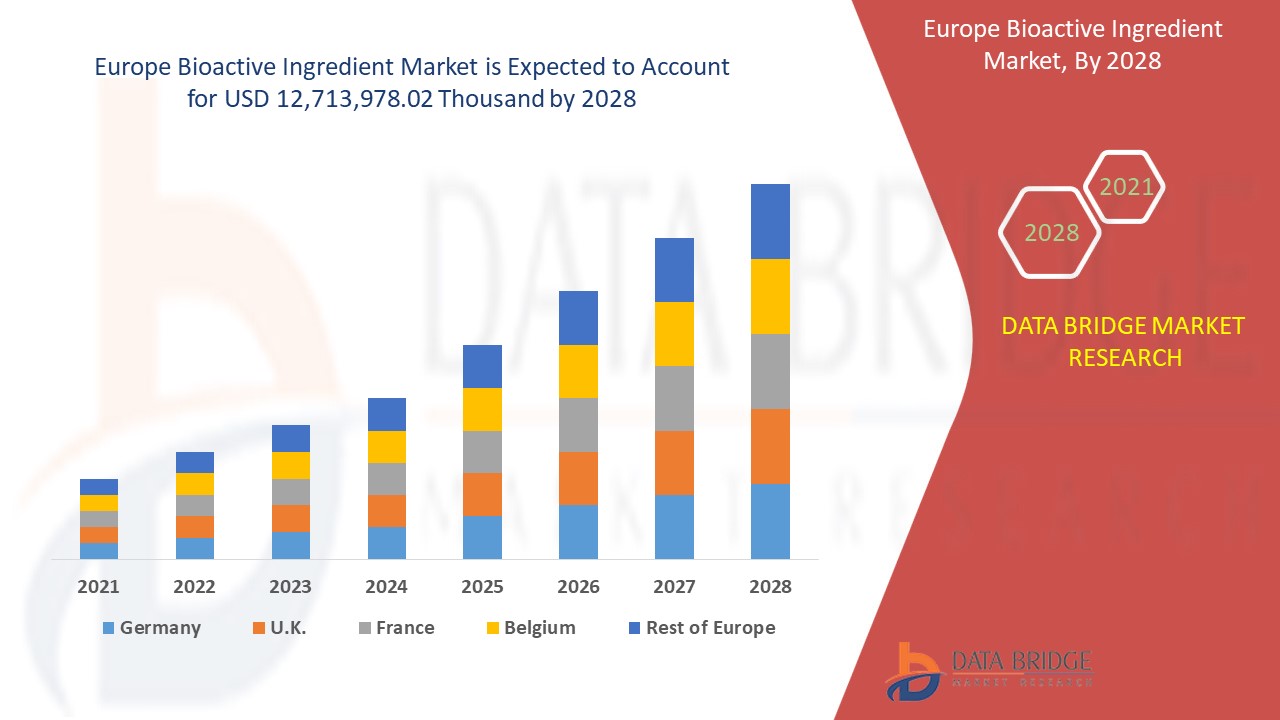

Espera-se que o mercado europeu de ingredientes bioativos ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer a um CAGR de 7,1% no período previsto de 2021 a 2028 e deverá atingir os US$ 12.713.978,02 mil até 2028.

Os ingredientes bioativos são substâncias que têm um efeito biológico nos organismos vivos. Os componentes provêm de uma variedade de fontes, incluindo plantas, alimentos, animais, mar e microrganismos. As substâncias bioativas são adicionadas aos alimentos e rações para melhorar a saúde física e fisiológica dos clientes. Os alimentos e bebidas funcionais, os suplementos nutricionais e a nutrição para recém-nascidos fazem um uso extensivo de substâncias bioativas. Estes produtos químicos podem ajudar a prevenir o cancro, doenças cardíacas e outras enfermidades.

As substâncias bioativas são amplamente utilizadas em diversos setores, incluindo alimentos e bebidas, medicamentos e nutracêuticos, artigos de higiene pessoal e rações para animais. Os carotenoides, os óleos essenciais e os antioxidantes são exemplos de substâncias bioativas utilizadas em alimentos funcionais para melhorar as suas qualidades sensoriais e nutricionais. São um tipo de biomolécula que auxilia no processo metabólico de moléculas saudáveis adicionadas aos alimentos e a diferentes tipos de produtos.

O relatório de mercado de ingredientes bioativos fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, geografias expansões e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um Briefing de Analista.

Âmbito e dimensão do mercado de ingredientes bioativos na Europa

Âmbito e dimensão do mercado de ingredientes bioativos na Europa

O mercado europeu de ingredientes bioativos está categorizado em três segmentos notáveis, que se baseiam no tipo de ingrediente, aplicação e fonte. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo de ingrediente, o mercado global de ingredientes bioativos está segmentado em prebióticos, probióticos, aminoácidos , peptídeos, ómega 3 e lípidos estruturados, fitoquímicos e extratos vegetais, minerais, vitaminas, fibras e hidratos de carbono especiais, carotenoides e antioxidantes e outros. . O prebiótico é ainda segmentado em frutanos, galacto-oligossacarídeos, oligossacarídeos derivados de amido e glucose, oligossacarídeos não hidratos de carbono e outros. Os probióticos são ainda segmentados em lactobacilos, bifidobactérias e leveduras. O aminoácido é ainda segmentado em isoleucina, histidina, leucina, lisina, metionina, fenilalanina, treonina, triptofano, valina e outros. Os péptidos são ainda segmentados em dipéptidos, tripéptidos, oligopéptidos e polipéptidos. Os minerais são ainda segmentados em cálcio , fósforo, magnésio, sódio, potássio, manganês, ferro, cobre, iodo, zinco e outros. As vitaminas estão segmentadas em vitamina A, vitamina C, vitamina D, vitamina E, vitamina K, vitamina B1, vitamina B2, vitamina B3, vitamina B6, vitamina B12 e outras.

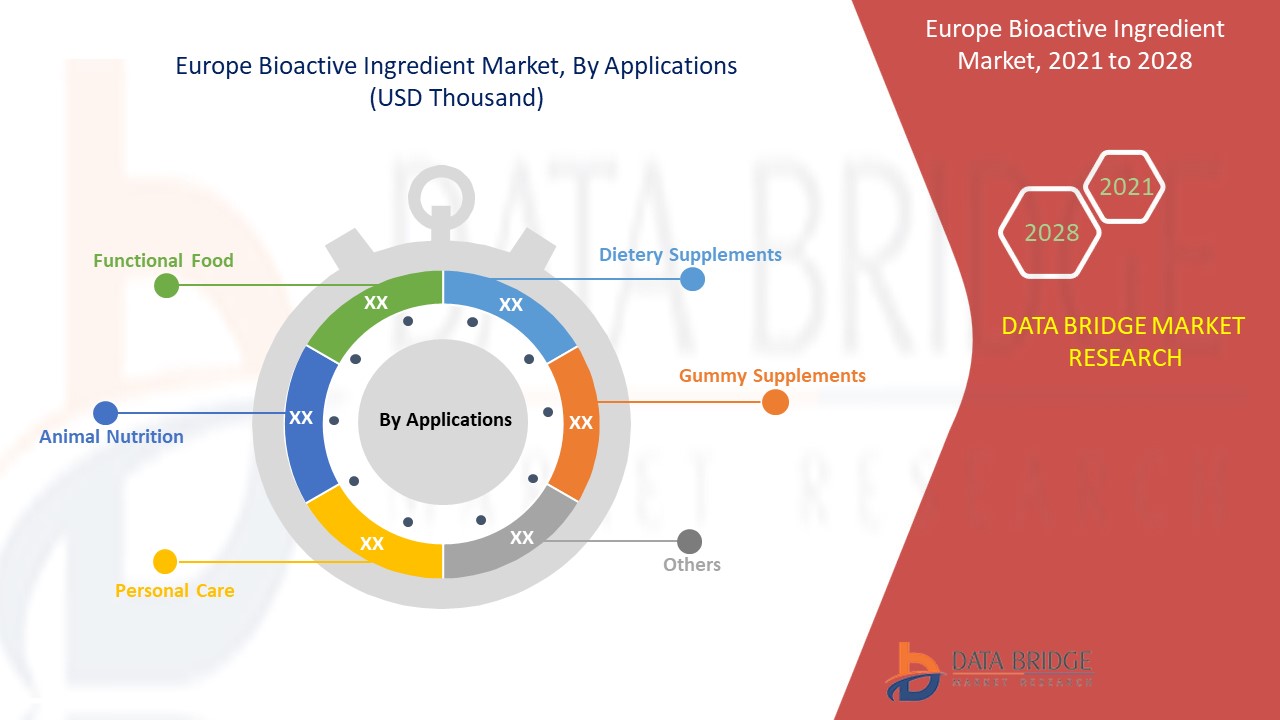

- Com base na aplicação, o mercado global de ingredientes bioativos está segmentado em alimentos funcionais, suplementos alimentares, suplementos de goma, nutrição animal, cuidados pessoais e outros. Os alimentos funcionais são ainda segmentados em produtos lácteos, alternativas aos produtos lácteos, pão, massas, cereais, produtos à base de ovos, barras de snacks, barras e bebidas . Os laticínios subdividem-se em leite, iogurte, queijo, manteiga e outros. As alternativas lácteas subdividem-se em leite vegetal, iogurte vegetal, ingredientes bioativos e outros. As barras subdividem-se em barras de proteína, barras de nutrição desportiva, barras de ioga, barras pré-treino, barras pós-treino e outras. As bebidas subdividem-se em sumos e vitaminas. A nutrição animal está ainda segmentada por categoria animal em carne de bovino, aves, marisco e carne de porco. Os cuidados pessoais são ainda segmentados em cuidados capilares e cuidados com a pele.

- Com base na origem, o mercado global de ingredientes bioativos está segmentado em vegetais, animais e microbianos.

Análise do mercado de ingredientes bioativos na Europa a nível de país

O mercado europeu de ingredientes bioativos é analisado e as informações sobre o tamanho do mercado são fornecidas por Ingrediente, Aplicação, Fonte.

Os países abrangidos pelo relatório de mercado de ingredientes bioativos da Europa são a Alemanha, o Reino Unido, a França, a Itália, a Espanha, os Países Baixos, a Bélgica, a Rússia, a Turquia, a Suíça, a Polónia, a Dinamarca e o Resto da Europa.

O mercado europeu de ingredientes bioativos está a dominar o mercado devido ao crescimento populacional e ao aumento de doenças em grande parte da sociedade

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade das marcas e os desafios enfrentados devido à grande ou escassa concorrência das marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

Crescimento na indústria de ingredientes bioativos

O mercado europeu de ingredientes bioativos também fornece uma análise detalhada do mercado para cada país, o crescimento da base instalada de diferentes tipos de produtos para o mercado de ingredientes bioativos, o impacto da tecnologia utilizando curvas de linha de vida e as mudanças nos cenários regulamentares das fórmulas infantis e o seu impacto no mercado dos ingredientes bioativos. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Análise do cenário competitivo e da quota de mercado dos ingredientes bioativos

O panorama competitivo do mercado europeu de ingredientes bioativos fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos , pipelines de ensaios clínicos, análise de marca, aprovações de produtos , patentes, largura e extensão do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado europeu de ingredientes bioativos.

Os principais participantes do mercado envolvidos no mercado global de ingredientes bioativos são a DSM, BASF SE, Kerry, DuPont, ADM, Global Bio-chem Technology Group Company Limited, Evonik Industries AG, Cargill, Incorporated, Arla Food Ingredients Group P/S (uma subsidiária da Arla Foods amba), FMC Corporation, Sunrise Nutrachem Group, Adisseo (uma subsidiária da Bluestar Adisseo Co., Ltd.), Chr.Hansen Holding A/S, Sabinsa, Ajinomoto Co., Inc, NOVUS INTERNATIONAL (uma subsidiária da Mitsui & Co. (EUA), Inc.), Ingredion, Roquette Frères, Probi e Advanced Animal Nutrition Pty Ltd., entre outros.

Por exemplo,

- Em junho de 2020, a Sabinsa lançou um novo ingrediente de extrato de ervas, as 'Curcuminas', que ajuda a estimular o sistema imunitário. O produto foi implementado para trazer uma nova solução para o mercado durante o período da COVID-19

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.