Europe And Us Recycled Solid Board Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

9.26 Billion

USD

11.46 Billion

2024

2032

USD

9.26 Billion

USD

11.46 Billion

2024

2032

| 2025 –2032 | |

| USD 9.26 Billion | |

| USD 11.46 Billion | |

|

|

|

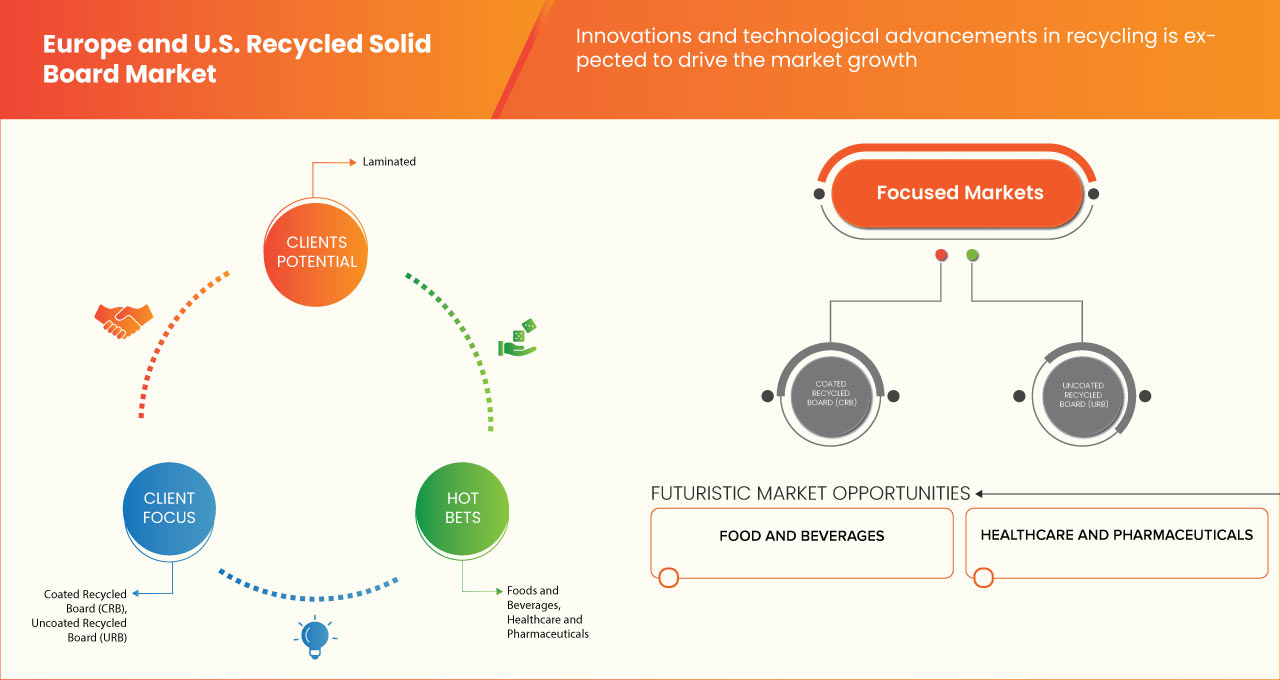

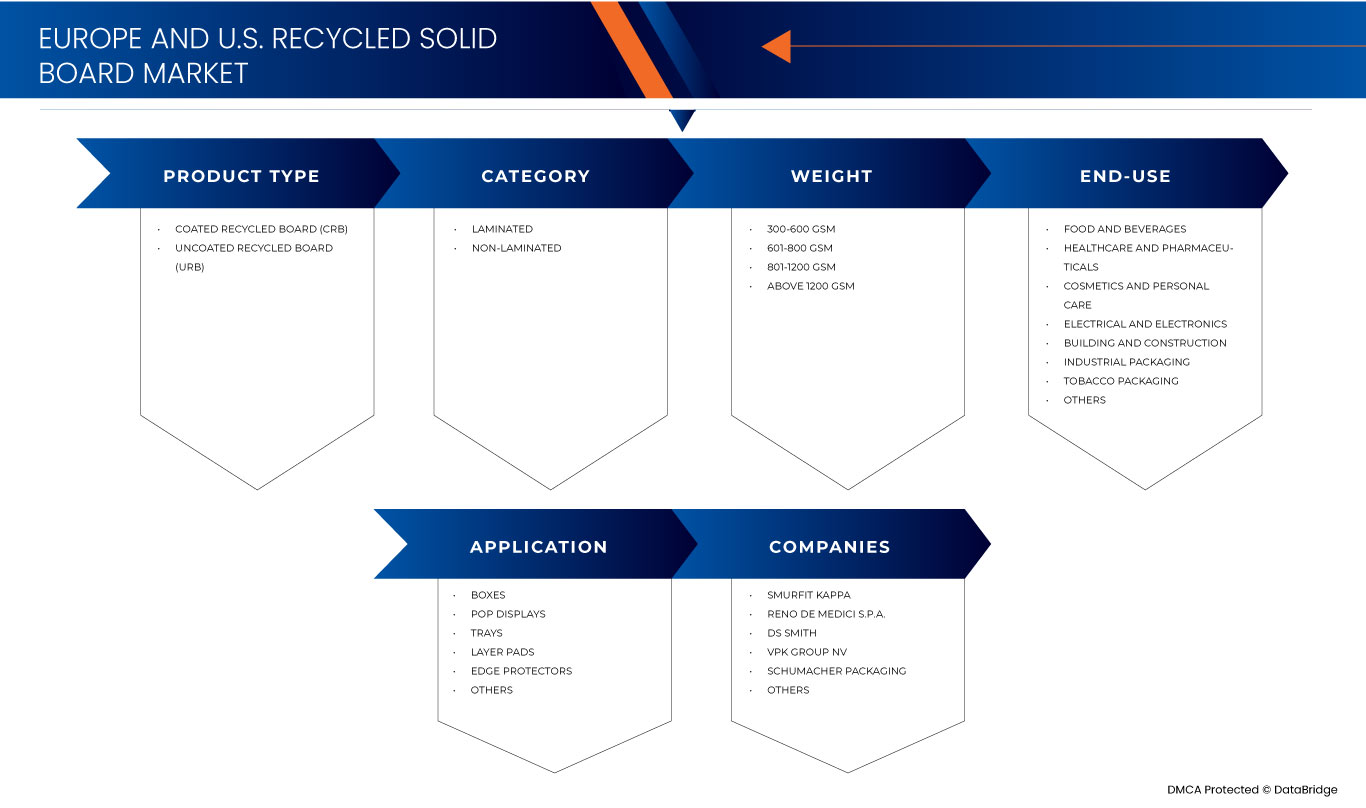

The Europe and U.S. Recycled Solid Board Market, By Product Type (Coated Recycled Board (CRB) and Uncoated Recycled Board (URB)), Category (Laminated and Non-Laminated), Weight (300-600 GSM, 601-800 GSM, 801-1200 GSM, and Above 1200 GSM), Application (Boxes, Pop Displays, Trays, Layer Pads, Edge Protectors, and Others), End-Use (Food and Beverages, Healthcare and Pharmaceuticals, Cosmetics and Personal Care, Electrical and Electronics, Building and Construction, Industrial Packaging, Tobacco Packaging, and Others) - Industry Trends and Forecast to 2031.

Europe and U.S. Recycled Solid Board Market Analysis and Size

The Europe and U.S. recycled solid board market is witnessing steady growth driven increase in demand from various end-use industries. Growing awareness regarding sustainability and rising environmental concerns propelling the market forward. However, limited supply of raw materials could hinder market expansion to some extent.

Data Bridge Market Research analyzes that Europe and U.S. recycled solid board market is expected to reach USD 11.19 billion by 2031 from USD 9.02 billion in 2023, growing with a CAGR of 2.7% in forecast period 2024-2031.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

Product Type (Coated Recycled Board (CRB) and Uncoated Recycled Board (URB)), Category (Laminated and Non-Laminated), Weight (300-600 GSM, 601-800 GSM, 801-1200 GSM, and Above 1200 GSM), Application (Boxes, Pop Displays, Trays, Layer Pads, Edge Protectors, and Others), End-Use (Food and Beverages, Healthcare and Pharmaceuticals, Cosmetics and Personal Care, Electrical and Electronics, Building and Construction, Industrial Packaging, Tobacco Packaging, and Others) |

|

Countries Covered |

U.S., Germany, Italy, U.K., France, Poland, Russia, Spain, Turkey, Netherlands, Belgium, Sweden, Finland, Switzerland, Denmark, Norway, and Rest of Europe |

|

Market Players Covered |

Smurfit Kappa, Reno De Medici S.p.A., DS Smith, VPK Group NV, Schumacher Packaging, Solidus, Koehler Paper, LEIPA GROUP, Guangzhou bmpaper, Cartiera San Martino, Cartiera Fornaci spa., Cartiera Marchigiana, Kartonfabrik Porstendorf, Preston Board & Packaging Ltd., Magnia Group, PREMIER PAPER GROUP, Cartiera Cama, SEVEROČESKÁ PAPÍRNA, sro, Advanced Packaging Ltd., KAPAG Karton + Papier AG, and Merckens among others |

Market Definition

Recycled solid board is a type of material made from recycled paper fibers. It's commonly used in packaging and various paper-based products. The process involves collecting used paper and cardboard, breaking them down into fibers, and then recombining them into a solid board material. This material is often sought after for its environmental benefits, as it reduces the need for virgin paper fibers and helps divert waste from landfills. Additionally, it's typically sturdy and versatile, making it suitable for a range of applications.

Europe and U.S. Recycled Solid Board Market Dynamics

Drivers

- Increase in Demand from Various End-Use Industries

The increase in demand from various end-use industries stems from a growing recognition of the environmental benefits associated with recycled solid board. Industries such as food and beverage, retail, e-commerce, cosmetics, and electronics are increasingly seeking packaging materials that align with their sustainability goals and meet the expectations of eco-conscious consumers. Recycled solid board offers a compelling solution, providing a renewable and recyclable alternative to traditional packaging materials like virgin paperboard or plastic. Moreover, the versatility and adaptability of recycled solid board make it suitable for a wide range of applications, including corrugated boxes, cartons, displays, and inserts, catering to the diverse needs of end-use industries. As businesses across sectors prioritize sustainability and environmental stewardship, the demand for recycled solid board is expected to continue its upward trajectory, driving market growth and innovation in the Europe and the U.S.

- Expansion in E-Commerce

As consumers increasingly turn to online shopping for convenience and accessibility, the demand for packaging materials that ensure the safe and efficient delivery of goods has surged. Recycled solid board emerges as a favorable solution for e-commerce packaging due to its eco-friendly properties, offering both protective capabilities and sustainability credentials. With the rise of online retail platforms, there is a growing need for sturdy and reliable packaging materials that can withstand the rigors of shipping and handling while minimizing environmental impact. Recycled solid board fulfills this requirement by providing a sustainable alternative to traditional packaging materials like plastic or virgin paperboard, aligning with the eco-conscious values of consumers and businesses. Furthermore, as regulations and consumer preferences increasingly prioritize sustainability, e-commerce companies are under pressure to adopt environmentally friendly packaging solutions. This creates a favorable market environment for recycled solid board, driving demand and market growth.

Opportunities

- Product Innovation and Expansion into New Markets

Innovation in product development allows manufacturers to overcome technical limitations and enhance the performance, functionality, and aesthetic appeal of recycled solid board. For example, advancements in recycling and manufacturing technologies enable the production of recycled solid board with improved strength, durability, and printability, making it suitable for a broader range of applications, including premium packaging, point-of-sale displays, and promotional materials. Moreover, innovations in surface treatments, coatings, and laminates enhance the appearance and functionality of recycled solid board, meeting the diverse needs and preferences of customers across different industries. Furthermore, expansion into new markets offers opportunities for growth and diversification. By targeting sectors such as food and beverage, cosmetics, electronics, and retail, where sustainability and eco-friendly packaging are increasingly valued, manufacturers can tap into new revenue streams and expand their customer base. Additionally, exploring international markets presents opportunities for exporting recycled solid board products to regions with growing demand for sustainable packaging solutions, further driving market expansion.

- Growing Awareness Regarding Sustainability and Rising Environmental Concerns

As consumers and businesses become increasingly conscious of the environmental impact of their purchasing decisions, there is a growing demand for eco-friendly packaging solutions that minimize resource depletion, pollution, and waste. Recycled solid board offers a sustainable alternative to conventional packaging materials, as it is made from post-consumer or post-industrial recycled fibers, reducing the need for virgin resources and diverting waste from landfills. Furthermore, recycled solid board aligns with circular economy principles by promoting the reuse and recycling of materials, contributing to a more sustainable and resource-efficient supply chain.

Restraints/Challenges

- Lack of Awareness Regarding Recycled Packaging Solutions

Despite growing environmental consciousness, many consumers and businesses may not fully understand the benefits or availability of recycled solid board as a sustainable packaging option. This lack of awareness can stem from various factors, including misconceptions about the quality and performance of recycled materials, limited education about recycling processes, and insufficient promotion of recycled solid board by manufacturers and retailers. As a result, consumers may default to traditional packaging options made from virgin materials, assuming they offer higher quality or reliability. Similarly, businesses may prioritize familiar packaging materials without fully considering the environmental impact of their choices or the availability of recycled alternatives. Addressing this challenge requires comprehensive education and awareness campaigns to highlight the advantages of recycled solid board, including its lower environmental footprint, reduced resource consumption, and contribution to a circular economy.

- High Investments in Infrastructure Development

Developing robust recycling infrastructure, including collection, sorting, processing, and manufacturing facilities, requires substantial investments in equipment, technology, and personnel. Additionally, the fragmented nature of the recycling industry and varying regulations across different regions can complicate the planning and implementation of infrastructure projects, leading to delays and cost overruns. Moreover, the return on investment for recycling infrastructure projects may be uncertain or prolonged, as revenue streams from recycled materials and end products are influenced by market dynamics, commodity prices, and demand fluctuations. High upfront costs and uncertain financial returns may deter private investors and limit public funding for recycling infrastructure, constraining the expansion and modernization of facilities needed to support the growth of the recycled solid board market. Furthermore, regulatory barriers, permitting processes, and community opposition can further complicate infrastructure development efforts, delaying projects and increasing costs. Overcoming these challenges requires coordinated efforts from government agencies, industry stakeholders, and financial institutions to streamline permitting processes, provide incentives for private investment, and facilitate public-private partnerships

Recent Developments

- In July 2019, according to an article by National Library of Medicine, the widespread use of paper and paperboard in the global packaging market, constituting 31%, is driven by its versatility and eco-friendly reputation. Particularly prominent in food packaging, it offers containment, protection, and convenient communication of information to consumers. Nearly half of the paper and paperboard produced in 2000 was dedicated to packaging applications. With its environmentally friendly image, paper is preferred by the food industry, especially for direct food contact and transportation/storage purposes. Examples include ice-cream cups, microwave popcorn bags, milk cartons, and fast food containers, highlighting its diverse applications and driving demand for recycled solid board as a sustainable alternative

- In September 2023, The use of recycled solid board in the pharmaceutical industry offers significant advantages over traditional packaging materials due to its recyclability. This eco-friendly packaging option, derived from recycled paper fibers, provides microbial resistance and ease of recycling, aligning with the industry's need for environmentally friendly solutions. By utilizing this, pharmaceutical goods can be packaged in materials that minimize ecosystem disruption and are biodegradable

- In June 2020, according to an article by Springer Nature, the growing adoption of e-commerce and rising socioeconomic levels have significantly boosted the demand for cardboard packaging materials, leading to increased recycling and waste generation. Consequently, recycled paper sludge waste emerges as a valuable resource for energy and water treatment applications, contributing to enhanced sustainability and circular economy practices within the paper and cardboard recycling sector

- In July 2023, according to an article by flinder, as e-commerce continues to grow, there is an increasing demand for sustainable packaging solutions such as recycled solid board. Achieving sustainability in e-commerce requires tailored approaches that consider the unique needs of businesses, consumer expectations, and available resources. One crucial aspect is evaluating product life cycles and sourcing practices to minimize environmental impact. This involves extending product life cycles, offering repairs, and implementing take-back schemes or selling second-hand items. Additionally, assessing the ecological footprint of the supply chain and sourcing from suppliers committed to ethical and sustainable practices is essential. Businesses can also explore innovative packaging solutions, such as minimal, reusable, recyclable, or compostable options

Europe and U.S. Recycled Solid Board Market Scope

The Europe and U.S. recycled solid board market is segmented into five notable segments based on product type, category, weight, application, and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Coated Recycled Board (CRB)

- Uncoated Recycled Board (URB)

On the basis of product type, the market is segmented into Coated Recycled Board (CRB) and Uncoated Recycled Board (URB).

Category

- Laminated

- Non-Laminated

On the basis of category, the market is segmented into laminated and non-laminated.

Weight

- 300-600 GSM

- 601-800 GSM

- 801-1200 GSM

- Above 1200 GSM

On the basis of weight, the market is segmented into 300-600 GSM, 601-800 GSM, 801-1200 GSM, and above 1200 GSM.

Application

- Boxes

- Pop Displays

- Trays

- Layer Pads

- Edge Protectors

- Others

On the basis of application, the market is segmented into boxes, pop displays, trays, layer pads, edge protectors, and others.

End-Use

- Food and Beverages

- Healthcare and Pharmaceuticals

- Cosmetics and Personal Care

- Electrical and Electronics

- Building and Construction

- Industrial Packaging

- Tobacco Packaging

- Others

On the basis of end-use, the market is segmented into food and beverages, healthcare and pharmaceuticals, cosmetics and personal care, electrical and electronics, building and construction, industrial packaging, tobacco packaging, and others.

Europe and U.S. Recycled Solid Board Market Regional Analysis/Insights

The Europe and U.S. recycled solid board market is segmented into five notable segments based on product type, category, weight, application, and end-use.

The countries covered in Europe and U.S. recycled solid board market report are U.S., Germany, Italy, U.K., France, Poland, Russia, Spain, Turkey, Netherlands, Belgium, Sweden, Finland, Switzerland, Denmark, Norway, and rest of Europe.

Germany is expected to dominate in Europe due to increasing use and demand of recycled solid board from various end-use industries including cosmetics and personal care.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe and U.S. recycled solid board Market Share Analysis

The Europe and U.S. recycled solid board market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Europe and U.S. recycled solid board market

Some of the prominent participants operating in the Europe and U.S. recycled solid board market are Smurfit Kappa, Reno De Medici S.p.A., DS Smith, VPK Group NV, Schumacher Packaging, Solidus, Koehler Paper, LEIPA GROUP, Guangzhou bmpaper, Cartiera San Martino, Cartiera Fornaci spa., Cartiera Marchigiana, Kartonfabrik Porstendorf, Preston Board & Packaging Ltd., Magnia Group, PREMIER PAPER GROUP, Cartiera Cama, SEVEROČESKÁ PAPÍRNA, sro, Advanced Packaging Ltd., KAPAG Karton + Papier AG, and Merckens among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.