Asia Pacific Wood Coatings Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.68 Billion

USD

4.14 Billion

2025

2033

USD

2.68 Billion

USD

4.14 Billion

2025

2033

| 2026 –2033 | |

| USD 2.68 Billion | |

| USD 4.14 Billion | |

|

|

|

|

Mercado de revestimentos de madeira Ásia-Pacífico, por tipo ( tintas acrílicas , manchas e vernizes, conservantes de madeira, repelentes de água, revestimentos de goma-laca, óleo de linhaça, cera de abelha e misturas de cera de carnaúba, outros), tipo de resina (poliuretano, nitrocelulose, acrílico, poliéster insaturado, Outros), Tecnologia (Solvente Sólido Convencional, Solvente de Alto Sólido, Revestimento em Pó, Água, Curado por Radiação, Outros), Método de Aplicação (Revestimento por Pulverização, Revestimento com Rolo e Pincel, Revestimento a Vácuo), Aplicação (Mobiliário, Revestimentos, Decks e Pavimentos). , Armários, Marcenaria, Outros), Utilizador Final (Residencial, Não Residencial), País (China, Índia, Japão, Coreia do Sul, Austrália e Nova Zelândia, Indonésia, Singapura, Malásia, Tailândia, Filipinas, Vietname, Resto da APAC ), Tendências de Mercado e Previsão para 2028

Análise e insights de mercado: Mercado de revestimentos de madeira da Ásia-Pacífico

Espera-se que o mercado de revestimentos de madeira da Ásia-Pacífico ganhe crescimento de mercado no período de previsão de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer a um CAGR de 5,6% no período de previsão de 2021 a 2028 e deverá atingir os 3.163.316,77 mil dólares até 2028.

Os revestimentos de madeira são aplicados nas superfícies de madeira de mobiliário, armários, revestimentos, decks e pavimentos, entre outras coisas, para melhorar o apelo estético e proporcionar proteção superficial. Tanto em usos residenciais como não residenciais, os acabamentos em madeira são amplamente empregados. O produto pode incluir, mas não está limitado a, sistemas de revestimento à base de água, UV e hidro-UV e pode ser levado à aplicação utilizando uma máquina, manualmente por pincel ou rolo e pulverização.

A crescente procura de renovação à base de madeira está a impulsionar o crescimento do mercado. A crescente procura por revestimentos na indústria do mobiliário está a atuar como um potencial impulsionador de mercado. Além disso, o aumento significativo das atividades de construção, aumentando as vendas e o lucro dos players que operam no mercado.

A principal restrição que impacta o mercado dos revestimentos de madeira são as rigorosas regulamentações governamentais em relação às emissões de COV. Além disso, a flutuação dos preços das matérias-primas constituirá um desafio para o crescimento do mercado. As oportunidades para o mercado dos revestimentos de madeira são os crescentes investimentos e iniciativas orientadas para as atividades de construção. Alguns dos impulsionadores significativos associados ao mercado de revestimentos de madeira da Ásia-Pacífico são os avanços significativos na tecnologia de revestimento.

Este relatório de mercado de revestimentos de madeira fornece detalhes da quota de mercado, novos desenvolvimentos e análise do pipeline de produtos, o impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos. Para compreender a análise e o cenário do mercado, contacte-nos para obter um Analyst Brief; a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir a meta desejada.

Âmbito e dimensão do mercado de revestimentos de madeira da Ásia-Pacífico

O mercado de revestimentos de madeira Ásia-Pacífico está segmentado com base no tipo, tipo de resina, tecnologia, método de aplicação, aplicação e utilizador final. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo, o mercado de revestimentos de madeira da Ásia-Pacífico está segmentado em tintas acrílicas, manchas e vernizes, conservantes de madeira, repelentes de água, revestimentos de goma-laca, óleo de linhaça, cera de abelha e misturas de cera de carnaúba, outros. Em 2021, prevê-se que a tinta acrílica domine o mercado de revestimentos de madeira da ÁSIA-PACÍFICO, uma vez que é o tipo de material mais estável e permanente. Além disso, é de secagem rápida por natureza, o que ajuda a aumentar a sua procura no ano previsto.

- Com base no tipo de resina, o mercado de revestimentos de madeira da Ásia-Pacífico está segmentado em poliuretano , nitrocelulose , acrílico, poliéster insaturado, entre outros. Em 2021, prevê-se que o poliuretano domine o mercado de revestimentos de madeira da ÁSIA-PACÍFICO. É considerada um tipo de resina versátil utilizada na produção de diversos artigos, como tintas, tintas e revestimentos, o que ajuda a aumentar a sua procura no ano previsto.

- Com base na tecnologia, o mercado de revestimentos de madeira da Ásia-Pacífico está segmentado em solvente sólido convencional, solvente de alto teor de sólidos, revestimento em pó , à base de água, curado por radiação, entre outros. Em 2021, prevê-se que os solventes sólidos convencionais dominem o mercado de revestimentos de madeira da ÁSIA-PACÍFICO, uma vez que esta tecnologia é uma tecnologia de revestimento tradicional, que está a ser comummente utilizada. Os operadores escolhem frequentemente esta tecnologia de revestimento porque têm experiência com a sua utilização, o que aumenta a procura no ano previsto.

- Com base no método de aplicação, o mercado de revestimentos de madeira ÁSIA-PACÍFICO está segmentado em revestimento por pulverização, revestimento com rolo e pincel, revestimento a vácuo. Em 2021, prevê-se que o revestimento por pulverização domine o mercado de revestimentos para madeira da Ásia-Pacífico. Proporciona um revestimento durável e resistente a manchas para superfícies de madeira interiores e exteriores, o que ajuda a aumentar a procura no ano previsto.

- Com base na aplicação, o mercado de revestimentos de madeira da Ásia-Pacífico está segmentado em mobiliário, revestimentos, decks e pavimentos, armários, marcenaria, entre outros. Em 2021, espera-se que os móveis dominem o mercado de revestimentos de madeira ÁSIA-PACÍFICO, uma vez que os móveis de madeira maciça são um material duradouro e durável, com um apelo estético muito melhor, o que ajuda a aumentar a sua procura no ano previsto.

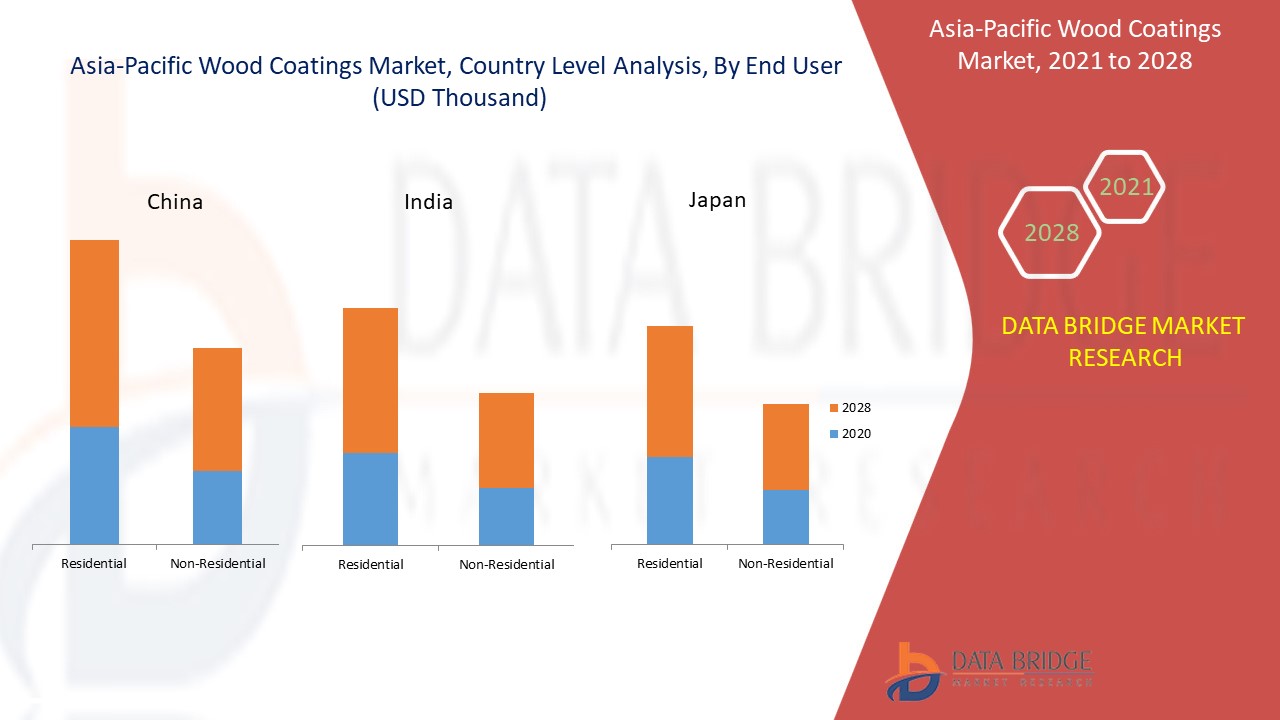

- Com base no utilizador final, o mercado de revestimentos de madeira da Ásia-Pacífico está segmentado em residencial e não residencial. Em 2021, prevê-se que o setor residencial domine o mercado de revestimentos de madeira ÁSIA-PACÍFICO, uma vez que a urbanização contínua resulta no aumento progressivo da procura de mobiliário residencial de madeira.

Análise ao nível do país do mercado de revestimentos de madeira

O mercado da Ásia-Pacífico é analisado e são fornecidas informações sobre o tamanho do mercado por país, tipo, tipo de resina, tecnologia, método de aplicação, aplicação e utilizador final.

Os países abrangidos no relatório de mercado de revestimentos de madeira são a China, Índia, Japão, Coreia do Sul, Austrália, Nova Zelândia, Indonésia, Singapura, Malásia, Tailândia, Filipinas, Vietname e o resto da APAC.

- Na APAC, o mercado de revestimentos de madeira é dominado pela China, uma vez que é um grande produtor de revestimentos e fornece uma quota significativa do mercado global de revestimentos. E a urbanização contínua está a resultar no aumento progressivo da procura de mobiliário residencial de madeira entre os utilizadores finais. Na Índia, está comprovado que o aumento do investimento governamental no sector residencial, como os projectos de cidades inteligentes, aumenta a procura de revestimentos de madeira no sector residencial. Enquanto no Japão, o aumento da renovação de casas de madeira e o aumento da procura de mobiliário de madeira impulsionam a procura de revestimentos de madeira entre os utilizadores finais do país.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da Ásia-Pacífico e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, o impacto dos canais de vendas são considerados ao mesmo tempo que fornecem análises de previsão dos dados do país.

Crescimento na indústria de revestimentos de madeira

O mercado Ásia-Pacífico de revestimentos de madeira também fornece uma análise de mercado detalhada para o crescimento de cada país na base instalada de diferentes tipos de produtos para o mercado de revestimentos de madeira, o impacto da tecnologia utilizando curvas de linha de vida e as alterações nos cenários regulamentares das fórmulas infantis e o seu impacto no mercado de revestimentos para madeira. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Análise do panorama competitivo e da quota de mercado dos revestimentos de madeira

O panorama competitivo do mercado de revestimentos de madeira da Ásia-Pacífico fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos , pipeline de ensaios clínicos, análise de marca, aprovações de produtos , patentes, largura e amplitude do produto, domínio da aplicação, curva da linha de vida da tecnologia. Os dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de revestimentos de madeira da Ásia-Pacífico.

Os principais participantes abrangidos pelo relatório são a Akzo Nobel NV, Axalta Coating Systems, LLC, BASF SE, Dow, Eastman Chemical Company, PPG Industries, Inc., KANGNAM JEVISCO CO., LTD., CHOKWANG PAINT, The Sherwin-Williams Company, RPM International Inc., Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Wengyuan Henghui Chemical Coating Co., Ltd., Stahl Holdings BV, entre outros players nacionais e regionais. Os analistas DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Por exemplo,

- Em novembro de 2020, a BASF SE lançou o novo portefólio Joncryl 953X com cinco dispersões acrílicas para mobiliário e revestimentos de pavimentos. Oferece soluções sustentáveis para níveis de COV baixos a zero. Com este desenvolvimento a empresa pode melhorar o seu mercado de produtos sustentáveis

- Em março de 2020, a Dow introduziu duas inovações que simplificam a formulação de revestimentos industriais à base de água e resistentes a altas temperaturas. Com este desenvolvimento a empresa pode valorizar a sua marca no mercado

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.