Mercado de unidades de refrigeração para camiões Ásia-Pacífico, por tipo (sistema dividido e sistema de montagem no telhado), comprimento (12 metros), aplicação (refrigerado e congelado), fonte de energia (motor Acionado e Independente), Capacidade de Potência (Abaixo de 5 kW, 5 kW - 19 kW e Acima de 19 kW), Tipo de Veículo (Veículos Comerciais Ligeiros (LCV), Veículos Comerciais Médios e Pesados, Reboque (Contentor), Autocarros e Outros) - Tendências e previsões da indústria para 2030.

Análise e insights do mercado da unidade de refrigeração de camiões da Ásia-Pacífico

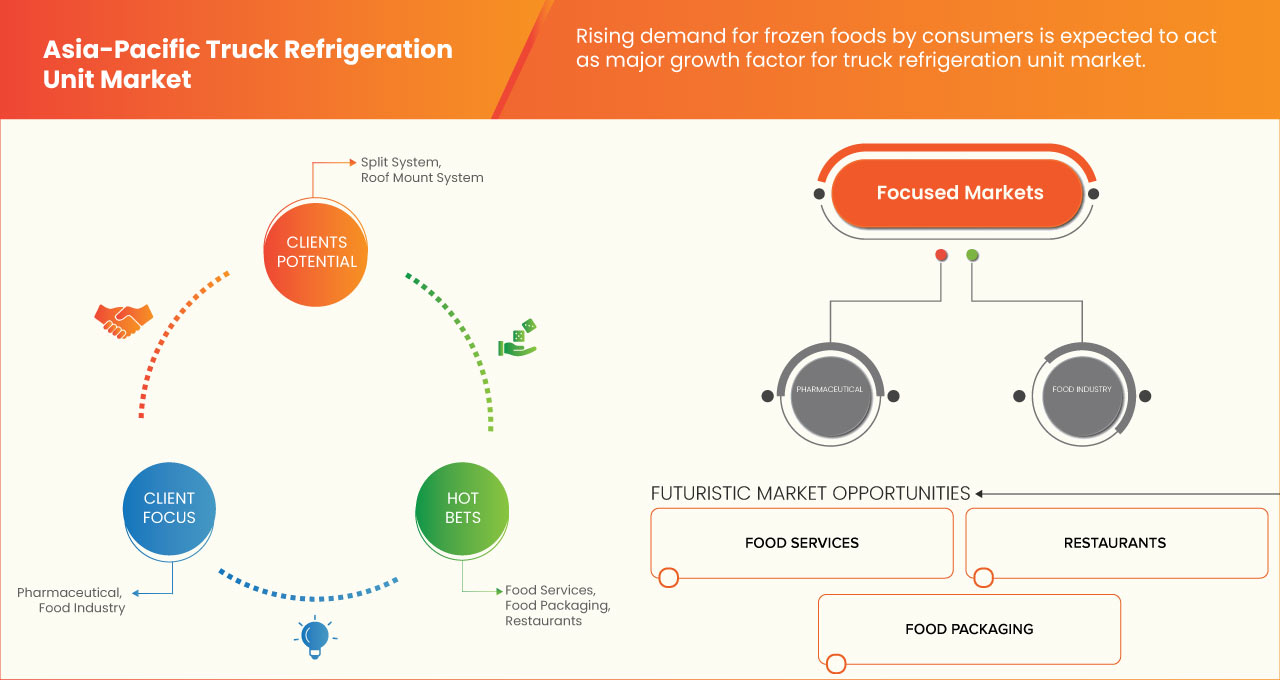

Uma mudança na preferência dos consumidores por produtos alimentares congelados resultou na crescente procura de unidades de refrigeração para camiões por parte de muitas indústrias. Além disso, tem-se verificado uma maior adoção de frutas e legumes refrigerados pelos consumidores e o transporte de medicamentos, vacinas , medicamentos gerais e suplementos em todo o mundo.

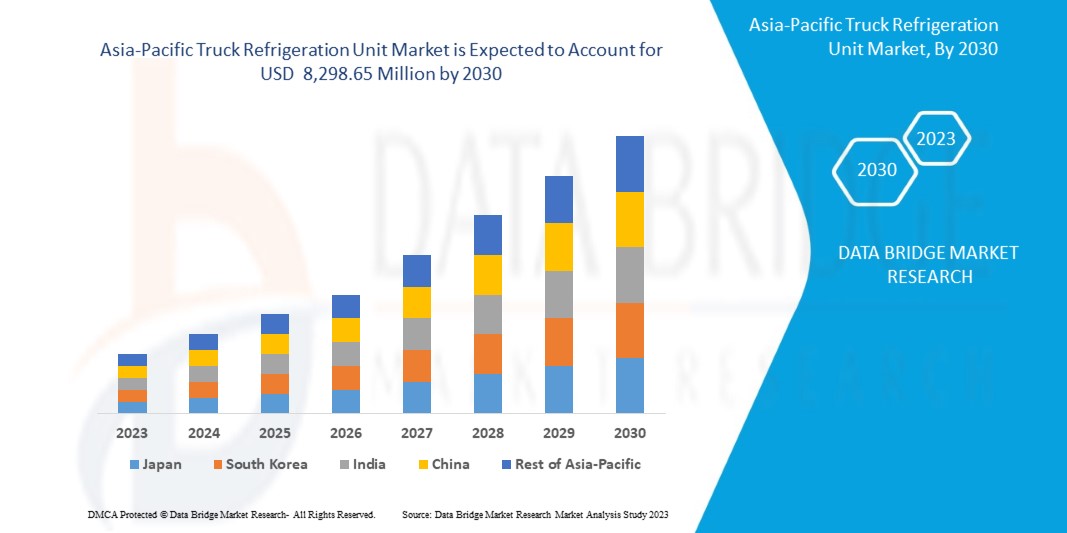

A Data Bridge Market Research analisa que o mercado de unidades de refrigeração de camiões da Ásia-Pacífico deverá atingir um valor de 8.298,65 milhões de dólares até 2030, com um CAGR de 6,4%, durante o período de previsão de 2023 a 2030. O mercado das unidades de refrigeração para camiões abrange também a análise de preços, a análise de patentes e os avanços tecnológicos em profundidade.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (personalizável para 2015-2020) |

|

Unidades Quantitativas |

Receita em milhões, volumes em mil unidades, preços em dólares |

|

Segmentos cobertos |

Por tipo (sistema dividido e sistema de montagem no telhado), comprimento (<8 metros, 8-12 metros e> 12 metros), aplicação (refrigerado e congelado), fonte de energia (motor alimentado e independente), capacidade de energia ( Abaixo de 5 Kw, 5 Kw - 19 Kw e acima de 19 Kw), tipo de veículo (veículos comerciais ligeiros (LCV), veículos comerciais médios e pesados, reboque (contentor), autocarro e outros) |

|

Países abrangidos |

China, Índia, Japão, Coreia do Sul, Austrália, Singapura, Taiwan, Nova Zelândia, Tailândia, Malásia, Vietname, Filipinas e Resto da Ásia-Pacífico |

|

Participantes do mercado abrangidos |

MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD., DAIKIN INDUSTRIES, Ltd., Carrier, DENSO CORPORATION, Grayson, SANDEN CORPORATION, Mobile Climate Control., ZHENGZHOU GUCHEN INDUSTRY CO., LTD., TRANE TECHNOLOGIES PLC, Subros Limited, Klinge Corporation, Webasto SE, KRONE, SONGZ AUTOMOBILE AIR CONDITIONING CO., LTD e Schmitz Cargobull, entre outros |

Definição de Mercado

Os sistemas de refrigeração de camiões são utilizados como camiões frigoríficos/reefer com sistemas de refrigeração mecânica para transportar produtos perecíveis (como alimentos congelados, legumes, frutas, gelados e vinho) de forma a manter os produtos refrigerados ou congelados a temperaturas adequadas durante todo o percurso até ao ponto de venda. Um frigorífico é um camião, reboque ou contentor de carga que possui uma unidade de refrigeração para transportar mercadorias sensíveis à temperatura. Estão disponíveis alternativas gerais para suportar o frete numa gama de temperatura "fria" ou "fresca" ou numa gama de temperatura congelada para envios LTL (Less-Than-Truckload). Para cargas como alimentos frescos ou outros produtos perecíveis, é normalmente utilizada uma faixa "fria". Os frigoríficos movimentam ocasionalmente os seus reboques com carga seca que não requer refrigeração. É crucial observar alguns detalhes durante o transporte de mercadorias. O transporte de longa distância de mercadorias perecíveis e sensíveis à temperatura exige a utilização de camiões frigoríficos. Os exemplos mais comuns são as carnes congeladas e os produtos frescos.

Dinâmica do mercado de unidades de refrigeração para camiões Ásia-Pacífico

Esta secção trata da compreensão dos impulsionadores do mercado, vantagens, oportunidades, restrições e desafios. Tudo isto é discutido em detalhe abaixo:

Motoristas

-

Aumentar o transporte de produtos perecíveis, como alimentos e produtos farmacêuticos

Os produtos alimentares congelados requerem meios de transporte refrigerados para manter a qualidade dos produtos a distâncias mais longas. Os produtos alimentares transportados necessitam de ser refrigerados para que os produtos não se deteriorem e percam o seu valor original. Da exploração agrícola à fábrica e ao prato, os produtos alimentares podem encontrar uma série de riscos para a saúde durante o seu percurso através da cadeia de abastecimento. As práticas e procedimentos seguros de manipulação de alimentos são, portanto, implementados em todas as fases do ciclo de vida da produção alimentar, de forma a reduzir estes riscos e prevenir danos para os consumidores.

-

Aumento da procura de alimentos congelados por parte dos consumidores

As características de conveniência são o foco dos pacotes que melhoram a facilidade de utilização, tanto em casa como em viagem. As características de conveniência, como a abertura fácil, a portabilidade e a utilização com uma mão, continuam a impulsionar a inovação em embalagens de alimentos congelados para uma vasta gama de alimentos processados, incluindo entradas, snacks e até produtos de serviços alimentares. Como os alimentos processados requerem materiais de embalagem fáceis e flexíveis, isso torna-os convenientes e fáceis de utilizar. Assim, espera-se que a crescente procura de alimentos congelados por parte dos consumidores impulsione a procura do mercado.

-

Crescimento crescente de supermercados e restaurantes como o KFC e o Subway

O crescente crescimento dos restaurantes e supermercados está a promover em maior medida os produtos alimentares congelados. Após a era COVID, o uso de alimentos congelados aumentou tremendamente devido ao estilo de vida e ao menor tempo. Os serviços de entrega de comida tornaram-se imensamente importantes, mas trouxeram desafios únicos. A confiança no processo de manipulação de alimentos, nos métodos de entrega e na procura de transações contactless tornaram-se o centro das atenções para quem utiliza os restaurantes para entrega ao domicílio. Recordar que mais de 900.000 pessoas morreram nos EUA torna a situação actual uma consideração a longo prazo para os trabalhadores dos serviços de alimentação, trabalhadores de campo e outros empregados relacionados com o campo.

Oportunidades

-

Aumentar o investimento nos sectores dos serviços alimentares por parte de países como a Índia e a China

A importância do sector agro-industrial para os países em desenvolvimento é avaliada à luz de duas tendências distintas. Em primeiro lugar, os produtos transformados congelados dominam agora o comércio alimentar da Ásia-Pacífico, o que é o caso tanto das exportações como das importações dos países em desenvolvimento. Em segundo lugar, verificou-se uma mudança significativa na composição das exportações de alimentos dos países em desenvolvimento, com as “exportações não tradicionais” a liderarem o caminho. Estas exportações oferecem novas oportunidades para estratégias de desenvolvimento, embora os países menos desenvolvidos tenham passado de exportadores líquidos de alimentos para principalmente importadores líquidos de produtos transformados.

-

Enorme procura por produtos alimentares higiénicos e embalagens de alimentos

A segurança alimentar é de primordial importância para os consumidores, bem como para os processadores de alimentos, uma vez que ajuda a proteger a saúde dos consumidores contra as doenças de origem alimentar e as intoxicações alimentares. A produção higiénica de produtos alimentares envolve o manuseamento, preparação e armazenamento de alimentos ou bebidas de forma a minimizar o risco de doenças do consumidor causadas por doenças de origem alimentar. As diretrizes de segurança alimentar visam evitar que os alimentos sejam contaminados e causem intoxicação alimentar.

Restrições

-

Elevado custo associado ao sistema de AC com eficiência energética

Os custos do sistema de ar condicionado dos veículos de transporte de alimentos incluem tanto o gasto em matéria-prima como os custos necessários para transportar os produtos acabados. As empresas de manufatura operam em setores altamente competitivos. Para competir, estas empresas procuram formas de reduzir custos, permitindo-lhes oferecer preços mais baixos aos clientes. No processo produtivo, a oferta e a procura de matérias-primas desempenham um papel muito importante na determinação do custo da empresa.

-

Crescimento das preocupações de saúde sobre o consumo de frutas e legumes congelados

Os alimentos altamente processados incluem geralmente níveis prejudiciais à saúde de adição de açúcar, sódio e gordura. Estes ingredientes melhoram o sabor dos alimentos, mas muitos deles levam a problemas de saúde graves, como obesidade, doenças cardíacas, hipertensão e diabetes.

Desafios

- Falta de sensibilização sobre os efeitos perigosos dos alimentos congelados

A higiene alimentar é a condição e as medidas necessárias para garantir a segurança dos alimentos desde a produção até ao consumo dos alimentos. A falta de higiene alimentar pode levar a doenças de origem alimentar e até à morte do consumidor. Milhões de pessoas no mundo sofrem com a transmissão de doenças ao consumirem alimentos não higiénicos todos os anos.

- Falta de infraestruturas

Muitos laboratórios de testes de segurança de alimentos congelados carecem de infraestruturas. É muito difícil controlar a presença de resíduos de pesticidas altamente tóxicos, antibióticos ou metais pesados, e de microrganismos perigosos nas matérias-primas alimentares. Durante o processamento, a implementação de controlos microbiológicos, como num programa HACCP ou GMP, está basicamente fora de questão devido às condições e infra-estruturas inadequadas da fábrica, à formação do pessoal, à água potável, às tecnologias modernas para operações de embalagem, à garantia de qualidade e aos procedimentos de higienização padrão. Espera-se que isto restrinja o crescimento do mercado.

Desenvolvimento recente

- Em setembro de 2019, a MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD conquistou o contrato para o fornecimento de equipamentos de tração de alta tecnologia à empresa Construcciones y Auxiliar de Ferrocarriles, SA (CAF). A empresa entregou equipamento de tração aos 88 comboios utilizados na rede ferroviária holandesa. Esta empresa aumentou o valor da sua marca no mercado e na base de clientes

Âmbito de mercado da unidade de refrigeração de camiões Ásia-Pacífico

O mercado de unidades de refrigeração para camiões Ásia-Pacífico está segmentado com base no tipo, comprimento, aplicação, fonte de energia, capacidade de energia e tipo de veículo. O crescimento entre estes segmentos irá ajudá-lo a analisar os escassos segmentos de crescimento nas indústrias e fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Sistema dividido

- Sistema de montagem no tejadilho

Com base no tipo, o mercado de unidades de refrigeração para camiões da Ásia-Pacífico está segmentado em sistema dividido e sistema de montagem no tejadilho.

Comprimento

- <8 metros

- 8-12 metros

- >12 metros

Com base no comprimento, o mercado de unidades de refrigeração para camiões da Ásia-Pacífico está segmentado em <8 metros, 8-12 metros e >12 metros.

Aplicação

- Refrigerado

- Congelado

Com base na aplicação, o mercado de unidades de refrigeração para camiões da Ásia-Pacífico está segmentado em refrigerados e congelados.

Fonte de energia

- Motor movido

- Independente

Com base na fonte de energia, o mercado de unidades de refrigeração para camiões da Ásia-Pacífico está segmentado em motorizado e independente.

Capacidade de energia

- Abaixo de 5 kW

- 5 kW - 19 kW

- Acima de 19 kW

Com base na capacidade de potência, o mercado de unidades de refrigeração para camiões da Ásia-Pacífico está segmentado em abaixo de 5 kW, 5 kW - 19 kW e acima de 19 kW.

Tipo de veículo

- Veículos Comerciais Ligeiros (VCL)

- Veículos Comerciais Médios e Pesados

- Reboque (contentor)

- Autocarro

- Outros

Com base na propriedade, o mercado de unidades de refrigeração para camiões Ásia-Pacífico está segmentado em Veículos Comerciais Ligeiros (LCV), veículos comerciais médios e pesados, reboque (contentor), autocarros, entre outros.

Análise/perspetivas regionais do mercado de unidades de refrigeração para camiões da Ásia-Pacífico

O mercado de unidades de refrigeração para camiões da Ásia-Pacífico é analisado, e são fornecidos insights e tendências de tamanho de mercado por tipo, comprimento, aplicação, fonte de energia, capacidade de energia e tipo de veículo.

Os países abrangidos no relatório de mercado de unidades de refrigeração para camiões da Ásia-Pacífico são a China, Índia, Japão, Coreia do Sul, Austrália, Singapura, Taiwan, Nova Zelândia, Tailândia, Malásia, Vietname, Filipinas e Resto da Ásia-Pacífico .

Espera-se que a Índia domine o mercado devido ao crescente número de empresas de entrega de alimentos na região.

A secção regional do relatório também fornece fatores individuais de impacto no mercado e alterações nas regulamentações do mercado interno que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, epidemiologia de doenças e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da Ásia-Pacífico e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, o impacto dos canais de vendas são considerados ao mesmo tempo que fornecem análises de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado da unidade de refrigeração de camiões da Ásia-Pacífico

O panorama competitivo do mercado de unidades de refrigeração para camiões da Ásia-Pacífico fornece detalhes de um concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na Ásia-Pacífico, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de soluções, largura e amplitude do produto e domínio da aplicação. Os dados fornecidos acima estão apenas relacionados com o foco das empresas relacionado com o mercado de unidades de refrigeração para camiões da Ásia-Pacífico.

Alguns dos principais players que operam no mercado de unidades de refrigeração de camiões Ásia-Pacífico são MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD., DAIKIN INDUSTRIES, Ltd., Carrier, DENSO CORPORATION, Grayson, SANDEN CORPORATION, Mobile Climate Control., ZHENGZHOU GUCHEN INDUSTRY CO. ., LTD., TRANE TECHNOLOGIES PLC, Subros Limited, Klinge Corporation, Webasto SE, KRONE, SONGZ AUTOMOBILE AIR CONDITIONING CO., LTD e Schmitz Cargobull, entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TYPE CURVE

2.1 MARKET APPLICATION GRID

2.11 THE MARKET CHALLENGE MATRIX BY TYPE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCE MODEL

4.2 TECHNOLOGICAL TRENDS

4.2.1 NATURAL REFRIGERANTS

4.2.2 ELECTRIC VEHICLES

4.2.3 TRAILER-TOP SOLAR

4.2.4 LIQUID NITROGEN

4.2.5 SMARTER REEFERS

4.2.6 ADVANCED THERMAL MATERIALS

4.3 VALUE CHAIN ANALYSIS

4.4 NUMBER OF UNITS IN THE MARKET

4.5 NUMBER OF UNITS BY TRUCK TYPE

4.6 NUMBER OF UNITS BY PLAYERS

4.7 NUMBER OF UNITS BY REGION

4.8 PRODUCT FLOW FROM UNIT SALE TO USER

4.9 BRAND ANALYSIS

4.1 ECOSYSTEM MARKET MAP

4.11 TOP WINNING STRATEGIES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING TRANSPORTATION OF PERISHABLE GOODS SUCH AS FOOD ITEMS, PHARMACEUTICALS

5.1.2 RISING DEMAND FOR FROZEN FOODS BY CONSUMERS

5.1.3 INCREASING GROWTH OF SUPERMARKETS AND RESTAURANTS SUCH AS KFC, SUBWAY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH ENERGY-EFFICIENT AC SYSTEM

5.2.2 GROWTH IN HEALTH CONCERNS ABOUT THE CONSUMPTION OF FROZEN FRUIT AND VEGETABLES

5.3 OPPORTUNITIES

5.3.1 INCREASING INVESTMENT IN THE FOOD SERVICE SECTORS BY COUNTRIES LIKE INDIA AND CHINA

5.3.2 HUGE DEMAND FOR HYGIENIC FOOD PRODUCTS AND FOOD PACKAGING

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS REGARDING THE HAZARDOUS EFFECTS OF FROZEN FOOD

5.4.2 LACK OF INFRASTRUCTURE

6 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE

6.1 OVERVIEW

6.2 SPLIT SYSTEM

6.3 ROOF MOUNT SYSTEM

7 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY LENGTH

7.1 OVERVIEW

7.2 < 8-METER

7.3 8-12-METER

7.4 >12-METER

8 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CHILLED

8.3 FROZEN

9 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE

9.1 OVERVIEW

9.2 ENGINE POWERED

9.3 INDEPENDENT

10 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY

10.1 OVERVIEW

10.2 BELOW 5 KW

10.3 5 KW - 19 KW

10.4 ABOVE 19 KW

11 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 LIGHT COMMERCIAL VEHICLES (LCV)

11.2.1 BY TYPE

11.2.1.1 SPLIT SYSTEM

11.2.1.2 ROOF MOUNT SYSTEM

11.3 MEDIUM & HEAVY COMMERCIAL VEHICLES

11.3.1 BY TYPE

11.3.1.1 SPLIT SYSTEM

11.3.1.2 ROOF MOUNT SYSTEM

11.4 TRAILER (CONTAINER)

11.4.1 BY TYPE

11.4.1.1 SPLIT SYSTEM

11.4.1.2 ROOF MOUNT SYSTEM

11.5 BUS

11.5.1 BY TYPE

11.5.1.1 SPLIT SYSTEM

11.5.1.2 ROOF MOUNT SYSTEM

11.6 OTHERS

11.6.1 BY TYPE

11.6.1.1 SPLIT SYSTEM

11.6.1.2 ROOF MOUNT SYSTEM

12 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 INDIA

12.1.3 JAPAN

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 TAIWAN

12.1.8 NEW ZEALAND

12.1.9 THAILAND

12.1.10 MALAYSIA

12.1.11 VIETNAM

12.1.12 PHILIPPINES

12.1.13 REST OF ASIA-PACIFIC

13 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CARRIER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 DENSO CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 DAIKIN INDUSTRIES, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SCHMITZ CARGOBULL.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ADVANCED TEMPERATURE CONTROL

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 KRONE

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 GRAYSON

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 KLINGE CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 KIDRON

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MOBILE CLIMATE CONTROL

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 SUBROS LIMITED

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 TRANE TECHNOLOGIES PLC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 UTILITY TRAILER MANUFACTURING COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SANDEN CORPORATION

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 SONGZ AUTOMOBILE AIR CONDITIONING CO., LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 WEBASTO SE

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 ZHENGZHOU GUCHEN INDUSTRY CO., LTD.,

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 NUMBER OF UNITS IN THE MARKET (THOUSAND)

TABLE 2 ACCORDING TO THE MARKET ESTIMATION DONE BY DBMR, THE NUMBER OF UNITS BY TRUCK TYPE ACROSS THE GLOBE ARE AS FOLLOWS

TABLE 3 NUMBER OF UNITS BY THE PLAYER (USD MILLION)

TABLE 4 NUMBER OF UNITS BY REGION (THOUSAND UNITS)

TABLE 5 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 7 ASIA PACIFIC SPLIT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 ASIA PACIFIC SPLIT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 9 ASIA PACIFIC ROOF MOUNT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 ASIA PACIFIC ROOF MOUNT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 11 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 12 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 13 ASIA PACIFIC < 8-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 ASIA PACIFIC < 8-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 15 ASIA PACIFIC 8-12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 ASIA PACIFIC 8-12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 17 ASIA PACIFIC >12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 ASIA PACIFIC >12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 19 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 21 ASIA PACIFIC CHILLED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 ASIA PACIFIC CHILLED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 23 ASIA PACIFIC FROZEN IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 ASIA PACIFIC FROZEN IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 25 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 26 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 27 ASIA PACIFIC ENGINE POWERED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 ASIA PACIFIC ENGINE POWERED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 29 ASIA PACIFIC INDEPENDENT IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 ASIA PACIFIC INDEPENDENT IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 31 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 32 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 33 ASIA PACIFIC BELOW 5 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 ASIA PACIFIC BELOW 5 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 35 ASIA PACIFIC 5 KW - 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 ASIA PACIFIC 5 KW - 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 37 ASIA PACIFIC ABOVE 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 ASIA PACIFIC ABOVE 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 39 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 40 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 41 ASIA PACIFIC LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 ASIA PACIFIC LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 43 ASIA PACIFIC LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 ASIA PACIFIC LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 45 ASIA PACIFIC MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 ASIA PACIFIC MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 47 ASIA PACIFIC MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 ASIA PACIFIC MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 49 ASIA PACIFIC TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 ASIA PACIFIC TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 51 ASIA PACIFIC TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 ASIA PACIFIC TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 53 ASIA PACIFIC BUS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 ASIA PACIFIC BUS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 55 ASIA PACIFIC BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 ASIA PACIFIC BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 57 ASIA PACIFIC OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 ASIA PACIFIC OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 59 ASIA PACIFIC OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 ASIA PACIFIC OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 61 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 62 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 63 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 65 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 66 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 67 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 69 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 70 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 71 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 72 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 73 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 74 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 75 ASIA-PACIFIC LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 ASIA-PACIFIC LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 77 ASIA-PACIFIC MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 ASIA-PACIFIC MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 79 ASIA-PACIFIC TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 ASIA-PACIFIC TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 81 ASIA-PACIFIC BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 ASIA-PACIFIC BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 83 ASIA-PACIFIC OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 ASIA-PACIFIC OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 85 CHINA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 CHINA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 87 CHINA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 88 CHINA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 89 CHINA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 CHINA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 91 CHINA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 92 CHINA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 93 CHINA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 94 CHINA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 95 CHINA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 96 CHINA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 97 CHINA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 CHINA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 99 CHINA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 CHINA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 101 CHINA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 CHINA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 103 CHINA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 CHINA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 105 CHINA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 CHINA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 107 INDIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 INDIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 109 INDIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 110 INDIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 111 INDIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 112 INDIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 113 INDIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 114 INDIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 115 INDIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 116 INDIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 117 INDIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 118 INDIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 119 INDIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 120 INDIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 INDIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 122 INDIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 INDIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 124 INDIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 INDIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 126 INDIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 INDIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 128 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 130 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 131 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 132 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 133 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 134 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 135 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 136 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 137 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 138 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 139 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 140 JAPAN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 JAPAN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 142 JAPAN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 143 JAPAN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 144 JAPAN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 145 JAPAN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 146 JAPAN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 JAPAN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 148 JAPAN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 JAPAN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 150 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 152 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 153 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 THOUSAND UNITS)

TABLE 154 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 155 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 156 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 157 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 158 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 159 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 160 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 161 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 162 SOUTH KOREA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 SOUTH KOREA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 164 SOUTH KOREA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 SOUTH KOREA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 166 SOUTH KOREA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 SOUTH KOREA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 168 SOUTH KOREA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 SOUTH KOREA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 170 SOUTH KOREA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 SOUTH KOREA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 172 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 174 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 175 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 176 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 177 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 178 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 179 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 180 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 181 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 182 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 183 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 184 AUSTRALIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 AUSTRALIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 186 AUSTRALIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 187 AUSTRALIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 188 AUSTRALIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 AUSTRALIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 190 AUSTRALIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 191 AUSTRALIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 192 AUSTRALIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 AUSTRALIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 194 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 196 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 197 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 198 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 199 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 200 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 201 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 202 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 203 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 204 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 205 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 206 SINGAPORE LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 SINGAPORE LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 208 SINGAPORE MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 209 SINGAPORE MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 210 SINGAPORE TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 211 SINGAPORE TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 212 SINGAPORE BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 213 SINGAPORE BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 214 SINGAPORE OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 215 SINGAPORE OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 216 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 217 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 218 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 219 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 220 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 221 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 222 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 223 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 224 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 225 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 226 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 227 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 228 TAIWAN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 229 TAIWAN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 230 TAIWAN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 231 TAIWAN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 232 TAIWAN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 233 TAIWAN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 234 TAIWAN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 235 TAIWAN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 236 TAIWAN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 237 TAIWAN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 238 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 240 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 241 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 242 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 243 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 244 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 245 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 246 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 247 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 248 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 249 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 250 NEW ZEALAND LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 251 NEW ZEALAND LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 252 NEW ZEALAND MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 253 NEW ZEALAND MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 254 NEW ZEALAND TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 255 NEW ZEALAND TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 256 NEW ZEALAND BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 NEW ZEALAND BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 258 NEW ZEALAND OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 259 NEW ZEALAND OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 260 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 261 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 262 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 263 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 264 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 265 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 266 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 267 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 268 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 269 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 270 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 271 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 272 THAILAND LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 THAILAND LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 274 THAILAND MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 275 THAILAND MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 276 THAILAND TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 THAILAND TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 278 THAILAND BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 279 THAILAND BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 280 THAILAND OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 281 THAILAND OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 282 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 283 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 284 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 285 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 286 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 287 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 288 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 289 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 290 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 291 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 292 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 293 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 294 MALAYSIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 295 MALAYSIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 296 MALAYSIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 297 MALAYSIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 298 MALAYSIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 299 MALAYSIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 300 MALAYSIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 301 MALAYSIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 302 MALAYSIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 303 MALAYSIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 304 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 305 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 306 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 307 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 308 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 309 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 310 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 311 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 312 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 313 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 314 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 315 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 316 VIETNAM LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 317 VIETNAM LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 318 VIETNAM MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 319 VIETNAM MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 320 VIETNAM TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 321 VIETNAM TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 322 VIETNAM BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 323 VIETNAM BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 324 VIETNAM OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 325 VIETNAM OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 326 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 327 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 328 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 329 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 330 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 331 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 332 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 333 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 334 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 335 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 336 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 337 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 338 PHILIPPINES LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 339 PHILIPPINES LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 340 PHILIPPINES LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 341 PHILIPPINES MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 342 PHILIPPINES TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 PHILIPPINES TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 344 PHILIPPINES BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 345 PHILIPPINES BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 346 PHILIPPINES OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 347 PHILIPPINES OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 348 REST OF ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 349 REST OF ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

Lista de Figura

FIGURE 1 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR FROZEN FOODS BY CONSUMERS IS EXPECTED TO BE A KEY DRIVER FOR ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SPLIT SYSTEM IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET

FIGURE 14 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: BY TYPE, 2022

FIGURE 15 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: BY LENGTH, 2022

FIGURE 16 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2022

FIGURE 17 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2022

FIGURE 18 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2022

FIGURE 19 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2022

FIGURE 20 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET: SNAPSHOT (2022)

FIGURE 21 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET: BY COUNTRY (2022)

FIGURE 22 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET: BY TYPE (2023-2030)

FIGURE 25 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.