Asia-Pacific Thermal Insulation Packaging Market, By Product (Box, Bags, Carton Liners, Bubble Cushioning and Others), Packaging Type (Passive Packaging, Active Packaging and Cold Storage), Material (Polystyrene, Polyurethane (PUR), Polyethylene, Vacuum Insulated Panels (VIP), Polylactic (PLA), Corrugated Fiber Board and Others), Temperature Range (Refrigerated, Frozen and Ambient), Application (Pharmaceutical, Food & Beverage, Chemicals, Horticulture Products, Electronics and Others) – Industry Trends and Forecast to 2029.

Asia-Pacific Thermal Insulation Packaging Market Analysis and Size

Thermal insulation material acts as a barrier preventing heat transfer between objects of differing temperatures. Thermal packaging helps to preserve the chemical composition of pharmaceutical products, ensuring no efficacy is lost during transit. It is important to know the maximum possible time that a shipment can take, according to which the insulation must adequately keep temperatures controlled until the product reaches its destination. These material are used in packaging as part of a cold chain to help maintain product freshness and efficacy.

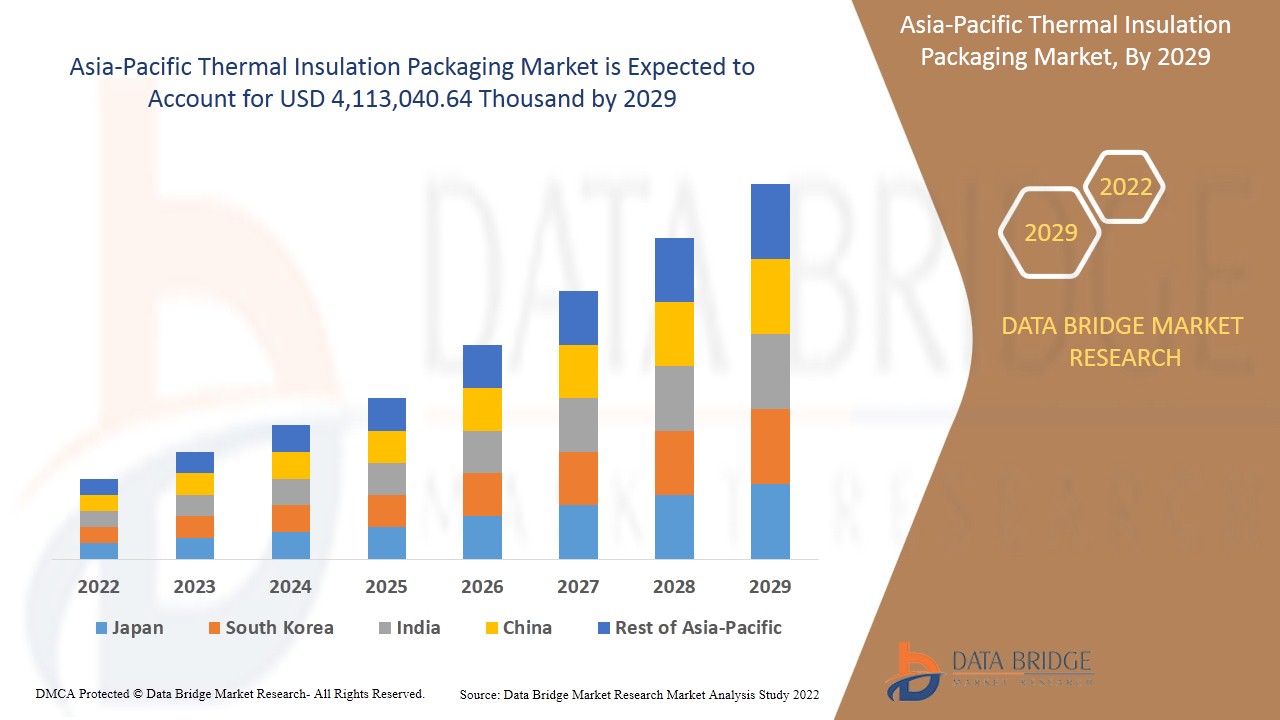

Data Bridge Market Research analyses that the thermal insulation packaging market is expected to reach the value of USD 4,113,040.64 thousand by the year 2029, at a CAGR of 6.4% during the forecast period. "Pharmaceuticals" accounts for the most prominent application segment in the respective market owing to rise in thermal insulation packaging in pharmaceuticals. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Box, Bags, Carton Liners, Bubble Cushioning and Others), Packaging Type (Passive Packaging, Active Packaging and Cold Storage), Material (Polystyrene, Polyurethane (PUR), Polyethylene, Vacuum Insulated Panels (VIP), Polylactic (PLA), Corrugated Fiber Board and Others), Temperature Range (Refrigerated, Frozen and Ambient), Application (Pharmaceutical, Food & Beverage, Chemicals, Horticulture Products, Electronics and Others) |

|

Countries Covered |

Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific |

|

Market Players Covered |

Thermal Ice, QProducts & Services, Nordic Cold Chain Solutions, Biobright, Sealed Air, ABBE, DUFAYLITE, Cellulose Material Solutions, LLC, Cold Chain Technologies, Sonoco Products Company, SOFRIGAM, The Wool Packaging Company Limited, Insulated Products Corporation, Cryopak, DS Smith, Intelsius, Softbox, WestRock Company, and Avantor, Inc. among others. |

Market Definition

Thermal packaging is a product that acts as an insulator between a product being shipped and the outside air. It allows shipping a hot product in winter or a cold product in the summer. Insulated shipping containers are a type of packaging used to ship temperature-sensitive products such as foods, pharmaceuticals, organs, blood, biological materials, vaccines, and chemicals. They are used as part of a cold chain to help maintain product freshness and efficacy.

Regulatory Framework

- ASTM (American Society for Testing and Materials) D3103-07, a US standard or test method covers the determination of the thermal insulation quality of a package and the thermal stability of its contents when exposed to variable ambient temperature conditions. This standard does not purport to address all of the safety concerns, if any, associated with its use. It is the responsibility of the user of this standard to establish appropriate safety, health, and environmental practices and determine the applicability of regulatory limitations prior to use.

COVID-19 had a Minimal Impact on Thermal Insulation Packaging Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, no significant impact was noticed on their thermal insulation packaging Asia-Pacific operations and supply chain, as import and export of vaccines and essential goods led to increasing demand of thermal insulation packaging. With this growing awareness and governmental push to the research and development and introducing eco-friendly and sustainable thermal insulation packaging increasing the growth of thermal insulation packaging market.

The Market Dynamics of the Thermal Insulation Packaging Market Include:

- Growing Demand for Ready-to-Eat Food Products

The convenience provided by ready-to-eat foods provides a way to eat a healthy diet while adapting to the healthy insulating packaging requirements that helps in storing the food for a longer period of time. Ready-to-cook food requires perfect packaging solutions to protect the food from biological contamination and physical influence. This has in turn increased the demand for thermal insulating packaging materials.

- Rise in Application Usage in the Pharmaceutical Industry

A thermal insulation packaging system is necessary for maintaining the integrity and safety of the medical products which in turn increases the demand for thermal insulating packaging.

- Shifting Consumer’s Preference Towards Temperature-Sensitive Goods

The increased demand for temperature sensitive goods has further led to the rise in the demand for insulated packaging materials to keep the food safe and fresh. This in turn rises the demand for thermal insulating packaging materials.

- Increasing Spending Towards Cold-Chain Delivery System

Cold chain pharmaceutical and food products require a reliable infrastructure such as insulated packaging and storage facilities, for maintaining a precise temperature range when transporting from the manufacturer to the consumers. This in turn increases the demand for thermal insulating packaging materials.

- Positive Outlook Towards E-Commerce Industry

The ever-changing trends in the e-commerce industry have opened up ample opportunities for thermal insulating packaging solutions providers to adopt innovative technologies and designs to increase their market share. This in turn increases the demand for thermal insulating packaging materials.

- Advances in Technology for Producing Thermal Packaging Products

The rising and fast pacing advancement in technology of thermal insulating packaging production will help manufacturers achieve more profits and help them increase their production capacities, which will, in turn, fulfill the increasing demand for thermal insulating packaging materials.

Restraints/Challenges faced by the Thermal Insulation Packaging Market

- Volatility in the Prices of Raw Materials

Increased global trade, urbanization, transportation needs, and energy demands put further pressure on the cost of the intermediaries required for thermal insulating packaging materials manufacturing. Therefore, changes in the costs of raw materials for producing thermal insulating packaging materials affect the demand of the product.

- Implementation of Strict Government Regulations

Heat waves and hot climates can aggravate photochemical processes and enhance the generation of low-level ozone. Therefore, the governments of various countries have specified strict rules and regulations for the packaging manufacturing units adhering to pollution and environmental concerns, which in turn sinks the demand for thermal insulating packaging.

This thermal insulation packaging market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Thermal Insulation Packaging market contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In December 2021, Avantor, Inc. entered into a distribution agreement to supply Agilent technologies’ chemistries and supplies division products in the U.S. and Canada. This has in turn helped the company to earn revenue from the North American market.

- In July, 2021, Nordic Cold Chain Solutions informed about the methods and importance for using cold chain process. This has helped the company to attract more customers in the region.

Asia-Pacific Thermal Insulation Packaging Market Scope

The thermal insulation packaging market is segmented on the basis of product, packaging type, material, temperature range, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Box

- Bags

- Carton Liners

- Bubble Cushioning

- Others

On the basis of product, the Asia-Pacific thermal insulation packaging market is segmented into box, bags, carton liners, bubble cushioning, and others. Box accounts for the largest market, and are expected to witness high growth owing to their capability to maintain the freshness and quality of the products more than other the products.

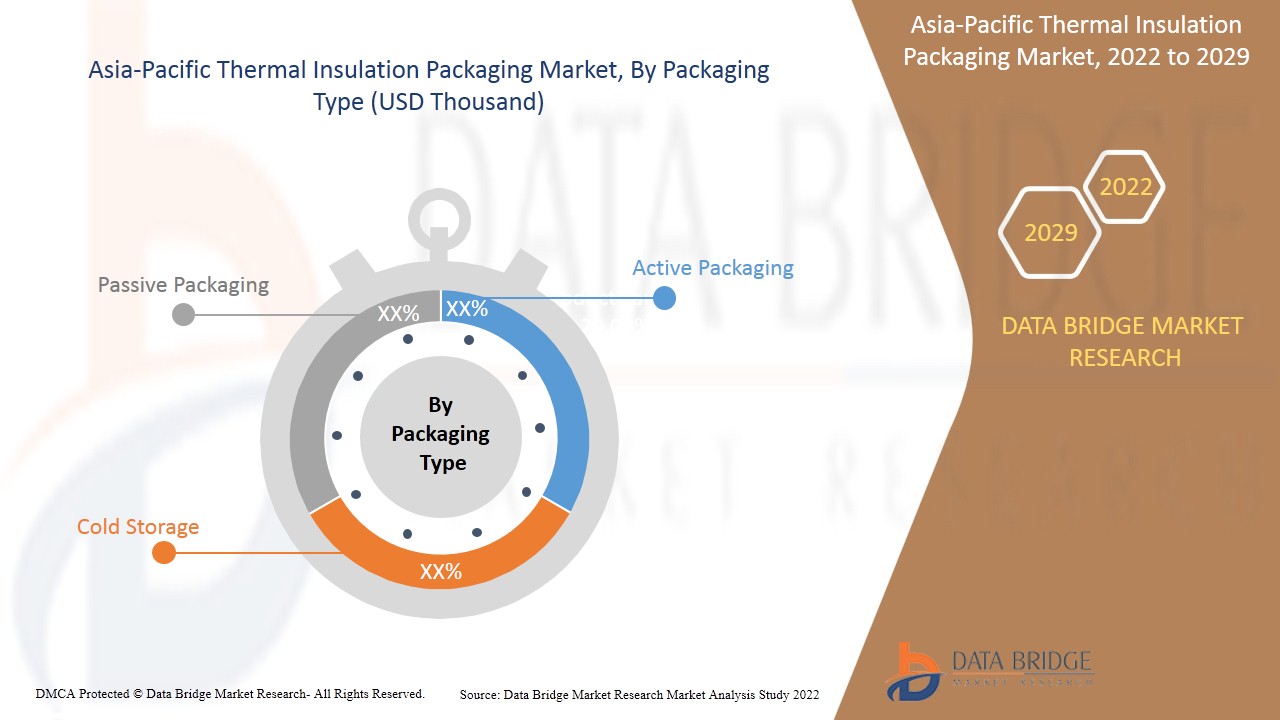

Packaging Type

- Passive Packaging

- Active Packaging

- Cold Storage

On the basis of packaging type, the Asia-Pacific thermal insulation packaging market is segmented into passive packaging, active packaging and cold storage.

Material

- Polystyrene

- Polyurethane (PUR)

- Corrugated fibre board

- Vacuum insulated panels (VIP)

- Polyethylene

- Polylactic (PLA)

- Others

On the basis of material, Asia-Pacific thermal insulation packaging market is segmented into polystyrene, polyurethane (PUR), polyethylene, vacuum insulated panels (VIP), polylactic (PLA), corrugated fiber board and others.

Temperature Range

- Ambient

- Refrigerated

- Frozen

On the basis of temperature range, the Asia-Pacific thermal insulation packaging market is segmented into refrigerated, frozen and ambient.

Application

- Pharmaceutical

- Food And Beverages

- Electronics

- Chemicals

- Horticulture Products

- Others

On the basis of application, Asia-Pacific thermal insulation packaging market is segmented into pharmaceutical, food & beverage, chemicals, horticulture products, electronics and others. The pharmaceutical segment is expected to grow at high rate as thermal insulation packaging reduces heat movements and vapor condensation.

Thermal Insulation Packaging Market Regional Analysis/Insights

The thermal insulation packaging market is analyzed and market size insights and trends are provided by country, product, packaging type, material, temperature range, and application as referenced above.

The countries covered in the thermal insulation packaging market report are the Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific.

China dominates the thermal insulation packaging market due to the rising demand for temperature-sensitive goods in the country. The rise in application usage in the pharmaceutical industry and food & beverages industry is expected to increase demand for thermal insulation packaging in country.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Thermal Insulation Packaging Market Share Analysis

The thermal insulation packaging market competitive landscape provides details by competitor. details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, asia-pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. the above data points provided are only related to the companies' focus related to thermal insulation packaging market.

Some of the major players operating in the thermal insulation packaging market are Thermal Ice, QProducts & Services, Nordic Cold Chain Solutions, Biobright, Sealed Air, ABBE, DUFAYLITE, Cellulose Material Solutions, LLC, Cold Chain Technologies, Sonoco Products Company, SOFRIGAM, The Wool Packaging Company Limited, Insulated Products Corporation, Cryopak, DS Smith, Intelsius, Csafe Global, WestRock Company, and Avantor, Inc. among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PACKAGING TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 LIST OF KEY PATENTS LAUNCHED

4.2 TECHNOLOGICAL ADVANCEMENT

4.3 PORTER’S FIVE FORCES:

4.3.1 THE THREAT OF NEW ENTRANTS:

4.3.2 THE THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 VENDOR SELECTION CRITERIA

4.5 PESTLE ANALYSIS

4.5.1 POLITICAL FACTORS:

4.5.2 ECONOMIC FACTORS:

4.5.3 SOCIAL FACTORS:

4.5.4 TECHNOLOGICAL FACTORS:

4.5.5 LEGAL FACTORS:

4.5.6 ENVIRONMENTAL FACTORS:

4.6 REGULATION COVERAGE

4.6.1 CERTIFIED STANDARDS

4.6.2 SAFETY STANDARDS

4.6.2.1 MATERIAL HANDLING & STORAGE

4.6.2.2 TRANSPORT & PRECAUTIONS

4.6.2.3 HAZARD IDENTIFICATION

4.7 LEGISLATION ISSUE

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS:

6.2 INDUSTRY RESPONSE

6.3 G O V E R NME N T’ S ROLE

6.4 ANALYST RECOMMENDATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING DEMAND FOR READY-TO-EAT FOOD PRODUCTS

7.1.2 RISE IN APPLICATION USAGE IN PHARMACEUTICAL INDUSTRY

7.1.3 SHIFTING CONSUMER’S PREFERENCE TOWARDS TEMPERATURE-SENSITIVE GOODS

7.1.4 INCREASING SPENDING TOWARDS COLD-CHAIN DELIVERY SYSTEM

7.2 RESTRAINT

7.2.1 VOLATILITY IN PRICES OF RAW MATERIALS

7.3 OPPORTUNITIES

7.3.1 POSITIVE OUTLOOK TOWARDS E-COMMERCE INDUSTRY

7.3.2 ADVANCES IN TECHNOLOGY FOR PRODUCING THERMAL PACKAGING PRODUCTS

7.4 CHALLENGES

7.4.1 EXTENSIVE COST REQUIRED FOR ADHERING TO QUALIFICATION STANDARDS IN INSULATED PACKAGING

7.4.2 IMPLEMENTATION OF STRICT GOVERNMENT REGULATIONS

8 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 BOX

8.3 BAGS

8.4 CARTON LINERS

8.5 BUBBLE CUSHIONING

8.6 OTHERS

9 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 PASSIVE PACKAGING

9.3 ACTIVE PACKAGING

9.4 COLD STORAGE

10 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 POLYSTYRENE

10.2.1 EXTRUDED POLYSTYRENE

10.2.2 EXPANDED POLYSTYRENE FOAM (EPS)

10.3 POLYURETHANE (PUR)

10.4 POLYETHYLENE

10.5 VACUUM INSULATED PANELS (VIP)

10.6 POLYLACTIC (PLA)

10.7 CORRUGATED FIBRE BOARD

10.8 OTHERS

11 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE

11.1 OVERVIEW

11.2 REFRIGERATED

11.3 FROZEN

11.4 AMBIENT

12 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 PHARMACEUTICAL

12.2.1 BY PRODUCT

12.2.1.1 BOX

12.2.1.2 BAGS

12.2.1.3 CARTON LINERS

12.2.1.4 BUBBLE CUSHIONING

12.2.1.5 OTHERS

12.2.2 BY SEGMENT

12.2.2.1 PHARMA MANUFACTURING

12.2.2.2 CONTRACT PACKAGING

12.2.2.3 RETAIL PHARMACY

12.2.2.4 INSTITUTIONAL PHARMACY

12.3 FOOD & BEVERAGE

12.3.1 BY PRODUCT

12.3.1.1 BOX

12.3.1.2 BAGS

12.3.1.3 CARTON LINERS

12.3.1.4 BUBBLE CUSHIONING

12.3.1.5 OTHERS

12.3.2 BY TYPE

12.3.2.1 BEVERAGES

12.3.2.2 PROCESSED FOOD

12.3.2.2.1 MEAT & POULTRY

12.3.2.2.2 READY MEALS

12.3.2.2.3 BAKERY PRODUCTS

12.3.2.2.4 PIZZA

12.3.2.2.5 SOUP & NOODLES

12.3.2.2.6 OTHERS

12.3.2.3 SEA FOOD

12.3.2.3.1 FISH

12.3.2.3.2 CRABS

12.3.2.3.3 SHRIMPS

12.3.2.3.4 PRAWNS

12.3.2.3.5 OTHERS

12.4 CHEMICALS

12.4.1 BY PRODUCT

12.4.1.1 BOX

12.4.1.2 BAGS

12.4.1.3 CARTON LINERS

12.4.1.4 BUBBLE CUSHIONING

12.4.1.5 OTHERS

12.5 HORTICULTURE PRODUCTS

12.5.1 BY PRODUCT

12.5.1.1 BOX

12.5.1.2 BAGS

12.5.1.3 CARTON LINERS

12.5.1.4 BUBBLE CUSHIONING

12.5.1.5 OTHERS

12.5.2 BY SEGMENT

12.5.2.1 FRUITS

12.5.2.2 VEGETABLES

12.5.2.3 FLOWER & ORNAMENTAL PLANTS

12.5.2.4 OTHERS

12.6 ELECTRONICS

12.6.1 BY PRODUCT

12.6.1.1 BOX

12.6.1.2 BAGS

12.6.1.3 CARTON LINERS

12.6.1.4 BUBBLE CUSHIONING

12.6.1.5 OTHERS

12.6.2 BY SEGMENT

12.6.2.1 CONSUMER ELECTRONICS

12.6.2.2 INDUSTRIAL ELECTRONICS

12.7 OTHERS

12.7.1 BY PRODUCT

12.7.2 BOX

12.7.3 BAGS

12.7.4 CARTON LINERS

12.7.5 BUBBLE CUSHIONING

12.7.6 OTHERS

13 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 INDIA

13.1.3 JAPAN

13.1.4 INDONESIA

13.1.5 PHILIPPINES

13.1.6 THAILAND

13.1.7 SOUTH KOREA

13.1.8 MALAYSIA

13.1.9 AUSTRALIA & NEW ZEALAND

13.1.10 SINGAPORE

13.1.11 REST OF ASIA-PACIFIC

14 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14.2 MERGERS & ACQUISITIONS

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENTS

14.5 PARTNERSHIPS

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SONOCO PRODUCTS COMPANY

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT UPDATES

16.2 DS SMITH

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT UPDATES

16.3 AVANTOR, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT UPDATES

16.4 WESTROCK COMPANY

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT UPDATES

16.5 SEALED AIR

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT UPDATES

16.6 CSAFE ASIA PACIFIC

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT UPDATES

16.7 ABBE

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT UPDATES

16.8 BIOBRIGHT

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT UPDATE

16.9 CELLULOSE MATERIAL SOLUTIONS, LLC

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT UPDATE

16.1 COLD CHAIN TECHNOLOGIES

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATES

16.11 CRYOPAK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATE

16.12 DUFAYLITE

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT UPDATE

16.13 INSULATED PRODUCTS CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT UPDATE

16.14 INTELSIUS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT UPDATE

16.15 NORDIC COLD CHAIN SOLUTIONS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT UPDATE

16.16 QPRODUCTS & SERVICES

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATE

16.17 SOFRIGAM

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATES

16.18 THE WOOL PACKAGING COMPANY LIMITED

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT UPDATE

16.19 THERMAL ICE

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT UPDATE

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 IMPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS, HS CODE - 392310 (USD THOUSAND)

TABLE 2 EXPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS, HS CODE - 392310 (USD THOUSAND)

TABLE 3 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 5 ASIA PACIFIC BOX IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC BOX IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 7 ASIA PACIFIC BAGS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC BAGS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 9 ASIA PACIFIC CARTON LINERS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC CARTON LINERS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 11 ASIA PACIFIC BUBBLE CUSHIONING IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC BUBBLE CUSHIONING IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 13 ASIA PACIFIC OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 15 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC PASSIVE PACKAGING IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC ACTIVE PACKAGING IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC COLD STORAGE IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC POLYURETHANE (PUR) IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC POLYETHYLENE IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC VACUUM INSULATED PANELS (VIP) IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC POLYLACTIC (PLA) IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC CORRUGATED FIBRE BOARD IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC REFRIGERATED IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC FROZEN IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC AMBIENT IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC PHARMACEUTICALS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA PACIFIC PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA PACIFIC FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA PACIFIC FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA PACIFIC FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA PACIFIC PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA PACIFIC SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA PACIFIC CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA PACIFIC CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA PACIFIC HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 ASIA PACIFIC HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA PACIFIC HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 46 ASIA PACIFIC ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA PACIFIC ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 48 ASIA PACIFIC ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA PACIFIC OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 50 ASIA PACIFIC OTHERSS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 53 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 55 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 72 CHINA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 CHINA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 74 CHINA THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 CHINA THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 76 CHINA POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 CHINA THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 78 CHINA THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 CHINA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 80 CHINA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 81 CHINA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 82 CHINA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 CHINA PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 84 CHINA SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 85 CHINA CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 86 CHINA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 CHINA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 88 CHINA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 CHINA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 90 CHINA OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 91 INDIA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 92 INDIA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 93 INDIA THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 INDIA THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 95 INDIA POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 INDIA THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 97 INDIA THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 98 INDIA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 99 INDIA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 100 INDIA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 101 INDIA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 INDIA PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 103 INDIA SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 104 INDIA CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 105 INDIA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 106 INDIA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 107 INDIA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 108 INDIA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 109 INDIA OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 110 JAPAN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 111 JAPAN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 112 JAPAN THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 JAPAN THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 114 JAPAN POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 JAPAN THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 116 JAPAN THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 117 JAPAN PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 118 JAPAN PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 119 JAPAN FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 120 JAPAN FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 JAPAN PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 122 JAPAN SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 123 JAPAN CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 124 JAPAN HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 125 JAPAN HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 126 JAPAN ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 127 JAPAN ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 128 JAPAN OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 129 INDONESIA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 130 INDONESIA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 131 INDONESIA THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 132 INDONESIA THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 133 INDONESIA POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 134 INDONESIA THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 135 INDONESIA THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 INDONESIA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 137 INDONESIA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 138 INDONESIA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 139 INDONESIA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 INDONESIA PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 141 INDONESIA SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 142 INDONESIA CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 143 INDONESIA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 144 INDONESIA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 145 INDONESIA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 146 INDONESIA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 147 INDONESIA OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 148 PHILIPPINES THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 149 PHILIPPINES THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 150 PHILIPPINES THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 151 PHILIPPINES THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 152 PHILIPPINES POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 153 PHILIPPINES THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 154 PHILIPPINES THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 155 PHILIPPINES PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 156 PHILIPPINES PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 157 PHILIPPINES FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 158 PHILIPPINES FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 PHILIPPINES PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 160 PHILIPPINES SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 161 PHILIPPINES CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 162 PHILIPPINES HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 163 PHILIPPINES HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 164 PHILIPPINES ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 165 PHILIPPINES ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 166 PHILIPPINES OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 167 THAILAND THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 168 THAILAND THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 169 THAILAND THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 170 THAILAND THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 171 THAILAND POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 172 THAILAND THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 173 THAILAND THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 174 THAILAND PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 175 THAILAND PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 176 THAILAND FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 177 THAILAND FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 178 THAILAND PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 179 THAILAND SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 180 THAILAND CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 181 THAILAND HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 182 THAILAND HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND

TABLE 183 THAILAND ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 184 THAILAND ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 185 THAILAND OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 186 SOUTH KOREA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 187 SOUTH KOREA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 188 SOUTH KOREA THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 189 SOUTH KOREA THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 190 SOUTH KOREA POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 191 SOUTH KOREA THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 192 SOUTH KOREA THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 193 SOUTH KOREA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 194 SOUTH KOREA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 195 SOUTH KOREA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 196 SOUTH KOREA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 197 SOUTH KOREA PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 198 SOUTH KOREA SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 199 SOUTH KOREA CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 200 SOUTH KOREA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 201 SOUTH KOREA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 202 SOUTH KOREA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 203 SOUTH KOREA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 204 SOUTH KOREA OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 205 MALAYSIA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 206 MALAYSIA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 207 MALAYSIA THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 208 MALAYSIA THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 209 MALAYSIA POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 210 MALAYSIA THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 211 MALAYSIA THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 212 MALAYSIA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 213 MALAYSIA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 214 MALAYSIA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 215 MALAYSIA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 216 MALAYSIA PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 217 MALAYSIA SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 218 MALAYSIA CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 219 MALAYSIA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 220 MALAYSIA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 221 MALAYSIA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 222 MALAYSIA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 223 MALAYSIA OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 224 AUSTRALIA & NEW ZEALAND THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 225 AUSTRALIA & NEW ZEALAND THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 226 AUSTRALIA & NEW ZEALAND THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 227 AUSTRALIA & NEW ZEALAND THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 228 AUSTRALIA & NEW ZEALAND POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 229 AUSTRALIA & NEW ZEALAND THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 230 AUSTRALIA & NEW ZEALAND THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 231 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 232 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 233 AUSTRALIA & NEW ZEALAND FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 234 AUSTRALIA & NEW ZEALAND FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 235 AUSTRALIA & NEW ZEALAND PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 236 AUSTRALIA & NEW ZEALAND SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 237 AUSTRALIA & NEW ZEALAND CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 238 AUSTRALIA & NEW ZEALAND HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 239 AUSTRALIA & NEW ZEALAND HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 240 AUSTRALIA & NEW ZEALAND ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 241 AUSTRALIA & NEW ZEALAND ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 242 AUSTRALIA & NEW ZEALAND OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 243 SINGAPORE THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 244 SINGAPORE THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 245 SINGAPORE THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 246 SINGAPORE THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 247 SINGAPORE POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 248 SINGAPORE THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 249 SINGAPORE THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 250 SINGAPORE PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 251 SINGAPORE PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 252 SINGAPORE FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 253 SINGAPORE FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 254 SINGAPORE PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 255 SINGAPORE SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 256 SINGAPORE CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 257 SINGAPORE HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 258 SINGAPORE HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 259 SINGAPORE ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 260 SINGAPORE ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 261 SINGAPORE OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 262 REST OF ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 263 REST OF ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

Lista de Figura

FIGURE 1 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: PACKAGING TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: SEGMENTATION

FIGURE 14 EUROPE IS EXPECTED TO DOMINATE THE ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 RISE IN APPLICATION USAGE IN PHARMACEUTICAL INDUSTRY IS DRIVING THE ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 16 BOX IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET

FIGURE 18 RETAIL E-COMMERCE SALES WORLDWIDE, (USD BILLION)

FIGURE 19 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: BY PRODUCT, 2021

FIGURE 20 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: BY PACKAGING TYPE, 2021

FIGURE 21 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: BY MATERIAL, 2021

FIGURE 22 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: BY TEMPERATURE RANGE, 2021

FIGURE 23 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2021

FIGURE 24 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 25 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 26 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 ASIA-PACIFIC THERMAL INSULATION PACKAGING MARKET: BY PRODUCT (2022-2029)

FIGURE 29 ASIA PACIFIC THERMAL INSULATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.