Asia Pacific Surfactant Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

22.02 Billion

USD

31.94 Billion

2024

2032

USD

22.02 Billion

USD

31.94 Billion

2024

2032

| 2025 –2032 | |

| USD 22.02 Billion | |

| USD 31.94 Billion | |

|

|

|

|

Segmentação do mercado de surfactantes da Ásia-Pacífico, por tipo (surfactantes aniônicos, surfactantes não iônicos, surfactantes catiônicos, surfactantes anfotéricos, surfactantes de silicone e outros), substrato (surfactantes sintéticos e surfactantes de base biológica), aplicação (sabões e detergentes domésticos, cuidados pessoais, processamento têxtil, limpeza industrial e institucional, mineração, produtos farmacêuticos, tintas e revestimentos , produtos químicos para campos petrolíferos, processamento de alimentos, produtos químicos agrícolas, celulose e papel, fabricação de couro, polimerização em emulsão, agentes espumantes, lubrificantes e aditivos de combustível, plásticos e elastômeros, adesivos, galvanoplastia e outros) - Tendências do setor e previsão para 2032

Tamanho do mercado de surfactantes da Ásia-Pacífico

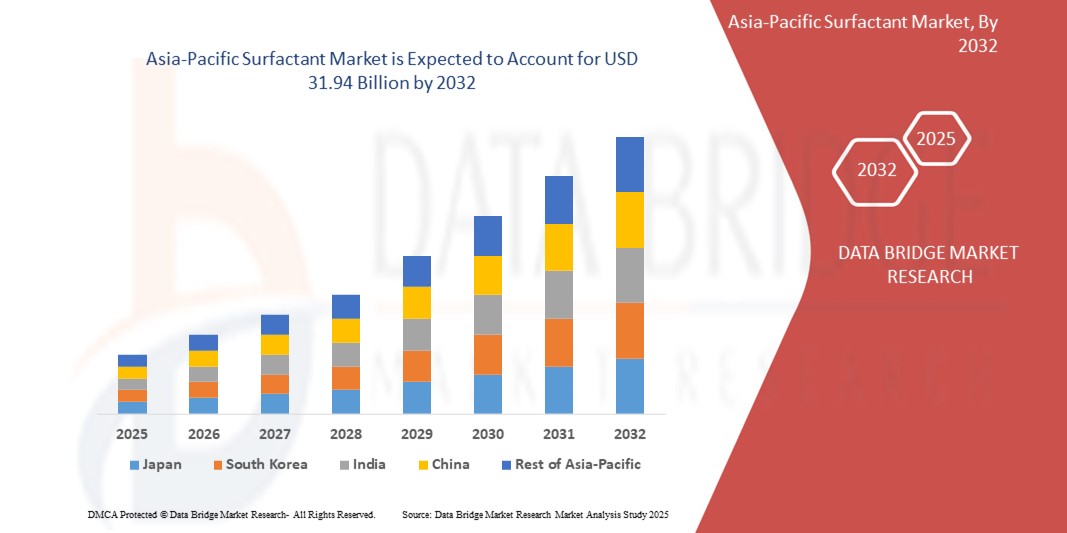

- O tamanho do mercado de surfactantes da Ásia-Pacífico foi avaliado em US$ 22,02 bilhões em 2024 e deve atingir US$ 31,94 bilhões até 2032 , com um CAGR de 4,76% durante o período previsto.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por surfactantes em diversas aplicações, incluindo cuidados pessoais, limpeza doméstica e processos industriais. A rápida urbanização e a expansão da população de classe média na Ásia-Pacífico estão impulsionando ainda mais a demanda por bens de consumo que incorporem surfactantes.

- A crescente adoção de soluções surfactantes sustentáveis, aliada aos avanços na química verde, desempenha um papel fundamental na formação do mercado. Essa mudança para surfactantes ecológicos e de base biológica está impulsionando o crescimento do setor, à medida que consumidores e empresas se tornam mais conscientes dos impactos ambientais.

Análise do Mercado de Surfactantes da Ásia-Pacífico

- Os surfactantes, que são componentes cruciais em detergentes, produtos de higiene pessoal e aplicações industriais, estão se tornando cada vez mais importantes na região da Ásia-Pacífico devido à sua funcionalidade versátil em produtos de consumo e industriais.

- A crescente demanda por surfactantes é impulsionada principalmente pelo uso crescente de agentes de limpeza, cosméticos e produtos de higiene pessoal, bem como pela expansão das indústrias têxtil, agrícola e de petróleo e gás. O aumento da renda disponível e as mudanças no estilo de vida na região Ásia-Pacífico também contribuem para o aumento do consumo de produtos que contêm surfactantes.

- Espera-se que a China domine a região da Ásia-Pacífico com uma maior quota de mercado de 44%, devido à sua vantagem competitiva em termos de eficiência de produção e relação custo-eficácia.

- A Índia deverá ser o país com crescimento mais rápido no mercado de surfactantes da Ásia-Pacífico durante o período previsto, devido à rápida urbanização do país e à expansão da classe média, que está aumentando a demanda por produtos de higiene pessoal e limpeza doméstica, que são os principais consumidores de surfactantes.

- Espera-se que os surfactantes anfotéricos dominem o mercado de surfactantes da Ásia-Pacífico, com uma participação de mercado de 87% em 2025, devido à sua suavidade e à suavidade para a pele, o que os torna ideais para aplicação em produtos para bebês, produtos para pele sensível e cosméticos de alta qualidade. Possuem excelentes propriedades, como formação de espuma, estabilidade em água dura e ótima compatibilidade com outros surfactantes, o que impulsiona sua demanda.

Escopo do Relatório e Segmentação do Mercado de Surfactantes da Ásia-Pacífico

|

Atributos |

Principais insights do mercado de surfactantes da Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de surfactantes da Ásia-Pacífico

“Aumento da demanda impulsionado pelo crescimento industrial e soluções sustentáveis”

- Uma tendência importante e crescente no mercado de surfactantes da Ásia-Pacífico é a crescente demanda de setores-chave de uso final, como cuidados pessoais, limpeza doméstica, têxteis e agricultura, impulsionada pela rápida industrialização e urbanização em toda a região. Esse aumento na demanda é particularmente forte em economias emergentes como China, Índia, Indonésia e Vietnã.

- Por exemplo, o crescimento da população de classe média na Índia e na China está impulsionando o consumo de produtos de higiene pessoal e cuidados domésticos, levando ao aumento da demanda por surfactantes aniônicos e não iônicos usados em xampus , detergentes e amaciantes de roupas. Além disso, empresas multinacionais como a Unilever e a P&G estão expandindo suas operações na região para explorar essa crescente base de consumidores.

- Preocupações ambientais e pressões regulatórias também estão moldando o mercado, incentivando os fabricantes a desenvolver surfactantes de base biológica e biodegradáveis. Empresas como a Galaxy Surfactants e a Kao Corporation estão investindo em linhas de produtos sustentáveis que reduzem o impacto ecológico, atendem aos padrões de certificação verde e atraem consumidores ambientalmente conscientes.

- Os avanços tecnológicos na síntese de surfactantes estão permitindo a produção de surfactantes de alto desempenho com maior eficiência, menor toxicidade e funcionalidade direcionada. Por exemplo, surfactantes especiais estão ganhando força em setores como farmacêutico, agroquímico e químico para campos petrolíferos devido à sua capacidade de aumentar a solubilidade e o desempenho em condições extremas.

- Os governos regionais estão apoiando a produção nacional por meio de políticas favoráveis, subsídios e investimentos em P&D, especialmente em países como China e Índia. Isso está fomentando a inovação local e reduzindo a dependência de importações, contribuindo para um cenário de mercado mais resiliente e competitivo.

- O mercado de surfactantes da Ásia-Pacífico também está testemunhando um aumento no investimento em redes de distribuição e parcerias estratégicas para atender às necessidades diversificadas e crescentes dos mercados regionais. Como resultado, grandes players estão estabelecendo joint ventures e expandindo suas unidades de produção em todo o Sudeste Asiático para capitalizar o crescimento econômico e a crescente demanda da região.

- Essa tendência contínua de expansão industrial, foco na sustentabilidade e inovação tecnológica está transformando fundamentalmente o mercado de surfactantes da Ásia-Pacífico. Consequentemente, fabricantes globais e regionais estão adaptando suas estratégias para atender às preferências dos consumidores e aos cenários regulatórios em constante evolução, reforçando a Ásia-Pacífico como um polo crítico na indústria global de surfactantes.

Dinâmica do mercado de surfactantes da Ásia-Pacífico

Motorista

“Necessidade crescente devido à expansão das indústrias de uso final e à urbanização”

- O rápido crescimento de setores-chave de uso final, como cuidados pessoais, cuidados domésticos, têxteis, agricultura e limpeza industrial na região da Ásia-Pacífico, é um dos principais impulsionadores do aumento da demanda por surfactantes. Essa expansão é amplamente impulsionada pelo aumento da renda disponível, pela urbanização e pela evolução do estilo de vida dos consumidores nas principais economias, incluindo China, Índia, Indonésia e Tailândia.

- Por exemplo, de acordo com relatórios da indústria, espera-se que o mercado de cuidados pessoais e cosméticos na Índia cresça significativamente até 2031, apoiado pela demanda por xampus, produtos de limpeza facial e produtos para a pele, todos os quais dependem fortemente de surfactantes como ingredientes funcionais essenciais.

- Além disso, o rápido crescimento populacional da região e a crescente conscientização sobre higiene e limpeza estão impulsionando o consumo de detergentes, desinfetantes e agentes de limpeza, o que impulsiona diretamente o mercado de surfactantes. Os governos também estão promovendo campanhas de higiene, especialmente em áreas rurais, impulsionando ainda mais a penetração do produto.

- O foco crescente em surfactantes sustentáveis e de origem biológica, devido a preocupações ambientais e pressões regulatórias, está incentivando a inovação e o investimento em química verde. Fabricantes regionais estão cada vez mais migrando para surfactantes de origem vegetal para atender às preferências dos consumidores e cumprir os padrões ambientais internacionais.

- Outro fator significativo é a expansão dos setores industrial e agrícola, particularmente em países como China e Vietnã. Surfactantes são usados em formulações de pesticidas, emulsificantes e agentes umectantes, onde a crescente demanda por soluções de produtividade agrícola sustenta o crescimento do mercado.

- Além disso, as iniciativas governamentais favoráveis que apoiam a produção local, o desenvolvimento de infraestruturas e os fluxos de IDE nos setores de produtos químicos e cuidados pessoais estão a promover a capacidade de produção regional e a criar oportunidades de crescimento a longo prazo para os fabricantes de surfactantes.

- Essa combinação de expansão industrial, demanda impulsionada pelo consumidor e crescente foco regulatório na sustentabilidade está reforçando a posição da região Ásia-Pacífico como um dos mercados de surfactantes de crescimento mais rápido e dinâmico do mundo. Grandes players estão respondendo aumentando a produção, diversificando portfólios e estabelecendo parcerias estratégicas em toda a região.

Restrição/Desafio

“Regulamentações ambientais e preços voláteis de matérias-primas”

- Regulamentações ambientais rigorosas e preocupações crescentes com o impacto ecológico dos surfactantes sintéticos representam um desafio significativo para o mercado de surfactantes da Ásia-Pacífico. Muitos surfactantes convencionais, especialmente aqueles derivados de petroquímicos, não são biodegradáveis e podem contribuir para a poluição da água, gerando escrutínio regulatório e resistência do consumidor.

- Por exemplo, órgãos governamentais e agências ambientais em países como China, Japão e Índia estão cada vez mais implementando políticas destinadas a reduzir o uso de produtos químicos prejudiciais ao meio ambiente, incentivando os fabricantes a mudarem para alternativas verdes e sustentáveis — uma transição que requer investimentos significativos em P&D e adaptação dos processos de fabricação.

- A região da Ásia-Pacífico enfrenta o desafio constante da volatilidade dos preços das matérias-primas, especialmente para insumos derivados do petróleo, como alquilbenzeno linear e óxido de etileno. Essas flutuações podem afetar os custos de produção e as margens de lucro, tornando os preços imprevisíveis tanto para produtores quanto para usuários finais.

- A dependência de matérias-primas importadas em diversos países acrescenta outra camada de complexidade, expondo os fabricantes locais a interrupções na cadeia de suprimentos internacional, flutuações cambiais e tensões geopolíticas. A pandemia de COVID-19 e os recentes gargalos logísticos globais evidenciaram essas vulnerabilidades, causando atrasos e aumento nos custos operacionais.

- Pequenos e médios players da região frequentemente enfrentam dificuldades para cumprir as normas regulatórias em constante evolução e gerenciar simultaneamente as pressões de custos, o que pode prejudicar a competitividade e a inovação no mercado. Além disso, a transição para alternativas de base biológica não só exige muito capital, como também depende da disponibilidade consistente de matéria-prima vegetal, o que nem sempre é garantido.

- Enfrentar esses desafios exige esforços coordenados para o fornecimento sustentável de matérias-primas, investimentos em tecnologias de produção mais sustentáveis e a construção da resiliência da cadeia de suprimentos regional. Embora o mercado apresente forte potencial de crescimento, superar essas restrições é essencial para alcançar a sustentabilidade a longo prazo e a conformidade regulatória em toda a indústria de surfactantes da Ásia-Pacífico.

Escopo do mercado de surfactantes da Ásia-Pacífico

O mercado é segmentado com base no tipo, substrato e aplicação.

- Por tipo

Com base no tipo, o mercado de surfactantes da Ásia-Pacífico é segmentado em surfactantes aniônicos, surfactantes não iônicos, surfactantes catiônicos, surfactantes anfotéricos, surfactantes de silicone e outros. O segmento de surfactantes anfotéricos domina e detém a maior fatia de mercado, com 87% de receita, impulsionado por sua capacidade de atuar eficazmente em uma ampla faixa de pH, minimizando a irritação. Sua compatibilidade com surfactantes aniônicos e catiônicos aumenta a flexibilidade da formulação, tornando-os a escolha preferida para xampus, produtos de limpeza facial e itens de cuidados com o bebê.

Prevê-se que o segmento de surfactantes não iônicos apresentará a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda em setores como processamento de alimentos, agricultura e farmacêutica. Sua baixa toxicidade, biodegradabilidade e estabilidade em água dura tornam os surfactantes não iônicos ideais para formulações industriais e ecológicas. Além disso, seu uso crescente em emulsificantes e agentes umectantes está alinhado ao crescente foco da região em produtos sustentáveis e de alto desempenho.

- Por substrato

Com base no substrato, o mercado de surfactantes da Ásia-Pacífico é segmentado em surfactantes sintéticos e surfactantes de origem biológica. Os surfactantes sintéticos dominarão o mercado em 2025, detendo a maior fatia da receita. Seu amplo uso é atribuído à sua relação custo-benefício, desempenho superior e facilidade de produção em massa. Surfactantes sintéticos, como surfactantes aniônicos (como o alquilbenzeno sulfonato linear) e surfactantes não iônicos (como os etoxilatos), são predominantes em agentes de limpeza, produtos de higiene pessoal e detergentes.

Espera-se que o segmento de surfactantes de origem biológica apresente a maior taxa de crescimento anual composta entre 2025 e 2032, impulsionado pela crescente demanda do consumidor por produtos sustentáveis e ecologicamente corretos. Surfactantes de origem biológica, derivados de fontes renováveis, como óleos vegetais e açúcares, oferecem menor impacto ambiental em comparação com alternativas sintéticas. Esses surfactantes estão ganhando força significativa em cuidados pessoais, processamento de alimentos e aplicações agrícolas devido à sua biodegradabilidade, suavidade e menor toxicidade.

Por aplicação

Com base na aplicação, o mercado de surfactantes da Ásia-Pacífico é segmentado em sabões e detergentes domésticos, cuidados pessoais, processamento têxtil, limpeza industrial e institucional, mineração, produtos farmacêuticos, tintas e revestimentos, produtos químicos para campos petrolíferos, processamento de alimentos, produtos químicos agrícolas, celulose e papel, fabricação de couro, polimerização em emulsão, agentes espumantes, lubrificantes e aditivos para combustíveis, plásticos e elastômeros, adesivos, galvanoplastia e outros. O segmento de sabões e detergentes domésticos detém a maior fatia de mercado em 2025, impulsionado pela alta demanda contínua por produtos de limpeza, incluindo detergentes para roupas, detergentes líquidos para lavar louças e limpadores multiuso. Os surfactantes nesta categoria oferecem forte poder de limpeza e propriedades espumantes, tornando-os essenciais para o uso doméstico diário.

O segmento de cuidados pessoais deverá apresentar rápido crescimento entre 2025 e 2032, devido à crescente preferência do consumidor por produtos de cuidados pessoais de alta qualidade, como xampus, sabonetes líquidos e produtos para a pele. Surfactantes em aplicações de cuidados pessoais atuam como emulsificantes, agentes espumantes e condicionadores da pele, atendendo à demanda do consumidor por produtos eficazes e suaves. À medida que os consumidores priorizam cada vez mais ingredientes sustentáveis e naturais, os surfactantes de origem biológica estão ganhando popularidade neste segmento.

Análise regional do mercado de surfactantes da Ásia-Pacífico

- A China domina o mercado de surfactantes da Ásia-Pacífico, com a maior participação na receita, de aproximadamente 44%, impulsionada por sua ampla base industrial e pela forte demanda por surfactantes em cuidados pessoais, limpeza doméstica e aplicações industriais. O forte crescimento industrial da China, aliado à crescente preferência do consumidor por produtos de limpeza e cuidados pessoais de alta qualidade, impulsiona a demanda por surfactantes.

- Os consumidores na China estão cada vez mais optando por produtos sustentáveis e ecologicamente corretos, impulsionando a demanda por surfactantes de origem biológica em produtos de higiene pessoal e limpeza doméstica. A crescente conscientização sobre questões ambientais e as regulamentações governamentais que promovem produtos químicos verdes também contribuem para o crescimento deste segmento.

- A crescente popularidade dos surfactantes de base biológica na Índia está alinhada com a mudança em direção a formulações de produtos mais sustentáveis e ecologicamente corretas, especialmente nos segmentos de cuidados pessoais e produtos químicos agrícolas.

Visão do mercado de surfactantes na Índia e Ásia-Pacífico

O mercado indiano de surfactantes deverá crescer a uma taxa composta de crescimento anual (CAGR) de 6% durante o período previsto de 2025 a 2032, impulsionado pela rápida industrialização, pelo aumento da renda disponível e pela crescente demanda por produtos de higiene pessoal, limpeza doméstica e têxteis. A expansão da classe média do país, aliada à crescente urbanização, está impulsionando o consumo de surfactantes em diversos setores. Além disso, a crescente conscientização sobre higiene e saneamento, juntamente com o aumento de consumidores ecoconscientes, está estimulando a demanda por surfactantes de origem biológica e sustentáveis. O foco do governo na promoção de produtos químicos verdes e a crescente adoção de formulações sustentáveis impulsionarão ainda mais o crescimento do mercado na Índia.

Visão do mercado de surfactantes da Ásia-Pacífico no Japão

O mercado japonês de surfactantes continua apresentando crescimento estável, impulsionado pela alta demanda por surfactantes especializados em cuidados pessoais, automotivos e aplicações industriais. Os avanços tecnológicos do país e a ênfase em produtos premium de alta qualidade o tornam um mercado significativo para surfactantes não iônicos, de silicone e de origem biológica. O envelhecimento da população japonesa também contribui para a demanda por produtos de cuidados pessoais com formulações ecologicamente corretas e que não agridem a pele. A crescente preferência por produtos químicos sustentáveis e ecológicos em cuidados pessoais e limpeza doméstica deve continuar impulsionando o mercado japonês.

Visão do mercado de surfactantes da China Ásia-Pacífico

A China domina o mercado de surfactantes na Ásia-Pacífico, detendo a maior fatia de mercado, com 44% da receita em 2025. A rápida industrialização do país, a expansão da classe média e a alta adoção de tecnologias são fatores-chave que impulsionam a demanda por surfactantes em produtos de higiene pessoal, limpeza, têxteis e aplicações industriais. A China também está testemunhando uma mudança significativa em direção a surfactantes sustentáveis e de base biológica, impulsionada pela crescente conscientização dos consumidores sobre questões ambientais e por regulamentações governamentais mais rigorosas que promovem a sustentabilidade. Como um dos maiores polos de manufatura do mundo, a produção doméstica de surfactantes na China torna esses produtos altamente acessíveis e baratos, contribuindo para seu amplo uso nos setores residencial e industrial.

Participação no mercado de surfactantes da Ásia-Pacífico

O setor de fechaduras inteligentes é liderado principalmente por empresas bem estabelecidas, incluindo:

- Galaxy Surfactants Ltd. (Índia)

- Aarti Industries Ltd. (Índia)

- KLK OLEO (Malásia)

- Indorama Ventures Public Company Limited (Tailândia)

- Godrej Industries Limited (Índia)

- Reliance Industries Limited (Índia)

- Kao Corporation (Japão)

- Lion Corporation (Japão)

- SABIC (Arábia Saudita)

- Sumitomo Chemical Co., Ltd. (Japão)

- Cepsa (Espanha)

- Bayer AG (Alemanha)

- SANYO CHEMICAL INDUSTRIES, LTD. (Japão)

- Croda International Plc (Reino Unido)

- Grupo de Tecnologia Zanyu (China)

- Ashland (Estados Unidos)

- GALAXY (Índia)

- Grupo EOC (Taiwan)

- Lankem (Sri Lanka)

- DKS Co., Ltd. (Japão)

Últimos desenvolvimentos no mercado de surfactantes da Ásia-Pacífico

- Em janeiro de 2024, a Evonik Industries AG lançou com sucesso seu primeiro produto em sua planta em escala industrial para biossurfactantes sustentáveis na Eslováquia, concluindo a instalação antes do previsto. Esta planta de última geração é a primeira do mundo a produzir biossurfactantes ramnolipídicos sustentáveis, representando um marco significativo na indústria. Este desenvolvimento está aumentando a demanda por surfactantes sustentáveis e ecologicamente corretos. À medida que a região continua a experimentar rápido crescimento industrial e a crescente preferência do consumidor por produtos químicos verdes, as soluções inovadoras em biossurfactantes da Evonik posicionam a empresa para atender à crescente demanda por alternativas sustentáveis.

- Em outubro de 2023, a Sasol Chemicals, uma divisão da Sasol Ltd., lançou duas novas marcas, CARINEX e LIVINEX, com o objetivo de expandir o portfólio de produtos sustentáveis da empresa. Os produtos iniciais lançados sob essas marcas, CARINEX SL e LIVINEX SL, são biossurfactantes que representam uma adição significativa à oferta da Sasol no segmento de surfactantes sustentáveis. Este lançamento prioriza cada vez mais soluções sustentáveis e ecologicamente corretas. À medida que a demanda do consumidor por surfactantes verdes e de base biológica continua a aumentar, particularmente em cuidados pessoais, limpeza doméstica e aplicações industriais, os novos biossurfactantes da Sasol se alinham ao crescente compromisso da região com a sustentabilidade.

- Em outubro de 2023, a Ashland lançou seus agentes umectantes de substrato Easy-Wet, uma nova categoria de polióis alquil poliéter oligoméricos de alto desempenho, isentos de silicone, projetados especificamente para aplicações de revestimentos industriais premium. Essa inovação permite que a Ashland ofereça soluções transformadoras para a indústria de revestimentos. Essa demanda por surfactantes avançados e ecologicamente corretos está aumentando rapidamente, especialmente no setor de revestimentos. À medida que a região continua a priorizar a sustentabilidade e soluções de alto desempenho, os agentes umectantes Easy-Wet da Ashland oferecem uma alternativa atraente aos produtos tradicionais à base de silicone.

- Em janeiro de 2023, a Holiferm Limited e a Sasol Chemicals, uma unidade de negócios da Sasol Ltd., anunciaram uma colaboração estratégica para desenvolver e comercializar conjuntamente ramnolipídios e manosileritritol lipídios (MELs) — duas classes avançadas de biossurfactantes. Este acordo se baseia na parceria inicial estabelecida em março de 2022, focada no desenvolvimento e introdução no mercado de soforolipídios. Esta parceria é de grande relevância para o mercado de surfactantes da Ásia-Pacífico, onde a demanda por biossurfactantes sustentáveis e de alto desempenho está em aceleração, especialmente em setores como cuidados pessoais, cuidados domésticos e limpeza industrial.

- Em janeiro de 2023, a Cepsa Química lançou o NextLab, a primeira linha sustentável de Alquilbenzeno Linear (LAB) do mundo, projetada especificamente para produtos de cuidados com o lar. O anúncio foi feito na Convenção Anual da ACI, em Orlando. Essa inovação é particularmente relevante para o mercado de surfactantes da Ásia-Pacífico, onde a demanda por matérias-primas sustentáveis e de baixa emissão está crescendo rapidamente, especialmente nos setores de cuidados com o lar e limpeza.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.