Mercado de ecrãs industriais robustos da Ásia-Pacífico, por tecnologia (LCD, LED, OLED, ecrã de papel eletrónico), tamanho do ecrã (8”-11”, 11”-12”, 13”-18”, 19”- 25”, 40”-em cima), resolução (1920x1200, 1920x1080, 1280x1024, 1024x768, 800x600, 1366x768), montagem (montagem em painel, montagem em bastidor, montagem em parede, montagem em braço, estrutura aberta, outros), tipo de ecrã táctil ( Resistivo, PCAP, IR Touch, Capacitivo), Aplicação (Médica, HMI, Automação Industrial, QUIOSQUE/POS, Sinalética Digital, Imagem, Jogos/Lotaria), Vertical (Petróleo e Gás, Fabrico, Química, Energia e Energia , Mineração e Metais , Transportes, Militar e Defesa, Outros), País (China, Coreia do Sul, Japão, Índia, Austrália, Singapura, Malásia, Indonésia, Tailândia, Filipinas, Resto da Ásia-Pacífico) Tendências e previsões da indústria para 2028

Análise e insights de mercado: Mercado de ecrãs industriais robustos da Ásia-Pacífico

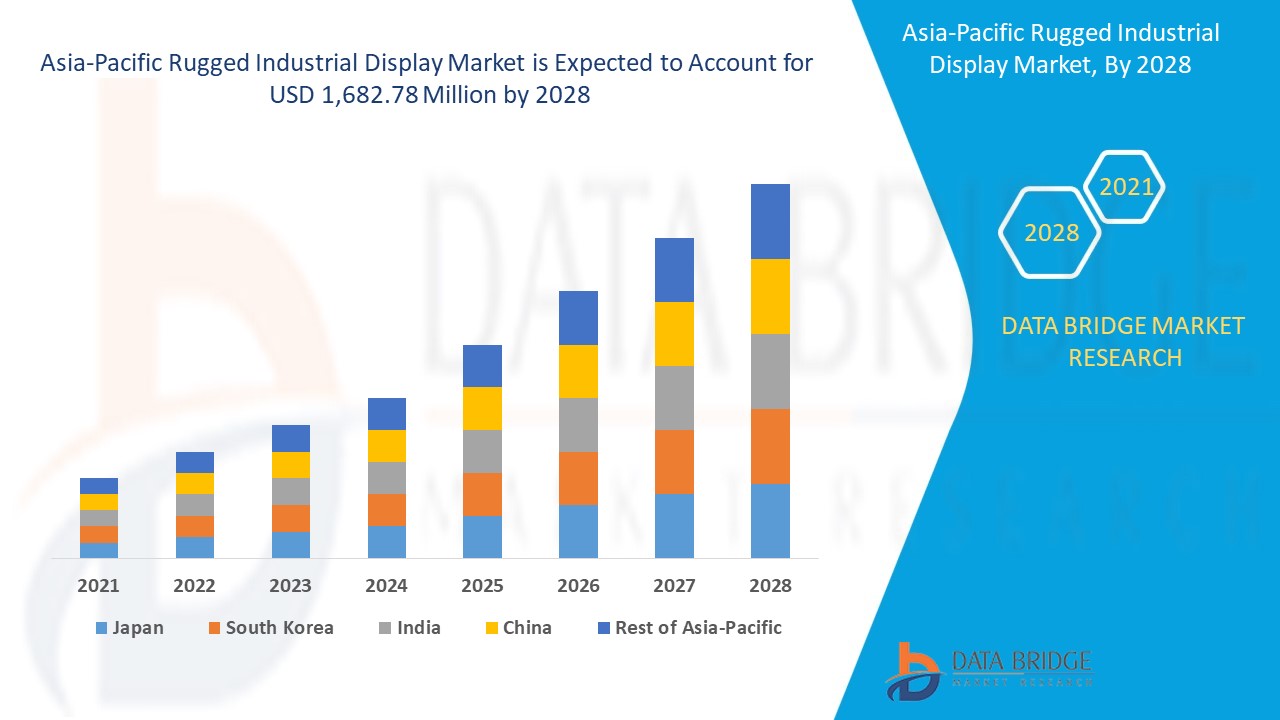

Espera-se que o mercado de displays industriais robustos ganhe crescimento de mercado no período de previsão de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 7,9% no período de previsão de 2021 a 2028 e deverá atingir os 1.682,78 milhões de USD até 2028. O aumento da automação e da IoT no âmbito da Indústria 4.0 e o aumento dos dados digitais nas áreas médica, industrial, militar e de defesa exigem ecrãs de interação mais adequados aos ambientes adversos dos respetivos setores, atuando assim como impulsionadores para o crescimento robusto do mercado de displays industriais.

O display industrial robusto é o tipo especial de display concebido para os ambientes agressivos enfrentados nas aplicações marítimas, militares e industriais, onde o elevado desempenho e a robustez são cruciais. Oferecem características como revestimento resistente a choques, ecrãs resistentes a riscos, resistência à corrosão e revestimentos especiais dependendo do caso de utilização.

Os desenvolvimentos tecnológicos emergentes e os processos automatizados nas indústrias estão a revelar-se o principal impulsionador do mercado de ecrãs industriais robustos da Ásia-Pacífico. O aumento da interação homem-máquina nos últimos anos tem assistido ao aumento do mercado de ecrãs HMI nos últimos anos e a crescente adoção da automação no setor da indústria transformadora está a impulsionar o mercado. O custo mais elevado da adoção de ecrãs robustos e o elevado custo de desenvolvimento para condições desafiantes podem revelar-se uma restrição, no entanto, muitas indústrias que migram para a indústria 4.0 e a rápida digitalização e automação são a maior oportunidade para o mercado. O desenvolvimento de ecrãs para todas as condições meteorológicas pode ser um desafio e os desafios enfrentados devido ao impacto da COVID-19 na cadeia de abastecimento de matérias-primas, especialmente as importações da China, que é um importante fornecedor internacional de produtos eletrónicos.

O relatório de mercado de display industrial robusto fornece detalhes de quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa oportunidades em termos de bolsas de receitas emergentes, mudanças nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos , expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário robusto do mercado de ecrãs industriais, contacte a Data Bridge Market Research para obter um resumo do analista, a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir o objetivo desejado.

Âmbito e tamanho do mercado de display industrial robusto

O mercado dos displays industriais robustos está segmentado com base na tecnologia, tamanho do display, resolução, montagem, tipo de ecrã táctil, aplicação e vertical. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base na tecnologia, o mercado dos displays industriais robustos está segmentado em displays LCD, LED, OLED e E-Paper. Em 2021, o segmento LCD está a dominar o mercado dos ecrãs industriais robustos, uma vez que é o mais barato para adoção entre todos.

- Com base no tamanho do ecrã, o mercado de ecrãs industriais robustos está segmentado em 8"-11", 11"-12", 13"-18", 19"-25", 40"-acima. Em 2021, o segmento de 13”-18” está a dominar o mercado, pois é o tamanho de ecrã ideal para todos os tipos de aplicação e tipo de montagem.

- Com base na resolução, o mercado dos displays industriais robustos está segmentado em 1920x1200, 1920x1080, 1280x1024, 1024x768, 800x600 e 1366x768. Em 2021, o segmento 1024x768 está a dominar o mercado, uma vez que a sua relação de aspecto 4:3 é comum nos monitores HMI e também suporta software legado.

- Com base na montagem, o mercado dos expositores industriais robustos está segmentado em montagem em painel, montagem em rack, montagem em parede, montagem em braço, estrutura aberta e outros. Em 2021, o segmento de montagem em painel está a dominar o mercado devido à sua natureza versátil de adoção a diferentes adaptadores e à ampla adoção no setor da indústria transformadora.

- Com base no tipo de ecrã táctil, o mercado dos ecrãs industriais robustos está segmentado em resistivo, PCAP, toque IR e capacitivo. Em 2021, o segmento resistivo domina o mercado devido ao seu menor custo de adoção e à facilidade de utilização com luvas e caneta passiva.

- Com base na aplicação, o mercado dos displays industriais robustos está segmentado em medicina, HMI, automação industrial , QUIOSQUE/POS, sinalização digital, imagem e jogos/lotaria. Em 2021, o segmento HMI está a dominar o mercado devido à rápida industrialização e utilização na automação.

- Com base na vertical, o mercado de display industrial robusto está segmentado em petróleo e gás, manufatura, química , energia e energia, mineração e metais, transporte, militar e defesa e outros. Em 2021, o segmento da indústria transformadora está a dominar o mercado devido à maior procura devido à crescente automatização e ao crescimento das instalações de fabrico em toda a Ásia-Pacífico.

Análise ao nível do país do mercado de display industrial robusto

O mercado de displays industriais robustos é analisado e são fornecidas informações sobre o tamanho do mercado por país, tecnologia, tamanho do display, resolução, montagem, tipo de ecrã táctil, aplicação e vertical, conforme mencionado acima.

Os países abrangidos no relatório do mercado de ecrãs industriais robustos são a China, Coreia do Sul, Japão, Índia, Austrália, Singapura, Malásia, Indonésia, Tailândia, Filipinas e resto da Ásia-Pacífico.

A China domina a região Ásia-Pacífico devido ao rápido crescimento das indústrias e à utilização do HMI na indústria transformadora.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado interno que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da Ásia-Pacífico e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, o impacto dos canais de vendas são considerados, ao mesmo tempo que fornece uma análise de previsão dos dados do país.

O crescimento das atividades estratégicas dos principais players do mercado para aumentar a sensibilização para a exposição industrial robusta está a impulsionar o crescimento do mercado de exposição industrial robusta.

O mercado de ecrãs industriais robustos também fornece análises de mercado detalhadas para o crescimento de cada país num mercado específico. Além disso, fornece informações detalhadas sobre a estratégia dos intervenientes no mercado e a sua presença geográfica. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Análise do cenário competitivo e da quota de mercado de display industrial robusto

O cenário competitivo do mercado de ecrãs industriais robustos fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes, largura e amplitude do produto, domínio de aplicação, curva de segurança da tecnologia. Os dados fornecidos acima estão apenas relacionados com o foco da empresa relacionado com o mercado de displays industriais robustos.

As principais empresas que lidam com displays industriais robustos são a SAMSUNG ELECTRONICS AMERICA, Advantech Co., Ltd., AU Optronics Corp., BOE Technology UK Limited, Curtiss-Wright Corporation, GETAC, Kyocera, Pepperl+Fuchs SE, Rockwell Automation, Inc. , Siemens e TCI GmbH, entre outros players nacionais. Os analistas DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos contratos e acordos são também iniciados por empresas de todo o mundo, que também estão a acelerar o mercado dos ecrãs industriais robustos.

Por exemplo,

- Em abril de 2021, a divisão de soluções de defesa Curtiss-Wright foi selecionada pela Scientific Research Corporation (SRC) para fornecer uma versão do seu sistema de gravador de voo de fortaleza líder do setor para atualizar o avião de treino T-6 Texan II utilizado pelos EUA. Isto ajudará a empresa a explorar ainda mais outras aplicações de gravadores de voo dentro do DoD na sua divisão de defesa

- Em março de 2021, a Advantech Co. Ltd, líder da Ásia-Pacífico em tecnologia IoT, anunciou o lançamento da maior série de conferências de parceiros online do mundo, o tema da série é “Edge+ para o futuro da AIoT”. A série reuniu mais de 60 especialistas industriais e colaboradores do ecossistema para partilhar novas soluções e tecnologias Edge+. A empresa planeia também trabalhar com estes colaboradores a longo prazo para co-criar um ambiente sustentável e melhorar as oportunidades de negócio da IoT.

A colaboração, o lançamento de produtos, a expansão de negócios, a atribuição de prémios e reconhecimento, as joint ventures e outras estratégias do player de mercado estão a melhorar a presença da empresa no mercado de displays industriais robustos, o que também oferece o benefício para o crescimento do lucro da organização.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRIAL DISPLAY TYPES

4.2 STANDARD RATINGS FOR INDUSTRIAL DISPLAYS

4.2.1 INGRESS PROTECTION (IP) RATING:

4.2.2 NATIONAL ELECTRIC MANUFACTURERS ASSOCIATION (NEMA) RATINGS

4.3 KEY CUSTOMERS BY INDUSTRY

4.3.1 MILITARY & DEFENSE INDUSTRY

4.3.2 INDUSTRIAL AUTOMATION & MANUFACTURING

4.3.3 OIL & GAS INDUSTRY

4.3.4 CHEMICAL INDUSTRY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EMERGENCE OF VARIOUS TECHNOLOGICAL DEVELOPMENTS AND AUTOMATED PROCESSES IN INDUSTRIES

5.1.2 LED AND LCD BASED DISPLAY PRODUCTS REDUCES RISK OF EYE DAMAGE

5.1.3 RISE IN DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN VARIOUS INDUSTRIES

5.1.4 INCREASE IN MANUFACTURING FACILITIES WORLDWIDE ENHANCES ADOPTION OF INDUSTRIAL DISPLAYS

5.1.5 AVAILABILITY OF ROBUST DISPLAY SCREEN AND WIRELESS CONNECTION

5.1.6 RISE IN DEMAND FOR COST-EFFECTIVE KIOSKS FOR INDUSTRIAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 HIGH INVESTMENTS REQUIRED FOR INSTALLING OF INDUSTRIAL DISPLAYS/PANELS

5.2.2 DEVELOPING & DESIGNING OF DISPLAY EQUIPMENT FOR ALL WEATHER CONDITIONS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR DIGITAL SIGNAGE APPLICATIONS IN INDUSTRIES FOR DISPLAYING NECESSARY INFORMATION

5.3.2 INCREASE IN DIGITALIZATION OF FACILITIES WITH INDUSTRY 4.0

5.3.3 RISE IN ADOPTION OF OLED DISPLAYS IN VARIOUS APPLICATIONS

5.3.4 TRANSFORMATION OF MANUAL PROCESS INTO DIGITAL PROCESS BY COMPANIES

5.3.5 INCREASE IN PARTNERSHIPS AND ACQUISITIONS AMONGST DIFFERENT MARKET PLAYERS

5.4 CHALLENGES

5.4.1 SUITABILITY OF INDUSTRIAL DISPLAY FOR ALL WEATHER CONDITIONS

5.4.2 DEPENDENCY OF MANUFACTURERS ON VARIOUS SUPPLIERS TO PROVIDE EQUIPMENT AND COMPONENTS

5.4.3 ECONOMIC CRISIS OCCURRED DUE TO VARIOUS FACTORS

6 IMPACT OF COVID-19 ON THE ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 CONCLUSION

7 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LCD

7.3 LED

7.3.1 FULL ARRAY

7.3.2 EDGE LIT

7.3.3 DIRECT LIT

7.4 OLED

7.4.1 AMOLED DISPLAY

7.4.2 PMOLED DISPLAY

7.5 E-PAPER DISPLAY

8 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE

8.1 OVERVIEW

8.2” – 18”

8.3 8” – 11”

8.4” – 12”

8.5” – 25”

8.6 ABOVE 40"

9 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION

9.1 OVERVIEW

9.24X768

9.36X768

9.40X1080

9.5X600

9.60X1024

9.70X1200

10 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING

10.1 OVERVIEW

10.2 PANEL MOUNTING

10.3 OPEN-FRAME

10.4 RACK MOUNTING

10.5 WALL MOUNTING

10.6 ARM-MOUNTED

10.7 OTHERS

11 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE

11.1 OVERVIEW

11.2 RESISTIVE

11.3 P CAP

11.4 CAPACITIVE

11.5 IR TOUCH

12 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 HMI

12.2.1” – 18”

12.2.2 8” – 11”

12.2.3” – 25”

12.2.4” – 12”

12.2.5 ABOVE 40"

12.3 MEDICAL

12.3.1” – 18”

12.3.2” – 25”

12.3.3” – 12”

12.3.4 8” – 11”

12.3.5 ABOVE 40"

12.4 INDUSTRIAL AUTOMATION

12.4.1 ABOVE 40"

12.4.2” – 25”

12.4.3” – 18”

12.4.4” – 12”

12.4.5 8” – 11”

12.5 DIGITAL SIGNAGE

12.5.1 ABOVE 40"

12.5.2” – 25”

12.5.3” – 18”

12.5.4” – 12”

12.5.5 8” – 11”

12.6 KIOSK/ POS

12.6.1 8” – 11”

12.6.2” – 12”

12.6.3” – 18”

12.6.4” – 25”

12.6.5 ABOVE 40"

12.7 GAMING/ LOTTERY

12.7.1” – 18”

12.7.2” – 25”

12.7.3” – 12”

12.7.4 8” – 11”

12.7.5 ABOVE 40"

12.8 IMAGING

12.8.1” – 18”

12.8.2” – 25”

12.8.3 ABOVE 40"

12.8.4” – 12”

12.8.5 ABOVE 40"

13 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL

13.1 OVERVIEW

13.2 MANUFACTURING

13.2.1 LCD

13.2.2 LED

13.2.3 OLED

13.3 MILITARY & DEFENCE

13.3.1 LCD

13.3.2 LED

13.3.3 OLED

13.4 ENERGY & POWER

13.4.1 LCD

13.4.2 LED

13.4.3 OLED

13.5 OIL & GAS

13.5.1 LCD

13.5.2 LED

13.5.3 OLED

13.6 CHEMICAL

13.6.1 LCD

13.6.2 LED

13.6.3 OLED

13.7 TRANSPORTATION

13.7.1 LCD

13.7.2 LED

13.7.3 OLED

13.8 METAL & MINING

13.8.1 LCD

13.8.2 LED

13.8.3 OLED

13.9 OTHERS

14 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY GEOGRAPHY

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 SOUTH KOREA

14.1.4 INDIA

14.1.5 SINGAPORE

14.1.6 AUSTRALIA

14.1.7 MALAYSIA

14.1.8 THAILAND

14.1.9 INDONESIA

14.1.10 PHILLIPPINES

14.1.11 REST OF ASIA-PACIFIC

15 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SAMSUNG ELECTRONICS AMERICA

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 AU OPTRONICS CORP.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALSYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 KYOCERA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CURTISS-WRIGHT CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 ROCKWELL AUTOMATION INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 GETAC

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ADVANCED EMBEDDED SOLUTIONS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ADVANTECH CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 BIT TRADITION GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BLUESTONE TECHNOLOGY LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BOE TECHNOLOGY UK LIMITED

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 BRESSNER TECHNOLOGY GMBH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 CRYSTAL GROUP INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 GENERAL DIGITAL CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 HEMATEC GMBH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 HOPE INDUSTRIAL SYSTEMS, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 NOAX TECHNOLOGIES AG

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PEPPERL+FUCHS SE

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 SIEMENS

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 TCI GMBH

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 DESCRIPTION OF VARIOUS IP RATING NUMBERS

TABLE 2 SIGNIFICANCE OF NEMA RATING

TABLE 3 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 4 ASIA-PACIFIC LCD IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 5 ASIA-PACIFIC LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 6 ASIA-PACIFIC LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 7 ASIA-PACIFIC OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 8 ASIA-PACIFIC OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 9 ASIA-PACIFIC E-PAPER DISPLAY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 10 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 11 ASIA-PACIFIC 13” – 18” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 12 ASIA-PACIFIC 8” – 11” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 13 ASIA-PACIFIC 11” – 12” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 14 ASIA-PACIFIC 19” – 25” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 15 ASIA-PACIFIC ABOVE 40" IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 16 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 17 ASIA-PACIFIC 1024X768 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 18 ASIA-PACIFIC 1366X768 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 19 ASIA-PACIFIC 1920X1080 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 20 ASIA-PACIFIC 800X600 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 21 ASIA-PACIFIC 1280X1024 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 22 ASIA-PACIFIC 1920X1200 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 23 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 24 ASIA-PACIFIC PANEL MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 25 ASIA-PACIFIC OPEN-FRAME IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 26 ASIA-PACIFIC RACK MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 27 ASIA-PACIFIC WALL MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 28 ASIA-PACIFIC ARM-MOUNTED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 29 ASIA-PACIFIC OTHERS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 30 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 31 ASIA-PACIFIC RESISTIVE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 32 ASIA-PACIFIC P CAP IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 33 ASIA-PACIFIC CAPACITIVE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 34 ASIA-PACIFIC IR TOUCH IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 35 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 36 ASIA-PACIFIC HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 37 ASIA-PACIFIC HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 38 ASIA-PACIFIC MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 39 ASIA-PACIFIC MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 40 ASIA-PACIFIC INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 41 ASIA-PACIFIC INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 42 ASIA-PACIFIC DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 43 ASIA-PACIFIC DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 44 ASIA-PACIFIC KIOSK/POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 45 ASIA-PACIFIC KIOSK/ POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 46 ASIA-PACIFIC GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 47 ASIA-PACIFIC GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 48 ASIA-PACIFIC IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 49 ASIA-PACIFIC IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 50 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 51 ASIA-PACIFIC MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 52 ASIA-PACIFIC MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 53 ASIA-PACIFIC MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 54 ASIA-PACIFIC MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 55 ASIA-PACIFIC ENERGY AND POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 56 ASIA-PACIFIC ENERGY & POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 57 ASIA-PACIFIC OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 58 ASIA-PACIFIC OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 59 ASIA-PACIFIC CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 60 ASIA-PACIFIC CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 61 ASIA-PACIFIC TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 62 ASIA-PACIFIC TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 63 ASIA-PACIFIC METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 64 ASIA-PACIFIC METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 65 ASIA-PACIFIC OTHERS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 66 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 67 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 68 ASIA-PACIFIC LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 69 ASIA-PACIFIC OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 70 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 71 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 72 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 73 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 74 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 75 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (THOUSAND UNITS)

TABLE 76 ASIA-PACIFIC HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 77 ASIA-PACIFIC MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 78 ASIA-PACIFIC INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 79 ASIA-PACIFIC MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 80 ASIA-PACIFIC KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 81 ASIA-PACIFIC GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 82 ASIA-PACIFIC IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 83 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 84 ASIA-PACIFIC MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 85 ASIA-PACIFIC MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 86 ASIA-PACIFIC ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 87 ASIA-PACIFIC OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 88 ASIA-PACIFIC CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 89 ASIA-PACIFIC TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 90 ASIA-PACIFIC METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 91 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 92 CHINA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 93 CHINA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 94 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 95 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 96 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 97 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 98 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 99 CHINA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 100 CHINA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 101 CHINA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 102 CHINA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 103 CHINA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 104 CHINA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 105 CHINA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 106 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 107 CHINA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 108 CHINA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 109 CHINA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 110 CHINA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 111 CHINA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 112 CHINA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 113 CHINA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 114 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 115 JAPAN LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 116 JAPAN OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 117 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 118 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 119 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 120 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 121 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 122 JAPAN HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 123 JAPAN MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 124 JAPAN INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 125 JAPAN MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 126 JAPAN KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 127 JAPAN GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 128 JAPAN IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 129 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 130 JAPAN MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 131 JAPAN MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 132 JAPAN ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 133 JAPAN OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 134 JAPAN CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 135 JAPAN TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 136 JAPAN METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 137 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 138 SOUTH KOREA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 139 SOUTH KOREA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 140 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 141 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 142 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 143 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 144 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 145 SOUTH KOREA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 146 SOUTH KOREA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 147 SOUTH KOREA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 148 SOUTH KOREA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 149 SOUTH KOREA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 150 SOUTH KOREA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 151 SOUTH KOREA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 152 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 153 SOUTH KOREA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 154 SOUTH KOREA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 155 SOUTH KOREA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 156 SOUTH KOREA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 157 SOUTH KOREA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 158 SOUTH KOREA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 159 SOUTH KOREA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 160 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 161 INDIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 162 INDIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 163 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 164 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 165 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 166 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 167 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 168 INDIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 169 INDIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 170 INDIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 171 INDIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 172 INDIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 173 INDIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 174 INDIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 175 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 176 INDIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 177 INDIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 178 INDIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 179 INDIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 180 INDIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 181 INDIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 182 INDIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 183 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 184 SINGAPORE LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 185 SINGAPORE OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 186 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 187 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 188 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 189 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 190 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 191 SINGAPORE HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 192 SINGAPORE MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 193 SINGAPORE INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 194 SINGAPORE MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 195 SINGAPORE KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 196 SINGAPORE GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 197 SINGAPORE IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 198 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 199 SINGAPORE MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 200 SINGAPORE MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 201 SINGAPORE ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 202 SINGAPORE OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 203 SINGAPORE CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 204 SINGAPORE TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 205 SINGAPORE METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 206 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 207 AUSTRALIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 208 AUSTRALIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 209 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 210 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 211 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 212 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 213 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 214 AUSTRALIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 215 AUSTRALIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 216 AUSTRALIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 217 AUSTRALIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 218 AUSTRALIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 219 AUSTRALIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 220 AUSTRALIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 221 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 222 AUSTRALIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 223 AUSTRALIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 224 AUSTRALIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 225 AUSTRALIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 226 AUSTRALIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 227 AUSTRALIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 228 AUSTRALIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 229 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 230 MALAYSIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 231 MALAYSIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 232 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 233 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 234 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 235 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 236 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 237 MALAYSIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 238 MALAYSIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 239 MALAYSIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 240 MALAYSIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 241 MALAYSIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 242 MALAYSIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 243 MALAYSIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 244 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 245 MALAYSIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 246 MALAYSIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 247 MALAYSIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 248 MALAYSIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 249 MALAYSIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 250 MALAYSIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 251 MALAYSIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 252 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 253 THAILAND LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 254 THAILAND OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 255 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 256 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 257 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 258 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 259 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 260 THAILAND HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 261 THAILAND MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 262 THAILAND INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 263 THAILAND MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 264 THAILAND KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 265 THAILAND GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 266 THAILAND IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 267 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 268 THAILAND MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 269 THAILAND MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 270 THAILAND ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 271 THAILAND OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 272 THAILAND CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 273 THAILAND TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 274 THAILAND METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 275 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 276 INDONESIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 277 INDONESIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 278 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 279 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 280 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 281 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 282 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 283 INDONESIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 284 INDONESIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 285 INDONESIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 286 INDONESIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 287 INDONESIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 288 INDONESIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 289 INDONESIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 290 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 291 INDONESIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 292 INDONESIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 293 INDONESIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 294 INDONESIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 295 INDONESIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 296 INDONESIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 297 INDONESIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 298 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 299 PHILLIPPINES LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 300 PHILLIPPINES OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 301 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 302 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 303 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 304 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 305 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 306 PHILLIPPINES HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 307 PHILLIPPINES MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 308 PHILLIPPINES INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 309 PHILLIPPINES MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 310 PHILLIPPINES KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 311 PHILLIPPINES GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 312 PHILLIPPINES IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 313 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 314 PHILLIPPINES MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 315 PHILLIPPINES MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 316 PHILLIPPINES ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 317 PHILLIPPINES OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 318 PHILLIPPINES CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 319 PHILLIPPINES TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 320 PHILLIPPINES METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 321 REST OF ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

Lista de Figura

FIGURE 1 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 10 RISE IN DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN VARIOUS INDUSTRIES IS EXPECTED TO DRIVE TH ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 LCD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET IN 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET

FIGURE 13 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY TECHNOLOGY, 2020

FIGURE 14 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY DISPLAY SIZE, 2020

FIGURE 15 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY RESOLUTION, 2020

FIGURE 16 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY MOUNTING, 2020

FIGURE 17 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY TOUCH SCREEN TYPE, 2020

FIGURE 18 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY APPLICATION, 2020

FIGURE 19 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY VERTICAL, 2020

FIGURE 20 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: SNAPSHOT (2020)

FIGURE 21 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020)

FIGURE 22 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2021 & 2028)

FIGURE 23 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020 & 2028)

FIGURE 24 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY TECHNOLOGY (2019-2028)

FIGURE 25 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY SHARE 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.