Asia Pacific Restaurant Pos Software Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

787.54 Million

USD

1,313.21 Million

2025

2033

USD

787.54 Million

USD

1,313.21 Million

2025

2033

| 2026 –2033 | |

| USD 787.54 Million | |

| USD 1,313.21 Million | |

|

|

|

|

Segmentação do mercado de software POS para restaurantes na Ásia-Pacífico, por componente (software, hardware e serviços), tipo (sistema POS para terminal, sistema POS para tablet, sistema POS móvel, sistema POS online, sistema POS para quiosque de autoatendimento e outros), sistema operacional (Android, macOS, DOS, Windows e Linux), uso (online e offline), aplicação (gestão de estoque, relatórios e análises, registro de ponto de funcionários, compatibilidade com tablets, impressão de recibos, criação de cardápios, integração de contas, processamento de cartões de débito/crédito e outros), porte da empresa (grandes empresas e PMEs), modo de implantação (nuvem e local), tipo de restaurante (restaurantes de serviço completo e restaurantes de serviço rápido) - Tendências e previsões do setor até 2033.

Tamanho do mercado de software POS para restaurantes na região Ásia-Pacífico

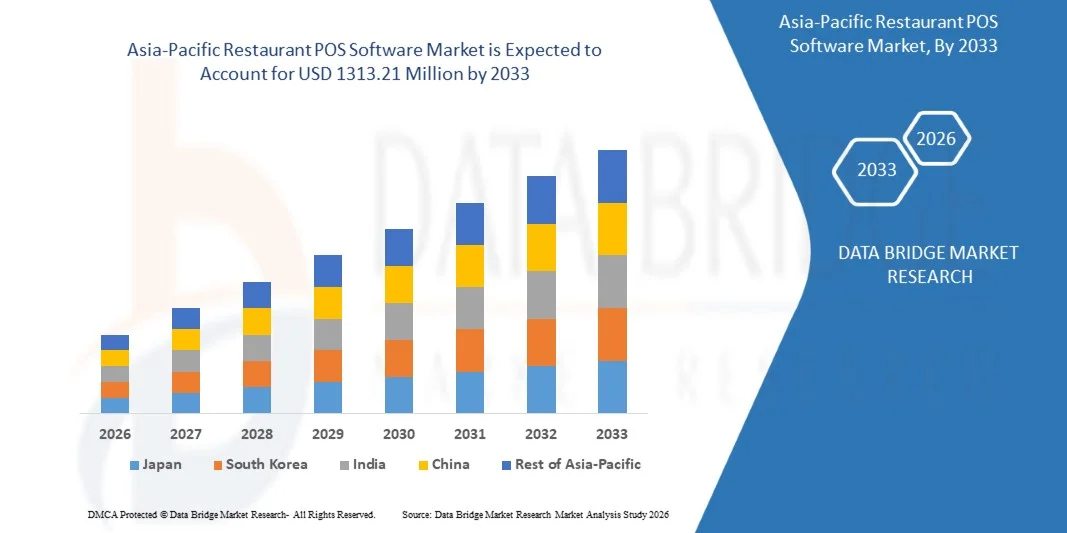

- O mercado de software POS para restaurantes na região Ásia-Pacífico foi avaliado em US$ 787,54 milhões em 2025 e deverá atingir US$ 1.313,21 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 6,60% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente adoção de soluções de pagamento digital, sistemas de PDV baseados em nuvem e integração com plataformas móveis de pedidos e entregas.

- A crescente demanda por gestão eficiente de restaurantes, melhoria da experiência do cliente e insights baseados em dados está impulsionando ainda mais a expansão do mercado.

Análise do mercado de software POS para restaurantes na região Ásia-Pacífico

- Os avanços tecnológicos contínuos, como análises baseadas em IA, pagamentos sem contato e aplicativos de PDV móvel, estão moldando as tendências de desenvolvimento e adoção de produtos.

- A crescente preferência do consumidor por um serviço mais rápido, opções de pagamento descomplicadas e experiências gastronômicas personalizadas está incentivando os restaurantes a atualizarem seus sistemas de PDV (Ponto de Venda) e a adotarem recursos avançados.

- A China dominou o mercado de software POS para restaurantes, com a maior participação na receita em 2025, impulsionada pela rápida adoção de sistemas POS baseados em nuvem, análises assistidas por IA e plataformas de pedidos móveis.

- Prevê-se que o Japão registre a maior taxa de crescimento anual composta (CAGR) no mercado de software POS para restaurantes na região Ásia-Pacífico, devido ao aumento dos investimentos em tecnologias para restaurantes inteligentes, à alta penetração de smartphones e ao crescente foco em análises baseadas em IA e soluções de pagamento sem contato, tanto em áreas urbanas quanto semiurbanas.

- O segmento de software detinha a maior participação na receita de mercado em 2025, impulsionado pela crescente adoção de aplicativos de PDV (Ponto de Venda) baseados em nuvem e ferramentas avançadas de análise. As soluções de software oferecem gerenciamento centralizado, relatórios em tempo real e integração perfeita com gateways de pagamento, aprimorando a eficiência operacional para os operadores de restaurantes.

Escopo do relatório e segmentação do mercado de software POS para restaurantes na região Ásia-Pacífico

|

Atributos |

Principais insights do mercado de software POS para restaurantes na região Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de informações de mercado como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado elaborado pela equipe da Data Bridge Market Research inclui análises aprofundadas de especialistas, análises de importação/exportação, análises de preços, análises de produção e consumo e análises PESTEL. |

Tendências do mercado de software POS para restaurantes na região Ásia-Pacífico

“A ascensão das soluções de PDV baseadas em nuvem e impulsionadas por IA”

A crescente adoção de softwares de PDV (Ponto de Venda) em nuvem para restaurantes está transformando o cenário tecnológico do setor alimentício, possibilitando o gerenciamento de pedidos em tempo real, o controle de estoque e a análise de dados. Esses sistemas permitem a tomada de decisões operacionais imediatas, principalmente em restaurantes com várias unidades, melhorando a eficiência e reduzindo erros. Além disso, oferecem relatórios e insights centralizados, auxiliando os operadores a identificar tendências, otimizar a equipe e realizar ajustes no cardápio com base em dados.

A crescente demanda por recursos baseados em IA, como análises preditivas de vendas, sugestões dinâmicas de cardápio e promoções personalizadas, está acelerando a adoção de plataformas de PDV inteligentes. Essas ferramentas ajudam a otimizar a receita, reduzir o desperdício de alimentos e aprimorar a experiência geral do cliente. A integração da IA também possibilita vendas adicionais automatizadas, previsão de demanda e personalização de programas de fidelidade, aumentando a lucratividade operacional.

• A acessibilidade, a facilidade de implementação e a escalabilidade das soluções modernas de PDV (Ponto de Venda) as tornam atraentes para restaurantes de pequeno e médio porte. Os operadores se beneficiam da gestão centralizada sem altos custos iniciais de infraestrutura, o que impulsiona a transformação digital no setor. Além disso, os modelos de preços baseados em assinatura reduzem o risco financeiro e permitem a rápida adoção da tecnologia em diversas unidades.

Por exemplo, diversas redes de restaurantes que implementaram plataformas de PDV (Ponto de Venda) baseadas em nuvem relataram maior rotatividade de mesas, operações de cozinha mais eficientes e maior satisfação do cliente devido ao serviço mais rápido e à tomada de decisões baseada em dados. Opções aprimoradas de pedidos via celular e pagamentos sem contato também contribuíram para a eficiência operacional e o aumento das vendas nos horários de pico.

Embora as soluções de PDV baseadas em nuvem e habilitadas por IA estejam impulsionando a eficiência operacional, seu impacto depende da inovação contínua, da segurança cibernética, do treinamento do usuário e da integração perfeita com gateways de pagamento e aplicativos de terceiros. Espera-se que melhorias futuras, como a integração de dispositivos IoT e painéis de análise avançados, otimizem ainda mais os fluxos de trabalho em restaurantes.

Dinâmica do mercado de software POS para restaurantes na região Ásia-Pacífico

Motorista

“Crescente digitalização no setor de serviços de alimentação e foco na eficiência operacional”

A expansão das ferramentas digitais em restaurantes está impulsionando os operadores a adotarem sistemas de PDV (Ponto de Venda) avançados para processamento automatizado de pedidos, gestão de estoque e soluções de pagamento integradas. Essa tendência está aumentando significativamente a adoção no mercado. A melhoria na visibilidade dos dados também auxilia na tomada de decisões mais assertivas para promoções, dimensionamento de equipe e otimização do cardápio.

Os consumidores esperam cada vez mais um serviço mais rápido, ofertas personalizadas e experiências de pagamento perfeitas, impulsionando a demanda por soluções de PDV (Ponto de Venda) com recursos avançados de análise e gestão de relacionamento com o cliente (CRM). Os sistemas de PDV equipados com funcionalidades de CRM permitem que os restaurantes acompanhem as preferências dos clientes, aumentem as visitas recorrentes e aprimorem a eficácia dos programas de fidelidade.

• Os crescentes investimentos em computação em nuvem, pedidos via dispositivos móveis e sistemas preditivos baseados em IA estão impulsionando a implementação de plataformas de PDV (Ponto de Venda) de alto desempenho que otimizam as operações de restaurantes e reduzem custos. Esses investimentos também facilitam soluções escaláveis para redes com múltiplas unidades, permitindo padrões operacionais e relatórios consistentes.

A crescente concorrência entre os operadores de serviços de alimentação incentiva a adoção de sistemas de PDV (Ponto de Venda) para melhorar a eficiência, reduzir erros humanos e aumentar a fidelização de clientes por meio de insights baseados em dados. Restaurantes que adotam tecnologias inovadoras de PDV obtêm vantagem competitiva por meio de um serviço mais rápido, promoções personalizadas e maior satisfação geral dos clientes.

• Por exemplo, uma rede de restaurantes de serviço rápido melhorou a rotatividade de mesas e as taxas de vendas adicionais após integrar soluções de PDV (Ponto de Venda) com inteligência artificial. O sistema forneceu análises de vendas em tempo real, recomendações automatizadas de cardápio com base nas preferências do cliente e alertas preditivos de estoque. Isso levou à redução do desperdício de alimentos, à otimização da alocação de funcionários e ao aumento da satisfação do cliente. Além disso, a gerência relatou maior receita por mesa e tempos de serviço mais rápidos, demonstrando os benefícios operacionais e financeiros tangíveis da adoção de PDV com inteligência artificial.

Embora a adoção de tecnologia esteja impulsionando o crescimento do mercado, manter a confiabilidade do software, a segurança do sistema e a facilidade de uso continua sendo fundamental para a expansão sustentável. Garantir a integração perfeita com plataformas de terceiros, processadores de pagamento e sistemas de pedidos online é essencial para maximizar o valor das soluções de PDV (Ponto de Venda).

Restrição/Desafio

“Altos custos de software e complexidades de integração”

O alto preço de softwares de PDV avançados, especialmente com recursos de IA e nuvem, limita a adoção por restaurantes menores e operadores independentes. As taxas de assinatura e os custos contínuos de manutenção podem ser proibitivos. Além disso, os custos com hardware, dispositivos móveis e equipamentos periféricos aumentam o investimento total.

• Os desafios de integração com os sistemas de gestão de restaurantes, gateways de pagamento e aplicativos de terceiros existentes podem atrasar a implementação e aumentar a complexidade operacional. Os sistemas legados geralmente exigem personalização e migração de dados, o que prolonga os prazos de implementação e aumenta os custos.

• Atualizações frequentes, riscos de cibersegurança e a necessidade de treinamento da equipe complicam ainda mais a adoção, principalmente em estabelecimentos com conhecimento técnico limitado. Sem o treinamento adequado, a equipe pode enfrentar ineficiências operacionais, impactando a qualidade do serviço e a experiência do cliente.

• A conectividade limitada à internet em certas áreas pode afetar a funcionalidade de sistemas baseados em nuvem, reduzindo a confiabilidade e a confiança do usuário. Interrupções na rede podem afetar o processamento de pedidos, atualizações de estoque e transações de pagamento, destacando a necessidade de soluções híbridas ou que funcionem offline.

• Por exemplo, várias pequenas cadeias de restaurantes enfrentaram atrasos e custos mais elevados ao integrar software de PDV com inteligência artificial a sistemas legados de estoque e pagamento, o que destaca a necessidade de soluções robustas, fáceis de usar e escaláveis.

Embora as tecnologias de PDV (Ponto de Venda) continuem a evoluir, abordar a acessibilidade, a facilidade de integração e a robustez do sistema é crucial para desbloquear todo o potencial de crescimento do mercado global de software de PDV para restaurantes. As empresas que investem em plataformas seguras, fáceis de usar e escaláveis estão em melhor posição para aproveitar as oportunidades de mercado em expansão.

Escopo do mercado de software POS para restaurantes na região Ásia-Pacífico

O mercado é segmentado com base em componente, tipo, sistema operacional, uso, aplicação, porte da empresa, modo de implantação e tipo de restaurante.

• Por componente

Com base nos componentes, o mercado de software POS para restaurantes na região Ásia-Pacífico é segmentado em software, hardware e serviços. O segmento de software detinha a maior participação na receita de mercado em 2025, impulsionado pela crescente adoção de aplicativos POS baseados em nuvem e ferramentas avançadas de análise. As soluções de software oferecem gerenciamento centralizado, relatórios em tempo real e integração perfeita com gateways de pagamento, aumentando a eficiência operacional para os operadores de restaurantes.

O segmento de hardware deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela demanda por terminais modernos, tablets e totens de autoatendimento. Inovações em hardware, como interfaces touchscreen, tablets duráveis e dispositivos POS móveis, melhoram a usabilidade, reduzem o tempo de transação e suportam o gerenciamento de múltiplas unidades, tornando-se essenciais tanto para restaurantes de serviço completo quanto para restaurantes de serviço rápido.

• Por tipo

Com base no tipo, o mercado de software POS para restaurantes na região Ásia-Pacífico é segmentado em sistemas POS para terminais, sistemas POS para tablets, sistemas POS móveis, sistemas POS online, sistemas POS para quiosques de autoatendimento e outros. O segmento de sistemas POS para terminais detinha a maior participação na receita de mercado em 2025, impulsionado por sua confiabilidade, hardware robusto e compatibilidade com diversas operações de restaurantes. Os sistemas para terminais oferecem processamento rápido, transações seguras e integração com periféricos, tornando-os adequados para estabelecimentos de alto volume.

O segmento de sistemas POS baseados em tablets deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente adoção em restaurantes de pequeno e médio porte. Os sistemas em tablets oferecem portabilidade, interfaces de toque intuitivas e fácil conectividade com a nuvem, permitindo a mobilidade da equipe, um serviço mais ágil e uma gestão simplificada de múltiplas unidades.

• Por sistema operacional

Com base no sistema operacional, o mercado de software POS para restaurantes na região Ásia-Pacífico é segmentado em Android, macOS, DOS, Windows e Linux. O segmento Android detinha a maior participação em 2025, impulsionado por sua acessibilidade, flexibilidade e compatibilidade com soluções POS móveis e baseadas em tablets. Os sistemas Android oferecem fácil integração de aplicativos, atualizações frequentes e interfaces amigáveis, proporcionando suporte a operações eficientes em restaurantes.

Prevê-se que o segmento de sistemas Windows apresente o crescimento mais rápido entre 2026 e 2033, devido à sua confiabilidade, ampla compatibilidade de software e adoção generalizada em implantações de PDV (Ponto de Venda) de nível empresarial. Os sistemas baseados em Windows oferecem suporte a análises avançadas, geração de relatórios e conectividade com periféricos, aprimorando o controle operacional e a escalabilidade.

• Por uso

Com base no uso, o mercado de software POS para restaurantes na região Ásia-Pacífico é segmentado em online e offline. O segmento online detinha a maior participação em 2025, impulsionado pela crescente demanda por soluções baseadas em nuvem, processamento de pedidos em tempo real e gerenciamento remoto. Os sistemas POS online permitem a sincronização de dados entre várias localidades, a integração com plataformas de e-commerce e o acesso a análises preditivas.

Espera-se que o segmento offline apresente um crescimento significativo de 2026 a 2033, principalmente em regiões com conectividade intermitente à internet. Os sistemas de PDV offline proporcionam operações ininterruptas durante quedas de rede, garantindo a precisão dos pedidos e a continuidade dos negócios.

• Mediante inscrição

Com base na aplicação, o mercado de software POS para restaurantes na região Ásia-Pacífico é segmentado em gestão de estoque, relatórios e análises, controle de ponto de funcionários, compatibilidade com tablets, impressão de recibos, criação de cardápios, integração de contas, processamento de cartões de débito/crédito e outros. O segmento de relatórios e análises detinha a maior participação em 2025, impulsionado pela crescente necessidade de tomada de decisões baseada em dados e otimização operacional.

O segmento de gestão de estoque deverá apresentar o crescimento mais rápido entre 2026 e 2033, à medida que os restaurantes buscam minimizar o desperdício, monitorar os níveis de estoque e otimizar as operações da cadeia de suprimentos. Outras aplicações, como a criação de cardápios e o processamento de cartões de débito/crédito, também contribuem para aprimorar a experiência do cliente e simplificar as operações.

• Por porte da empresa

Com base no porte da empresa, o mercado de software de PDV (Ponto de Venda) para restaurantes na região Ásia-Pacífico é segmentado em grandes empresas e PMEs (Pequenas e Médias Empresas). O segmento de grandes empresas detinha a maior participação na receita em 2025, impulsionado por operações em múltiplas localidades e pela necessidade de soluções de PDV integradas que suportem análises avançadas, relatórios e gerenciamento centralizado.

Espera-se que o segmento de PMEs apresente a taxa de crescimento mais rápida de 2026 a 2033, impulsionado pela acessibilidade e escalabilidade dos modernos sistemas de PDV (Ponto de Venda) baseados em nuvem. As PMEs se beneficiam de modelos de preços flexíveis, facilidade de implementação e acesso a ferramentas com inteligência artificial para eficiência operacional e engajamento do cliente.

• Por Modo de Implantação

Com base no modo de implantação, o mercado de software POS para restaurantes na região Ásia-Pacífico é segmentado em nuvem e local (on-premise). O segmento de nuvem detinha a maior participação em 2025, impulsionado pela crescente adoção de soluções POS baseadas em SaaS, que oferecem acesso em tempo real, gerenciamento remoto e atualizações automáticas.

O segmento de sistemas de PDV instalados localmente deverá apresentar um crescimento significativo entre 2026 e 2033, principalmente entre restaurantes que priorizam a segurança de dados, operações offline e soluções personalizadas. Os sistemas de PDV instalados localmente permitem controle total sobre software, hardware e gerenciamento de dados, proporcionando confiabilidade e conformidade com as políticas internas.

• Por tipo de restaurante

Com base no tipo de restaurante, o mercado de software POS para restaurantes na região Ásia-Pacífico é segmentado em restaurantes de serviço completo (FSR) e restaurantes de serviço rápido (QSR). O segmento de restaurantes de serviço rápido detinha a maior participação em 2025, impulsionado pela necessidade de processamento rápido de pedidos, alto volume de atendimento e sistemas de pagamento integrados para maior conveniência do cliente.

O segmento de restaurantes de serviço completo deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela adoção de soluções avançadas de PDV (Ponto de Venda) para gestão de mesas, personalização da experiência do cliente e relatórios aprimorados. Os estabelecimentos de serviço completo utilizam plataformas de PDV para melhorar a qualidade do serviço, otimizar a alocação de pessoal e aprimorar a experiência gastronômica como um todo.

Análise Regional do Mercado de Software POS para Restaurantes na Ásia-Pacífico

• A China dominou o mercado de software POS para restaurantes, com a maior participação na receita em 2025, impulsionada pela rápida adoção de sistemas POS baseados em nuvem, análises assistidas por IA e plataformas de pedidos móveis.

• Os operadores de restaurantes no país valorizam muito o gerenciamento de pedidos em tempo real, o rastreamento de estoque e o engajamento personalizado com o cliente, o que aumenta a eficiência operacional e a lucratividade.

Essa ampla adoção é ainda mais impulsionada por iniciativas governamentais que promovem a digitalização no setor de alimentação, pelo número crescente de restaurantes de serviço completo e de serviço rápido e pelos investimentos cada vez maiores em soluções escaláveis e baseadas em dados.

Análise do mercado de software POS para restaurantes no Japão

O mercado de software POS para restaurantes no Japão deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela alta adoção de tecnologia, urbanização e crescente demanda por uma experiência aprimorada para o cliente. Os restaurantes estão integrando sistemas POS com dispositivos habilitados para IoT, soluções de pedidos móveis e análises baseadas em IA para previsão de vendas e otimização de cardápios. A crescente ênfase em pagamentos digitais, eficiência operacional e serviços personalizados está acelerando a adoção do mercado.

Participação de mercado de software POS para restaurantes na região Ásia-Pacífico

O setor de software POS para restaurantes na região Ásia-Pacífico é liderado principalmente por empresas consolidadas, incluindo:

- POSist Technologies Pvt. Ltd. (Índia)

- Fujitsu Ltda. (Japão)

- Corporação EPSON (Japão)

- Moka POS (Indonésia)

- iCHEF (Taiwan)

- Kounta (Austrália)

- HioPOS (Coreia do Sul)

- Olsera POS (Indonésia)

- Loyverse POS (Japão)

- SmartTouch POS (Índia)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.