Asia Pacific Photoacoustic Imaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

8.59 Million

USD

26.83 Million

2025

2033

USD

8.59 Million

USD

26.83 Million

2025

2033

| 2026 –2033 | |

| USD 8.59 Million | |

| USD 26.83 Million | |

|

|

|

|

Asia-Pacific Photoacoustic Imaging Market, By Component (Hardware (Component & Substance Medium), Software and Services), Type (Photoacoustic Imaging System, Photoacoustic Computed Tomography System), Application (Preclinical, Clinical), Modality (Portable, Standalone, Handheld), Platform (Pulsed Laser Diode, LED-Based, Xenon Flash, Others), Dimension (2D, 3D), Diagnostic Application (Oncology, Hematology, Dermatology, Cardiology, Neurology, Others), End User (Ambulatory Surgical Centers, Research Laboratories, Hospitals and Clinics, Diagnostic Imaging Centers, Pharmaceutical and Biotechnology Companies, Others), Distribution Channel (Direct Tender, Retail Sales, Online Sales, Others), Country (Japan, China, South Korea, India, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific) Industry Trends and Forecast To 2028

Market Analysis and Insights: Asia-Pacific Photoacoustic Imaging Market

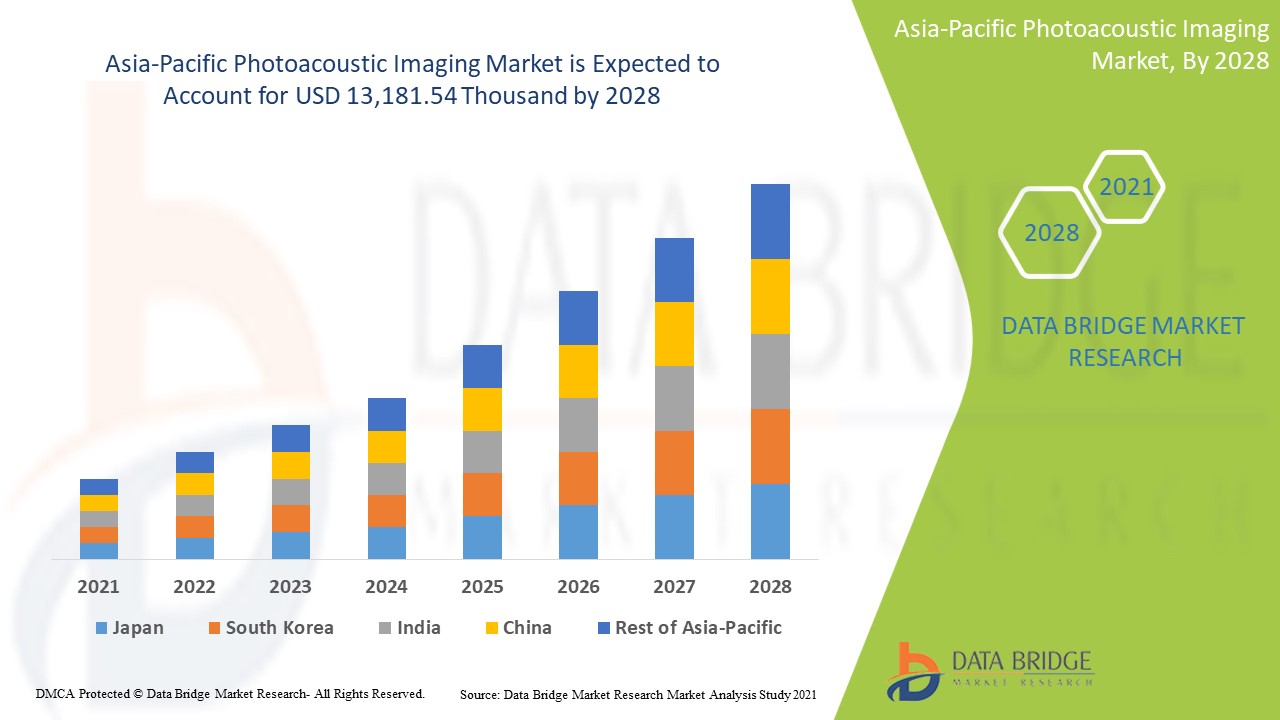

Asia-Pacific photoacoustic imaging market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 15.3% in the forecast period of 2021 to 2028 and is expected to reach USD 13,181.54 thousand by 2028. Rise in incidences of cancer, growing geriatric population around the world acts as driver for the photoacoustic imaging market growth.

Photoacoustic imaging can be defined as a hybrid imaging technique with a high potential in clinical biomedical application areas and multi-scale preclinical matters. It is considered one of the rapidly developing biomedical imaging modalities of the decade, providing sustainable imaging resolution and depth, along with optical spectroscopic contrast, thereby making it an ideal solution for real-time functional, structural, and molecular imaging of tissue.

Rise in cases of infection and fungal diseases is expected to boost the market in the forecast period. On the other hand, the high cost of PACT system is anticipated to hamper the growth of the market. A new application of photoacoustic imaging for high potential of theranostic usage is anticipated to create larger development opportunities in the market. This would tend to keep the future of the market strong and advanced.

The photoacoustic imaging market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the photoacoustic imaging market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Asia-Pacific Photoacoustic Imaging Market Scope and Market Size

The photoacoustic imaging market is segmented on the based on the component, type, platform, dimension, modality, diagnostic application, application, end user and distribution channel. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of component, the photoacoustic imaging market is segmented into hardware (component & substance medium), software and services. In 2021, the hardware segment is expected to dominate the market due to its wide range of application in healthcare industry.

- On the basis of type, the photoacoustic imaging market is segmented into photoacoustic imaging system and photoacoustic computed tomography system. In 2021, the photoacoustic imaging system segment is expected to dominate the market because of rich optical contrast, and high spatial ultrasonic resolution in a single modality which is fostering its demand in medical field.

- On the basis of platform, the photoacoustic imaging market is segmented into LED-based, xenon flash, pulsed laser diode and others. In 2021, pulse laser diode segment is expected to dominate the market as it is handheld, light-weight and cost-efficient which is widely used in preclinical and clinical applications.

- On the basis of dimension, the photoacoustic imaging market is segmented into 2D and 3D. In 2021, 2D segment is expected to dominate the market as it assist in diagnosing various diseases with ease and have wider applications in the characteristics of the images.

- On the basis of modality, the photoacoustic imaging market is segmented standalone, portable and handheld. In 2021, the portable segment is expected to dominate the market due to pandemic situation it is high in demand in the healthcare industry.

- On the basis of application, the photoacoustic imaging market is segmented into clinical and preclinical. In 2021, preclinical segment is expected to dominate the market due to its increased efficiency for detailed diagnostic information in the healthcare sector.

- On the basis of diagnostic application, the photoacoustic imaging market is segmented into oncology, dermatology, cardiology, neurology, hematology and others. In 2021, the oncology segment is expected to dominate the market due to its wide imaging applications in breast cancer, thyroid cancer and brain cancer as photoacoustic imaging instruments helps in detecting the cancer tumor easily without any surgical procedures also, the image produced will be very detailed with high resolution to find the thickness of the tumor.

- On the basis of end user, the photoacoustic imaging market is segmented into hospitals and clinics, diagnostic imaging centers, ambulatory surgical centers, research laboratories, pharmaceutical and biotechnology companies and others. In 2021, the diagnostic imaging centers segment is expected to dominate the market due to the increased requirement of pharmaceutics due to the prevailing COVID-19 pandemic situation.

- On the basis of distribution channel, the photoacoustic imaging market is segmented into direct tender, retail sales, online sales and others. In 2021, the direct tender market is expected to dominate the market due to rise in fungal infection post-COVID and prevailing pandemic situation.

Asia-Pacific Photoacoustic Imaging Market Country Level Analysis

The photoacoustic imaging market is analyzed and market size information is provided by the country, component, type, platform, dimension, modality, diagnostic application, application, end user and distribution channel as referenced above.

The countries covered in the photoacoustic imaging market report are Japan, China, South Korea, India, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and Rest of Asia-Pacific

China is expected to dominate the market due to continuous research and major manufacturer acting as a key player in the industry.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Growing Strategic Activities by Major Market Players to Enhance the Awareness for Photoacoustic Imaging is Boosting the Market Growth of Asia-Pacific Photoacoustic Imaging Market.

The Asia-Pacific photoacoustic imaging market also provides you with detailed market analysis for every country growth in particular market. Additionally, it provides the detail information regarding the market players’ strategy and their geographical presence. The data is available for historic period 2010 to 2019.

Competitive Landscape and Asia-Pacific Photoacoustic Imaging Market Share Analysis

Photoacoustic imaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to photoacoustic imaging market.

The major companies which are dealing in the Asia-Pacific photoacoustic imaging are PreXion, PST Inc., Litron Lasers, FUJIFILM Visualsonics, Inc., kibero, InnoLas Laser GmbH, BK Medical Holding Company, Inc., EKSPLA, Aspectus GmbH, ADVANTEST CORPORATION, and Vibronix, Inc. among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many contract and agreement are also initiated by the companies’ worldwide which are also accelerating the photoacoustic imaging market.

For instance,

- In May 2021, PreXion had announced the launching of the PreXion 3D Explorer PRO, its newest model in the market. This version of the equipment includes a first-of-its-kind integrated cephalometric. X-ray arm, in addition to flawless 3D imaging quality. This new feature in the model will allow dental and specialty practices to save some office space, while equipping them to capture cephalometric X-rays with conversion from CT or in only 30 seconds. With this product, the company can offer unrivaled customer support and dedication to continuing education opportunities by partnerships among fellow industry leaders such as Catapult Education and 3D Diagnostics (3DDX) and thereby, expanding their product range in the market.

- In November 2020, FUJIFILM Visualsonics, Inc. has celebrated the first installation of the Vevo F2 Equipped with Vevo Advanced Data Acquisition (VADA), the Vevo F2 allows access to pre-beam formed individual channel data via an all new, easy-to-use, graphical user interface. With full control over transmit profiles, researchers have the power and freedom to develop and explore new imaging methods in a quick, iterative fashion—going beyond existing imaging modes.

Collaboration, product launch, business expansion, award and recognition, joint ventures and other strategies by the market player is enhancing the company footprints in the Photoacoustic Imaging market which also provides the benefit for organization’s profit growth.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.