Asia Pacific Oil Field Specialty Chemicals Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.01 Billion

USD

1.53 Billion

2025

2033

USD

1.01 Billion

USD

1.53 Billion

2025

2033

| 2026 –2033 | |

| USD 1.01 Billion | |

| USD 1.53 Billion | |

|

|

|

|

Mercado de produtos químicos especiais para campos petrolíferos da Ásia-Pacífico, por tipo (surfactantes, demulsificantes, inibidores, biocidas, aditivos, ácidos, deformadores, polímeros , redutores de atrito, emulsionantes, agentes de controlo de ferro, dispersantes, viscosificantes, agentes humectantes , retardadores e outros), localização (Onshore e Offshore ), Aplicação (Perfuração, Estimulação, Produção, Recuperação Avançada de Petróleo (EOR), Cimentação, Workover e Conclusão e Outros), País (Japão, China, Índia, Coreia do Sul, Austrália e Nova Zelândia, Singapura, Malásia, Tendências e previsões do setor (Tailândia, Indonésia, Filipinas e resto da Ásia-Pacífico) até 2028.

Análise de Mercado e Insights: Mercado de Produtos Químicos Especiais para Campos Petrolíferos da Ásia-Pacífico

Análise de Mercado e Insights: Mercado de Produtos Químicos Especiais para Campos Petrolíferos da Ásia-Pacífico

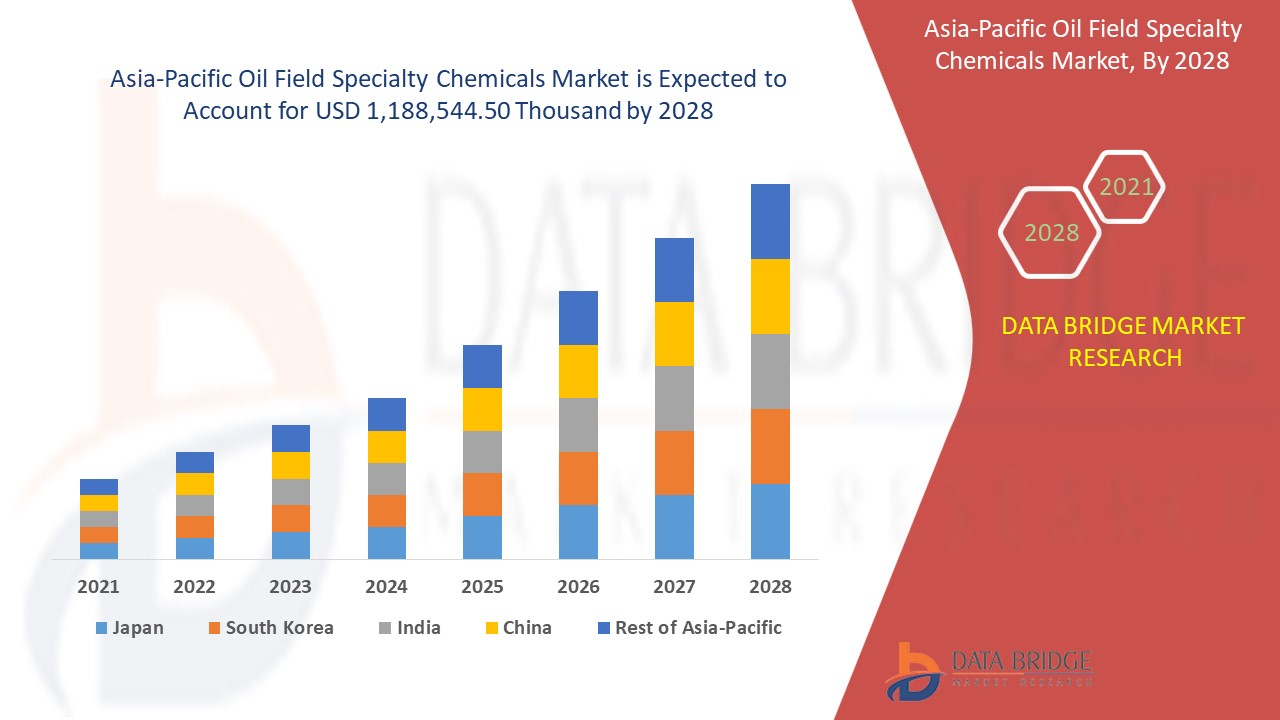

Espera-se que o mercado de produtos químicos especiais para campos petrolíferos da Ásia-Pacífico ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer a um CAGR de 5,3% no período previsto de 2021 a 2028 e prevê-se que atinja os 1.188.544,50 mil dólares até 2028.

Os produtos químicos especiais para campos petrolíferos são aqueles que são comummente utilizados na recuperação de petróleo de forma eficiente dos recursos, sem impacto no ambiente e nos equipamentos. Os produtos químicos especiais para campos petrolíferos têm diversas funções positivas, como a melhor recuperação de petróleo, a otimização da perfuração, a proteção contra a corrosão, a prevenção da perda de lama em diferentes formações geológicas e a estabilização de fluidos de perfuração em ambientes de alta pressão e alta temperatura, entre outros.

Na extração de petróleo bruto, são utilizadas máquinas enormes para diferentes processos. Os inibidores de corrosão são produtos químicos que ajudam a prevenir a corrosão dos oleodutos utilizados para transportar petróleo no campo petrolífero. Os elementos de oxigénio no campo petrolífero causam principalmente corrosão na superfície, uma vez que a água contém partículas de oxigénio, o que torna necessário o uso de inibidores de corrosão na fábrica.

Os produtos químicos especiais absorvem as partículas de oxigénio nas emulsões de água e óleo . A corrosão dos oleodutos no campo petrolífero levará a perdas e a maiores custos de manutenção. A corrosão num oleoduto de um campo petrolífero pode ser causada pelo ataque de oxigénio, dióxido de carbono ou sulfureto de hidrogénio. Vários tipos de equipamentos são altamente propensos a partículas de oxigénio, que só podem ser protegidas por produtos químicos especiais para campos petrolíferos.

Este relatório de mercado de produtos químicos especiais para campos petrolíferos fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado nacional e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, produtos lançamentos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um Briefing de Analista.

Âmbito e dimensão do mercado de produtos químicos especiais para campos petrolíferos da Ásia-Pacífico

Âmbito e dimensão do mercado de produtos químicos especiais para campos petrolíferos da Ásia-Pacífico

O mercado de produtos químicos especiais para campos petrolíferos está segmentado e categorizado por tipo, localização e aplicação. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo, o mercado de produtos químicos especiais para campos petrolíferos está segmentado em tensioativos, desemulsificantes, inibidores, biocidas, aditivos, ácidos, deformadores, polímeros, redutores de atrito, emulsionantes, agentes de controlo de ferro, dispersantes, viscosificantes, agentes humectantes, retardadores e outros. Em 2021, a procura pelo segmento dos tensioativos será maior na China e na Índia devido à crescente procura de produtos petrolíferos para o funcionamento de produtos automóveis.

- Com base na localização, o mercado de produtos químicos especiais para campos petrolíferos está segmentado em onshore e offshore. Em 2021, espera-se que o segmento de localização onshore domine, uma vez que foram empregues grandes sistemas de tubagem na fábrica, o que aumenta a procura de produtos químicos especiais para os campos petrolíferos da região.

- Com base na aplicação, o mercado de produtos químicos especiais para campos petrolíferos está segmentado em perfuração, estimulação, produção, recuperação avançada de petróleo (EOR), cimentação, workover e completação, entre outros. Em 2021, prevê-se que o segmento da perfuração domine o mercado, uma vez que a perfuração é mais utilizada para a extração de petróleo bruto, o que faz com que a aplicação da perfuração domine na região.

Análise ao nível do país do mercado de produtos químicos especiais para campos petrolíferos da Ásia-Pacífico

O mercado de produtos químicos especiais para campos petrolíferos está segmentado e categorizado por tipo, localização e aplicação.

Os países abrangidos pelo relatório de mercado de produtos químicos especiais para campos petrolíferos da Ásia-Pacífico são o Japão, a China, a Coreia do Sul, a Índia, a Austrália e a Nova Zelândia, Singapura, a Tailândia, a Indonésia, a Malásia, as Filipinas e o resto da Ásia-Pacífico .

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas da Ásia-Pacífico e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

Aumento da extração de petróleo bruto de reservas novas e não convencionais

Técnicas avançadas de extração, como a mineração e a perfuração de areia betuminosa, estão a ser utilizadas para recuperar petróleo mais pesado que não flui independentemente. As reservas não convencionais de petróleo leve e compacto (LTO) encontram-se bem abaixo da superfície terrestre, principalmente em formações rochosas de baixa permeabilidade, incluindo reservatórios de xisto, arenito e siltito. A extração de petróleo bruto de reservas não convencionais utiliza a perfuração horizontal e a fraturação hidráulica.

Análise do panorama competitivo e da quota de mercado de produtos químicos especiais para campos petrolíferos

O panorama competitivo do mercado de produtos químicos especiais para campos petrolíferos na Ásia-Pacífico fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na Ásia-Pacífico, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de ensaios clínicos, análise de marcas, aprovações de produtos, patentes, amplitude e abrangência do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de produtos químicos especiais para campos petrolíferos na Ásia-Pacífico.

Os principais participantes do mercado de produtos químicos especiais para campos petrolíferos da Ásia-Pacífico são a BASF SE, Solvay, DOW, Baker Hughes Company, Clariant, Evonik Industries, Kemira, Thermax Limited., Huntsman International LLC., Innospec, Stepan Company, Chevron Phillips Chemical Company LLC., Kraton Corporation., Jiaxing Midas Oilfield Chemical Mfg Co., Ltd, Versalis SpA, Halliburton., Albemarle Corporation e entre outras.

Por exemplo,

- Em março de 2019, a Chevron Phillips Chemical Company LLC decidiu aumentar a produção da unidade de 1-hexeno. A adição expandiria a produção normal de alfa olefinas (NAO). Este desenvolvimento ajudou a empresa a aumentar a receita

A colaboração, o lançamento de produtos, a expansão de negócios, prémios e reconhecimentos, joint ventures e outras estratégias dos participantes do mercado estão a aumentar o mercado da empresa no mercado de produtos químicos especiais para campos petrolíferos, o que também traz o benefício para a organização melhorar a sua oferta de produtos químicos especiais para campos petrolíferos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.