Asia Pacific Medical Imaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

23.60 Billion

USD

36.22 Billion

2024

2032

USD

23.60 Billion

USD

36.22 Billion

2024

2032

| 2025 –2032 | |

| USD 23.60 Billion | |

| USD 36.22 Billion | |

|

|

|

Segmentação do mercado de imagiologia médica da Ásia-Pacífico, por tipo (serviços e produtos), modalidade (estacionária e portátil), procedimento (tomografia computorizada (TC), imagem de raios X, imagem de ressonância magnética (RM), ecografia, imagiologia nuclear (SPECT /PET) e outros), tecnologia (radiologia digital direta e radiologia computorizada), idade do doente (adultos e pediátricos), aplicação (cardiologia, pélvica e abdominal, oncologia, mamografia, ginecologia, neurologia, urologia, musculoesquelética, dentária e outros). ), Utentes finais (hospitais, centros de diagnóstico, centros de imagiologia, clínicas especializadas, centros de cirurgia ambulatória, institutos académicos e de investigação e outros) – Tendências e previsões do setor até 2032

Análise de mercado de imagens médicas

A imagiologia médica refere-se às técnicas e processos utilizados para fazer imagens do corpo humano (ou partes dele) para uma variedade de aplicações clínicas, incluindo operações e diagnósticos médicos, bem como a ciência médica, que inclui o estudo da anatomia e função normais. É um subconjunto de imagens biológicas que inclui radiografia, endoscopia, termografia, fotografia médica e microscopia num sentido mais amplo. As técnicas de medição e registo, como a eletroencefalografia (EEG) e a magnetoencefalografia (MEG), são exemplos de imagens médicas, uma vez que criam dados que podem ser representados como mapas em vez de imagens.

Tamanho do mercado de imagens médicas

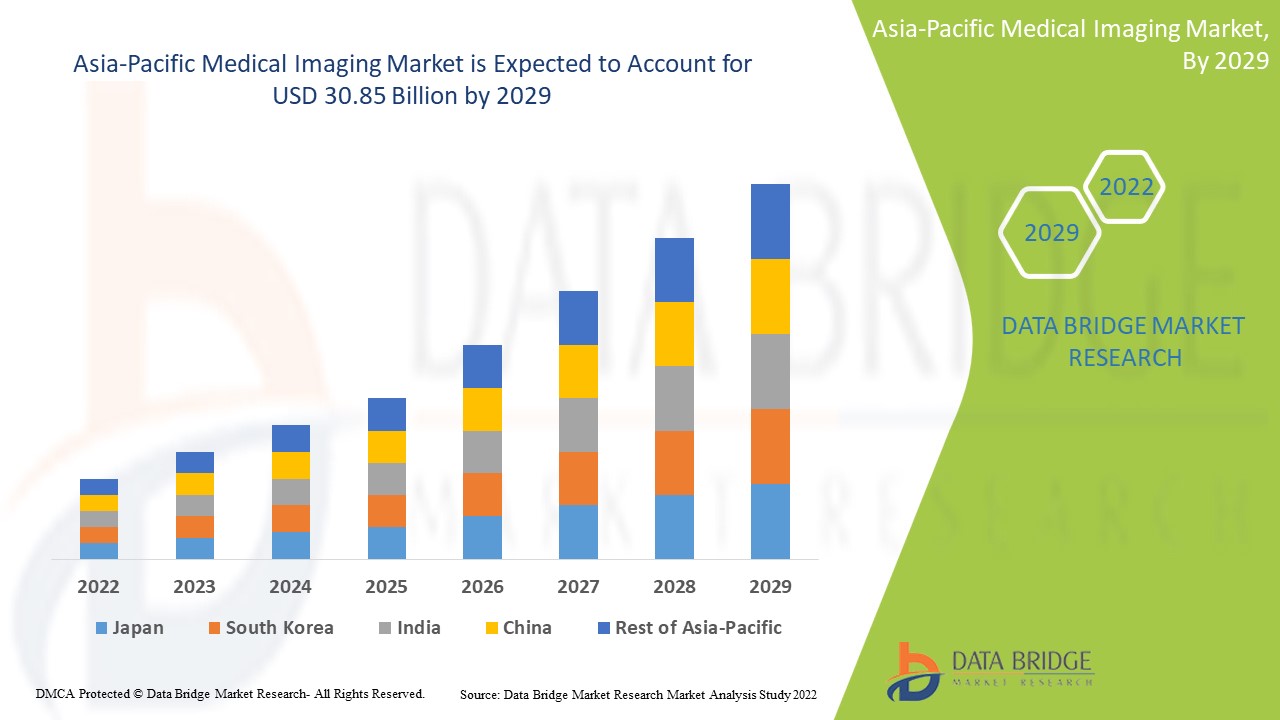

O tamanho do mercado de imagiologia médica da Ásia-Pacífico foi avaliado em 23,60 mil milhões de dólares em 2024 e está projetado para atingir 36,22 mil milhões de dólares até 2032, com um CAGR de 5,50% durante o período previsto de 2025 a 2032.

Âmbito do Relatório e Segmentação de Mercado

|

Atributos |

Principais insights do mercado de imagiologia médica |

|

Segmentação |

|

|

Países abrangidos |

China, Japão, Índia, Coreia do Sul, Singapura, Malásia, Austrália, Tailândia, Indonésia, Filipinas, Resto da Ásia-Pacífico (APAC) na Ásia-Pacífico (APAC) |

|

Principais participantes do mercado |

Koninklijke Philips NV (Holanda), RamSoft, Inc. (Canadá), InHealth Group (Reino Unido), Radiology Reports online (EUA), Siemens (Alemanha), Sonic Healthcare Limited (Austrália), RadNet, Inc. (EUA), General Electric (EUA), Akumin Inc. (EUA), Hologic Inc. (EUA), Shimadzu Corporation (Japão), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), CANON MEDICAL SYSTEMS CORPORATION (Japão), Carl Zeiss Ag (Alemanha), FUJIFILM Corporation (Japão), Hitachi, Ltd. (Japão), MEDNAX Services, Inc. (EUA), Carestream Health (EUA), Teleradiology Solutions (EUA), UNILABS (Suíça), ONRAD, Inc. ( EUA ) |

|

Oportunidades de Mercado |

|

Definição de mercado de imagens médicas

A imagiologia médica é uma técnica para gerar diversas imagens internas do corpo para diagnóstico e terapia de doenças. Esta técnica é muito importante para melhorar a saúde das pessoas em todo o mundo, pois pode ajudar na deteção precoce de certas doenças internas e no tratamento adequado destes distúrbios. É também possível verificar o que já foi diagnosticado e tratado.

Dinâmica do mercado de imagiologia médica

Motoristas

- Aumento da procura por modalidades inovadoras de imagem

O setor está a ser impulsionado pela integração de fatos cirúrgicos com tecnologia de imagem. No entanto, o número de novos hospitais nos países em desenvolvimento da Ásia-Pacífico aumentou drasticamente. A entrada de prestadores globais de serviços de saúde é a culpada por isso. Os participantes privados dominam o sector da saúde nestes países. As modalidades de imagiologia recebem geralmente espaço específico em novos hospitais. Nos próximos anos, a crescente concorrência e a procura por serviços de saúde de alto nível deverão impulsionar a expansão do segmento.

- Aumento de casos de doenças crónicas

O mercado de reagentes de imagem médica da Ásia-Pacífico é impulsionado por fatores como o cancro e as doenças cardiovasculares, desenvolvimentos técnicos, desenvolvimento de reagentes de imagem médica e elevadas exigências não satisfeitas de procedimentos de imagem médica e de diagnóstico. As perturbações cardiovasculares, por exemplo, são uma das principais causas de morte no mundo. Além disso, como os idosos são mais propensos a desenvolver doenças crónicas, prevê-se que o crescimento crescente da população geriátrica aumente a procura de reagentes para a imagiologia médica.

- Desenvolvimento na procura de reagentes de imagem médica

O número crescente de doentes oncológicos que necessitam de técnicas avançadas de diagnóstico por imagem, como imagens fotoacústicas e reagentes de imagem para um melhor diagnóstico, também contribui para a expansão do mercado. Além disso, o crescimento da população idosa, o aumento dos gastos com a saúde e a crescente procura de procedimentos eficazes e medicamentos seguros provavelmente impulsionarão o mercado dos reagentes de imagem médica.

Oportunidades

Espera-se que os avanços tecnológicos, quando combinados com investimentos e dinheiro do governo, contribuam para a expansão do mercado, particularmente em países em desenvolvimento como a Índia e a China. Em janeiro de 2020, a Allengers, por exemplo, revelou o primeiro tomógrafo computorizado de 32 cortes fabricado localmente na Índia. A Canon Medical Systems auxiliou na criação do sistema.

Prevê-se que o ensino, os hospitais e as universidades aumentem a sua necessidade de modalidades de imagem de última geração para fornecer formação em tecnologia avançada, o que terá um impacto substancial no crescimento do mercado nos próximos anos. Esta tendência, que antes se limitava aos países ricos, está a alastrar cada vez mais para os países em desenvolvimento. Por exemplo, o único equipamento certificado de ressonância magnética (RM) 7T, o MAGNETOM Terra da Siemens Healthineers, foi instalado apenas nos Estados Unidos.

Restrições/Desafios

No entanto, a expansão do mercado será provavelmente prejudicada pela escassez de pessoal médico experiente, elevados custos de equipamento, falta de fornecedores de reagentes de imagem e regulamentos governamentais rigorosos.

Este relatório de mercado de imagens médicas fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações no mercado regulamentações, análise estratégica de crescimento de mercado, tamanho de mercado, crescimento de mercado de categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado de imagiologia médica, contacte a Data Bridge Market Research para obter um briefing de analista.

Âmbito do mercado de imagens médicas

O mercado de imagiologia médica é segmentado com base no tipo, modalidade, procedimento, tecnologia, idade do paciente, aplicação e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Serviços

- Produto

Modalidade

- Estacionário

- Portátil

Procedimento

- Tomografia Computadorizada (TC)

- Imagem de Raio X

- Imagem por ressonância magnética (RM)

- Ecografia, Imagiologia Nuclear (SPECT/PET)

- Outros

Tecnologia

- Radiologia Digital Direta

- Radiologia Computadorizada

Idade do doente

- Adultos

- Pediátrico

Aplicação

- Cardiologia

- Pélvica e Abdominal

- Oncologia

- Mamografia

- Ginecologia

- Neurologia

- Urologia

- Músculo-esquelético

- Dental

- Outros

Utilizadores finais

- Hospitais

- Centros de Diagnóstico

- Centros de Imagiologia

- Clínicas especializadas

- Centros Cirúrgicos Ambulatoriais

- Institutos Académicos e de Investigação

- Outros

Análise regional do mercado de imagiologia médica

O mercado de imagiologia médica é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por país, tipo, modalidade, procedimento, tecnologia, idade do paciente, aplicação e utilizador final, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de imagiologia médica são a China, Japão, Índia, Coreia do Sul, Singapura, Malásia, Austrália, Tailândia, Indonésia, Filipinas e Resto da Ásia-Pacífico (APAC).

A Ásia-Pacífico está a crescer com a maior taxa de crescimento, devido ao número crescente de geriatria e ao aumento dos gastos com a saúde. Devido à infraestrutura de saúde avançada do país, o setor de imagiologia médica do Japão é dominante. Os serviços de imagiologia médica são muito procurados no Japão devido ao envelhecimento da população e às doenças crónicas do país.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Participação no mercado de imagens médicas

O panorama competitivo do mercado de imagiologia médica fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento do produto, amplitude e abrangência do produto, aplicação domínio. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas relacionadas com o mercado de imagiologia médica.

Os líderes de mercado de imagiologia médica que operam no mercado são:

- Koninklijke Philips NV (Holanda)

- RamSoft, Inc. (Canadá)

- InHealth Group (Reino Unido)

- Relatórios de Radiologia online (EUA)

- Siemens (Alemanha)

- Sonic Healthcare Limited (Austrália)

- RadNet, Inc. (EUA)

- General Electric (EUA)

- Akumin Inc. (EUA)

- Hologic Inc. (EUA)

- Shimadzu Corporation (Japão)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- CANON MEDICAL SYSTEMS CORPORATION (Japão)

- Carl Zeiss Ag (Alemanha)

- FUJIFILM Corporation (Japão)

- Hitachi, Ltd. (Japão)

- MEDNAX Services, Inc. (EUA),

- Carestream Health (EUA)

- Soluções de Telerradiologia (EUA)

- UNILABS (Suíça)

- ONRAD, Inc. (EUA)

Últimos desenvolvimentos no mercado de imagiologia médica

- Em março de 2021, o Vscan AirTM é um ultrassom de bolso sem fios de última geração da GE Healthcare que fornece aos médicos qualidade de imagem cristalina, capacidades de digitalização de corpo inteiro e software intuitivo

- Em janeiro de 2021, no Canadá, a Esaote North America lançou o sistema de ultrassons MyLab X8. O MyLab X8 é um sistema de imagem premium completo que integra as mais recentes tecnologias e oferece uma maior qualidade de imagem sem comprometer o fluxo de trabalho ou a eficiência. Foi previamente autorizado pela FDA nos EUA

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.