Asia Pacific Industrial Metrology Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.72 Billion

USD

4.60 Billion

2024

2032

USD

2.72 Billion

USD

4.60 Billion

2024

2032

| 2025 –2032 | |

| USD 2.72 Billion | |

| USD 4.60 Billion | |

|

|

|

|

Segmentação do mercado de metrologia industrial da Ásia-Pacífico, por oferta (hardware, software e serviços), equipamento (CMM, ODS, raio-X e tomografia computadorizada), aplicação (controle de qualidade e inspeção, engenharia reversa, mapeamento e modelagem e outros), usuário final (automotivo, manufatura, aeroespacial e defesa, semicondutores e outros) - Tendências e previsões do setor até 2032

Tamanho do mercado de metrologia industrial da Ásia-Pacífico

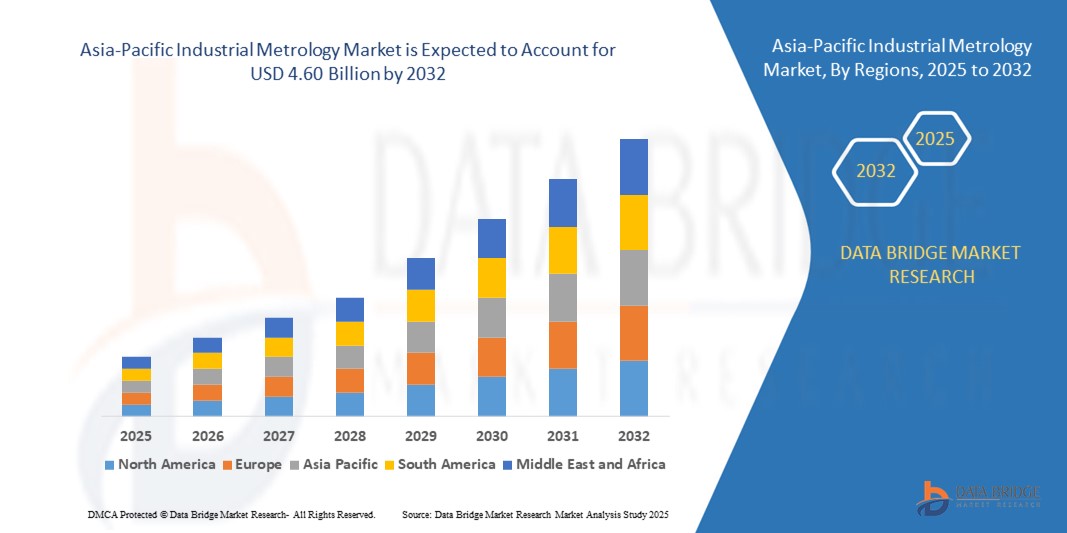

- O tamanho do mercado de metrologia industrial da Ásia-Pacífico foi avaliado em US$ 2,72 bilhões em 2024 e deve atingir US$ 4,60 bilhões até 2032 , com um CAGR de 6,8% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção de tecnologias de medição de precisão nas indústrias automotiva, aeroespacial, de semicondutores e de manufatura, impulsionado pela demanda por precisão, garantia de qualidade e conformidade com os padrões internacionais

- Além disso, a crescente integração de soluções avançadas, como digitalização 3D, sistemas multissensores e inspeção automatizada em linhas de produção está acelerando a eficiência, reduzindo defeitos e fortalecendo a competitividade, impulsionando significativamente o crescimento da indústria.

Análise de Mercado de Metrologia Industrial da Ásia-Pacífico

- Metrologia industrial refere-se à aplicação de tecnologias de medição de precisão, incluindo máquinas de medição por coordenadas (CMM), digitalizadores ópticos, scanners e sistemas multissensores, para garantir precisão dimensional, confiabilidade do produto e otimização de processos em todos os setores.

- A crescente demanda por metrologia industrial é alimentada principalmente pela ênfase crescente no controle de qualidade, pela crescente complexidade dos componentes fabricados e pela mudança em direção à manufatura digital e às iniciativas da Indústria 4.0, que exigem recursos avançados de inspeção e medição.

- A China dominou o mercado de metrologia industrial em 2024, devido à sua ampla base de fabricação, rápida industrialização e crescente adoção de sistemas de medição de precisão nos setores automotivo, aeroespacial e eletrônico.

- Espera-se que a Índia seja o país com crescimento mais rápido no mercado de metrologia industrial durante o período previsto devido ao rápido crescimento na fabricação automotiva, aeroespacial e de semicondutores.

- O segmento de hardware dominou o mercado, com uma participação de mercado de 59,5% em 2024, devido à ampla adoção de máquinas de medição por coordenadas, digitalizadores ópticos, scanners e outros instrumentos de precisão em todos os setores. O hardware é considerado a espinha dorsal da metrologia, pois permite medições precisas, essenciais para a garantia da qualidade e validação de produtos. Avanços contínuos na tecnologia de sensores, resolução aprimorada e dispositivos de metrologia portáteis impulsionaram ainda mais a demanda por hardware, especialmente nos setores automotivo e aeroespacial, onde a precisão da tolerância é crítica.

Escopo do Relatório e Segmentação do Mercado de Metrologia Industrial da Ásia-Pacífico

|

Atributos |

Principais insights de mercado da metrologia industrial da Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights de mercado, como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipe de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise pilão. |

Tendências do mercado de metrologia industrial da Ásia-Pacífico

Integração da Metrologia Industrial com a Indústria 4.0 e Manufatura Inteligente

- A integração da metrologia industrial com a Indústria 4.0 e a manufatura inteligente é uma tendência fundamental que impulsiona o avanço do mercado. Os fabricantes estão adotando sistemas avançados de metrologia como parte de iniciativas de transformação digital para garantir precisão, eficiência e automação em ambientes de produção.

- Por exemplo, a Hexagon AB desenvolveu soluções de metrologia inteligentes integradas a plataformas digitais, permitindo a coleta e análise de dados em tempo real para o controle de qualidade da fabricação. Da mesma forma, a ZEISS oferece sistemas de metrologia com conectividade avançada e recursos de integração de software que suportam fluxos de trabalho de inspeção automatizados em fábricas inteligentes.

- A transição para a Indústria 4.0 elevou a demanda por soluções de metrologia conectadas que alimentem dados de medição diretamente nos sistemas de manufatura, reduzindo erros e permitindo o controle de qualidade preditivo. Essa integração melhora a transparência dos processos, acelera a tomada de decisões e garante maior consistência na produção.

- Ferramentas de metrologia, como máquinas de medição por coordenadas (CMMs), scanners ópticos e sistemas a laser 3D, agora estão equipadas com monitoramento habilitado para IoT e análises baseadas em IA, alinhando-se a ecossistemas mais amplos de manufatura digital. Essas soluções inteligentes permitem que as empresas migrem da inspeção por amostragem para a garantia de qualidade contínua e em linha.

- Além disso, indústrias como a aeroespacial, automotiva e eletrônica, que exigem tolerâncias de precisão extremamente altas, estão cada vez mais integrando soluções de metrologia com automação robótica, apoiando a montagem sem erros e reduzindo o tempo de inatividade operacional.

- Em resumo, a integração da metrologia industrial com a Indústria 4.0 e a manufatura inteligente representa uma tendência importante que molda o mercado. Essa mudança em direção à medição de precisão digitalizada ressalta a importância da metrologia como um facilitador fundamental de sistemas de produção industrial eficientes e baseados em dados.

Dinâmica do Mercado de Metrologia Industrial da Ásia-Pacífico

Motorista

Aumento da demanda por soluções de medição de alta precisão

- A crescente necessidade de garantia de qualidade precisa nos setores automotivo, aeroespacial, eletrônico e de dispositivos médicos é um fator crucial para o mercado de metrologia industrial. À medida que a complexidade da fabricação aumenta, as empresas buscam soluções de medição capazes de detectar desvios em nível micrométrico para garantir a confiabilidade do produto e a conformidade com os rigorosos padrões do setor.

- Por exemplo, a Nikon Metrology expandiu seus sistemas de inspeção óptica e de raios X para aplicações eletrônicas e semicondutoras, permitindo que os fabricantes alcancem precisão consistente em microescala. Da mesma forma, a Mitutoyo Corporation fornece CMMs avançadas que oferecem alta repetibilidade e precisão, necessárias na produção de motores automotivos e na inspeção de componentes aeroespaciais.

- A medição de precisão está se tornando cada vez mais vital em indústrias onde até mesmo pequenos defeitos podem levar a problemas significativos de segurança e desempenho. Isso é particularmente crítico em setores como aeroespacial e saúde, onde a confiabilidade do produto é inegociável.

- A crescente adoção da manufatura aditiva está ampliando ainda mais a necessidade de metrologia de precisão, visto que geometrias complexas e materiais avançados exigem inspeção exata para validar a qualidade da produção. O uso expandido da nanotecnologia e da eletrônica miniaturizada também reforça a demanda por sistemas de metrologia altamente avançados.

- Em conclusão, o mercado está sendo fortemente impulsionado por indústrias que não abrem mão da precisão, exatidão ou qualidade. Essa demanda garante relevância e expansão de longo prazo de soluções de metrologia de alta precisão em todo o mundo.

Restrição/Desafio

Alto Investimento Inicial

- Um dos principais desafios do mercado de metrologia industrial é o alto custo inicial associado à aquisição de equipamentos metrológicos avançados. Sistemas sofisticados, como scanners a laser 3D, CMMs e ferramentas de inspeção por raios X, envolvem investimentos de capital substanciais, limitando o acesso para pequenas e médias empresas (PMEs).

- Por exemplo, as soluções avançadas de metrologia oferecidas pela ZEISS e pela Hexagon representam frequentemente despesas de capital significativas para os fabricantes, tornando a adopção mais viável para grandes empresas do que para empresas mais pequenas que operam com restrições orçamentais apertadas.

- Além dos custos com equipamentos, a implementação exige pessoal qualificado, treinamento especializado e integração com os sistemas de fabricação existentes, o que aumenta ainda mais as despesas totais. Esses fatores impedem empresas sensíveis a custos de investir em soluções avançadas de metrologia, apesar de seus benefícios a longo prazo.

- O ritmo acelerado das atualizações tecnológicas também levanta preocupações financeiras, já que os fabricantes podem ter dificuldades para justificar investimentos recorrentes para manter os sistemas atualizados com as tendências digitais e de automação em evolução.

- Como resultado, os altos custos de investimento inicial continuam sendo uma restrição significativa no mercado de metrologia industrial, especialmente para PMEs que buscam equilibrar eficiência de custos com necessidades de precisão. Para lidar com isso, os fornecedores estão cada vez mais oferecendo soluções modulares, opções de leasing e serviços de metrologia em nuvem para reduzir as barreiras de acessibilidade e incentivar uma adoção mais ampla.

Escopo do mercado de metrologia industrial da Ásia-Pacífico

O mercado é segmentado com base na oferta, equipamento, aplicação e usuário final.

- Ao oferecer

Com base na oferta, o mercado de metrologia industrial é segmentado em hardware, software e serviços. O segmento de hardware dominou a maior fatia de mercado, com 59,5% da receita em 2024, impulsionado pela ampla adoção de máquinas de medição por coordenadas, digitalizadores ópticos, scanners e outros instrumentos de precisão em todos os setores. O hardware é considerado a espinha dorsal da metrologia, pois permite medições precisas essenciais para a garantia da qualidade e a validação de produtos. Avanços contínuos na tecnologia de sensores, resolução aprimorada e dispositivos portáteis de metrologia impulsionaram ainda mais a demanda por hardware, especialmente nos setores automotivo e aeroespacial, onde a precisão da tolerância é crítica.

Prevê-se que o segmento de serviços apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por serviços de calibração, manutenção e medição terceirizada. À medida que as empresas buscam otimizar a eficiência operacional e reduzir o tempo de inatividade, a dependência de prestadores de serviços terceirizados para obter expertise especializada está aumentando. A tendência crescente de metrologia como serviço, apoiada por plataformas digitais, também está expandindo a adoção de serviços, especialmente entre pequenas e médias empresas que não possuem infraestrutura metrológica interna.

- Por equipamento

Com base nos equipamentos, o mercado de metrologia industrial é segmentado em CMM (Máquinas de Medição por Coordenadas), ODS (Digitalizadores e Scanners Ópticos), Raio-X e Tomografia Computadorizada. O segmento de CMM dominou a participação de mercado em 2024, principalmente devido ao seu papel consolidado na medição dimensional de alta precisão em aplicações industriais e automotivas. As CMMs são amplamente reconhecidas por sua capacidade de fornecer dados repetíveis e precisos para peças complexas, suportando inspeções em linha e fora de linha. Sua versatilidade em técnicas de apalpação e integração com sistemas de automação fortalece sua liderança na categoria de equipamentos.

O segmento de ODS deverá apresentar a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por soluções de medição sem contato e pela rápida digitalização nos fluxos de trabalho de fabricação. Os sistemas ODS oferecem velocidade, flexibilidade e recursos de escaneamento 3D de alta resolução, tornando-os particularmente atraentes para engenharia reversa, validação de projetos e prototipagem. Sua portabilidade e facilidade de uso impulsionam ainda mais a adoção, especialmente nas indústrias aeroespacial e de semicondutores, onde geometrias complexas exigem tecnologias avançadas de escaneamento.

- Por aplicação

Com base na aplicação, o mercado de metrologia industrial é segmentado em controle de qualidade e inspeção, engenharia reversa, mapeamento e modelagem, entre outros. O segmento de controle de qualidade e inspeção dominou a maior fatia da receita de mercado em 2024, impulsionado por seu papel fundamental em garantir a conformidade dos produtos com os rigorosos padrões da indústria. Fabricantes dos setores automotivo, aeroespacial e eletrônico dependem fortemente da inspeção precisa para minimizar defeitos, reduzir recalls e manter a reputação da marca. A integração de sistemas avançados de metrologia nas linhas de produção aumenta ainda mais a eficiência, contribuindo para a liderança deste segmento.

Espera-se que o segmento de engenharia reversa registre o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente demanda por desenvolvimento de produtos, otimização de projetos e reprodução de peças legadas. Com os setores migrando para a personalização e a manufatura digital, as ferramentas de engenharia reversa fornecem a base para prototipagem rápida e inovação. A capacidade dos sistemas de metrologia de capturar modelos 3D precisos de produtos existentes é particularmente valiosa nos setores aeroespacial e automotivo, onde o redesenho de peças críticas sem a documentação original é frequentemente necessário.

- Por usuário final

Com base no usuário final, o mercado de metrologia industrial é segmentado em automotivo, manufatura, aeroespacial e defesa, semicondutores e outros. O setor automotivo dominou a participação de mercado na receita em 2024, devido à sua alta dependência de medições de precisão para montagem de veículos, testes de componentes e conformidade com os padrões de segurança. A tendência crescente de veículos elétricos intensificou ainda mais a demanda por soluções de metrologia, visto que os fabricantes precisam validar sistemas complexos de baterias, conjuntos de transmissão e materiais leves com extrema precisão. A presença de OEMs estabelecidos e linhas de produção em larga escala garante a adoção constante de equipamentos avançados de metrologia.

Prevê-se que o setor de semicondutores apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente miniaturização de componentes eletrônicos e pela rigorosa necessidade de precisão de medição em nanoescala. A complexidade dos processos de fabricação de semicondutores exige sistemas de metrologia avançados, capazes de analisar padrões microscópicos e garantir uma produção sem defeitos. À medida que a demanda por chips continua a aumentar em eletrônicos de consumo, infraestrutura 5G e aplicações de IA, a indústria de semicondutores emerge como um impulsionador fundamental da inovação metrológica e da rápida adoção.

Análise regional do mercado de metrologia industrial da Ásia-Pacífico

- A China dominou o mercado de metrologia industrial com a maior participação na receita em 2024, impulsionada por sua ampla base de fabricação, rápida industrialização e crescente adoção de sistemas de medição de precisão nos setores automotivo, aeroespacial e eletrônico.

- A forte demanda interna por produtos de alta qualidade, aliada aos investimentos contínuos em tecnologias avançadas de fabricação, reforça a liderança da China no mercado regional

- A integração de escaneamento 3D, CMMs automatizadas e sistemas multissensores aos fluxos de trabalho de produção aumenta a eficiência e a precisão, consolidando sua posição dominante. A presença de fornecedores nacionais líderes e players globais, juntamente com iniciativas de manufatura inteligente apoiadas pelo governo, garante o domínio contínuo da China durante o período previsto.

Visão do mercado de metrologia industrial do Japão

Prevê-se que o mercado japonês cresça de forma constante entre 2025 e 2032, impulsionado por seus fortes setores automotivo e eletrônico, liderança em inovação tecnológica e alta demanda por soluções avançadas de garantia de qualidade. Os fabricantes japoneses priorizam a engenharia de precisão e a melhoria contínua, impulsionando a adoção de digitalizadores ópticos, tomógrafos computadorizados e sistemas de inspeção de alta precisão. A liderança do país na produção de veículos híbridos e elétricos, aliada à sua ênfase em componentes semicondutores miniaturizados, sustenta a demanda estável. Colaborações estratégicas entre empresas nacionais e OEMs globais, juntamente com investimentos contínuos em P&D, reforçam ainda mais o papel inovador do Japão no mercado de metrologia industrial.

Visão do mercado de metrologia industrial da Índia

A Índia deverá registrar o CAGR mais rápido no mercado de metrologia industrial da Ásia-Pacífico entre 2025 e 2032, impulsionado pelo rápido crescimento na fabricação de automóveis, aeroespacial e semicondutores. O aumento da renda disponível, a forte expansão industrial e iniciativas governamentais como o "Make in India" e programas de manufatura digital estão acelerando a adoção de sistemas avançados de metrologia. O aumento dos investimentos de OEMs globais e fornecedores de nível 1, juntamente com a crescente demanda por soluções de medição acessíveis e precisas, posiciona a Índia como o mercado de crescimento mais rápido. A expansão da produção de veículos elétricos, o desenvolvimento de infraestrutura e o crescimento do ecossistema de manufatura nacional fortalecem ainda mais sua trajetória.

Participação no mercado de metrologia industrial da Ásia-Pacífico

O setor de metrologia industrial é liderado principalmente por empresas bem estabelecidas, incluindo:

- Bruker (EUA)

- Baker Hughes Company (EUA)

- Hexagon AB (Suécia)

- KEYENCE CORPORATION (Japão)

- Applied Materials, Inc. (EUA)

- SGS Société Générale de Surveillance (Suíça)

- FARO (EUA)

- Intertek Group plc (Reino Unido)

- CREAFORM (Canadá)

- Automated Precision Inc (API) (EUA)

- Grupo Metrológico (França)

Últimos desenvolvimentos no mercado de metrologia industrial da Ásia-Pacífico

- Em setembro de 2024, a Hexagon AB lançou o Leica Absolute Tracker ATS800, integrando rastreamento a laser e funcionalidade de radar para solucionar gargalos de inspeção na fabricação em larga escala. Ao permitir medições precisas de características a longa distância e suportar tolerâncias de montagem rigorosas, o sistema aumentou a eficiência nas linhas de produção aeroespacial e automotiva. Essa inovação fortaleceu a posição competitiva da Hexagon AB no mercado de metrologia industrial, demonstrando seu compromisso com o avanço das tecnologias de inspeção automatizada e com o atendimento à crescente demanda por soluções de controle de qualidade mais rápidas e confiáveis.

- Em julho de 2024, os professores Andrew Webb e Bernhard Blumich receberam o Prêmio Richard R. Ernst na EUROMAR 2024 por suas contribuições significativas à ressonância magnética nuclear (RMN) e à pesquisa em ressonância magnética. O reconhecimento destaca o papel crescente da pesquisa científica avançada no fomento da inovação em metrologia industrial, particularmente em ensaios não destrutivos e caracterização de materiais. Essa conquista reflete como os avanços acadêmicos estão acelerando o desenvolvimento de novas aplicações metrológicas e reforçando a ligação entre a excelência em pesquisa e o progresso da indústria.

- Em março de 2023, a KEYENCE CORPORATION lançou o sistema de medição multissensor LM-X, uma plataforma de alta precisão que combina medições ópticas, a laser e por apalpador em uma única unidade. Projetado para simplificar os fluxos de trabalho e eliminar o posicionamento demorado, o sistema permitiu que os fabricantes obtivessem relatórios de inspeção confiáveis e precisos com mais eficiência. Este lançamento impulsionou a posição de mercado da KEYENCE ao atender à crescente demanda por soluções multissensores que melhoram a produtividade, otimizam o controle de qualidade e reduzem erros em diversos ambientes industriais.

- Em junho de 2022, a Applied Materials, Inc. adquiriu a Picosun Oy para fortalecer seu portfólio de ICAPS (IoT, Comunicações, Automotivo, Energia e Sensores) por meio da expertise da Picosun em tecnologia de deposição de camada atômica. A aquisição permitiu à Applied Materials atender melhor à crescente demanda por semicondutores especiais, expandindo seu alcance para setores que exigem revestimentos ultrafinos e precisão em nanoescala. Essa aquisição aprimorou as capacidades de metrologia e inspeção da empresa, reforçando sua posição como um player-chave no ecossistema de fabricação de semicondutores.

- Em fevereiro de 2021, a Baker Hughes Company adquiriu a ARMS Reliability para expandir seu portfólio de Gestão de Desempenho de Ativos (APM) e integrar soluções avançadas de confiabilidade à sua plataforma Bently Nevada. Essa aquisição aprimorou a capacidade da Baker Hughes de fornecer soluções precisas de monitoramento de ativos, gestão do ciclo de vida e manutenção preditiva em setores como mineração, energia e serviços públicos. A aquisição reforçou o compromisso da empresa com a transformação digital em metrologia industrial, melhorando a eficiência operacional e a produtividade de sua base global de clientes.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.