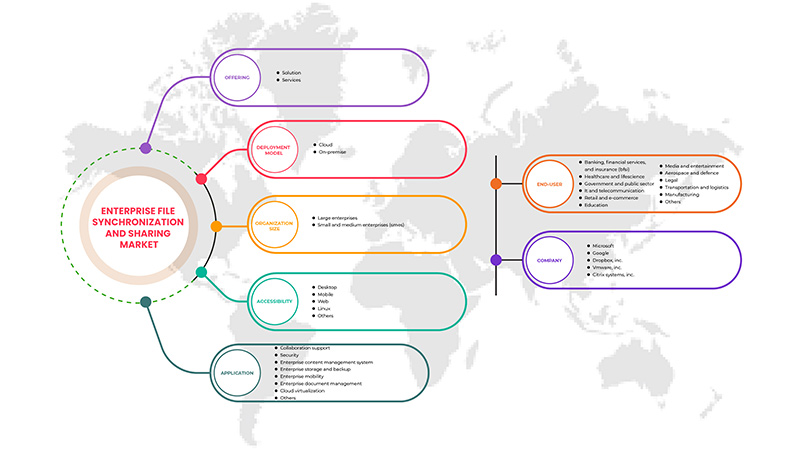

Asia-Pacific Enterprise File Synchronization and Sharing Market, By Offering (Solution and Services), By Deployment Model (On-Premise and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Accessibility (Desktop, Mobile, Web, Linux, and Others), Application (Collaboration Support, Security, Enterprise Content Management System, Enterprise Storage and Backup, Enterprise Mobility, Enterprise Document Management, Cloud Virtualization, and Others), End User (Banking, Financial Services and Insurance (BFSI), Healthcare and Lifescience, Government and Public Sector, IT and Telecommunication, Retail and E-Commerce, Education, Media and Entertainment, Aerospace and Defence, Legal, Transportation and Logistics, Manufacturing, and Others), Industry Trends and Forecast to 2029

Asia-Pacific Enterprise File Synchronization and Sharing Market Analysis and Insights

Businesses can use enterprise file sync-and-share to improve content management, collaboration and secure file sharing among employees. EFSS services include features such as live commenting, document version tracking and workflow process management to help users store, edit, review, and share files. Organizations often adopt EFSS as a means to deter employees from sharing corporate data via consumer-oriented public cloud storage and file-sharing services that are outside of IT's control.

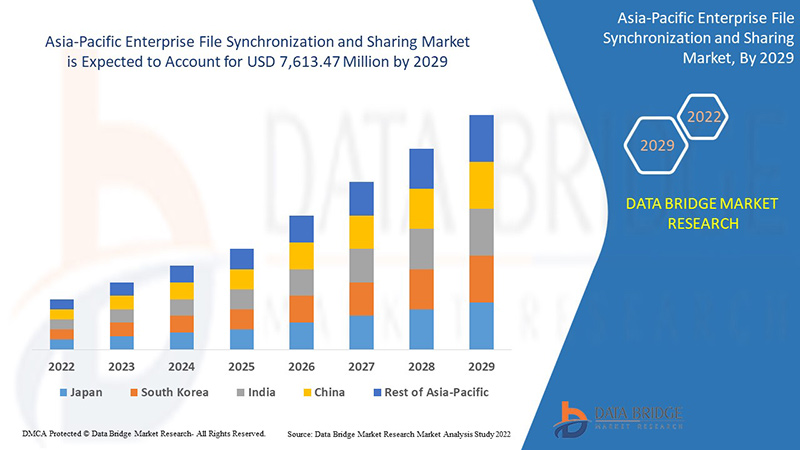

Data Bridge Market Research analyses that the Asia-Pacific enterprise file synchronization and sharing market is expected to reach the value of USD 7,613.47 million by 2029, at a CAGR of 26.6% during the forecast period. Solution segment accounts for the largest offering segment in the Asia-Pacific enterprise file synchronization and sharing market. The Asia-Pacific enterprise file synchronization and sharing market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Offering (Solution and Services), By Deployment Model (On-Premise and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Accessibility (Desktop, Mobile, Web, Linux, and Others), Application (Collaboration Support, Security, Enterprise Content Management System, Enterprise Storage and Backup, Enterprise Mobility, Enterprise Document Management, Cloud Virtualization, and Others), End User (Banking, Financial Services and Insurance (BFSI), Healthcare and Lifescience, Government and Public Sector, IT and Telecommunication, Retail and E-Commerce, Education, Media and Entertainment, Aerospace and Defence, Legal, Transportation and Logistics, Manufacturing, and Others) |

|

Countries Covered |

China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, and rest of Asia-Pacific |

|

Market Players Covered |

IBM Corporation, Axway, Citrix Systems, Inc., Google, Microsoft, Dropbox, Inc., Micro Focus, Nextcloud GmbH, Citrix Systems, Inc., Open Text Corporation, Qnext Corp., Thru, Inc., VMware, Inc., Thomson Reuters, FileCloud, Ziff Davis, Inc., Seafile Ltd., Files.com, ACCELLION, Egnyte, Inc., Intralinks, Inc., Box, ownCloud GmbH, MyWorkDrive LLC., CTERA Networks Ltd., DryvIQ among others |

Market Definition

Enterprise file sync-and-share is a service that allows users to save files in cloud or on-premises storage and then access them on desktop and mobile devices. Enterprise file-sharing tools allow users to securely share documents, photos, videos and more across multiple devices and with multiple people. They use file synchronization, or copying, to allow files to be stored in an approved data repository, then accessed remotely by employees from PCs, tablets or smartphones that support the EFSS product.

Sharing can happen among people within or outside the organization, as well as among applications. Smooth search, retrieval and access of files stored in multiple data repositories from different client devices complement these offerings, as well as security, data protection and collaboration capabilities. EFSS offerings enable modern user productivity and collaboration scenarios for the creation of a digital workplace. Typical deployment architectures for EFSS offerings can be public cloud, hybrid cloud, private cloud or on-premises.

Market Dynamics

Drivers

- Continuously rising digital workplace and mobile workforce

Workplaces have evolved from referring to a physical space including offices to remote offices through desktop, mobile devices, and others. Many office documents and projects have gone instant messaging which has become a popular communication choice within office industry. Digital Workplace Solutions (DWS) create connections and remove barriers between people. Growth in the area of digital workplace and mobile workforce is further helping the Asia-Pacific enterprise file synchronization and sharing market to grow significantly.

- Emphasis of businesses on corporate data security

Data safety has continuously been important; however the significance is growing each day. Data protection is organization’s defensive measure to preserve any unauthorized entry in databases, websites, and computers. In recent days, businesses are in need to protect data from any type of attack. It is been a serious problem to consider. Increasing cyber-attacks on businesses are actually compelling to introduce EFSS platforms which is helping the market to grow.

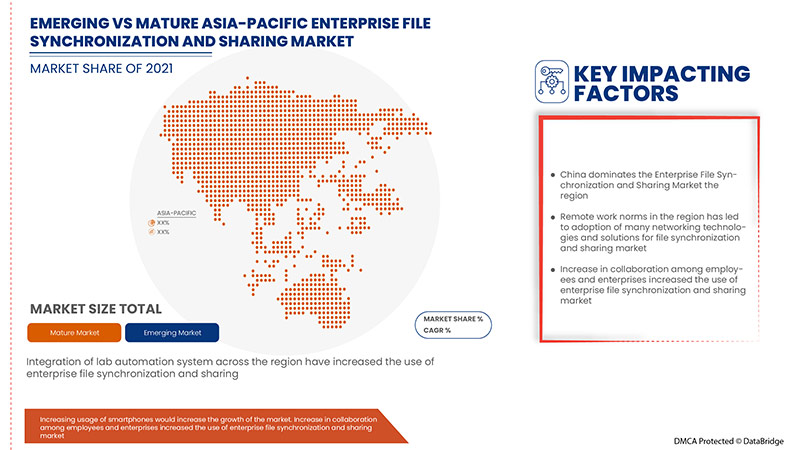

- Increase in collaboration among employees and enterprises

Online file sharing resolutions are gaining attraction in industries like healthcare, government, finance, law, engineering, and more. With the growing need for digital and content collaboration across endpoints help teams to achieve their goals and enable employees to keep pace with the requirements of their tasks. Organizations are increasingly moving towards collaboration of employees and the data on different levels, which is propelling the growth of the Asia-Pacific enterprise file synchronization and sharing market to an extent.

- Rising incidences of data theft in BFSI and healthcare sector

Data stealing has evolved to be one amongst the main cyber-crimes that happens in the digital world from time to time since the very starting of the virtual world. Both large and small health care businesses are targeted by cyber criminals. The requirement of data security among BFSI and healthcare sector will help in the growth of the Asia-Pacific enterprise file synchronization and sharing market to some extent.

Opportunities

-

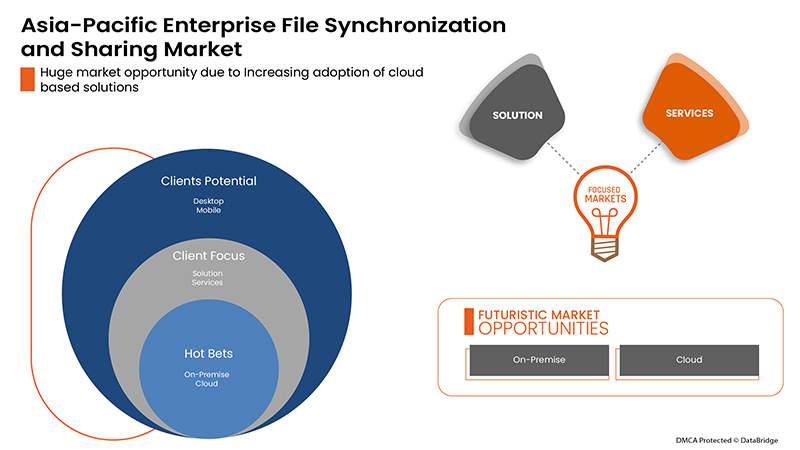

Increasing adoption of cloud based solutions

The cloud based EFSS solution offers several benefits like scalability, flexibility, ease of access, multi-device support, and lower costs. Also, as on-premises solutions have high cost, it becomes a hurdle for SMEs in adopting EFSS solution. However, with the emergence of cloud-based services, SMEs are readily implementing EFSS solutions.

Restraints/Challenges

- High cost of EFSS solution

The high cost involved serves as a barrier to the expansion of the Asia-Pacific enterprise file synchronization and sharing market despite the significant benefits associated with the installation of EFSS solutions and services. Vendors offer EFSS solutions in the form of enterprise subscription models or per-user licencing models at very high costs. For a single user, the yearly Average Selling Price (ASP) range of EFSS systems ranges between USD 150 and USD 170 and includes, customization, integration, the cost of cloud capabilities, and recovery tools among other things.

COVID-19 Impact on Asia-Pacific Enterprise File Synchronization and Sharing Market

COVID-19 created a major impact on various industries as almost every country has opted for the shutdown for every facility except the ones dealing in the essential goods segment. The government has taken some strict actions such as the shutdown of facilities and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

COVID-19 outbreak is causing widespread concern and economic hardship for consumers, businesses and communities across the globe. COVID-19 forced many organizations to digitally transform their places of work and education to operate effectively. Nowadays, companies are more and more relying on advanced technologies, such as cloud, AI, and IoT, for the future to sustain in the digital transformation race and to remain ahead of competitors. The pandemic behaviour forced companies to adopt work from home model so that work can still be accomplished while taking measures to halt the virus spread. The growing digital workplace and mobile workforce trends among businesses have become the driving forces behind the growth of the Asia-Pacific enterprise file synchronization and sharing market in the pandemic period.

Manufacturers are making various strategic decisions to meet the growing demand in COVID-19 period. The players are involved in strategic activities such as partnership, collaborations, acquisitions, and others to improve the technology involved in the Asia-Pacific enterprise file synchronization and sharing market. With this, the companies will bring advanced and accurate solutions to the market. In addition, the government initiatives to boost digitization across industries has led to the market's growth.

Recent Developments

- In September 2021, Google announced the launch of two products, Google Filestore Enterprise and Backup for Google Kubernetes Engine (GKE). The service intends to help enterprises migrate common file NAS needs from on-premises to the cloud without rebuilding at a larger scale than their prior basic and high tiers. Thus, with this, the company is expanding its product portfolio in the market

- In January 2021, Microsoft announced that it will allow user to share large file up to 250 GB through its SharePoint, Teams and OneDrive. The company has also included differential sync feature, which basically sync the changes made by the user or their workmate made in the file, so that the user don't have to spend time waiting to sync large files only to re-upload after a small change is made. Thus, with this, the company is catering the needs of people and attracting more customers

Asia-Pacific Enterprise File Synchronization and Sharing Market Scope

The Asia-Pacific enterprise file synchronization and sharing market is segmented on the basis of offering, deployment model, organization size, accessibility, application and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Offering

- Solution

- Services

On the basis of offering, the Asia-Pacific enterprise file synchronization and sharing market is segmented into solution and services.

By Deployment Model

- On-Premise

- Cloud

On the basis of deployment model, the Asia-Pacific enterprise file synchronization and sharing market is segmented into on-premise and cloud.

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

On the basis of organization size, the Asia-Pacific enterprise file synchronization and sharing market is segmented into large enterprises and small and medium enterprises (SMEs).

By Accessibility

- Desktop

- Mobile

- Web

- Linux

- Others

On the basis of accessibility, the Asia-Pacific enterprise file synchronization and sharing market is segmented into desktop, mobile, web, linux, and others.

By Application

- Collaboration Support

- Security

- Enterprise Content Management System

- Enterprise Storage and Backup

- Enterprise Mobility

- Enterprise Document Management

- Cloud Virtualization

- Others

On the basis of application, the Asia-Pacific enterprise file synchronization and sharing market is segmented into collaboration support, security, enterprise content management system, enterprise storage and backup, enterprise mobility, enterprise document management, cloud virtualization, and others.

By End-User

- Banking, Financial Services and Insurance (BFSI)

- Healthcare and Lifescience

- Government and Public Sector

- IT and Telecommunication

- Retail and E-Commerce

- Education

- Media and Entertainment

- Aerospace and Defence

- Legal

- Transportation and Logistics

- Manufacturing

- Others

On the basis of end-user, the Asia-Pacific enterprise file synchronization and sharing market is segmented into Banking, Financial Services and Insurance (BFSI), healthcare and lifescience, government and public sector, IT and telecommunication, retail and e-commerce, education, media and entertainment, aerospace and defence, legal, transportation and logistics, manufacturing, and others.

Asia-Pacific Enterprise File Synchronization and Sharing Market Regional Analysis/Insights

The Asia-Pacific enterprise file synchronization and sharing market is analysed and market size insights and trends are provided by offering, deployment model, organization size, accessibility, application, and end-user as referenced above.

The Asia-Pacific enterprise file synchronization and sharing market covers countries such as China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, and rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific enterprise file synchronization and sharing market to rise in adoption of cloud-based solutions and emerging potential markets. However, stringent government regulations and emphasis of businesses on security aspects of corporate data especially in developing countries, including India, Japan, China, and Indonesia has led to the huge growth of the Asia-Pacific enterprise file synchronization and sharing market.

The country section of the Asia-Pacific enterprise file synchronization and sharing market report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Enterprise File Synchronization and Sharing Market Share Analysis

The Asia-Pacific enterprise file synchronization and sharing market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on the Asia-Pacific enterprise file synchronization and sharing market.

Some of the major players operating in the Asia-Pacific enterprise file synchronization and sharing market are IBM Corporation, Axway, Citrix Systems, Inc., Google, Microsoft, Dropbox, Inc., Micro Focus, Nextcloud GmbH, Citrix Systems, Inc., Open Text Corporation, Qnext Corp., Thru, Inc., VMware, Inc., Thomson Reuters, FileCloud, Ziff Davis, Inc., Seafile Ltd., Files.com, ACCELLION, Egnyte, Inc., Intralinks, Inc., Box, ownCloud GmbH, MyWorkDrive LLC., CTERA Networks Ltd., DryvIQ among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FEDERAL INFORMATION SECURITY MANAGEMENT ACT (FISMA)

4.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)

4.3 GENERAL DATA PROTECTION REGULATION (GDPR)

4.4 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) 27001

4.5 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI DSS)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 CONSTANT RISING DIGITAL WORKPLACE AND MOBILE WORKFORCE

5.1.2 EMPHASIS OF BUSINESSES ON CORPORATE DATA SECURITY

5.1.3 INCREASE IN COLLABORATION AMONG EMPLOYEES AND ENTERPRISES

5.1.4 SURGING FOCUS AND ADOPTION OF REMOTE WORKING CULTURE

5.1.5 RISE IN INCIDENCE OF DATA THEFT IN BFSI & HEALTHCARE SECTOR

5.2 RESTRAINTS

5.2.1 HIGH COST OF EFSS SOLUTION

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF CLOUD BASED SOLUTIONS

5.3.2 INCREASE IN USAGE OF SMARTPHONES

5.3.3 INCREASING BYOD TREND ACROSS ENTERPRISES

5.3.4 INCREASING PACE OF DIGITALIZATION IN BUSINESSES

5.4 CHALLENGES

5.4.1 CONCERNS REGARDING DATA SECURITY AND PRIVACY

6 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 INTEGRATED EFSS SOLUTION

6.2.2 STANDALONE EFSS SOLUTION

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.1.1 INTEGRATION AND DEPLOYMENT

6.3.1.2 TRAINING AND CONSULTING

6.3.1.3 SUPPORT AND MAINTENANCE

6.3.2 MANAGED SERVICES

7 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 CLOUD

7.2.1 PUBLIC

7.2.2 HYBRID

7.2.3 PRIVATE

7.3 ON-PREMISE

8 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISES

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

9 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY

9.1 OVERVIEW

9.2 DESKTOP

9.2.1 WINDOWS

9.2.2 MAC

9.3 MOBILE

9.3.1 ANDROID

9.3.2 IOS

9.4 WEB

9.5 LINUX

9.6 OTHERS

10 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 COLLABORATION SUPPORT

10.3 SECURITY

10.4 ENTERPRISE CONTENT MANAGEMENT SYSTEM

10.5 ENTERPRISE STORAGE AND BACKUP

10.6 ENTERPRISE MOBILITY

10.7 ENTERPRISE DOCUMENT MANAGEMENT

10.8 CLOUD VIRTUALIZATION

10.9 OTHERS

11 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END-USER

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

11.2.1 SOLUTION

11.2.2 SERVICES

11.3 HEALTHCARE AND LIFESCIENCE

11.3.1 SOLUTION

11.3.2 SERVICES

11.4 GOVERNMENT AND PUBLIC SECTOR

11.4.1 SOLUTION

11.4.2 SERVICES

11.5 IT AND TELECOMMUNICATION

11.5.1 SOLUTION

11.5.2 SERVICES

11.6 RETAIL AND E-COMMERCE

11.6.1 SOLUTION

11.6.2 SERVICES

11.7 EDUCATION

11.7.1 SOLUTION

11.7.2 SERVICES

11.8 MEDIA AND ENTERTAINMENT

11.8.1 SOLUTION

11.8.2 SERVICES

11.9 AEROSPACE AND DEFENCE

11.9.1 SOLUTION

11.9.2 SERVICES

11.1 LEGAL

11.10.1 SOLUTION

11.10.2 SERVICES

11.11 TRANSPORTATION AND LOGISTICS

11.11.1 SOLUTION

11.11.2 SERVICES

11.12 MANUFACTURING

11.12.1 SOLUTION

11.12.2 SERVICES

11.13 OTHERS

12 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 INDIA

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 INDONESIA

12.1.8 THAILAND

12.1.9 MALAYSIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MICROSOFT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DROPBOX, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 VMWARE, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 CITRIX SYSTEMS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 BOX, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCTS PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ZIFF DAVIS, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 ACCELLION

15.8.1 COMPANY SNAPSHOT

15.8.2 SOLUTION PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 AXWAY

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 CTERA NETWORKS LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCTS PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 DRYVIQ (SKYSYNC)

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCTS PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 EGNYTE, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FILECLOUD

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 FILES.COM

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 IBM CORPORATION

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 INTRALINKS, INC.(SS&C)

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 MICRO FOCUS

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 MYWORKDRIVE (BY WANPATH LLC.)

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCTS PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 NEXTCLOUD GMBH

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 OPEN TEXT CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 OWNCLOUD GMBH

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCTS PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 QNEXT CORP.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 SEAFILE, INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 THOMSON REUTERS

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 THRU, INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC ON-PREMISE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC LARGE ENTERPRISES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC WEB IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC LINUX IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC OTHERS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC COLLABORATION SUPPORT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC SECURITY IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC ENTERPRISE CONTENT MANAGEMENT SYSTEM IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ENTERPRISE STORAGE AND BACKUP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ENTERPRISE MOBILITY IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC ENTERPRISE DOCUMENT MANAGEMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC CLOUD VIRTUALIZATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC HEALTHCARE AND LIFESCIENCE SEGMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC RETAIL AND E-COMMERCE SEGMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC OTHERS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 ASIA-PACIFIC PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 61 ASIA-PACIFIC CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 63 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 64 ASIA-PACIFIC DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 ASIA-PACIFIC MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 ASIA-PACIFIC BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 69 ASIA-PACIFIC HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 ASIA-PACIFIC GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 71 ASIA-PACIFIC IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 72 ASIA-PACIFIC RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 73 ASIA-PACIFIC EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 74 ASIA-PACIFIC MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 75 ASIA-PACIFIC AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 76 ASIA-PACIFIC LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 77 ASIA-PACIFIC TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 78 ASIA-PACIFIC MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 79 CHINA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 80 CHINA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CHINA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CHINA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CHINA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 84 CHINA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 CHINA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 86 CHINA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 87 CHINA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CHINA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CHINA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 CHINA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 CHINA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 92 CHINA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 93 CHINA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 CHINA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 95 CHINA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 96 CHINA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 97 CHINA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 98 CHINA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 99 CHINA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 100 CHINA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 101 CHINA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 102 JAPAN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 103 JAPAN SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 JAPAN SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 JAPAN PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 JAPAN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 107 JAPAN CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 JAPAN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 109 JAPAN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 110 JAPAN DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 JAPAN MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 JAPAN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 JAPAN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 JAPAN BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 115 JAPAN HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 116 JAPAN GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 117 JAPAN IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 118 JAPAN RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 119 JAPAN EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 120 JAPAN MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 121 JAPAN AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 122 JAPAN LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 123 JAPAN TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 124 JAPAN MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 125 INDIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 126 INDIA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 INDIA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 INDIA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 INDIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 130 INDIA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 INDIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 132 INDIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 133 INDIA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 INDIA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 INDIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 INDIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 137 INDIA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 138 INDIA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 139 INDIA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 140 INDIA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 141 INDIA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 142 INDIA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 143 INDIA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 144 INDIA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 145 INDIA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 146 INDIA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 147 INDIA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 148 SOUTH KOREA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 149 SOUTH KOREA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 SOUTH KOREA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 SOUTH KOREA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 SOUTH KOREA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 153 SOUTH KOREA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 SOUTH KOREA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 155 SOUTH KOREA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 156 SOUTH KOREA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 SOUTH KOREA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 SOUTH KOREA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 SOUTH KOREA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 SOUTH KOREA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 161 SOUTH KOREA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 162 SOUTH KOREA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 163 SOUTH KOREA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 164 SOUTH KOREA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 165 SOUTH KOREA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 166 SOUTH KOREA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 167 SOUTH KOREA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 168 SOUTH KOREA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 169 SOUTH KOREA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 170 SOUTH KOREA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 171 AUSTRALIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 172 AUSTRALIA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 AUSTRALIA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 AUSTRALIA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 AUSTRALIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 176 AUSTRALIA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 AUSTRALIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 178 AUSTRALIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 179 AUSTRALIA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 AUSTRALIA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 AUSTRALIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 AUSTRALIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 183 AUSTRALIA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 184 AUSTRALIA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 185 AUSTRALIA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 186 AUSTRALIA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 187 AUSTRALIA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 188 AUSTRALIA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 189 AUSTRALIA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 190 AUSTRALIA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 191 AUSTRALIA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 192 AUSTRALIA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 193 AUSTRALIA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 194 SINGAPORE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 195 SINGAPORE SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 SINGAPORE SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 SINGAPORE PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 SINGAPORE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 199 SINGAPORE CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 SINGAPORE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 201 SINGAPORE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 202 SINGAPORE DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 SINGAPORE MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 SINGAPORE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 205 SINGAPORE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 206 SINGAPORE BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 207 SINGAPORE HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 208 SINGAPORE GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 209 SINGAPORE IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 210 SINGAPORE RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 211 SINGAPORE EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 212 SINGAPORE MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 213 SINGAPORE AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 214 SINGAPORE LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 215 SINGAPORE TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 216 SINGAPORE MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 217 INDONESIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 218 INDONESIA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 INDONESIA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 220 INDONESIA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 221 INDONESIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 222 INDONESIA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 INDONESIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 224 INDONESIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 225 INDONESIA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 INDONESIA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 INDONESIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 228 INDONESIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 229 INDONESIA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 230 INDONESIA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 231 INDONESIA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 232 INDONESIA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 233 INDONESIA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 234 INDONESIA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 235 INDONESIA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 236 INDONESIA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 237 INDONESIA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 238 INDONESIA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 239 INDONESIA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 240 THAILAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 241 THAILAND SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 THAILAND SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 THAILAND PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 THAILAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 245 THAILAND CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 THAILAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 247 THAILAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 248 THAILAND DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 THAILAND MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 THAILAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 251 THAILAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 252 THAILAND BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 253 THAILAND HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 254 THAILAND GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 255 THAILAND IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 256 THAILAND RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 257 THAILAND EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 258 THAILAND MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 259 THAILAND AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 260 THAILAND LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 261 THAILAND TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 262 THAILAND MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 263 MALAYSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 264 MALAYSIA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 MALAYSIA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 266 MALAYSIA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 MALAYSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 268 MALAYSIA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 MALAYSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 270 MALAYSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 271 MALAYSIA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 MALAYSIA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 273 MALAYSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 274 MALAYSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 275 MALAYSIA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 276 MALAYSIA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 277 MALAYSIA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 278 MALAYSIA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 279 MALAYSIA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 280 MALAYSIA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 281 MALAYSIA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 282 MALAYSIA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 283 MALAYSIA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 284 MALAYSIA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 285 MALAYSIA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 286 PHILIPPINES ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 287 PHILIPPINES SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 288 PHILIPPINES SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 289 PHILIPPINES PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 PHILIPPINES ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 291 PHILIPPINES CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 292 PHILIPPINES ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 293 PHILIPPINES ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 294 PHILIPPINES DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 295 PHILIPPINES MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 296 PHILIPPINES ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 297 PHILIPPINES ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 298 PHILIPPINES BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 299 PHILIPPINES HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 300 PHILIPPINES GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 301 PHILIPPINES IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 302 PHILIPPINES RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 303 PHILIPPINES EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 304 PHILIPPINES MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 305 PHILIPPINES AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 306 PHILIPPINES LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 307 PHILIPPINES TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 308 PHILIPPINES MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 309 REST OF ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: SEGMENTATION

FIGURE 11 CONTINUOUSLY RISING DIGITAL WORKPLACE AND MOBILE WORKFORCE IS EXPECTED TO DRIVE ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKETIN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 12 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKETIN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET

FIGURE 15 NUMBER OF SMARTPHONE USERS WORLDWIDE, FROM 2017 TO 2022

FIGURE 16 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY OFFERING, 2021

FIGURE 17 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: DEPLOYMENT MODEL, 2021

FIGURE 18 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 19 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY ACCESSIBILITY, 2021

FIGURE 20 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY APPLICATION, 2021

FIGURE 21 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY END-USER, 2021

FIGURE 22 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY OFFERING (2022-2029)

FIGURE 27 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.