Asia Pacific Drug Device Combination Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.65 Billion

USD

5.39 Billion

2025

2033

USD

2.65 Billion

USD

5.39 Billion

2025

2033

| 2026 –2033 | |

| USD 2.65 Billion | |

| USD 5.39 Billion | |

|

|

|

|

O mercado de combinação de medicamentos e dispositivos, por produto (autoinjetor, adesivo de microagulha, comprimido digital, inalador inteligente, hidrogéis de administração de medicamentos, lentes de libertação de medicamentos e outros), tipo de aplicação (doenças ortopédicas, doenças respiratórias, diabetes , oncologia, doenças cardiovasculares) , e outros), Utilizador final (clínicas, hospitais, ambientes de cuidados domiciliários, centros de atendimento ambulatório e outros), Canal de distribuição (licitação direta, vendas a retalho e outros), País (China, Coreia do Sul, Japão, Índia, Austrália, Singapura, Tendências e previsões da indústria (Malásia, Indonésia, Tailândia, Filipinas e resto da Ásia-Pacífico) até 2028.

Análise e Insights de Mercado: Mercado de Combinação de Medicamentos e Dispositivos da Ásia-Pacífico

Análise e Insights de Mercado: Mercado de Combinação de Medicamentos e Dispositivos da Ásia-Pacífico

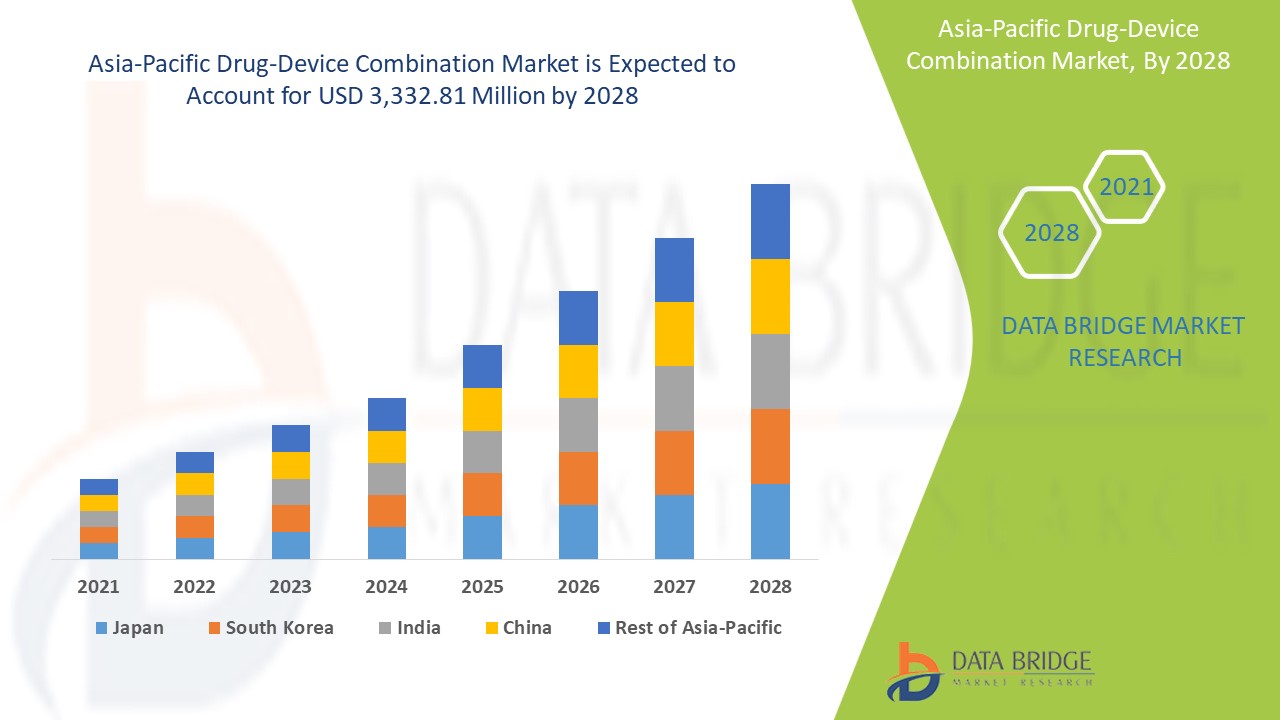

Espera-se que o mercado de combinação de medicamentos e dispositivos ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 9,3% no período previsto de 2021 a 2028 e prevê-se que atinja os 3.332,81 milhões de dólares até 2028, face aos 1.703,67 milhões de dólares em 2020. O aumento da carga de doenças crónicas e a crescente procura por melhores combinações de medicamentos e dispositivos são os principais impulsionadores da procura do mercado no período previsto.

A crescente prevalência de doenças crónicas e o avanço da tecnologia ajudam eficazmente o crescimento do mercado de combinação de medicamentos e dispositivos. No entanto, as limitações e complicações associadas aos dispositivos médicos podem dificultar o crescimento futuro do mercado de dispositivos médicos. As parcerias e colaborações dos principais participantes do mercado funcionam como uma oportunidade para o crescimento do mercado de combinação de medicamentos e dispositivos. No entanto, uma estrutura regulamentar rigorosa representa um desafio para o crescimento do mercado de combinação de medicamentos e dispositivos.

O relatório de mercado de combinação de medicamentos e dispositivos fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos , o impacto dos participantes do mercado nacional e localizado, analisa oportunidades em termos de bolsões de receita emergentes, mudanças nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um Briefing de Analista.

Âmbito e dimensão do mercado de combinação de medicamentos e dispositivos da Ásia-Pacífico

Âmbito e dimensão do mercado de combinação de medicamentos e dispositivos da Ásia-Pacífico

O mercado de combinação de medicamentos e dispositivos está categorizado em quatro segmentos notáveis que se baseiam no produto, aplicação, utilizador final e canal de distribuição.

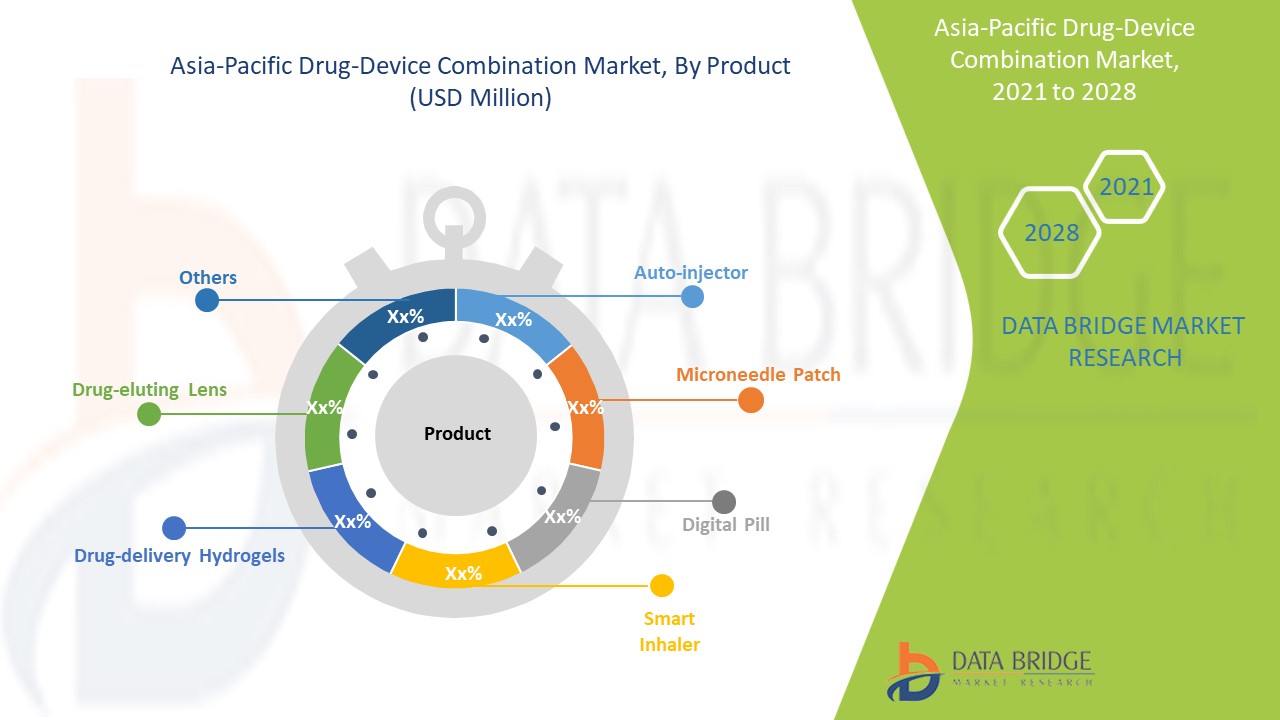

- Com base no produto, o mercado de combinação de medicamentos e dispositivos está segmentado em autoinjetores, adesivos de microagulhas, comprimidos digitais, inaladores inteligentes, hidrogéis de administração de medicamentos, lentes libertadoras de medicamentos e outros. Em 2021, os autoinjetores detêm a maior fatia do mercado de combinação de medicamentos e dispositivos, devido ao aumento do apoio governamental no desenvolvimento de produtos de saúde e à sensibilização geral para a utilização entre as massas.

- Com base na aplicação, o mercado de combinação de medicamentos e dispositivos está segmentado em doenças ortopédicas, doenças respiratórias, diabetes, oncologia, doenças cardiovasculares e outras. Em 2021, as doenças ortopédicas dominaram o mercado de combinação de medicamentos e dispositivos devido à crescente procura de produtos de combinação de medicamentos e dispositivos altamente avançados e eficientes para o tratamento.

- Com base no utilizador final, o mercado de combinação de medicamentos e dispositivos está segmentado em clínicas, hospitais, ambientes de cuidados domiciliários, centros de cuidados ambulatórios e outros. Em 2021, prevê-se que as clínicas dominem o mercado da combinação de medicamentos e dispositivos devido ao número crescente de clínicas especializadas em todo o mundo. Além disso, a crescente procura de vários dispositivos de administração de medicamentos serve como outro factor determinante.

- Com base no canal de distribuição, o mercado de combinação de medicamentos e dispositivos está segmentado em licitação direta, vendas a retalho e outros. Em 2021, prevê-se que a licitação direta domine o mercado de combinação de medicamentos e dispositivos devido ao número crescente de hospitais nos países desenvolvidos e em desenvolvimento, o que aumenta as vendas de licitação direta e acelera o crescimento do mercado.

Análise ao nível do país do mercado de combinação de medicamentos e dispositivos da Ásia-Pacífico

O mercado de combinação de medicamentos e dispositivos é analisado, e a informação sobre o tamanho do mercado é fornecida por produto, aplicação, utilizador final e canal de distribuição.

Os países abrangidos pelo relatório de mercado de dispositivos medicamentosos são a China, o Japão, a Índia, a Coreia do Sul, a Austrália, Singapura, a Tailândia, a Malásia, a Indonésia, as Filipinas e o resto da Ásia-Pacífico.

Espera-se que a Ásia-Pacífico cresça com o CAGR mais rápido nos períodos previstos. Na Ásia-Pacífico, os países que exigem combinações de medicamentos e dispositivos estão a aumentar rapidamente devido ao aumento populacional e aos gastos com a saúde. Espera-se que a China domine o mercado da Ásia-Pacífico. A China é um dos países líderes na Ásia-Pacífico, que utiliza produtos avançados de combinação de medicamentos e dispositivos no tratamento e monitorização de doenças.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade das marcas da Ásia-Pacífico e os desafios enfrentados devido à grande ou escassa concorrência das marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

As iniciativas estratégicas dos fabricantes estão a criar novas oportunidades para os participantes do mercado de combinação de medicamentos e dispositivos

O mercado de combinação de medicamentos e dispositivos também fornece uma análise detalhada do crescimento de cada país. Além disso, fornece dados detalhados sobre o crescimento das vendas de dispositivos médicos, parcerias, aquisições e acordos de distribuição entre os participantes do mercado da região Ásia-Pacífico. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Cenário competitivo e mercado de combinação de medicamentos e dispositivos - Análise da quota

O panorama competitivo do mercado de combinação de medicamentos e dispositivos fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, amplitude do produto, e amplitude, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de combinação de medicamentos e dispositivos.

Os principais participantes abrangidos pelos relatórios são a Medtronic, GlaxoSmithKline plc, BD, Janssen Pharmaceuticals, Inc., Bayer AG, YPSOMED, CosMED Pharmaceutical Co. Ltd., Otsuka America Pharmaceutical, Inc, VAXXAS, Raphas Co., Ltd., Zimmer A Biomet , a SONCEBOZ, a CGbio, a EOFLOW CO.,LTD, entre outras, são empresas nacionais e da Ásia-Pacífico. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos contratos e lançamentos de produtos são também iniciados por empresas de todo o mundo, acelerando o mercado de combinação de medicamentos e dispositivos.

Por exemplo,

- Em novembro de 2020, a YPSOMED colaborou com a SCHOTT e a Lonza para desenvolver uma solução abrangente para injetores de adesivos vestíveis e produtos combinados baseados na autoinjeção subcutânea. Isto ajudou uma empresa a entrar em ensaios clínicos e a comercializar os produtos mais rapidamente, o que impulsionou o mercado

- Em junho de 2017, a CosMED Pharmaceutical Co. Ltd. lançou e iniciou as vendas de microagulhas para crescimento capilar, “fa:sa”. Isto aumentou o crescimento da empresa na tecnologia de microagulhas

A colaboração, as joint ventures e outras estratégias do participante no mercado melhoram a impressão da empresa no mercado de dispositivos médicos, o que também beneficia a organização ao melhorar o seu crescimento de vendas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.