Asia Pacific Departmental Pacs Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.39 Billion

USD

5.52 Billion

2024

2032

USD

3.39 Billion

USD

5.52 Billion

2024

2032

| 2025 –2032 | |

| USD 3.39 Billion | |

| USD 5.52 Billion | |

|

|

|

|

Segmentação do mercado de PACS departamentais da região APAC, por tipo de produto (PACS tradicional e PACS especializado), componente (software, serviços e hardware), aplicação (ressonância magnética, tomografia computadorizada, radiografia digital, ultrassom, imagens nucleares, arcos em C e outros), nível de integração (PACS integrado e PACS autônomo), usuário final (hospitais, redes/centros de radiologia, centros cirúrgicos ambulatoriais e outros), canal de distribuição (licitações diretas, administradores terceirizados e outros) - tendências do setor e previsão até 2032

Tamanho do mercado de PACS departamentais da região APAC

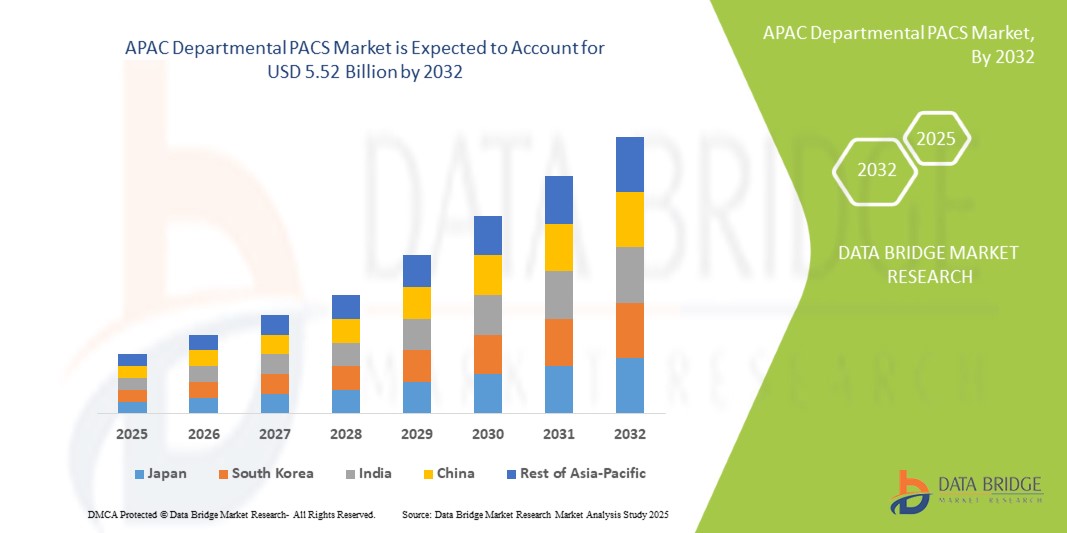

- O tamanho do mercado de PACS departamental da APAC foi avaliado emUS$ 3,39 bilhões em 2024e espera-se que alcanceUS$ 5,52 bilhões até 2032, em umCAGR de 6,30%durante o período de previsão

- Este crescimento é impulsionado por fatores como a crescente digitalização da saúde, o aumento da prevalência de doenças crônicas, os avanços tecnológicos, as iniciativas governamentais, a melhoria da infraestrutura e a adoção em economias emergentes.

Análise de mercado de PACS departamentais da região APAC

- O mercado de PACS departamentais está em constante expansão, impulsionado pela crescente adoção de tecnologias avançadas de saúde em instituições médicas. Hospitais e centros de diagnóstico estão cada vez mais integrando esses sistemas para aprimorar o fluxo de trabalho e o atendimento ao paciente.

- A demanda por soluções PACS departamentais também é influenciada pela crescente necessidade de sistemas eficientes de armazenamento e recuperação de dados em imagens médicas. Esses sistemas fornecem acesso centralizado às imagens dos pacientes, melhorando a precisão do diagnóstico e reduzindo os custos operacionais.

- Espera-se que a China domine o mercado de PACS departamentais da APAC devido à sua infraestrutura avançada de saúde, alta adoção de tecnologias de imagem digital e forte presença de fornecedores líderes de PACS

- Espera-se que a Índia seja a região de crescimento mais rápido no mercado de PACS departamentais da APAC durante o período previsto devido à rápida digitalização da saúde, ao aumento dos investimentos em imagens médicas e à crescente demanda por soluções de diagnóstico eficientes.

- Espera-se que o segmento de PACS especializados domine o mercado com uma participação de mercado de 28% em 2025 devido às suas funcionalidades personalizadas para especialidades médicas específicas, melhorando a precisão do diagnóstico e a eficiência do fluxo de trabalho.

Escopo do relatório e segmentação do mercado de PACS departamental da APAC

|

Atributos |

Principais insights de mercado do PACS departamental da região APAC |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de pipeline, análise de preços e estrutura regulatória. |

Tendências do mercado de PACS departamentais da APAC

“Aumento da integração deInteligência artificialem Sistemas de Imagem”

- A IA está revolucionando as indústrias, melhorando a eficiência, a precisão e a funcionalidade dos sistemas de imagem

- Por exemplo, a DeepMind do Google desenvolveu um sistema de IA que supera os especialistas humanos no diagnóstico de doenças oculares a partir de exames de retina.

- Na área da saúde, os algoritmos de IA analisam imagens médicas (raios-X, ressonâncias magnéticas, tomografias computadorizadas, ultrassons) com alta precisão

- Por exemplo, o software de IA da Aidoc auxilia os radiologistas na identificação rápida de casos críticos em tomografias computadorizadas, reduzindo o tempo de resposta em atendimentos de emergência.

- A IA ajuda a detectar condições como câncer, doenças cardiovasculares e distúrbios neurológicos de forma mais precoce e precisa

- Por exemplo, os modelos de aprendizagem profunda da PathAI auxiliam os patologistas no diagnóstico de tecidos cancerígenos com maior precisão, reduzindo erros de diagnóstico.

- A IA pode identificar padrões em imagens que especialistas humanos podem não perceber, levando a diagnósticos mais rápidos e confiáveis

- Por exemplo, o sistema de IA desenvolvido pela Enlitic demonstrou que pode detectar fraturas sutis em raios X que muitas vezes são ignoradas pelos radiologistas.

- Em segurança, os sistemas de imagem baseados em IA são usados para reconhecimento facial e vigilância para monitorar atividades e identificar indivíduos

Dinâmica do Mercado de PACS Departamental da APAC

Motorista

“Crescente demanda por detecção precoce de doenças”

- A crescente demanda por detecção precoce de doenças está impulsionando o mercado de PACS departamentais da APAC

- Os prestadores de cuidados de saúde estão a concentrar-se nos cuidados preventivos, o que requer tecnologias de imagem avançadas para a identificação precoce de doenças

- Os sistemas PACS permitem o armazenamento, a recuperação e o compartilhamento eficientes deimagens médicas, levando a diagnósticos oportunos e precisos

- A detecção precoce de condições como câncer, doenças cardiovasculares e distúrbios neurológicos resulta em melhores resultados para os pacientes

- A integração de IA e aprendizado de máquina com PACS aumenta a precisão do diagnóstico e a eficiência do fluxo de trabalho, impulsionando o crescimento do mercado

Por exemplo,

- A solução PACS baseada em IA da Aidoc auxilia radiologistas a identificar casos críticos em tomografias computadorizadas mais rapidamente, melhorando a velocidade do diagnóstico em situações de emergência

- A IA DeepMind do Google demonstrou a capacidade de superar especialistas humanos no diagnóstico de doenças oculares a partir de exames de retina, ilustrando o poder da integração da IA no PACS para detecção precoce de doenças.

Oportunidade

“Crescente demanda por soluções PACS baseadas em nuvem”

- A crescente demanda por soluções PACS baseadas em nuvem representa uma oportunidade significativa no mercado de PACS departamentais da APAC

- As organizações de saúde estão cada vez mais buscando reduzir os custos de infraestrutura e melhorar a escalabilidade

- Os PACS baseados em nuvem oferecem flexibilidade, menor investimento de capital inicial e manutenção simplificada em comparação aos sistemas tradicionais no local

- Esses sistemas permitem que os provedores de saúde armazenem e acessem dados de imagens médicas remotamente, o que é especialmente benéfico em regiões com infraestrutura física limitada ou para instalações de saúde que operam em vários locais.

- A escalabilidade da nuvem ajuda a gerenciar o crescente volume de dados de imagens médicas sem a necessidade de atualizações constantes de hardware

Por exemplo,

- A Ambra Health oferece soluções PACS baseadas em nuvem que permitem aos provedores de saúde acessar e compartilhar dados de imagem remotamente, reduzindo custos de infraestrutura e melhorando a flexibilidade operacional.

- A Everlight Radiology usa PACS baseado em nuvem para fornecer relatórios de radiologia em tempo real, permitindo acesso a opiniões de especialistas em áreas carentes, melhorando o atendimento ao paciente e a eficiência do diagnóstico.

Restrição/Desafio

“Altos custos associados à implementação”

- Os altos custos associados à implementação de sistemas de gerenciamento de imagens médicas, como PACS, atuam como uma restrição significativa para o mercado de PACS departamentais da APAC

- Os custos incluem não apenas o investimento inicial em hardware e software, mas também despesas contínuas relacionadas à manutenção do sistema, atualizações e treinamento de pessoal.

- As unidades de saúde menores e aquelas em regiões em desenvolvimento muitas vezes enfrentam restrições orçamentárias, o que dificulta a alocação de fundos para soluções avançadas de imagem.

- O ônus financeiro da integração do PACS com os sistemas de informação hospitalares existentes, garantindo a segurança dos dados e cumprindo as regulamentações de saúde aumenta ainda mais os custos

- Esses desafios econômicos podem impedir que os provedores de saúde adotem a tecnologia PACS, apesar de seus benefícios na melhoria da precisão do diagnóstico e da eficiência operacional.

Por exemplo,

- Em muitos hospitais rurais da Índia, os altos custos de implementação dos sistemas PACS atrasaram a adoção dessas tecnologias, limitando o acesso a ferramentas avançadas de diagnóstico.

- Um estudo da Organização Mundial da Saúde (OMS) destacou que as pequenas clínicas no Sudeste Asiático enfrentam dificuldades com os custos de instalação e manutenção de sistemas PACS, o que prejudica sua capacidade de fornecer serviços de imagem de alta qualidade.

Escopo de mercado de PACS departamentais da APAC

O mercado é segmentado com base no tipo de produto, componente, aplicação, nível de integração, usuário final e canal de distribuição.

|

Segmentação |

Sub-segmentação |

|

Por tipo de produto |

|

|

Por componente |

|

|

Por aplicação |

|

|

Por nível de integração |

|

|

Por usuário final |

|

|

Por canal de distribuição |

|

Em 2025, projeta-se que as soluções PACS especializadas dominem o mercado com a maior participação no segmento de tipo de produto

Espera-se que o segmento de PACS especializados domine o mercado de PACS departamentais da APAC com a maior participação de 28% em 2025 Graças às suas soluções personalizadas que atendem a especialidades médicas específicas, como oncologia, cardiologia, ortopedia e oftalmologia, esses sistemas são projetados para lidar com dados de imagem complexos, melhorando a precisão diagnóstica e a eficiência do fluxo de trabalho.

Espera-se que a ressonância magnética seja responsável pela maior fatia do mercado de tecnologia durante o período previsto

Em 2025, espera-se que o segmento de ressonância magnética domine o mercado, com a maior participação de mercado, de 30% a 35%, devido ao seu papel fundamental em diagnósticos não invasivos e à sua capacidade de fornecer imagens de alta resolução de tecidos moles. A ressonância magnética é amplamente utilizada para diagnosticar distúrbios neurológicos, problemas musculoesqueléticos, cânceres e outras condições complexas.

Análise regional do mercado de PACS departamental da região APAC

“A China detém a maior participação no mercado de PACS departamentais da APAC”

- Espera-se que a China detenha a maior quota de mercado devido à sua robusta infraestrutura de saúde e à ampla adoção de tecnologias avançadas de imagem

- Os investimentos substanciais do país na digitalização da saúde e na expansão da rede hospitalar contribuem para sua posição de liderança no mercado de PACS

- Com o crescimento da indústria de dispositivos médicos, a China está bem posicionada para manter seu domínio no setor de PACS

- Iniciativas governamentais que apoiam ferramentas de saúde digital fortalecem ainda mais a integração de sistemas PACS em instalações de saúde na China

“A Índia deverá registrar o maior CAGR no mercado de PACS departamentais da região APAC”

- A Índia deverá experimentar a maior taxa de crescimento anual composta (CAGR) no mercado de PACS da APAC, impulsionada pela expansão do seu setor de saúde

- A crescente demanda por soluções avançadas de imagem nas indústrias de dispositivos médicos e hospitalares em rápido desenvolvimento da Índia alimenta o rápido crescimento do mercado

- O setor de saúde da Índia é um impulsionador fundamental, respondendo por uma parcela significativa do setor médico em geral, impulsionando a adoção do PACS

- O número crescente de hospitais e centros de diagnóstico na Índia destaca a necessidade de sistemas de imagem eficientes, acelerando o crescimento do PACS na região

Participação de mercado de PACS departamentais da APAC

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluem visão geral da empresa, finanças da empresa, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, presença global, locais e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, abrangência e amplitude do produto e domínio da aplicação. Os pontos de dados fornecidos acima referem-se apenas ao foco das empresas em relação ao mercado.

Os principais líderes de mercado que operam no mercado são:

- Corporação FUJIFILM(Japão)

- Mach 7 Technologies Limited (Austrália)

- Reyence (Japão)

- SinoVision (China)

- TeleRAD Reporting Services Private Limited (Índia)

- Canon Medical Systems Corporation(Japão)

- Konica Minolta, Inc.(Japão)

- INFINITT Saúde(Coréia do Sul)

- Samsung Medison(Coréia do Sul)

Últimos desenvolvimentos no mercado de PACS departamentais da APAC

- Em janeiro de 2024, a FUJIFILM Diosynth Biotechnologies (EUA) e a SHL Medical (Suíça) firmaram uma parceria estratégica para atender à crescente demanda do mercado por medicamentos autoinjetores. A colaboração aumentará a capacidade de produção da FUJIFILM na Dinamarca, atingindo até 30 milhões de unidades anuais até o início de 2025. Ao integrar a plataforma de autoinjetores Molly da SHL, a parceria visa otimizar os processos de produção e reduzir os riscos da cadeia de suprimentos. Este desenvolvimento beneficiará empresas farmacêuticas e de biotecnologia, proporcionando prazos mais rápidos para o lançamento no mercado e melhorando o acesso dos pacientes a medicamentos autoinjetores.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.