>Mercado de laboratórios dentários da Ásia-Pacífico, por produtos (dispositivos gerais e de diagnóstico, dispositivos baseados em tratamento e outros), tendências da indústria e previsão para 2029

Análise e insights de mercado

Os equipamentos do laboratório dentário incluem toda a gama de sistemas utilizados para o fabrico de próteses dentárias fixas ou removíveis. A tarefa do técnico de laboratório dentário é fabricar coroas, pontes, próteses dentárias e aparelhos ortodônticos com base na prescrição de um médico dentista. Muitas destas tarefas exigem uma elevada precisão e a habilidade do técnico pesa muito no sucesso final do tratamento. Os técnicos de laboratório são formados no trabalho ou em programas de educação formal.

O avanço tecnológico na indústria dentária é a utilização de processos de design assistido por computador e de fabrico assistido por computador (CAD/CAM); processo, desenvolvendo dispositivos de digitalização 3D de alta definição, software de design mais preciso, rápido e simples e fabrico subtrativo ou aditivo preciso de materiais inovadores.

Definição de mercado

A principal função de um laboratório dentário é fornecer medicina dentária restauradora, copiar perfeitamente todos os parâmetros funcionais e estéticos que foram definidos pelo médico dentista numa solução restauradora. Ao longo de todo o processo restaurador, desde a consulta inicial do paciente, diagnóstico e planeamento do tratamento até à colocação final da restauração, as vias de comunicação entre o médico dentista e o técnico de laboratório podem agora proporcionar uma transferência completa de informação. Componentes funcionais, parâmetros oclusais, fonética e requisitos estéticos são apenas alguns dos tipos de informação essenciais necessárias para que os técnicos concluam o fabrico de restaurações funcionais e estéticas bem-sucedidas. Hoje, tal como no passado, as ferramentas de comunicação entre o médico dentista e o técnico incluem a fotografia, a documentação escrita e as impressões da dentição existente do paciente.

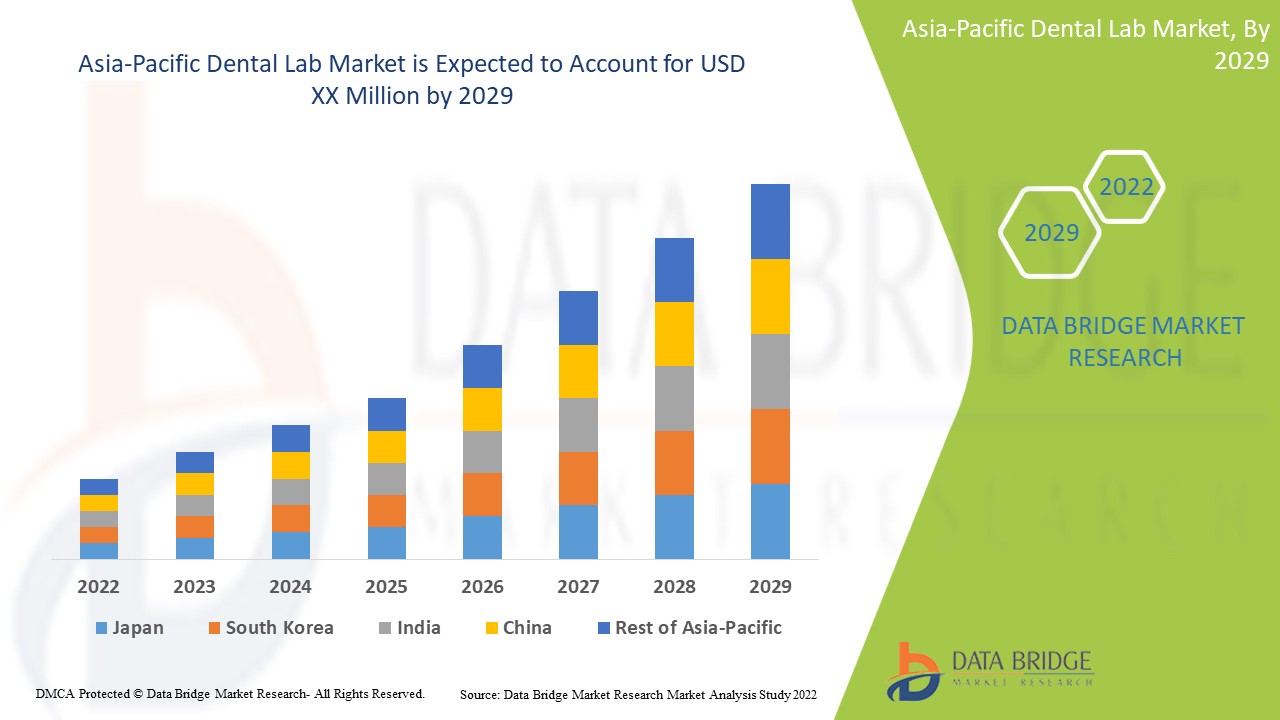

O laboratório dentário da Ásia-Pacífico apoia e visa reduzir a gravidade dos sintomas. A Data Bridge Market Research analisa que o mercado de laboratórios dentários irá crescer a um CAGR de 13,4%, durante o período previsto de 2022 a 2029.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (personalizável para 2019 - 2014) |

|

Unidades Quantitativas |

Receita em milhões de dólares, preços em dólares |

|

Segmentos cobertos |

Por Produtos (Dispositivos Gerais e de Diagnóstico, Dispositivos Baseados no Tratamento e Outros) |

|

Países abrangidos |

Japão, Índia, China, Coreia do Sul, Austrália, Singapura, Tailândia, Malásia, Indonésia, Filipinas e Resto da Ásia-Pacífico |

|

Participantes do mercado abrangidos |

Ultradent Products Inc., A-dec Inc., BioHorizons IPH Inc., Carestream Health, Dentatus, Roland DGA Corporation, 3Shape A/S, Formlabs, PLANMECA OY, Septodont, 3M, BEGO GmbH & Co. Schein, Inc., GC Corporation, BIOLASE, Inc., Bicon, LLC, Dentsply Sirona, Envista (uma subsidiária da Danaher Corporation)., Kulzer GmbH. (uma subsidiária da Mitsui Chemicals, Inc), CAMLOG Biotechnologies GmbH, Zimvie Inc. (uma subsidiária da Zimmer Biomet), Institut Straumann AG e OSSTEM UK |

Dinâmica do mercado de laboratórios dentários da Ásia-Pacífico

Motoristas

- Elevada prevalência de doenças dentárias

A saúde oral é um dos aspetos mais importantes para manter a saúde das gengivas, dos dentes e do sistema buco-facial, que permite falar, mastigar e sorrir. De acordo com o relatório da Organização Mundial de Saúde de março de 2022, cerca de 2,0 mil milhões de pessoas em todo o mundo sofrem de cárie num dente permanente, entre as quais cerca de 520 milhões de crianças sofrem de cárie no dente decíduo .

Os distúrbios dentários mais comuns incluem cáries, doenças periodontais e cancro oral.

Por exemplo,

- Em 2021, nos EUA, os dados dos Centros de Controlo e Prevenção de Doenças (CDC) referem que mais de 1 em cada 4 (26%) adultos nos EUA tem cáries dentárias não tratadas. 70,1% dos adultos com 65 ou mais anos têm doença periodontal e 47,2% dos adultos com 30 ou mais anos têm alguma forma de doença periodontal

Como as empresas estão constantemente envolvidas em actividades de investigação e desenvolvimento, o conhecimento sobre a prevalência de distúrbios orais ajudaria a encontrar novas soluções e isso ajudaria em mais colaborações e parcerias com intervenientes no mercado em países como a região Ásia-Pacífico. Assim, espera-se que o aumento dos casos de distúrbios dentários, como a cárie dentária, a cárie dentária e o cancro oral, impulsione o crescimento do mercado global de laboratórios dentários.

- Aumento da atividade de investigação e desenvolvimento nas indústrias dentárias

A pressão sobre os preços resultou em alterações na dinâmica central da indústria de implantes dentários. As inovações criaram um aumento substancial do número de intervenientes locais e regionais envolvidos na criação de produtos semelhantes e na sua oferta a um custo mais baixo.

Por exemplo,

- Em 2018, a Young Innovations (EUA) anunciou a aquisição da Johnson-Promidet (EUA). A empresa concentra-se em soluções de peças de mão dentárias de alta qualidade. Esta aquisição resultará no fornecimento de produtos e soluções inovadores e de alta qualidade para os médicos e os seus pacientes e também na melhoria do seu portefólio de marcas e produtos através do crescimento orgânico e de aquisições.

O aumento das atividades de investigação e desenvolvimento tornou as empresas mais ativas na expansão dos seus serviços no mercado visando mais clientes no mercado levando a um crescimento no mercado global de laboratórios dentários.

Oportunidades

- Lançamentos de novos produtos

The major players are also trying to devise specific strategies, such as product launches, acquisitions, approvals, expansions, and partnerships, to ensure the smooth running of the business, avoid risks, and increase the long-term growth in the sales of the market.

The companies which are involved in the dental lab market have been coming up with various new products based on new technologies most noticeable launches amongst these in the field of dental labs are in the field of Dental Imaging and digital dentistry.

For instance,

- In 2019, Zimmer Biomet (Indiana, U.S.) announced the launch of its new line of non-resorbable membranes and sutures which are specifically designed to eliminate bacterial infiltration into the surgical site

These strategic initiatives such as by the market players, including acquisition, conferences, and focused segment product launches, are helping the companies grow and improve the company's product portfolio, ultimately leading to more revenue generation. Hence, these strategic initiatives by the market players provide an opportunity that is helping them to drive market growth.

Restraints/Challenges

- Lack Of Proper Reimbursement Scenario

There is a rapid change that is occurring in the dentistry treatments, dental insurance, reimbursement rates, and rules and regulations are also changing. The dental billing services have been aiming at submitting accurate claims to insurance payers and have been receiving maximum reimbursement; these claims are being declined due to many factors which may include invalid documentation amongst others. The survey conducted by Bankers Healthcare Group (BHG) revealed that the decline in the reimbursement rates is a very major concern amongst the dental professionals.

The current coverage evaluation procedure lacks transparency, and also it differs among different payers, which ultimately leads to inconsistent coverage decisions and hence limits healthcare professionals and patients' to access the best treatment. This insurance issue hinders the market and creates various challenges for the industry making it an accountable restrain to the market.

- Lack Of Skilled Technicians

There is a shortage of skilled labor in the field of healthcare in emerging or developing countries due to migrations and several other factors.

Africa had the most inadequate health system especially dealing with the regions in sub-Saharan Africa, which have been severely damaged due to the migration of the health professionals. On average 57 countries were noted to have a critical shortage of healthcare workers with a deficit of around 2.4 million doctors and nurses.

Covid-19 Impact on the Dental Lab Market

During the pandemic, dental lab has a remarkable effect on reducing mortality and morbidity of patients with COVID-19. Further large-scale studies are needed to approve these results. A protocol for dental lab in COVID-19 infection should be defined to achieve the best possible clinical outcomes. Dental laboratories and the technicians are leaving declining levels of extinction. According to National Center of Biotechnology Information, studies have shown that there is high level of contamination for dental impressions arriving in a dental laboratory.

Recent Development

- In September, Envista formed an agreement with Planmeca OY. The agreement stated that, Envista, would sell its KaVo Treatment Unit and Instrument business to Planmeca OY for USD 455 million, for the potential earn-out payment of up to USD 30 million. It would increase the number of customers and increase the availability of KaVo Treatment Unit across dental clinics.

Asia-Pacific Dental Lab Market Scope

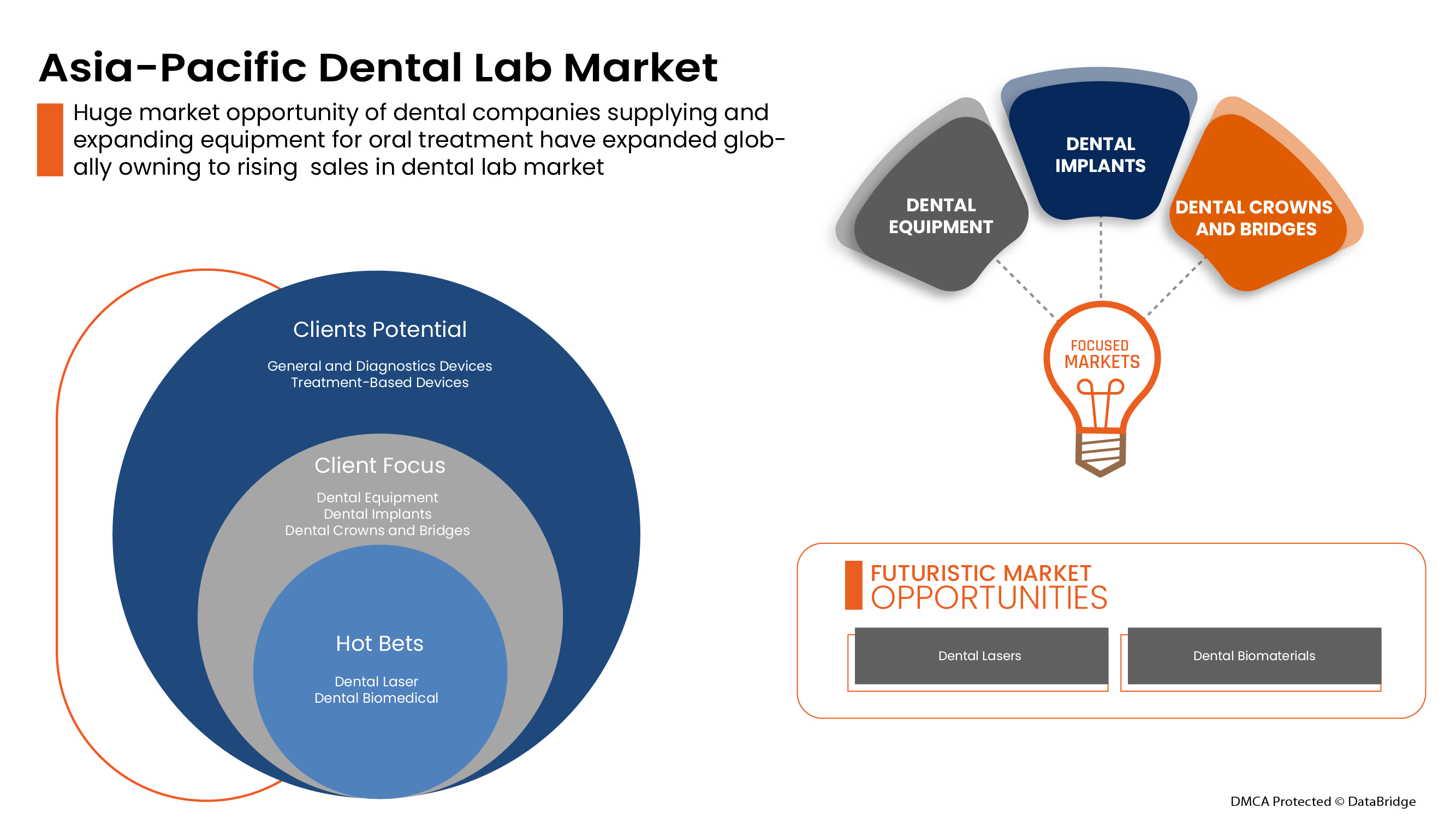

The dental lab market is segmented on the basis of one segment: products. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Products

- General & Diagnostic Devices

- Treatment-Based Devices

- Others

On the basis of products, the Asia-Pacific dental lab market is segmented into general & diagnostic devices, treatment-based devices and others.

Pipeline Analysis

Dental lab Market Regional Analysis/Insights

The Asia-Pacific dental lab market is analysed and market size insights and trends are provided by regions, product as referenced above.

The countries covered in the dental lab market report are Japan, India, China, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines and Rest of Asia Pacific.

China is expected to dominate the market due to rise in cases of periodontal disorders, rise in medical tourism and the rise in patient population dental lab in Asia-Pacific region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Dental lab Market Share Analysis

O panorama competitivo do mercado de laboratórios dentários da Ásia-Pacífico fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na Ásia-Pacífico, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produtos, largura do produto e amplitude, domínio de aplicação. Os dados acima fornecidos estão apenas relacionados com o foco das empresas no mercado dos laboratórios dentários.

Alguns dos principais players que operam no mercado dos laboratórios dentários são a Ultradent Products Inc., A-dec Inc., BioHorizons IPH Inc., Carestream Health, Dentatus, Roland DGA Corporation, 3Shape A/S, Formlabs, PLANMECA OY, Septodont, 3M KG, VOCO Gmbh, Henry Schein, Inc., GC Corporation, BIOLASE, Inc., Bicon, LLC, Dentsply Sirona, Envista (uma subsidiária da Danaher Corporation)., Kulzer GmbH. (uma subsidiária da Mitsui Chemicals, Inc), CAMLOG Biotechnologies GmbH, Zimvie Inc. (uma subsidiária da Zimmer Biomet), Institut Straumann AG e OSSTEM UK, entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC DENTAL LAB MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 ASIA PACIFIC DENTAL LABMARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 ASIA PACIFIC DENTAL LAB MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID GROWTH IN THE GERIATRIC POPULATION

6.1.2 HIGH PREVALENCE OF DENTAL DISORDERS

6.1.3 RISE IN RESEARCH AND DEVELOPMENT ACTIVITY IN DENTAL INDUSTRIES

6.1.4 INCREASING AWARENESS OF PERIODONTAL DISEASE

6.1.5 GROWING MEDICAL TOURISM FOR DENTAL PROCEDURES

6.2 RESTRAINTS

6.2.1 HIGH COST OF DENTAL EQUIPMENT AND MATERIALS

6.2.2 LACK OF PROPER REIMBURSEMENT SCENARIO

6.2.3 LACK OF DENTAL KNOWLEDGE IN EMERGING COUNTRIES

6.3 OPPORTUNITIES

6.3.1 NEW PRODUCT RELEASES

6.3.2 INCREASED AESTHETIC DENTISTRY IN DENTAL LABS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED TECHNICIANS

6.4.2 DELAYED ADOPTION OF ADVANCED TECHNOLOGIES IN EMERGING ECONOMIES

7 ASIA PACIFIC DENTAL LAB MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 GENERAL AND DIAGNOSTICS DEVICES

7.2.1 DENTAL EQUIPMENT

7.2.1.1 DENTAL CHAIRS

7.2.1.2 HAND PIECES

7.2.1.3 LIGHT CURE EQUIPMENT

7.2.1.4 SCALING UNITS

7.2.2 DENTAL IMPLANTS

7.2.2.1 TITANIUM DENTAL IMPLANTS

7.2.2.2 ZIRCONIA DENTAL IMPLANTS

7.2.3 DENTAL CROWNS & BRIDGES

7.2.3.1 METAL-FUSED CERAMIC CROWNS

7.2.3.2 CERAMIC CAD/CAM

7.2.3.3 CERAMIC CONVENTIONAL CROWNS & BRIDGES

7.2.4 DENTAL SYSTEMS AND PARTS

7.2.4.1 INSTRUMENT DELIVERY SYSTEMS

7.2.4.2 CONE BEAM CT SCANNING

7.2.4.3 CAD/CAM SYSTEMS

7.2.4.4 3D PRINTERS

7.2.4.5 DENTAL MILLING MACHINE

7.2.5 DENTAL RADIOLOGY EQUIPMENT

7.2.5.1 EXTRA-ORAL RADIOLOGY

7.2.5.1.1 FILM-BASED DEVICES

7.2.5.1.2 DIGITAL DEVICES

7.2.5.2 INTRA-ORAL RADIOLOGY

7.2.5.2.1 BITEWINGS

7.2.5.2.2 PERIAPICALS

7.2.5.2.3 OCCUSAL

7.2.6 DENTAL BIOMATERIALS

7.2.7 DENTAL LASERS

7.2.7.1 DIODE LASERS

7.2.7.2 YTTRIUM LASERS

7.2.7.3 CO2 LASERS

7.3 TREATMENT-BASED DEVICES

7.3.1 ORTHODONTICS

7.3.1.1 REMOVABLE

7.3.1.2 FIXED

7.3.1.2.1 BRACKETS

7.3.1.2.2 ARCHWIRES

7.3.1.2.3 ANCHORAGE APPLIANCES

7.3.1.2.4 LIGATURES

7.3.2 ENDOTONICS

7.3.2.1 PERMANENT ENDODONTIC SEALERS

7.3.2.2 OBTURATORS

7.3.3 PERIODONTICS

7.3.3.1 DENTAL ANESTHETICS

7.3.3.1.1 INJECTABLE ANESTHETICS

7.3.3.1.2 TOPICAL ANESTHETICS

7.3.3.2 DENTAL SUTURES

7.3.3.3 DENTAL HEMOSTATS

7.3.3.3.1 COLLAGEN-BASED HEMOSTATS

7.3.3.3.2 OXIDIZED REGENERATED CELLULOSE-BASED HEMOSTATS

7.3.3.3.3 GELATIN-BASED HEMOSTATS

7.4 OTHERS

7.4.1 OTHER DENTAL LABORATORY MACHINES

7.4.2 HYGIENE MAINTENANCE DEVICES

7.4.3 RETAIL DENTAL CARE ESSENTIALS

7.4.4 OTHER CONSUMABLES

8 ASIA PACIFIC DENTAL LAB MARKET, BY REGION

8.1 ASIA-PACIFIC

8.1.1 CHINA

8.1.2 JAPAN

8.1.3 INDIA

8.1.4 SOUTH KOREA

8.1.5 AUSTRALIA

8.1.6 SINGAPORE

8.1.7 THAILAND

8.1.8 MALAYSIA

8.1.9 INDONESIA

8.1.10 PHILIPPINES

8.1.11 REST OF ASIA-PACIFIC

9 ASIA PACIFIC DENTAL LAB MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 HENRY SCHEIN, INC.(2021)

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENTS

11.2 DENTSPLY SIRONA (2021)

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENTS

11.3 ENVISTA (A SUBSIDIARY OF DANAHER CORPORATION) (2021)

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT DEVELOPMENTS

11.4 INSTITUT STRAUMANN AG (2021)

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 COMPANY SHARE ANALTSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT DEVELOPMENTS

11.5 PLANMECA OY. (2021)

11.5.1 COMPANY SNAPSHOT

11.5.2 COMPANY SHARE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENTS

11.6 3M (2021)

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENTS

11.7 A-DEC-IN (2021)

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENTS

11.8 BIOHORIZONS IPH, INC. (2021)

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENTS

11.9 BIOLASE, INC.(2021)

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT DEVELOPMENTS

11.1 BEGO GMBH & CO. KG

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENTS

11.11 BICON, LLC

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT DEVELOPMENTS

11.12 CAMLOG BIOTECHNOLOGIES GMBH

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENTS

11.13 CARESTREAM HEALTH (2021)

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT DEVELOPMENTS

11.14 DENTATUS (2021)

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT DEVELOPMENTS

11.15 FORMLABS (2021)

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENTS

11.16 GC CORPORATION

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT DEVELOPMENTS

11.17 KULZER GMBH (A SUBSIDIARY OF MITSUI CHEMICALS, INC) (2021)

11.17.1 COMPANY SNAPSHOT

11.17.2 REVENUE ANALYSIS

11.17.3 PRODUCT PORTFOLIO

11.17.4 RECENT DEVELOPMENTS

11.18 OSSTEM U.K.(2021)

11.18.1 COMPANY SNAPSHOT

11.18.2 PRODUCT PORTFOLIO

11.18.3 RECENT DEVELOPMENTS

11.19 PINDAN DENTAL LABORATORY

11.19.1 COMPANY SNAPSHOT

11.19.2 PRODUCT PORTFOLIO

11.19.3 RECENT DEVELOPMENTS

11.2 ROLAND DG CORPORATION (2021)

11.20.1 COMPANY SNAPSHOT

11.20.2 REVENUE ANALYSIS

11.20.3 PRODUCT PORTFOLIO

11.20.4 RECENT DEVELOPMENTS

11.21 SEPTODONT (2021)

11.21.1 COMPANY SNAPSHOT

11.21.2 PRODUCT PORTFOLIO

11.21.3 RECENT DEVELOPMENTS

11.22 3 SHAPE A/S (2021)

11.22.1 COMPANY SNAPSHOT

11.22.2 PRODUCT PORTFOLIO

11.22.3 RECENT DEVELOPMENTS

11.23 ULTRADENT PRODUCTS INC (2021)

11.23.1 COMPANY SNAPSHOT

11.23.2 PRODUCT PORTFOLIO

11.23.3 RECENT DEVELOPMENTS

11.24 VOCO GMBH (2021)

11.24.1 COMPANY SNAPSHOT

11.24.2 PRODUCT PORTFOLIO

11.24.3 RECENT DEVELOPMENTS

11.25 YOUNG INNOVATIONS, INC (2021)

11.25.1 COMPANY SNAPSHOT

11.25.2 PRODUCT PORTFOLIO

11.25.3 RECENT DEVELOPMENTS

11.26 ZIMVIE INC. (A SUBSIDIARY OF ZIMMET BIOMET HOLDINGS)(2021)

11.26.1 COMPANY SNAPSHOT

11.26.2 REVENUE ANALYSIS

11.26.3 PRODUCT PORTFOLIO

11.26.4 RECENT DEVELOPMENTS

12 QUESTIONNAIRE

13 RELATED REPORTS

Lista de Tabela

TABLE 1 DENTAL TREATMENT COSTS IN THE U.K.

TABLE 2 AESTHETIC PROCEDURES AND COST RANGES IN THE U.S. (2018)

TABLE 3 ASIA PACIFIC DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC GENERAL & DIAGNOSTICS DEVICES IN DENTAL LAB MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC GENERAL & DIAGNOSTICS DEVICES IN DENTAL LAB MARKET, BY PRODUCTS ,2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC DENTAL CROWNS & BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC DENTAL RADIOLOGY EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ENDODONTICS IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC OTHERS IN DENTAL LAB MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 24 ASIA-PACIFIC DENTAL LAB MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 43 CHINA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 44 CHINA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 45 CHINA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 46 CHINA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 47 CHINA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 48 CHINA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 49 CHINA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 50 CHINA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 51 CHINA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 52 CHINA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 53 CHINA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 54 CHINA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 55 CHINA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 56 CHINA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 57 CHINA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 58 CHINA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 59 CHINA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 60 CHINA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 61 JAPAN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 62 JAPAN GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 63 JAPAN DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 64 JAPAN DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 65 JAPAN DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 66 JAPAN DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 67 JAPAN DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 68 JAPAN EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 69 JAPAN INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 70 JAPAN DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 71 JAPAN TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 72 JAPAN ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 73 JAPAN FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 74 JAPAN ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 75 JAPAN PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 76 JAPAN DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 77 JAPAN DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 78 JAPAN OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 79 INDIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 80 INDIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 81 INDIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 82 INDIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 83 INDIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 84 INDIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 85 INDIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 86 INDIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 87 INDIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 88 INDIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 89 INDIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 90 INDIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 91 INDIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 92 INDIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 93 INDIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 94 INDIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 95 INDIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 96 INDIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 105 SOUTH KOREA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 106 SOUTH KOREA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 107 SOUTH KOREA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 108 SOUTH KOREA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 109 SOUTH KOREA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 110 SOUTH KOREA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 111 SOUTH KOREA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 112 SOUTH KOREA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 113 SOUTH KOREA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 114 SOUTH KOREA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 123 AUSTRALIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 124 AUSTRALIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 125 AUSTRALIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 126 AUSTRALIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 127 AUSTRALIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 128 AUSTRALIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 129 AUSTRALIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 130 AUSTRALIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 131 AUSTRALIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 132 AUSTRALIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 135 SINGAPORE DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 146 SINGAPORE ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 147 SINGAPORE PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 148 SINGAPORE DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 149 SINGAPORE DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 150 SINGAPORE OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 151 THAILAND DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 152 THAILAND GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 153 THAILAND DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 154 THAILAND DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 155 THAILAND DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 156 THAILAND DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 157 THAILAND DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 158 THAILAND EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 159 THAILAND INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 160 THAILAND DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 161 THAILAND TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 162 THAILAND ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 163 THAILAND FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 164 THAILAND ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 165 THAILAND PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 166 THAILAND DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 167 THAILAND DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 168 THAILAND OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 169 MALAYSIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 170 MALAYSIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 171 MALAYSIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 172 MALAYSIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 173 MALAYSIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 174 MALAYSIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 175 MALAYSIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 176 MALAYSIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 177 MALAYSIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 178 MALAYSIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 179 MALAYSIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 180 MALAYSIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 181 MALAYSIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 182 MALAYSIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 183 MALAYSIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 184 MALAYSIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 185 MALAYSIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 186 MALAYSIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 187 INDONESIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 189 INDONESIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 191 INDONESIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 192 INDONESIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 193 INDONESIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 194 INDONESIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 195 INDONESIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 196 INDONESIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 197 INDONESIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 198 INDONESIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 199 INDONESIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 200 INDONESIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 201 INDONESIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 202 INDONESIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 203 INDONESIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 204 INDONESIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 205 PHILIPPINES DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 206 PHILIPPINES GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 207 PHILIPPINES DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 208 PHILIPPINES DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 209 PHILIPPINES DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 210 PHILIPPINES DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 211 PHILIPPINES DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 212 PHILIPPINES EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 213 PHILIPPINES INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 214 PHILIPPINES DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 215 PHILIPPINES TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 216 PHILIPPINES ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 217 PHILIPPINES FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 218 PHILIPPINES ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 219 PHILIPPINES PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 220 PHILIPPINES DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 221 PHILIPPINES DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 222 PHILIPPINES OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 223 REST OF ASIA-PACIFIC DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 ASIA PACIFIC DENTAL LAB MARKET : SEGMENTATION

FIGURE 2 ASIA PACIFIC DENTAL LABMARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC DENTAL LABMARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC DENTAL LABMARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC DENTAL LABMARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC DENTAL LABMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC DENTAL LABMARKET: DBMR POSITION GRID

FIGURE 8 ASIA PACIFIC DENTAL LABMARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC DENTAL LAB MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC DENTAL LAB MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASED INCIDENCE OF DENTAL DISEASES, RISE IN PRODUCT LAUNCHES AND MEDICAL TOURISM FOR DENTAL TREATMENT ACROSS THE WORLD IS EXPECTED TO DRIVE THE ASIA PACIFIC DENTAL LAB MARKET FROM 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE ASIA PACIFIC DENTAL LAB MARKET FROM 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC DENTAL LAB MARKET

FIGURE 14 FORECAST GERIATRIC POPULATION 2010-2050 TIME PERIOD (IN MILLIONS)

FIGURE 15 INCREASED INCIDENCE OF PERIODONTAL DISEASE IN THE U.S., 2020

FIGURE 16 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, 2021

FIGURE 17 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, 2022-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC DENTAL LAB MARKET: SNAPSHOT (2021)

FIGURE 21 ASIA-PACIFIC DENTAL LAB MARKET: BY COUNTRY (2021)

FIGURE 22 ASIA-PACIFIC DENTAL LAB MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 ASIA-PACIFIC DENTAL LAB MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 ASIA-PACIFIC DENTAL LAB MARKET: BY PRODUCTS (2022-2029)

FIGURE 25 ASIA PACIFIC DENTAL LAB MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.