Asia Pacific Compressed Natural Gas Cng Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

41.10 Billion

USD

55.47 Billion

2024

2032

USD

41.10 Billion

USD

55.47 Billion

2024

2032

| 2025 –2032 | |

| USD 41.10 Billion | |

| USD 55.47 Billion | |

|

|

|

|

Segmentação do mercado de gás natural comprimido (GNC) da Ásia-Pacífico, por fonte (gás associado e gás não associado), kits (sequenciais e Venturi), tipo de distribuição (cilindros/tanques, acumuladores, coletores compostos e outros), uso final (veículos leves, médios e pesados) – Tendências e previsões do setor até 2032

Tamanho do mercado de gás natural comprimido da Ásia-Pacífico

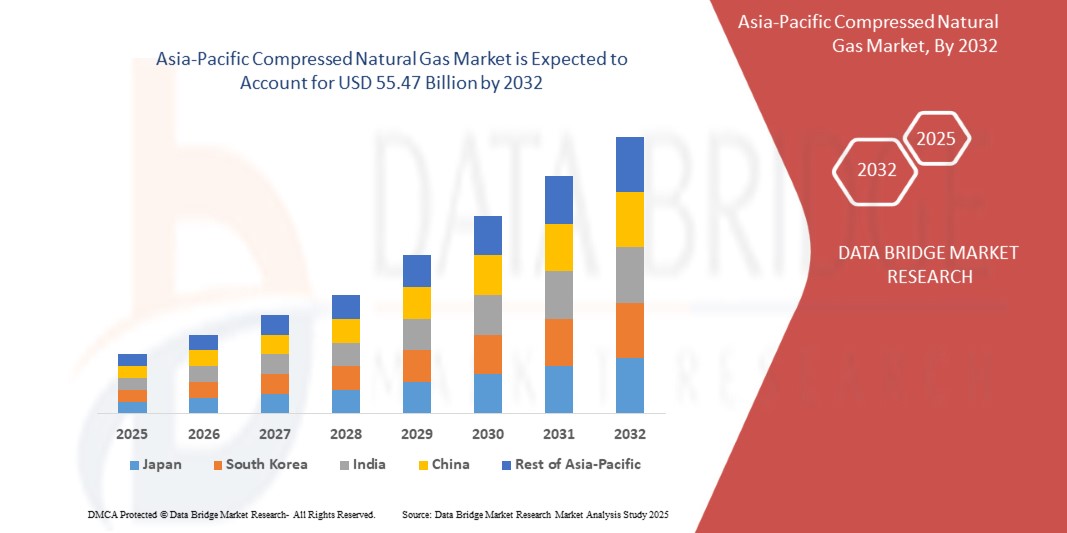

- O tamanho do mercado de gás natural comprimido (GNC) da Ásia-Pacífico foi avaliado em US$ 41,1 bilhões em 2024 e está projetado para atingir US$ 55,47 bilhões até 2032 , registrando um CAGR de 3,8% durante o período previsto.

- O crescimento do mercado é impulsionado, em grande parte, pela rápida urbanização, pelo aumento da demanda por combustíveis limpos para transporte e pelas iniciativas governamentais para reduzir as emissões de gases de efeito estufa. Países como China, Índia e Paquistão lideram a adoção do gás natural comprimido devido ao forte apoio político e ao crescimento da frota de veículos.

- Além disso, o aumento do custo dos combustíveis convencionais, como a gasolina e o gasóleo, encorajou tanto os consumidores individuais como os operadores de frotas a optarem pelo gás natural comprimido como uma alternativa mais económica e amiga do ambiente.

- Coletivamente, esses impulsionadores estão posicionando o gás natural comprimido como um combustível essencial na transição para energia limpa na Ásia-Pacífico, especialmente no setor de transportes, onde a demanda por soluções de mobilidade acessíveis e sustentáveis continua a aumentar.

Análise do Mercado de Gás Natural Comprimido da Ásia-Pacífico

- O mercado de gás natural comprimido da Ásia-Pacífico está testemunhando um forte crescimento devido à forte dependência da região no transporte rodoviário, combinado com iniciativas de combustível limpo apoiadas pelo governo e incentivos financeiros para consumidores e fabricantes

- A China e a Índia dominam coletivamente o mercado regional, com investimentos em larga escala em redes de distribuição de gás natural comprimido, programas de conversão de veículos e políticas que exigem o uso de combustível limpo em frotas de transporte público.

- A crescente adoção de veículos motorizados leves (LMVs) movidos a gás natural comprimido, como automóveis de passageiros e veículos de três rodas, é um importante impulsionador do crescimento, apoiado pela acessibilidade, menores custos operacionais e maior disponibilidade de postos de abastecimento.

- A Índia é o mercado com crescimento mais rápido, com projeção de crescimento de gás natural comprimido de 8,9% (2025–2032), apoiado pela rápida expansão da infraestrutura de abastecimento, subsídios para veículos movidos a GNC e aumento da demanda de frotas de passageiros e comerciais.

- A China dominará o mercado de gás natural comprimido da Ásia-Pacífico em 2024, avaliado em US$ 13,6 bilhões, devido às suas vastas reservas de gás natural, adoção em larga escala no transporte público e políticas de redução de emissões apoiadas pelo governo.

- O segmento de gás não associado dominou o mercado em 2024, detendo a maior fatia da receita, apoiado por vastas reservas em países como China, Índia e Indonésia

Escopo do Relatório e Segmentação do Mercado de Gás Natural Comprimido da Ásia-Pacífico

|

Atributos |

Principais insights do mercado de gás natural comprimido da Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além do valor de mercado, taxa de crescimento, segmentação, cobertura regional e principais participantes, o relatório inclui análise aprofundada de especialistas, análise de preços e custos, padrões de demanda do consumidor, estrutura política e regulatória, tendências de adoção de tecnologia, insights sobre a cadeia de suprimentos e de valor e análise das Cinco Forças de PESTLE e Porter. |

Tendências do mercado de gás natural comprimido na Ásia-Pacífico

Adoção crescente de veículos movidos a GNC impulsionada por iniciativas de energia limpa

- Uma tendência significativa no mercado de gás natural comprimido da Ásia-Pacífico é a crescente adoção de veículos movidos a gás natural comprimido, apoiada por iniciativas governamentais de energia limpa, normas de emissão mais rigorosas e vantagens crescentes no custo do combustível em comparação com a gasolina e o diesel.

- Por exemplo, a Índia e a China estão expandindo rapidamente suas redes de postos de abastecimento de gás natural comprimido, com a indiana GAIL e a Indraprastha Gas Limited investindo pesadamente em corredores urbanos e rodoviários. Da mesma forma, a chinesa CNPC e a Sinopec estão ampliando a infraestrutura de gás natural comprimido para se alinhar às metas de redução de carbono.

- As montadoras estão lançando mais veículos compatíveis com gás natural comprimido nas categorias leve, médio e pesado para atender à crescente demanda, especialmente em frotas de transporte público urbano e setores de logística comercial. Empresas como a Maruti Suzuki, na Índia, e a Hyundai, na Coreia do Sul, estão fortalecendo seus portfólios de veículos a gás natural comprimido.

- Benefícios ambientais, como menores emissões de gases de efeito estufa e redução de material particulado, estão atraindo apoio significativo das autoridades reguladoras, tornando o gás natural comprimido um combustível de transição preferido na mudança energética da região da Ásia-Pacífico.

- Além disso, a acessibilidade do gás natural comprimido em comparação aos combustíveis convencionais está estimulando a demanda entre consumidores e empresas sensíveis a custos. Subsídios, benefícios fiscais e incentivos para operadores de frotas estão acelerando ainda mais a adoção.

- O foco crescente no transporte sustentável, apoiado por avanços tecnológicos em kits sequenciais de gás natural comprimido e sistemas de armazenamento de alta capacidade, está remodelando as preferências do consumidor e promovendo a implantação em larga escala em toda a região.

Dinâmica do Mercado de Gás Natural Comprimido da Ásia-Pacífico

Motorista

Incentivos governamentais e expansão da infraestrutura impulsionam a adoção do GNC

- O mercado de gás natural comprimido da Ásia-Pacífico é significativamente impulsionado pelo forte apoio governamental na forma de subsídios, incentivos e políticas favoráveis que visam reduzir a dependência de combustíveis fósseis convencionais e diminuir as emissões de carbono. Países como Índia, China e Paquistão estão investindo pesadamente em infraestrutura de reabastecimento de gás natural comprimido, tornando o gás natural comprimido mais acessível a consumidores e operadores de frotas.

- Por exemplo, os projetos de expansão da Rede Nacional de Gás da Índia e de distribuição de gás urbano (CGD) estão promovendo a ampla adoção de gás natural comprimido em veículos leves e pesados. Da mesma forma, a China está priorizando o gás natural como parte de sua transição para energia limpa, apoiada por investimentos em larga escala em gasodutos e infraestrutura de armazenamento.

- A acessibilidade do gás natural comprimido em comparação com a gasolina e o diesel é outro forte impulsionador. Com a alta dos preços globais do petróleo bruto, consumidores e operadores de frotas comerciais, preocupados com os custos, estão migrando cada vez mais para veículos movidos a gás natural comprimido para reduzir os custos operacionais.

- Além disso, a menor pegada de carbono do gás natural comprimido está alinhada às metas climáticas globais e regionais. Os benefícios ambientais, incluindo a redução das emissões de gases de efeito estufa e de material particulado, estão impulsionando a adoção no transporte público, na logística e na mobilidade privada.

- Os avanços tecnológicos em kits sequenciais de gás natural comprimido, armazenamento de cilindros compostos e sistemas de combustível duplo estão melhorando ainda mais o desempenho e a segurança, aumentando a confiança do consumidor e a adoção no mercado da Ásia-Pacífico.

Restrição/Desafio

Lacunas de infraestrutura e altos custos iniciais de conversão

- Apesar das fortes perspectivas de crescimento, o mercado de gás natural comprimido da Ásia-Pacífico enfrenta desafios devido à infraestrutura inadequada em diversas economias emergentes. Enquanto as grandes cidades testemunham uma rápida expansão dos postos de abastecimento de gás natural comprimido, as áreas rurais e semiurbanas continuam a apresentar acessibilidade limitada, o que impede a adoção generalizada.

- Por exemplo, os altos custos iniciais de conversão para a adaptação de veículos com kits de gás natural comprimido também atuam como um fator limitante, especialmente em mercados sensíveis a preços. Para muitos consumidores, a economia a longo prazo nos custos de combustível é compensada pelo investimento inicial significativo necessário para a conversão.

- Preocupações com a segurança relacionadas ao armazenamento e manuseio de cilindros de gás natural comprimido continuam sendo uma barreira em algumas regiões. Embora as melhorias tecnológicas tenham reduzido os riscos, a percepção pública e a falta de conscientização continuam a influenciar a hesitação do consumidor.

- Além disso, a flutuação dos preços do gás natural e as incertezas na cadeia de suprimentos podem impactar a acessibilidade e a disponibilidade, limitando o potencial do mercado. Países que dependem fortemente de importações de gás natural enfrentam riscos de volatilidade, o que pode dificultar estratégias de adoção a longo prazo.

- A superação destes desafios exige esforços coordenados dos governos e das partes interessadas da indústria para expandir a infraestrutura, fornecer subsídios para a modernização e investir em campanhas de conscientização que enfatizem tanto a economia de custos quanto os benefícios ambientais do gás natural comprimido.

Escopo do mercado de gás natural comprimido da Ásia-Pacífico

O mercado é segmentado com base na origem, kits, tipo de distribuição e uso final.

• Por fonte

Com base na fonte, o mercado de gás natural comprimido da Ásia-Pacífico é segmentado em gás associado, gás não associado e fontes não convencionais. O segmento de gás não associado dominou o mercado em 2024, detendo a maior fatia da receita, sustentado por vastas reservas em países como China, Índia e Indonésia. A produção abundante, aliada às políticas governamentais para maximizar a utilização das reservas nacionais, tornou o gás não associado o principal contribuinte para o fornecimento de GNC na região.

Prevê-se que o segmento de fontes não convencionais apresentará o crescimento mais rápido entre 2025 e 2032, impulsionado pelo aumento dos investimentos em projetos de gás de xisto e metano de jazidas de carvão, especialmente na China e na Austrália. Os avanços nas tecnologias de extração, juntamente com a crescente demanda por fontes diversificadas de gás natural, estão acelerando a adoção de gás não convencional para a produção de GNC.

• Por Kits

Com base nos kits, o mercado de gás natural comprimido da Ásia-Pacífico é segmentado em kits montados por fabricantes de equipamentos originais (OEM) e kits adaptados. O segmento de kits montados por fabricantes de equipamentos originais (OEM) deteve a maior participação na receita em 2024, impulsionado pela crescente adoção de veículos movidos a GNC de fábrica, oferecidos por montadoras líderes como Maruti, Suzuki, Hyundai e Toyota. A crescente preferência do consumidor por soluções confiáveis e com garantia fortaleceu o domínio desse segmento.

Espera-se que o segmento de kits adaptados apresente o CAGR mais rápido entre 2025 e 2032, impulsionado pelo aumento da acessibilidade, pelo grande volume de veículos a gasolina existentes e pela forte demanda em países em desenvolvimento, como Índia, Paquistão e Bangladesh. Os kits adaptados estão se tornando uma solução econômica para proprietários individuais e operadores de frotas, especialmente em mercados com alta volatilidade nos preços dos combustíveis.

• Por tipo de distribuição

Com base na distribuição, o mercado de gás natural comprimido da Ásia-Pacífico é segmentado em distribuição por gasodutos e entrega em cascata/caminhão. O segmento de distribuição por gasodutos dominou o mercado em 2024, respondendo pela maior fatia devido aos robustos investimentos em redes de gasodutos na China, Índia e Austrália. A conectividade dos gasodutos garante um fornecimento confiável e econômico para postos de abastecimento urbanos, apoiando a adoção em larga escala do GNC.

O segmento de entregas em cascata/caminhões deverá crescer ao ritmo mais acelerado entre 2025 e 2032, impulsionado pela crescente demanda em áreas remotas e rurais, onde a infraestrutura de gasodutos permanece subdesenvolvida. A crescente implantação de cascatas móveis e gasodutos virtuais está preenchendo lacunas de infraestrutura, tornando o gás natural comprimido mais acessível a regiões carentes.

• Até o uso final

Com base no uso final, o mercado de gás natural comprimido da Ásia-Pacífico é segmentado em transporte, indústria e geração de energia. O segmento de transporte dominou o mercado em 2024, detendo mais de 70% da participação total de mercado, impulsionado pela adoção em larga escala do gás natural comprimido em automóveis de passeio, táxis, ônibus e frotas de logística. Fortes incentivos governamentais, programas de redução da poluição urbana e a crescente conscientização sobre redução de custos consolidaram o transporte como o principal setor de uso final.

Espera-se que o segmento de geração de energia apresente a taxa composta de crescimento anual (CAGR) mais rápida entre 2025 e 2032, especialmente no Paquistão e em Bangladesh, onde os governos estão promovendo ativamente a geração de eletricidade a partir do gás natural. A crescente demanda por fontes de energia limpas, confiáveis e acessíveis, aliada aos esforços para reduzir a dependência de combustíveis importados, está acelerando a transição para o GNC no setor energético.

Análise regional do mercado de gás natural comprimido da Ásia-Pacífico

- A Ásia-Pacífico dominou o mercado global de gás natural comprimido com a maior participação na receita de mais de 55% em 2024, apoiada pela alta demanda por combustíveis alternativos em aplicações industriais e de transporte, e fortes iniciativas governamentais para reduzir as emissões de carbono

- As extensas reservas de gás natural da região, a rápida expansão da infraestrutura de abastecimento de gás natural comprimido e a adoção em larga escala de gás natural comprimido em frotas de transporte público e logística estão acelerando a penetração no mercado

- A crescente urbanização, a relação custo-benefício do gás natural comprimido em comparação com os combustíveis convencionais e políticas de apoio, como subsídios e incentivos fiscais, estão impulsionando o forte consumo nas principais economias, incluindo China, Índia, Paquistão e Tailândia.

- Os crescentes investimentos em gás natural biocomprimido e projetos de gás natural renovável, juntamente com a presença de grandes players da indústria e frotas de veículos em rápido crescimento, fortalecem ainda mais a posição dominante da Ásia-Pacífico no mercado global de gás natural comprimido.

Visão do mercado de gás natural comprimido da China

A China detém uma fatia significativa de US$ 13,6 bilhões do mercado de gás natural comprimido da Ásia-Pacífico, impulsionada por seu forte foco na redução das emissões de carbono e da dependência de petróleo importado. Os grandes setores de logística e transporte público do país estão na vanguarda da adoção do gás natural comprimido, com ônibus, táxis e caminhões cada vez mais movidos a gás natural. Os governos regionais estão incentivando a conversão de frotas, enquanto os fabricantes nacionais estão ampliando a produção de veículos e a infraestrutura de reabastecimento. Além disso, os investimentos da China em sistemas avançados de armazenamento e distribuição de gás natural comprimido, aliados aos seus vastos recursos nacionais de gás natural, garantem um fornecimento consistente e preços competitivos.

Visão do mercado de gás natural comprimido da Índia

A Índia é um dos maiores e mais crescentes mercados de gás natural comprimido na Ásia-Pacífico, com um CAGR de 8,9%. O forte compromisso do governo com a expansão da mobilidade limpa, incluindo subsídios para veículos movidos a gás natural comprimido e a rápida implantação de corredores de reabastecimento de gás natural comprimido, está impulsionando a expansão do mercado. O aumento dos níveis de poluição do ar urbano e o aumento dos custos dos combustíveis também estão levando consumidores e operadores de frotas a optarem por alternativas acessíveis de gás natural comprimido. Fabricantes nacionais de automóveis, como Maruti Suzuki, Tata Motors e Hyundai, estão expandindo seus portfólios de gás natural comprimido de fábrica, tornando a adoção do gás natural comprimido mais comum. O mercado indiano se beneficia do desenvolvimento contínuo da infraestrutura de gasodutos e da expansão de parcerias entre participantes públicos e privados para atender à crescente demanda.

Visão geral do mercado de gás natural comprimido do Japão

O mercado de gás natural comprimido do Japão, embora menor em comparação com a Índia e a China, está crescendo gradualmente devido à ênfase do país na sustentabilidade e na redução das emissões de gases de efeito estufa. O governo japonês está incentivando a adoção de combustíveis alternativos, juntamente com o hidrogênio e a mobilidade elétrica. A adoção do GNC é particularmente forte em frotas comerciais específicas, como transporte municipal e logística. Tecnologia avançada de cilindros, recursos de segurança e integração com sistemas inteligentes de reabastecimento caracterizam o mercado japonês, refletindo sua abordagem voltada para a inovação.

Visão geral do mercado de gás natural comprimido da Coreia do Sul

A Coreia do Sul consolidou-se como participante ativa no mercado de GNC da Ásia-Pacífico, especialmente no setor de transporte público. O governo promoveu o uso de ônibus e táxis movidos a gás natural comprimido para solucionar problemas de qualidade do ar urbano. Fabricantes locais, como Hyundai e Kia, estão expandindo sua oferta de veículos movidos a gás natural comprimido, o que está fortalecendo a adoção doméstica. A Coreia do Sul também se beneficia da forte infraestrutura e da confiança do consumidor em soluções de mobilidade limpa.

Participação no mercado de gás natural comprimido da Ásia-Pacífico

A indústria de gás natural comprimido da Ásia-Pacífico é liderada principalmente por empresas bem estabelecidas, incluindo:

- Indraprastha Gas Limited (Índia)

- GAIL (Índia) Limitada (Índia)

- Corporação Nacional de Petróleo da China (China)

- Sinopec (China)

- PTT Public Company Limited (Tailândia)

- Tokyo Gas Co., Ltd. (Japão)

- SK E&S (Coreia do Sul)

- ENN Energy Holdings Limited (China)

- Petronas (Malásia)

- Osaka Gas Co., Ltd. (Japão)

Últimos desenvolvimentos no mercado de gás natural comprimido da Ásia-Pacífico

- Em março de 2024, a Indraprastha Gas Limited (Índia) anunciou a expansão de mais de 150 novos postos de abastecimento de GNC em importantes cidades indianas para atender à crescente demanda dos segmentos de veículos de passeio e comerciais. A iniciativa está alinhada à meta da Índia de aumentar a penetração do GNC em todo o país.

- Em janeiro de 2024, a China National Petroleum Corporation (CNPC) modernizou seu grande centro de reabastecimento de GNC em Pequim para atender frotas de veículos pesados. Essa expansão faz parte da estratégia mais ampla de diversificação energética da China e de seu compromisso com a redução das emissões do setor de transportes.

- Em dezembro de 2023, a PT Pertamina (Indonésia) lançou uma parceria público-privada com o objetivo de implementar instalações avançadas de armazenamento e distribuição de GNC. Este projeto visa aumentar a adoção em frotas logísticas e, ao mesmo tempo, reduzir a dependência de combustíveis importados.

- Em outubro de 2023, a Korea Gas Corporation (KOGAS) firmou parceria com a Hyundai Motor Group para aprimorar a infraestrutura de GNC para ônibus públicos e frotas municipais. A colaboração se concentra na implantação de cilindros compostos e sistemas de reabastecimento de última geração, mais seguros.

- Em setembro de 2023, a Tokyo Gas Co., Ltd. (Japão) introduziu um programa piloto para postos de abastecimento de GNC inteligentes equipados com sistemas de pagamento digital e monitoramento em tempo real para aumentar a conveniência e a segurança do consumidor.

- Em agosto de 2023, a PTT Public Company Limited (Tailândia) anunciou um investimento na construção de novos postos de varejo de GNC em Bangkok e regiões vizinhas, visando maior adoção em táxis e frotas de compartilhamento de viagens.

- Em julho de 2023, a Philippine National Oil Company (PNOC) anunciou um plano estratégico para estabelecer corredores de ônibus movidos a GNC na área metropolitana de Manila como parte de seu esforço para lidar com a piora da qualidade do ar urbano e o aumento dos custos do diesel.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.