Asia Pacific Biodegradable Paper Plastic Packaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.14 Billion

USD

2.66 Billion

2024

2032

USD

1.14 Billion

USD

2.66 Billion

2024

2032

| 2025 –2032 | |

| USD 1.14 Billion | |

| USD 2.66 Billion | |

|

|

|

|

Segmentação do mercado de embalagens plásticas e de papel biodegradável da Ásia-Pacífico, por tipo (plástico e papel), material (plástico e papel), usuário final (embalagens, alimentos e bebidas, utensílios para serviços de bufê, cuidados pessoais e domésticos, saúde e outros) - Tendências do setor e previsões até 2032

Tamanho do mercado de embalagens de papel e plástico biodegradáveis

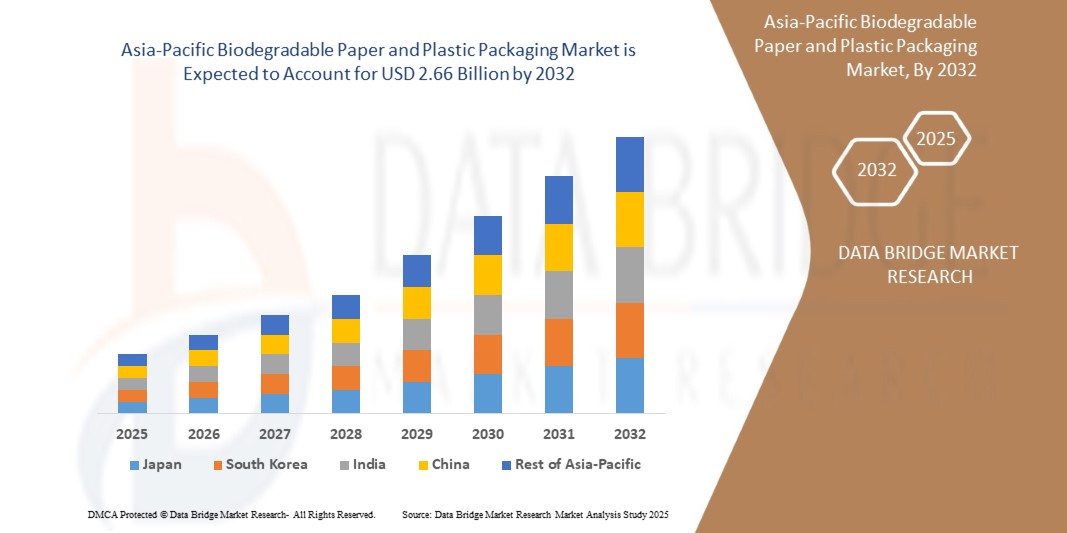

- O tamanho do mercado de embalagens de papel e plástico biodegradáveis da Ásia-Pacífico foi avaliado em US$ 1,14 bilhão em 2024 e deve atingir US$ 2,66 bilhões até 2032 , com um CAGR de 11,2% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pelo aumento da conscientização sobre materiais que emitem menos carbono

- Além disso, o aumento da urbanização na Índia e na China, que aumenta a demanda por embalagens de papel e plástico biodegradáveis entre os consumidores, deve impulsionar ainda mais o crescimento do mercado de embalagens de papel e plástico biodegradáveis.

Análise de Mercado de Embalagens de Papel e Plástico Biodegradáveis

- A crescente demanda na indústria de cuidados pessoais com a alta disponibilidade de matérias-primas para a fabricação de embalagens de papel e plástico biodegradáveis está impulsionando o mercado de embalagens de papel e plástico biodegradáveis

- A China domina o mercado de embalagens plásticas e de papel biodegradáveis com a maior participação de receita de 42,1% em 2024, caracterizada por políticas governamentais rigorosas visando a redução de resíduos plásticos e a promoção de alternativas de base biológica.

- Espera-se que a Índia seja a região de crescimento mais rápido no mercado de embalagens de papel e plástico biodegradáveis durante o período previsto devido à rápida urbanização, ao setor de bens de consumo de movimento rápido em expansão e ao maior foco regulatório em plásticos de uso único.

- Espera-se que o segmento de plástico domine o mercado de embalagens plásticas e de papel biodegradáveis com uma participação de mercado de 54,2% em 2024, impulsionado por sua versatilidade, facilidade de processamento e aplicação em vários formatos de embalagem, como bolsas.

Escopo do Relatório e Segmentação do Mercado de Embalagens de Papel e Plástico Biodegradáveis

|

Atributos |

Principais insights de mercado sobre compósitos plásticos reforçados com fibra de vidro |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de embalagens de papel e plástico biodegradáveis

“ Integração de tecnologias de embalagens inteligentes para maior sustentabilidade e rastreabilidade ”

- Uma tendência significativa no mercado de embalagens biodegradáveis da Ásia-Pacífico é a adoção de tecnologias de embalagens inteligentes, incluindo RFID, códigos QR e sensores IoT, para melhorar a rastreabilidade e a sustentabilidade do produto.

- Por exemplo, empresas na China estão cada vez mais implementando soluções de embalagens inteligentes habilitadas para RFID em logística, melhorando a eficiência da cadeia de suprimentos e o envolvimento do consumidor.

- Na Coreia do Sul, a integração das tecnologias NFC e IoT em soluções de embalagem está ganhando força, impulsionada pela infraestrutura tecnológica avançada do país e pelo cenário industrial focado em inovação.

- A adoção de embalagens inteligentes está alinhada com a crescente demanda por transparência e eficiência nas cadeias de suprimentos, especialmente em setores como comércio eletrônico, alimentos e saúde

Dinâmica do mercado de embalagens de papel e plástico biodegradáveis

Motorista

“Aumento da demanda nas indústrias de comércio eletrônico e embalagens de alimentos”

- O crescimento exponencial do comércio eletrônico e da indústria de embalagens de alimentos na região da Ásia-Pacífico é um grande impulsionador do mercado de embalagens de papel e plástico biodegradáveis.

- Varejistas on-line e provedores de serviços de alimentação estão investindo em soluções de embalagem sustentáveis e econômicas para atender às preferências dos consumidores e aos requisitos regulatórios.

- A necessidade de embalagens eficientes, protetoras e ecológicas em serviços de comércio eletrônico e entrega de alimentos levou ao aumento da demanda por materiais biodegradáveis.

- Essa tendência é ainda mais apoiada pela crescente ênfase na sustentabilidade ambiental, levando a uma maior demanda por opções de embalagens recicláveis e compostáveis.

Restrição/Desafio

“ Disponibilidade limitada de matérias-primas e infraestrutura para embalagens biodegradáveis ”

- A disponibilidade limitada de matérias-primas, como matérias-primas agrícolas como milho e cana-de-açúcar, representa um desafio significativo para o mercado.

- Esses materiais podem ser limitados por demandas concorrentes para produção de alimentos ou biocombustíveis, afetando o fornecimento consistente para produção de embalagens.

- Além disso, a falta de infraestrutura adequada, como instalações de compostagem industrial, em muitas regiões dificulta a degradação eficaz de materiais biodegradáveis.

- Essa lacuna de infraestrutura, aliada à potencial contaminação dos fluxos de reciclagem quando plásticos biodegradáveis são misturados com plásticos convencionais, cria incerteza para fabricantes e consumidores.

Escopo do mercado de embalagens de papel e plástico biodegradáveis

O mercado é segmentado com base no tipo, material e usuário final.

- Por tipo

Com base no tipo, o mercado de embalagens de papel e plástico biodegradáveis da Ásia-Pacífico é segmentado em plástico e papel. O segmento de plástico domina a maior fatia de mercado, com 54,2% da receita em 2025, impulsionado por sua versatilidade, facilidade de processamento e aplicação em diversos formatos de embalagem, como pouches, filmes e recipientes. Plásticos biodegradáveis como PLA, PHA e PBS estão ganhando força devido à sua compostabilidade, desempenho e crescente adoção nos setores de bens de consumo de movimento rápido (FMCG) e entrega de alimentos. As proibições governamentais de plásticos descartáveis impulsionam ainda mais a demanda.

O segmento de papel deverá apresentar a maior taxa de crescimento, de 8,7%, entre 2025 e 2032, impulsionado pela crescente consciência ambiental e pela preferência do consumidor por materiais renováveis e recicláveis. Embalagens biodegradáveis à base de papel são favorecidas por sua baixa pegada de carbono e reciclabilidade, especialmente em aplicações de alimentos secos, cuidados pessoais e varejo. A expansão do e-commerce e do varejo sustentável também impulsiona a demanda.

- Por Material

Com base no material, o mercado é segmentado em Plástico e Papel. O segmento de Plástico deteve a maior fatia de mercado em 2025, devido ao amplo uso de polímeros de origem biológica, como PLA e misturas de amido. Esses materiais oferecem desempenho equivalente ao dos plásticos convencionais, ao mesmo tempo em que atendem às metas ambientais. Seu uso em soluções de embalagens flexíveis e rígidas os torna adequados para diversas aplicações em embalagens de varejo, cuidados pessoais e industriais.

O segmento de papel deverá apresentar o CAGR mais rápido entre 2025 e 2032, impulsionado pela crescente demanda por alternativas à base de fibras e pela implementação de mandatos de substituição de plástico nos países da Ásia-Pacífico. Os materiais de papel oferecem alta capacidade de impressão e biodegradabilidade, tornando-os ideais para iniciativas de branding sustentável e rotulagem ecológica.

- Por usuário final

Com base no consumidor final, o mercado de embalagens de papel e plástico biodegradáveis da Ásia-Pacífico é segmentado em embalagens, alimentos e bebidas, utensílios para serviços de buffet, cuidados pessoais e domésticos, saúde e outros. O segmento de alimentos e bebidas domina a maior fatia de mercado da receita, com 42,1% em 2025, impulsionado pela demanda por embalagens sustentáveis em fast food, refeições prontas para consumo e bebidas. As marcas estão adotando formatos biodegradáveis para se alinhar ao consumo sustentável e reduzir a dependência do plástico.

Prevê-se que o segmento de Saúde apresente a taxa de crescimento mais rápida, de 9,8%, entre 2025 e 2032, impulsionado pelo crescente escrutínio regulatório sobre o descarte de resíduos e pela necessidade de materiais biodegradáveis seguros e de uso único. Aplicações em blisters farmacêuticos, bandejas médicas e kits de diagnóstico impulsionam a rápida adoção em todos os setores regionais de saúde.

Análise regional do mercado de embalagens de papel e plástico biodegradáveis

- A China domina o mercado de embalagens plásticas e de papel biodegradáveis com a maior participação na receita de 42,1% em 2024, impulsionada por políticas governamentais rigorosas que visam a redução de resíduos plásticos e a promoção de alternativas de base biológica.

- A expansão da capacidade de produção e a conscientização crescente entre os consumidores sobre embalagens sustentáveis são fatores-chave de crescimento.

Visão geral do mercado de embalagens plásticas e de papel biodegradável da Índia

O mercado indiano de embalagens de papel e plástico biodegradáveis está crescendo rapidamente, com a maior taxa composta de crescimento anual (CAGR) de 6,7%, impulsionado pela rápida urbanização, um setor de bens de consumo de movimento rápido (FMCG) em expansão e maior foco regulatório em plásticos de uso único. As Regras de Gestão de Resíduos Plásticos de 2023 do governo estão acelerando a adoção de embalagens biodegradáveis.

Visão geral do mercado de embalagens plásticas e de papel biodegradável do Japão

O mercado japonês de embalagens de papel e plástico biodegradáveis deverá crescer a um CAGR substancial ao longo do período previsto, impulsionado principalmente pela preferência do consumidor por embalagens ecológicas e pelos fortes compromissos corporativos com a sustentabilidade. Os avanços tecnológicos em formulações de materiais biodegradáveis e os incentivos governamentais estão facilitando uma maior adoção de soluções de embalagens sustentáveis.

Participação no mercado de embalagens de papel e plástico biodegradáveis

A indústria de compósitos plásticos reforçados com fibra de vidro é liderada principalmente por empresas bem estabelecidas, incluindo:

- SmartSolve Industries (Índia)

- STOROPACK HANS REICHENECKER GMBH (Alemanha)

- Shanghai Disoxidation Enterprise Development Co. Ltd (China)

- Stora Enso (Finlândia)

- Tekpak Solutions (Índia)

- International Paper (EUA)

- Sede da Be Green Packaging (Índia)

- Hsing Chung Paper Ltd. (Taiwan)

- Ecoware (Índia)

Últimos desenvolvimentos no mercado de embalagens de papel e plástico biodegradáveis da Ásia-Pacífico

- Em outubro de 2024, a startup australiana Earthodic levantou US$ 6 milhões em financiamento inicial para desenvolver seu inovador revestimento protetor reciclável para embalagens de papel e papelão. O revestimento, feito de lignina — um subproduto da indústria de celulose e papel — reforça as caixas e as torna impermeáveis, oferecendo uma alternativa ecológica aos revestimentos não recicláveis. O financiamento apoiará a criação de uma sede nos EUA e a continuidade da pesquisa e desenvolvimento, incluindo a certificação da FDA para copos de café termoseláveis.

- Em 2024, a Nestlé iniciou um programa piloto na Austrália, introduzindo embalagens de papel reciclável para seus pacotes de 45g de KitKat. Realizado exclusivamente com supermercados Coles na Austrália Ocidental, Austrália Meridional e Território do Norte, este teste busca feedback do público para refinar a embalagem. Apesar de incorporar uma fina película metálica para manter o frescor do chocolate, a iniciativa marca um passo significativo no compromisso da Nestlé de reduzir o uso de plástico virgem em um terço até 2025.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.