Asia Pacific Anti Money Laundering Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

919.25 Million

USD

2,696.76 Million

2024

2032

USD

919.25 Million

USD

2,696.76 Million

2024

2032

| 2025 –2032 | |

| USD 919.25 Million | |

| USD 2,696.76 Million | |

|

|

|

|

Segmentação do mercado de combate à lavagem de dinheiro na Ásia-Pacífico, por oferta (solução e serviços), função (gerenciamento de conformidade, gerenciamento de identidade do cliente, monitoramento de transações, relatórios de transações monetárias e outros), implantação (nuvem e local), tamanho da empresa (grandes empresas e pequenas e médias empresas), uso final (bancos e instituições financeiras, provedores de seguros, governo, jogos e apostas e outros) - Tendências do setor e previsão até 2032.

Tamanho do mercado de combate à lavagem de dinheiro

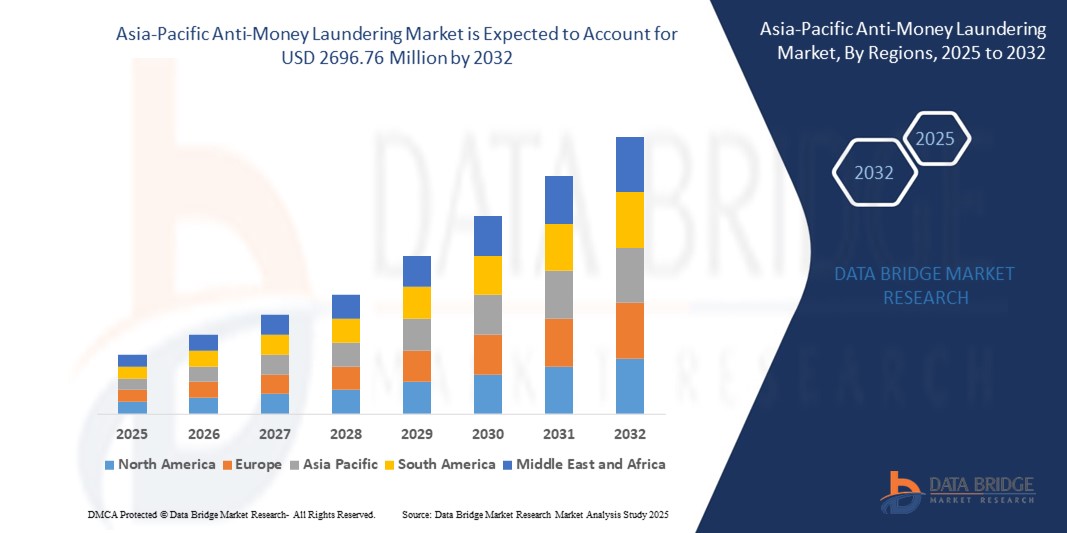

- O tamanho do mercado de combate à lavagem de dinheiro da Ásia-Pacífico foi avaliado em US$ 919,25 milhões em 2024 e deve atingir US$ 2.696,76 milhões até 2032 , com um CAGR de 14,4% durante o período previsto.

- O crescimento do mercado é impulsionado principalmente pelo aumento do escrutínio regulatório, pela ascensão do banco digital e pela crescente adoção de tecnologias avançadas, como inteligência artificial e aprendizado de máquina, para combater crimes financeiros.

- Além disso, a maior conscientização sobre fraudes financeiras, aliada à necessidade de soluções de conformidade robustas em todos os setores, está posicionando os sistemas de combate à lavagem de dinheiro (AML) como ferramentas essenciais para a segurança financeira e a adesão regulatória.

Análise de Mercado de Combate à Lavagem de Dinheiro

- Soluções de combate à lavagem de dinheiro, abrangendo software e serviços para detectar e prevenir atividades financeiras ilícitas, são cada vez mais vitais para instituições financeiras, governos e outros setores devido à sua capacidade de garantir a conformidade, aumentar a segurança e integrar-se aos ecossistemas digitais.

- A procura por soluções AML é alimentada por quadros regulatórios mais rigorosos, pela proliferação de transações digitais e pelas crescentes preocupações com atividades de branqueamento de capitais e financiamento do terrorismo.

- A China dominou o mercado de combate à lavagem de dinheiro da Ásia-Pacífico com a maior participação na receita de 38,5% em 2024, impulsionada por seu grande setor financeiro, regulamentações governamentais rigorosas e investimentos significativos em tecnologias AML por grandes bancos e empresas de tecnologia financeira.

- Espera-se que o Japão seja o país com crescimento mais rápido no mercado de combate à lavagem de dinheiro na Ásia-Pacífico durante o período previsto, devido à rápida transformação digital, à crescente adoção de soluções baseadas em nuvem e às iniciativas governamentais proativas para combater crimes financeiros.

- O segmento de soluções deteve a maior participação de mercado na receita, de 60,2% em 2024, impulsionado pela crescente demanda por software avançado de combate à lavagem de dinheiro que permite monitoramento de transações em tempo real, gerenciamento de conformidade e verificação de identidade do cliente.

Escopo do Relatório e Segmentação do Mercado de Combate à Lavagem de Dinheiro

|

Atributos |

Principais Insights de Mercado sobre Combate à Lavagem de Dinheiro |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights de mercado, como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipe de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise pilão. |

Tendências do Mercado Antilavagem de Dinheiro

“Aumento da integração de IA e análise de Big Data”

- O mercado de combate à lavagem de dinheiro (AML) da Ásia-Pacífico está vivenciando uma tendência significativa de integração de inteligência artificial (IA) e análises de big data para aprimorar a conformidade e os recursos de detecção.

- Essas tecnologias permitem o processamento e a análise avançados de dados, fornecendo insights mais profundos sobre padrões de transação, comportamento do cliente e riscos potenciais de crimes financeiros.

- Soluções de combate à lavagem de dinheiro baseadas em IA facilitam a identificação proativa de atividades suspeitas, como lavagem de dinheiro, financiamento do terrorismo e fraude, antes que se transformem em ameaças significativas

- Por exemplo, as empresas estão a desenvolver plataformas baseadas em IA que analisam dados transacionais para detetar anomalias, simplificar os processos de Conheça o Seu Cliente (KYC) e otimizar os fluxos de trabalho de conformidade, especialmente em mercados de elevado crescimento, como o Japão.

- Esta tendência aumenta a eficiência e a precisão dos sistemas AML, tornando-os mais atraentes para instituições financeiras, seguradoras e operadores de jogos em toda a região da Ásia-Pacífico.

- Os algoritmos de IA podem analisar vastos conjuntos de dados, incluindo padrões de transações incomuns, perfis de clientes de alto risco e atividades transfronteiriças, melhorando a detecção de crimes financeiros

Dinâmica do Mercado Antilavagem de Dinheiro

Motorista

“Crescente demanda por sistemas de conformidade robustos e fiscalização regulatória”

- O aumento do escrutínio regulatório e os rigorosos requisitos de conformidade contra a lavagem de dinheiro, especialmente em países como a China, são os principais impulsionadores do mercado de combate à lavagem de dinheiro na Ásia-Pacífico.

- Os sistemas de combate à lavagem de dinheiro aumentam a segurança financeira ao fornecer recursos como monitoramento de transações em tempo real, verificação de identidade do cliente e relatórios automatizados de atividades suspeitas

- Mandatos governamentais, como a Lei de Prevenção à Lavagem de Dinheiro da Índia (PMLA) e regulamentações do Grupo de Ação Financeira Internacional (GAFI), estão impulsionando a adoção generalizada de soluções de combate à lavagem de dinheiro em toda a região

- A proliferação de serviços bancários digitais, transações internacionais e plataformas de criptomoedas, especialmente no Japão, está alimentando a necessidade de tecnologias avançadas de combate à lavagem de dinheiro com processamento de dados mais rápido e menor latência.

- As instituições financeiras e outros setores, como jogos de azar e apostas, estão adotando cada vez mais sistemas de combate à lavagem de dinheiro como soluções padrão para atender às expectativas regulatórias e proteger suas operações.

Restrição/Desafio

“Altos custos de implementação e preocupações com a privacidade de dados”

- O alto investimento inicial necessário para a integração de hardware, software e sistemas de combate à lavagem de dinheiro representa uma barreira significativa à adoção, especialmente para pequenas e médias empresas (PMEs) em mercados emergentes na região da Ásia-Pacífico.

- A integração de soluções de combate à lavagem de dinheiro em sistemas financeiros existentes pode ser complexa e dispendiosa, especialmente para instituições com infraestrutura legada.

- As preocupações com a segurança e a privacidade dos dados são um grande desafio, uma vez que os sistemas de combate à lavagem de dinheiro coletam e transmitem dados confidenciais de clientes e transações, aumentando os riscos de violações e de não conformidade com os regulamentos de proteção de dados, como o GDPR ou as leis locais de privacidade.

- O cenário regulatório fragmentado nos países da Ásia-Pacífico, como os diversos requisitos de conformidade na China, Japão e Índia, complica as operações de organizações multinacionais e provedores de serviços.

- Esses fatores podem impedir a adoção, especialmente em regiões com alta sensibilidade a custos ou onde a conscientização sobre questões de privacidade de dados está crescendo.

Âmbito do mercado de combate à lavagem de dinheiro

O mercado é segmentado com base na oferta, função, implantação, tamanho da empresa e uso final.

- Ao oferecer

Com base na oferta, o mercado de combate à lavagem de dinheiro da Ásia-Pacífico é segmentado em soluções e serviços. O segmento de soluções deteve a maior participação de mercado, com 60,2% da receita em 2024, impulsionado pela crescente demanda por softwares avançados de combate à lavagem de dinheiro que permitem o monitoramento de transações em tempo real, a gestão de conformidade e a verificação da identidade do cliente. Essas soluções utilizam IA e aprendizado de máquina para aprimorar a detecção de crimes financeiros, como lavagem de dinheiro e financiamento do terrorismo.

Espera-se que o segmento de serviços apresente a taxa de crescimento mais rápida, de 15,8%, entre 2025 e 2032, impulsionado pela crescente necessidade de orientação especializada e serviços gerenciados para navegar pelas complexas regulamentações de combate à lavagem de dinheiro. As instituições financeiras estão cada vez mais terceirizando tarefas de conformidade para garantir a aderência regulatória com melhor custo-benefício e reduzir os riscos operacionais.

- Por função

Com base na função, o mercado de combate à lavagem de dinheiro da Ásia-Pacífico é segmentado em gestão de conformidade, gestão de identidade de clientes, monitoramento de transações, relatórios de transações cambiais, entre outros. O segmento de gestão de conformidade dominou o mercado, com uma participação de 32,6% na receita em 2024, devido a regulamentações rigorosas e à necessidade de as instituições financeiras fortalecerem suas estruturas de combate à lavagem de dinheiro para evitar penalidades e garantir a conformidade regulatória.

Espera-se que o segmento de monitoramento de transações experimente a taxa de crescimento mais rápida de 16,4% entre 2025 e 2032, impulsionado pela crescente adoção de sistemas baseados em IA que melhoram a detecção de transações suspeitas e reduzem falsos positivos, melhorando a eficiência no combate a crimes financeiros.

- Por implantação

Com base na implantação, o mercado de combate à lavagem de dinheiro da Ásia-Pacífico é segmentado em nuvem e on-premise. O segmento de nuvem deteve a maior participação de mercado, 54,4%, em 2024, devido à sua flexibilidade, escalabilidade e custo-benefício, permitindo que instituições financeiras integrem tecnologias avançadas, como IA e análises em tempo real, sem investimentos significativos em infraestrutura.

Espera-se que o segmento on-premise testemunhe um crescimento significativo entre 2025 e 2032, impulsionado por organizações que priorizam o controle e a segurança em detrimento de seus sistemas de conformidade. Soluções on-premise oferecem personalização e integração com a infraestrutura de TI existente, o que é crucial para grandes empresas com necessidades regulatórias complexas.

- Por tamanho da empresa

Com base no porte da empresa, o mercado de combate à lavagem de dinheiro da Ásia-Pacífico é segmentado em grandes empresas e pequenas e médias empresas (PMEs). O segmento de grandes empresas dominou o mercado, com uma participação de 56,8% na receita em 2024, impulsionado pelo foco em sistemas de pagamento digital e pela necessidade de soluções robustas de combate à lavagem de dinheiro para atender aos requisitos de monitoramento de transações e conformidade em operações financeiras de alto volume.

Espera-se que o segmento de PMEs cresça rapidamente a um CAGR de 17,2% entre 2025 e 2032, impulsionado pela crescente conscientização sobre regulamentações contra lavagem de dinheiro e pela adoção de soluções baseadas em nuvem com boa relação custo-benefício, que atendem a organizações menores com recursos limitados.

- Por uso final

Com base no uso final, o mercado de combate à lavagem de dinheiro da Ásia-Pacífico é segmentado em bancos e instituições financeiras, seguradoras, governo, jogos e apostas, entre outros. O segmento de bancos e instituições financeiras deteve a maior participação de mercado, com 45,3% da receita em 2024, impulsionado pela necessidade crítica de soluções de combate à lavagem de dinheiro para combater crimes financeiros, como fraude, financiamento do terrorismo e lavagem de dinheiro no setor bancário.

Espera-se que o segmento de jogos e apostas testemunhe a taxa de crescimento mais rápida de 18,1% entre 2025 e 2032, impulsionado pela crescente adoção de soluções de combate à lavagem de dinheiro para monitorar transações de alto risco e garantir a conformidade com as regulamentações, especialmente em plataformas de jogos de azar on-line, onde fluxos financeiros ilícitos são uma preocupação.

Análise regional do mercado de combate à lavagem de dinheiro

- A China dominou o mercado de combate à lavagem de dinheiro da Ásia-Pacífico com a maior participação na receita de 38,5% em 2024, impulsionada por seu grande setor financeiro, regulamentações governamentais rigorosas e investimentos significativos em tecnologias AML por grandes bancos e empresas de tecnologia financeira.

- O crescente volume de transações digitais e a crescente conscientização sobre a conformidade com a AML impulsionam a demanda por soluções avançadas. O forte desenvolvimento tecnológico nacional e os preços competitivos aumentam a acessibilidade ao mercado, com bancos e instituições financeiras liderando a adoção.

- A integração de IA e aprendizado de máquina no monitoramento de transações e no gerenciamento de identidade do cliente oferece suporte adicional ao crescimento do mercado

Visão do mercado antilavagem de dinheiro no Japão

Espera-se que o Japão testemunhe a maior taxa de crescimento no mercado de AML da Ásia-Pacífico, impulsionado por fortes estruturas regulatórias e um alto foco em inovação tecnológica. As instituições financeiras japonesas priorizam soluções avançadas de AML para aprimorar a conformidade e combater crimes financeiros sofisticados. A adoção de sistemas AML baseados em nuvem e a integração dessas soluções em grandes empresas e PMEs aceleram a penetração no mercado. O crescente interesse em gestão de conformidade e monitoramento de transações, especialmente nos setores bancário e de seguros, também contribui para o crescimento sustentado.

Participação de mercado de combate à lavagem de dinheiro

O setor de combate à lavagem de dinheiro é liderado principalmente por empresas bem estabelecidas, incluindo:

- NICE (Israel)

- IBM (EUA)

- sanções.io (EUA)

- Intel Corporation (EUA)

- Oracle (EUA)

- SAP SE (Alemanha)

- Accenture (EUA)

- Solução de Informação Experian

- Inc. (Irlanda)

- Open Text Corporation (Canadá)

- BAE Systems (Reino Unido)

- SAS Institute Inc (EUA)

- ACI Worldwide (EUA)

- Cognizant (EUA)

- Trulioo (Canadá)

- Sede da Temenos SA (Suíça)

- WorkFusion, Inc, (EUA)

- Vixio Regulatory Intelligence (Inglaterra)

Quais são os desenvolvimentos recentes no mercado de combate à lavagem de dinheiro da Ásia-Pacífico?

- Em fevereiro de 2025, a Mastercard lançou oficialmente o TRACE (Trace Financial Crime) na região da Ásia-Pacífico, introduzindo uma solução de combate à lavagem de dinheiro (AML) em nível de rede, impulsionada por inteligência artificial. O TRACE analisa dados de pagamentos em larga escala em diversas instituições financeiras para detectar e prevenir crimes financeiros, oferecendo uma visão holística que transcende sistemas isolados. As Filipinas se tornaram o primeiro mercado na Ásia-Pacífico a implementar o TRACE, integrando-o à sua rede de Pagamentos em Tempo Real (RTP) por meio de uma parceria com o BancNet, que integrou 36 bancos nacionais. Esta implementação apoia a conformidade com a Lei Antifraude em Contas Financeiras (AFASA) do país e marca um passo transformador nos esforços regionais de combate à lavagem de dinheiro.

- Em julho de 2024, o Banco Asiático de Desenvolvimento (BAD), em parceria com o Fórum Global sobre Transparência e Troca de Informações para Fins Tributários e órgãos regionais do Grupo de Ação Financeira Internacional (GAFI), organizou um workshop de três dias sobre transparência na propriedade beneficiária. Realizado de 3 a 5 de julho, o evento reuniu mais de 60 autoridades tributárias e de combate à lavagem de dinheiro de toda a Ásia e do Pacífico, além de especialistas da sociedade civil e internacionais. O treinamento se concentrou no alinhamento dos padrões de transparência tributária com as recomendações atualizadas do GAFI, promovendo uma abordagem abrangente do governo para combater fluxos financeiros ilícitos, lavagem de dinheiro e evasão fiscal.

- Em abril de 2024, a Oracle Financial Services lançou o Compliance Agent, um serviço em nuvem com tecnologia de IA projetado para ajudar os bancos a gerenciar proativamente os riscos de combate à lavagem de dinheiro (AML). A plataforma permite testes de cenários hipotéticos para ajustar sistemas de monitoramento de transações (TMS), avaliar perfis de risco de novos produtos e otimizar controles para tipologias de alto risco, como tráfico de pessoas. Ao automatizar a análise de risco do modelo e apoiar decisões baseadas em evidências, o Compliance Agent reduz os custos de conformidade e aprimora a prontidão regulatória. Essa inovação reflete a tendência crescente de adoção de IA e nuvem na prevenção de crimes financeiros na Ásia e em outros lugares.

- Em outubro de 2023, a WorkFusion lançou o Isaac, um Digital Worker com tecnologia de IA projetado para automatizar revisões de alertas de primeiro nível (L1) no monitoramento de transações de combate à lavagem de dinheiro. O Isaac se integra aos sistemas de vigilância existentes para avaliar alertas, escalonar automaticamente atividades suspeitas e encerrar automaticamente alertas não suspeitos com um dossiê de suporte. Ao reduzir a sobrecarga de revisões manuais e os falsos positivos — que frequentemente representam 90% a 95% dos alertas — o Isaac permite que os analistas se concentrem em investigações de alto risco. A solução aprimora a consistência, a transparência e a eficiência da conformidade, refletindo uma mudança mais ampla do setor em direção à gestão de crimes financeiros baseada em IA.

- Em novembro de 2023, o Grupo de Ação Financeira Internacional (GAFI) e o Grupo Ásia-Pacífico sobre Lavagem de Dinheiro (APG) realizaram conjuntamente um Workshop de Treinamento para Avaliadores em Ottawa, Canadá, com foco especial nas jurisdições da Ásia-Pacífico. O evento recebeu 40 delegados de países como Taipé Chinês, Indonésia, Mongólia, Tailândia e Emirados Árabes Unidos, e contou com o apoio do Departamento de Finanças do Canadá. Os participantes realizaram simulações de avaliações de um país fictício, abrangendo revisão da legislação, entrevistas e elaboração de relatórios. O treinamento teve como objetivo preparar os avaliadores para as próximas avaliações mútuas, reforçando os esforços regionais para aprimorar a conformidade com a legislação ALD/CFT e implementar a metodologia em evolução do GAFI.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.