>Mercado de alimentação animal Ásia-Pacífico por tipo (aminoácidos, minerais, vitaminas, acidificantes , desintoxicantes de micotoxinas, enzimas, fosfato, carotenóides, antioxidantes, aromas e adoçantes, antibióticos, azoto não proteico e outros), pecuária (suínos, aves, ruminantes ) , Animais Aquáticos e Outros), Forma (Seca e Líquida), – Tendências da Indústria e Previsão para 2029

Análise e dimensão do mercado

Para satisfazer as necessidades das alterações nos padrões alimentares da população, a produção pecuária aumentou em vários países do mundo, particularmente nos mercados em desenvolvimento. O sector pecuário no mercado da Ásia-Pacífico, particularmente na Ásia-Pacífico, está a tornar-se cada vez mais industrial, apesar do facto de um grande número de agricultores em países como a Índia e a China permanecerem pequenos e marginais.

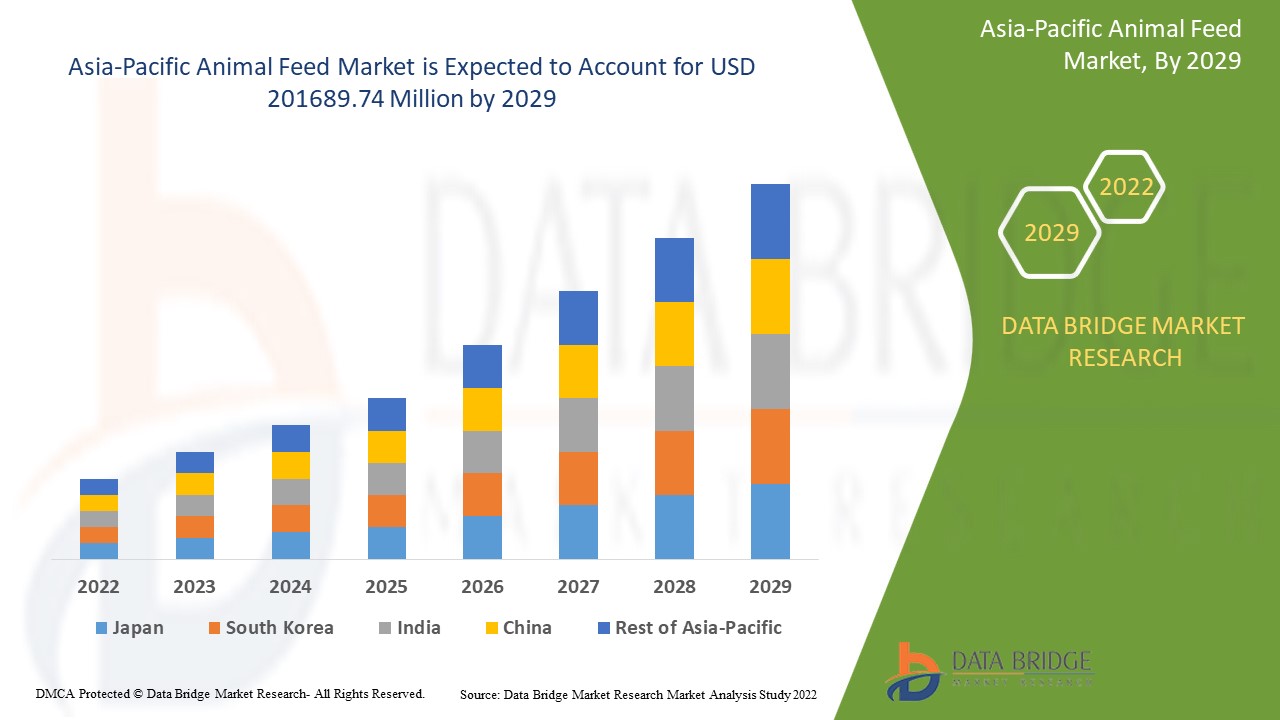

A Data Bridge Market Research analisa que o mercado de rações para animais que estava a crescer a um valor de 140.744,14 milhões em 2021 e deverá atingir o valor de 2.016.89,74 milhões de dólares até 2029, com um CAGR de 4,6% durante o período de previsão de 2022 a 2029.

Definição de mercado

A alimentação animal é um alimento nutritivo com elevados níveis de proteínas, minerais e vitaminas que é fornecido ao gado, à exploração e aos animais aquáticos. É consumido principalmente por animais domésticos sob a forma de forragem, feno, silagem, ração peletizada, oleaginosas, grãos germinados e forragem, entre outras coisas. A alimentação animal é uma componente importante da criação animal e varia consoante os animais são criados para carne, ovos ou leite.

Âmbito do relatório e segmentação de mercado

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (personalizável para 2014 - 2019) |

|

Unidades Quantitativas |

Receita em milhões de dólares, volumes em unidades, preços em dólares |

|

Segmentos cobertos |

Por Tipo (Aminoácidos, Minerais, Vitaminas, Acidificantes, Desintoxicantes de Micotoxinas, Enzimas, Fosfato, Carotenóides, Antioxidantes, Aromas e Adoçantes, Antibióticos, Azoto Não Proteico e Outros), Pecuária (Suínos, Aves, Ruminantes, Animais Aquáticos e Outros), Forma (seca e líquida) |

|

Países abrangidos |

China, Índia, Japão, Austrália, Coreia do Sul, Singapura, Indonésia, Tailândia, Filipinas, Malásia e Resto da Ásia-Pacífico |

|

Participantes do mercado abrangidos |

CDH. Hansen Holdings A/S (Dinamarca), Lallemand Inc. (Canadá), Novus International (EUA), DSM (Holanda), BASF SE (Alemanha), Alltech (EUA), ADM (EUA), Charoen Popkphand Foods PCL (Tailândia) , Associated British Foods Plc (Reino Unido), Cargill Incorporated (EUA), Purina Animal Nutrition LLC (EUA), Zinpro Corp (EUA), Dallas Keith (Reino Unido), Balchem Inc., (EUA), Kemin Industries, Inc. ) |

|

Oportunidades |

|

Dinâmica do mercado de alimentação animal

Motoristas

- Foco crescente na saúde animal

O maior foco na saúde animal também impulsionará a expansão do mercado. O aumento da pecuária irá quase certamente aumentar a procura de alimentação animal. A crescente procura de produtos de origem animal por parte dos humanos aumentará a procura do mercado. Espera-se que os apoiantes do crescimento natural estejam activos no mercado à medida que o seu ímpeto aumenta. A sensibilização dos consumidores para as vantagens da utilização de aditivos alimentares para reduzir as doenças aumentou a procura do mercado.

- Aumento da procura de carne orgânica

As preocupações com a segurança alimentar aumentaram a procura de rações para animais de alta qualidade para garantir a segurança da carne. Outro fator que impulsiona o crescimento do mercado de rações para animais é aumentar a consciencialização dos proprietários agrícolas sobre a importância de manter uma dieta animal saudável. Como resultado, estão a mudar da alimentação animal padrão para variantes funcionais e premium que ajudam a melhorar a imunidade a doenças enzoóticas, ao mesmo tempo que minimizam o risco de distúrbios metabólicos, acidose, lesões e infeções.

Além disso, o aumento da procura de carne biológica por parte dos consumidores dos países desenvolvidos, bem como a adopção de novas práticas de criação de animais e a manutenção de elevados padrões agrícolas, criaram uma perspectiva positiva para a indústria.

Oportunidade

Prevê-se que o aumento do consumo de carne nas economias em desenvolvimento, como a China, a Índia e o Brasil, impulsione a procura na Ásia-Pacífico. A Austrália é um importante país exportador de carne de porco que deverá impulsionar a procura do produto durante o período de previsão.

Restrições

Durante o período de previsão, os elevados preços das matérias-primas, bem como um número crescente de restrições e proibições regulamentares, funcionarão como restrições de mercado ao crescimento da alimentação animal. A sensibilização para o produto será uma restrição ao crescimento do mercado de rações para animais durante o período de previsão.

Este relatório de mercado de rações para animais fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação-exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações no mercado regulamentações, análise estratégica de crescimento de mercado, tamanho de mercado, crescimento de mercado de categoria, nichos de aplicação e domínio, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado de rações para animais, contacte a Data Bridge Market Research para obter um resumo do analista, a nossa equipa irá ajudá-lo a tomar uma decisão de mercado informada para alcançar o crescimento do mercado.

Impacto do COVID-19 no mercado de alimentação animal

Durante a situação da COVID-19, a agricultura e a produção alimentar foram identificadas como sectores críticos na Ásia-Pacífico. Como resultado, os agricultores continuaram a fornecer nutrição de alta qualidade aos animais de criação, de forma a alimentar um número crescente de consumidores da Ásia-Pacífico. No entanto, a perturbação da cadeia de abastecimento tornou-se o factor mais significativo que afecta o mercado da alimentação animal. A China é um grande produtor e exportador de rações para animais e armazenou produto suficiente para um abastecimento de 2 a 3 meses durante o surgimento da situação da COVID-19, enquanto as empresas estavam encerradas para o Ano Novo Lunar. Além disso, as questões logísticas têm dificultado o fornecimento de contentores e embarcações, bem como o transporte de determinados microingredientes.

Desenvolvimento recente

- Em outubro de 2021, a Cargill e a BASF anunciaram uma parceria no negócio da nutrição animal, acrescentando capacidades de investigação e desenvolvimento e novos mercados aos acordos existentes de distribuição de enzimas alimentares dos parceiros. Esta colaboração ajudou na criação, fabrico, comercialização e venda de produtos e soluções enzimáticas para animais, incluindo suínos, focados no cliente.

- Em julho de 2021, a De Heus adquiriu a Coppens Diervoeding, uma empresa holandesa de fabrico de rações especializada no setor da suinicultura. Com esta aquisição, a empresa conseguiu duplicar a sua capacidade de produção e aumentar a sua presença regional em 400 mil.

Âmbito do mercado de alimentação animal Ásia-Pacífico

O mercado de rações para animais é segmentado com base no tipo, pecuária e forma. O crescimento entre estes segmentos irá ajudá-lo a analisar os escassos segmentos de crescimento nas indústrias e fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Aminoácido

- Minerais

- Vitaminas

- Acidificantes

- Desintoxicantes de micotoxinas

- Enzimas

- Fosfato

- Carotenóides

- Antioxidantes

- Sabores e adoçantes

- Antibióticos

- Azoto não proteico

- Outros

Com base no tipo, o mercado está segmentado em aminoácidos, minerais, vitaminas, acidificantes, desintoxicantes de micotoxinas, enzimas, fosfato, carotenóides, antioxidantes, aromas e adoçantes, antibióticos, azoto não proteico e outros.

Pecuária

- Suínos

- Aves

- Ruminantes

- Animais aquáticos

- Outros

Baseado na pecuária, o mercado está segmentado em suínos, aves, ruminantes, animais aquáticos e outros.

Forma

- Seco

- Líquido

Com base na forma, o mercado está segmentado em seco e líquido.

Análise/perspetivas regionais do mercado de rações para animais

O mercado de rações para animais é analisado e são fornecidos insights e tendências do tamanho do mercado por país, tipo, gado e forma como mencionado acima.

Os países abrangidos no relatório do mercado de alimentação animal são a China, Índia, Japão, Austrália, Coreia do Sul, Singapura, Indonésia, Tailândia, Filipinas, Malásia e Resto da Ásia-Pacífico.

A Ásia é responsável por cerca de metade da produção da Ásia-Pacífico e é o mercado mais importante para o consumo e produção de carne de porco. Devido ao elevado consumo de carne de porco, a região Ásia-Pacífico é o maior mercado para produtos de alimentação animal. O Sudeste Asiático é o maior produtor e exportador mundial de carne de porco. A China é o mercado mais importante para os produtores de carne de porco, seguida pelo Vietname, Tailândia, Coreia do Sul, Japão e Filipinas. Os mercados de consumo de carne de porco no Japão, Coreia do Sul e Taiwan estão saturados, enquanto o Vietname e as Filipinas estão a emergir.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a jusante e a montante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas da Ásia-Pacífico e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado de rações para animais

O panorama competitivo do mercado de rações para animais fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na Ásia-Pacífico, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produtos, largura e amplitude do produto , dominância da aplicação. Os dados acima fornecidos estão apenas relacionados com o foco das empresas relacionado com o mercado de rações para animais.

Alguns dos principais players que trabalham no mercado da alimentação animal são:

- CDH. Hansen Holdings A/S (Dinamarca)

- (Canadá)

- Novus Internacional (EUA)

- DSM (Holanda)

- BASF SE (Alemanha)

- Alltech (EUA)

- ADM (EUA)

- Charoen Popkphand Foods PCL (Tailândia)

- Associated British Foods Plc (Reino Unido)

- Cargill Incorporated (EUA)

- Purina Animal Nutrition LLC (EUA)

- Zinpro Corp (EUA)

- Dallas Keith (Reino Unido)

- Balchem Inc., (EUA)

- (EUA)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC ANIMAL FEED MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TECHNOLOGY LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.1.1 GROWING DEMAND OF EDIBLE MEAT

3.1.2 MODERNIZATION AND GROWTH OF AQUACULTURE & LIVESTOCK FEED SECTORS

3.1.3 OUTBURSTS OF DISEASES VIA ANIMALS IS CONTRIBUTING TO THE INCREASE IN ADOPTION FOR ANIMAL FEED

3.1.4 BAN ON THE USE OF ANTIBIOTIC GROWTH PROMOTERS (AGPS) ON ANIMALS

3.1.5 RAPID INCREASING POPULATION OF PETS AND DOMESTICATED ANIMALS

3.2 RESTRAINTS

3.2.1 INCREASING VEGAN POPULATION IS HINDERING THE SALES OF MEAT AND MEAT-BASED PROTEINS

3.2.2 LOW QUALITY OF NUTRITION CHEMICALS IS A MAJOR DETERRENT FOR THE MARKET GROWTH

3.2.3 HIGH COST OF RAW MATERIALS

3.3 OPPORTUNITIES

3.3.1 IMPLEMENTING ALTERNATIVE FEEDING STRATEGIES THAT FOSTER EFFICIENCY IN MODERN ANIMAL NUTRITION

3.3.2 UREA MOLASSES MINERAL BLOCK (UMMB) LICKS USAGE IN CROP RESIDUE FOR ENHANCEMENT OF LIVESTOCK PRODUCTIVITY

3.3.3 BYPASS PROTEIN (UDP) DIET FOR CROSSBRED COWS CAN PAVE THE WAY FOR HIGH YIELD

3.4 CHALLENGES

3.4.1 REGULATIONS ON DIFFERENT FEED ADDITIVES AT COUNTRY LEVEL ESPECIALLY IN EUROPE AND THE U.S.

3.4.2 OUTBREAK OF EPIDEMIC CONTAGIOUS DISEASES THAT AFFECTS THE ANIMAL HEALTH IS LEADING TO LOSS OF LIVESTOCKS

3.4.3 AVAILABILITY OF LIMITED OPTIONS FOR SHRIMP FEED PRODUCTS IN PLANT-BASED MEALS

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL PRICING IN ASIA-PACIFIC, 2019 (USD/KG)

5.2 PRODUCTION AND CONSUMPTION PATTERN

5.3 MARKETING STRATEGIES

5.4 LIST OF SUBSTITUTES

6 REGULATORY FRAMEWORK

7 BRAND ANALYSIS

7.1 TOP BRANDS OF ANIMAL FEED AND THEIR COMPANY

8 ASIA-PACIFIC ANIMAL FEED MARKET, BY TYPE

8.1 OVERVIEW

8.2 AMINO ACID

8.2.1 METHIONINE

8.2.2 LYSINE

8.2.3 THREONINE

8.2.4 OTHERS

8.3 MINERALS

8.3.1 CALCIUM

8.3.2 POTASSIUM

8.3.3 MAGNESIUM

8.3.4 OTHERS

8.4 VITAMINS

8.4.1 WATER-SOLUBLE

8.4.2 FAT-SOLUBLE

8.5 ACIDIFIERS

8.5.1 PROPIONIC ACID

8.5.2 FUMARIC ACID

8.5.3 FORMIC ACID

8.5.4 OTHERS

8.6 MYCOTOXIN DETOXIFIERS

8.6.1 BINDERS

8.6.2 MODIFIERS

8.7 ENZYMES

8.7.1 PHYTASE

8.7.2 PROTEASE

8.7.3 OTHERS

8.8 PHOSPHATE

8.8.1 DICALCIUM

8.8.2 MONOCALCIUM

8.8.3 OTHERS

8.9 CAROTENOIDS

8.9.1 ASTAXANTHIN

8.9.2 BETA-CAROTENE

8.9.3 OTHERS

8.1 ANTIOXIDANTS

8.10.1 ETHOXYQUIN

8.10.2 BHA

8.10.3 BHT

8.10.4 OTHERS

8.11 FLAVORS & SWEETENERS

8.11.1 SWEETENERS

8.11.2 FLAVORS

8.12 ANTIBIOTICS

8.12.1 TETRACYCLINE

8.12.2 PENICILLIN

8.12.3 OTHERS

8.13 NON-PROTEIN NITROGEN

8.13.1 UREA

8.13.2 AMMONIA

8.13.3 OTHERS

8.14 OTHERS

9 ASIA-PACIFIC ANIMAL FEED MARKET, BY LIVESTOCK

9.1 OVERVIEW

9.2 SWINE

9.2.1 GROWER

9.2.2 STARTER

9.2.3 SOW

9.3 POULTRY

9.3.1 BROILERS

9.3.2 LAYERS

9.3.3 BREEDERS

9.4 RUMINANTS

9.4.1 DAIRY CATTLE

9.4.2 BEEF CATTLE

9.4.3 CALVES

9.4.4 OTHERS

9.5 AQUATIC ANIMALS

9.6 OTHERS

10 ASIA-PACIFIC ANIMAL FEED MARKET, BY FORM

10.1 OVERVIEW

10.2 DRY

10.2.1 PELLETS

10.2.2 CRUMBLES

10.2.3 MASH

10.2.4 OTHERS

10.2.4.1 GRAIN MIX

10.2.4.2 CRUSHED GRAIN OR SCRATCH

10.2.4.3 OTHERS

10.3 LIQUID

11 ASIA-PACIFIC ANIMAL FEED MARKET: COUNTRY

11.1 ASIA- PACIFIC

11.1.1 CHINA

11.1.2 INDIA

11.1.3 JAPAN

11.1.4 AUSTRALIA

11.1.5 SOUTH KOREA

11.1.6 SINGAPORE

11.1.7 INDONESIA

11.1.8 THAILAND

11.1.9 PHILIPPINES

11.1.10 MALAYSIA

11.1.11 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC ANIMAL FEED MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.2 MERGERS & ACQUISITIONS

12.3 NEW PRODUCT DEVELOPMENT & APPROVALS

12.4 EXPANSIONS

12.5 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

13.1 SWOT ANALYSIS

13.1.1 STRENGTH: - ENHANCING PRODUCT PORTFOLIO FOR VARIOUS TYPES OF ANIMAL FEED

13.1.2 WEAKNESS: - LOW LABOR EFFICIENCY OF POOR FARMERS

13.1.3 OPPORTUNITY: - HIGH RATE OF AGRICULTURAL DIVERSIFICATION AND ANIMAL WELFARE

13.1.4 THREAT: - SEVERE CLIMATIC CHANGES AFFECTS THE FARM ANIMALS

13.2 DATA BRIDGE MARKET RESEARCH ANALYSIS

14 COMPANY PROFILES

14.1 NEW HOPE GROUP

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENT

14.2 BASF SE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 AMBOS STOCKFEEDS

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT

14.4 GUANGDONG HAID GROUP CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENT

14.5 ALLTECH.

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 CHAROEN POKPHAND GROUP

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 GEORGE WESTON FOODS LIMITED

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 AJINOMOTO CO., INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 ARCHER DANIELS MIDLAND COMPANY

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 AUSTRALIAN PREMIUM FEEDS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMEN

14.11 CARGILL, INCORPORATED

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 CHR. HANSEN HOLDING A/S

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 DSM

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 DUPONT

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 EVONIK INDUSTRIES AG

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 INVIVO

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 KEMIN INDUSTRIES, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 NUTRECO (A SUBSIDIARY OF SHV HOLDINGS N.V.)

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SOLVAY

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 TYSON FOODS, INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO - TYSON INGREDIENT SOLUTIONS

14.20.4 PRODUCT PORTFOLIO-NUDGES

14.20.5 RECENT DEVELOPMENT

15 CONCLUSION

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 IMPORT DATA OF OF PREPARATIONS OF A KIND USED IN ANIMAL FEEDING; HS CODE: 2309 (USD MILLION)

TABLE 2 EXPORT DATA OF OF PREPARATIONS OF A KIND USED IN ANIMAL FEEDING; HS CODE: 2309 (USD MILLION)

TABLE 3 ASIA-PACIFIC ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 4 ASIA-PACIFIC ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 5 ASIA-PACIFIC AMINO ACID IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 6 ASIA-PACIFIC AMINO ACID IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 7 ASIA-PACIFIC AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 8 ASIA-PACIFIC MINERALS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 9 ASIA-PACIFIC MINERALS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 10 ASIA-PACIFIC MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 11 ASIA-PACIFIC VITAMINS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 12 ASIA-PACIFIC VITAMINS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 13 ASIA-PACIFIC VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 14 ASIA-PACIFIC ACIDIFIERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 15 ASIA-PACIFIC ACIDIFIERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 16 ASIA-PACIFIC ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 17 ASIA-PACIFIC MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 18 ASIA-PACIFIC MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 19 ASIA-PACIFIC MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 20 ASIA-PACIFIC ENZYMES IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 21 ASIA-PACIFIC ENZYMES IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 22 ASIA-PACIFIC ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 23 ASIA-PACIFIC PHOSPHATE IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 24 ASIA-PACIFIC PHOSPHATE IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 25 ASIA-PACIFIC PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 26 ASIA-PACIFIC CAROTENOIDS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 27 ASIA-PACIFIC CAROTENOIDS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 28 ASIA-PACIFIC CAROTENOIDS IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 29 ASIA-PACIFIC ANTIOXIDANTS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 30 ASIA-PACIFIC ANTIOXIDANTS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 31 ASIA-PACIFIC ANTIOXIDANTS IN ANIMAL FEED MARKET, BY ANTIOXIDANTS TYPE, 2018-2027 (USD MILLION)

TABLE 32 ASIA-PACIFIC FLAVOURS & SWEETENERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 33 ASIA-PACIFIC FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 34 ASIA-PACIFIC FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVOURS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 35 ASIA-PACIFIC ANTIBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 36 ASIA-PACIFIC ANTIBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 37 ASIA-PACIFIC ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 38 ASIA-PACIFIC NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 39 ASIA-PACIFIC NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 40 ASIA-PACIFIC NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 41 ASIA-PACIFIC OTHERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 42 ASIA-PACIFIC OTHERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 43 ASIA-PACIFIC ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 44 ASIA-PACIFIC SWINE IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 45 ASIA-PACIFIC SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 46 ASIA-PACIFIC POULTRY IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 47 ASIA-PACIFIC POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 48 ASIA-PACIFIC RUMINANTS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 49 ASIA-PACIFIC RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 50 ASIA-PACIFIC RUMINANTS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 51 ASIA-PACIFIC OTHERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 52 ASIA-PACIFIC ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 53 ASIA-PACIFIC DRY IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 54 ASIA-PACIFIC DRY IN ANIMAL FEED MARKET, BY DRY FROM, 2018-2027 (USD MILLION)

TABLE 55 ASIA-PACIFIC OTHERS IN ANIMAL FEED MARKET, BY OTHERS DRY FROM, 2018-2027 (USD MILLION)

TABLE 56 ASIA-PACIFIC LIQUID IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 57 ASIA- PACIFIC ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 58 ASIA-PACIFIC ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 59 ASIA-PACIFIC ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 60 ASIA- PACIFIC ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 61 ASIA-PACIFIC AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 62 ASIA-PACIFIC PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 63 ASIA-PACIFIC VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 64 ASIA-PACIFIC ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 65 ASIA-PACIFIC CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 66 ASIA-PACIFIC ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 67 ASIA-PACIFIC MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 68 ASIA-PACIFIC FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 69 ASIA-PACIFIC ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 70 ASIA-PACIFIC MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 71 ASIA-PACIFIC ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 72 ASIA-PACIFIC NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 73 ASIA-PACIFIC ANIMAL FEED MARKET, BY LIVESTOCK,2018-2027 (USD MILLION)

TABLE 74 ASIA-PACIFIC RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 75 ASIA-PACIFIC POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK,2018-2027 (USD MILLION)

TABLE 76 ASIA-PACIFIC SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 77 ASIA-PACIFIC ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 78 ASIA-PACIFIC DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 79 ASIA-PACIFIC OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 80 CHINA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 81 CHINA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 82 CHINA AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 83 CHINA PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 84 CHINA VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 85 CHINA ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 86 CHINA CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 87 CHINA ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 88 CHINA MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 89 CHINA FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 90 CHINA ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 91 CHINA MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 92 CHINA ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 93 CHINA NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 94 CHINA ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 95 CHINA RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 96 CHINA POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 97 CHINA SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 98 CHINA ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 99 CHINA DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 100 CHINA OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 101 INDIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 102 INDIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 103 INDIA AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 104 INDIA PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 105 INDIA VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 106 INDIA ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 107 INDIA CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 108 INDIA ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 109 INDIA MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 110 INDIA FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 111 INDIA ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 112 INDIA MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 113 INDIA ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 114 INDIA NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 115 INDIA ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 116 INDIA RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 117 INDIA POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 118 INDIA SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 119 INDIA ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 120 INDIA DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 121 INDIA OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 122 JAPAN ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 123 JAPAN ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 124 JAPAN AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 125 JAPAN PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 126 JAPAN VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 127 JAPAN ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 128 JAPAN CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 129 JAPAN ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 130 JAPAN MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 131 JAPAN FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 132 JAPAN ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 133 JAPAN MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 134 JAPAN ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 135 JAPAN NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 136 JAPAN ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 137 JAPAN RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 138 JAPAN POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 139 JAPAN SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 140 JAPAN ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 141 JAPAN DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 142 JAPAN OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 143 AUSTRALIA ANIMAL FEED MARKET , BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 144 AUSTRALIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 145 AUSTRALIA AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 146 AUSTRALIA PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 147 AUSTRALIA VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 148 AUSTRALIA ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 149 AUSTRALIA CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 150 AUSTRALIA ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 151 AUSTRALIA MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 152 AUSTRALIA FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 153 AUSTRALIA ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 154 AUSTRALIA MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 155 AUSTRALIA ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 156 AUSTRALIA NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 157 AUSTRALIA ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 158 AUSTRALIA RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 159 AUSTRALIA POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 160 AUSTRALIA SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 161 AUSTRALIA ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 162 AUSTRALIA DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 163 AUSTRALIA OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 164 SOUTH KOREA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 165 SOUTH KOREA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 166 SOUTH KOREA AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 167 SOUTH KOREA PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 168 SOUTH KOREA VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 169 SOUTH KOREA ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 170 SOUTH KOREA CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 171 SOUTH KOREA ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 172 SOUTH KOREA MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 173 SOUTH KOREA FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 174 SOUTH KOREA ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 175 SOUTH KOREA MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 176 SOUTH KOREA ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 177 SOUTH KOREA NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 178 SOUTH KOREA ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 179 SOUTH KOREA RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 180 SOUTH KOREA POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 181 SOUTH KOREA SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 182 SOUTH KOREA ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 183 SOUTH KOREA DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 184 SOUTH KOREA OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 185 SINGAPORE ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 186 SINGAPORE ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 187 SINGAPORE AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 188 SINGAPORE PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 189 SINGAPORE VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 190 SINGAPORE ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 191 SINGAPORE CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 192 SINGAPORE ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 193 SINGAPORE MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 194 SINGAPORE FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 195 SINGAPORE ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 196 SINGAPORE MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 197 SINGAPORE ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 198 SINGAPORE NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 199 SINGAPORE ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 200 SINGAPORE RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 201 SINGAPORE POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 202 SINGAPORE SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 203 SINGAPORE ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 204 SINGAPORE DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 205 SINGAPORE OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 206 INDONESIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 207 INDONESIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 208 INDONESIA AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 209 INDONESIA PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 210 INDONESIA VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 211 INDONESIA ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 212 INDONESIA CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 213 INDONESIA ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 214 INDONESIA MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 215 INDONESIA FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 216 INDONESIA ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 217 INDONESIA MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 218 INDONESIA ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 219 INDONESIA NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 220 INDONESIA ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 221 INDONESIA RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 222 INDONESIA POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 223 INDONESIA SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 224 INDONESIA ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 225 INDONESIA DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 226 INDONESIA OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 227 THAILAND ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 228 THAILAND ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 229 THAILAND AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 230 THAILAND PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 231 THAILAND VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 232 THAILAND ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 233 THAILAND CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 234 THAILAND ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 235 THAILAND MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 236 THAILAND FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 237 THAILAND ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 238 THAILAND MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 239 THAILAND ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 240 THAILAND NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 241 THAILAND ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 242 THAILAND RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 243 THAILAND POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 244 THAILAND SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 245 THAILAND ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 246 THAILAND DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 247 THAILAND OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 248 PHILIPPINES ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 249 PHILIPPINES ANIMAL FEED MARKET , BY TYPE, 2018-2027 (USD MILLION)

TABLE 250 PHILIPPINES AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 251 PHILIPPINES PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 252 PHILIPPINES VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 253 PHILIPPINES ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 254 PHILIPPINES CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 255 PHILIPPINES ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 256 PHILIPPINES MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 257 PHILIPPINES FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 258 PHILIPPINES ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 259 PHILIPPINES MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 260 PHILIPPINES ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 261 PHILIPPINES NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 262 PHILIPPINES ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 263 PHILIPPINES RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 264 PHILIPPINES POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 265 PHILIPPINES SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 266 PHILIPPINES ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 267 PHILIPPINES DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 268 PHILIPPINES OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 269 MALAYSIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 270 MALAYSIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 271 MALAYSIA AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 272 MALAYSIA PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 273 MALAYSIA VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 274 MALAYSIA ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 275 MALAYSIA CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 276 MALAYSIA ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 277 MALAYSIA MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 278 MALAYSIA FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 279 MALAYSIA ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 280 MALAYSIA MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 281 MALAYSIA ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 282 MALAYSIA NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 283 MALAYSIA ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 284 MALAYSIA RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 285 MALAYSIA POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 286 MALAYSIA SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 287 MALAYSIA ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 288 MALAYSIA DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 289 MALAYSIA OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 290 REST OF ASIA-PACIFIC ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 291 REST OF ASIA-PACIFIC ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

Lista de Figura

FIGURE 1 ASIA-PACIFIC ANIMAL FEED MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC ANIMAL FEED MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC ANIMAL FEED MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC ANIMAL FEED MARKET : REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC ANIMAL FEED MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC ANIMAL FEED MARKET: THE TECHNOLOGY LIFE LINE CURVE

FIGURE 7 ASIA-PACIFIC ANIMAL FEED MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC ANIMAL FEED MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC ANIMAL FEED MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC ANIMAL FEED MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC ANIMAL FEED MARKET

FIGURE 12 PROJECTED DEMAND GROWTH FOR DIFFERENT TYPES OF MEAT AND EGGS BY ASIAN SUBREGIONS FROM 2000 TO 2030

FIGURE 13 FEED CONVERSION RATION (FCR), BY LIVESTOCK TYPE (KILOGRAM PER ANIMAL)

FIGURE 14 INCIDENCE OF LIVESTOCK DISEASES IN INDIA (JAN TO OCT 2016)

FIGURE 15 PERCENTAGE SHARES IN NO. OF DAIRY COWS IN THAILAND, BY DAIRY FARM SIZE

FIGURE 16 PERCENTAGE SHARES IN NO. OF SWINES IN THAILAND, BY SWINE FARM SIZE

FIGURE 17 PERCENTAGE SHARES IN NO. OF CHICKENS IN THAILAND, BY CHICKEN FARM SIZE

FIGURE 18 PERCENTAGE SHARE OF VEGAN DIET FOLLOWERS WORLDWIDE IN 2016

FIGURE 19 PHYSICAL COMPOSITION OF UREA MOLASSES MINERAL SUPPLEMENTS

FIGURE 20 SOUTH KOREA ANNUAL INCIDENCE OUTBREAKS OF VECTOR-BORNE DISEASES, 2002-2006 (IN PERCENTAGE)

FIGURE 21 ASIA-PACIFIC ANIMAL FEED MARKET: SEGMENTATION

FIGURE 22 GROWING CONSUMPTION OF EDIBLE MEAT AND RAPIDLY INCREASING POPULATION OF PETS, AND DOMESTICATED ANIMALS IS DRIVING ASIA-PACIFIC ANIMAL FEED MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 23 AMINO ACID IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC ANIMAL FEED MARKET IN 2020 & 2027

FIGURE 24 ASIA-PACIFIC ANIMAL FEED MARKET: BY TYPE, 2019

FIGURE 25 ASIA-PACIFIC ANIMAL FEED MARKET: BY LIVESTOCK, 2019

FIGURE 26 ASIA-PACIFIC ANIMAL FEED MARKET: BY FORM, 2019

FIGURE 27 ASIA-PACIFIC ANIMAL FEED MARKET: SNAPSHOT (2019)

FIGURE 28 ASIA- PACIFIC ANIMAL FEED MARKET: BY COUNTRY (2019)

FIGURE 29 ASIA-PACIFIC ANIMAL FEED MARKET: BY COUNTRY (2020 & 2027)

FIGURE 30 ASIA-PACIFIC ANIMAL FEED MARKET : BY COUNTRY (2019 & 2027)

FIGURE 31 ASIA-PACIFIC ANIMAL FEED MARKET : BY TYPE (2020-2027)

FIGURE 32 ASIA-PACIFIC ANIMAL FEED MARKET: COMPANY SHARE 2018 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.