Asia Pacific And Us Warehouse Management System Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.06 Billion

USD

3.79 Billion

2024

2032

USD

1.06 Billion

USD

3.79 Billion

2024

2032

| 2025 –2032 | |

| USD 1.06 Billion | |

| USD 3.79 Billion | |

|

|

|

|

Segmentação de mercado de sistemas de gerenciamento de armazéns da Ásia-Pacífico e dos EUA, por componentes (guindastes, sistemas automatizados de armazenamento e recuperação, robôs, transportadores e sistemas de classificação, veículos guiados automatizados e outros), funções (recebimento e armazenamento, controle de estoque, gerenciamento de pátio e doca, alocação, coleta, gerenciamento de força de trabalho e tarefas, remessa e outros), oferta (software e serviços), implantação (nuvem/SaaS e local), tipo de camada (WMS avançado, WMS intermediário e WMS básico), usuário final (comércio eletrônico, alimentos e bebidas, logística terceirizada, elétrica e eletrônica, automotiva, metais e máquinas, saúde, produtos químicos e outros) - tendências do setor e previsão até 2032

Tamanho do mercado de sistemas de gerenciamento de armazéns da Ásia-Pacífico

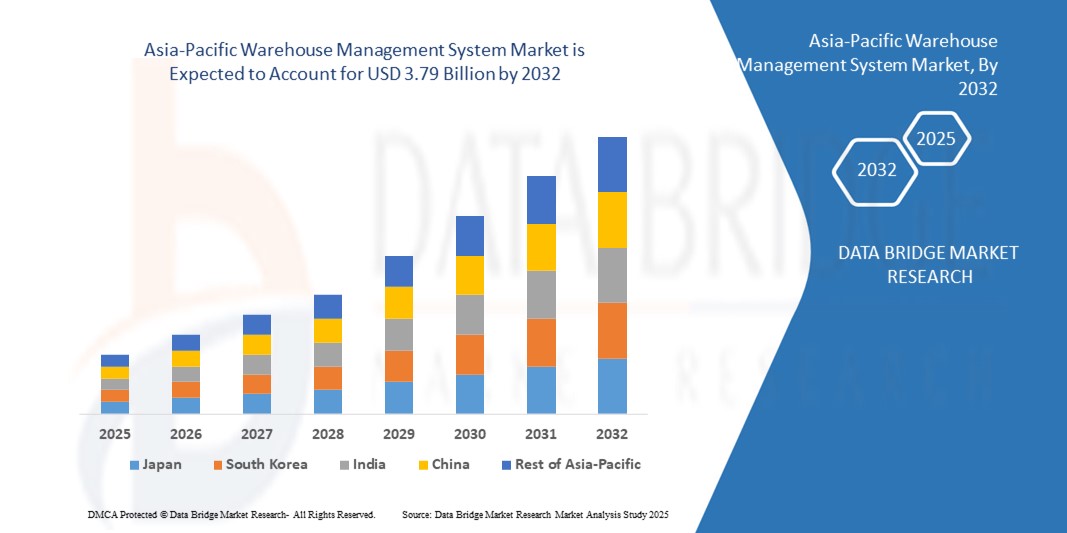

- O tamanho do mercado de sistemas de gerenciamento de armazéns da Ásia-Pacífico foi avaliado em US$ 1,06 bilhão em 2024 e deve atingir US$ 3,79 bilhões até 2032 , com um CAGR de 17,30% durante o período previsto, e o tamanho do mercado de sistemas de gerenciamento de armazéns dos EUA foi avaliado em US$ 991,8 milhões em 2024 e deve atingir US$ 3.506,54 milhões até 2032 , com um CAGR de 17,1% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção de automação, robótica e tecnologias de cadeia de suprimentos digitais em armazéns e centros de distribuição, levando à melhoria da eficiência operacional, redução de custos de mão de obra e gerenciamento aprimorado de estoque.

- Além disso, a crescente demanda dos setores de comércio eletrônico, varejo, manufatura e logística terceirizada por visibilidade em tempo real, rastreamento preciso de estoque e operações de armazém simplificadas está consolidando os sistemas de gestão de armazéns como uma solução crucial para as cadeias de suprimentos modernas. Esses fatores convergentes estão acelerando a adoção de sistemas de gestão de armazéns, impulsionando significativamente o crescimento do setor.

Análise de mercado do sistema de gerenciamento de armazéns da Ásia-Pacífico

- Os sistemas de gestão de armazéns são soluções de software que permitem às empresas gerenciar e otimizar as operações de armazém, incluindo controle de estoque, atendimento de pedidos, recebimento e armazenamento, separação, expedição e gestão da força de trabalho. Esses sistemas integram-se a plataformas de automação, robótica e planejamento de recursos empresariais para aumentar a eficiência e a precisão das operações de armazém.

- A crescente demanda por sistemas de gestão de armazéns é impulsionada principalmente pelo crescimento do e-commerce e do varejo omnicanal, pela crescente complexidade das cadeias de suprimentos, pelo aumento dos custos com mão de obra e pela necessidade de um atendimento de pedidos mais rápido e preciso. As empresas estão adotando cada vez mais soluções de WMS baseadas em nuvem, com tecnologia de IA e acessíveis por dispositivos móveis para alcançar agilidade operacional e competitividade.

- A China dominou o mercado de sistemas de gerenciamento de armazéns em 2024, devido ao seu rápido crescimento no setor de comércio eletrônico, à expansão da base de fabricação e à crescente adoção de automação e soluções de cadeia de suprimentos digital.

- Espera-se que a Ásia-Pacífico seja o país com crescimento mais rápido no mercado de sistemas de gerenciamento de armazéns durante o período previsto devido a

- O segmento de serviços dominou o mercado, com uma participação de mercado de 81,41% em 2024, devido à crescente demanda por soluções de implementação, customização, treinamento e manutenção que garantam integração perfeita e desempenho ideal dos sistemas de gestão de armazéns. As empresas estão priorizando serviços profissionais para reduzir riscos de implantação, aumentar a eficiência operacional e aproveitar todo o potencial dos recursos avançados de software. Além disso, a crescente complexidade das operações de armazéns e a necessidade de suporte e atualizações contínuas contribuem ainda mais para o domínio do segmento de serviços no mercado.

Escopo do relatório e segmentação do mercado de sistemas de gerenciamento de armazém

|

Atributos |

Principais insights de mercado do sistema de gerenciamento de armazém |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

NÓS |

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights de mercado, como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipe de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise Pilstle. |

Tendências de mercado do sistema de gerenciamento de armazéns da Ásia-Pacífico

Integração de IA e robótica para automatizar operações de armazém

- A integração de inteligência artificial e robótica em sistemas de gestão de armazéns está aumentando rapidamente a eficiência operacional e a escalabilidade. Essas tecnologias permitem que os armazéns aumentem a velocidade, a precisão e a produtividade, minimizando tarefas que exigem muita mão de obra e erros humanos em ambientes logísticos complexos.

- Por exemplo, a GreyOrange implementou robôs avançados com inteligência artificial para operações automatizadas de triagem e coleta em armazéns de marcas como a Flipkart. Isso ilustra como a robótica e a inteligência artificial estão transformando as funções dos armazéns e redefinindo padrões de precisão de pedidos e eficiência de processamento.

- Sistemas de gestão de armazéns com IA estão sendo cada vez mais utilizados para análises preditivas, o que ajuda a prever a demanda, otimizar o posicionamento do estoque e agilizar o processamento de pedidos. Esses recursos oferecem imenso valor para empresas que buscam equilibrar mercados em rápida evolução com controle de custos e qualidade de serviço.

- A integração da robótica proporciona fluxos de trabalho otimizados por meio de sistemas de coleta automatizados, braços robóticos para paletização e veículos autônomos para movimentação de materiais. Juntas, essas soluções reduzem significativamente os tempos de ciclo e aumentam a flexibilidade para lidar com a demanda sazonal ou flutuante.

- A tendência também está se expandindo para pequenas e médias empresas, onde a integração de IA e robótica habilitada para a nuvem está sendo adotada para nivelar a eficiência operacional com os grandes varejistas. Essa democratização da automação avançada de armazéns está abrindo novos caminhos para uma penetração mais ampla no mercado.

- Em conclusão, a fusão de IA e robótica nos sistemas de gestão de armazéns está remodelando a forma como os armazéns operam. Ao possibilitar automação, precisão e inteligência em tempo real, esses avanços estão impulsionando o setor em direção a infraestruturas de cadeia de suprimentos mais inteligentes e preparadas para o futuro.

Dinâmica de mercado do sistema de gerenciamento de armazéns da Ásia-Pacífico

Motorista

Crescente demanda por visibilidade de estoque em tempo real e atendimento mais rápido de pedidos

- A crescente demanda por visibilidade do estoque em tempo real, aliada à pressão para atender pedidos rapidamente, é um fator-chave que impulsiona a adoção de sistemas de gestão de armazéns. As empresas buscam sistemas que permitam rastrear, gerenciar e otimizar o estoque com precisão, além de oferecer suporte ao processamento contínuo de pedidos.

- Por exemplo, a Manhattan Associates desenvolveu soluções avançadas de WMS que permitem aos varejistas obter insights de estoque em tempo real, tanto em centros de distribuição quanto em lojas. Sua implementação com grandes marcas de varejo exemplifica como o WMS é fundamental para garantir experiências de atendimento ao cliente mais rápidas e eficientes.

- A visibilidade em tempo real garante que as discrepâncias de estoque sejam minimizadas, enquanto a precisão dos pedidos é maximizada. Isso permite que as empresas reduzam os pedidos em atraso, evitem rupturas de estoque dispendiosas e proporcionem maior satisfação do cliente por meio da disponibilidade confiável dos produtos.

- A ascensão do varejo omnicanal está aumentando ainda mais a demanda por sistemas de gestão de armazéns. Com os clientes esperando entregas no dia seguinte ou até mesmo no mesmo dia, as empresas precisam de sistemas que coordenem o estoque em vários canais para fornecer atendimento unificado.

- Em resumo, a crescente importância da velocidade e da precisão no atendimento de pedidos está tornando a visibilidade em tempo real uma necessidade estratégica para as empresas modernas. Os sistemas de gestão de armazéns tornaram-se, portanto, ferramentas essenciais para alcançar vantagem competitiva em mercados de alta demanda.

Restrição/Desafio

Altos custos e complexidade da implementação do sistema

- O alto investimento inicial e a complexidade associados à implementação de sistemas de gestão de armazéns continuam sendo um desafio significativo para as organizações. Os custos relacionados a licenciamento de software, infraestrutura de hardware, personalização e integração podem ser substanciais para muitas empresas.

- Por exemplo, empresas que adotam o SAP Extended Warehouse Management frequentemente relatam prazos de implementação extensos e altos custos de consultoria e treinamento. Isso demonstra a grande quantidade de recursos necessários para a transição de processos tradicionais de warehouse para plataformas WMS totalmente otimizadas.

- As dificuldades de integração aumentam ainda mais a complexidade, pois o WMS deve se integrar perfeitamente a sistemas ERP, plataformas de gerenciamento de pedidos e sistemas de gerenciamento de transporte. Garantir a compatibilidade e o fluxo de dados uniforme entre múltiplas plataformas frequentemente estende os cronogramas dos projetos e aumenta os custos.

- Além disso, treinar a equipe do armazém para operar e gerenciar com eficácia soluções avançadas de WMS exige tempo e investimento, gerando reduções temporárias de produtividade durante as fases de transição. Isso se torna particularmente desafiador para empresas que gerenciam altos volumes diariamente.

- Em última análise, as barreiras combinadas de custo e complexidade retardam a adoção em larga escala, especialmente para pequenas e médias empresas. Desenvolver soluções baseadas em nuvem mais econômicas, interfaces amigáveis e estratégias de implementação modulares será fundamental para reduzir essas restrições e expandir as oportunidades de adoção global.

Escopo de mercado do sistema de gerenciamento de armazéns da Ásia-Pacífico

O mercado é segmentado com base em componentes, funções, oferta, implantação, tipo de nível e usuário final.

- Por componentes

Com base nos componentes, o mercado de Sistemas de Gestão de Armazéns é segmentado em guindastes, sistemas automatizados de armazenagem e recuperação, robôs, transportadores e sistemas de triagem, veículos guiados automatizados e outros. O segmento de sistemas automatizados de armazenagem e recuperação dominou a maior fatia da receita de mercado em 2024, impulsionado por sua eficiência na automação dos processos de armazenagem e recuperação, minimizando custos de mão de obra e erros humanos. Os armazéns dependem cada vez mais de sistemas automatizados de armazenagem e recuperação para armazenamento de alta densidade, atendimento mais rápido de pedidos e integração perfeita com a infraestrutura existente. A capacidade de lidar com diversos tipos de produtos e otimizar a utilização do espaço reforça ainda mais sua preferência entre armazéns de grande porte e de comércio eletrônico.

Prevê-se que o segmento de veículos guiados automatizados (VAAs) apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela sua crescente adoção na movimentação automatizada de materiais e na intralogística. Os veículos guiados automatizados oferecem soluções de transporte flexíveis e autônomas dentro de armazéns, reduzindo a dependência de mão de obra manual e agilizando o fluxo de trabalho. Sua compatibilidade com robótica e softwares de Sistema de Gestão de Armazéns os torna particularmente adequados para operações de alto volume e layouts dinâmicos de armazéns, impulsionando a demanda nos setores de logística e manufatura.

- Por Funções

Com base em suas funções, o mercado de Sistemas de Gestão de Armazéns é segmentado em recebimento e depósito, controle de estoque, gestão de pátio e doca, alocação, separação de pedidos, gestão de força de trabalho e tarefas, expedição, entre outros. O segmento de controle de estoque deteve a maior fatia da receita de mercado em 2024, devido ao seu papel fundamental em garantir níveis precisos de estoque, reduzir o excesso ou a ruptura de estoque e oferecer visibilidade do armazém em tempo real. Recursos avançados de gestão de estoque, incluindo código de barras, rastreamento por identificação por radiofrequência e integração com sistemas de planejamento de recursos empresariais, tornaram essa função indispensável para armazéns modernos que buscam eficiência operacional e redução de custos.

Espera-se que o segmento de picking apresente a maior taxa de crescimento anual composta entre 2025 e 2032, impulsionado pela crescente necessidade de atendimento de pedidos mais rápido e preciso nos setores de e-commerce e varejo. Soluções de picking automatizadas e semiautomatizadas, frequentemente integradas à robótica e à inteligência artificial, reduzem erros de picking, otimizam a alocação de mão de obra e aumentam a produtividade, tornando-se uma área funcional de alto crescimento nas operações de armazém.

- Ao oferecer

Com base na oferta, o mercado de Sistemas de Gestão de Armazéns é segmentado em software e serviços. O segmento de serviços dominou a maior fatia da receita de mercado, com 81,41% em 2024, impulsionado pela crescente demanda por soluções de implementação, customização, treinamento e manutenção que garantam integração perfeita e desempenho ideal dos sistemas de gestão de armazéns. As empresas estão priorizando serviços profissionais para reduzir os riscos de implantação, aumentar a eficiência operacional e aproveitar todo o potencial dos recursos avançados de software. Além disso, a crescente complexidade das operações de armazém e a necessidade de suporte e atualizações contínuas contribuem ainda mais para o domínio do segmento de serviços no mercado.

O segmento de software deverá apresentar a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente necessidade de visibilidade em tempo real, automação e tomada de decisões baseada em dados em armazéns. O software de Sistema de Gestão de Armazéns permite o controle centralizado do estoque, gestão de pedidos e otimização do fluxo de trabalho, fornecendo insights práticos que aumentam a eficiência operacional e reduzem os custos operacionais.

- Por implantação

Com base na implantação, o mercado de Sistemas de Gestão de Armazéns é segmentado em nuvem ou software como serviço e on-premise. O segmento on-premise deteve a maior participação de mercado na receita em 2024 devido à preferência de grandes empresas por maior controle sobre a segurança de dados, personalização e requisitos de conformidade. As soluções de Sistemas de Gestão de Armazéns on-premise oferecem às organizações a flexibilidade para se integrar à infraestrutura de tecnologia da informação existente e atender a rigorosos padrões regulatórios em setores sensíveis, como saúde e produtos químicos.

Espera-se que o segmento de nuvem ou software como serviço apresente a maior taxa de crescimento anual composta entre 2025 e 2032, impulsionado pela crescente adoção de soluções flexíveis, escaláveis e econômicas. O Sistema de Gestão de Armazéns baseado em nuvem permite acesso em tempo real a partir de múltiplos locais, reduz os custos iniciais de infraestrutura e oferece suporte à rápida implantação, tornando-o altamente atraente para pequenas e médias empresas e operações de e-commerce multilocalizadas que buscam agilidade e transformação digital.

- Por tipo de nível

Com base no tipo de camada, o mercado de Sistemas de Gestão de Armazéns é segmentado em Sistemas de Gestão de Armazéns Avançados, Sistemas de Gestão de Armazéns Intermediários e Sistemas de Gestão de Armazéns Básicos. O segmento de Sistemas de Gestão de Armazéns Avançados dominou a maior fatia da receita de mercado em 2024, impulsionado por seus recursos abrangentes, incluindo análises baseadas em inteligência artificial, integração de automação e monitoramento de desempenho em tempo real. Armazéns de grande porte e operações de e-commerce preferem Sistemas de Gestão de Armazéns Avançados para otimizar fluxos de trabalho complexos, melhorar a precisão e aprimorar a visibilidade da cadeia de suprimentos em múltiplos nós.

Prevê-se que o segmento de Sistemas de Gestão de Armazéns intermediários apresentará a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente adoção entre empresas de médio porte que buscam um equilíbrio entre custo e sofisticação funcional. Sistemas de Gestão de Armazéns intermediários oferecem recursos modulares, facilidade de integração e automação suficiente, permitindo que empresas em crescimento aumentem a eficiência dos armazéns sem grandes investimentos iniciais.

- Por usuário final

Com base no usuário final, o mercado de Sistemas de Gestão de Armazéns é segmentado em e-commerce, alimentos e bebidas, logística terceirizada, eletroeletrônicos, automotivo, metais e máquinas, saúde, produtos químicos e outros. O segmento de e-commerce deteve a maior fatia da receita de mercado em 2024, impulsionado pelo crescimento exponencial do varejo online e pela necessidade de um atendimento de pedidos mais rápido e sem erros. Um Sistema de Gestão de Armazéns eficiente permite que os players de e-commerce gerenciem pedidos de alto volume e pequenos lotes, otimizem o giro de estoque e atendam às expectativas dos consumidores por entregas no mesmo dia ou no dia seguinte.

Espera-se que o segmento de logística terceirizada apresente a maior taxa de crescimento anual composta entre 2025 e 2032, impulsionado pela crescente terceirização de serviços de armazenagem e distribuição. Os provedores de logística terceirizada contam cada vez mais com o Sistema de Gestão de Armazéns para oferecer soluções logísticas escaláveis, integradas e baseadas em tecnologia, permitindo-lhes gerenciar múltiplos clientes, garantir entregas pontuais e aumentar a eficiência operacional em suas redes.

Análise regional do mercado de sistemas de gerenciamento de armazéns da Ásia-Pacífico

- A China dominou o mercado de sistemas de gerenciamento de armazéns com a maior participação na receita em 2024, impulsionada pelo rápido crescimento do setor de comércio eletrônico, pela expansão da base de fabricação e pela crescente adoção de soluções de automação e cadeia de suprimentos digital.

- Investimentos robustos em infraestrutura de armazéns, juntamente com o impulso do governo para iniciativas de logística inteligente e Indústria 4.0, reforçam a liderança da China no mercado regional

- A presença dos principais fornecedores nacionais de tecnologia de armazém, as colaborações com fornecedores globais de soluções e a introdução de sistemas de gestão de armazém económicos, mas tecnologicamente avançados, continuam a consolidar-se

Visão do mercado de sistemas de gerenciamento de armazéns do Japão

O mercado de sistemas de gestão de armazéns no Japão deverá crescer de forma constante entre 2025 e 2032, apoiado por seus avançados setores de manufatura e logística e pela forte ênfase em eficiência operacional e transformação digital. As empresas japonesas estão adotando cada vez mais soluções de armazenamento automatizado, robótica e sistemas de software integrados para otimizar as operações de armazém. A demanda por sistemas de gestão de armazéns compactos, multifuncionais e altamente eficientes está aumentando devido ao espaço limitado nos armazéns e aos altos custos de mão de obra. Investimentos contínuos em pesquisa e desenvolvimento e parcerias entre provedores de soluções japoneses e empresas globais de tecnologia reforçam a perspectiva de crescimento constante do mercado. O foco do Japão em inovação, confiabilidade e otimização da cadeia de suprimentos sustenta seu forte posicionamento regional.

Visão do mercado de sistemas de gerenciamento de armazéns na Índia

O mercado indiano de sistemas de gestão de armazéns deverá registrar a maior taxa de crescimento anual composta na região da Ásia-Pacífico entre 2025 e 2032, impulsionado pela rápida expansão do comércio eletrônico, pelo aumento das atividades de manufatura e pela crescente adoção de automação e soluções de gestão de armazéns baseadas em nuvem. A crescente conscientização sobre eficiência operacional, otimização de custos e gestão digital da cadeia de suprimentos está acelerando a adoção entre pequenas e médias empresas. A demanda por sistemas de gestão de armazéns acessíveis, escaláveis e fáceis de implementar é particularmente forte entre empresas emergentes. A expansão das redes de varejo e logística, o rápido crescimento do comércio eletrônico e as iniciativas governamentais que promovem a infraestrutura digital estão aprimorando a acessibilidade aos produtos. O crescente foco da Índia na modernização de armazéns garante sua emergência como o mercado de crescimento mais rápido na região.

Visão do mercado de sistemas de gerenciamento de armazéns dos EUA

O mercado de sistemas de gestão de armazéns nos EUA deverá crescer de forma constante entre 2025 e 2032, impulsionado por avanços tecnológicos contínuos, investimentos crescentes em armazéns automatizados e um forte foco na transformação digital. As empresas estão priorizando soluções baseadas em software que permitam análises preditivas, previsão de demanda e gestão inteligente de estoque. Colaborações contínuas entre provedores de tecnologia dos EUA e fornecedores globais, juntamente com políticas de apoio que promovem a logística inteligente, reforçam a perspectiva de crescimento constante. O foco do país em inovação, eficiência operacional e resiliência da cadeia de suprimentos sustenta seu forte posicionamento regional no mercado de sistemas de gestão de armazéns.

Participação de mercado do sistema de gerenciamento de armazéns da Ásia-Pacífico

O setor de sistemas de gerenciamento de armazéns é liderado principalmente por empresas bem estabelecidas, incluindo:

- Blue Yonder Group, Inc. (EUA)

- Oracle Corporation (EUA)

- SAP SE (Alemanha)

- Infor (EUA)

- Manhattan Associates (EUA)

- Tecsys Inc. (Canadá)

- SENKO Co., Ltd. (Japão)

- Softeon (EUA)

- Accelogix LLC (EUA)

- Datex Corporation (EUA)

- Made4net (EUA)

- SOFTWARE CAMELOT 3PL (Alemanha)

- ShipBob, Inc. (EUA)

- JAPAN LOGISTIC SYSTEMS CORP. (Japão)

- Synergy Logistics Ltd (Reino Unido)

- Honeywell International Inc. (EUA)

- IBM Corporation (EUA)

- NEC Corporation (Japão)

- Cisco Systems, Inc. (EUA)

- Extensiv (EUA)

- The Raymond Corporation (EUA)

Últimos desenvolvimentos no mercado de sistemas de gerenciamento de armazéns da Ásia-Pacífico e dos EUA

- Em março de 2024, a Made4net demonstrou seu Sistema de Gestão de Armazéns WarehouseExpert e soluções de execução de ponta a ponta da cadeia de suprimentos na MODEX 2024. A demonstração destacou a integração do sistema com tecnologias de robótica e automação, enfatizando sua capacidade de aumentar a velocidade e a eficiência das cadeias de suprimentos. Este desenvolvimento destaca a tendência crescente de incorporar a automação aos sistemas de gestão de armazéns para aumentar a eficiência operacional e atender às demandas das cadeias de suprimentos modernas.

- Em novembro de 2023, a Blue Yonder, fornecedora líder de soluções para a cadeia de suprimentos, anunciou a aquisição da Doddle, uma empresa de tecnologia focada em logística de primeira e última milha. Essa aquisição permite que a Blue Yonder ofereça um pacote logístico mais abrangente, abordando os desafios de otimizar a logística de primeira e última milha, que historicamente têm sido difíceis de gerenciar. Ao integrar a tecnologia da Doddle ao seu conjunto existente de recursos de comércio e devoluções, a Blue Yonder visa construir cadeias de suprimentos de ponta a ponta mais sustentáveis e lucrativas.

- Em novembro de 2023, a Epicor, líder global em software empresarial para setores específicos, anunciou a aquisição da Elite EXTRA, fornecedora líder de soluções de entrega de última milha baseadas em nuvem. Essa aquisição amplia a capacidade da Epicor de ajudar seus clientes em diversos setores a simplificar a logística de última milha e competir de forma mais eficaz em um mercado hipercompetitivo. Ao integrar as soluções da Elite EXTRA, a Epicor visa aprimorar sua oferta nos setores de "fabricação, movimentação e venda", oferecendo aos clientes recursos avançados de entrega de última milha.

- Em fevereiro de 2021, a Raymond Corporation anunciou o lançamento de um novo transempilhador automatizado como complemento à sua oferta de soluções intralogísticas. O transempilhador automatizado, equipado com software de gerenciamento de pedidos, integra-se totalmente aos sistemas de gestão de armazéns para otimizar o desempenho e eliminar erros. Este desenvolvimento oferece às empresas uma solução flexível para instalações de armazenagem de alta densidade e alta seletividade, diversificando seu portfólio de automação com novos produtos.

- Em março de 2021, a Extensiv lançou um pacote aprimorado para pequenas encomendas com funcionalidade expandida para aumentar a eficiência e um armazém sem papel para provedores de logística terceirizados que oferecem e-commerce e atendimento omnicanal. A solução ajuda as empresas a otimizar e gerenciar com eficiência a funcionalidade de pequenas encomendas, reduzindo o tempo de embalagem e aumentando a lucratividade. Ao integrar este pacote aos seus sistemas de gestão de armazém, as empresas podem aprimorar seus processos de embalagem e expedição, resultando em maior eficiência operacional.

- Em maio de 2025, a Körber Supply Chain anunciou o lançamento de um módulo avançado de sistema de gestão de armazéns com análise preditiva orientada por IA. O novo módulo permite que os armazéns prevejam a demanda, otimizem a alocação de estoque e gerenciem proativamente gargalos operacionais. Este desenvolvimento fortalece a posição da Körber no mercado, permitindo que os clientes aumentem a produtividade dos armazéns, reduzam os custos operacionais e melhorem os níveis de serviço em cadeias de suprimentos cada vez mais complexas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.