Asia Pacific Aluminum Foil Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

37.73 Billion

USD

97.50 Billion

2024

2032

USD

37.73 Billion

USD

97.50 Billion

2024

2032

| 2025 –2032 | |

| USD 37.73 Billion | |

| USD 97.50 Billion | |

|

|

|

Asia-Pacific Aluminum Foil Market Segmentation, By Product (Foil Wrappers, Pouches, Blister Packs, Collapsible Tubes, Trays/Containers, Capsules, Laminated Lids, Foil Lined Bags, Chocolate Foils, Foil Round Seals, Others), Type (Printed, Unprinted), Thickness (0.07 MM, 0.09 MM , 0.2 MM, 0.4 MM), End-User (Food, Pharmaceuticals, Cosmetics, Insulation, Electronics, Geochemical Sampling, Automotive Components, Others) – Industry Trends and Forecast to 2032

Aluminum Foil Market Analysis

Aluminum foil is used in a wide range of products all around the world. Due to a increasing awareness of the pollution generated by plastics in the environment. Customers can use aluminum foil in both traditional and fan-assisted ovens, providing them the choice to utilize it in both. They also protect rock samples from organic solvents by forming a seal.

Aluminum Foil Market Size

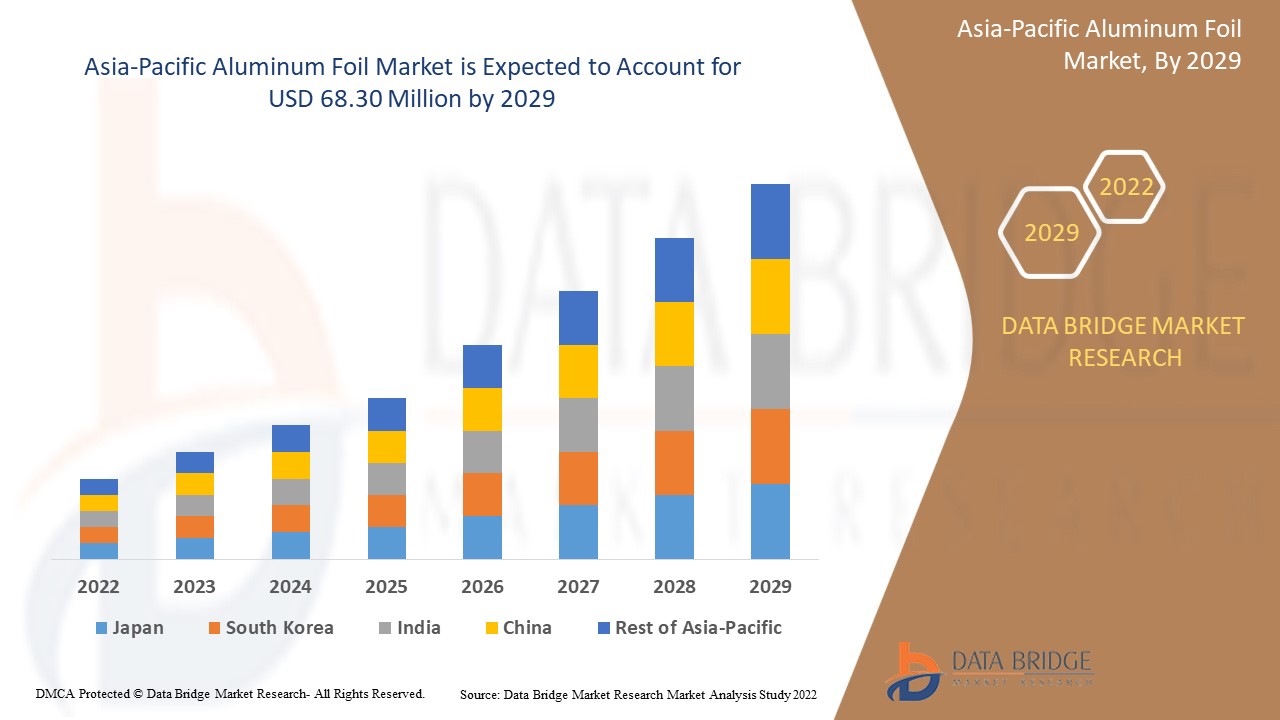

Asia-Pacific aluminum foil market size was valued at USD 37.73 billion in 2024 and is projected to reach USD 97.50 billion by 2032, with a CAGR of 12.6% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Aluminum Foil Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific. |

|

Key Market Players |

Amcor PLC (Switzerland), Constantia Flexibles (Austria), Coppice Alupack Limited (UK), Aditya Birla management corporation Pvt ltd (Mumbai), Eurofoil (Luxembourg), Hulamin Limited (South Africa), Novelis Aluminum (US), Tetra Pak SA (Switzerland), RUSAL (Russia), Wyda Packaging (Pty) LTD (South Africa), Alufoil Products Pvt Ltd (India), Assan Aluminyum Sanavi ve Ticaret AS (Istanbul), Constellium SE (France), Norsk Hydro ASA (Norway), Reynolds Consumer Products (US), Raviraj Foils Ltd (India), Zhangjiagang Goldshine Aluminum Foil Co. (China), Aliberico (Spain) |

|

Market Opportunities |

|

Aluminum Foil Market Definition

Aluminum foil is a key component of laminates and is commonly found in food packaging. It offers a higher barrier function against moisture, oxygen, and other gases, as well as volatile smell and light, than any plastic laminate material. Aluminum foil is also used to make sterilised packaging. Aluminum foils deliver many advantages to the packaging and food industries and the consumer, including consumer-friendliness & recyclability.

Aluminum Foil Market Dynamics

Drivers

- Rising government initiatives for spreading consumer awareness

Due to increased government activities to raise awareness about food safety, the market is being pushed by increased demand for aluminum foil from end-users such as food, pharmaceuticals, and cosmetics.

- Stringent rules and regulations toward food safety

The progress of the household aluminum foil industry is due to government regulations toward food safety and quality standards, which encourage manufacturers to create effective packaging solutions that prevent food contamination.

- Increase the demand of E-retailing

Changing retail industry dynamics are likely to boost the demand for different retail products, therefore positively propelling the growth of the ready-to-use packaging products. Furthermore, the development of the e-retailing segment has moved consumers to online stores from retail stores. The online food industry will likely remain a key consumer market for aluminum foil products.

- Increasing demand of biologics

Development in biotechnology and the increasing demand for biologics are expected to drive the demand for aluminum foil in goods, such as powders, liquids and tablets in the country.

Opportunities

- Rise in product innovations

For the market's growth pace, the increasing number of product innovations would enhance new market prospects. Aluminum is a recyclable material that represents a lucrative opportunity for manufacturers as rising collection and recovery rates for the product mean less production price and improved profitability.

- Demand for producing lightweight packages

Use of aluminum foil accompanied by flexible films to produce lightweight packages has been increasing reasonably. This is probable to offer new opportunities for the market sellers over the short term. These packages can be used in food, coffee, and fish packaging.

Restraints/ Challenges

The global market is growing enormously. However, there are some difficulties in the paths of growth. These hindrances include a lack of proper packaging techniques; some countries are still stuck to traditional methods. Due to the changing lifestyle of people, there is still a major part of the world that does not have enough money to buy packaged food. These are the major market restraints that will obstruct the market's growth rate.

This aluminum foil market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the aluminum foil market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Asia-Pacific Aluminum Foil Market Scope

The aluminum foil market is segmented on the basis of products, types, thickness and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Products

- Foil Wrappers

- Pouches

- Blister Packs

- Collapsible Tubes

- Trays/Containers

- Capsules

- Laminated Lids

- Foil Lined Bags

- Chocolate Foils

- Foil Round Seals

- Others

Type

- Printed

- Unprinted

Thickness

- 0.07 MM

- 0.09 MM

- 0.2 MM

- 0.4 MM

End-User

- Food

- Pharmaceuticals

- Cosmetics

- Insulation

- Electronics

- Geochemical Sampling

- Automotive Components

- Others

Aluminum Foil Market Regional Analysis

The aluminum foil market is analyzed and market size insights and trends are provided by country, products, types, thickness and end-user as referenced above.

The countries covered in the aluminum foil market report are Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific,

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Aluminum Foil Market Share

The aluminum foil market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to aluminum foil market.

Aluminum Foil Market Leaders Operating in the Market Are:

- Amcor PLC (Switzerland)

- Constantia Flexibles (Austria)

- Coppice Alupack Ltd. (UK)

- Aditya Birla Management Corporation Pvt Ltd (India)

- Eurofoil (Luxembourg)

- Hulamin Limited (South Africa)

- Novelis Aluminum (US)

- Tetra Pak International SA (Switzerland)

- RUSAL (Russia)

- Wyda Packaging (Pty) LTD (South Africa)

- Alufoil Products Pvt Ltd (India)

- Assan Aluminyum Sanavi ve Ticaret AS (Istanbul)

- Constellium SE (France)

- Norsk Hydro ASA (Norway)

- Reynolds Consumer Products (US)

- Raviraj Foils Ltd (India)

- Zhangjiagang Goldshine Aluminum Foil Co. (China)

- Aliberico (Spain)

Latest Developments in Aluminum Foil Market

- In November 2021, ProAmpac declared that their parent company, IFP Investments Limited had developed Irish Flexible Packaging and Fispak. These are Ireland based producers and suppliers of sustainable, flexible packaging serving the fish, dairy, bakery, meat and cheese markets in Ireland and globally

- In September 2021, Flex Films, the film manufacturing arm of flexible packaging company Uflex, launched its BOPET high barrier film F-UHB-M. The film is planned to replace aluminum foil in flexible packaging applications to resolve the tasks of the Industry that have weak integrity, material availability, high material price amongst others. These alternatives in the market which can lead food production to substitute aluminum foil for packaging the products which is expected to challenge the market growth

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.