Europe Uv Filter Market

Tamanho do mercado em biliões de dólares

CAGR :

%

| 2024 –2031 | |

| USD 331.00 Million | |

| USD 430.46 Million | |

|

|

|

>Mercado europeu de filtros UV, por produto (biológico, inorgânico e híbrido), aplicação (cuidados pessoais e cosméticos, plástico, embalagens, revestimentos industriais, construção, lentes óticas, têxteis, agricultura, eletrónica de consumo e outros) – Tendências e previsões do setor para 2031.

Análise de mercado de filtros UV

O Filtro UV tem um rápido crescimento na expansão da indústria de cuidados com a pele e respondeu a esta maior consciencialização inovando e melhorando as formulações de filtros UV. As empresas estão a investir em investigação e desenvolvimento para criar produtos de proteção UV mais eficazes, duradouros e fáceis de utilizar. A indústria cosmética está a evoluir rapidamente, com um forte foco no desenvolvimento de produtos que ofereçam benefícios adicionais para além dos cuidados básicos com a pele. Os filtros UV estão agora a ser incorporados numa vasta gama de produtos, incluindo hidratantes, bases e bálsamos labiais, para proporcionar uma proteção solar abrangente. Esta tendência é particularmente proeminente em regiões com elevada exposição UV, onde os consumidores são mais propensos a procurar produtos com proteção UV incorporada. impulsionando assim o crescimento do mercado.

Tamanho do mercado de filtros UV

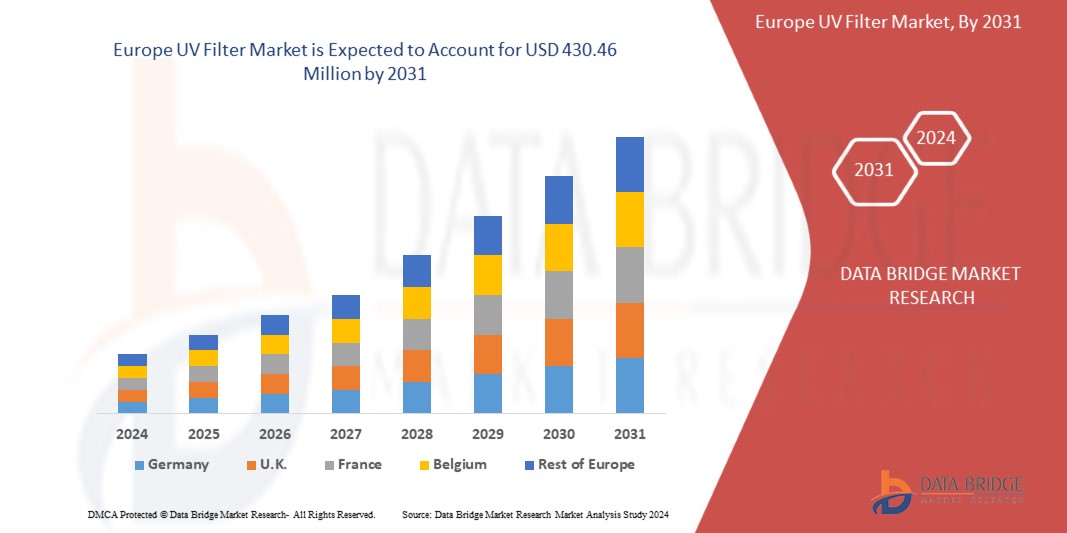

O tamanho do mercado europeu de filtros UV foi avaliado em 331,00 milhões de dólares em 2023 e deverá atingir os 430,46 milhões de dólares até 2031, com um CAGR de 3,39% durante o período de previsão de 2024 a 2031.

Tendências do mercado de filtros UV

“Aplicações crescentes de filtros UV em revestimentos industriais ”

Os filtros UV são cada vez mais utilizados em revestimentos industriais para proteger as superfícies da radiação ultravioleta (UV), que pode provocar degradação, descoloração e redução da vida útil dos revestimentos. À medida que as indústrias procuram aumentar a durabilidade e longevidade dos seus produtos, a procura por filtros UV tem aumentado. Estes filtros são essenciais para fornecer uma barreira protetora que evita os danos induzidos pelos UV, tornando-os um componente crítico na formulação de revestimentos de alto desempenho.

Exemplos da indústria da construção civil também contribuem para a crescente procura de filtros UV nos revestimentos. Os revestimentos arquitetónicos utilizados em exteriores de edifícios estão expostos a diversas condições climatéricas, incluindo radiação UV intensa. Ao incorporar filtros UV nestes revestimentos, os fabricantes podem oferecer produtos que resistem ao desbotamento e mantêm as suas qualidades protetoras durante longos períodos. Esta aplicação de filtros UV está a tornar-se cada vez mais crucial à medida que os proprietários e promotores de edifícios dão prioridade a soluções duradouras e de baixa manutenção. Além disso, o setor dos bens de consumo, incluindo a eletrónica e os eletrodomésticos, beneficia dos filtros UV nos revestimentos. Os dispositivos e eletrodomésticos eletrónicos apresentam frequentemente revestimentos que protegem contra os danos UV, garantindo que a sua aparência e funcionalidade permanecem intactas. À medida que cresce o mercado de bens de consumo duráveis e esteticamente atrativos, aumenta a necessidade de filtros UV nestes revestimentos. Esta procura é apoiada pelos avanços tecnológicos e pelas crescentes expectativas dos consumidores por produtos de elevada qualidade.

Âmbito do relatório e segmentação de mercado

|

Atributos |

Principais insights do mercado de filtros UV |

|

Segmentos cobertos |

Por produto : biológico, inorgânico e híbrido Por aplicação : cuidados pessoais e cosméticos, plástico, embalagens, revestimentos industriais, construção, lentes ópticas, têxteis, agricultura, electrónica de consumo e outros |

|

Países abrangidos |

Alemanha, França, Reino Unido, Itália, Rússia, Espanha, Países Baixos, Bélgica, Suécia, Suíça, Polónia, Noruega, Dinamarca, Turquia, Finlândia e Resto da Europa. |

|

Principais participantes do mercado |

BASF SE (Alemanha), DSM (Holanda), Ashland (EUA), MFCI CO., LTD (China), SUNJIN BEAUTY SCIENCE (Coreia do Sul), EverCare (EUA), Sarex (Índia), UNIPROMA Hot Products (Reino Unido ), Omega Óptica, Lda. (EUA) e IRA Istituto Ricerche Applicate SpA (Itália) |

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os grandes players, os relatórios de mercado com curadoria da Data Bridge Market Research incluem também a análise de importação e exportação, a visão geral da capacidade de produção , análise de consumo de produção, análise de tendências de preço, cenário de alterações climáticas, análise da cadeia de abastecimento, análise da cadeia de valor, visão geral das matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Definição do mercado de filtros UV

Os filtros UV são compostos utilizados para bloquear ou absorver a radiação ultravioleta (UV). São comummente encontrados em protetores solares, cosméticos e vários produtos para a pele. Estes filtros protegem a pele dos raios UV nocivos, que podem causar queimaduras solares, envelhecimento precoce e cancro de pele. Os filtros UV são classificados em dois tipos principais: absorventes químicos e bloqueadores físicos. Os absorventes químicos absorvem a radiação UV e convertem-na em calor inofensivo. Os bloqueadores físicos, como o óxido de zinco e o dióxido de titânio, refletem e dispersam os raios UV da pele. A sua utilização é essencial para manter a saúde da pele e prevenir os danos induzidos pelos UV.

Dinâmica do mercado dos filtros UV

Motoristas

- Aumento da consciencialização sobre a proteção e doenças da pele

The skincare industry has responded to this heightened awareness by innovating and improving UV filter formulations. Companies are investing in research and development to create more effective, long-lasting, and user-friendly UV protection products. These advancements are crucial as consumers look for products that not only provide high SPF protection but also cater to different skin types and preferences, such as water-resistant and non-greasy formulations. This innovation is driving the market forward, as more consumers integrate UV protection into their daily skincare routines. Moreover, regulatory bodies worldwide are implementing stricter guidelines for UV protection in skincare products, ensuring that products on the market are both safe and effective. These regulations are compelling manufacturers to enhance their UV filter offerings, thereby boosting market growth. The increasing scrutiny and demand for transparency in product formulations are pushing companies to use high-quality, compliant ingredients, which further fuels the expansion of the UV filter market.

For instance,

- In July 2024, in according to an article published by MJH Life Sciences, World Skin Health Day was inaugurated by the International League of Dermatological Societies (ILDS) and the International Society of Dermatology (ISD). The event aimed to promote "Skin Health for All" with Europe activities. CeraVe, the first official corporate partner, supported initiatives worldwide to enhance skin health education and access. Events included free consultations in Malta, a skin cancer program in Tanzania, and educational sessions in Canada and Australia. The day marked a significant step towards addressing barriers to dermatological care Europe.

Growing Demand for Personal Care and Cosmetic Products

The cosmetic industry is rapidly evolving, with a strong focus on developing products that offer additional benefits beyond basic skincare. UV filters are now being incorporated into a wide range of products, including moisturizers, foundations, and lip balms, to provide comprehensive sun protection. This trend is particularly prominent in regions with high UV exposure, where consumers are more likely to seek out products with built-in UV protection. Advancements in UV filter technology are also playing a crucial role in market growth. Manufacturers are investing in research and development to create more efficient and stable UV filters that provide broad-spectrum protection. These innovations not only enhance the efficacy of personal care and cosmetic products but also address consumer concerns about potential side effects and environmental impact.

For instance,

- In July 2024, according to article published by Cision US Inc., A new study by Veylinx revealed consumer preferences for sunscreen, highlighting increased demand for products with added benefits like anti-aging (+49%), hydration (+33%), and vitamin C (+23%). Consumers showed a willingness to pay more for these enhanced features. The study also noted rising "sunxiety," with 38% feeling uneasy in the sun and a significant percentage burning easily. Usage trends indicated 30% applied sunscreen daily in summer, while 65% preferred SPF greater than 40.

Opportunities

- Rising Demand for Natural and Organic UV Filter Products

Consumers are increasingly seeking products made with natural ingredients due to growing awareness about the potential health and environmental impacts of synthetic chemicals. This shift in consumer preference is driven by a desire for safer, eco-friendly, and sustainable products. Natural and organic UV filters often use plant-based or mineral ingredients like zinc oxide and titanium dioxide, which are perceived as safer and more environmentally friendly.

For instance,

- In July 2024, according to an article published by UL LLC, consumers are placing greater emphasis on transparency and clean beauty in their skincare products. In response, sunscreen brands are removing problematic ingredients such as oxybenzone and octinoxate, which have been associated with environmental and health issues. Clean formulations focus on natural and organic ingredients that are safe for both skin and the environment, in line with the clean beauty trend.

- Advancements And Innovations In Formulation Technology

Improved formulation techniques enhance the effectiveness, stability, and sensory attributes of UV filters, making them more attractive to both manufacturers and consumers. New technologies enable the development of UV filters that offer better protection against a broader spectrum of UV radiation. Innovations such as encapsulation techniques help improve the stability and longevity of UV filters in various products, ensuring they remain effective throughout their intended use.

For instance,

- In July 2024, according to a blog published by Let's Make Beauty by Presperse, encapsulation technology offers excellent flexibility, enabling its use in various cosmetic products to improve their performance, stability, and user experience. Encapsulating UV filters can boost a product's photo stability and comfort, minimize potential skin irritation, and enhance protection against harmful sun exposure

Restraints/Challenges

- Potential Health and Environmental Concerns

Certain UV filters, such as oxybenzone and octocrylene, have raised concerns due to their potential health impacts. Research has indicated that these compounds may have endocrine-disrupting effects, which can interfere with hormonal systems in humans. This has led to increased scrutiny and regulation, as consumers become more aware of the potential risks associated with these chemicals. Consequently, the demand for UV filters is impacted by the growing preference for products with safer, more natural ingredients.

Environmental issues also contribute to the restraint on the UV filter market. Many UV filters have been found to have harmful effects on marine ecosystems. For example, some chemicals can contribute to coral reef bleaching and disrupt aquatic life, leading to adverse environmental impacts. This has led to stricter regulations and bans on certain UV filters in various regions, particularly in places with sensitive marine environments. These ecological concerns result in increased regulatory compliance costs and limit the market's ability to use certain UV filters, impacting overall market growth.

For instances

- In September 2021, According to an article published by Environmental Working Group, the FDA proposed updating sunscreen regulations, determining only zinc oxide and titanium dioxide as “generally recognized as safe and effective” (GRASE). Other ingredients, including oxybenzone and octinoxate, faced scrutiny for safety and were not classified as GRASE due to insufficient data. Concerns arose over systemic absorption, hormone disruption, and potential health risks. European standards differed, proposing stricter limits for some non-mineral UV filters. The FDA requested more safety data for these ingredients while allowing their continued use in the U.S. market.

High Cost of High-Quality UV Filters

For industrial applications, such as in automotive and architectural coatings, the cost of high-quality UV filters can be a significant barrier. These filters are crucial for enhancing the durability and performance of coatings by preventing UV-induced degradation. However, the high cost can lead to increased production costs for manufacturers, which might deter them from using premium filters. As a result, the market may see slower growth in sectors where cost constraints are a critical factor. Additionally, the high cost of advanced UV filters can restrict innovation and the development of new products within the market. Manufacturers might be hesitant to invest in research and development of novel UV filter technologies if the high costs make it challenging to achieve a return on investment. This reluctance can slow down the introduction of new and improved UV filters, further stalling market progress.

Climate Change Scenario

The Europe UV filter market faces significant environmental concerns, particularly regarding the impact of certain UV filters on marine ecosystems. Ingredients such as oxybenzone and octocrylene have been linked to coral reef degradation, harming coral health and disrupting aquatic life due to their toxic effects. In response to environmental and health concerns, the Europe UV filter market is undergoing significant changes. The industry is shifting towards safer, eco-friendly alternatives to traditional UV filters like oxybenzone and octocrylene, which have been linked to coral reef damage and other environmental issues. Governments play a pivotal role in shaping the Europe UV filter market through regulation, policy-making, and enforcement. They establish regulations and safety standards for UV filters to protect consumers, setting limits on concentrations and defining efficacy and safety profiles, as seen with agencies like the U.S. FDA and the European Commission. Analysts recommend several strategic approaches for the Europe UV filter market to address current challenges and leverage emerging opportunities. Firstly, shifting towards eco-friendly alternatives is crucial due to increasing environmental concerns about traditional UV filters like oxybenzone and octocrylene, which have been linked to coral reef damage. Adopting biodegradable and reef-safe ingredients can help companies align with regulatory trends and meet consumer demand for sustainable products

Regulatory Framework content

Regulations play a crucial role in the UV Filter market, ensuring product quality, safety, and environmental compliance throughout the manufacturing process, For UV systems used in water treatment, adherence to Environmental Protection Agency (EPA) guidelines ensures that the UV systems effectively inactivate pathogens and meet safety standards. Regulations on waste disposal and recycling vary by region, requiring manufacturers to implement proper waste management practices to minimize environmental impact.

Below is a detailed coverage of regulations and standards affecting the Europe UV Filter market:

Europe

Regulation (EC) No 1223/2009

- UV filters used in cosmetics must be approved and listed in Annex VI of Regulation (EC) No 1223/2009. This annex specifies which UV filters can be used, their maximum allowable concentrations, and any specific conditions of use.

- Before a UV filter can be included in Annex VI, it must undergo rigorous safety evaluations. This includes toxicological testing to ensure it does not pose a risk to human health when used as intended.

- Products containing UV filters must demonstrate their effectiveness in protecting against UV radiation. This typically involves standardized testing methods for SPF (Sun Protection Factor) and UVA protection.

- Sunscreens and other products containing UV filters must include appropriate labeling, which includes:

SPF Value: Indicates the level of UVB protection.

UVA Protection: Must include a UVA logo or statement if the product offers UVA protection.

Directions for Use: Instructions on how to apply the product effectively.

Warnings: Any specific warnings related to sun exposure and use of the product.

United States

21 CFR Part 352 :

- It includes a list of UV filters that are generally recognized as safe and effective for use in sunscreens. These filters are categorized into two types:

Chemical UV Filters: These include ingredients like:

- Avobenzone (Butyl Methoxydibenzoylmethane): Provides broad-spectrum UVA protection.

- Octocrylene: Used to stabilize other UV filters and provides UVB protection.

- Octinoxate (Ethylhexyl Methoxycinnamate): Absorbs UVB rays.

- Oxybenzone: Provides UVB and some UVA protection.

- Homosalate: Absorbs UVB rays.

Physical (Mineral) UV Filters: These include ingredients like:

- Titanium Dioxide: Provides broad-spectrum protection, including UVA and UVB.

- Zinc Oxide: Also provides broad-spectrum protection.

The UV energy required to produce an MED on protected skin divided by the UV energy required to produce an MED on unprotected skin, which may also be defined by the following ratio: SPF value = MED (protected skin (PS))/MED (unprotected skin (US)), where MED (PS) is the minimal erythema dose for protected skin after application of 2 milligrams per square centimeter of the final formulation of the sunscreen product, and MED (US) is the minimal erythema dose for unprotected skin, e., skin to which no sunscreen product has been applied. In effect, the SPF value is the reciprocal of the effective transmission of the product viewed as a UV radiation filter.

Production Cost Scenario

As per our analysis the average production of UV Filters is 19,011.47 Tons in the year 2023, and it is expected to reach 22,384.32 Tons in 2031. The average consumption is 17,469.64 Tons in the year 2023 and it is expected to reach 21,267.34 Tons in 2031.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Impacto esperado da desaceleração económica nos preços e na disponibilidade dos produtos

Quando a actividade económica abranda, as indústrias começam a sofrer. Os efeitos previstos da recessão económica nos preços e na acessibilidade dos produtos são tidos em conta nos relatórios de visão de mercado e nos serviços de inteligência fornecidos pela DBMR. Com isto, os nossos clientes conseguem normalmente manter-se um passo à frente dos seus concorrentes, projetar as suas vendas e receitas e estimar os seus gastos com lucros e perdas.

Âmbito do mercado de filtros UV da Europa

O mercado é segmentado com base no produto, aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar os escassos segmentos de crescimento nas indústrias e fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Produto

- Orgânico

- Avobenzona

- Octinoxato

- Octocrileno

- Oxibenzona

- Homossalato

- Octisalado

- Ensulizol

- Bis-Etilhexiloxifenol Metoxifenil Triazina (Bemotrizinol)

- Metileno Bis-Benzotriazolil Tetrametilbutilfenol (Bisoctrizol)

- Drometrizol Trissiloxano

- Meradimato (Antranilato de Mentilo)

- Octiltriazona (Etilhexil Triazona)

- Polissilicone-15

- Ácido Aminobenzóico

- Octil Dimetil Paba

- Outros

- Inorgânico

- Dióxido de Titânio (TIO2)

- Óxido de Zinco (ZNO)

- Óxido de Ferro (FE2O3)

- Óxido de Silicone (SIO2)

- Óxido de Tântalo

- Outros

- Híbrido

Aplicação

- Cuidados Pessoais e Cosmética

- Protetor solar

- Creme BB e CC

- Base

- Creme facial

- Loção

- Bálsamo labial

- Batom

- Champôs

- Condicionador

- Outros

- Plástico, Embalagem

- Embalagem de alimentos

- Embalagem Farmacêutica

- Revestimentos Industriais

- Revestimentos Protetores

- Máquinas

- Gasodutos

- Equipamentos Industriais

- Outros

- Revestimentos Auto

- Casaco Transparente

- Tintas

- Faróis

- Windows

- Pára-brisas

- Pára-choques

- Espelhos laterais

- Compostura

- Outros

- Construção

- Lentes ópticas

- Óculos de sol

- Óculos

- Lentes de contacto

- Têxteis

- Roupas esportivas

- Fatos de banho

- Outros

- Agricultura

- Filmes de efeito de estufa

- Panos de sombra

- Capas de colheita

- Outros

- Eletrónicos de consumo

- Smartphones

- Monitores

- Televisores

- Outros

- Outros

- Revestimentos Protetores

Análise regional do mercado de filtros UV da Europa

O mercado é segmentado com base no produto e na aplicação .

Os países abrangidos pelo mercado são a Alemanha, França, Reino Unido, Itália, Rússia, Espanha, Países Baixos, Bélgica, Suécia, Suíça, Polónia, Noruega, Dinamarca, Turquia, Finlândia e resto da Europa.

Espera-se que a Alemanha domine o mercado devido à sua grande e crescente população, aumentando a consciencialização sobre a proteção da pele e aumentando o rendimento disponível.

Espera-se que a França seja o país com crescimento mais rápido devido à crescente indústria de cosméticos e cuidados pessoais da região, que também impulsiona a procura de filtros UV em protetores solares e produtos para a pele.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado interno que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a jusante e a montante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas europeias e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas nacionais e das rotas comerciais, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Participação no mercado de filtros UV na Europa

O cenário competitivo do mercado fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na Europa, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, largura e amplitude do produto, aplicação domínio. Os dados acima fornecidos estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes de mercado de filtros UV que operam no mercado são:

- BASF SE (Alemanha)

- DSM (Holanda)

- Ashland (EUA)

- MFCI CO., LTD (China)

- CIÊNCIA DA BELEZA SUNJIN (Coreia do Sul)

- EverCare (EUA)

- Sarex (Índia)

- Produtos quentes UNIPROMA (Reino Unido)

- Omega Óptica, Lda. (NÓS)

- IRA Istituto Ricerche Applicate SpA (Itália)

Últimos desenvolvimentos no mercado de filtros UV

- Em setembro de 2023, a BASF expandiu ainda mais a sua área de produção do seu moderno portefólio de filtros UV na região Ásia-Pacífico. Uvinul A Plus é um dos poucos filtros UVA fotoestáveis disponíveis no mercado atualmente que filtra de forma fiável os raios UVA prejudiciais do sol e proporciona proteção contra os radicais livres e danos na pele.

- Em março de 2023, a DSM alarga o portefólio PARSOL com o lançamento do PARSOL DHHB. O PARSOL DHHB oferece flexibilidade aos formuladores para criarem produtos multifuncionais com proteção UVA adequada e formulações de alta classe ecológica (de acordo com o DSM Sunscreen Optimizer™ 2.0). A sua excelente solubilidade e ampla compatibilidade de formulação fazem com que o PARSOL DHHB se destaque da multidão e seja adequado para uma vasta gama de aplicações, incluindo protetores solares, cuidados faciais e cosméticos com cor.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRIAL RIVALRY

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST'S RECOMMENDATIONS

4.4 DETAILED INFORMATION FOR UV FILTERS MANUFACTURERS

4.5 EUROPE VS CHINA UV FILTER MARKET

4.5.1 OVERVIEW

4.5.2 EUROPE UV FILTER MARKET OVERVIEW

4.5.3 CHINA UV FILTER MARKET OVERVIEW

4.5.4 EUROPE VS CHINA UV FILTER MARKET

4.6 OVERVIEW ON HISTORICAL, PRESENT AND FUTURE OUTLOOK OF UV FILTER AT EUROPE LEVEL

4.6.1 HISTORICAL OVERVIEW

4.6.2 PRESENT SCENARIO

4.6.3 FUTURE OUTLOOK

4.7 PRODUCTION COST SCENARIO BY MANUFACTURERS

4.7.1 RAW MATERIAL COSTS

4.7.2 MANUFACTURING COSTS

4.7.3 REGULATORY COMPLIANCE

4.7.4 DISTRIBUTION AND LOGISTICS

4.7.5 RESEARCH AND DEVELOPMENT

4.7.6 ENVIRONMENTAL AND SUSTAINABILITY INITIATIVES

4.8 RAW MATERIAL COVERAGE

4.8.1 TITANIUM DIOXIDE(TIO2)

4.8.2 ZINC OXIDE

4.8.3 AVOBENZONE

4.8.4 OCTINOXATE

4.8.5 OXYBENZONE

4.8.6 HOMOSALATE

4.8.7 OCTOCRYLENE

4.8.8 OCTISALATE

4.8.9 RAW MATERIAL SUPPLY CHAIN CONSIDERATIONS

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.10.1 BROAD-SPECTRUM PROTECTION:

4.10.2 ENHANCED STABILITY AND EFFICACY:

4.10.3 MINERAL AND HYBRID FILTERS:

4.10.4 SKIN COMPATIBILITY:

4.10.5 SUSTAINABILITY:

4.11 VENDOR SELECTION CRITERIA

4.11.1 QUALITY AND CONSISTENCY OF SUPPLY

4.11.2 RELIABILITY AND TIMELINESS

4.11.3 COST COMPETITIVENESS

4.11.4 TECHNICAL CAPABILITY AND INNOVATION

4.11.5 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.11.6 FINANCIAL STABILITY

4.11.7 CUSTOMER SERVICE AND SUPPORT

4.12 PRICING ANALYSIS

4.12.1 RAW MATERIAL COSTS

4.12.2 MANUFACTURING PROCESSES

4.12.3 TECHNOLOGICAL ADVANCEMENTS

4.12.4 MARKET DEMAND

4.12.5 WHOLESALE MARGINS

4.12.5.1 Raw Material Costs

4.12.5.2 Production Costs

4.12.5.3 Regulatory Compliance

4.12.5.4 Market Demand

4.12.5.5 Competition and Market Saturation

4.13 PRODUCTION CONSUMPTION ANALYSIS

4.14 TOP 10 COUNTRIES DATA

4.15 REGULATION COVERAGE

4.15.1 QUALITY STANDARDS AND CERTIFICATION

4.15.2 ENVIRONMENTAL REGULATIONS

4.15.3 OCCUPATIONAL HEALTH AND SAFETY

4.15.4 EXPORT CONTROLS AND INTERNATIONAL TRADE

4.15.5 INTELLECTUAL PROPERTY RIGHTS (IPR)

4.15.6 COMPLIANCE CHALLENGES AND CONSIDERATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING AWARENESS OF SKIN PROTECTION AND SKIN CONDITIONS

5.1.2 GROWING DEMAND FOR PERSONAL CARE AND COSMETIC PRODUCTS

5.1.3 INCREASING APPLICATION OF UV FILTERS IN POLYMER STABILIZATION AND DURABILITY

5.1.4 RISING APPLICATIONS OF UV FILTERS IN INDUSTRIAL COATINGS

5.2 RESTRAINTS

5.2.1 POTENTIAL HEALTH AND ENVIRONMENTAL CONCERNS

5.2.2 HIGH COST OF HIGH-QUALITY UV FILTERS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR NATURAL AND ORGANIC UV FILTER PRODUCTS

5.3.2 ADVANCEMENTS AND INNOVATIONS IN FORMULATION TECHNOLOGY

5.3.3 STRINGENT REGULATIONS AND GUIDELINES FOR UV PROTECTION

5.4 CHALLENGES

5.4.1 HARMFUL ENVIRONMENTAL EFFECTS OF UV FILTERS IN VARIOUS PRODUCTS

5.4.2 COMPLEX REGULATORY LANDSCAPE AND COMPLIANCE WITH DIFFERENT STANDARDS

6 EUROPE UV FILTER MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 ORGANIC

6.3 INORGANIC

6.4 HYBRID

7 EUROPE UV FILTER MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 PERSONAL CARE AND COSMETICS

7.3 PLASTIC

7.3.1 PACKAGING

7.3.2 INDUSTRIAL COATINGS

7.3.3 CONSTRUCTION

7.4 OPTICAL LENSES

7.4.1 TEXTILES

7.5 AGRICULTURE

7.6 CONSUMER ELECTRONICS

7.7 OTHERS

8 EUROPE UV FILTER MARKET, BY REGION

8.1 EUROPE

8.1.1 GERMANY

8.1.2 FRANCE

8.1.3 U.K.

8.1.4 ITALY

8.1.5 RUSSIA

8.1.6 SPAIN

8.1.7 NETHERLANDS

8.1.8 BELGIUM

8.1.9 SWEDEN

8.1.10 SWITZERLAND

8.1.11 POLAND

8.1.12 NORWAY

8.1.13 DENMARK

8.1.14 TURKEY

8.1.15 FINLAND

8.1.16 REST OF EUROPE

9 EUROPE UV FILTER MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: EUROPE

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 BASF SE

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENTS

11.2 DSM

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENTS

11.3 ASHLAND

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT UPDATES

11.4 MFCI CO.,LTD

11.4.1 COMPANY SNAPSHOT

11.4.2 COMPANY SHARE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 1.4.3 RECENT DEVELOPMENT

11.5 SUNJIN BEAUTY SCIENCE

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 COMPANY SHARE ANALYSIS

11.5.4 PRODUCT PORTFOLIO

11.5.5 RECENT DEVELOPMENT

11.6 EVERCARE

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT DEVELOPMENT

11.7 IRA ISTITUTO RICERCHE APPLICATE

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENT

11.8 OMEGA OPTICAL LLC.

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT UPDATES

11.9 SAREX

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENT

11.1 UNIPROMA HOT PRODUCTS

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

Lista de Tabela

TABLE 1 LISTS OF TOP 10 MANUFACTURERS, AND THEIR ESTIMATED PRODUCTION COST AND AVERAGE SELLING PRICE ARE LISTED BELOW:

TABLE 2 EUROPE VS CHINA UV FILTER MARKET DEMAND ANALYSIS (USD THOUSAND)

TABLE 3 EUROPE UV FILTER MARKET, WHOLESALE MARGINS

TABLE 4 TOP 10 COUNTRIES DATA, (USD THOUSAND, TONS AND AVERAGE SELLIN GPRICE (USD/KG): EUROPE UV FILTER MARKET

TABLE 5 REGULATIONS ACROSS VARIOUS REGIONS AND COUNTRIES

TABLE 6 EUROPE UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 7 EUROPE UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 8 EUROPE UV FILTER MARKET, AVERAGE SELLING PRICE, BY PRODUCT, 2022-2031 (USD/KG)

TABLE 9 EUROPE ORGANIC IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 EUROPE ORGANIC IN UV FILTER MARKET, BY REGION, 2022-2031 (TONS)

TABLE 11 EUROPE ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 12 EUROPE INORGANIC IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 13 EUROPE INORGANIC IN UV FILTER MARKET, BY REGION, 2022-2031 (TONS)

TABLE 14 EUROPE INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 15 EUROPE HYBRID IN UV FILTER MARKET, BY REGION 2022-2031 (USD THOUSAND)

TABLE 16 EUROPE HYBRID IN UV FILTER MARKET, BY REGION 2022-2031 (TONS)

TABLE 17 EUROPE UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 18 EUROPE PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 19 EUROPE PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 EUROPE PLASTIC IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 EUROPE PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 EUROPE PACKAGING IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 23 EUROPE PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 EUROPE INDUSTRIAL COATINGS IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 EUROPE INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 26 EUROPE PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 27 EUROPE AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 28 EUROPE CONSTRUCTION IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 29 EUROPE CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 EUROPE OPTICAL LENSES IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 EUROPE OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 32 EUROPE TEXTILES IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 EUROPE TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 34 EUROPE AGRICULTURE IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 35 EUROPE AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 36 EUROPE CONSUMER ELECTRONICS IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 EUROPE CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 38 EUROPE OTHERS IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 EUROPE UV FILTER MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 40 EUROPE UV FILTER MARKET, BY COUNTRY, 2022-2031 (TONS)

TABLE 41 EUROPE UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 42 EUROPE UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 43 EUROPE ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 44 EUROPE INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 45 EUROPE UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 46 EUROPE PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 EUROPE PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 EUROPE PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 EUROPE INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 EUROPE PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 51 EUROPE AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 52 EUROPE CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 EUROPE OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 EUROPE TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 55 EUROPE AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 EUROPE CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 GERMANY UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 58 GERMANY UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 59 GERMANY ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 60 GERMANY INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 61 GERMANY UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 62 GERMANY PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 63 GERMANY PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 GERMANY PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 GERMANY INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 66 GERMANY PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 67 GERMANY AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 68 GERMANY CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 GERMANY OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 GERMANY TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 71 GERMANY AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 GERMANY CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 FRANCE UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 74 FRANCE UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 75 FRANCE ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 76 FRANCE INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 77 FRANCE UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 78 FRANCE PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 FRANCE PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 FRANCE PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 FRANCE INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 FRANCE PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 83 FRANCE AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 84 FRANCE CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 85 FRANCE OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 86 FRANCE TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 FRANCE AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 FRANCE CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 U.K. UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 90 U.K. UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 91 U.K. ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 92 U.K. INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 93 U.K. UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 94 U.K. PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 95 U.K. PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 U.K. PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 U.K. INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 U.K. PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 99 U.K. AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 100 U.K. CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 U.K. OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 U.K. TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 U.K. AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 104 U.K. CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 105 ITALY UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 106 ITALY UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 107 ITALY ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 108 ITALY INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 109 ITALY UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 110 ITALY PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 ITALY PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 ITALY PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 ITALY INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 ITALY PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 115 ITALY AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 116 ITALY CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 117 ITALY OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 ITALY TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 119 ITALY AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 ITALY CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 RUSSIA UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 122 RUSSIA UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 123 RUSSIA ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 124 RUSSIA INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 125 RUSSIA UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 126 RUSSIA PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 RUSSIA PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 128 RUSSIA PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 129 RUSSIA INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 RUSSIA PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 131 RUSSIA AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 132 RUSSIA CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 RUSSIA OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 RUSSIA TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 135 RUSSIA AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 136 RUSSIA CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 SPAIN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 138 SPAIN UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 139 SPAIN ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 140 SPAIN INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 141 SPAIN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 142 SPAIN PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 143 SPAIN PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 144 SPAIN PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 145 SPAIN INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 146 SPAIN PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 147 SPAIN AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 148 SPAIN CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 SPAIN OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 SPAIN TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 151 SPAIN AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 SPAIN CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 NETHERLANDS UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 154 NETHERLANDS UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 155 NETHERLANDS ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 156 NETHERLANDS INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 157 NETHERLANDS UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 158 NETHERLANDS PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 NETHERLANDS PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 NETHERLANDS PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 161 NETHERLANDS INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 NETHERLANDS PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 163 NETHERLANDS AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 164 NETHERLANDS CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 165 NETHERLANDS OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 166 NETHERLANDS TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 167 NETHERLANDS AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 168 NETHERLANDS CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 169 BELGIUM UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 170 BELGIUM UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 171 BELGIUM ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 172 BELGIUM INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 173 BELGIUM UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 174 BELGIUM PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 175 BELGIUM PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 176 BELGIUM PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 177 BELGIUM INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 178 BELGIUM PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 179 BELGIUM AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 180 BELGIUM CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 181 BELGIUM OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 BELGIUM TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 183 BELGIUM AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 184 BELGIUM CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 185 SWEDEN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 186 SWEDEN UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 187 SWEDEN ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 188 SWEDEN INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 189 SWEDEN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 190 SWEDEN PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 191 SWEDEN PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 192 SWEDEN PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 193 SWEDEN INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 194 SWEDEN PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 195 SWEDEN AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 196 SWEDEN CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 197 SWEDEN OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 198 SWEDEN TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 199 SWEDEN AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 200 SWEDEN CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 201 SWITZERLAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 202 SWITZERLAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 203 SWITZERLAND ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 204 SWITZERLAND INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 205 SWITZERLAND UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 206 SWITZERLAND PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 207 SWITZERLAND PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 208 SWITZERLAND PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 209 SWITZERLAND INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 210 SWITZERLAND PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 211 SWITZERLAND AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 212 SWITZERLAND CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 213 SWITZERLAND OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 214 SWITZERLAND TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 215 SWITZERLAND AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 216 SWITZERLAND CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 POLAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 218 POLAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 219 POLAND ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 220 POLAND INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 221 POLAND UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 222 POLAND PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 223 POLAND PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 224 POLAND PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 225 POLAND INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 226 POLAND PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 227 POLAND AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 228 POLAND CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 229 POLAND OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 230 POLAND TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 231 POLAND AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 232 POLAND CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 233 NORWAY UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 234 NORWAY UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 235 NORWAY ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 236 NORWAY INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 237 NORWAY UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 238 NORWAY PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 239 NORWAY PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 240 NORWAY PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 241 NORWAY INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 242 NORWAY PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 243 NORWAY AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 244 NORWAY CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 245 NORWAY OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 246 NORWAY TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 247 NORWAY AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 248 NORWAY CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 249 DENMARK UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 250 DENMARK UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 251 DENMARK ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 252 DENMARK INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 253 DENMARK UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 254 DENMARK PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 255 DENMARK PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 256 DENMARK PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 257 DENMARK INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 258 DENMARK PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 259 DENMARK AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 260 DENMARK CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 261 DENMARK OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 262 DENMARK TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 263 DENMARK AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 264 DENMARK CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 265 TURKEY UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 266 TURKEY UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 267 TURKEY ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 268 TURKEY INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 269 TURKEY UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 270 TURKEY PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 271 TURKEY PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 272 TURKEY PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 273 TURKEY INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 274 TURKEY PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 275 TURKEY AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 276 TURKEY CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 277 TURKEY OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 278 TURKEY TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 279 TURKEY AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 280 TURKEY CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 281 FINLAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 282 FINLAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 283 FINLAND ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 284 FINLAND INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 285 FINLAND UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 286 FINLAND PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 287 FINLAND PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 288 FINLAND PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 289 FINLAND INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 290 FINLAND PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 291 FINLAND AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 292 FINLAND CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 293 FINLAND OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 294 FINLAND TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 295 FINLAND AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 296 FINLAND CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 297 REST OF EUROPE UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 298 REST OF EUROPE UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

Lista de Figura

FIGURE 1 EUROPE UV FILTER MARKET

FIGURE 2 EUROPE UV FILTER MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE UV FILTER MARKET: DROC ANALYSIS

FIGURE 4 EUROPE UV FILTER MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE UV FILTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE UV FILTER MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE UV FILTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE UV FILTER MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE UV FILTER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE UV FILTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE UV FILTER MARKET: SEGMENTATION

FIGURE 12 THREE SEGMENTS COMPRISE THE EUROPE UV FILTER MARKET, BY PRODUCT

FIGURE 13 EUROPE UV FILTER MARKET: OVERVIEW

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWING DEMAND FOR PERSONAL CARE AND COSMETIC PRODUCTS IS EXPECTED TO DRIVE THE EUROPE UV FILTER MARKET IN THE FORECAST PERIOD

FIGURE 16 THE ORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE UV FILTER MARKET IN 2024 AND 2031

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 EUROPE UV FILTER MARKET, 2022-2031, AVERAGE SELLING PRICE (USD/KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS: EUROPE UV FILTER MARKET

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE UV FILTER MARKET

FIGURE 23 EUROPE UV FILTER MARKET: BY PRODUCT, 2023

FIGURE 24 EUROPE UV FILTER MARKET: BY APPLICATION, 2023

FIGURE 25 EUROPE UV FILTER MARKET: SNAPSHOT (2023)

FIGURE 26 EUROPE UV FILTER MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.