Mexico Rfid And Electronic Article Surveillance Systems Market

Tamanho do mercado em biliões de dólares

CAGR :

%

| 2024 –2031 | |

| USD 408,499.95 Thousand | |

| USD 775,431.35 Thousand | |

|

|

|

|

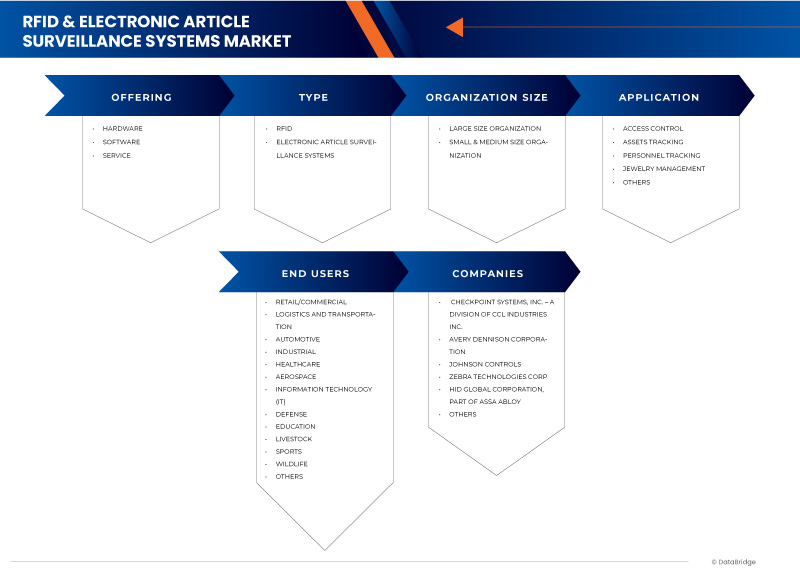

>Mercado de sistemas de vigilância de artigos eletrónicos e RFID do México, por ofertas (hardware, software e serviço), tipo (sistemas de vigilância de artigos eletrónicos e RFID), dimensão da organização (organização de grande dimensão e organização de pequena e média ), aplicação (controlo de acessos, Rastreio de ativos, Rastreio de Pessoal, Gestão de Joias e Outros), Utilizadores Finais (Retalho/Comercial, Logística e Transportes, Automóvel, Industrial, Saúde, Aeroespacial, Tecnologia da Informação (TI), Defesa, Educação, Pecuária, Desporto, Vida Selvagem e Outros) , Canal de Vendas (Indiretas e Diretas) - Tendências do Setor e Previsão para 2031.

Análise e tamanho do mercado de sistemas de vigilância eletrónica e RFID do México

Os sistemas RFID (identificação por radiofrequência) e vigilância eletrónica de artigos (EAS) representam soluções tecnológicas de ponta que revolucionaram os setores do retalho e da logística. Os sistemas RFID utilizam ondas de rádio para identificar e rastrear artigos em tempo real, oferecendo uma visibilidade incomparável nas operações da cadeia de abastecimento. Ao anexar etiquetas RFID aos produtos, as empresas podem monitorizar o seu movimento ao longo de toda a cadeia de abastecimento, desde a produção até ao ponto de venda, permitindo uma gestão precisa do inventário e operações logísticas eficientes. Por outro lado, os sistemas EAS empregam diversas tecnologias, tais como etiquetas e antenas, para impedir o roubo e evitar a remoção não autorizada de artigos das instalações retalhistas. Estes sistemas funcionam como um poderoso impedimento contra o furto em lojas e ajudam os retalhistas a minimizar as perdas decorrentes do furto. Combinados, os sistemas RFID e EAS proporcionam uma supervisão abrangente dos ativos, melhoram a precisão do inventário, otimizam os processos da cadeia de abastecimento e garantem uma maior segurança nas operações de retalho e logística. Com a sua capacidade de agilizar as operações, reduzir custos e melhorar a segurança, os sistemas RFID e EAS continuam a desempenhar um papel fundamental na promoção da eficiência e da rentabilidade nos setores do retalho e da logística.

A Data Bridge Market Research analisa que o mercado de sistemas de vigilância de artigos eletrónicos e RFID do México deverá atingir um valor de 775.431,35 mil dólares até 2031, face aos 408.499,95 mil de 2023, crescendo a um CAGR de 8,5 % durante o período de previsão de 2024 a 2031.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2024 a 2031 |

|

Ano base |

2023 |

|

Anos históricos |

2022 (personalizável para 2016-2021) |

|

Unidades Quantitativas |

Receita em mil dólares |

|

Segmentos cobertos |

Ofertas (hardware, software e serviço), tipo (RFID e sistemas eletrónicos de vigilância de artigos), dimensão da organização (organização de grande dimensão e organização de pequena e média dimensão), aplicação (controlo de acessos, rastreio de ativos, rastreio de pessoal, gestão de joias e outros ), Utilizadores Finais (Retalho/Comercial, Logística e Transportes, Automóvel, Industrial, Saúde, Aeroespacial, Tecnologia da Informação (TI), Defesa, Educação, Pecuária, Desporto, Vida Selvagem e Outros), Canal de Vendas (Indireto e Direto) |

|

Estados abrangidos |

Jalisco, Oaxaca, Chihuahua, Coahuila de Saragoça, Sonora, Zacatecas e resto do México |

|

Participantes do mercado abrangidos |

Checkpoint Systems, Inc, AVERY DENNISON CORPORATION, Johnson Controls, Zebra Technologies Corp, HID Global Corporation, parte da ASSA ABLOY, Honeywell International Inc., Dahua Technology, Amersec sro, Datalogic SpA e Gunnebo AB |

Definição de mercado

Os sistemas RFID (identificação por radiofrequência) e vigilância eletrónica de artigos (EAS) referem-se a soluções tecnológicas avançadas empregues principalmente nos setores do retalho e da logística para melhorar a gestão de stocks, a prevenção de roubos e a otimização da cadeia de abastecimento. Os sistemas RFID utilizam ondas de rádio para identificar e rastrear artigos em tempo real, oferecendo uma visibilidade incomparável nas operações da cadeia de abastecimento. Por outro lado, os sistemas EAS empregam diversas tecnologias, tais como etiquetas e antenas, para impedir o roubo e evitar a remoção não autorizada de artigos das instalações de retalho. Em conjunto, estes sistemas proporcionam uma supervisão abrangente dos ativos, melhoram a precisão do inventário e garantem uma maior segurança nos setores do retalho e da logística.

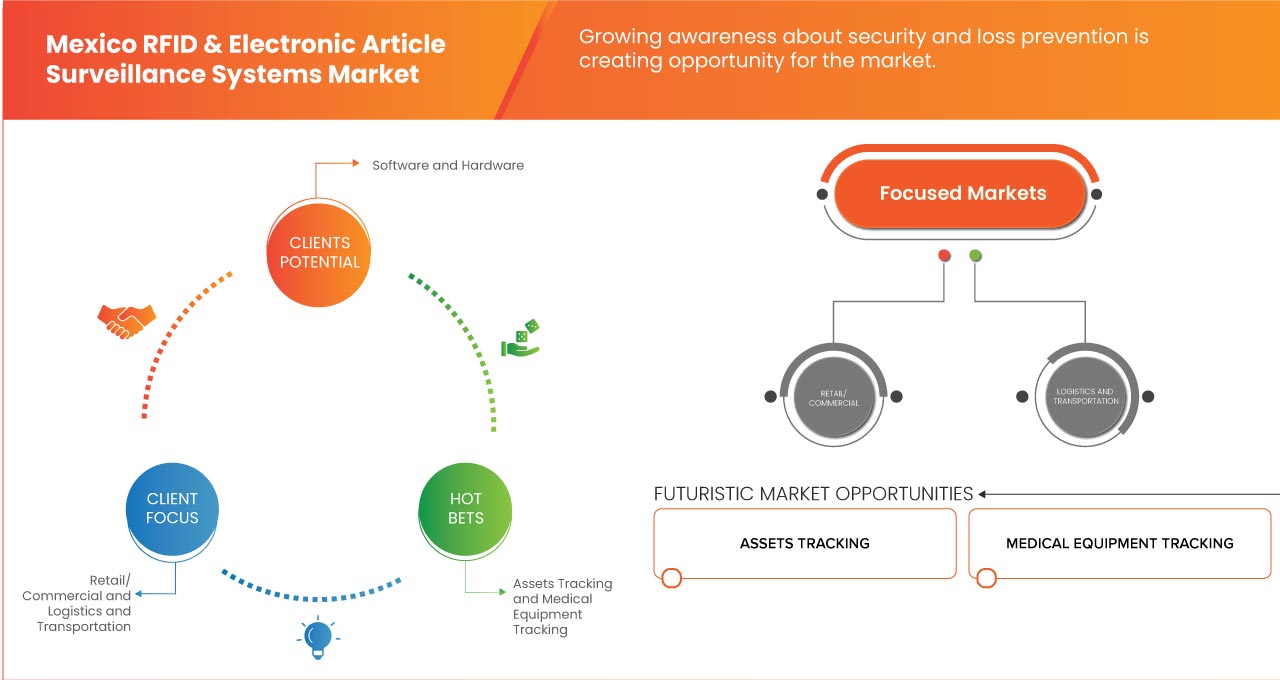

Mercado mexicano de sistemas de vigilância de artigos eletrónicos e RFID

Esta secção trata da compreensão dos impulsionadores do mercado, vantagens, oportunidades, restrições e desafios. Tudo isto é discutido em detalhe abaixo:

Motoristas

- A expansão do setor do retalho exige a integração de sistemas RFID e EAS

A expansão do sector retalhista sublinha a necessidade crucial de integração de sistemas de identificação por radiofrequência (RFID) e de vigilância electrónica de artigos (EAS). A combinação de RFID, que facilita a gestão de stocks em tempo real e aumenta a eficiência operacional, com o EAS, que proporciona proteção antirroubo, garante soluções abrangentes de rastreio e segurança de ativos . Esta integração otimiza a visibilidade do stock, reduz as ocorrências de rutura de stock, minimiza as perdas por roubo e agiliza os processos de checkout. Ao aproveitar o RFID para o rastreio preciso de stocks e o EAS para a prevenção de roubos, os retalhistas podem aumentar a satisfação do cliente, aumentar as vendas e manter a vantagem competitiva no panorama dinâmico do retalho.

- Aumento da procura por maior visibilidade da cadeia de abastecimento, o que leva a uma melhor logística e a custos reduzidos

A crescente procura por uma melhor visibilidade da cadeia de abastecimento está a levar os retalhistas a adotar tecnologias avançadas como a RFID. A visibilidade melhorada permite o seguimento do stock em tempo real, permitindo uma gestão logística mais precisa e reduzindo os custos operacionais. Esta visão granular da movimentação de mercadorias desde a origem até à venda ajuda a identificar ineficiências e a agilizar processos, resultando num serviço mais rápido e preciso. Como resultado, os retalhistas podem reduzir o excesso de stock, minimizar o desperdício e melhorar a capacidade de resposta global da cadeia de abastecimento. A adoção da tecnologia RFID não só aumenta a eficiência logística como também reduz significativamente os custos, contribuindo para uma melhor rentabilidade e competitividade no mercado.

Oportunidades

- Avanços Tecnológicos em Sistemas RFID e EAS

Os avanços tecnológicos nos sistemas de identificação por radiofrequência (RFID) e de vigilância eletrónica de artigos (EAS) abriram oportunidades significativas para o mercado. Com a integração de sensores avançados , análise de dados e algoritmos de aprendizagem automática, os modernos sistemas RFID e EAS oferecem capacidades melhoradas na gestão de stocks, prevenção de perdas e otimização da experiência do cliente. Estes avanços permitem aos retalhistas e às empresas de logística acompanhar e gerir eficientemente o seu inventário em tempo real, levando a uma maior eficiência operacional e redução de custos.

Além disso, a convergência dos sistemas RFID e EAS com outras tecnologias emergentes, como a IoT (Internet das Coisas) e a computação em nuvem , expandiu as suas aplicações potenciais em vários setores para além do retalho, incluindo cuidados de saúde, produção e logística . A capacidade de recolher e analisar grandes volumes de dados gerados por sistemas RFID e EAS facilita a análise preditiva, permitindo às empresas tomar decisões baseadas em dados, otimizar processos e melhorar o desempenho global. À medida que estas tecnologias continuam a evoluir, o mercado de sistemas RFID e EAS está preparado para um crescimento sustentado, impulsionado pela crescente procura por uma gestão eficiente de inventário, maior segurança e experiências perfeitas dos clientes.

- Aumento da procura por rastreamento de equipamentos médicos no setor da saúde

A crescente procura de rastreio de equipamentos médicos no setor da saúde apresenta uma oportunidade significativa para o mercado de sistemas RFID e de vigilância eletrónica de artigos (EAS). À medida que os hospitais e as instalações de saúde se esforçam para melhorar a eficiência e os cuidados prestados aos doentes, a necessidade de um rastreio preciso e em tempo real dos equipamentos médicos torna-se fundamental. A tecnologia RFID oferece uma solução robusta, permitindo a identificação e rastreamento automáticos de dispositivos , instrumentos e material médico durante todo o seu ciclo de vida. Ao implementar sistemas RFID, os prestadores de cuidados de saúde podem melhorar a utilização dos activos, reduzir a perda ou o roubo de equipamento, agilizar a gestão de inventário e garantir a conformidade regulamentar.

Restrições/Desafios

- Os custos iniciais de investimento podem impedir a adoção de RFID e EAS

Os custos de investimento iniciais associados à implementação de sistemas de identificação por radiofrequência (RFID) e de vigilância eletrónica de artigos (EAS) podem representar uma barreira significativa à adoção pelos retalhistas. Estas tecnologias requerem despesas iniciais com equipamento, software e formação, o que pode sobrecarregar os orçamentos limitados. Além disso, a complexidade da integração de RFID e EAS na infra-estrutura existente aumenta os encargos financeiros. Os retalhistas podem hesitar em comprometer recursos sem uma compreensão clara do retorno do investimento e dos benefícios a longo prazo. Consequentemente, apesar de reconhecerem as potenciais vantagens em termos de gestão de inventário e prevenção de perdas, muitas empresas podem atrasar ou renunciar à adopção devido a restrições financeiras.

- A integração de sistemas RFID e EAS com infraestruturas e processos de TI existentes pode ser complexa e morosa

A integração dos sistemas RFID (Identificação por Radiofrequência) e EAS (Vigilância Eletrónica de Artigos) com a infraestrutura e processos de TI existentes representa um desafio significativo para o Mercado de Sistemas de Vigilância de Artigos Eletrónicos e RFID. Uma das principais complexidades surge da diversidade de sistemas informáticos já implementados em diferentes setores e organizações. Cada empresa pode ter aplicações de software, bases de dados e configurações de rede exclusivas, tornando um desafio integrar perfeitamente as tecnologias RFID e EAS sem interrupções nas operações existentes.

Além disso, o processo de integração pode ser demorado devido à necessidade de planeamento, personalização e testes minuciosos para garantir a compatibilidade e funcionalidade com a infraestrutura de TI existente. Isto envolve frequentemente a coordenação com diversas partes interessadas, incluindo equipas de TI, administradores de sistemas e utilizadores finais, para resolver potenciais conflitos e otimizar o desempenho do sistema. Como resultado, o longo calendário de integração pode impedir as organizações de adotarem soluções RFID e EAS, especialmente aquelas com necessidades urgentes de segurança ou gestão de inventário.

Além disso, quaisquer atrasos ou interrupções durante a integração podem afetar a produtividade e as receitas, resultando potencialmente em despesas adicionais. Por conseguinte, simplificar o processo de integração e oferecer soluções económicas adaptadas a diversos ambientes de TI são fatores críticos para que os fornecedores de sistemas RFID e EAS superem este desafio e impulsionem o crescimento do mercado.

Desenvolvimentos recentes

- Em abril de 2023, a Checkpoint Systems, Inc. associou-se à Partner Tech Europe para criar uma solução de Self-Service Checkout (SCO) baseada em RFID de próxima geração, destinada a melhorar a conveniência do cliente e a segurança na loja. Esta colaboração reforça a presença da Checkpoint Systems, Inc. no mercado RFID, incorporando a sua tecnologia em sistemas SCO avançados. A nova solução melhora a experiência do cliente, aumenta a prevenção de perdas e fornece dados de compra precisos, aumentando assim as vendas e a eficiência operacional para os retalhistas

- In February 2024, Zebra Technologies debuted "The Modern Store" at NRF'24 Retail's Big Show, introducing a groundbreaking retail approach with RFID technology. This innovation boosts inventory management, personalizes customer interactions, and streamlines store operations with features like self-checkout and personalized user profiles. By embedding RFID into retail settings, Zebra solidifies its reputation for delivering advanced solutions that enhance operational efficiency, accuracy, and customer experience. The success of "The Modern Store" strengthens Zebra's market position and broadens its impact in the retail technology industry

- In January 2022, Johnson Controls’ Sensormatic Solutions released its 2021 Sustainability Story white paper, detailing its commitment to sustainability through innovative RFID technology. Their Electronic Article Surveillance (EAS) systems now consume 50% less power, and the Inventory Intelligence solution, leveraging RFID, reduces waste and carbon emissions in the supply chain. This focus on sustainability benefits both retailers and shoppers, ensuring efficient operations, reduced energy use, and seamless shopping experiences

- In February 2023, HID Global Corporation has expanded its healthcare offering with the acquisition of GuardRFID, a real-time location services company. This move enhances HID's presence in the active RFID and RTLS space, allowing them to offer innovative solutions for infant security, staff duress, asset tracking, and wandering patients. The acquisition strengthens HID's ability to protect patients and staff in healthcare facilities, positioning them as a leader in the industry

- In August 2020, Datalogic S.p.A has unveiled the 2128P UHF RFID Reader, tailored for the Memor 10 PDA, to bolster inventory accuracy with rapid and precise RFID tag scanning. This advancement amplifies Datalogic SPA's RFID capabilities, enabling superior performance in tag reading. With the introduction of the 2128P UHF RFID Reader, Datalogic elevates inventory accuracy and efficiency for its clientele. Key features like maximum output power, extended read range, and tag de-duplication software streamline inventory management processes, positioning Datalogic as a leading provider of cutting-edge RFID solutions across industries including retail, transportation and logistics, manufacturing, and healthcare

Mexico RFID & Electronic Article Surveillance Systems Market Scope

The Mexico RFID & electronic article surveillance systems market is categorized into six notable segments based on offerings, type, organization size, application, end users, sales channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offerings

- Hardware

- Software

- Service

On the basis of offerings, the market is segmented into hardware, software, and service.

Type

- RFID

- Electronic Article Surveillance Systems

On the basis of type, the market is segmented into RFID and electronic article surveillance systems

Organization Size

- Large Size Organization

- Small & Medium Size Organization

On the basis of organization size, the market is segmented into large size organization and small & medium size organization.

Application

- Access Control

- Assets Tracking

- Personnel Tracking

- Jewelry Management

- Others

On the basis of application, the market is segmented into access control, assets tracking, personnel tracking, jewelry management, and others.

End Users

- Retail/Commercial

- Logistics and Transportation

- Automotive

- Industrial

- Healthcare

- Aerospace

- Information Technology (IT)

- Defense

- Education

- Livestock

- Sports

- Wildlife

- Others

On the basis of end users, the market is segmented into retail/commercial, logistics and transportation, automotive, industrial, healthcare, aerospace, Information Technology (IT), defense, education, livestock, sports, wildlife, and others.

Sales Channel

- Indirect

- Direct

On the basis of sales channel, the market is segmented into indirect and direct.

Mexico RFID & Electronic Article Surveillance Systems Market Regional Analysis/Insights

The Mexico RFID & electronic article surveillance systems market is analyzed and market size insights and trends are provided by offerings, type, organization size, application, end users, and sales channel.

The states covered in the Mexico RFID & electronic article surveillance systems market Jalisco, Oaxaca, Chihuahua, Coahuila de Zaragoza, Sonora, Zacatecas, and rest of Mexico.

The Jalisco is expected to dominate the Mexico RFID & electronic article surveillance systems market due to its robust industrial base and strong retail sector.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of country brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Mexico RFID & Electronic Article Surveillance Systems Market Share Analysis

O panorama competitivo do mercado de sistemas de vigilância de artigos eletrónicos e RFID do México fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, largura e amplitude do produto, domínio de aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas relacionado com o mercado mexicano de RFID e sistemas eletrónicos de vigilância de artigos.

Alguns dos principais players que operam no mercado mexicano de sistemas de vigilância de artigos eletrónicos e RFID são a Checkpoint Systems, Inc, a AVERY DENNISON CORPORATION, a Johnson Controls, a Zebra Technologies Corp, a HID Global Corporation, parte da ASSA ABLOY, a Honeywell International Inc., a Dahua Technology, Amersec sro, Datalogic SpA e Gunnebo AB.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 OFFERINGS TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 REGULATORY STANDARDS

4.3 TECHNOLOGICAL TRENDS

4.4 CASE STUDY

4.5 PATENT ANALYSIS

4.6 VALUE CHAIN ANALYSIS

4.7 COMPANY COMPARATIVE ANALYSIS

4.8 INDSUTRY WISE RFID IMPLEMENTATION

4.9 LIST OF THE COMPANIES ALONG WITH THEIR PROSPECT INDUSTRIES, POTENTIAL CLIENTS/CUSTOMERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RETAIL SECTOR EXPANSION NECESSITATES RFID AND EAS SYSTEM INTEGRATION

5.1.2 RISING DEMAND FOR IMPROVED SUPPLY CHAIN VISIBILITY WHICH LEADS TO BETTER LOGISTICS AND REDUCED COSTS

5.1.3 INDUSTRY 4.0 FOSTERS IOT AND RFID ASSET TRACKING ADOPTION

5.1.4 HEIGHTENED SECURITY CONCERNS DRIVE EAS SYSTEM INSTALLATIONS

5.2 RESTRAINTS

5.2.1 INITIAL INVESTMENT COSTS MAY HINDER RFID AND EAS ADOPTION

5.2.2 CONCERNS OVER DATA SECURITY AND PRIVACY IMPEDE TECHNOLOGY ADOPTION

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL ADVANCEMENTS IN RFID AND EAS SYSTEMS

5.3.2 INCREASING DEMAND FOR MEDICAL EQUIPMENT TRACKING IN HEALTHCARE SECTOR

5.3.3 GROWING AWARENESS ABOUT SECURITY AND LOSS PREVENTION

5.4 CHALLENGE

5.4.1 INTEGRATING RFID AND EAS SYSTEMS WITH EXISTING IT INFRASTRUCTURE AND PROCESSES CAN BE COMPLEX AND TIME-CONSUMING

6 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 ANTENNA

6.2.1.1 RFID ANTENNA

6.2.1.2 EAS SECURITY ANTENNA

6.2.2 TAGS

6.2.2.1 BY PRODUCT TYPE

6.2.2.1.1 RFID TAG

6.2.2.1.2 EAS TAG

6.2.2.2 BY TYPE

6.2.2.2.1 PASSIVE TAG

6.2.2.2.2 ACTIVE TAG

6.2.2.2.3 BATTERY-ASSISTED PASSIVE(BAP) RFID

6.2.2.3 BY FORM FACTOR

6.2.2.3.1 INLAY

6.2.2.3.2 LABEL

6.2.2.3.3 CARD

6.2.2.3.4 WRISTBANDS

6.2.2.3.5 OTHERS

6.2.2.4 BY MATERIAL

6.2.2.4.1 CERAMIC

6.2.2.4.2 PLASTICS

6.2.2.4.3 TEFLON

6.2.2.4.4 OTHERS

6.3 SOFTWARE

6.3.1 OPERATING SYSTEM

6.3.1.1 WINDOWS

6.3.1.2 ANDROID

6.3.1.3 iOS

6.3.1.4 OTHERS

6.3.2 DEPLOYMENT MODE

6.3.2.1 CLOUD

6.3.2.2 ON-PREMISE

6.4 SERVICES

6.4.1 SUPPORT & MAINTENANCE

6.4.2 SYSTEM INTEGRATION

6.4.3 CONSULTING

7 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE

7.1 OVERVIEW

7.2 RFID

7.2.1 HIGH FREQUENCY RFID SYSTEMS

7.2.2 LOW FREQUENCY RFID SYSTEMS

7.2.3 ULTRA-HIGH FREQUENCY RFID SYSTEMS

7.2.4 MICROWAVE RFID SYSTEMS

7.3 ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS

7.3.1 ACOUSTIC MAGNETIC (AM) SYSTEMS

7.3.2 RADIO FREQUENCY (RF) SYSTEMS & RFID

7.3.3 ELECTRO MAGNETIC (EM) SYSTEMS

7.3.4 MICROWAVE

7.3.5 OTHERS

8 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ACCESS CONTROL

8.3 ASSETS TRACKING

8.4 PERSONNEL TRACKING

8.5 JEWELRY MANAGEMENT

8.6 OTHERS

9 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE SIZE ORGANIZATION

9.3 SMALL & MEDIUM SIZE ORGANIZATION

10 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 INDIRECT

10.2.1 BY TYPE

10.2.1.1 DISTRIBUTOR/WHOLESALER

10.2.1.2 SPECIALTY STORE

10.2.1.3 OTHERS

10.3 DIRECT

11 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS

11.1 OVERVIEW

11.2 RETAIL/COMMERCIAL

11.2.1 BY TYPE

11.2.1.1 APPAREL

11.2.1.2 CONSUMER PACKAGED GOODS

11.2.1.3 KIOSK

11.2.1.4 JEWELLERY TRACKING

11.2.1.5 LAUNDRY

11.2.1.6 ADVERTISING

11.2.1.7 OTHERS

11.2.2 BY OFFERING

11.2.2.1 HARDWARE

11.2.2.2 SOFTWARE

11.2.2.3 SERVICE

11.3 LOGISTICS AND TRANSPORTATION

11.3.1 BY OFFERING

11.3.1.1 HARDWARE

11.3.1.2 SOFTWARE

11.3.1.3 SERVICE

11.4 AUTOMOTIVE

11.4.1 BY OFFERING

11.4.1.1 HARDWARE

11.4.1.2 SOFTWARE

11.4.1.3 SERVICE

11.5 INDUSTRIAL

11.5.1 BY OFFERING

11.5.1.1 HARDWARE

11.5.1.2 SOFTWARE

11.5.1.3 SERVICE

11.6 HEALTHCARE

11.6.1 BY TYPE

11.6.1.1 EQUIPMENT MANAGEMENT

11.6.1.2 DRUGS MANAGEMENT

11.6.1.3 PATIENTS MANAGEMENT

11.6.1.4 LABORATORY MANAGEMENT

11.6.1.5 WASTE MANAGEMENT

11.6.1.6 OTHERS

11.6.2 BY OFFERING

11.6.2.1 HARDWARE

11.6.2.2 SOFTWARE

11.6.2.3 SERVICE

11.7 AEROSPACE

11.7.1 BY TYPE

11.7.1.1 BAGGAGE TRACKING

11.7.1.2 MATERIALS MANAGEMENT

11.7.1.3 MRO

11.7.1.4 LIFETIME TRACEABILITY

11.7.1.5 FLYABLE PARTS TRACKING

11.7.1.6 OTHERS

11.7.2 BY OFFERING

11.7.2.1 HARDWARE

11.7.2.2 SOFTWARE

11.7.2.3 SERVICE

11.8 INFORMATION TECHNOLOGY (IT)

11.8.1 BY OFFERING

11.8.1.1 HARDWARE

11.8.1.2 SOFTWARE

11.8.1.3 SERVICE

11.9 DEFENCE

11.9.1 BY OFFERING

11.9.1.1 WEAPON MANAGEMENT TRACKING

11.9.1.2 BORDER SECURITY

11.9.1.3 SOLDIER MOVEMENT TRACKING

11.9.1.4 OTHERS

11.9.2 BY TYPE

11.9.2.1 HARDWARE

11.9.2.2 SOFTWARE

11.9.2.3 SERVICE

11.1 EDUCATION

11.10.1 BY OFFERING

11.10.1.1 HARDWARE

11.10.1.2 SOFTWARE

11.10.1.3 SERVICE

11.11 LIVESTOCK

11.11.1 BY OFFERING

11.11.1.1 HARDWARE

11.11.1.2 SOFTWARE

11.11.1.3 SERVICE

11.12 SPORTS

11.12.1 BY OFFERING

11.12.1.1 HARDWARE

11.12.1.2 SOFTWARE

11.12.1.3 SERVICE

11.13 WILDLIFE

11.13.1 BY OFFERING

11.13.1.1 HARDWARE

11.13.1.2 SOFTWARE

11.13.1.3 SERVICE

11.14 OTHERS

11.14.1 BY OFFERING

11.14.1.1 HARDWARE

11.14.1.2 SOFTWARE

11.14.1.3 SERVICE

12 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY STATE

12.1 MEXICO

12.1.1 JALISCO

12.1.2 OAXACA

12.1.3 CHIHUAHUA

12.1.4 COAHUILA DE ZARAGOZA

12.1.5 SONORA

12.1.6 ZACATECAS

12.1.7 REST OF MEXICO

13 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MEXICO

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CHECKPOINT SYSTEMS, INC. – A DIVISION OF CCL INDUSTRIES INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 AVERY DENNISON CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 ZEBRA TECHNOLOGIES CORP

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 JOHNSON CONTROLS

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 HID GLOBAL CORPORATION, PART OF ASSA ABLOY

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 AMERSEC

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DAHUA TECHNOLOGY

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 DATALOGIC S.P.A.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 HONEYWELL INTERNATIONAL INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 GUNNEBO AB

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 GAO REPORT (GAO-05-551): RFID TECHNOLOGY STANDARDS

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 LIST OF THE COMPANIES ALONG WITH THEIR PROSPECT INDUSTRIES, POTENTIAL CLIENTS

TABLE 4 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 5 MEXICO HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 6 MEXICO ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY RODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 8 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 10 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 11 MEXICO SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 12 MEXICO SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 13 MEXICO SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 14 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 15 MEXICO RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 16 MEXICO ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 17 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 18 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 19 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 20 MEXICO INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 21 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 22 MEXICO RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 MEXICO RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 24 MEXICO LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 25 MEXICO AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 26 MEXICO INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 27 MEXICO HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 28 MEXICO HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 29 MEXICO AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 MEXICO AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 31 MEXICO INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 32 MEXICO DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 33 MEXICO DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 34 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKE: BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 35 MEXICO LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 36 MEXICO SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 37 MEXICO WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 38 MEXICO OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 39 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY STATES, 2022-2031 (USD THOUSAND)

TABLE 40 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 41 MEXICO HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 42 MEXICO ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 43 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 44 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 45 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 46 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 47 MEXICO SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 48 MEXICO SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 49 MEXICO SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 MEXICO RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 52 MEXICO ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 53 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 54 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 55 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 56 MEXICO RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 MEXICO RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 58 MEXICO LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 59 MEXICO AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 60 MEXICO INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 61 MEXICO HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 MEXICO HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 63 MEXICO AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 MEXICO AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 65 MEXICO INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 66 MEXICO DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 MEXICO DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 68 MEXICO EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 69 MEXICO LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 70 MEXICO SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 71 MEXICO WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 72 MEXICO OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 73 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 74 MEXICO INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 75 TABLE-37: JALISCO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 76 JALISCO HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 JALISCO ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 JALISCO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 JALISCO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 JALISCO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 81 JALISCO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 82 JALISCO SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 83 JALISCO SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 84 JALISCO SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 85 JALISCO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 86 JALISCO RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 87 JALISCO ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 88 JALISCO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 89 JALISCO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 90 JALISCO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 91 JALISCO RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 JALISCO RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 93 JALISCO LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 94 JALISCO AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 95 JALISCO INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 96 JALISCO HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 JALISCO HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 98 JALISCO AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 99 JALISCO AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 100 JALISCO INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 101 JALISCO DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 JALISCO DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 103 JALISCO EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 104 JALISCO LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 105 JALISCO SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 106 JALISCO WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 107 JALISCO OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 108 JALISCO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 109 JALISCO INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 OAXACA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 111 OAXACA HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 OAXACA ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 OAXACA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 OAXACA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 115 OAXACA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 116 OAXACA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 117 OAXACA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 118 OAXACA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 119 OAXACA SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 OAXACA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 OAXACA RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 122 OAXACA ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 123 OAXACA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 124 OAXACA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 125 OAXACA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 126 OAXACA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 OAXACA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 128 OAXACA LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 129 OAXACA AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 130 OAXACA INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 131 OAXACA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 OAXACA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 133 OAXACA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 OAXACA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 135 OAXACA INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 136 OAXACA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 OAXACA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 138 OAXACA EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 139 OAXACA LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 140 OAXACA SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 141 OAXACA WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 142 OAXACA OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 143 OAXACA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 144 OAXACA INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 145 CHIHUAHUA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 146 CHIHUAHUA HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 147 CHIHUAHUA ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 148 CHIHUAHUA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 CHIHUAHUA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 CHIHUAHUA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 151 CHIHUAHUA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 152 CHIHUAHUA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 153 CHIHUAHUA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 154 CHIHUAHUA SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 155 CHIHUAHUA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 156 CHIHUAHUA RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 157 CHIHUAHUA ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 158 CHIHUAHUA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 159 CHIHUAHUA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 160 CHIHUAHUA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 161 CHIHUAHUA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 CHIHUAHUA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 163 CHIHUAHUA LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 164 CHIHUAHUA AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 165 CHIHUAHUA INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 166 CHIHUAHUA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 167 CHIHUAHUA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 168 CHIHUAHUA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 169 CHIHUAHUA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 170 CHIHUAHUA INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 171 CHIHUAHUA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 172 CHIHUAHUA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 173 CHIHUAHUA EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 174 CHIHUAHUA LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 175 CHIHUAHUA SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 176 CHIHUAHUA WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 177 CHIHUAHUA OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 178 CHIHUAHUA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 179 CHIHUAHUA INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 180 COAHUILA DE ZARAGOZA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 181 COAHUILA DE ZARAGOZA HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 COAHUILA DE ZARAGOZA ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 183 COAHUILA DE ZARAGOZA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 184 COAHUILA DE ZARAGOZA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 185 COAHUILA DE ZARAGOZA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 186 COAHUILA DE ZARAGOZA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 187 COAHUILA DE ZARAGOZA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 188 COAHUILA DE ZARAGOZA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 189 COAHUILA DE ZARAGOZA SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 190 COAHUILA DE ZARAGOZA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 191 COAHUILA DE ZARAGOZA RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 192 COAHUILA DE ZARAGOZA ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 193 COAHUILA DE ZARAGOZA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 194 COAHUILA DE ZARAGOZA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 195 COAHUILA DE ZARAGOZA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 196 COAHUILA DE ZARAGOZA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 197 COAHUILA DE ZARAGOZA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 198 COAHUILA DE ZARAGOZA LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 199 COAHUILA DE ZARAGOZA AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 200 COAHUILA DE ZARAGOZA INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 201 COAHUILA DE ZARAGOZA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 202 COAHUILA DE ZARAGOZA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 203 COAHUILA DE ZARAGOZA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 204 COAHUILA DE ZARAGOZA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 205 COAHUILA DE ZARAGOZA INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 206 COAHUILA DE ZARAGOZA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 207 COAHUILA DE ZARAGOZA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 208 COAHUILA DE ZARAGOZA EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 209 COAHUILA DE ZARAGOZA LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 210 COAHUILA DE ZARAGOZA SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 211 COAHUILA DE ZARAGOZA WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 212 COAHUILA DE ZARAGOZA OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 213 COAHUILA DE ZARAGOZA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 214 COAHUILA DE ZARAGOZA INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 215 SONORA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 216 SONORA HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 SONORA ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 218 SONORA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 219 SONORA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 220 SONORA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 221 SONORA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 222 SONORA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 223 SONORA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 224 SONORA SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 225 SONORA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 226 SONORA RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 227 SONORA ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 228 SONORA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 229 SONORA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 230 SONORA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 231 SONORA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 232 SONORA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 233 SONORA LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 234 SONORA AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 235 SONORA INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 236 SONORA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 237 SONORA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 238 SONORA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 239 SONORA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 240 SONORA INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 241 SONORA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 242 SONORA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 243 SONORA EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 244 SONORA LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 245 SONORA SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 246 SONORA WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 247 SONORA OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 248 SONORA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 249 SONORA INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 250 ZACATECAS RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 251 ZACATECAS HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 252 ZACATECAS ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 253 ZACATECAS TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 254 ZACATECAS TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 255 ZACATECAS TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 256 ZACATECAS TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 257 ZACATECAS SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 258 ZACATECAS SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 259 ZACATECAS SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 260 ZACATECAS RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 261 ZACATECAS RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 262 ZACATECAS ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 263 ZACATECAS RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 264 ZACATECAS RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 265 ZACATECAS RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 266 ZACATECAS RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 267 ZACATECAS RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 268 ZACATECAS LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 269 ZACATECAS AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 270 ZACATECAS INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 271 ZACATECAS HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 272 ZACATECAS HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 273 ZACATECAS AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 274 ZACATECAS AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 275 ZACATECAS INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 276 ZACATECAS DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 277 ZACATECAS DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 278 ZACATECAS EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 279 ZACATECAS LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 280 ZACATECAS SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 281 ZACATECAS WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 282 ZACATECAS OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 283 ZACATECAS RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 284 ZACATECAS INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 285 REST OF MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

Lista de Figura

FIGURE 1 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: SEGMENTATION

FIGURE 2 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: SEGMENTATION

FIGURE 10 RETAIL SECTOR EXPANSION NECESSITATES RFID AND EAS SYSTEM INTEGRATION ARE EXPECTED TO DRIVE THE MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET IN THE FORECAST PERIOD

FIGURE 11 THE HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET IN 2024 & 2031

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GLOBAL ARTIFICIAL TURF MARKET

FIGURE 13 MEXICO RETAIL SALES YOY (%)

FIGURE 14 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: BY OFFERINGS, 2023

FIGURE 15 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2023

FIGURE 16 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: BY APPLICATION, 2023

FIGURE 17 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: BY ORGANIZATION SIZE, 2023

FIGURE 18 FIGURE 1: MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: BY SALES CHANNEL, 2023

FIGURE 19 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: BY END USERS, 2023

FIGURE 20 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: COMPANY SHARE 2023 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.