Abrasivos são materiais usados para lixar, polir, cortar ou moldar outros materiais por desgaste. Esses materiais podem ser naturais, como lixas de granada ou esmeril, ou sintéticos, como carboneto de silício ou óxido de aluminio. Os abrasivos encontram amplas aplicações em setores como manufatura, construção, automotivo e eletrônico. Na fabricação, eles são cruciais para moldar e dar acabamento em metais, cerâmicae compostos. Na construção, os abrasivos são usados para alisar superfícies e cortar materiais como concreto e pedra. No setor automotivo, auxiliam no acabamento de metais, remoção de ferrugem e preparação de pintura. Além disso, na eletrônica, os abrasivos desempenham um papel vital na modelagem e polimento de componentes delicados, como semicondutores e lentes ópticas, garantindo precisão e qualidade nos processos de produção.

Acesse o Relatório completo @https://www.databridgemarketresearch.com/reports/us-abrasive-market

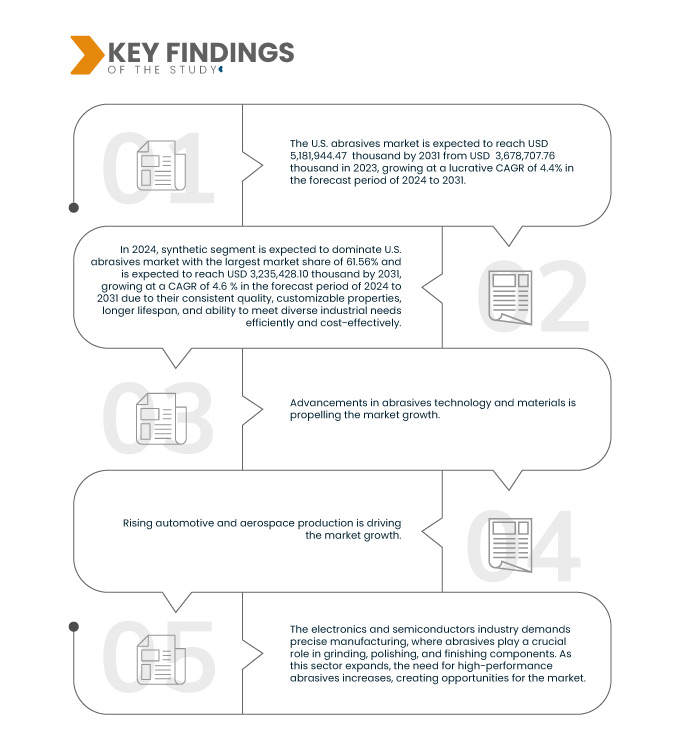

A Data Bridge Market Research analisa que o Mercado de Abrasivos dos EUA espera-se que atinja 5,18 mil milhões de dólares até 2031, contra 3,68 mil milhões de dólares em 2023, crescendo com um CAGR substancial de 4,4% no período de previsão de 2024 a 2031.

Principais conclusões do estudo

Aumento das atividades de fabricação de metal

A procura pela fabricação de metais, que é uma componente crucial de várias indústrias, testemunhou um aumento notável com a expansão da industrialização em todo o mundo. A fabricação de metal envolve processos de corte, soldagem, retificação e polimento, todos os quais dependem fortemente de abrasivos para precisão e eficiência. Este aumento nas actividades de fabricação de metal, particularmente em sectores como o automóvel, a construção e o aeroespacial, está a traduzir-se directamente num aumento da procura de abrasivos.

Escopo do relatório e segmentação de mercado

|

Métrica de relatório

|

Detalhes

|

|

Período de previsão

|

2024 a 2031

|

|

Ano base

|

2023

|

|

Anos históricos

|

2022 (personalizável para 2021-2016)

|

|

Unidades Quantitativas

|

Receita em bilhões de dólares, volume em toneladas e unidades, preços em dólares

|

|

Segmentos cobertos

|

Por matéria-prima (sintética e natural), tipo (abrasivo ligado, abrasivo revestido e superabrasivo), produto (disco, copos, cilindro e outros), forma (forma em pó e forma de bloco), aplicação (retificação, polimento , Corte, Acabamento, Perfuração e Outros), Uso Final (Automotivo, Construção Civil, Fabricação de Metal, Máquinas, Aeroespacial e Defesa, Elétrica e Eletrônica, dispositivos médicos, Petróleo e Gás e Outros)

|

|

Países abrangidos

|

NÓS

|

|

Participantes do mercado cobertos

|

ARC ABRASIVES INC. (EUA), Bullard Abrasives Inc. (EUA), Engis Corporation (EUA), INDASA (Portugal), Klingspor Abrasives Limited (Alemanha), Osborn (EUA), SAK ABRASIVES LIMITED (Índia), ., Ltd. (Japão), CUMI (Índia), Hermes Schleifmittel GmbH (Alemanha), Robert Bosch GmbH (Alemanha), SAIT ABRASIVI SpA (Itália), Mirka USA (EUA), Saint-Gobain (França), 3M (EUA), Weiler Abrasives .(EUA), VSM AG (Alemanha), entre outros

|

|

Pontos de dados abordados no relatório

|

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e grandes players, os relatórios de mercado com curadoria da Data Bridge Market Research também incluem análises especializadas aprofundadas, produção geograficamente representada pela empresa e capacidade, layouts de rede de distribuidores e parceiros, análise detalhada e atualizada de tendências de preços e análise de déficit da cadeia de suprimentos e demanda

|

Análise de Segmento

O mercado de abrasivos dos EUA é segmentado em seis segmentos notáveis: matéria-prima, tipo, produto, forma, aplicação e uso final.

- Com base na matéria-prima, o mercado de abrasivos dos EUA é segmentado em sintéticos e naturais

Em 2024, espera-se que o segmento sintético domine o Mercado de Abrasivos dos EUA

Em 2024, espera-se que o segmento sintético domine o mercado com uma participação de mercado de 61,56% devido à sua qualidade consistente, propriedades personalizáveis, vida útil mais longa e capacidade de atender diversas necessidades industriais de forma eficiente e econômica.

- Com base no tipo, o mercado de abrasivos dos EUA é segmentado em abrasivos ligados, abrasivos revestidos e superabrasivos

Em 2024, espera-se que o segmento de abrasivos aglomerados domine o Mercado de Abrasivos dos EUA

Em 2024, espera-se que o segmento de abrasivos ligados domine o mercado com uma participação de mercado de 56,31%. devido à sua versatilidade, durabilidade e capacidade de manter formas precisas durante o uso, tornando-os ideais para uma ampla gama de aplicações de retificação e corte.

- Com base no produto, o mercado de abrasivos dos EUA é segmentado em discos, copos, cilindros, entre outros. Em 2024, espera-se que o segmento de discos domine o mercado com 52,54% de participação de mercado

- Com base na forma, o mercado de abrasivos dos EUA é segmentado em pó e bloco. Em 2024, espera-se que o segmento em pó domine o mercado com uma participação de mercado de 59,62%

- Com base na aplicação, o mercado de abrasivos dos EUA é segmentado em retificação, polimento, corte, acabamento, perfuração, entre outros. Em 2024, espera-se que o segmento de moagem domine o mercado com 38,85% de participação de mercado

- Com base no uso final, o mercado de abrasivos dos EUA é segmentado em automotivo, construção civil, fabricação de metais, máquinas, aeroespacial e defesa, elétrica e eletrônica, dispositivos médicos, petróleo e gás, entre outros. Em 2024, espera-se que o segmento automotivo domine o mercado com 25,98% de participação de mercado

Jogadores principais

A Data Bridge Market Research analisa 3M (EUA), Robert Bosch Power Tools GmbH (Alemanha), Saint-Gobain (França), Tyrolit - Schleifmittelwerke Swarovski AG & Co KG (Áustria), Klingspor Abrasives Limited (Alemanha) como o principal player do Mercado de abrasivos dos EUA.

Desenvolvimentos recentes

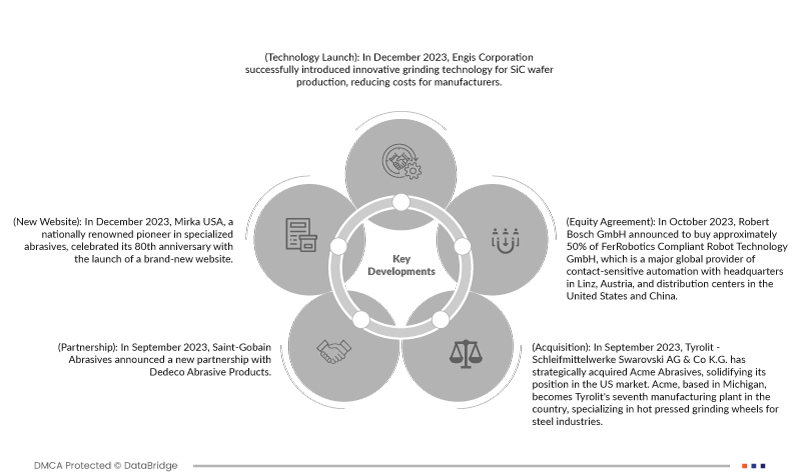

- Em dezembro de 2023, a Engis Corporation introduziu com sucesso uma tecnologia inovadora de moagem para a produção de wafers de SiC, reduzindo custos para os fabricantes. O avançado sistema de moagem, incluindo o modelo Hyprez EAG, ofereceu benefícios econômicos com controle preciso da espessura do wafer. O investimento no sistema minimizou o gasto de capital inicial e maximizou o desempenho com os rebolos Engis. A tecnologia teve como objetivo produzir wafers ultraplanos em uma operação totalmente automatizada, otimizando a rugosidade superficial e a vida útil do rebolo. Outros investimentos em ferramentas Engis foram planejados para o futuro

- Em dezembro de 2023, a Mirka USA, pioneira de renome nacional em abrasivos especializados, celebrou seu 80º aniversário com o lançamento de um novo site. O novo site apresenta os excelentes abrasivos, equipamentos e soluções de lixamento sem poeira da Mirka, bem como uma área de know-how para indústrias como reparo de colisões, carpintaria e acabamento de interiores. Ajudará clientes e profissionais a solucionar suas necessidades e problemas de negócios de forma simples, rápida e eficiente

- Em outubro de 2023, a Robert Bosch GmbH anunciou a compra de aproximadamente 50% da FerRobotics Compliant Robot Technology GmbH, que é um importante fornecedor global de automação sensível ao contato com sede em Linz, Áustria, e centros de distribuição nos Estados Unidos e na China. Robert Bosch GmbH e FerRobotics assinaram acordos para esse efeito em 29 de setembro de 2023. Com a participação acionária prevista na FerRobotics, a empresa abrirá novos nichos de mercado na indústria de acessórios

- Em setembro de 2023, a Saint-Gobain Abrasives anunciou uma nova parceria com a Dedeco Abrasive Products. A adição da linha de produtos Sunburst da Dedeco à equipe de vendas do distribuidor Saint-Gobain Abrasives na América do Norte oferece aos clientes uma seleção ainda mais ampla de abrasivos em todos os mercados industriais

- Em setembro de 2023, a Tyrolit - Schleifmittelwerke Swarovski AG & Co KG adquiriu estrategicamente a Acme Abrasives, solidificando sua posição no mercado dos EUA. A Acme, com sede em Michigan, torna-se a sétima fábrica da Tyrolit no país, especializada em rebolos prensados a quente para indústrias siderúrgicas. A mudança expande o portfólio de produtos da Tyrolit para as indústrias siderúrgica, de fundição e ferroviária, aumentando a competitividade operacional

Para obter informações mais detalhadas sobre o relatório do Mercado de Abrasivos dos EUA, clique aqui –https://www.databridgemarketresearch.com/reports/us-abrasive-market