A prevalência de doenças infecciosas e crónicas, como o cancro, a diabetes e as doenças cardiovasculares, está a aumentar rapidamente em toda a Europa. Segundo a Organização Mundial da Saúde (OMS), a contribuição das doenças crônicas foi de cerca de 60%, o que foi responsável pelo número de mortes.

Acesse o relatório completo @https://www.databridgemarketresearch.com/reports/south-africa-and-europe-poct-market

Na Europa, a principal razão por trás do número crescente de doenças crónicas é o aumento contínuo do número de população geriátrica. Essas taxas crescentes de doenças são diretamente proporcionais ao crescimento do POCT, pois são utilizados no diagnóstico de quase todas as doenças.

A Data Bridge Market Research analisa que o Mercado de testes de ponto de atendimento (POCT) deverá crescer a um CAGR de 9,3% no período de previsão de 2023 a 2030 e deverá atingir US$ 17.289,45 milhões até 2030. Os produtos de monitoramento de glicose devem impulsionar o crescimento do mercado devido à crescente prevalência do diabetes.

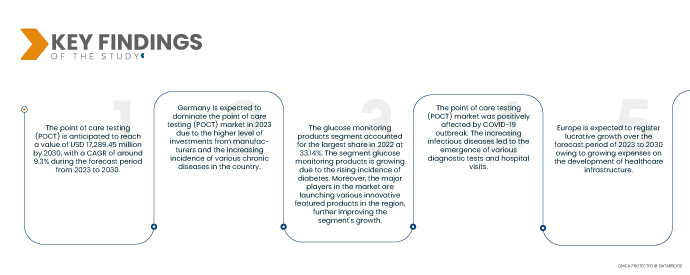

Principais conclusões do estudo

- Prevê-se que o Point-of-Care-Testing (POCT) atinja um valor de US$ 17.289,45 milhões até 2030, com um CAGR de cerca de 9,3% durante o período de previsão de 2023 a 2030

- Espera-se que a Alemanha domine o mercado de Testes Point of Care (POCT) em 2023 devido ao maior nível de investimentos dos fabricantes e à crescente incidência de diversas doenças crônicas no país

- O segmento de produtos para monitoramento de glicose foi responsável pela maior participação em 2022, com 33,14%. O segmento de produtos de monitoramento de glicose está crescendo devido ao aumento da incidência de diabetes. Além disso, os principais players do mercado estão lançando diversos produtos inovadores em destaque na região, melhorando ainda mais o crescimento do segmento

- O mercado de testes no local de atendimento (POCT) foi afetado positivamente pelo surto de COVID-19. O número crescente de doenças infecciosas levou ao surgimento de vários testes de diagnóstico e visitas hospitalares

- Espera-se que a Europa registe um crescimento lucrativo durante o período previsto de 2021 a 2030 devido às despesas crescentes no desenvolvimento de infraestruturas de saúde

O aumento da prevalência de doenças infecciosas e crônicas pode impulsionar o crescimento do mercado

A prevalência de doenças infecciosas e crónicas, como o cancro, a diabetes e as doenças cardiovasculares, está a aumentar rapidamente em toda a Europa. Segundo a Organização Mundial da Saúde (OMS), a contribuição das doenças crônicas foi de cerca de 60%, o que foi responsável pelo número de mortes. Na Europa, a principal razão por trás do número crescente de doenças crónicas é o aumento contínuo do número de população geriátrica. Essas taxas crescentes das doenças são diretamente proporcionais ao crescimento do POCT, pois são utilizados no diagnóstico de quase todas as doenças.

A crescente incidência de doenças crónicas na Europa, como cancro, asma e doenças cardíacas, entre outras, melhorou a utilização e a sensibilização para o diagnóstico precoce de doenças. Esta consciência fez com que as pessoas comprassem mais prémios de saúde, incluindo exames regulares de corpo inteiro que incluem quase todos os testes. Ao mesmo tempo, a população de doenças crónicas está a aumentar rapidamente. Assim, espera-se que um grande aumento na prevalência de doenças crônicas atue como um grande impulsionador para o crescimento do mercado, uma vez que os dispositivos POCT podem gerenciar efetivamente o distúrbio e proporcionar melhor conforto e tratamento para monitoramento sempre que necessário.

Escopo do relatório e segmentação de mercado

|

Métrica de relatório

|

Detalhes

|

|

Período de previsão

|

2023 a 2030

|

|

Ano base

|

2022

|

|

Anos históricos

|

2021 (personalizável 2015-2020)

|

|

Unidades Quantitativas

|

Receita em milhões de dólares, volumes em unidades e preços em dólares

|

|

Segmentos cobertos

|

Por tipo de produto (produtos de monitoramento de glicose, produtos de teste de doenças infecciosas, produtos de monitoramento cardiometabólico, produtos de teste de gravidez e fertilidade, produtos de teste hematológico, produtos de monitoramento de coagulação, produtos de teste de drogas de abuso (DOA), produtos de teste de urinálise, produtos de teste de colesterol, Produtos para teste de marcadores de tumor/câncer, produtos para testes ocultos nas fezes e outros), aplicação (glicemia, monitoramento cardíaco, coagulação hematológica, análise de sangue total, monitoramento de sinais vitais, monitoramento não invasivo de Spo2, monitoramento não invasivo de PCO2, transfusão de sangue, e outros), modo de prescrição (testes baseados em prescrição e testes de balcão), plataforma (ensaios de fluxo lateral/testes de imunocromatografia, varetas, diagnóstico molecular, imunoensaios, microfluídica, ensaio de química clínica, hematologia e outros), usuário final (clínicas , Atendimento Domiciliar, Hospitais, Laboratórios, Centros Cirúrgicos Ambulatoriais e Outros), Canal de Distribuição (Licitação Direta, Venda no Varejo, Venda Online e Outros)

|

|

Países abrangidos

|

África do Sul, Alemanha, França, Reino Unido, Itália, Espanha, Holanda, Rússia, Suíça, Turquia, Bélgica e Resto da Europa.

|

|

Participantes do mercado cobertos

|

F. Hoffmann-La Roche Ltd. (Suíça), Siemens Healthcare GmbH (Alemanha), Werfen (Espanha), Sysmex Europe SE. (Alemanha), Danaher (EUA), Quidel Corporation (EUA), LumiraDx (Reino Unido), BD (EUA), Abbott (EUA), Nova Biomedical (EUA), Abaxis (EUA), Trividia Health, Inc. Sekisui Diagnostics (EUA), Thermo Fisher Scientific Inc. (EUA), EKF Diagnostics (Reino Unido), Trinity Biotech (Irlanda), Chembio Diagnostics, Inc. , QuantuMDx Group Ltd.

|

|

Pontos de dados abordados no relatório

|

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e grandes players, os relatórios de mercado com curadoria da Data Bridge Market Research também incluem análises especializadas aprofundadas, epidemiologia de pacientes, análise de pipeline, análise de preços, e quadro regulamentar.

|

Análise do segmento:

O mercado de testes no ponto de atendimento (POCT) da África do Sul e da Europa é segmentado em seis segmentos notáveis, como tipo de produto, aplicação, modo de prescrição, plataforma, usuário final e canal de distribuição.

- Com base no tipo de produto, o mercado é segmentado em produtos de monitoramento de glicose, produtos de teste de doenças infecciosas, produtos de monitoramento cardiometabólico, produtos de teste de gravidez e fertilidade, produtos de teste de hematologia, produtos de monitoramento de coagulação, produtos de teste de drogas de abuso (DOA), testes de urinálise produtos, produtos para teste de colesterol, produtos para teste de marcadores de tumor/câncer, produtos para teste de ocultismo fecal e outros

Em 2023, espera-se que o segmento de produtos de monitoramento de glicose domine o mercado devido ao aumento da prevalência do diabetes.

Em 2023, o segmento de produtos de monitoramento de glicose deverá dominar o mercado com uma participação de mercado de 33,74% e deverá atingir US$ 6.531,29 milhões até 2030, crescendo com um CAGR de 11,1% no período previsto de 2023 a 2030.

- Com base na aplicação, o mercado é segmentado em glicemia, monitoramento cardíaco, hematologia, coagulação, análise de sangue total, monitoramento de sinais vitais, monitoramento não invasivo de Spo2, monitoramento não invasivo de Pco2, transfusão de sangue, entre outros.

Em 2023, espera-se que o segmento de glicemia domine o mercado devido à crescente demanda por testes no local de atendimento entre a população.

Em 2023, o segmento de glicose no sangue deverá dominar o mercado com uma participação de mercado de 36,98% e deverá atingir US$ 7.033,78 milhões até 2030, crescendo com um CAGR de 10,8% no período previsto de 2023 a 2030.

- Com base no modo de prescrição, o mercado é segmentado em testes baseados em prescrição e testes de balcão. Em 2023, espera-se que o segmento de testes baseados em prescrição domine o mercado com uma participação de mercado de 54,82% e deverá atingir US$ 9.742,74 milhões até 2030, crescendo com um CAGR de 9,7% no período previsto de 2023 a 2030.

- Com base na plataforma, o mercado é segmentado em ensaios de fluxo lateral/testes de imunocromatografia, varetas, diagnóstico molecular, imunoensaios, microfluídica, ensaio de química clínica, hematologia, entre outros. Em 2023, o segmento de ensaios de fluxo lateral/testes de imunocromatografia deverá dominar o mercado com uma participação de mercado de 52,99% e deverá atingir US$ 9.646,09 milhões até 2030, crescendo com um CAGR de 10,1% no período previsto de 2023 a 2030.

- Com base no usuário final, o mercado é segmentado em clínicas, atendimento domiciliar, hospitais, laboratórios, centros cirúrgicos ambulatoriais, entre outros. Em 2023, o segmento de clínicas deverá dominar o mercado com uma participação de mercado de 36,88% e deverá atingir US$ 6.890,49 milhões até 2030, crescendo com um CAGR de 10,5% no período previsto de 2023 a 2030

- Com base no canal de distribuição, o mercado é segmentado em licitação direta, vendas no varejo, vendas online, entre outros. Em 2023, o segmento de leilão direto deverá dominar o mercado com uma participação de mercado de 34,66% e deverá atingir US$ 6.499,71 milhões até 2030, crescendo com um CAGR de 10,6% no período previsto de 2023 a 2030

Jogadores principais

A Data Bridge Market Research reconhece as seguintes empresas como participantes do mercado na África do Sul e na Europa Mercado de testes de ponto de atendimento (POCT) F. Hoffmann-La Roche Ltd. (Suíça), Siemens Healthcare GmbH (Alemanha), Werfen (Espanha ), Sysmex Europa SE. (Alemanha), Danaher (EUA), Quidel Corporation (EUA), LumiraDx (Reino Unido), BD (EUA), Abbott (EUA), Nova Biomedical (EUA), Abaxis (EUA), Trividia Health, Inc. Sekisui Diagnostics (EUA), Thermo Fisher Scientific Inc. (EUA), EKF Diagnostics (Reino Unido), Trinity Biotech (Irlanda), Chembio Diagnostics, Inc. (EUA) e QuantuMDx Group Ltd. (Reino Unido), entre outros.

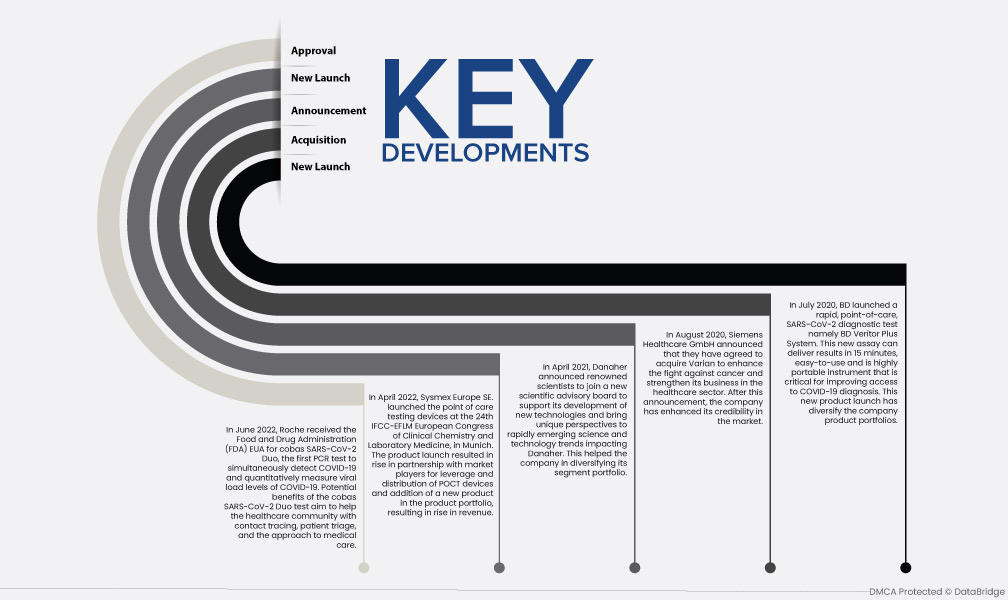

Desenvolvimento de mercado

- Em junho de 2022, a Roche recebeu os EUA da Food and Drug Administration (FDA) para o cobas SARS-CoV-2 Duo, o primeiro teste PCR para detectar simultaneamente a COVID-19 e medir quantitativamente os níveis de carga viral da COVID-19. Os potenciais benefícios do teste cobas SARS-CoV-2 Duo visam ajudar a comunidade de saúde no rastreio de contactos, triagem de pacientes e abordagem aos cuidados médicos

- Em abril de 2022, a Sysmex Europe SE. lançou os dispositivos de teste no local de atendimento no 24º Congresso Europeu de Química Clínica e Medicina Laboratorial da IFCC-EFLM, em Munique. O lançamento do produto resultou no aumento da parceria com players do mercado para alavancagem e distribuição de dispositivos POCT e na adição de um novo produto no portfólio de produtos, resultando em aumento de receita

- Em abril de 2021, a Danaher anunciou que cientistas renomados se juntariam a um novo conselho consultivo científico para apoiar o desenvolvimento de novas tecnologias e trazer perspectivas únicas para tendências científicas e tecnológicas rapidamente emergentes que impactam a Danaher. Isso ajudou a empresa a diversificar seu portfólio de segmentos

- Em agosto de 2020, a Siemens Healthcare GmbH anunciou que concordou em adquirir a Varian para melhorar a luta contra o cancro e fortalecer os seus negócios no setor da saúde. Após esse anúncio, a empresa aumentou sua credibilidade no mercado.

- Em julho de 2020, a BD lançou um teste de diagnóstico SARS-CoV-2 rápido, no local de atendimento, denominado BD Veritor Plus System. Este novo ensaio pode fornecer resultados em 15 minutos, é fácil de usar e é um instrumento altamente portátil, fundamental para melhorar o acesso ao diagnóstico da COVID-19. Este lançamento de novos produtos deve diversificar o portfólio de produtos da empresa

- Em março de 2020, a Abbott lançou um teste molecular no local de atendimento para detectar novos coronavírus em apenas cinco minutos. Os testes são projetados para identificar o vírus, visando pequenas quantidades dele e amplificando essa porção até que haja o suficiente para detecção. O lançamento desta tecnologia de fluxo lateral ajudou a empresa a aprimorar sua plataforma

Análise Regional

Geograficamente, os países cobertos no relatório de mercado Point-of-Care-Testing (POCT) são África do Sul, Alemanha, França, Reino Unido, Itália, Espanha, Holanda, Rússia, Suíça, Turquia, Bélgica e resto da Europa.

De acordo com a análise da pesquisa de mercado da Data Bridge:

A Alemanha é o país que mais cresce e domina na região da Europa no mercado Point-of-Care-Testing (POCT) durante o período de previsão 2023-2030

Em 2023, a Alemanha dominou o mercado de testes no local de atendimento (POCT) devido ao maior nível de investimentos de vários fabricantes e à crescente prevalência de doenças infecciosas e crônicas na região. A Alemanha continuará a dominar o mercado de testes no ponto de atendimento (POCT) em termos de participação de mercado e receita de mercado e continuará a florescer seu domínio durante o período de previsão. Estima-se que a Alemanha seja o país que mais cresce no mercado de testes no ponto de atendimento (POCT) para o período de previsão 2023-2030. Isso se deve à crescente adoção de tecnologia avançada e ao lançamento de novos produtos nesta região.

Para obter informações mais detalhadas sobre o Point-of-Care-Testing (POCT) mercado relatório, clique aqui –