O mercado global de produtos para fumar e alternativas para fumar é fragmentado e composto por muitos participantes globais. Estas empresas produzem preços competitivos, vários tipos de soluções e produtos inovadores com serviços em todo o mundo. Devido à presença de players a nível regional e internacional, os fornecedores e fabricantes oferecem produtos e serviços com diferentes soluções e funcionalidades para todos os orçamentos. O aumento da cultura de fumar em todo o mundo está a impulsionar significativamente o mercado global de produtos para fumar e alternativas para fumar. Além disso, a crescente prevalência de produtos para fumar está a impulsionar ainda mais o mercado. No entanto, espera-se que a formulação de regulamentos rigorosos por parte do governo restrinja o crescimento do mercado. Além disso, espera-se que as diretrizes rigorosas de publicidade para produtos de tabaco desafiem o crescimento do mercado. No entanto, espera-se que a crescente adoção de produtos para fumar e a modernização de alternativas para fumar ofereçam oportunidades lucrativas para o crescimento do mercado.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/global-smoking-products-and-smoking-alternatives-market

Mercado global de produtos para fumar e alternativas para fumar

A Data Bridge Market Research analisa que o mercado global de produtos e alternativas para fumar deverá atingir os 1.491.228,44 milhões de dólares até 2030, face aos 902.870,00 milhões de dólares em 2022, crescendo com um CAGR substancial de 6,6% no período previsto de 2023 a 2030.

Principais conclusões do estudo

Aumento da cultura tabágica em todo o mundo

A cultura de fumar tem vindo a evoluir ao longo dos anos, à medida que o tabaco ganha popularidade e o seu uso aumenta significativamente, apesar dos alarmantes riscos para a saúde. No entanto, existe uma variedade de tipos de fumo, como o cachimbo de água/shisha, os cigarros, os charutos e os vapes. Entre eles, o cachimbo de água está profundamente enraizado nas tradições culturais partilhadas de geração em geração. Além disso, a moda do cachimbo de água aumentou tremendamente entre os jovens, que incorporaram uma nova cultura na vida universitária. Devido a esta tradição, existem agora mais cafés, restaurantes e lounges que oferecem uma variedade de serviços, incluindo serviços de tabaco para shisha. Isto tem ajudado a revolucionar o setor da hotelaria, restauração e cafés (HoReCa).

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2023 a 2030

|

Ano base

|

2022

|

Anos Históricos

|

2021 (personalizável para 2015 - 2020)

|

Unidades quantitativas

|

Receita em milhões de dólares americanos

|

Segmentos abrangidos

|

Produtos (cigarros, charutos e cigarrilhas, cigarros eletrónicos e vaporizadores, produtos de terapia de substituição da nicotina (TRN), tabaco para shisha e produtos à base de plantas)

|

Países abrangidos

|

EUA, África, Arábia Saudita, Alemanha, Emirados Árabes Unidos, Índia, Espanha, Indonésia, Japão, Iraque e Coreia do Sul.

|

Participantes do mercado abrangidos

|

Fumari Inc. (EUA), Haze Tobacco (EUA), Al Fakher (EUA), SOCIALSMOKE (EUA), Japan Tobacco Inc. (Japão), SOEX (Índia), Romman Shisha (Jordânia), MAZAYA (Jordânia), Ugly Hookah (EUA), Cloud Tobacco (EUA), Nakhla Tobacco Company SAE (Egipto), ITC Limited (Índia), Imperial Brands plc (Reino Unido), Swedish Match AB (Suécia), MujeebSons (Índia), Godfrey Phillips India Ltd. (Índia), ALWAHA-TOBACCO. (Jordânia), Eastern Co SAE (Egipto), Agera Tobacco (EUA), Oliva Cigar Family (EUA), Herbal Tobacco Company (Índia), Mountain Rose Herbs (EUA), ShopStarbuzz (EUA), ALTADIS USA INC. (EUA), RealLeaf. (EUA) e Meo Marley's (Canadá)

|

Pontos de dados abordados no relatório

|

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, análise de modelos de cartazes, análise de pilão, análise de preços e estrutura regulamentar.

|

Análise de Segmentos:

O mercado global de produtos para fumar e alternativas para fumar está segmentado num segmento notável com base no produto.

- Com base no produto, o mercado global de produtos para fumar e alternativas para fumar está segmentado em cigarros, charutos e cigarrilhas, cigarros eletrónicos e vapes, produtos de terapia de substituição de nicotina (TRN), tabaco para shisha e produtos à base de plantas. Em 2023, prevê-se que o segmento dos cigarros domine o mercado global de produtos para fumar e alternativas para fumar, com 93,62% de quota de mercado.

Em 2023, prevê-se que o segmento dos cigarros domine os produtos e as alternativas para fumar em todo o mundo.

Em 2023, prevê-se que o segmento dos cigarros domine os produtos e alternativas para fumar em todo o mundo, devido ao aumento de fabricantes de produtos para fumar em todo o mundo.

Com base no produto, o mercado global de produtos para fumar e alternativas para fumar está segmentado em cigarros, charutos e cigarrilhas, cigarros eletrónicos e vapes, produtos de terapia de substituição de nicotina (TRN), tabaco para shisha e produtos à base de plantas. O segmento dos cigarros eletrónicos e vapes é subdividido com base no tipo de nicotina em nicotina e não nicotina. O tabaco para cachimbo de água é segmentado com base no sabor em duplo sabor a maçã, cítrico, menta, misto, mirtilo, ursinhos de goma, morango, sem sabor, manga, melão, ananás, chocolate, caramelo, maracujá e outros. O tabaco para cachimbo de água é subsegmentado com base nos canais de distribuição ao domicílio e nos canais diretos. O segmento residencial é ainda segmentado com base na categoria em lojas especializadas, lojas online, lojas de conveniência, supermercados, hipermercados, lojas duty-free e outras. Os canais diretos são segmentados com base na categoria em lounges de shisha e cafés/restaurantes/bares/pubs. O tabaco para cachimbo de água é segmentado com base na aplicação em grupo e pessoal. Os produtos à base de plantas são segmentados com base na categoria em produtos de CBD e cigarros de ervas. Os produtos de CBD são segmentados com base no tipo em cigarros, gomas e outros. Um cigarro de ervas é ainda segmentado com base no tipo de nicotina em nicotina e não nicotina. Um cigarro de ervas é ainda segmentado com base nas folhas em damiana, verbasco, alecrim, sálvia, ditamno e outros.

Principais jogadores

A Data Bridge Market Research reconhece as seguintes empresas como os principais participantes no mercado global de produtos para fumar e alternativas para fumar: Fumari Inc. (EUA), Haze Tobacco (EUA), Al Fakher (EUA), SOCIALSMOKE (EUA), Japan Tobacco Inc. (Japão), SOEX (Índia), Romman Shisha (Jordânia), MAZAYA (Jordânia), Ugly Hookah (EUA), Cloud Tobacco (EUA), Nakhla Tobacco Company SAE (Egipto), ITC Limited (Índia), Imperial Brands plc (Reino Unido), Swedish Match AB (Suécia), MujeebSons (Índia), Godfrey Phillips India Ltd. (Índia), ALWAHA-TOBACCO. (Jordânia), Eastern Co SAE (Egipto), Agera Tobacco (EUA), Oliva Cigar Family (EUA), Herbal Tobacco Company (Índia), Mountain Rose Herbs (EUA), ShopStarbuzz (EUA), ALTADIS USA INC. (EUA), RealLeaf. (EUA) e Meo Marley's (Canadá).

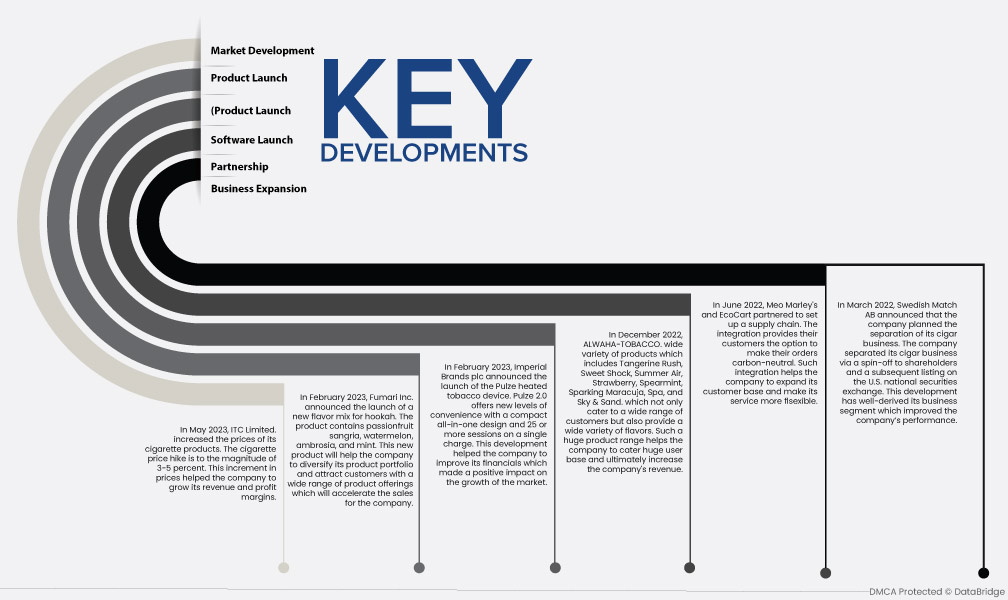

Desenvolvimentos de mercado

- Em maio de 2023, a ITC Limited. aumentou os preços dos seus produtos de cigarros. O aumento do preço dos cigarros é da ordem dos 3-5 por cento. Este aumento dos preços ajudou a empresa a aumentar as suas receitas e margens de lucro.

- Em fevereiro de 2023, a Fumari Inc. anunciou o lançamento de uma nova mistura de sabores para shisha. O produto contém sangria de maracujá, melancia, ambrósia e menta. Este novo produto ajudará a empresa a diversificar o seu portefólio de produtos e a atrair clientes com uma vasta gama de ofertas de produtos, o que irá acelerar as vendas da empresa.

- Em fevereiro de 2023, a Imperial Brands plc anunciou o lançamento do dispositivo de tabaco aquecido Pulze. O Pulze 2.0 oferece novos níveis de conveniência com um design compacto e completo e 25 ou mais sessões com uma única carga. Este desenvolvimento ajudou a empresa a melhorar as suas finanças, o que teve um impacto positivo no crescimento do mercado.

- Em dezembro de 2022, a ALWAHA-TOBACCO. grande variedade de produtos que inclui Tangerine Rush, Sweet Shock, Summer Air, Strawberry, Spearmint, Sparking Maracuja, Spa e Sky & Sand. que não só atendem a uma vasta gama de clientes, como também oferecem uma grande variedade de sabores. Uma gama tão grande de produtos ajuda a empresa a servir uma enorme base de utilizadores e, consequentemente, a aumentar a receita da empresa.

- Em junho de 2022, a Meo Marley's e a EcoCart estabeleceram uma parceria para criar uma cadeia de abastecimento. A integração oferece aos clientes a opção de tornar os seus pedidos neutros em carbono. Esta integração ajuda a empresa a expandir a sua base de clientes e a tornar o seu serviço mais flexível.

- Em março de 2022, a Swedish Match AB anunciou que a empresa planeava a separação do seu negócio de charutos. A empresa separou o seu negócio de charutos através de uma cisão para acionistas e de uma subsequente entrada na bolsa de valores nacional dos EUA. Este desenvolvimento beneficiou o seu segmento de negócio, o que melhorou o desempenho da empresa.

Análise de País

Geograficamente, os países abrangidos pelo relatório do mercado global de produtos para fumar e alternativas para fumar são os EUA, África, Arábia Saudita, Alemanha, Emirados Árabes Unidos, Índia, Espanha, Indonésia, Japão, Iraque e Coreia do Sul.

De acordo com a análise de pesquisa de mercado da Data Bridge:

A Índia é a região dominante no mercado global de produtos para fumar e alternativas para fumar durante o período previsto de 2023 a 2030.

Em 2023, prevê-se que a Índia domine o mercado, uma vez que esta região tem as maiores terras de cultivo de tabaco. Isto ajudará a aumentar o uso de tabaco.

Estima-se que a Índia seja a região de crescimento mais rápido no mercado global de produtos para fumar e alternativas para fumar no período previsto de 2023 a 2030.

- Prevê-se que a Índia aumente o mercado global de produtos para fumar e de alternativas para fumar devido ao aumento da procura de tabaco aromatizado e à crescente procura pelo uso do tabaco como medicamento à base de plantas.

Para obter informações mais detalhadas sobre o mercado global de produtos para fumar e alternativas para fumar, clique aqui – https://www.databridgemarketresearch.com/reports/global-smoking-products-and-smoking-alternatives-market