Um fator significativo que contribui para o crescimento do mercado de sistemas de inspeção por raios X da ASEAN é o foco crescente na segurança alimentar e em regulamentações rigorosas. À medida que a procura de alimentos processados e embalados continua a aumentar nos países da ASEAN, as preocupações com a segurança e a qualidade dos alimentos tornaram-se mais pronunciadas. Os sistemas de inspeção por raios X desempenham um papel crucial na garantia da integridade dos produtos alimentícios, detectando contaminantes, como metal, vidro ou plástico, durante os processos de fabricação e embalagem.

Os governos dos países da ASEAN estão a implementar regulamentos e normas rigorosas para abordar questões de segurança alimentar e proteger a saúde dos consumidores. Os sistemas de inspeção por raios X permitem que os fabricantes de alimentos cumpram essas regulamentações, fornecendo um método confiável e não destrutivo para inspecionar produtos embalados. Ajudam a identificar e eliminar materiais estranhos ou defeitos na linha de produção, evitando que produtos contaminados cheguem aos consumidores.

Acesse o relatório completo @https://www.databridgemarketresearch.com/reports/asean-x-ray-inspection-system-market

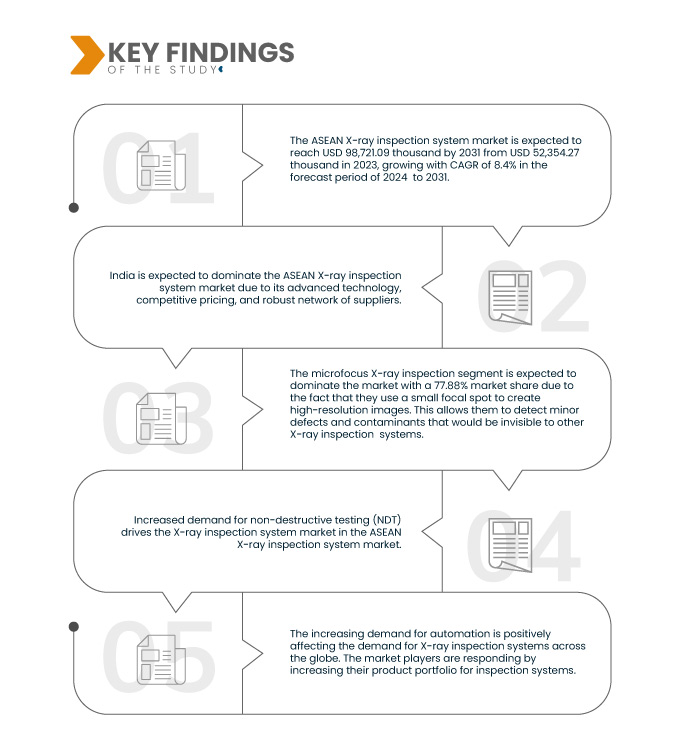

A Data Bridge Market Research analisa que o Mercado de sistemas de inspeção de raios X da ASEAN espera-se que atinja um valor de US$ 98.721,09 mil até 2031, de US$ 52.354,27 mil em 2023, crescendo a um CAGR de 8,4% durante o período de previsão.

Principais conclusões do estudo

Desenvolvimento de Sistemas de Inspeção Compactos, Portáteis e Móveis

Os sistemas de inspeção por raios X portáteis e móveis oferecem diversas vantagens, incluindo serem compactos, leves e fáceis de transportar, tornando-os ideais para uso em locais remotos ou de difícil acesso. Assim, os sistemas de inspeção por raios X portáteis e móveis podem realizar END em locais remotos ou de difícil acesso e têm a capacidade de configurar e desmontar rapidamente o sistema conforme necessário. A procura por estes sistemas está a aumentar em vários setores, incluindo petróleo e gás, automóvel, aeroespacial e na construção, onde o END é fundamental para garantir a segurança e a fiabilidade dos produtos.

Escopo do relatório e segmentação de mercado

|

Métrica de relatório

|

Detalhes

|

|

Período de previsão

|

2024 a 2031

|

|

Ano base

|

2023

|

|

Anos históricos

|

2022 (personalizável 2016-2021)

|

|

Unidades Quantitativas

|

Receita em mil dólares

|

|

Segmentos cobertos

|

Tipo (inspeção de raios X de microfoco, inspeção de raios X de minifoco, inspeção de raios X de contraste de fase e inspeção de raios X nano), técnica de imagem (Imagem digital e imagem baseada em filme), tipo de sistema (sistema de inspeção de raios X em linha e sistema de inspeção de raios X offline), resolução (2FD e 3D), tecnologia de digitalização (tecnologia HD, tecnologia Ultra HD e outros), número de pistas (única Lane, Multi Lane e Dual Lane), Modalidade (Estacionária e Portátil), Material (Metal e Liga, Cerâmica, Composto, Vidro, Plásticos, Silicone, Fibra, Material Misto e Outros), Canal de Distribuição (Canal Direto e Canal Indireto), Usuário Final (Automotivo, Aeroespacial, Eletrônico, Farmacêutico e Dispositivos médicos, Militar e Defesa, Energia, Produtos de Consumo, Manufatura Aditiva, Pesquisa e Academia, Arqueologia, Forense, Geologia e Outros)

|

|

País coberto

|

Índia, Singapura, Tailândia, Malásia, Indonésia, Filipinas, Vietname e Resto da ASEAN

|

|

Participantes do mercado cobertos

|

Shimadzu Corporation (Japão), Nikon Metrology Inc. (uma subsidiária da Nikon Corporation) (Japão), Thermo Fisher Scientific Inc. (EUA), ZEISS (Alemanha), TOSHIBA IT & CONTROL SYSTEMS CORPORATION (uma subsidiária da TOSHIBA CORPORATION) (Japão ), Dandong Aolong Radiative Instrument Group Co., Ltd (China), Hitachi, Ltd. (Japão), OMRON Corporation (Japão), Rigaku Corporation (Japão), Comet Group (Suíça), Baker Hughes Company (EUA), North Star (EUA), Jinan Horizon Imp.& Exp. (China), Royma Tech Suzhou) Precision Co., Ltd. (China) e Werth Inc.

|

|

Pontos de dados abordados no relatório

|

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e grandes players, os relatórios de mercado com curadoria da Data Bridge Market Research também incluem análises especializadas aprofundadas, produção geograficamente representada pela empresa e capacidade, layouts de rede de distribuidores e parceiros, análise detalhada e atualizada de tendências de preços e análise de déficit da cadeia de suprimentos e demanda

|

Análise de Segmento

O mercado de sistemas de inspeção de raios X é segmentado em dez segmentos notáveis que são baseados em tipo, técnica de imagem, tipo de sistema, resolução, tecnologia de digitalização, número de pistas, modalidade, material, canal de distribuição e usuário final.

- Com base no tipo, o mercado é segmentado em inspeção de raios X de microfoco, inspeção de raios X de minifoco, inspeção de raios X de contraste de fase e inspeção de raios X nano.

Em 2024, espera-se que o segmento de inspeção por raios X microfoco domine o mercado

Em 2024, espera-se que o segmento de inspeção por raios X microfoco domine o mercado com uma participação de mercado de 77,88% devido ao fato de que eles use um pequeno ponto focal para criar imagens de alta resolução. Isso permite detectar pequenos defeitos e contaminantes que seriam invisíveis para outros sistemas de inspeção por raios X.

- Com base na técnica de imagem, o mercado é segmentado em imagem digital e imagem baseada em filme

Em 2024, espera-se que o segmento de imagem digital domine o mercado

Em 2024, espera-se que o segmento de imagem digital domine o mercado com 86,91% de participação de mercado devido à sua qualidade de imagem superior, tempos de processamento mais rápidos e exposição reduzida à radiação em comparação com imagens analógicas tradicionais.

- Com base no tipo de sistema, o mercado é dividido em sistema de inspeção por raios X em linha e sistema de inspeção por raios X offline. Em 2024, espera-se que o sistema de inspeção por raios X em linha domine o mercado com uma participação de mercado de 71,38%

- Com base na resolução, o mercado é segmentado em 2D e 3D. Em 2024, espera-se que o segmento 2D domine o mercado com uma participação de mercado de 61,25%

- Com base na tecnologia de digitalização, o mercado é segmentado em tecnologia HD, tecnologia ultra HD, entre outras. Em 2024, espera-se que o segmento de tecnologia HD domine o mercado com uma participação de mercado de 54,36%

- Com base no número de faixas, o mercado é segmentado em faixa única, faixa múltipla e faixa dupla. Em 2024, espera-se que o segmento de faixa única domine o mercado com uma participação de mercado de 46,76%

- Com base na modalidade, o mercado é segmentado em estacionário e portátil. Em 2024, espera-se que o segmento Estacionário domine o mercado com uma participação de mercado de 68,74%

- Com base no material, o mercado é segmentado em metal e liga, cerâmica, compósito, vidro, plástico, silicone, fibra, material misto, entre outros. Em 2024, espera-se que o segmento de metais e ligas domine o mercado com uma participação de mercado de 26,65%

- Com base no canal de distribuição, o mercado é segmentado em canal direto e canal indireto. Em 2024, espera-se que o segmento de canal direto domine o mercado com uma participação de mercado de 74,99%

- Com base no usuário final, o mercado é segmentado em automotivo, aeroespacial, eletrônico, dispositivos farmacêuticos e médicos, militar e defesa, energia, produtos de consumo, fabricação aditiva, pesquisa e academia, arqueologia forense, geologia, entre outros. Em 2024, espera-se que o segmento automotivo domine o mercado com 20,30% de participação de mercado

Jogadores principais

A Data Bridge Market Research analisa alguns dos principais players que operam no mercado: Shimadzu Corporation (Japão), Baker Hughes Company (EUA), Hitachi, Ltd. (Japão), Nordson Corporation (Japão) e Comet Group (Suíça).

Desenvolvimentos de mercado

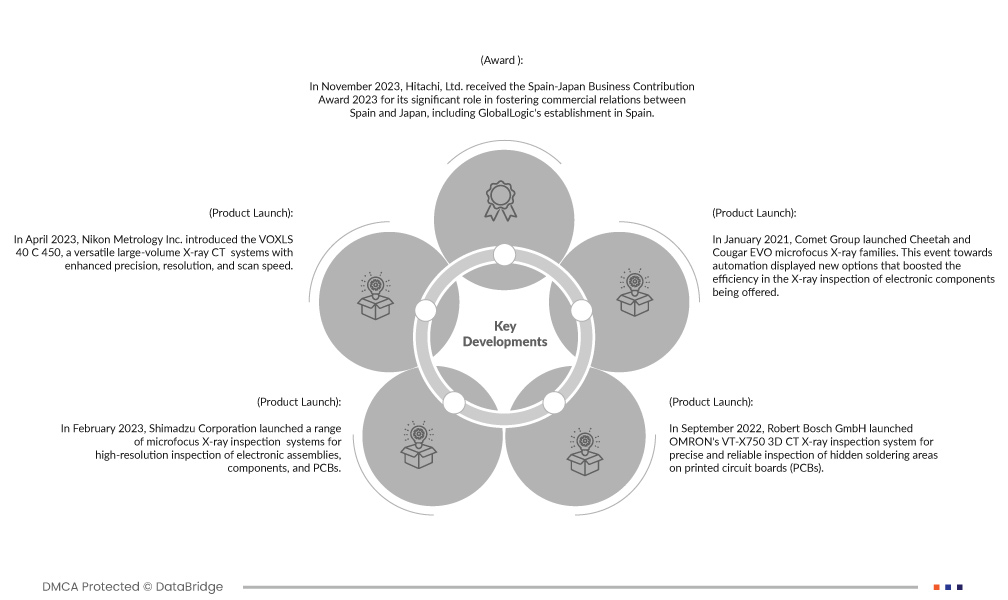

- Em novembro de 2023, a Hitachi, Ltd. recebeu o Prêmio de Contribuição Empresarial Espanha-Japão 2023 por seu papel significativo na promoção das relações comerciais entre a Espanha e o Japão, incluindo o estabelecimento da GlobalLogic na Espanha. O prémio destacou o compromisso da Hitachi com o avanço tecnológico em Espanha, exemplificado pelos planos para abrir novos centros de engenharia em todo o país. Tais desenvolvimentos podem melhorar a reputação da empresa no mercado

- Em abril de 2023, a Nikon Metrology Inc. lançou o VOXLS 40 C 450, um sistema versátil de tomografia computadorizada de raios X de grande volume com precisão, resolução e velocidade de digitalização aprimoradas. O sistema o torna adequado para uma ampla gama de aplicações em diversos setores, agências de inspeção e academia, permitindo a inspeção não destrutiva de componentes como baterias de íons de lítio, peças fabricadas aditivamente e chassis de fibra de carbono. Com a introdução do primeiro sistema na sua próxima geração de soluções de inspeção, a empresa está atraindo mais clientes para comprar sistemas de inspeção por raios X

- Em fevereiro de 2023, a Shimadzu Corporation lançou uma linha de sistemas de inspeção por raios X microfoco para inspeção de alta resolução de conjuntos eletrônicos, componentes e PCBs. Sua linha inclui o Xslicer SMX-1010/1020, com qualidade de imagem e fluxo de trabalho aprimorados, e o Xslicer SMX-6010, que fornece imagens de alta precisão com ampla faixa dinâmica para observação detalhada de estruturas e defeitos internos. Esses sistemas atendem indústrias como eletrônica, automotiva, semicondutores e aeroespacial, permitindo testes não destrutivos e análise 3D de materiais. O lançamento desses sistemas avançados de inspeção por raios X poderia atrair novos clientes e expandir o alcance de mercado da Shimadzu. Com este produto, a Shimadzu expandiu seu portfólio de produtos em indústrias que exigem inspeção precisa e controle de qualidade, como manufatura, eletrônica e automotiva, que podem se beneficiar dos recursos aprimorados desses sistemas

- Em setembro de 2022, a Robert Bosch GmbH selecionou o SISTEMA de inspeção por raios X VT-X750 3D CT da OMRON para inspeção precisa e confiável de áreas de solda ocultas em placas de circuito impresso (PCBs). O sistema oferece tecnologia de tomografia computadorizada (TC) de alta velocidade, possibilitando a detecção de defeitos de solda com melhor resolução e maior qualidade de imagem em comparação com outros métodos tomográficos. O VT-X750 atende aos requisitos da indústria automotiva para inspeção de PCB de alta qualidade, contribuindo para maior segurança e produtividade por meio de seus recursos avançados, como programação de IA e implementação de IOT. A adoção do novo SISTEMA de inspeção por raios X CT 3D em linha da OMRON VT-X750 da Robert Bosch GmbH melhora a reputação e a posição de mercado da OMRON como um fornecedor confiável de soluções avançadas de inspeção

- Em janeiro de 2021, o Comet Group lançou as famílias de raios X microfoco Cheetah e Cougar EVO. Este evento voltado para a automação apresentou novas opções que aumentaram a eficiência na inspeção radiográfica de componentes eletrônicos oferecidos. O lançamento dos novos sistemas de inspeção por raios X ajudou a empresa ao fornecer um produto de última geração que atende aos requisitos regulatórios e aos padrões do setor, aumentando a reputação e a competitividade da empresa no mercado. Além disso, os recursos e capacidades avançados dos sistemas melhoraram a eficiência e a precisão da inspeção de produtos, levando a uma maior satisfação do cliente e atraindo potencialmente novos clientes.

Análise do país

Geograficamente, os países abrangidos no relatório de mercado são Índia, Singapura, Tailândia, Malásia, Indonésia, Filipinas, Vietname e Resto da ASEAN.

De acordo com a análise da pesquisa de mercado da Data Bridge:

A Índia é o país dominante no sistema de inspeção de raios X da ASEAN mercado durante o período de previsão de 2024 a 2031

Espera-se que a Índia domine o mercado de sistemas de inspeção por raios X da ASEAN devido à sua tecnologia avançada, preços competitivos e rede robusta de fornecedores. A experiência tecnológica e as soluções económicas do país fazem dele a escolha preferida dos países da ASEAN que procuram sistemas de inspeção por raios X fiáveis e eficientes.

Cingapura é o país que mais cresce no sistema de inspeção de raios X da ASEAN mercado durante o período de previsão de 2024 a 2031

Espera-se que Singapura seja o país que mais cresce no mercado de sistemas de inspeção por raios X da ASEAN devido à sua localização estratégica como um importante centro regional de comércio e logística que levou a um aumento significativo no movimento de mercadorias através dos seus portos. Como resultado, há uma necessidade crescente de sistemas de inspeção eficientes e avançados para garantir a segurança das remessas.

Para obter informações mais detalhadas sobre o relatório de mercado do sistema de inspeção de raios X da ASEAN, clique aqui –https://www.databridgemarketresearch.com/reports/asean-x-ray-inspection-system-market