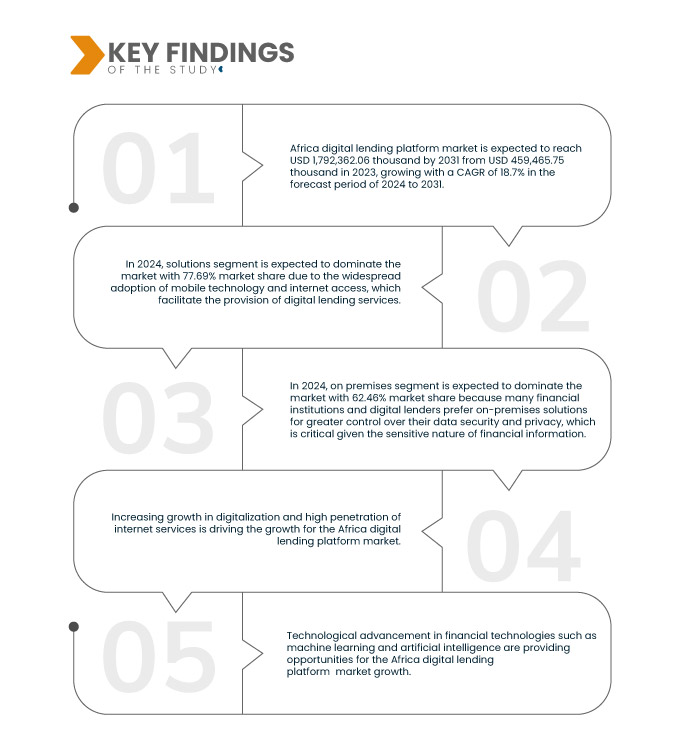

Desde 2009, tem-se assistido a uma transformação das instituições financeiras para a digitalização, integrando as tecnologias digitais e tornando-se FinTech. A transformação digital trouxe automatização, melhores serviços e eficiência aos processos financeiros. Os serviços de Internet foram um factor importante para a transformação destas instituições financeiras. À medida que as pessoas se habituam mais aos serviços de internet para utilização básica, os serviços financeiros aproveitam estes fatores. As empresas estão a desenvolver plataformas digitais para os seus serviços financeiros, como as plataformas de empréstimos digitais, mas estas plataformas seriam ineficazes sem a crescente adoção da internet. A crescente penetração dos serviços de internet irá impulsionar o mercado das plataformas de empréstimos digitais em África.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/africa-digital-lending-platform-market

A Data Bridge Market Research analisa que o mercado de plataformas de empréstimos digitais de África deverá atingir os 1.792.362,06 mil dólares até 2031, face aos 459.465,75 mil dólares de 2023, crescendo a um CAGR de 18,7% no período previsto de 2024 a 2031.

Principais conclusões do estudo

Aumento de smartphones para serviços financeiros

Os smartphones simplesmente revolucionaram o mercado dos serviços financeiros ao trazer tecnologias como os pagamentos por comunicação de campo próximo (NFC), os pagamentos por código de resposta rápida (QR), os pagamentos pela Internet, a cobrança direta da operadora e os serviços bancários móveis. Com a implementação do banco online nos smartphones , os serviços financeiros descobriram a necessidade de desenvolver plataformas digitais que possam ser utilizadas através dos smartphones, uma vez que existe uma elevada utilização de smartphones entre a população de África. Esta crescente adoção de smartphones entre as pessoas está a gerar um enorme crescimento para o mercado de plataformas de empréstimos digitais em África.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Anos Históricos

|

2022 (personalizável para 2016-2021)

|

Unidades quantitativas

|

Receita em USD Mil

|

Segmentos abrangidos

|

Componente (soluções e serviços), modelo de implementação (local e na cloud), montante do empréstimo (inferior a 7.000 dólares, 7.001 a 20.000 dólares e superior a 20.001 dólares), tipo de subscrição (gratuita e paga), tipo de empréstimo (empréstimo automóvel, empréstimo para financiamento de PME, crédito pessoal, crédito habitação, bens de consumo duradouros e outros), tipo (empresarial e de consumo), vertical (bancos, serviços financeiros, seguradoras, credores P2P (ponto a ponto), cooperativas de crédito, associações de poupança e empréstimo e hipotecas)

|

Países abrangidos

|

África do Sul, Nigéria, Quénia, Egipto, Uganda, Tanzânia, Etiópia, República Democrática do Congo, Sudão e resto de África

|

Participantes do mercado abrangidos

|

Branch International (EUA), Tala (EUA), OPay Digital Services Limited. (Nigéria), Carbon (Nigéria), FairMoney (Nigéria), Aella (Nigéria), FINT Technology Africa Ltd. (Nigéria), Lendable (Londres), Palmcredit (Nigéria), Renmoney Microfinance Bank Limited (Nigéria), JUMO (África), PesaZone (África), Backbase (Holanda), Fawry Banking and Payment Technology Services. (Egipto), Kashway (Quénia), XCreditplus (Nigéria), Okash (Quénia), iPesa (Quénia), Pesapro Ltd. (Quénia) e M-KOPA (Quénia), entre outros

|

Pontos de dados abordados no relatório

|

Para além das perspetivas de mercado, tais como o valor de mercado, a taxa de crescimento, os segmentos de mercado, a cobertura geográfica, os participantes do mercado e o cenário de mercado, o relatório de mercado selecionado pela equipa de pesquisa de mercado da Data Bridge inclui uma análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise de pilão.

|

Análise de Segmentos

O mercado de plataformas de empréstimos digitais de África está segmentado em sete segmentos notáveis que se baseiam no componente, modelo de implementação, tamanho do montante do empréstimo, tipo de assinatura, tipo de empréstimo, tipo e vertical.

- Com base nos componentes, o mercado de plataformas de empréstimos digitais de África está segmentado em soluções e serviços

Em 2024, o segmento de soluções dominará o mercado de plataformas de empréstimos digitais de África

Em 2024, o segmento de soluções dominará o mercado com uma quota de mercado de 77,69% devido à ampla adoção da tecnologia móvel e do acesso à internet, que facilitam a prestação de serviços de empréstimos digitais.

- Com base no modelo de implementação, o mercado de plataformas de empréstimos digitais de África está segmentado em locais e na nuvem

Em 2024, o segmento on-premises dominará o mercado das plataformas de empréstimos digitais em África

Em 2024, prevê-se que o segmento local domine o mercado com uma quota de mercado de 62,46%, porque muitas instituições financeiras e credores digitais preferem soluções locais para um maior controlo sobre a segurança e privacidade dos seus dados, o que é essencial dada a natureza sensível da informação financeira.

- Com base no montante do empréstimo, o mercado de plataformas de empréstimos digitais em África está segmentado em menos de 7.000 dólares, de 7.001 a 20.000 dólares e mais de 20.001 dólares. Em 2024, prevê-se que o segmento inferior a 7.000 dólares domine o mercado com uma quota de mercado de 43,15%.

- Com base no tipo de subscrição, o mercado de plataformas de empréstimos digitais de África está segmentado em gratuito e pago. Em 2024, prevê-se que o segmento livre domine o mercado com uma quota de mercado de 60,61%

- Com base no tipo de empréstimo, o mercado de plataformas de empréstimos digitais de África está segmentado em empréstimos automóveis, empréstimos para financiamento de PME, empréstimos pessoais, empréstimos imobiliários, bens de consumo duráveis e outros. Em 2024, prevê-se que o segmento de crédito automóvel domine o mercado com uma quota de mercado de 33,10%

- Com base no tipo, o mercado está segmentado em empresarial e consumidor. Em 2024, prevê-se que o segmento empresarial domine o mercado das plataformas de empréstimos digitais em África, com uma quota de mercado de 64,69%.

- Com base na vertical, o mercado de plataformas de empréstimos digitais de África está segmentado em bancos, serviços financeiros, companhias de seguros, credores P2P (Peer-to-Peer), cooperativas de crédito, associações de poupança e empréstimo e hipotecas. Em 2024, prevê-se que o segmento bancário domine o mercado com uma quota de mercado de 32,03%

Principais jogadores

A Data Bridge Market Research analisa a Branch International Financial Servid (EUA), Tala (EUA), OPay Digital Services Limited (Nigéria), Carbon (Nigéria), FairMoney (Nigéria), Aella (Nigéria), FINT Technology Africa, Ltd (Nigéria), Lendable (Londres), Palmcredit (Nigéria), Renmoney Microfinance Bank Limit (Nigéria), JUMO (África), PesaZone (África), Backbase (Holanda), Fawry Banking and Payment Techno (Egipto), Kashway (Quénia), XCreditplus (Quénia), Okash (Quénia) como as principais empresas que operam no mercado de plataformas de empréstimos digitais de África.

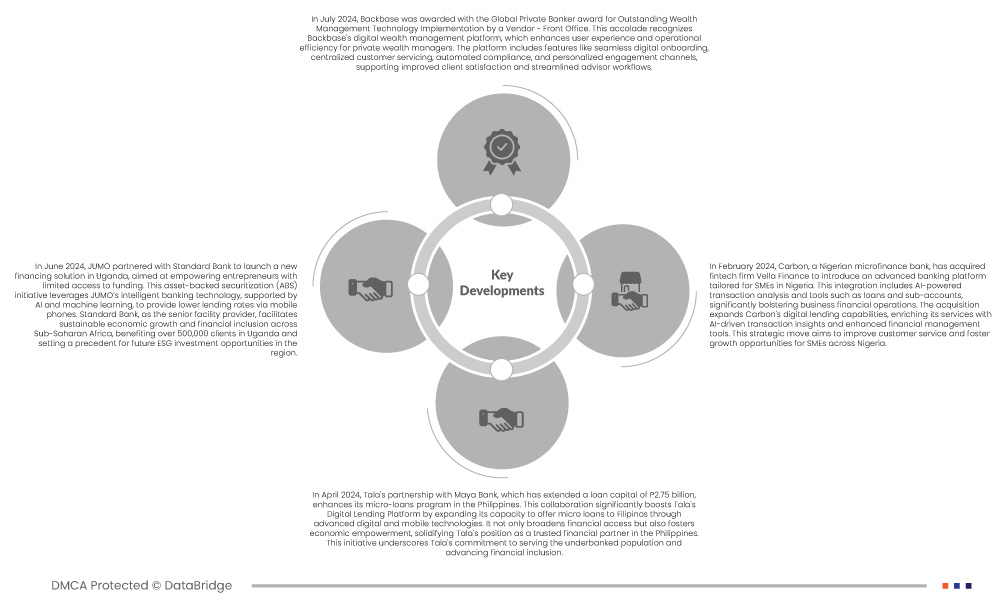

Desenvolvimento de Mercado

- Em dezembro de 2023, a M-KOPA expande-se para o Gana, desbloqueando 10 milhões de dólares em crédito digital. A presença reforçada no mercado promove a inclusão financeira e digital, impulsionando o crescimento e o impacto no cliente em toda a África Ocidental

- Em julho de 2023, a M-KOPA nomeia Babajide Duroshola para liderar a expansão na Nigéria. A sua experiência em entrada bem-sucedida no mercado e financiamento de ativos está alinhada com a estratégia da M-KOPA para o crescimento na maior economia de África.

- Em março de 2022, a Branch International adquiriu uma participação maioritária no Century Microfinance Bank do Quénia, permitindo a sua incursão no setor bancário de microfinanças. Esta mudança estratégica expande as capacidades da Branch International para oferecer serviços de receção de depósitos juntamente com empréstimos digitais, reforçando o seu apoio a particulares e PME. Aproveitando o robusto panorama da tecnologia móvel do Quénia, a Branch International pretende aumentar a inclusão e a acessibilidade financeira em toda a região

- Em abril de 2024, a parceria da Tala com o Maya Bank, que concedeu um capital de empréstimo de P2,75 mil milhões, melhora o seu programa de microcréditos nas Filipinas. Esta colaboração impulsiona significativamente a Plataforma de Empréstimos Digitais da Tala ao expandir a sua capacidade de oferecer microempréstimos aos filipinos através de tecnologias digitais e móveis avançadas. Não só alarga o acesso financeiro como também promove o empoderamento económico, consolidando a posição da Tala como um parceiro financeiro de confiança nas Filipinas. Esta iniciativa reforça o compromisso da Tala em servir a população sub-bancarizada e promover a inclusão financeira

- Em maio de 2024, a Tala foi mais uma vez homenageada pela sua presença impactante nas fintech, garantindo lugares na lista Fintech 50 da Forbes por oito anos consecutivos e na lista Disruptor 50 da CNBC por cinco anos consecutivos. Este reconhecimento sublinha a liderança da Tala na prestação de serviços financeiros personalizados a nível global, reforçando a sua reputação e alcance. Destaca a inovação contínua da Tala na melhoria da sua plataforma de empréstimos digitais, melhorando assim a acessibilidade e a eficiência dos serviços financeiros para as populações carenciadas em todo o mundo.

Análise Regional

Geograficamente, os países abrangidos pelo relatório de mercado de plataformas de empréstimos digitais de África são a África do Sul, a Nigéria, o Quénia, o Egipto, o Uganda, a Tanzânia, a Etiópia, a República Democrática do Congo, o Sudão e o resto de África.

De acordo com a análise de pesquisa de mercado da Data Bridge:

Espera-se que a África do Sul domine e seja o país com o crescimento mais rápido no mercado de plataformas de empréstimos digitais de África

Espera-se que a África do Sul domine o mercado devido à sua infraestrutura financeira avançada, elevada penetração de dispositivos móveis e ambiente regulamentar bem desenvolvido. O robusto setor bancário do país e a população familiarizada com a tecnologia criam um terreno fértil para o sucesso das plataformas de empréstimos digitais. Além disso, as regulamentações favoráveis e uma estrutura governamental de apoio às startups de fintech estabeleceram a África do Sul como um centro de inovações em empréstimos digitais, atraindo participantes locais e internacionais para o mercado.

Para obter informações mais detalhadas sobre o relatório de mercado das plataformas de empréstimos digitais em África, clique aqui – https://www.databridgemarketresearch.com/reports/africa-digital-lending-platform-market