أجهزة صحة الأم هي فئة متخصصة من الأدوات والمعدات الطبية المصممة لمراقبة وتشخيص وتحسين صحة المرأة الحامل وجنينها. تشمل هذه الأجهزة منتجات متنوعة، بما في ذلك أجهزة مراقبة الجنين، وأدوات التوليد، وأسرة الولادة، وكراسي الولادة، والمستلزمات الطبية التي تُستخدم لمرة واحدة. الهدف الرئيسي من أجهزة صحة الأم هو ضمان رعاية شاملة طوال فترة الحمل والولادة وما بعد الولادة، مما يساهم في سلامة وصحة الأم والمولود.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/us-maternal-health-devices-market

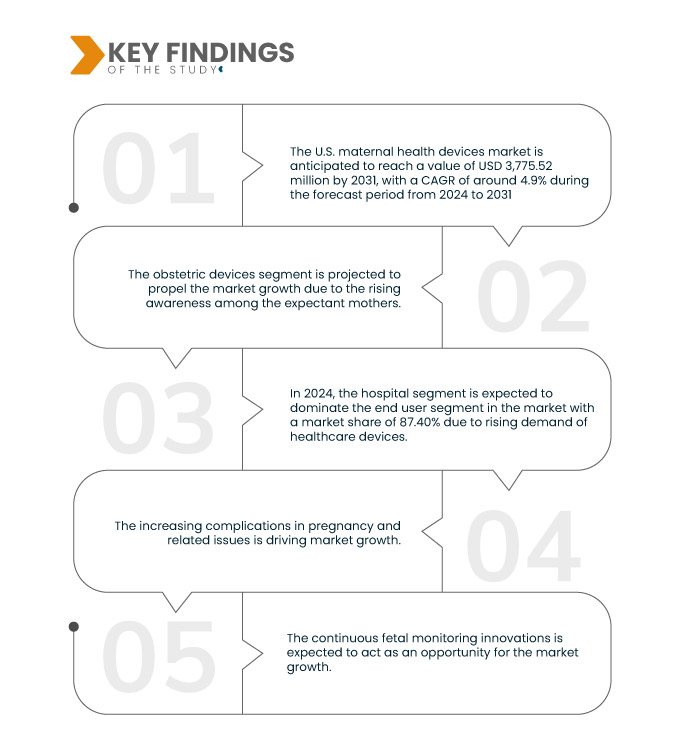

تحلل شركة Data Bridge Market Research أن سوق أجهزة صحة الأم في الولايات المتحدة من المتوقع أن يصل إلى 3,775.52 مليون دولار أمريكي بحلول عام 2031 من 2,618.06 مليون دولار أمريكي في عام 2023 بمعدل نمو سنوي مركب قدره 4.9٪ في الفترة المتوقعة من 2024 إلى 2031. ومن المتوقع أن يدفع قطاع أجهزة التوليد نمو السوق بسبب الوعي المتزايد بين الأمهات الحوامل.

النتائج الرئيسية للدراسة

تزايد المضاعفات المتعلقة بالحمل

هناك حاجة متزايدة لمعدات حديثة قادرة على مراقبة وإدارة الحمل وصعوبات ما قبل الولادة بفعالية، مع تزايد عدد حالات الحمل التي أصبحت معقدة بسبب ظروف تتراوح بين الأمراض المزمنة ومخاوف ما قبل الولادة. ويتطلب الأمر زيادة المراقبة وإجراءات تدخل فعّالة نظرًا لارتفاع معدل حدوث مضاعفات مثل سكري الحمل، وتسمم الحمل، وارتفاع ضغط الدم لدى الأم. ويعتمد الكشف المبكر عن هذه المشكلات وإدارتها بشكل متزايد على معدات صحة الأم التي تراقب العلامات الحيوية، ومستويات السكر في الدم، وصحة الجنين. ويدفع الحاجة إلى تقنيات أكثر تطورًا ودقة وسهولة في الاستخدام لتلبية الاحتياجات المختلفة لمقدمي الرعاية الصحية والنساء الحوامل الابتكار والتطوير الكبير. ويشهد سوق أجهزة صحة الأم تطورًا ملحوظًا نتيجة زيادة الطلب على الأجهزة القادرة على إدارة المشاكل ومراقبة حالات الحمل عالية الخطورة. ويجري تطوير تقنيات مبتكرة، بما في ذلك أجهزة الاستشعار القابلة للارتداء، وأنظمة المراقبة عن بُعد، والتحليلات القائمة على الذكاء الاصطناعي، لمعالجة هذه المشكلات، وتحسين نتائج الرعاية الصحية للأمهات في نهاية المطاف. وبالتالي، فإن المضاعفات المتزايدة أثناء الحمل تتطلب أجهزة أكثر تطورًا، مما يعزز نمو السوق.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

سنة تاريخية

|

2022 (قابلة للتخصيص للفترة 2016-2021)

|

الوحدات الكمية

|

الإيرادات بالملايين من الدولارات الأمريكية، والحجم والتسعير بالسعر المتوسط

|

القطاعات المغطاة

|

نوع المنتج (أجهزة التوليد، أجهزة مراقبة الجنين، أسرّة الولادة، كراسي الولادة، اللوازم والمواد الاستهلاكية التي تُستخدم لمرة واحدة وغيرها)، الوسيلة (محمولة، مستقلة، محمولة باليد، أجهزة قابلة للارتداء، وغيرها)، المرحلة (مرحلة الوالدين ومرحلة الولادة)، النوع (أجهزة نقطة الرعاية والتقليدية)، المستخدم النهائي (المستشفيات، مراكز الأمومة، مرافق التمريض، العيادات المتخصصة، أماكن الرعاية المنزلية، وغيرها)، قناة التوزيع (العطاء المباشر، مبيعات التجزئة، المبيعات عبر الإنترنت، وغيرها)

|

البلد المغطى

|

قملة

|

الجهات الفاعلة في السوق المغطاة

|

Medtronic (أيرلندا)، Stryker (الولايات المتحدة)، GE HealthCare (الولايات المتحدة)، Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (الصين)، Hill-Rom Holdings Inc. (شركة تابعة لشركة Baxter) (الولايات المتحدة)، FUJIFILM Corporation (اليابان)، Siemens Healthineers AG (ألمانيا)، Koninklijke Philips NV (هولندا)، CooperSurgical Inc. (الولايات المتحدة)، CANON MEDICAL SYSTEMS CORPORATION (اليابان)، Cook (الولايات المتحدة)، Olympus Corporation (اليابان)، ESAOTE SPA (إيطاليا)، KARL-STORZ SE & CO. KG (ألمانيا)، Hologic, Inc. (الولايات المتحدة)، MEDGYN PRODUCTS, INC. (الولايات المتحدة)، وHealcerion Co., Ltd. (كوريا الجنوبية) وغيرها.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي أعدتها Data Bridge Market Research أيضًا تحليلًا متعمقًا من الخبراء وعلم الأوبئة للمرضى وتحليل خط الأنابيب وتحليل التسعير والإطار التنظيمي.

|

تحليل القطاعات

يتم تصنيف سوق أجهزة صحة الأم في الولايات المتحدة إلى ستة قطاعات بارزة بناءً على نوع المنتج والوسيلة والمرحلة والنوع والمستخدم النهائي وقناة التوزيع.

- على أساس نوع المنتج، يتم تقسيم السوق إلى أجهزة مراقبة الجنين، وأجهزة التوليد، وأسرة الولادة، وكراسي الولادة، والإمدادات والمواد الاستهلاكية التي تستخدم لمرة واحدة

في عام 2024، من المتوقع أن تهيمن شريحة الأجهزة التوليدية من قطاع نوع المنتج على السوق

ومن المتوقع أن تهيمن شريحة الأجهزة التوليدية على السوق في عام 2024 بسبب ارتفاع الوعي بالرعاية الصحية بحصة سوقية تبلغ 31.49٪.

- على أساس الوسيلة، يتم تقسيم السوق إلى أجهزة محمولة، ومحمولة، ومستقلة، وقابلة للارتداء، وغيرها

في عام 2024، من المتوقع أن يهيمن قطاع الأجهزة المحمولة على السوق

من المتوقع أن تهيمن شريحة الأجهزة المحمولة على السوق في عام 2024 بسبب ارتفاع أنشطة البحث والتطوير في قطاع الرعاية الصحية بحصة سوقية تبلغ 34.16٪.

- بناءً على المرحلة، يُقسّم السوق إلى مرحلة ما قبل الولادة ومرحلة الولادة. في عام ٢٠٢٤، من المتوقع أن تهيمن مرحلة ما قبل الولادة على السوق بحصة سوقية تبلغ ٥٩.٧٥٪.

- بناءً على النوع، يُقسّم السوق إلى أجهزة رعاية مركزية وأجهزة تقليدية. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع أجهزة الرعاية المركزة على السوق بحصة سوقية تبلغ ٦٢.٩٦٪.

- بناءً على المستخدم النهائي، يُقسّم السوق إلى مستشفيات، ومراكز ولادة، ومرافق تمريض، وعيادات متخصصة، ومرافق رعاية منزلية، وغيرها. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع المستشفيات على السوق بحصة سوقية تبلغ ٨٧.٤٠٪.

- بناءً على قنوات التوزيع، يُقسّم السوق إلى مناقصة مباشرة، ومبيعات التجزئة، والمبيعات الإلكترونية، وغيرها. وفي عام ٢٠٢٤، من المتوقع أن يهيمن قطاع المناقصة المباشرة على السوق بحصة سوقية تبلغ ٤٠.٣٢٪.

اللاعبون الرئيسيون

تقوم شركة Data Bridge Market Research بتحليل شركات Medtronic (أيرلندا)، وStryker (الولايات المتحدة)، وGE HealthCare (الولايات المتحدة)، وShenzhen Mindray Bio-Medical Electronics Co.، Ltd. (الصين)، وHill-Rom Holdings Inc. (شركة تابعة لشركة Baxter) (الولايات المتحدة) باعتبارها الشركات الرئيسية في سوق أجهزة صحة الأم في الولايات المتحدة.

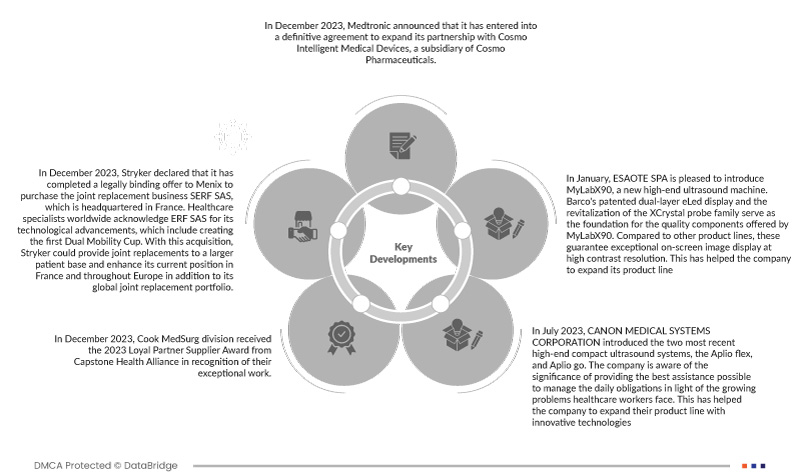

تطوير السوق

- في ديسمبر 2023، أعلنت شركة ميدوترونيك عن إبرامها اتفاقية نهائية لتوسيع شراكتها مع شركة كوزمو للأجهزة الطبية الذكية، وهي شركة تابعة لشركة كوزمو للأدوية. ستعزز هذه الشراكة القائمة على الذكاء الاصطناعي الإنجازات التي تحققت بالفعل مع وحدة التنظير الداخلي الذكية GI Genius، مما يوفر ابتكارًا مستمرًا وتقدمًا قابلًا للتطوير في مجال الرعاية الصحية للمرضى ومقدمي الرعاية على مستوى العالم. من خلال هذه الشراكة العالمية الحصرية، تلتزم ميدترونيك وكوزمو للأدوية بإحداث ثورة في مجال التنظير الداخلي من خلال تسخير قوة الذكاء الاصطناعي لتحسين نتائج المرضى. يعزز هذا التحالف الاستراتيجي مكانة ميدترونيك في حلول الرعاية الصحية المتكاملة مع الذكاء الاصطناعي، ويمثل قفزة نوعية في دمج الذكاء الاصطناعي في الرعاية التنظيرية.

- في ديسمبر 2023، أعلنت شركة سترايكر أنها قدمت عرضًا ملزمًا قانونًا لشركة مينيكس لشراء شركة استبدال المفاصل SERF SAS، ومقرها فرنسا. يُشيد خبراء الرعاية الصحية حول العالم بشركة ERF SAS لتطوراتها التكنولوجية، بما في ذلك ابتكار أول كأس مزدوج الحركة. بهذا الاستحواذ، ستتمكن سترايكر من توفير بدائل المفاصل لقاعدة أكبر من المرضى، وتعزيز مكانتها الحالية في فرنسا وأوروبا، بالإضافة إلى محفظة منتجاتها العالمية لاستبدال المفاصل.

- في ديسمبر 2023، حاز قسم كوك ميدسورج على جائزة الشريك المخلص للمورد لعام 2023 من تحالف كابستون الصحي تقديرًا لعملهم الاستثنائي. ويسعد كوك بالحصول على هذا التكريم، بالإضافة إلى عقد جديد لتوريد لوازم المسالك البولية.

- في يوليو 2023، طرحت شركة كانون للأنظمة الطبية أحدث نظامي الموجات فوق الصوتية المدمجين عاليي الجودة، Aplio flex وAplio go. وتدرك الشركة أهمية تقديم أفضل مساعدة ممكنة لإدارة الالتزامات اليومية في ظل التحديات المتزايدة التي يواجهها العاملون في مجال الرعاية الصحية. وقد ساعدها ذلك على توسيع خط إنتاجها بتقنيات مبتكرة.

- في يناير، يسرّ شركة ESAOTE SPA إطلاق جهاز MyLabX90، وهو جهاز تصوير بالموجات فوق الصوتية جديد ومتطور. تُشكّل شاشة eLed ثنائية الطبقات الحاصلة على براءة اختراع من Barco، بالإضافة إلى سلسلة مجسات XCrystal المُحسّنة، أساسًا لمكونات MyLabX90 عالية الجودة. وبالمقارنة مع خطوط المنتجات الأخرى، تضمن هذه المكونات عرضًا استثنائيًا للصور على الشاشة بدقة تباين عالية. وقد ساعد هذا الشركة على توسيع خط منتجاتها.

لمزيد من المعلومات التفصيلية حول تقرير سوق أجهزة صحة الأم في الولايات المتحدة، انقر هنا - https://www.databridgemarketresearch.com/reports/us-maternal-health-devices-market