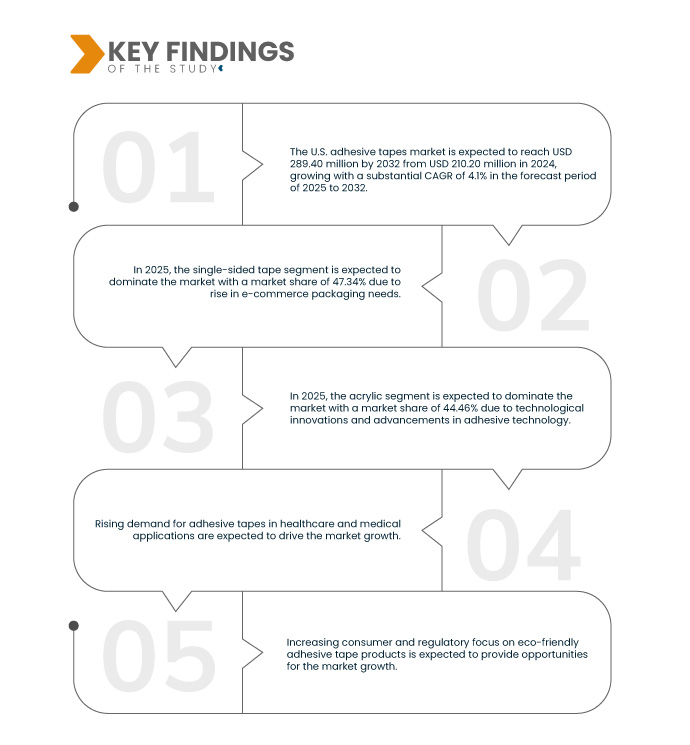

Die steigende Nachfrage nach Klebebändern im Gesundheitswesen und in medizinischen Anwendungen ist ein wichtiger Wachstumstreiber für den Klebebandmarkt. Klebebänder sind für verschiedene medizinische Verfahren, von der Wundversorgung bis hin zu chirurgischen Eingriffen, unverzichtbar und bieten Komfort, Wirksamkeit und Benutzerfreundlichkeit. Der Gesundheitssektor erkennt zunehmend den Wert von Klebebändern für sichere, hygienische und schmerzfreie Lösungen für Patienten, was zu ihrer breiten Akzeptanz geführt hat. Ein Hauptfaktor für diese Nachfrage ist der wachsende Bedarf an Wundpflegeprodukten. Medizinische Klebebänder werden häufig zum Fixieren von Verbänden, Wundauflagen und anderen medizinischen Geräten verwendet, um sicherzustellen, dass diese an Ort und Stelle bleiben, ohne Beschwerden zu verursachen. Diese Bänder tragen dazu bei, das Infektionsrisiko zu minimieren und eine schnellere Heilung zu fördern, indem sie eine saubere und geschützte Wundumgebung gewährleisten. Mit der Zunahme chronischer Krankheiten, Verletzungen und einer alternden Bevölkerung steigt die Nachfrage nach effektiven Wundpflegelösungen, was den Markt für medizinische Klebebänder antreibt.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/us-adhesives-tapes-market

Laut Marktforschungsanalyse von Data Bridge wird der US-Markt für Klebebänder voraussichtlich von 210,20 Millionen US-Dollar im Jahr 2024 auf 289,40 Millionen US-Dollar im Jahr 2032 anwachsen und im Prognosezeitraum von 2025 bis 2032 eine beachtliche jährliche Wachstumsrate von 4,1 % aufweisen.

Wichtigste Ergebnisse der Studie

Steigender Verpackungsbedarf im E-Commerce

Mit der rasanten Verbreitung des Online-Shoppings benötigen Unternehmen effiziente und sichere Verpackungslösungen, um eine sichere Lieferung ihrer Produkte an die Verbraucher zu gewährleisten. Klebebänder, insbesondere Verpackungsbänder, sind unerlässlich, um Kartons zu verschließen, Manipulationen zu verhindern und die Unversehrtheit von Sendungen während des Transports zu gewährleisten. Mit dem anhaltenden Wachstum der E-Commerce- Umsätze steigt auch die Nachfrage nach hochwertigen, langlebigen Klebebändern. Verpackungsbänder aus Materialien wie Polypropylen, Vinyl und Papier sind aufgrund ihrer Festigkeit, Haltbarkeit und Fähigkeit, Pakete sicher zu verschließen, sehr gefragt. E-Commerce-Unternehmen, darunter auch große Player wie Amazon, setzen auf Klebebänder, um ihre Verpackungsprozesse zu optimieren und sicherzustellen, dass Artikel sicher verpackt und vor Beschädigungen geschützt sind.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2025 bis 2032

|

Basisjahr

|

2024

|

Historische Jahre

|

2018 bis 2023 (Anpassbar auf 2013–2017)

|

Quantitative Einheiten

|

Umsatz in Millionen USD

|

Abgedeckte Segmente

|

Produkt (einseitiges Klebeband, doppelseitiges Klebeband, Transferband und Spezialband ), Klebstoff (Acryl, Gummi, Silikon und andere), Trägermaterial ( Polypropylen (PP), Polyethylen (PE), Papier, Polyvinylchlorid (PVC) und andere), Technologie (auf Wasserbasis, auf Lösungsmittelbasis, Schmelzklebstoff, UV-gehärtet und thermisch gehärtet), Anwendung (Lebensmittel und Getränke, Elektrik und Elektronik, Gesundheitswesen, Automobilindustrie, Fertigung, Bauwesen, Konsumgüter, Luft- und Raumfahrt und Verteidigung und andere)

|

Abgedecktes Land

|

LAUS

|

Abgedeckte Marktteilnehmer

|

Shurtape Technologies, LLC (USA), Pro Tapes (USA), Cactus Tape (USA), Valley Industrial Products (USA), 3F GmbH Klebe- & Kaschiertechnik (Deutschland), 3M (USA), tesa SE (ein Unternehmen der Beiersdorf-Gruppe) (Deutschland), Berry Global Inc. (USA), Nitto Denko Corporation (Japan), Specialty Tapes (USA), G-Tape (USA), AVERY DENNISON CORPORATION (USA), Worthen Industries (USA)

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen.

|

Segmentanalyse

Der US-Markt für Klebebänder ist basierend auf Produkt, Klebstoff, Trägermaterial, Technologie und Anwendung in fünf wichtige Segmente unterteilt.

- Auf der Grundlage des Produkts ist der Markt in einseitiges Klebeband, doppelseitiges Klebeband, Transferklebeband und Spezialklebeband segmentiert

Im Jahr 2025 wird das Segment der einseitigen Klebebänder voraussichtlich den US-Klebebandmarkt dominieren

Im Jahr 2025 wird das Segment der einseitigen Klebebänder voraussichtlich mit einem Marktanteil von 47,34 % den Markt dominieren. Dies ist auf die breite Anwendung in Verpackungs-, Versiegelungs-, Etikettier- und Isolieranwendungen in Branchen wie Logistik, Bauwesen und Elektronik zurückzuführen. Das Wachstum des Segments wird durch seine Kosteneffizienz, einfache Anwendung und Vielseitigkeit beim Verkleben und Sichern von Materialien vorangetrieben. Die steigende Nachfrage nach zuverlässigen Versiegelungslösungen im E-Commerce und in der Lebensmittelverpackungsbranche fördert die Akzeptanz zusätzlich.

- Auf der Grundlage von Klebstoffen ist der Markt in Acryl, Gummi, Silikon und andere segmentiert

Im Jahr 2025 wird das Acrylsegment voraussichtlich den US -Klebebandmarkt dominieren

Im Jahr 2025 wird das Acrylsegment voraussichtlich mit einem Marktanteil von 44,46 % den Markt dominieren, und zwar aufgrund seiner überlegenen Klebeeigenschaften, einschließlich einer ausgezeichneten Beständigkeit gegen UV-Licht, Feuchtigkeit und Temperaturschwankungen, wodurch es sich ideal für Anwendungen im Innen- und Außenbereich eignet.

- Der Markt ist nach Trägermaterial in Polypropylen (PP), Polyethylen (PE), Papier, Polyvinylchlorid (PVC) und weitere Materialien unterteilt. Im Jahr 2025 wird Polypropylen (PP) voraussichtlich mit einem Marktanteil von 36,61 % dominieren, da es als Trägermaterial eine hervorragende Balance aus Haltbarkeit, Flexibilität und Kosteneffizienz bietet. PP bietet eine hohe Beständigkeit gegen Feuchtigkeit, Chemikalien und Temperaturschwankungen und eignet sich daher ideal für vielfältige Anwendungen in den Bereichen Verpackung, elektrische Isolierung und medizinische Klebebänder.

- Auf der Grundlage der Technologie ist der Markt in wasserbasierte, lösungsmittelbasierte, Hotmelt-, UV-gehärtete und thermisch gehärtete Produkte segmentiert

Im Jahr 2025 wird das Segment der wasserbasierten Klebebänder voraussichtlich den US-Markt dominieren

Im Jahr 2025 wird das Segment der wasserbasierten Produkte voraussichtlich mit einem Marktanteil von 33,30 % den Markt dominieren. Dies ist auf die umweltfreundliche Zusammensetzung, die reduzierten Emissionen flüchtiger organischer Verbindungen (VOC) und die Einhaltung strenger Umweltvorschriften in den USA zurückzuführen.

- Auf der Grundlage der Anwendung ist der Markt in Lebensmittel und Getränke, Elektrotechnik und Elektronik, Gesundheitswesen, Automobilindustrie, Fertigung, Bauwesen, Konsumgüter, Luft- und Raumfahrt und Verteidigung und andere unterteilt

Im Jahr 2025 wird das Segment Lebensmittel und Getränke voraussichtlich den US- Klebebandmarkt dominieren

Im Jahr 2025 wird das Segment Lebensmittel und Getränke voraussichtlich mit einem Marktanteil von 20,57 % den Markt dominieren. Grund dafür ist die steigende Nachfrage nach Klebebändern für Verpackungsanwendungen, einschließlich Versiegelung, Etikettierung und Bündelung. Der zunehmende Fokus der Branche auf Nachhaltigkeit hat die Einführung umweltfreundlicher und biologisch abbaubarer Klebebänder vorangetrieben, die den Verbraucherpräferenzen und gesetzlichen Vorschriften entsprechen.

Hauptakteure

Data Bridge Market Research analysiert 3M (USA), tesa SE (ein Unternehmen von Beiersdorf) (Deutschland), Berry Global Inc. (USA), AVERY DENNISON CORPORATION (USA) und Shurtape Technologies, LLC (USA) als die wichtigsten Akteure auf dem Markt.

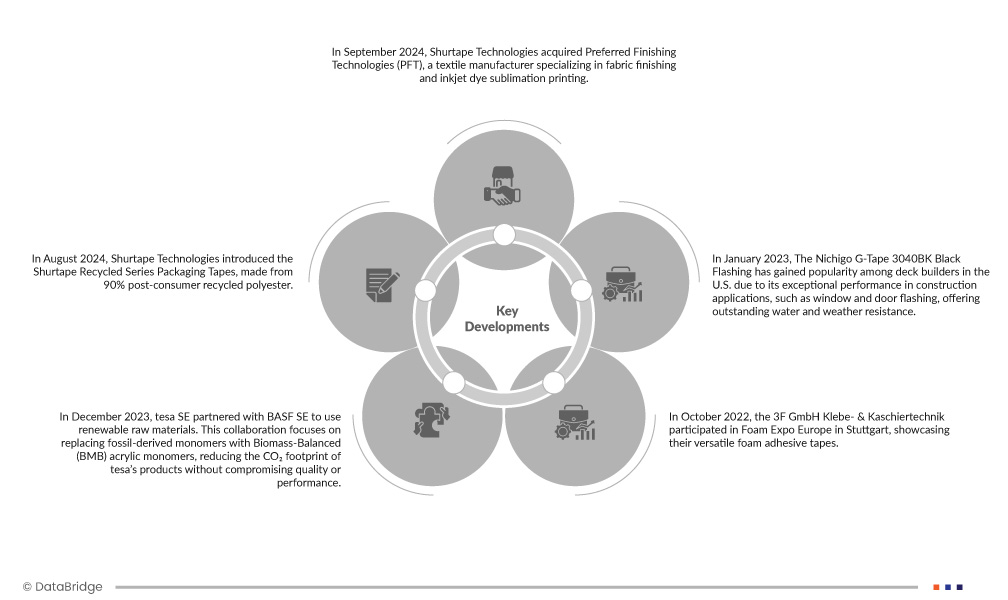

Marktentwicklungen

- Im September 2024 übernahm Shurtape Technologies Preferred Finishing Technologies (PFT), einen Textilhersteller, der auf Stoffveredelung und Tintenstrahl-Sublimationsdruck spezialisiert ist. Die Übernahme stärkt die Lieferkette von Shurtape, fördert das Wachstum in der Kunst- und Unterhaltungsklebebandbranche und sichert gleichzeitig die Betriebskontinuität.

- Im August 2024 stellte Shurtape Technologies die Verpackungsbänder der Shurtape Recycled Series vor, die zu 90 % aus recyceltem Polyester bestehen. Diese nachhaltige Produktlinie reduziert den Einsatz von Neukunststoff und gewährleistet gleichzeitig eine lange Haltbarkeit. Die Bänder unterstützen die Verpackungsautomatisierung und bieten umweltfreundliche Alternativen ohne Kompromisse bei Leistung und Zuverlässigkeit.

- Im Dezember 2023 ging die tesa SE eine Partnerschaft mit der BASF SE zur Nutzung nachwachsender Rohstoffe ein. Im Mittelpunkt dieser Zusammenarbeit steht der Ersatz fossiler Monomere durch biomassenbilanzierte (BMB) Acrylmonomere. Dadurch wird der CO₂-Fußabdruck der tesa Produkte reduziert, ohne Kompromisse bei Qualität oder Leistung einzugehen. Die Partnerschaft unterstützt tesa bei der Erreichung seiner Nachhaltigkeitsziele und hilft dem Unternehmen, umweltfreundlichere Produkte anzubieten und gleichzeitig hohe Standards einzuhalten.

- Im Oktober 2022 nahm die 3F GmbH Klebe- & Kaschiertechnik an der Foam Expo Europe in Stuttgart teil und präsentierte ihre vielseitigen Schaumklebebänder. Während der Veranstaltung stellte das Unternehmen seine Entwicklungs- und Fertigungskompetenzen heraus und bot kompetente Beratung zu allen Aspekten der Klebetechnologie.

- Im Januar 2023 erfreut sich das Nichigo G-Tape 3040BK Black Flashing bei Terrassenbauern in den USA großer Beliebtheit. Es zeichnet sich durch seine herausragende Leistung in Bauanwendungen wie Fenster- und Türverkleidungen sowie seine hervorragende Wasser- und Wetterbeständigkeit aus. Diese Entwicklung stärkt den Ruf von G-Tape und etabliert das 3040BK als erstklassiges Klebeband, das für seine einfache Handhabung, starke Haftung und lange Haltbarkeit bekannt ist. Damit ist es die bevorzugte Wahl für Bauunternehmer, die unter extremen Temperaturbedingungen arbeiten.

Für detailliertere Informationen zum US-Marktbericht für Klebebänder klicken Sie hier – https://www.databridgemarketresearch.com/reports/us-adhesives-tapes-market