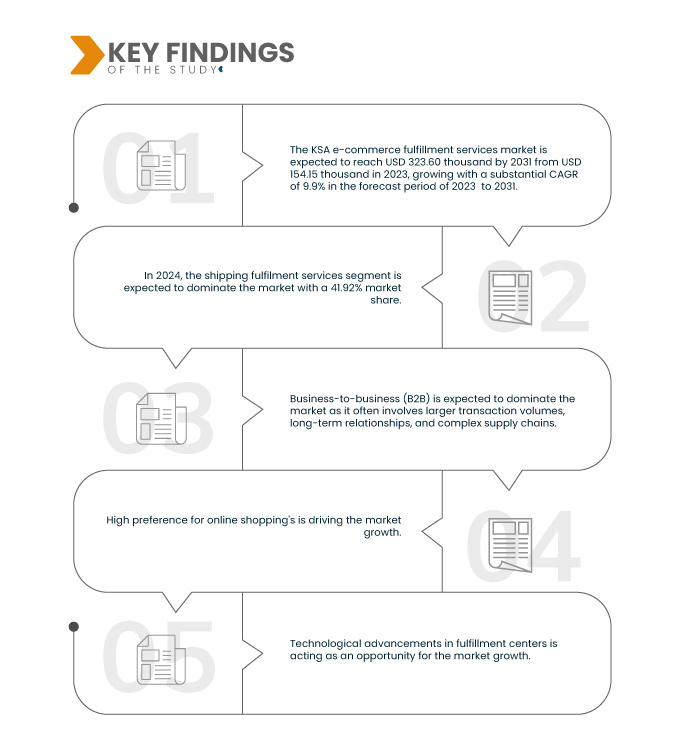

The Kingdom of Saudi Arabia (KSA) has witnessed a significant shift in consumer behavior with a growing preference for online shopping. This trend is primarily driven by factors such as convenience, accessibility, and the wide variety of products available online. Major Key driver of this opportunity is the convenience offered by online shopping. Consumers can browse through a diverse range of products from the comfort of their homes and place orders at any time of the day. This has led to an increased demand for efficient and reliable E-commerce fulfillment services to ensure timely and accurate delivery of orders. Moreover, the widespread availability of smartphones and the internet has played a crucial role in the growth of online shopping in the Kingdom.

Access Full Report @ https://www.databridgemarketresearch.com/reports/ksa-e-commerce-fulfillment-services-market

The KSA E-Commerce Fulfillment Services Market is expected to reach USD 323.60 million by 2031 from USD 154.15 million in 2023, growing with a substantial CAGR of 9.9% in the forecast period of 2024 to 2031.

Key Findings of the Study

- Rising Number of Internet Users

Growing number of individuals relying on online platforms for their shopping needs trend has created a tremendous opportunity for the e-commerce fulfillment services market in the country. The rising internet penetration has expanded the potential customer base for e-commerce businesses, leading to increased demand for fulfillment services.

The convenience offered by e-commerce platforms has fueled the adoption of online shopping in KSA. With an increasing number of consumers preferring the ease of browsing and purchasing products from the comfort of their homes, e-commerce fulfillment services play a crucial role in ensuring seamless and timely order fulfillment. This shift in consumer behavior has led to a surge in the volume of orders that e-commerce businesses need to manage, creating a robust market for fulfillment services. The competitive nature of the e-commerce landscape in KSA has pushed businesses to focus on enhancing their customer experience. Efficient fulfillment services contribute significantly to customer satisfaction by ensuring accurate and timely deliveries. This emphasis on customer experience becomes a key differentiator for e-commerce businesses, driving them to invest in reliable fulfillment services to gain a competitive edge.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customized to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Service Type (Shipping Fulfillment Services, Warehousing and Storage Fulfillment Services, Bundling Fulfillment Services, and Others), Sales Channel (Business to Business (B2B), Business to Consumer (B2C), and Direct to Consumer (D2C)), Organization Size (Large Organizations and Small and Mid-Size Organizations), Application (Apparel & Accessories, Consumer Electronics, Personal Care, Books & Stationary, Healthcare & Pharmaceutical, Food & Beverages, Automotive, Household Goods, Sports & Leisure, and Others)

|

|

Country Covered

|

Kingdom of Saudi Arabia

|

|

Market Players Covered

|

Amazon, Inc. (U.S.), Saudi Post Corporation (Saudi Arabia), SMSA Express Transportation Company Ltd (Saudi Arabia), FedEx (U.S.), Aramex (U.A.E.), Flow (U.A.E.), CEVA Logistics (Netherlands), Abdul Latif Jameel Transportation Company Limited (U.A.E.), SALASA (Saudi Arabia), Agility (Kuwait), Al-Bassami International Bussiness Group (Saudi Arabia), AFKAR Logistics (U.A.E.), United Parcel Service of America, Inc. (U.S.), DHL (Germany), NAQEL Company (U.A.E.), Thabit Logistics (Saudi Arabia), Beez Logistics (U.A.E.), ProConnect Integrated Logistics (U.A.E.), DIGGIPACKS (U.A.E.), Esnad Express (U.A.E.), Fulfillment Bridge, Inc (U.S.), CSS GROUP (Saudi Arabia), Zajil Express (U.A.E.), Saee (Saudi Arabia), Motion Supply Chain (U.A.E.), Aiduk (Saudi Arabia), AJEX (Saudi Arabia), Starlinks (U.S.), and Quickship (Dubai) among others

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis

|

Segment Analysis:

KSA e-commerce fulfillment services market is segmented on the basis of service type, sales channel, organization size, and application.

- On the basis of service type, the market is segmented into shipping fulfilment services, warehousing and storage fulfilment services, bundling fulfilment services, and others

In 2024, the shipping fulfillment services dominate the KSA e-commerce fulfillment services market

In 2024, the shipping fulfilment services segment is expected to dominate the market with a 41.92% market share due to the growing demand for quick and efficient order processing, with a focus on streamlined logistics and timely delivery.

- On the basis of organization size, the market is segmented into large organizations and small and mid-size organizations

In 2024, the large organizations is expected to dominate the KSA e-commerce fulfillment services market

In 2024, the large organizations is expected to dominate the market with a 61.27% market share due to their economies of scale, resource capabilities, and established market presence, enabling them to invest in innovation, negotiate favorable deals, and withstand competitive pressures more effectively.

- On the basis of application, the market is segmented into apparel & accessories, consumer electronics, personal care, books & stationary, healthcare & pharmaceutical, food & beverages, automotive, household goods, sports & leisure, and others. In 2024, the apparel & accessories segment is expected to dominate the market with a 24.78% market share

- On the basis of sales channel, the market is segmented into business to business (B2B), business to consumer (B2C), and direct to consumer (D2C). In 2024, the Business to Business (B2B) segment is expected to dominate the market with a 48.97% market share

Major Players

Data Bridge Market Research analyzes Amazon, Inc. (U.S.), Saudi Post Corporation (Saudi Arabia), SMSA Express Transportation Company Ltd. (Saudi Arabia), FedEx (U.S.), and Aramex (U.A.E.) as the major market players in this market.

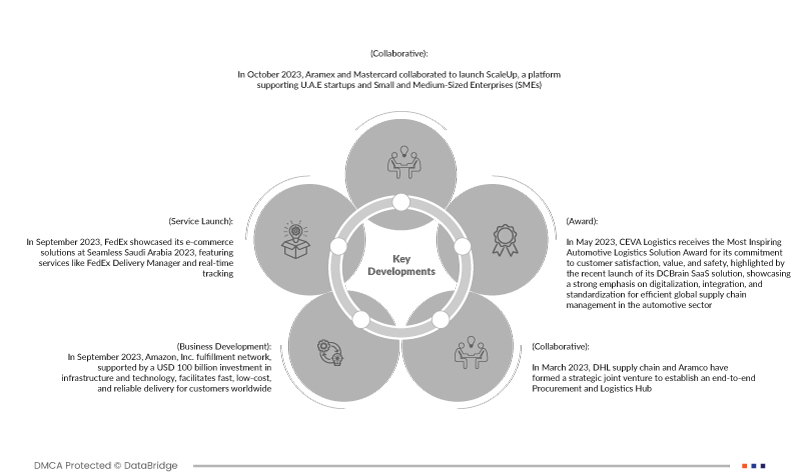

Market Developments

- In October 2023, Aramex and Mastercard collaborated to launch ScaleUp, a platform supporting U.A.E startups and SMEs (Small And Medium-Sized Enterprises). The initiative offered a substantial grant, opportunities to connect with angel investors, and marketing exposure, reinforcing Aramex's commitment to fostering entrepreneurship and providing essential support for SMEs. This endeavor facilitated the growth of the SME sector, aligning with the U.A.E's goals for economic development and innovation

- In September 2023, FedEx showcased its e-commerce solutions at Seamless Saudi Arabia 2023, featuring services like FedEx Delivery Manager and real-time tracking. The session underscores the pivotal role of logistics in cross-border e-commerce growth, emphasizing the potential for businesses to exceed customer expectations, increasing customer trust and sales through optimized shipping strategies and digital

- In September 2023, Amazon, Inc. fulfillment network, supported by a USD 100 billion investment in infrastructure and technology, facilitates fast, low-cost, and reliable delivery for customers worldwide. Through the) program, independent sellers benefit from outsourcing logistics, lowering operational costs, and gaining time for business growth, contributing to a thriving ecosystem of success for both sellers and customers

- In March 2023, DHL supply chain and Aramco have formed a strategic joint venture to establish an end-to-end Procurement and Logistics Hub. The collaboration, marked by the presence of key executives, signifies a robust partnership poised to enhance efficiency and innovation in the supply chain industry. This venture helped company in optimizing procurement processes and elevating logistics solutions with a global impact

- In May 2023, CEVA Logistics receives the Most Inspiring Automotive Logistics Solution Award for its outstanding commitment to customer satisfaction, value, and safety, highlighted by the recent launch of its DCBrain SaaS solution, showcasing a strong emphasis on digitalization, integration, and standardization for efficient global supply chain management in the automotive sector

For more detailed information about the KSA e-commerce fulfillment services market report, click here – https://www.databridgemarketresearch.com/reports/ksa-e-commerce-fulfillment-services-market