A crescente procura de automação em vários setores é um fator chave para o crescimento do mercado de braços robóticos. No setor da manufatura, os braços robóticos estão a ser amplamente adotados para melhorar a eficiência e a precisão em tarefas como a montagem, soldadura e manuseamento de materiais. Estes robôs permitem aos fabricantes satisfazer as crescentes exigências dos consumidores, melhorando as capacidades de produção e garantindo, ao mesmo tempo, uma qualidade consistente do produto. A capacidade dos braços robóticos de executar tarefas repetitivas com elevada precisão minimiza o erro humano e aumenta a eficiência operacional global, tornando-os essenciais em ambientes de fabrico contemporâneos.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/india-robotic-arm-market

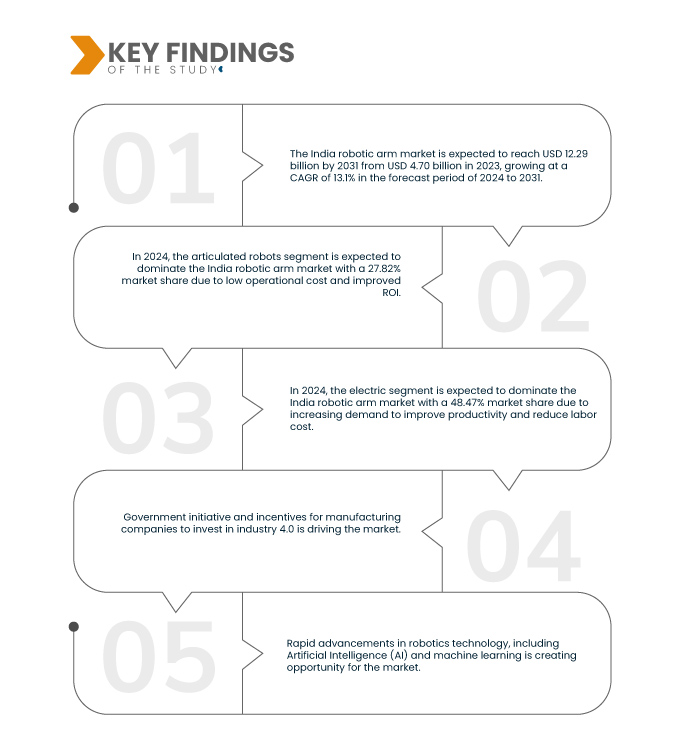

A Data Bridge Market Research analisa que o mercado indiano de braços robóticos deverá atingir um valor de 12,29 mil milhões de dólares até 2031, face aos 4,70 mil milhões de dólares em 2023, crescendo a um CAGR de 13,1% durante o período previsto de 2024 a 2031. Além da indústria transformadora, setores como a saúde, a logística e a agricultura estão também a integrar braços robóticos para otimizar as suas operações. Na área da saúde, os braços robóticos auxiliam nas cirurgias e nos processos laboratoriais, aumentando a precisão e aliviando a carga de trabalho dos profissionais médicos. As empresas de logística empregam braços robóticos para a classificação, embalagem e paletização, o que melhora a eficiência da cadeia de abastecimento e reduz os custos de mão-de-obra. Na agricultura, os braços robóticos facilitam tarefas como a colheita e a plantação, resolvendo a escassez de mão-de-obra e aumentando a produtividade. A adoção de braços robóticos nestes diversos setores realça a tendência crescente para a automação, impulsionada pela necessidade de aumentar a eficiência, reduzir custos e manter a competitividade num mundo cada vez mais automatizado.

Principais conclusões do estudo

Iniciativa governamental e incentivos para as empresas transformadoras investirem na Indústria 4.0

O governo indiano está a promover ativamente a adoção de tecnologias da indústria 4.0, incluindo a robótica, através de várias iniciativas e incentivos. Uma iniciativa notável é o programa Production Linked Incentive (PLI), que fornece subsídios a empresas que investem na capacidade de produção em setores como o automóvel, metais, produtos farmacêuticos e processamento de alimentos — os principais utilizadores de braços robóticos. Este esquema visa aumentar a competitividade destas indústrias e atrair mais investimento, impulsionando assim a procura de braços robóticos no mercado.

Além disso, os esforços do governo para melhorar a facilidade de fazer negócios e criar um ambiente propício para que as empresas de fabrico adotem tecnologias avançadas como a robótica são outros fatores significativos. Através de reformas políticas, desenvolvimento de infraestruturas e programas de desenvolvimento de competências, o governo está a promover um ecossistema de apoio à adoção de tecnologias da indústria 4.0, o que deverá acelerar ainda mais a procura de braços robóticos.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Anos Históricos

|

2022 (personalizável para 2016-2021)

|

Unidades quantitativas

|

Receita em biliões de dólares americanos

|

Segmentos abrangidos

|

Tipo de robô (robôs articulados, robôs cartesianos, robôs colaborativos , robôs SCARA, robôs paralelos , robôs cilíndricos e outros), tipo (elétrico, hidráulico e pneumático), capacidade de carga útil (100 kg a 500 kg, 500 kg a 1000 kg, abaixo de 100 kg, 1000 kg a 3000 kg e acima de 3000 kg), tipo de eixo (6 eixos, 7 eixos, 5 eixos, 4 eixos, 3 eixos, 2 eixos e 1 eixo), aplicação (manuseamento, montagem e desmontagem, soldadura e soldadura, distribuição, inspeção e ensaios de qualidade, processamento, classificação, colagem e vedação e outros), utilizadores finais (automóvel, elétrico e eletrónico, metais e máquinas, alimentar e Bebidas, Plástico e Embalagem, Produtos Químicos, Saúde e Farmacêuticos , Aeroespacial e Defesa, Logística e Transportes, Construção, Petróleo e Gás, Gestão de Resíduos e Reciclagem, Retalho, Agricultura e Outros)

|

País coberto

|

Índia

|

Participantes do mercado abrangidos

|

ABB (Suíça), Kawasaki Heavy Industries (Japão), DENSO CORPORATION (Japão), YASKAWA ELECTRIC CORPORATION (Japão) e FANUC CORPORATION (Japão) Mitsubishi Electric Corporation (Japão), MCI Robotics (Índia), Seiko Epson Corporation (Japão), Mecademic (Canadá), Asimov Robotics (Índia), Systemantics (Índia), Svaya Robotics Pvt. Ltd (Índia), Gridbots Technologies Private Limited. (Índia), JanyuTech, Universal Robots A/S (Índia), OMRON Corporation (Japão) e KUKA AG (Alemanha), entre outras

|

Pontos de dados abordados no relatório

|

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, produção e capacidade das empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas das tendências de preços e análises de défice da cadeia de abastecimento e da procura.

|

Análise de Segmentos

O mercado indiano de braços robóticos está categorizado em seis segmentos notáveis com base no tipo de robô, tipo, capacidade de carga útil, tipo de eixo, aplicação e utilizadores finais.

- Com base no tipo de robô, o mercado de braços robóticos da Índia está segmentado em robôs articulados, robôs cartesianos, robôs colaborativos, robôs SCARA , robôs paralelos, robôs cilíndricos e outros. Em 2024, prevê-se que o segmento dos robôs articulados domine o mercado indiano de braços robóticos com uma quota de mercado de 27,82%.

- Com base no tipo, o mercado de braços robóticos da Índia está segmentado em elétrico, hidráulico e pneumático. Em 2024, prevê-se que o segmento elétrico domine o mercado indiano de braços robóticos com uma quota de mercado de 48,47%

- Com base na capacidade de carga útil, o mercado de braços robóticos da Índia está segmentado em 100 kg a 500 kg, 500 kg a 1.000 kg, 1.000 kg a 3.000 kg, abaixo de 100 kg e acima de 3.000 kg.

Em 2024, prevê-se que o segmento dos 100 kg aos 500 kg domine o mercado de braços robóticos da Índia

Em 2024, prevê-se que o segmento dos 100 kg aos 500 kg domine o mercado com uma quota de mercado de 35,32% devido ao seu equilíbrio ideal entre capacidade de carga útil e versatilidade.

- Com base no tipo de eixo, o mercado de braços robóticos da Índia está segmentado em 6 eixos, 7 eixos, 5 eixos, 4 eixos, 3 eixos, 2 eixos e 1 eixo. Em 2024, prevê-se que o segmento de 6 eixos domine o mercado de braços robóticos da Índia com uma quota de mercado de 29,45%

- Com base na aplicação, o mercado indiano de braços robóticos está segmentado em manuseamento, montagem e desmontagem, soldadura e soldadura, distribuição, inspeção e testes de qualidade, processamento, classificação, colagem e selagem, entre outros. Em 2024, espera-se que o segmento de manuseamento domine o mercado de braços robóticos da Índia, com uma quota de mercado de 23,89%.

- Com base nos utilizadores finais, o mercado de braços robóticos da Índia está segmentado em automóvel, elétrico e eletrónico, metais e máquinas, alimentos e bebidas, plástico e embalagens, produtos químicos, saúde e produtos farmacêuticos, aeroespacial e defesa, logística e transportes, construção, petróleo e gás, gestão de resíduos e reciclagem, retalho, agricultura e outros.

Em 2024, espera-se que o setor automóvel domine o mercado de braços robóticos da Índia

Em 2024, prevê-se que o segmento automóvel domine o mercado com 25,66% de quota de mercado devido ao baixo custo operacional e ao melhor ROI.

Principais jogadores

A Data Bridge Market Research analisa a ABB (Suíça), a Kawasaki Heavy Industries, Ltd. (Japão), a DENSO CORPORATION (Japão), a YASKAWA ELECTRIC CORPORATION (Japão) e a FANUC CORPORATION (Japão) como as principais empresas que operam no mercado de braços robóticos da Índia.

Desenvolvimento de Mercado

- Em maio de 2024, a ABB expandiu a sua linha de braços robóticos industriais modulares com a introdução do IRB 7710 e do IRB 7720, oferecendo 16 novas variantes que servem principalmente os setores OEM automóvel e fornecedores de nível, bem como aplicações em logística, fundição, fabrico de máquinas, construção e agricultura. O design modular normalizado simplifica a instalação, aumentando a flexibilidade e a relação custo-benefício. Com uma precisão de trajetória até 0,6 mm e cargas úteis até 620 kg, estes robôs destacam-se em tarefas de elevada precisão, sublinhando o compromisso da ABB com a inovação e a satisfação do cliente

- Em janeiro de 2024, a ABB e a Simpliforge Creations colaboraram para fazer avançar as capacidades de impressão 3D para o setor da construção na Índia. Juntos, desenvolveram a maior impressora 3D robótica de betão do Sul da Ásia, que já foi utilizada para criar o primeiro local de culto impresso em 3D e uma ponte impressa em 3D da Índia. Esta colaboração visa revolucionar a construção, permitindo métodos de construção mais rápidos, sustentáveis e seguros.

- Em setembro de 2023, a YASKAWA ELECTRIC CORPORATION destacou-se no WeldfabMeet Pune 2023, apresentando soluções de automatização de soldadura de ponta e enfatizando a importância da soldadura de qualidade na engenharia e no fabrico. Com a sua presença proeminente e compromisso com a inovação, a Yaskawa Índia consolidou a sua liderança na indústria de automação de soldadura, pronta para continuar a fornecer soluções de ponta para as necessidades de automação dos clientes

- Em fevereiro de 2022, a YASKAWA ELECTRIC CORPORATION inaugurou uma nova Unidade de Soluções Robóticas em Manesar, Gurugram, com o objetivo de melhorar a automação robótica industrial. A instalação apresentou tecnologias de ponta para diversas aplicações, como a soldadura por arco, a paletização e a alimentação de máquinas, promovendo uma colaboração mais estreita com os clientes. Com um piso de fábrica de última geração que abrange 45.000 pés quadrados, a instalação suporta o fabrico, montagem, teste e integração de sistemas robóticos personalizados

- Em agosto de 2023, a FANUC CORPORATION Índia inaugurou o seu novo Centro de Tecnologia em Chennai. A instalação reforça o compromisso da FANUC CORPORATION em servir o país com soluções de automação de fábricas de última geração. O centro, equipado com infraestruturas essenciais, visa fornecer serviços melhorados ao polo industrial de rápido crescimento em Chennai, oferecendo suporte de manutenção vitalícia e promovendo o avanço tecnológico. O design ecológico sublinha a dedicação da FANUC CORPORATION à sustentabilidade, ao mesmo tempo que vai ao encontro das necessidades do mercado indiano e promove iniciativas Make-in-India

Para obter informações mais detalhadas sobre o relatório do mercado de braços robóticos da Índia, clique aqui – https://www.databridgemarketresearch.com/reports/india-robotic-arm-market