Non-destructive testing (NDT) is a testing and analysis technique used by industry to evaluate the properties of a material, component, structure or system for characteristic differences or welding defects and discontinuities without causing damage to the original part. NDT is also known as non-destructive examination (NDE), non-destructive inspection (NDI) and non-destructive evaluation (NDE). These methods are widely used in industries such as aerospace, automotive, and manufacturing to ensure product quality and safety. Therefore, the global X-ray Inspection Systems market is estimated to increase rapidly in the near future.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-x-ray-inspection-system-market

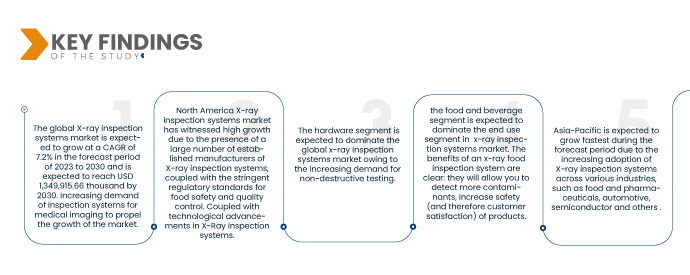

Data Bridge Market Research analyses that the Global X-Ray Inspection Systems Market is expected to grow at a CAGR of 7.2% in the forecast period of 2023 to 2030 and is expected to reach USD 1,349,915.66 thousand by 2030. Increasing demand of inspection systems for medical imaging to propel the growth of the market.

Key Findings of the Study

Growing safety regulations and quality standards regarding x-ray inspection systems

The aim of safety regulations is to ensure that a product, event, or material is safe and not dangerous, and every industry across the globe follows various governmental and organizational safety regulations for the marketed product. Also, quality standards are documents that provide requirements, specifications, guidelines, or characteristics that can be used consistently to ensure that materials, products, processes, and services are fit for their purpose. X-ray inspection systems are increasingly being adopted in these industries to meet the regulatory requirements and ensure the safety and quality of their products.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2020-2016)

|

|

Quantitative Units

|

Revenue in Thousand, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

By Offering (Hardware, Software and Services), Imaging Technique (Film Based Imaging and Digital Imaging), Dimension (2D and 3D), Product Type (Packaged Products, Un-Packaged Products, Pumped and Others), Scanning Technology (HD Technology, Ultra-HD Technology and Others), Number of Lanes (Single Lane, Multi Lane and Dual Lane), End-Use (Oil & Gas, Power Generation, Government Infrastructure, Food & Beverage, Aerospace, Automotive, Pharmaceuticals & Nutraceuticals, Semiconductor and Others).

|

|

Country Covered

|

U.S., Canada, Mexico, U.K., Germany, France, Italy, Netherlands, Spain, Switzerland, Russia, Sweden, Denmark, Belgium, Turkey, Poland, Norway, Finland, the rest of Europe, China, Japan, India, Philippines, South Korea, Australia, New Zealand, Singapore, Thailand, Indonesia, Malaysia, Vietnam, Taiwan, the rest of Asia-Pacific, Brazil, Argentina, the rest of South America, Saudi Arabia, U.A.E., Egypt, Israel, South Africa, Oman, Bahrain, Kuwait, Qatar and the rest of Middle East and Africa.

|

|

Market Players Covered

|

SHIMADZU CORPORATION (Japan), METTLER TOLEDO (U.S), Nordson Corporation (U.S), Smiths Detection Group Ltd (U.K.), ANRITSU CORPORATION (Japan), ZEISS (Germany), A&D Company (U.S), Sesotec GmbH (Germany), Nikon Metrology Inc. (Japan), Comet Group (U.S.), North Star Imaging In (U.S.), Viscom AG (Germany), ISHIDA CO.,LTD (U.K), MEKITEC GROUP (U.S), MATSUSADA PRECISION Inc (U.S), Scienscope (U.S.), SYSTEM SQUARE INC. (Japan), MAHA X-RAY EQUIPMENTS PVT. LTD (India), Sapphire Inspection (U.S.), VJElectronix, Inc. (U.S.), Loma Systems (Armenia ), Minebea Intec GMbH (Germany), TDI PACKSYS (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The global x-ray inspection systems market is segmented into seven notable segments, which are based on offering, imaging technique, dimension, product type, scanning technology, number of lanes, and end-use.

- On the basis of offering, the global x-ray inspection systems market is segmented into hardware, software and services. In 2023, the hardware segment is expected to dominate the global x-ray inspection systems market owing to the increasing demand for non-destructive testing.

- On the basis of imaging technique, the global x-ray inspection systems market is segmented into film based imaging and digital imaging. In 2023, digital imaging is expected to dominate the x-ray inspection systems market as most of the advanced form of x-ray inspection which produces a digital radiographic image instantly on a computer.

- On the basis of dimension, the global x-ray inspection systems market is segmented into 2D and 3D. In 2023, 2D segment is expected to dominate the global x-ray inspection systems market, as most of the user cannot bear the 3D price because it is costly as compared to the 2D.

- On the basis of product type, the global x-ray inspection systems market is segmented into packaged products, un-packaged products, pumped and others. Pumped is further segmented into semi-solids and fluids. In 2023, packaged product segment is expected to dominate the x-ray inspection systems market due to packaging serves as protection for the product inside. It makes shipping and transportation simple and ensures a decent shelf life for your product.

- On the basis of scanning technology, the global x-ray inspection systems market is segmented into HD technology, Ultra HD technology and others. In 2023, the HD technology segment is expected to dominate the x-ray inspection systems market due to low-costs and availability.

- On the basis of number of lanes, the global x-ray inspection systems market is segmented into single lane, multi-lane and dual lane. In 2023, the single lane segment is expected to dominate the x-ray inspection systems market due to presence of different scanning technology for X-Ray inspection systems.

- On the basis of end-use, the global x-ray inspection systems market is segmented into food & beverage, semiconductor, pharmaceuticals & nutraceuticals, automotive, oil & gas, aerospace, power generation, government infrastructure, and others. In 2023, the food and beverage segment is expected to dominate the x-ray inspection systems market. The benefits of an x-ray food inspection system are clear: they will allow you to detect more contaminants, increase the safety (and therefore customer satisfaction) of your products, reduce business costs and increase your business reputation.

In 2023, the hardware segment of offering segment is expected to dominate the global x-ray Inspection systems market

In 2023, the hardware segment of this market is expected to dominate the global x-ray inspection systems market owing to the technological advancements in x-ray inspection systems. The hardware segment is expected to reach the CAGR of 7.5% in the forecast period of 2023-2030.

- On the basis of imaging technique, the global x-ray inspection systems market is segmented into digital imaging and film based imaging. In 2023, the digital imaging segment is expected to dominate the global x-ray inspection systems market with a 67.52% share and is expected to reach USD 925,918.16 thousand by 2030 growing with the CAGR of 7.5% in the forecast period of 2023 to 2030.

- On the basis of dimension, the global x-ray inspection systems market is segmented into 2D and 3D. In 2023, 2D is expected to dominate the global x-ray inspection systems market with a 58.23% share and is expected to reach USD 766,357.77 thousand by 2030 growing with the CAGR of 6.8% in the forecast period of 2023 to 2030.

- On the basis of product type, the global x-ray inspection systems market is segmented into packaged products, un-packaged products, pumped and others. In 2023, packaged products inspection systems is expected to dominate the global x-ray inspection systems market with a 46.32% share and is expected to reach USD 651,347.24 thousand by 2030 growing with the CAGR of 7.9% in the forecast period of 2023 to 2030.

- On the basis of scanning technology, the global x-ray inspection systems market is segmented into HD technology, Ultra-HD technology and others. In 2023, HD technology is expected to dominate the global x-ray inspection systems market with a 53.16% share and is expected to reach USD 711,891.06 thousand by 2030 growing with the CAGR of 7.1% in the forecast period of 2023 to 2030.

- On the basis of number of lanes, the global x-ray inspection systems market is segmented into single lane, dual lane and multi-lane. In 2023 single lane is expected to dominate the global x-ray inspection systems market with a 42.02% share and is expected to reach USD 554,454.57 thousand by 2030, growing with the CAGR of 6.9% in the forecast period of 2023 to 2030.

In 2023, the food & beverage segment is projected to hold the largest share of end-use segment in the global x-ray inspection systems market

In 2023 food & beverage is expected to dominate the global x-ray inspection systems market with a 23.57% share and is expected to reach USD 340,674.35 thousand by 2030 growing with the CAGR of 8.3% in the forecast period of 2023 to 2030.

Major Players

Data Bridge Market Research recognizes the following companies as the major global X-ray Inspection systems market players in X-ray Inspection systems market are SHIMADZU CORPORATION, METTLER TOLEDO, Nordson Corporation, Smiths Detection Group Ltd, ANRITSU CORPORATION, ZEISS, A&D Company, Sesotec GmbH, Nikon Metrology Inc., Comet Group, North Star Imaging In, Viscom AG, ISHIDA CO., LTD, MEKITEC GROUP, MATSUSADA PRECISION Inc, Scienscope, systems SQUARE INC., MAHA X-RAY EQUIPMENTS PVT. LTD, Sapphire Inspection, VJElectronix, Inc., Loma Systems, Minebea Intec GMbH, TDI PACKSYS.

Market Development

- In November2022, MATSUSADA PRECISION Inc. introduced a new compact benchtop X-ray inspection system "precision µB4500" that enables the tomography of horizontal radiation to observe liquid or powder samples.

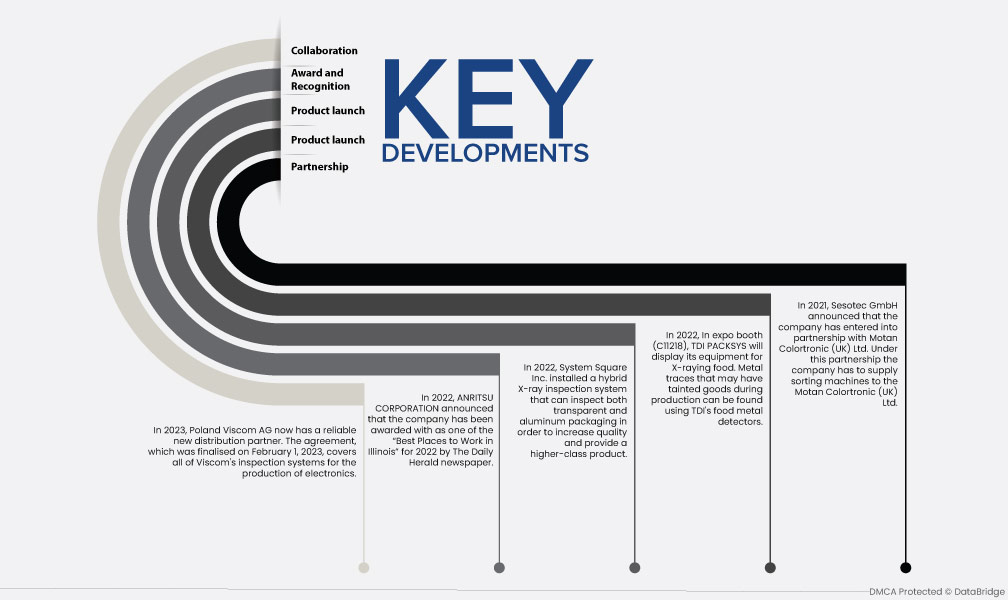

- In August 2022, ANRITSU CORPORATION announced that the company has been awarded with as one of the “Best Places to Work in Illinois” for 2022 by The Daily Herald newspaper. The company has receive this recognition and used it to promote its company culture, product portfolio across the U.S. region. This has allowed the company to gain revenue by increasing its product sales under global X-Ray inspection systems market.

- In September 2021, Loma Systems announced that the company has attended Pack Expo at Las Vegas. Through this exposition the company has showcased its latest advancement in the detector system and in inspection system. The company has inclined new consumers towards its product offerings and has gained recognition under global X-Ray inspection systems market.

- In July 2021, Sesotec GmbH announced that the company has entered into partnership with Motan Colortronic (UK) Ltd. Under this partnership the company has to supply sorting machines to the Motan Colortronic (UK) Ltd. The company is aiming to expand this partnership and additionally get contract for inspection systems that company offer under global X-Ray inspection systems market.

- In November 2020, Mekitec group announced on its official website that the company has entered into partnership with International Packaging Machinery Pty Ltd (IPM). Under this the company has provided its food X-ray inspection systems to International Packaging Machinery Pty Ltd. This has allowed the company to expand its business and gain market advancement under global X-Ray inspection systems market.

Regional Analysis

Geographically, the countries covered in the global X-ray Inspection Systems market report are U.S., Canada, Mexico, U.K., Germany, France, Italy, Netherlands, Spain, Switzerland, Russia, Sweden, Denmark, Belgium, Turkey, Poland, Norway, Finland, the rest of Europe, China, Japan, India, Philippines, South Korea, Australia, New Zealand, Singapore, Thailand, Indonesia, Malaysia, Vietnam, Taiwan, the rest of Asia-Pacific, Brazil, Argentina, the rest of South America, Saudi Arabia, U.A.E., Egypt, Israel, South Africa, Oman, Bahrain, Kuwait, Qatar and the rest of Middle East and Africa.

As per Data Bridge Market Research analysis:

North America is the dominant region in global x-ray inspection systems market during the forecast period 2023 - 2030

In 2022, North America x-ray inspection systems market has witnessed high growth and holds the largest share due to the presence of a large number of established manufacturers of x-ray inspection systems, coupled with the stringent regulatory standards for food safety and quality control. Coupled with technological advancements in x-ray inspection systems.

Asia-Pacific is estimated to be the fastest growing region in global x-ray inspection systems market the forecast period 2023 - 2030

In 2023, Asia-Pacific is expected to grow during the forecast period due to the increasing adoption of x-ray inspection systems across various industries, such as food and pharmaceuticals, automotive, semiconductor and others as well as the growing population and rising demand for packaged food products in the region is fueling the market growth. Various major players of Asia-Pacific X-ray inspection systems market operates in this region leading to various strategic plans and product launches.

COVID-19 Impact Analysis

The pandemic disrupted supply chains and manufacturing processes across various industries, including the x-ray inspection systems industry. Additionally, the global economic slowdown resulting from the pandemic affected the demand for x-ray inspection systems, as companies reduced their capital expenditure on equipment and technology.

However, despite the negative impact of the pandemic, the x-ray inspection systems market has also experienced some positive effects. The need for contactless inspection methods increased during the pandemic, and x-ray inspection systems proved to be a reliable and effective way to inspect and detect defects in products without physical contact. As a result, some industries, such as food and beverage, pharmaceuticals, and medical devices, have increased their adoption of x-ray inspection systems to ensure the safety and quality of their products.

For more detailed information about the x-ray inspection systems market report, click here – https://www.databridgemarketresearch.com/reports/global-x-ray-inspection-system-market