A high-quality paperboard substance known as an SBS board is produced, distributed, and used by a global industry. SBS board is distinguished by its great strength, printability, and adaptability. It is normally white on both sides. It is extensively utilized in many different contexts, including the packaging of consumer items like electronics, pharmaceuticals, chocolates, and cosmetics, and the production of high-quality brochures and printed graphics. Manufacturers, suppliers, and end users all depend on the SBS board because of its high quality and capacity to meet a variety of packaging and printing requirements. Market considerations may also include sustainability and environmental issues due to the increasing emphasis on eco-friendly packaging materials.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-solid-bleached-sulfate-sbs-board-market

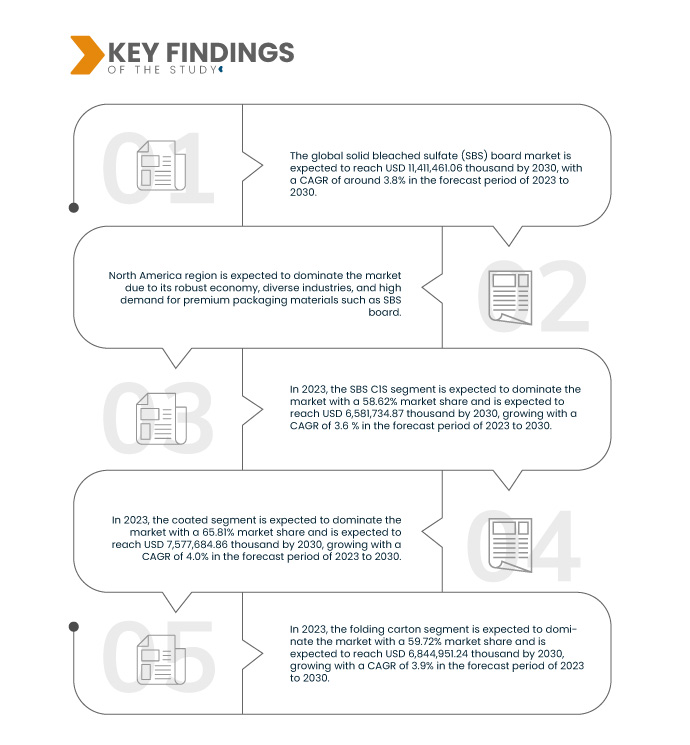

Data Bridge Market Research analyzes that the Global Solid Bleached Sulfate (SBS) Board Market is expected to grow with a CAGR of 3.8% from 2023 to 2030 and is expected to reach USD 11,411,461.06 thousand by 2030.

Key Findings of the Study

Expanding Packaging Industry is Expected to Drive the Market Growth

The market is experiencing significant growth due to the expanding packaging industry. Packaging plays a vital role in protecting and presenting products to consumers, and as a result, it has become an integral part of various industries such as food and beverages, cosmetics, pharmaceuticals, electronics, and more. This growth in the packaging sector is driving the demand for SBS board, a premium paperboard material known for its exceptional quality and versatility.

One of the primary reasons for the expanding packaging industry is the rise in e-commerce. With the proliferation of online shopping, businesses are seeking innovative ways to package their products securely for shipping while also delivering a pleasant unboxing experience for customers. SBS board is highly favored in this context due to its strength, smooth surface, and printability. It can withstand the rigors of shipping, ensuring that products reach consumers in excellent condition. Moreover, its smooth surface allows for high-quality printing, enhancing brand visibility and customer engagement.

This growth is attributed to the increasing importance of packaging across various sectors, including e-commerce and traditional retail. SBS board's exceptional qualities, such as strength, smoothness, and printability, make it a preferred choice for businesses aiming to ensure product safety during shipping and create eye-catching packaging designs. SBS board's versatility positions it as a key player in meeting the demands of modern packaging needs as the packaging industry continues to evolve. Thus, the expanding packaging industry is expected to drive market growth.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Product (SBS C1S and SBS C2S), Category (Coated and Uncoated), Application (Folding Carton, Cup and Plate, Liquid Packaging and Others), End Use (Food Packaging, Cosmetic Packaging, Pharmaceutical Packaging, Graphical Use, Electronics Packaging and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, Spain, U.K., Italy, Russia, Belgium, Netherlands, Turkey, Switzerland, Rest of Europe, China, India, Japan, South Korea, Singapore, Australia & New Zealand, Thailand, Indonesia, Malaysia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, United Arab Emirates, Saudi Arabia, South Africa, Egypt, Israel and Rest of Middle East and Africa

|

|

Market Players Covered

|

Graphic Packaging International, LLC (U.S.), Clearwater Paper Corporation (U.S.), WestRock Company (U.S.), Sappi, ITC Limited (India), Stora Enso (Finland), Pankakoski Mill Oy (Finland), Diamond Packaging (U.S.), Holmen Iggesund (Sweden), and Sandusky Packaging Corporation (U.S.) and among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Segment Analysis

The global solid bleached sulfate (SBS) board market is segmented into four notable segments based on product, category, application, and end use.

- On the basis of product, the market is segmented into SBS C1S and SBS C2S. In 2023, SBS C1S segment is anticipated to dominate the global solid bleached sulfate (SBS) board market with a market share of 58.62%.

- On the basis of category, the market is segmented into coated and uncoated. In 2023, coated segment is expected to dominate the market with a market share of 65.81%.

- On the basis of application, the market is segmented into folding carton, cup and plate, liquid packaging, and others.

In 2023, folding carton segment is anticipated to dominate the global solid bleached sulfate (SBS) board market

In 2023, folding carton segment is expected to dominate the market with a market share of 59.72% due to versatile packaging solutions demand.

- On the basis of end use, the market is segmented into food packaging, cosmetic packaging, pharmaceutical packaging, graphical use, electronics packaging and others.

In 2023, food packaging segment is anticipated to dominate the global solid bleached sulfate (SBS) board market

In 2023, food packaging segment is expected to dominate the market with a 35.33% market share due to the enduring and essential nature of food-related consumer needs.

Major Players

Data Bridge Market Research recognizes the following companies as the major players in the market that includes Graphic Packaging International, LLC(U.S.), Clearwater Paper Corporation (U.S.), WestRock Company (U.S.), Stora Enso (Finland), and Holmen Iggesund (Sweden) and among others.

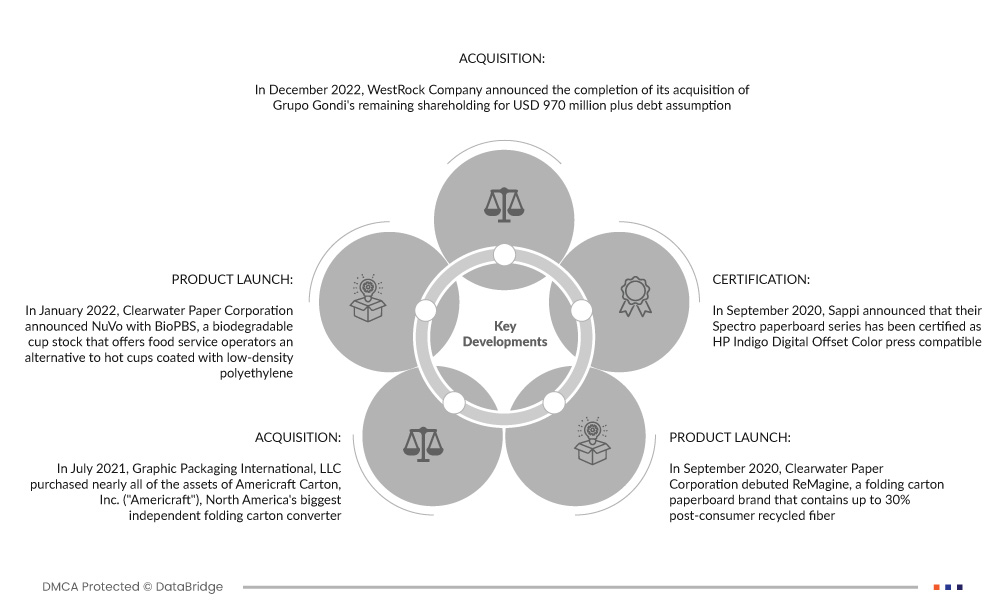

Market Developments

- In December 2022, WestRock Company announced the completion of its acquisition of Grupo Gondi's remaining shareholding for USD 970 million plus debt assumption. Grupo Gondi's purchase comprises four paper mills, nine corrugated packaging factories, and six high graphic businesses in Mexico that provide sustainable packaging for a variety of end markets in the area. This purchase will strengthen the Company's position as the industry leader in the developing Latin American containerboard, paperboard, consumer, and corrugated packaging industries.

- In January 2022, Clearwater Paper Corporation announced NuVo with BioPBS, a biodegradable cup stock that offers food service operators an alternative to hot cups coated with low-density polyethylene. It is the first cup material that has a biodegradable barrier, 35% post-consumer fiber, FSC chain-of-custody certification (FSC-C008402), and a high-definition print surface. This assists the firm in increasing product distinctiveness and sustainability.

- In July 2021, Graphic Packaging International, LLC purchased nearly all of the assets of Americraft Carton, Inc. ("Americraft"), North America's biggest independent folding carton converter. The deal comprised seven conversion factories in the U.S. This will allow the firm to expand its mill-to-converting plant integration levels and expand its client base in emerging regions.

- In September 2020, Clearwater Paper Corporation debuted ReMagine, a folding carton paperboard brand that contains up to 30% post-consumer recycled fiber. ReMagine, which was inspired by circular economy concepts, offers high quality print capacity as well as excellent conversion performance. This introduction enables the corporation to fulfill customers' preferences about emerging trends in sustainable packaging.g

- In September 2020, Sappi announced that their Spectro paperboard series has been certified as HP Indigo Digital Offset Color press compatible. As part of the certification process, the business expanded its solutions for bespoke, short-run packaging and commercial printing by adding additional Digital substrates to its C1S and C2S lines.

Regional Analysis

Geographically, the regions covered in the global solid bleached sulfate (SBS) board market report are U.S., Canada, Mexico, Germany, France, Spain, U.K., Italy, Russia, Belgium, Netherlands, Turkey, Switzerland, Rest of Europe, China, India, Japan, South Korea, Singapore, Australia & New Zealand, Thailand, Indonesia, Malaysia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, United Arab Emirates, Saudi Arabia, South Africa, Egypt, Israel and Rest of Middle East and Africa.

As per Data Bridge Market Research Analysis:

North America is the dominant region in the global solid bleached sulfate (SBS) board market

North America is expected to dominate the global solid bleached sulfate (SBS) board market due to its robust economy, diverse industries, and high demand for premium packaging materials such as SBS board.

Asia-Pacific is estimated to be the fastest-growing region in the global solid bleached sulfate (SBS) board market during the forecast period 2023 - 2030

Asia-Pacific is expected to grow during the forecast period due to increasing demand for packaging materials, expansion of the food and retail sectors, and rising consumer preferences for sustainable and high-quality packaging solutions.

For more detailed information about the global solid bleached sulfate (SBS) board market report, click here – https://www.databridgemarketresearch.com/reports/global-solid-bleached-sulfate-sbs-board-market