Protein hydrolysates are pivotal in animal feed applications as they offer high nutritional value and enhanced digestibility. Through the hydrolysis process, proteins are broken down into amino acids and peptides, promoting optimal absorption in animals' digestive systems. This not only improves feed efficiency but also contributes to superior growth and overall animal health in both livestock and aquaculture. A key advantage lies in their ability to provide a well-balanced amino acid profile, essential for comprehensive animal development. Notably, protein hydrolysates play a crucial role in addressing protein deficiencies in conventional feed sources, thereby enhancing the sustainability and efficiency of animal agriculture.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-protein-hydrolysates-for-animal-feed-application-market

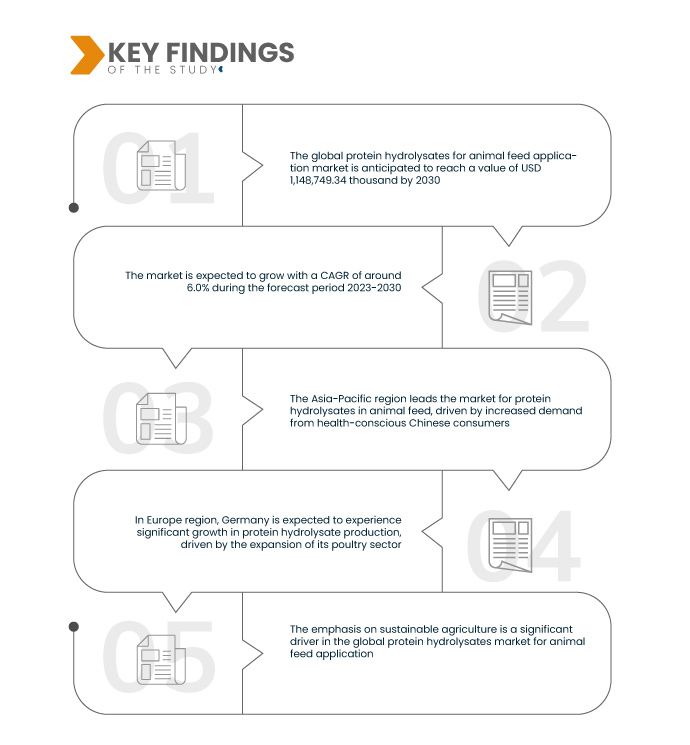

Data Bridge Market Research analyses that the Global Protein Hydrolysates for Animal Feed Application Market which was USD 720,130.90 thousand in 2022, will reach up to USD 1,148,749.34 thousand by 2030, and is expected to undergo a CAGR of 6.0% during the forecast period 2023-2030. The heightened awareness of the critical role of nutrition in animal health and productivity is a key driver in the global protein hydrolysates market for animal feed applications. As stakeholders increasingly emphasize specialized feed additives, protein hydrolysates stand out for providing a concentrated source of essential amino acids and nutrients.

Key Findings of the Study

Increasing demand from diverse industries is expected to drive the market's growth rate

The global protein hydrolysates market for animal feed applications is driven by high demand from diverse industries. Protein hydrolysates are favored in sports nutrition and protein supplements due to their fast absorption, aiding lean muscle development and reducing hypertension risks. Their use extends to medical nutrition, treating conditions such as irritable bowel syndrome and Crohn's disease. Additionally, protein hydrolysates serve as hypoallergenic protein sources in infant formulas for those with celiac disease, lactose, and gluten intolerance. The versatility and recognized nutritional benefits of protein hydrolysates contribute significantly to their widespread adoption, fueling market growth.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Thousand, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Source (Animal Protein Hydrolysate, Protein Hydrolysates for Animal Feed Application, Plant Protein Hydrolysate and Milk Protein Hydrolysate), Form (Powder and Paste), Livestock (Poultry, Swine, Cattle, Calves, Aquaculture, Equine and Pet), Technology (Acid Hydrolysis and Enzymatic Hydrolysis), Application (Industrial and Commercial)

|

|

Countries Covered

|

U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

|

|

Market Players Covered

|

Hofseth BioCare ASA (Norway), Diana Group (Brittany), Bio-marine Ingredients Ireland (Ireland), Copalis (France), Janatha Fish Meal & Oil Products (India), Scanbio Marine Group AS (Norway), Sopropêche (France), Omega Protein Corporation (U.S.), Sociedad Pesquera Landes Sa (Chile), TC Union Agrotech and United Fisheries (Thailand) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The global protein hydrolysates for animal feed application market are segmented on the basis of source, form, livestock, technology, and application.

- On the basis of source, the global protein hydrolysates for animal feed application market is segmented into animal protein hydrolysate, protein hydrolysates for animal feed application, plant protein hydrolysate, and milk protein hydrolysate

- On the basis of form, the global protein hydrolysates for animal feed application market is segmented into powder and paste

- On the basis of livestock, the global protein hydrolysates for animal feed application market is segmented into poultry, swine, cattle, calves, aquaculture, equine, and pet

- On the basis of technology, the global protein hydrolysates for animal feed application market is segmented into acid hydrolysis and enzymatic hydrolysis

- On the basis of application, the global protein hydrolysates for animal feed application market is segmented into industrial and commercial

Major Players

Data Bridge Market Research recognizes the following companies as the major global protein hydrolysates for animal feed application market in global protein hydrolysates for animal feed application market are Hofseth BioCare ASA (Norway), Diana Group (Brittany), Bio-marine Ingredients Ireland (Ireland), Copalis (France), Janatha Fish Meal & Oil Products (India), Scanbio Marine Group AS (Norway)

Market Developments

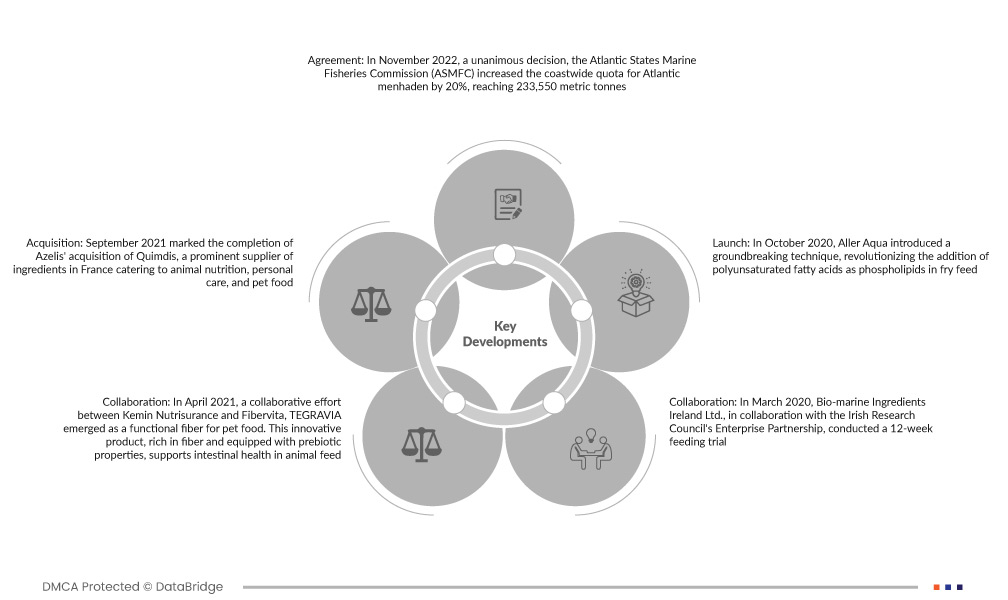

- In November 2022, with a unanimous decision, the Atlantic States Marine Fisheries Commission (ASMFC) increased the coastwide quota for Atlantic menhaden by 20%, reaching 233,550 metric tonnes. The Omega Protein Foundation endorses this decision, supported by the latest menhaden science, as part of the ASMFC's conservative resource management strategy, ensuring a substantial buffer to prevent exceeding target harvest rates

- In September 2021 marked the completion of Azelis' acquisition of Quimdis, a prominent supplier of ingredients in France catering to animal nutrition, personal care, and pet food. This strategic move reinforces Azelis' position as a leading company in the food and feed nutrition sector, expanding its offerings and capabilities

- In April 2021, a collaborative effort between Kemin Nutrisurance and Fibervita, TEGRAVIA emerged as a functional fiber for pet food. This innovative product, rich in fiber and equipped with prebiotic properties, supports intestinal health in animal feed. Additionally, TEGRAVIA proves beneficial in enhancing the texture and starch gelatinization of pet food formulations

- In October 2020, Aller Aqua introduced a groundbreaking technique, revolutionizing the addition of polyunsaturated fatty acids as phospholipids in fry feed. This innovation enhances the nutrient benefits in fry feed, resulting in accelerated growth for fish larvae. Notably, the technique addresses challenges such as early mortality, deformities, and delayed growth, marking a significant advancement in fry feed formulations and aquaculture practices

- In March 2020, Bio-marine Ingredients Ireland Ltd., in collaboration with the Irish Research Council's Enterprise Partnership, conducted a 12-week feeding trial. The study explored the impact of low fishmeal diets and high plant-protein, with and without FPH supplementation, on gut health and growth performance in freshwater Atlantic salmon. This recent study aims to pave the way for innovative approaches in the sustainable aquaculture feed market

Regional Analysis

Geographically, the countries covered in the global protein hydrolysates for animal feed application market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in global protein hydrolysates for animal feed application market during the forecast period 2023-2030

The Asia-Pacific region dominates in the protein hydrolysates for animal feed application market, with Chinese consumers driving this dominance due to their increasing health consciousness and preference for animal protein hydrolysates. The region's economic growth and urbanization have spurred demand for high-quality animal products, fostering a growing market for specialized feed additives. Chinese consumers prioritize health and nutrition, leading to a preference for animal protein hydrolysates known for their high biological value and easy digestibility.

Europe is estimated to be the fastest-growing region in the global protein hydrolysates for animal feed application market in the forecast period 2023-2030

In Europe, Germany is expected to experience significant growth in the production of protein hydrolysates market, primarily fueled by the expansion of its poultry sector. The increasing demand for poultry products, such as meat and eggs, is driving the need for specialized and high-quality feed additives, including protein hydrolysates, to support optimal poultry growth and health. This anticipated growth is a result of the direct correlation between the expanding poultry industry and the surge in protein hydrolysate production.

For more detailed information about the global protein hydrolysates for animal feed application market report, click here – https://www.databridgemarketresearch.com/reports/global-protein-hydrolysates-for-animal-feed-application-market