Le moulage par injection de métal (MIM) dans le secteur médical permet de produire des pièces métalliques complexes avec une grande précision. Il utilise des poudres métalliques fines et des liants , moulés et frittés pour obtenir les formes finales. Le MIM permet de concevoir des instruments chirurgicaux et des implants complexes . Ce procédé garantit une résistance et une biocompatibilité élevées, améliorant ainsi l'efficacité et la qualité de la fabrication des dispositifs médicaux.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/global-metal-injection-molding-mim-in-medical-application-market

Data Bridge Market Research analyse que le marché mondial du moulage par injection de métal (MIM) dans les applications médicales devrait atteindre 1 030 millions USD d'ici 2031, contre 535,45 millions USD en 2023, avec un TCAC substantiel de 8,45 % au cours de la période de prévision de 2024 à 2031.

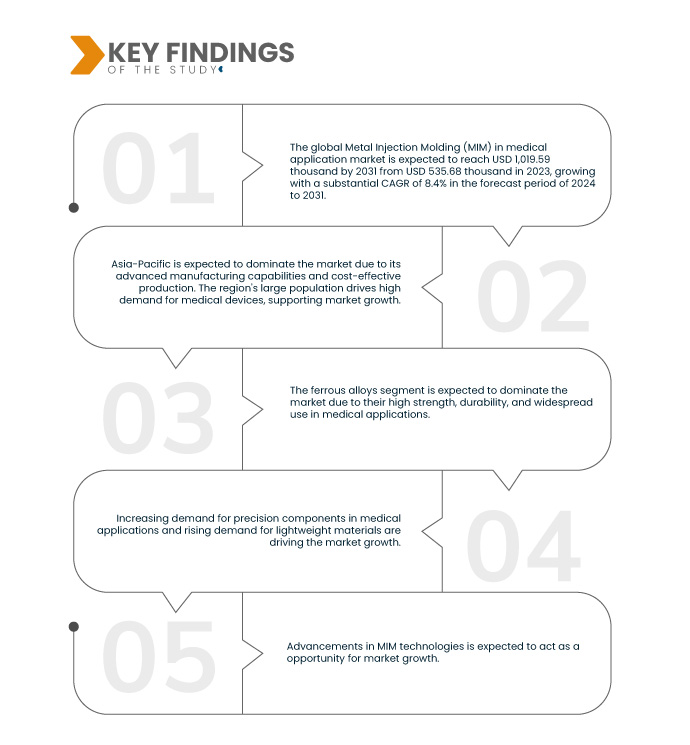

Principales conclusions de l'étude

Demande croissante de composants de précision dans les applications médicales

Les composants de précision sont essentiels aux dispositifs médicaux , garantissant fiabilité et hautes performances. Le moulage par injection de métal, capable de produire des pièces complexes et de haute précision, s'est imposé comme une solution idéale pour répondre aux exigences strictes du secteur médical. Cette méthode permet la production de composants compacts et complexes dotés d'excellentes propriétés mécaniques, essentielles aux instruments et implants médicaux.

Les applications médicales telles que les instruments chirurgicaux, les appareils orthodontiques et les implants orthopédiques bénéficient de la précision et de la régularité du MIM. La possibilité de fabriquer des composants avec des tolérances serrées et des finitions de surface supérieures fait du MIM un choix attractif pour la production de pièces médicales. De plus, l'efficacité du procédé pour la création de pièces en grande série et de qualité constante répond aux besoins du secteur médical en matière de solutions de fabrication rentables. Cet alignement favorise l'adoption de la technologie MIM dans le secteur médical, stimulant ainsi la croissance du marché.

En conclusion, la demande croissante de composants de précision pour les applications médicales stimule considérablement la croissance du marché du moulage par injection de métal. La capacité du MIM à produire efficacement des pièces complexes de haute précision répond parfaitement aux exigences strictes du secteur médical. Face à l'évolution constante du secteur médical, avec la tendance à la miniaturisation et le renforcement des normes réglementaires, le rôle du MIM devient encore plus crucial. Cette synergie entre les capacités du MIM et les besoins du secteur médical souligne la forte croissance du marché de la technologie du moulage par injection de métal.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024-2031

|

Année de base

|

2023

|

Années historiques

|

2022 (personnalisable pour 2016-2021)

|

Unités quantitatives

|

Chiffre d'affaires en millions USD

|

Segments couverts

|

Matériau (alliages ferreux, alliages de tungstène, métaux durs, matériaux spéciaux, autres), catégorie (implants, couronnes dentaires, endoscopes, dispositifs laparoscopiques, manche pour ciseaux chirurgicaux, mâchoire et autres)

|

Pays couverts

|

États-Unis, Canada, Mexique, Chine, Japon, Inde, Corée du Sud, Taïwan, Singapour, Vietnam, Malaisie, reste de l'Asie-Pacifique, Allemagne, Royaume-Uni, Italie, France, Espagne, Suisse, Russie, Turquie, Belgique, Pays-Bas, reste de l'Europe, Brésil, Argentine, reste de l'Amérique du Sud, Afrique du Sud, Émirats arabes unis, Arabie saoudite, Égypte, Israël et reste du Moyen-Orient et de l'Afrique

|

Acteurs du marché couverts

|

GKN Powder Metallurgy (États-Unis), Molex (États-Unis), Seiko Epson Corporation (Japon), INDO-MIM (Inde), ARC Group Worldwide (États-Unis), Jiangsu Gian MIM Parts (Chine), MPP (États-Unis), Reich MIM GmbH (Allemagne), SZS Co., Ltd. (Taïwan), Alpha Precision Group (États-Unis), Optimim (États-Unis), ASH INDUSTRIES (États-Unis), Parmaco Metal Injection Molding AG (Suisse), Advanced Powder Products, Inc. (États-Unis), AMT Pte Ltd (Singapour), Shilpan Steelcast Pvt. Ltd. (Inde), VDR Metals Inc. (Inde), Smith Metal Products (États-Unis), Taiwan Kodai Co., Ltd. (Taïwan) et ABIS MOLD Technology Co., Ltd (Chine)

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande.

|

Analyse des segments

Le marché du moulage par injection de métal (MIM) dans les applications médicales est segmenté en deux segments notables en fonction du matériau et de la catégorie.

- Sur la base du matériau, le marché est segmenté en alliages ferreux, alliages de tungstène, métaux durs, matériaux spéciaux et autres

En 2024, le segment des alliages ferreux devrait dominer le marché mondial du moulage par injection de métal (MIM) dans les applications médicales.

En 2024, le segment des alliages ferreux devrait dominer le marché avec une part de marché de 36,11 % en raison de leur résistance élevée, de leur durabilité et de leur utilisation généralisée dans les applications médicales.

- Sur la base de la catégorie, le marché est segmenté en implants, couronnes dentaires, endoscopes, dispositifs laparoscopiques, manche pour ciseaux chirurgicaux, mâchoires et autres

En 2024, le segment des implants devrait dominer le marché mondial du moulage par injection de métal (MIM) dans les applications médicales.

En 2024, le segment des implants devrait dominer le marché avec une part de marché de 31,81 % en raison de la haute précision et des géométries complexes requises pour les implants médicaux.

Acteurs majeurs

Data Bridge Market Research analyse GKN Powder Metallurgy (États-Unis), Molex (États-Unis), Seiko Epson Corporation (Japon), INDO-MIM (Inde) et ARC Group Worldwide (États-Unis) comme les principaux acteurs du moulage par injection de métal (MIM) mondial dans le marché des applications médicales.

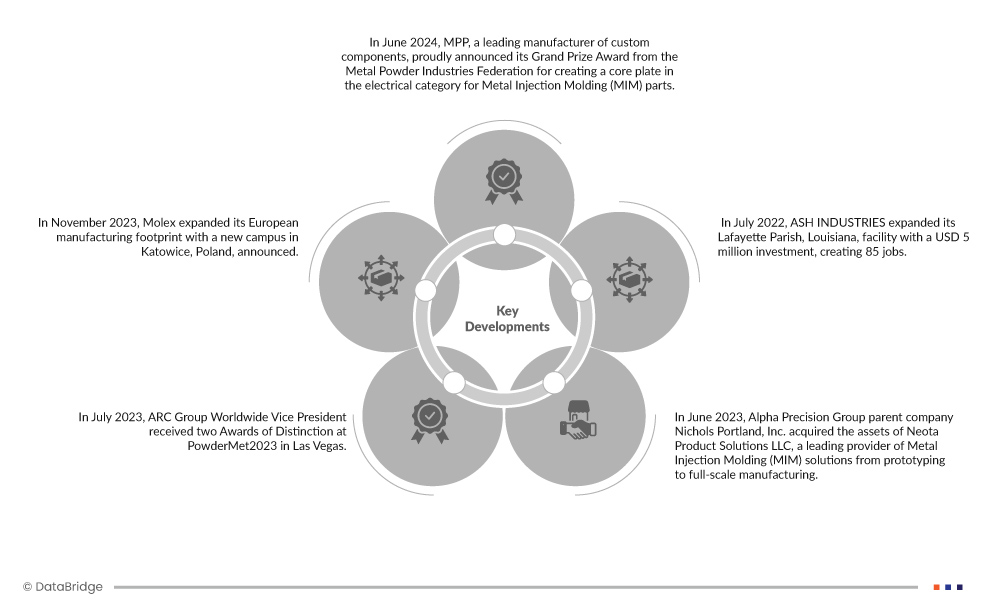

Évolution du marché

- En juin 2024, MPP, fabricant leader de composants sur mesure, a fièrement annoncé le Grand Prix de la Fédération des industries des poudres métalliques pour la création d'une plaque de base dans la catégorie électrique destinée aux pièces moulées par injection de métal (MIM). Cette plaque est essentielle à la tablette Cadence, le premier appareil capable d'afficher des graphiques tactiles animés. Cette reconnaissance attirera de nouveaux clients, renforcera leur confiance et ouvrira de nouvelles perspectives dans des secteurs de pointe comme l'électronique et les technologies tactiles.

- En novembre 2023, Molex a étendu son implantation industrielle européenne avec l'annonce d'un nouveau campus à Katowice, en Pologne. L'installation initiale de 23 000 m² accueillait des dispositifs médicaux de pointe et des solutions d'électrification, avec des projets d'agrandissement futurs jusqu'à 85 000 m². Molex a investi 110 millions de dollars dans ce site, qui a fourni des capacités de pointe et créé environ 350 emplois qualifiés. Le campus était en passe d'obtenir les certifications LEED Or et ISO 13485.

- En juillet 2023, le vice-président mondial d'ARC Group a reçu deux prix de distinction lors du salon PowderMet2023 à Las Vegas. Ces prix ont récompensé des composants innovants en moulage par injection de métal (MIM) pour armes à feu, notamment un bloc de verrouillage en acier à outils S-7 et une butée de culasse pour pistolet. Ces prix renforcent la réputation d'ARC Group Worldwide dans le secteur et favorisent de nouvelles opportunités commerciales en illustrant son leadership dans la technologie MIM de précision pour les composants d'armes à feu.

- En juin 2023, Nichols Portland, Inc., société mère d'Alpha Precision Group, a acquis les actifs de Neota Product Solutions LLC, un fournisseur leader de solutions de moulage par injection de métal (MIM), du prototypage à la production à grande échelle. Cette acquisition, annoncée par Thomas K. Houck, président-directeur général de Nichols, renforce les capacités MIM de Nichols. Jason Osborne, président de Neota, et son équipe rejoindront Nichols, renforçant ainsi l'expertise de l'entreprise en matière de conception et de fabrication de produits. Heidi Goldstein, d'Altus Capital Partners, propriétaire de Nichols, a souligné le potentiel de ce partenariat pour renforcer l'offre complète de services axés sur le client de Nichols. Les conditions financières n'ont pas été divulguées.

- En juillet 2022, ASH INDUSTRIES a agrandi son usine de Lafayette Parish, en Louisiane, grâce à un investissement de 5 millions de dollars américains, créant ainsi 85 emplois. Ce projet a permis de doubler la surface de production en ajoutant 1 800 m². Lors du lancement, l'entreprise a souligné l'importance d'un espace de production, d'une équipe solide et d'équipements de pointe, notamment un système interne de moulage par injection de métal.

Analyse régionale

Géographiquement, les régions couvertes par le rapport sur le marché mondial du moulage par injection de métal (MIM) pour les applications médicales sont l'Asie-Pacifique, l'Amérique du Nord, l'Europe, l'Amérique du Sud, le Moyen-Orient et l'Afrique. Ces régions sont ensuite segmentées par pays : États-Unis, Canada et Mexique, Allemagne, Royaume-Uni, France, Italie, Espagne, Pays-Bas, Russie, Suisse, Turquie, Belgique et reste de l'Europe, Chine, Japon, Inde, Corée du Sud, Thaïlande, Indonésie, Singapour, Australie et Nouvelle-Zélande, Malaisie, Philippines et reste de l'Asie-Pacifique, Brésil, Argentine et reste de l'Amérique du Sud, Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël et reste du Moyen-Orient et de l'Afrique.

Selon l'analyse de Data Bridge Market Research :

L'Asie-Pacifique est la région dominante sur le marché mondial du moulage par injection de métal (MIM) dans les applications médicales

En 2024, l'Asie-Pacifique devrait dominer le marché grâce à ses capacités de fabrication avancées et à sa production rentable. La forte population de la région stimule la forte demande de dispositifs médicaux, soutenant ainsi la croissance du marché.

L'Amérique du Nord est considérée comme la région connaissant la croissance la plus rapide sur le marché mondial du moulage par injection de métal (MIM) dans les applications médicales.

L'Amérique du Nord devrait connaître une croissance au cours de la période de prévision 2024 à 2031 en raison de la demande croissante de composants de précision dans les applications médicales.

Pour plus d'informations sur le rapport sur le marché mondial du moulage par injection de métal (MIM) dans les applications médicales, cliquez ici : https://www.databridgemarketresearch.com/reports/global-metal-injection-molding-mim-in-medical-application-market