تُدرك الحكومات حول العالم الدور الحيوي لصناعة تجهيز الأغذية في تعزيز الأمن الغذائي، وتقليل الهدر، وإضافة قيمة للمنتجات الزراعية. ولذلك، تُطبّق سياسات وتُخصّص الأموال لتعزيز نمو هذا القطاع وتحديثه.

في دول مثل الهند، أطلقت الحكومة مبادرات مثل برنامج برادان مانتري كيسان سامبادا يوجانا (PMKSY) لتقديم الدعم المالي لإنشاء وتطوير وحدات معالجة الأغذية. تهدف هذه المبادرات إلى إنشاء بنية تحتية، وتعزيز قدرات المعالجة، ورفع كفاءة سلسلة توريد الأغذية. تُحفّز هذه السياسات الداعمة الطلب على معدات معالجة الأغذية المتطورة، مما يُحفّز نمو السوق.

في الولايات المتحدة، تُقدّم وزارة الزراعة الأمريكية منحًا وقروضًا لمُصنّعي الأغذية لتبني تقنيات جديدة وتوسيع نطاق عملياتهم. تُشجّع هذه الحوافز المالية الشركات على الاستثمار في أحدث المعدات، مما يُحفّز الطلب على حلول مُبتكرة لتصنيع الأغذية. ويتماشى التركيز على تحديث قطاع تصنيع الأغذية مع الأهداف الأوسع المتمثلة في ضمان سلامة الغذاء، وتحسين جودة المنتج، وتحسين الكفاءة التشغيلية.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/global-food-processing-equipment-market

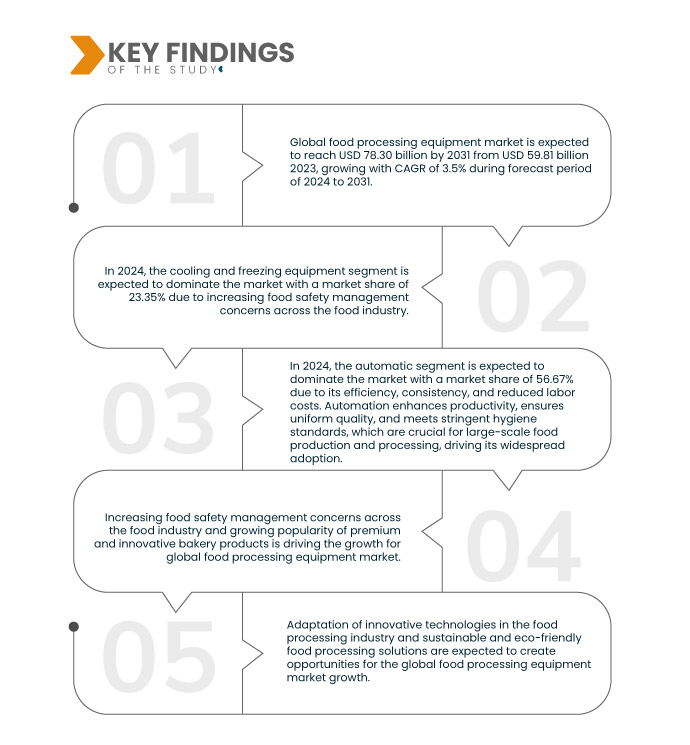

تحلل شركة Data Bridge Market Research أن سوق معدات معالجة الأغذية العالمية من المتوقع أن يصل إلى 78.30 مليار دولار أمريكي بحلول عام 2031 من 59.81 مليار دولار أمريكي في عام 2023، بنمو سنوي مركب بنسبة 3.5٪ خلال الفترة المتوقعة من 2024 إلى 2031.

النتائج الرئيسية للدراسة

تزايد المخاوف بشأن إدارة سلامة الأغذية في صناعة الأغذية

أدى الوعي المتزايد بسلامة وجودة الغذاء إلى تشديد اللوائح والمعايير، مما دفع مصنعي الأغذية إلى اعتماد معدات معالجة متطورة. ويعزى هذا التوجه إلى ضرورة ضمان الامتثال للوائح سلامة الغذاء، والحفاظ على اتساق المنتج، وتعزيز الكفاءة التشغيلية.

من أهم العوامل التي تُسهم في تزايد المخاوف المتعلقة بإدارة الأغذية ازدياد طلب المستهلكين على منتجات غذائية آمنة وعالية الجودة. ويتزايد وعي المستهلكين بالمخاطر الصحية المحتملة المرتبطة بالأغذية الملوثة، مما أدى إلى زيادة التركيز على سلامة الأغذية. وقد دفع هذا مُصنّعي الأغذية إلى الاستثمار في معدات متطورة تُمكّنهم من مراقبة مراحل إنتاج الأغذية المختلفة والتحكم فيها بفعالية، بدءًا من مناولة المواد الخام ووصولًا إلى التعبئة والتغليف. ويُسهم استخدام هذه المعدات في تقليل مخاطر التلوث، وضمان إمكانية التتبع، والحفاظ على معايير النظافة.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

السنوات التاريخية

|

2022 (قابلة للتخصيص حتى 2016-2021)

|

الوحدات الكمية

|

الإيرادات بالمليار دولار أمريكي

|

القطاعات المغطاة

|

نوع المعدات (معدات التبريد والتجميد، معدات الطهي والتسخين، آلات التعبئة، آلات الغلق، الخلاطات، المطاحن، آلات الطحن، آلات التقطيع والتقطيع، معدات التجفيف والتجفيف، آلات التقشير، آلات الفصل، وغيرها)، نوع التشغيل الآلي (آلي، نصف آلي، ويدوي)، الصناعة (اللحوم والدواجن والمأكولات البحرية، منتجات الألبان، المخابز، الفواكه والخضروات المصنعة ، الحلويات، منتجات مطاحن الحبوب، وغيرها)

|

الدول المغطاة

|

الولايات المتحدة، كندا، المكسيك، البرازيل، الأرجنتين، بقية دول أمريكا الجنوبية، الصين، الهند، اليابان، كوريا الجنوبية، أستراليا، إندونيسيا، تايلاند، فيتنام، الفلبين، ماليزيا، بقية دول آسيا والمحيط الهادئ، ألمانيا، فرنسا، إيطاليا، المملكة المتحدة، هولندا، إسبانيا، بلجيكا، سويسرا، بولندا، السويد، الدنمارك، بقية دول أوروبا، جنوب أفريقيا، مصر، الإمارات العربية المتحدة، المملكة العربية السعودية، إسرائيل، وبقية دول الشرق الأوسط وأفريقيا

|

الجهات الفاعلة في السوق المغطاة

|

JBT (الولايات المتحدة)، ALFA LAVAL (السويد)، Marel (أيسلندا)، The Middleby Corporation (الولايات المتحدة)، Bühler AG (سويسرا)، GEA Group Aktiengesellschaft (ألمانيا)، SPX FLOW (الولايات المتحدة)، Tetra Pak Group (سويسرا)، Bigtem Makine AS (تركيا)، TNA Australia Pty Limited (سويسرا)، Schaaf Technologie GmbH (ألمانيا)، ANKO FOOD MACHINE CO., LTD. (تايوان)، Bettcher Industries, Inc. (الولايات المتحدة)، Baker Perkins (المملكة المتحدة)، Heat and Control, Inc. (الولايات المتحدة)، Key Technology (الولايات المتحدة)، Provisur Technologies, Inc. (الولايات المتحدة)، PROXES GMBH (ألمانيا)، FME Food Machinery Europe Sp. z oo (بولندا)، وAlto-Shaam, Inc. (الولايات المتحدة) وغيرها.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي أعدتها شركة Data Bridge Market Research أيضًا تحليلًا متعمقًا من الخبراء والإنتاج والقدرة التمثيلية الجغرافية للشركة وتخطيطات الشبكة للموزعين والشركاء وتحليل اتجاهات الأسعار التفصيلية والمحدثة وتحليل العجز في سلسلة التوريد والطلب.

|

تحليل القطاعات

يتم تقسيم سوق معدات تجهيز الأغذية العالمية إلى ثلاثة قطاعات بارزة بناءً على نوع المعدات ونوع الأتمتة والصناعة.

- على أساس نوع المعدات، يتم تقسيم سوق معدات تجهيز الأغذية العالمية إلى معدات التبريد والتجميد، ومعدات الطهي والتدفئة، والحشوات، وأجهزة الغلق، والخلاطات، والمطاحن، والقواطع والمقطعات، ومعدات التجفيف والتجفيف، والمقشرات، والفواصل، وغيرها.

في عام 2024، من المتوقع أن يهيمن قطاع معدات التبريد والتجميد على سوق معدات تجهيز الأغذية العالمية

ومن المتوقع أن تهيمن شريحة معدات التبريد والتجميد على السوق في عام 2024 بحصة سوقية تبلغ 23.35% بسبب المخاوف المتزايدة بشأن إدارة سلامة الأغذية في جميع أنحاء صناعة الأغذية.

- على أساس نوع الأتمتة، يتم تقسيم سوق معدات معالجة الأغذية العالمية إلى أوتوماتيكية وشبه أوتوماتيكية ويدوية

في عام 2024، من المتوقع أن يهيمن القطاع الآلي على سوق معدات تجهيز الأغذية العالمية

في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع الأتمتة على السوق بحصة سوقية تبلغ ٥٦.٦٧٪ بفضل كفاءته واتساقه وانخفاض تكاليف العمالة. تُعزز الأتمتة الإنتاجية، وتضمن جودة موحدة، وتفي بمعايير النظافة الصارمة، وهي أمور بالغة الأهمية لإنتاج وتجهيز الأغذية على نطاق واسع، مما يُعزز انتشارها على نطاق واسع.

- بناءً على الصناعة، يُقسّم سوق معدات تجهيز الأغذية العالمي إلى: اللحوم والدواجن والمأكولات البحرية، ومنتجات الألبان، والمخابز، والفواكه والخضراوات المُصنّعة، والحلويات، ومنتجات مطاحن الحبوب، وغيرها. ومن المتوقع أن يُهيمن قطاع اللحوم والدواجن والمأكولات البحرية على السوق بحصة سوقية تبلغ 30.04% في عام 2024.

اللاعبون الرئيسيون

تعد مجموعة Tetra Pak (سويسرا)، وشركة Bühler AG (سويسرا)، وشركة Marel (أيسلندا)، وشركة GEA Group Aktiengesellschaft (ألمانيا)، وشركة SPX FLOW (الولايات المتحدة) من اللاعبين الرئيسيين في سوق معدات تجهيز الأغذية العالمية.

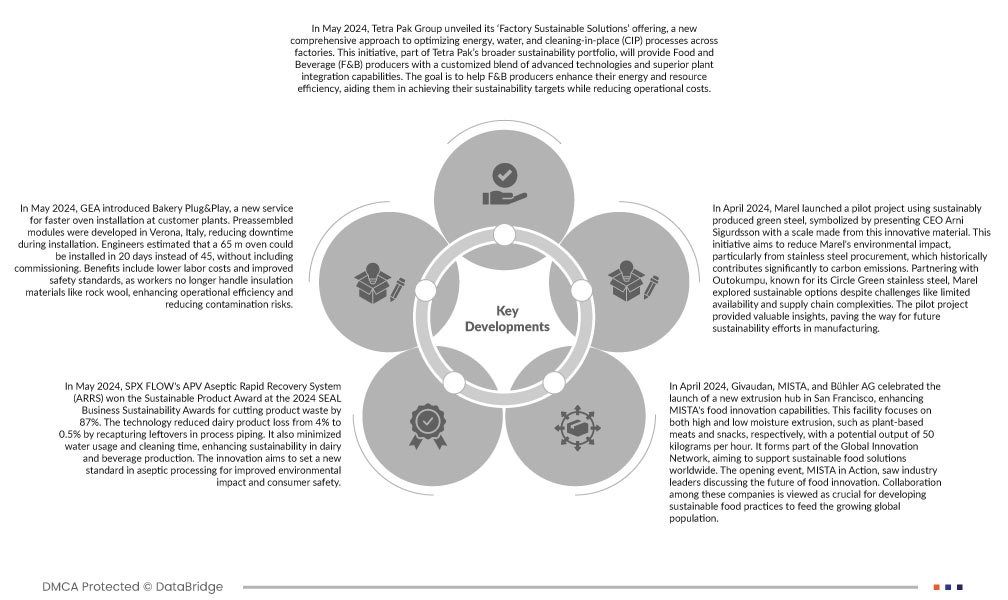

تطورات السوق

- في مايو 2024، كشفت مجموعة تترا باك عن عرضها "حلول الاستدامة للمصانع"، وهو نهج شامل جديد لتحسين عمليات الطاقة والمياه والتنظيف في الموقع (CIP) في جميع المصانع. تُوفر هذه المبادرة، التي تُعدّ جزءًا من محفظة تترا باك الأوسع للاستدامة، لمنتجي الأغذية والمشروبات مزيجًا مُصممًا خصيصًا من التقنيات المتقدمة وقدرات تكامل فائقة للمصانع. الهدف هو مساعدة منتجي الأغذية والمشروبات على تحسين كفاءة استخدام الطاقة والموارد، مما يُساعدهم على تحقيق أهدافهم في الاستدامة مع خفض تكاليف التشغيل.

- في مايو 2024، أطلقت شركة GEA خدمة Bakery Plug&Play، وهي خدمة جديدة لتركيب الأفران بسرعة أكبر في مصانع العملاء. طُوّرت وحدات مُجمّعة مسبقًا في فيرونا، إيطاليا، مما قلّل من وقت التوقف أثناء التركيب. وقدّر المهندسون إمكانية تركيب فرن بطول 65 مترًا في 20 يومًا بدلًا من 45 يومًا، دون احتساب فترة التشغيل. تشمل المزايا انخفاض تكاليف العمالة وتحسين معايير السلامة، حيث لم يعد العمال يتعاملون مع مواد عازلة مثل الصوف الصخري، مما يُحسّن الكفاءة التشغيلية ويُقلّل من مخاطر التلوث.

- في مايو 2024، فاز نظام الاسترداد السريع المعقم APV (ARRS) من SPX FLOW بجائزة المنتج المستدام ضمن جوائز SEAL لاستدامة الأعمال لعام 2024، وذلك لخفضه هدر المنتجات بنسبة 87%. وقد قللت هذه التقنية من هدر منتجات الألبان من 4% إلى 0.5% من خلال إعادة تجميع بقايا الطعام في أنابيب المعالجة. كما قللت من استهلاك المياه ووقت التنظيف، مما عزز الاستدامة في إنتاج الألبان والمشروبات. ويهدف هذا الابتكار إلى إرساء معيار جديد في المعالجة المعقمة لتحسين الأثر البيئي وسلامة المستهلك.

- في أبريل 2024، احتفلت جيفودان، وميستا، وبوهلر إيه جي بإطلاق مركز جديد للبثق في سان فرانسيسكو، مما عزز قدرات ميستا في مجال ابتكار الأغذية. يركز هذا المرفق على عمليات البثق عالية ومنخفضة الرطوبة، مثل اللحوم النباتية والوجبات الخفيفة، على التوالي، بطاقة إنتاجية تصل إلى 50 كيلوغرامًا في الساعة. وهو جزء من شبكة الابتكار العالمية، التي تهدف إلى دعم حلول الأغذية المستدامة عالميًا. شهد الحدث الافتتاحي، "ميستا في العمل"، نقاشًا بين قادة الصناعة حول مستقبل ابتكار الأغذية. ويُعتبر التعاون بين هذه الشركات أمرًا بالغ الأهمية لتطوير ممارسات غذائية مستدامة لإطعام سكان العالم المتزايدين.

- في أبريل 2024، أطلقت شركة ماريل مشروعًا تجريبيًا باستخدام فولاذ أخضر مُنتج بطريقة مستدامة، وتمثّل ذلك بتقديم ميزان مصنوع من هذه المادة المبتكرة إلى الرئيس التنفيذي أرني سيجوردسون. تهدف هذه المبادرة إلى الحد من التأثير البيئي لشركة ماريل، وخاصةً من خلال شراء الفولاذ المقاوم للصدأ، الذي يُسهم تاريخيًا بشكل كبير في انبعاثات الكربون. وبالشراكة مع شركة أوتوكومبو، المعروفة بفولاذها المقاوم للصدأ "سيركل جرين"، استكشفت ماريل خيارات مستدامة رغم تحديات مثل محدودية التوافر وتعقيدات سلسلة التوريد. وقد قدّم المشروع التجريبي رؤى قيّمة، ممهدًا الطريق لجهود الاستدامة المستقبلية في قطاع التصنيع.

التحليل الإقليمي

على أساس البلد، يتم تقسيم السوق إلى الولايات المتحدة وكندا والمكسيك والبرازيل والأرجنتين وبقية أمريكا الجنوبية والصين والهند واليابان وكوريا الجنوبية وأستراليا وإندونيسيا وتايلاند وفيتنام والفلبين وماليزيا وبقية دول آسيا والمحيط الهادئ وألمانيا وفرنسا وإيطاليا والمملكة المتحدة وهولندا وإسبانيا وبلجيكا وسويسرا وبولندا والسويد والدنمارك وبقية أوروبا وجنوب إفريقيا ومصر والإمارات العربية المتحدة والمملكة العربية السعودية وإسرائيل وبقية دول الشرق الأوسط وأفريقيا.

وفقًا لتحليل Data Bridge Market Research:

تعد منطقة آسيا والمحيط الهادئ الأسرع نموًا ومن المتوقع أن تكون المنطقة المهيمنة في سوق معدات تجهيز الأغذية العالمية

من المتوقع أن تهيمن منطقة آسيا والمحيط الهادئ على السوق نظرًا لكثافة سكانها، وتوسعها الحضري، وارتفاع مستويات الدخل. وتشهد المنطقة طلبًا متزايدًا على الأغذية المصنعة، مدفوعًا بتغير أنماط الحياة، والتفضيلات الغذائية، والنمو الاقتصادي القوي، والاستثمارات الكبيرة في صناعة تجهيز الأغذية، مما يعزز السوق.

لمزيد من المعلومات التفصيلية حول تقرير سوق معدات تجهيز الأغذية العالمي، انقر هنا - https://www.databridgemarketresearch.com/reports/global-food-processing-equipment-market