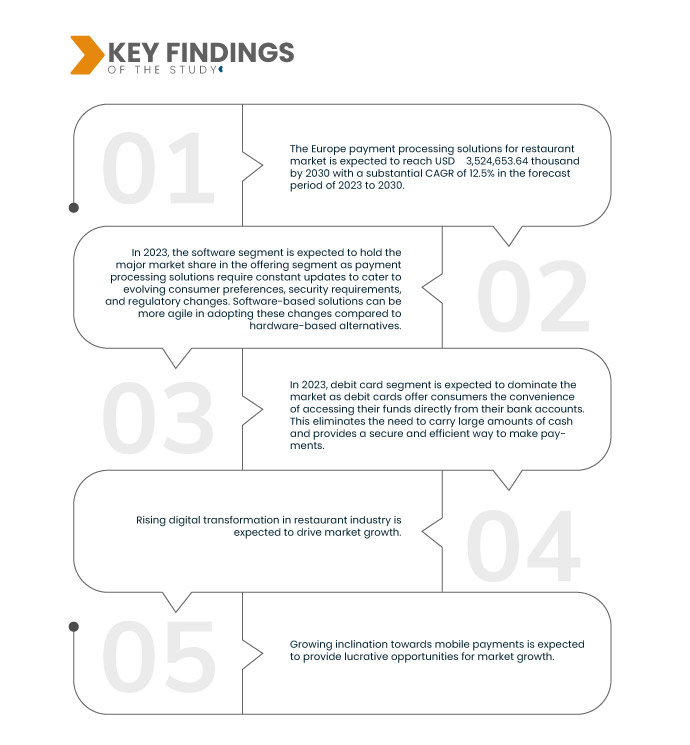

The rapid surge of digital transformation within the European restaurant industry is proving to be a pivotal driver behind the market expansion. The demand for advanced payment processing solutions is gaining momentum as restaurants increasingly embrace technological innovations to enhance their operations and customer experiences. This transformation is characterized by the adoption of digital ordering platforms, mobile app, and online reservation systems, which necessitates seamless and secure payment integration. As a result, the market for payment processing solutions tailored to the restaurant sector is experiencing significant growth, enabling establishments to cater to evolving consumer preferences and expectations in the digital age.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-payment-processing-solutions-for-restaurant-market

Data Bridge Market Research analyzes that the Europe Payment Processing Solutions for Restaurant Market is expected to grow with a CAGR of 12.5% in the forecast period of 2023 to 2030 and is expected to reach USD 3,524,653.64 thousand by 2030. The rising adoption of hybrid restaurant models is further expected to drive market growth.

Key Findings of the Study

Growing Emphasis on Enhancing Security Measures and Preventing Fraud

In the evolving landscape of payment processing within the European restaurant industry, the escalating emphasis on bolstering security measures and thwarting fraudulent activities has emerged as a potent driver propelling market growth. With technological advancements and the proliferation of digital transactions, the restaurant sector finds itself at the crossroads of convenience and vulnerability. The need to provide secure, seamless, and trustworthy payment options has become paramount as customers increasingly opt for digital payment methods.

For instance,

- In June 2023, Oracle Corporation planned to make available new Oracle Cloud Infrastructure (OCI) Compute E5 instances with 4th generation AMD EPYC processors. OCI Compute E5 instances will offer more CPU cores, better performance per core, better memory bandwidth, and higher storage capacity than previous iterations with customizable options. It helps deliver best-in-class conversational AI experiences to customers

- In June 2023, NCR Corporation successfully migrated 24 million NCR DI Digital Banking users to Google Cloud. It increases the speed of new digital banking services and improves resilience, security, and compliance capabilities for banks and credit unions

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Year

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Offering (Hardware, Software, and Services), Payment (Debit Card, Credit Card, E-Wallet, Third Party Bank Transfers, and Others), Deployment Mode (Cloud and On-Premise), Organization Size (Large Enterprise, and Small & Medium Size Enterprise), Fees Type (Flat Fees, Processing Fees, and Situational Fees), Payment Channel (Over-The-Counter, Web, Mobile Payments, Subscriber Payments, and Others), Restaurant Types (Café & Diner, Quick Service, Bar & Pub, Coffee Shop, Food Truck, Fast Casual, and Others)

|

|

Countries Covered

|

U,K Germany, U.K., France, Spain, Italy, Netherlands, Russia, Switzerland, Denmark, Sweden, Poland, Belgium, Turkey, Norway, Finland, and Rest of Europe

|

|

Market Players Covered

|

PayPal (U.S.), Global Payments Inc. (U.S.), Elavon Inc. (U.S.), Ingenico (France), Adyen (Netherlands), NCR Corporation (U.S.), Oracle Corporation (U.S.), BigCommerce Pty. Ltd. (U.S.), PayU (Netherlands), HiPay SAS (France), and QuadraPay (U.K.) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The Europe payment processing solutions for restaurant market is segmented into seven notable segments based on offering, payment, deployment mode, organization size, fees type, payment channel, and restaurant types.

- On the basis of offering, the market is segmented into software, hardware, and services.

In 2023, the software segment is expected to dominate the Europe payment processing solutions for restaurant market

In 2023, the software segment is expected to dominate the market, growing with a market share of 47.26%, due to the rapid evolution of technology, which has led to the development of sophisticated payment processing software solutions that offer advanced features, security measures, and integration capabilities.

- On the basis of payment, the market is segmented into debit card, credit card, e-wallet, third party bank transfers, and others.

In 2023, the debit card segment is expected to dominate the Europe payment processing solutions for restaurant market

In 2023, the debit card segment is expected to dominate the market, growing with a market share of 52.37%, due to its widespread adoption, ease of use, and the preference of consumers for cashless transactions in the region. Also, they offer lower processing fees for businesses compared to credit cards making them a more attractive choice for restaurants.

- On the basis of deployment mode, the market is segmented into on-premises and cloud based. In 2023, the on-premises segment is growing with a market share of 62.08%.

- On the basis of organization size, the market is segmented into large enterprise and small & medium size enterprise. In 2023, the large enterprise segment is expected to dominate with a market share of 67.75%.

- On the basis of fees type, the market is segmented into flat fees, processing fees, and situational fees. In 2023, the flat fees segment is expected expected to dominate with a market share of 58.64%.

- On the basis of payment channel, the market is segmented into over-the-counter, web, mobile payments, subscriber payments, and others. In 2023, the over-the-counter segment is expected to dominate with a market share of 46.12%.

- On the basis of restaurant types, the market is segmented into café & diner, quick service, bar & pub, coffee shop, food truck, fast casual, and others. In 2023, the café & diner segment is expected to dominate with a market share of 30.95%.

Major Players

Data Bridge Market Research recognizes the following companies as the major key players in the Europe payment processing solutions for restaurant market that include PayPal (U.S.), Global Payments Inc. (U.S.), Elavon Inc. (U.S.), Ingenico (France), Adyen (Netherlands), NCR Corporation (U.S.), Oracle Corporation (U.S.), BigCommerce Pty. Ltd. (U.S.), PayU (Netherlands), HiPay SAS (France), and QuadraPay (U.K.) among others.

Market Development

- In July 2023, Adyen launched Tap to Pay on Android, a software-based solution that enables businesses to accept contactless payment on compatible Android devices. This device-agnostic solution streamlines processes, reduces hardware costs, and enhances customer experiences. This allows retailers to accept payments on handheld devices, reducing cash register visits, and allowing delivery personnel to process payments at the door

- In June 2023, NCR Corporation successfully migrated 24 million NCR DI Digital Banking users to Google Cloud. It will increase the speed of new digital banking services and improves resilience, security, and compliance capabilities for banks and credit unions. This will further allow the company to gain the trust of its customers by providing innovative payment solutions

- In August 2023, Azumi Limited, a U.K.-based restaurant management company, selects Oracle MICROS Simphony Cloud Point-Of-Sale (POS) to streamline operations and enhance customer service. The adoption of MICROS Simphony POS enables real-time insights and unified reporting, aiding in cost optimization and adapting to evolving customer demands. Azumi praises the platform's scalability and proven track record in digital transactions, solidifying its decision to choose Oracle as its strategic partner for growth. This will further allow the company to gain the trust of its customers by providing innovative payment solutions

- In July 2022, BigCommerce Pty. Ltd. expanded its European presence to Austria, Denmark, Norway, Sweden, and Peru, offering tools for web design, hosting, SEO, security, and integrations with social media and payment gateways. This will enhance the European footprint of the company

- In November 2022, Oracle launched MICROS Simphony mobile order and pay solution. Restaurants can now enjoy unprecedented freedom in serving customers anywhere with this solution. This cutting-edge technology allows servers to easily handle payments through multiple channels, including contactless and mobile wallets. By switching to guest pay mode, patrons can conveniently use their preferred payment cards by swiping, dipping, or tapping. With Oracle MICROS Simphony, restaurants gain a powerful all-in-one solution to manage menus, payments, and more, all while enjoying a centralized view of revenue and credit card processing costs. Simplify your restaurant operations. This will further allow the company to gain the trust of its restaurant owners by providing innovative payment solutions

- In July 2021, PayU and Visa announced their partnership to enable push payments in Europe. With PayU’s integration with Visa Direct, businesses working with the provider will be able to make efficient payments to their clients, partners, and employees, which is critical during a worldwide push for economic recovery

Regional Analysis

Geographically, the countries covered in the Europe payment processing solutions for restaurant market report are Germany, France, Spain, Italy, U.K., Netherlands, Switzerland, Russia, Belgium, Turkey, and rest of Europe.

As per Data Bridge Market Research analysis:

Germany is expected to dominate the Europe payment processing solutions for restaurant market during the forecast period 2023 - 2030

Germany is expected to dominate the market due to several factors such as it is one of the largest economies in Europe and a key player on the global stage. Its strong economic foundation provides a conducive environment for the growth of various industries, including payment processing.

For more detailed information about the Europe payment processing solutions for restaurant market report, click here – https://www.databridgemarketresearch.com/reports/europe-payment-processing-solutions-for-restaurant-market