The Egypt physical security market refers to the industry dedicated to safeguarding physical assets, properties, and people within the Egyptian context. It encompasses various products and services, such as surveillance systems, access control solutions, alarm systems, and security personnel. Private sector investments have driven innovations in video surveillance, biometrics, and smart access control systems. These advancements aim to protect critical infrastructure, public spaces, and private assets, contributing to the overall safety and security of the nation.

Access Full Report @ https://www.databridgemarketresearch.com/reports/egypt-physical-security-market

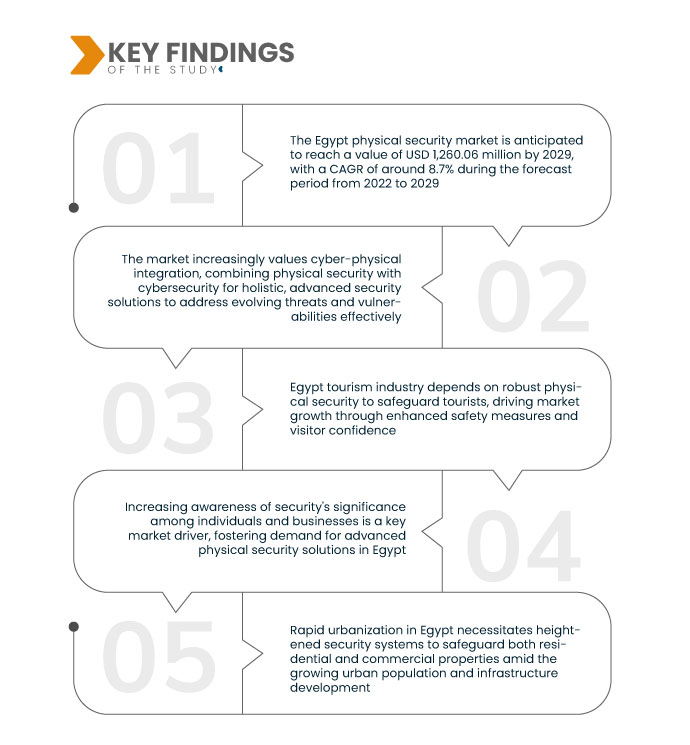

Data Bridge Market Research analyses that the Egypt Physical Security Market is expected to grow at a CAGR of 8.7% during the forecast period of 2022-2029 and is expected to reach USD 1,260.06 million by 2029 from USD 646.47 million in 2021. Ongoing security threats such as terrorism and criminal activities propel the demand for advanced security solutions in Egypt. To mitigate risks and ensure public safety, there's a growing need for sophisticated physical security measures, such as surveillance systems and access control, to protect critical assets and individuals.

Key Findings of the Study

Technological advancements are expected to drive the market's growth rate

Innovations in security technologies are propelling the growth of Egypt's physical security market. Cutting-edge developments, including video analytics, biometrics, and Internet of Things (IoT)-based solutions, are revolutionizing the industry. Video analytics offer intelligent monitoring and threat detection, while biometrics provide advanced access control. IoT-based solutions facilitate real-time data gathering and remote monitoring, enhancing overall security effectiveness. As these technologies continue to evolve, they meet the escalating demand for comprehensive, efficient, and adaptable security systems in Egypt, making them pivotal drivers for market expansion.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Component (Hardware, Services and Software), Authentication (Single-Factor Authentication, Two-Factor Authentication and Three-Factor Authentication), Deployment Model (On-Premise and Cloud), Enterprise Size (Large Sized Enterprises and Small and Medium-Sized Enterprises), End User (Commercial, Government, Industrial and Residential)

|

|

Market Players Covered

|

Thales (France), HID Global Corporation (U.S.), Bosch Sicherheitssysteme GmbH (Germany), Hangzhou Hikvision Digital Technology Co., Ltd. (China), Pelco (A Motorola Solutions Company) (U.S.), Cisco Systems, Inc. (U.S.), Axis Communications AB (Sweden), Johnson Controls (Ireland), Aware, Inc. (U.S.), IDEMIA (France).

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis:

The Egypt physical security market is segmented on component, authentication, deployment model, enterprise size, and end user.

- On the basis of component, the Egypt physical security market is segmented into hardware, services, and software

- On the basis of authentication, the Egypt physical security market has been segmented into single-factor authentication, two-factor authentication, and three-factor authentication

- On the basis of deployment model, the Egypt physical security market has been segmented into on-premise and cloud

- On the basis of enterprise size, the Egypt physical security market has been segmented into large sized enterprises and small and medium-sized enterprises

- On the basis of end user, the Egypt physical security market is segmented into commercial, government, industrial, and residential

Major Players

Data Bridge Market Research recognizes the following companies as the major Egypt physical security market players in Egypt physical security market are Hangzhou Hikvision Digital Technology Co., Ltd. (China), Pelco (A Motorola Solutions Company) (U.S.), Cisco Systems, Inc. (U.S.), Axis Communications AB (Sweden), Johnson Controls (Ireland), Aware, Inc. (U.S.), IDEMIA (France).

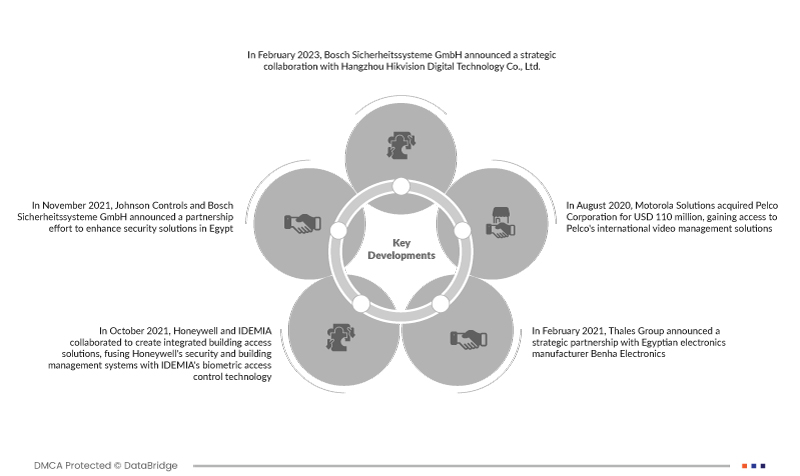

Market Developments

- In February 2023, Bosch Sicherheitssysteme GmbH announced a strategic collaboration with Hangzhou Hikvision Digital Technology Co., Ltd. The partnership focused on integrating Bosch's advanced video surveillance technology with Hikvision's cutting-edge analytics solutions. This collaboration aimed to enhance video analytics capabilities, providing comprehensive security solutions and strengthening their position in the evolving Egypt physical security market

- In November 2021, Johnson Controls and Bosch Sicherheitssysteme GmbH announced a collaborative effort to enhance security solutions in Egypt. Their partnership aimed to integrate Bosch's advanced video surveillance technology with Johnson Controls' access control systems, bolstering comprehensive security offerings for the Egyptian market

- In October 2021, Honeywell and IDEMIA collaborated to create integrated building access solutions, fusing Honeywell's security and building management systems with IDEMIA's biometric access control technology. This strategic partnership expanded product offerings, enabling both companies to venture into the burgeoning building access control market

- In February 2021, Thales Group announced a strategic partnership with Egyptian electronics manufacturer Benha Electronics. This collaboration focused on enhancing Egypt's physical security capabilities by integrating Thales' advanced technologies with Benha's local expertise to develop cutting-edge security solutions for critical infrastructure and public safety applications

- In August 2020, Motorola Solutions acquired Pelco Corporation for USD 110 million, gaining access to Pelco's international video management solutions. This strategic move made Pelco a key subsidiary in the physical security market under Motorola Solutions, bolstering its market presence and enabling the delivery of cutting-edge solutions to consumers

For more detailed information about the Egypt physical security market report, click here – https://www.databridgemarketresearch.com/reports/egypt-physical-security-market