Global Self Checkout Systems Market

Market Size in USD Billion

CAGR :

%

USD

5.03 Billion

USD

14.55 Billion

2024

2032

USD

5.03 Billion

USD

14.55 Billion

2024

2032

| 2025 –2032 | |

| USD 5.03 Billion | |

| USD 14.55 Billion | |

|

|

|

|

Self-Checkout Systems Market Size

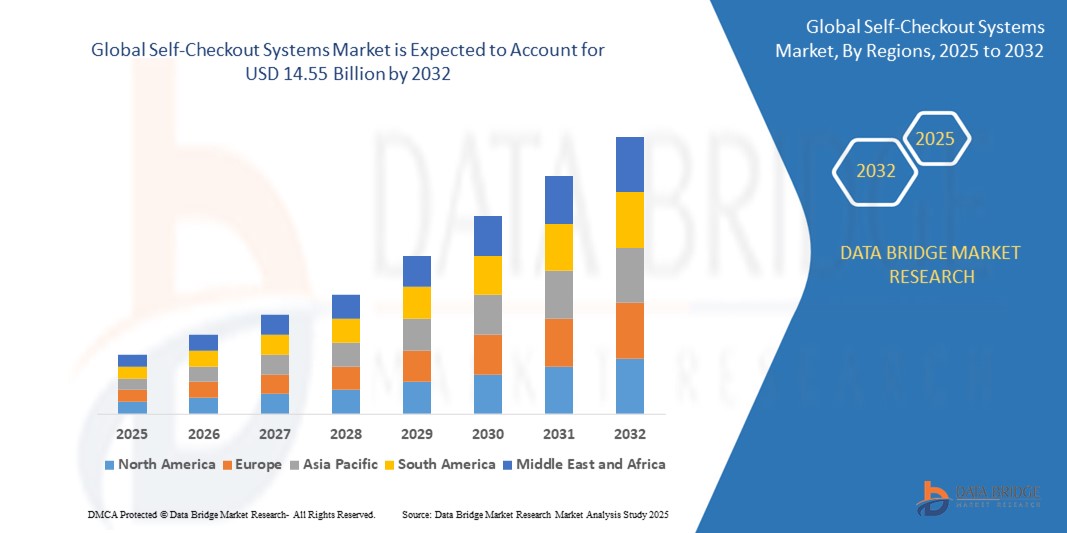

- The global Self-Checkout Systems market was valued at USD 5.03 billion in 2024 and is expected to reach USD 14.55 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 14.20%, primarily driven by rising demand for automation in retail and labour cost reduction

- This growth is driven by factors such as increasing adoption of AI and IoT in retail, rising consumer preference for contactless shopping, and retailer’s focus on cost savings

Self-Checkout Systems Market Analysis

- Self-checkout systems are automated solutions that allow customers to scan, bag, and pay for their purchases without cashier assistance. These systems enhance operational efficiency, reduce checkout time, and improve customer convenience in retail environments such as supermarkets, convenience stores, and hypermarkets

- The demand for self-checkout systems is significantly driven by labor shortages, increasing consumer preference for contactless transactions, and retailers’ focus on cost reduction. The integration of AI, computer vision, and IoT has further boosted adoption, enhancing security and ease of use

- North America region stands out as one of the dominant regions for self-checkout systems, driven by strong retail infrastructure, high consumer acceptance, and continuous technological advancements

- For instance, major retail chains in the U.S. and Canada have expanded self-checkout deployments, with some stores even shifting to entirely cashier-less models, leveraging AI-powered self-service solutions

- Globally, self-checkout systems rank as the second-most crucial automation technology in retail, following point-of-sale (POS) terminals, and play a pivotal role in streamlining retail operations while improving customer shopping experiences

Report Scope and Self-Checkout Systems Market Segmentation

|

Attributes |

Self-Checkout Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Self-Checkout Systems Market Trends

“Integration of AI and Smart Recognition Technologies”

- One prominent trend in the global self-checkout systems market is the increasing integration of AI and smart recognition technologies

- These advanced features enhance the efficiency and security of self-checkout systems by enabling real-time product identification, fraud detection, and seamless user experiences

- For instance, AI-powered computer vision technology can automatically recognize items without the need for barcode scanning, reducing checkout time and improving accuracy in retail transactions

- Smart recognition systems also facilitate personalized shopping experiences by integrating with loyalty programs, mobile payments, and voice assistance, making self-checkout more intuitive and user-friendly

- This trend is transforming retail automation, improving operational efficiency, reducing shrinkage, and driving the widespread adoption of advanced self-checkout solutions across various retail segments

Self-Checkout Systems Market Dynamics

Driver

“Rising Demand for Automation and Contactless Retail”

- The growing need for automation in retail, driven by labor shortages and increasing operational costs, is significantly contributing to the demand for self-checkout systems

- As consumers seek faster and more convenient shopping experiences, retailers are adopting self-checkout technology to reduce wait times, enhance efficiency, and improve customer satisfaction

- The shift toward contactless transactions, accelerated by the COVID-19 pandemic, has further increased the adoption of self-checkout solutions, allowing for minimal physical interaction during the payment process

- The ongoing advancements in artificial intelligence, RFID technology, and biometric authentication continue to improve the security, accuracy, and ease of use of self-checkout systems, making them an essential component of modern retail environments

- As retailers focus on cost-saving measures and operational efficiency, the demand for self-checkout solutions continues to rise, transforming the retail landscape and enhancing the shopping experience for consumers

For instance,

- In June 2023, according to an article published by the National Retail Federation, major U.S. retailers have expanded self-checkout deployments to meet consumer demand for faster and more autonomous shopping experiences. The trend is particularly strong in supermarkets, convenience stores, and big-box retailers

- In October 2022, according to the Retail Industry Leaders Association, nearly 60% of shoppers in North America preferred self-checkout options over traditional cashier-assisted checkouts, highlighting a significant shift toward automated retail solutions

- As a result of the increasing focus on automation, cost efficiency, and enhanced customer experiences, there is a significant rise in the demand for self-checkout systems across various retail sectors

Opportunity

“Enhancing Retail Efficiency with AI-Powered Self-Checkout”

- AI-powered self-checkout systems can improve transaction accuracy, reduce fraud, and enhance the overall shopping experience by enabling faster and more efficient checkout processes

- Advanced AI algorithms can analyze real-time purchasing behavior, detect unscanned items, and prevent theft, ensuring a secure and seamless shopping experience for both retailers and customers

- In addition, AI-powered self-checkout solutions can personalize customer interactions, integrate with loyalty programs, and provide recommendations based on past purchases, further enhancing consumer engagement

For instance,

- In February 2024, according to an article published by the National Retail Federation, AI-based self-checkout systems utilizing computer vision and machine learning reduced scanning errors by up to 40%, significantly improving transaction accuracy and reducing losses due to shrinkage

- In August 2023, according to an article published in the Journal of Retail and Consumer Services, AI-driven self-checkout system in major supermarkets successfully improved checkout speeds by 30% while simultaneously reducing labor costs, demonstrating the potential for widespread AI integration in retail automation

- The integration of AI in self-checkout systems can lead to improved operational efficiency, increased security, and enhanced customer satisfaction. By leveraging AI-driven automation, retailers can optimize their checkout processes, minimize errors, and improve the overall shopping experience

Restraint/Challenge

“High Equipment Costs Hindering Market Penetration”

- The high cost of self-checkout systems poses a significant challenge for the market, particularly affecting the adoption rates among small and mid-sized retailers

- These systems, which integrate advanced hardware and software components such as AI-driven recognition, RFID technology, and biometric authentication, can often range from several thousand to tens of thousands of dollars per unit

- This substantial financial investment can deter smaller retailers with limited budgets from adopting self-checkout technology, leading to a reliance on traditional cashier-based checkouts

For instance,

- In October 2024, according to an article published by the National Retail Federation, many small retail businesses reported that the high upfront cost of self-checkout implementation, coupled with maintenance expenses, remained a key barrier to adoption, slowing market penetration in cost-sensitive regions

- Consequently, such limitations can result in disparities in technology adoption between large retail chains and smaller independent stores, ultimately hindering the overall growth of the self-checkout systems market

Self-Checkout Systems Market Scope

The market is segmented on the basis of offering, transaction type, model type and end-users

|

Segmentation |

Sub-Segmentation |

|

By Offering |

|

|

By Transaction Type |

|

|

By Model Type |

|

|

By End User

|

|

Self-Checkout Systems Market Regional Analysis

“North America is the Dominant Region in the Self-Checkout Systems Market”

- North America dominates the self-checkout systems market, driven by a well-established retail sector, high adoption of automation technologies, and the strong presence of key market players

- The U.S. holds a significant share due to the widespread implementation of self-checkout kiosks in supermarkets, convenience stores, and hypermarkets, along with increasing consumer preference for contactless transactions

- The availability of advanced payment solutions, integration of AI-powered self-checkout technologies, and continuous investments in retail automation further strengthen the market

- In addition, major retailers in North America are increasingly adopting self-checkout systems to reduce labor costs, enhance customer convenience, and improve operational efficiency, further fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the self-checkout systems market, driven by rapid urbanization, expanding retail chains, and increasing digital payment adoption

- Countries such as China, India, and Japan are emerging as key markets due to the rising demand for self-service technologies, growing e-commerce influence, and the shift toward cashless transactions

- Japan, known for its technological advancements, remains a crucial market for self-checkout systems, with retailers integrating AI and biometric authentication to streamline checkout processes and enhance security

- China and India, with their expanding retail sectors and increasing consumer inclination toward convenience shopping, are witnessing significant investments in self-checkout infrastructure. The presence of global retail giants and improving accessibility to automated payment solutions further contribute to market growth

Self-Checkout Systems Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market

The Major Market Leaders Operating in the Market Are:

- NCR Voyix Corporation (U.S.)

- Diebold Nixdorf, Incorporated (U.S.)

- Toshiba Global Commerce Solutions (U.S.)

- Fujitsu (Japan)

- ITAB Group (Sweden)

- Pan-Oston (U.S.)

- ECR Software Corporation (ECRS) (U.S.)

- StrongPoint (Norway)

- Mashgin, Inc. (U.S.)

- Caper (U.S.)

- Gilbarco Veeder-Root Company (U.S.)

- Mad Mobile (U.S.)

- Olea Kiosks Inc. (U.S.)

- Pyramid Computer GmbH (Germany)

- Qingdao CCL Technology Co., Ltd. (China)

- Hisense Systems Europe (Netherlands)

- Erply (U.S.)

- QINGDAO HISTONE INTELLIGENT COMMERCIAL SYSTEM CO. LTD. (China)

- Wintec (U.S.)

- Telepower Communication Co (China)

Latest Developments in Global Self-Checkout Systems Market

- In January 2025, NCR Voyix, a leading provider of self-checkout technology, announced the launch of its next-generation AI-powered self-checkout system. This new system leverages computer vision and machine learning to enhance item recognition, reduce shrinkage, and provide seamless transactions for retailers across various industries

- In January 2024, Diebold Nixdorf launched an AI-based solution, Vynamic Smart Vision, designed to minimize shrinkage at self-checkout stations. This technology aims to enhance security and improve the customer experience by addressing theft and operational losses

- In October 2024, Diebold Nixdorf unveiled its latest self-service checkout solutions at the National Retail Federation (NRF) conference. The new models integrate biometric authentication, RFID technology, and real-time fraud detection to improve security and customer experience in high-traffic retail environments

- In September 2024, Toshiba Global Commerce Solutions introduced the ELERA Self-Checkout System at the Groceryshop Conference. The ELERA platform integrates AI-driven automation to reduce transaction times and offers personalized shopping recommendations, making self-checkout more intuitive for consumers

- In September 2024, StrongPoint launched a new cloud-based self-checkout solution designed for small and mid-sized retailers. The system enhances operational efficiency by integrating mobile payments, digital receipts, and advanced security features to prevent theft and ensure smooth transactions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.