Global Precipitated Barium Sulfate Market

Market Size in USD Million

CAGR :

%

USD

768.63 Million

USD

1,170.69 Million

2025

2033

USD

768.63 Million

USD

1,170.69 Million

2025

2033

| 2026 –2033 | |

| USD 768.63 Million | |

| USD 1,170.69 Million | |

|

|

|

|

What is the Global Precipitated Barium Sulfate Market Size and Growth Rate?

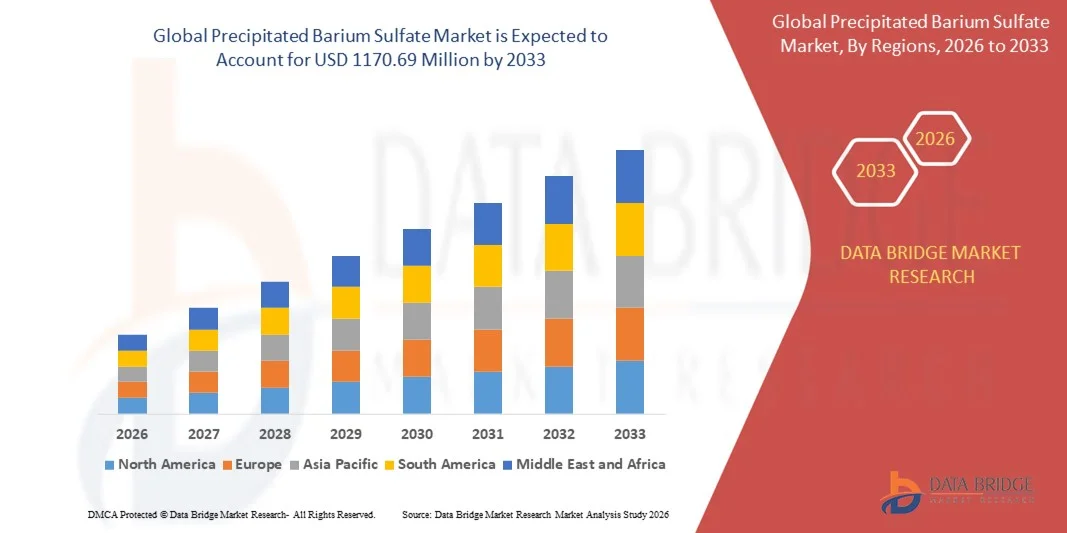

- The global precipitated barium sulfate market size was valued at USD 768.63 million in 2025 and is expected to reach USD 1170.69 million by 2033, at a CAGR of5.40% during the forecast period

- Rise in demand by paints and coatings coupled with growing application for lubricants is the root cause fuelling up the precipitated barium sulfate market growth rate

- Rising industrialization coupled with growth and expansion of various end user verticals such as rubber and plastic industries especially in the developing economies will also directly and positively impact the growth rate of the precipitated barium sulfate market

What are the Major Takeaways of Precipitated Barium Sulfate Market?

- Growth in the buildings and constructions activities coupled with surge in the technological advancements in industrial chemical manufacturing process will further carve the way for the growth of the precipitated barium sulfate market

- However, insufficiency in raw material supply owing to the lockdown and restrictions will pose a major challenge to the growth of the precipitated barium sulfate market

- Asia-Pacific dominated the Precipitated Barium Sulfate market with a 41.8% revenue share in 2025, driven by strong growth in coatings, plastics, rubber, and chemical manufacturing across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 10.87% from 2026 to 2033, supported by rising demand for high-performance coatings, advanced polymer formulations, and specialty chemicals across the U.S. and Canada

- The Ordinary Precipitated Barium Sulfate segment dominated the market with an estimated 44.6% share in 2025, owing to its widespread use as a cost-effective filler and extender in coatings, plastics, and rubber applications

Report Scope and Precipitated Barium Sulfate Market Segmentation

|

Attributes |

Precipitated Barium Sulfate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Precipitated Barium Sulfate Market?

Increasing Shift Toward High-Purity, Micronized, and Application-Specific Precipitated Barium Sulfates

- The precipitated barium sulfate market is witnessing growing demand for high-purity, fine-particle, and controlled morphology grades to meet performance requirements in paints & coatings, plastics, rubber, and pharmaceuticals

- Manufacturers are increasingly focusing on advanced precipitation technologies, particle size control, and surface-treated grades to improve opacity, dispersion, and chemical stability

- Rising demand for lightweight fillers, functional extenders, and environmentally compliant materials is accelerating adoption across automotive coatings, industrial paints, and polymer compounding

- For instance, leading chemical producers are expanding production of ultrafine and pharmaceutical-grade precipitated barium sulfate for medical imaging, specialtySO applications, and high-end coatings

- Growing emphasis on consistent quality, low abrasion, and enhanced brightness is driving innovation in specialty grades

- As end-use industries demand higher performance and regulatory compliance, Precipitated Barium Sulfate will remain a critical functional filler and contrast agent across diverse applications

What are the Key Drivers of Precipitated Barium Sulfate Market?

- Rising demand for high-performance fillers and extenders in paints, coatings, plastics, rubber, and adhesives

- For instance, in 2025, multiple global chemical manufacturers enhanced their precipitated barium sulfate capacities to serve growing coatings, polymer, and pharmaceutical demand

- Expanding use in medical imaging and pharmaceuticals due to high purity, chemical inertness, and radiopacity

- Growth in automotive, construction, and infrastructure activities is boosting demand for durable and corrosion-resistant coatings

- Increasing preference for low-toxicity, non-reactive, and environmentally compliant materials support market expansion

- Supported by industrial growth, healthcare demand, and material innovation, the Precipitated Barium Sulfate market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Precipitated Barium Sulfate Market?

- Volatility in raw material prices, particularly barite, impacts production costs and profit margins

- For instance, during 2024–2025, fluctuations in mining output and logistics costs affected supply consistency for several manufacturers

- Stringent environmental and mining regulations increase compliance and operational costs

- High competition from alternative fillers and extenders such as calcium carbonate and titanium dioxide in cost-sensitive applications

- Limited awareness of performance advantages in emerging markets slows adoption of premium grades

- To overcome these challenges, companies are investing in process optimization, sustainable sourcing, and application-specific product development to strengthen global adoption of Precipitated Barium Sulfate

How is the Precipitated Barium Sulfate Market Segmented?

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the precipitated barium sulfate market is segmented into Ordinary Precipitated Barium Sulfate, Modified Barium Sulfate, Nanometre Precipitated Barium Sulfate, and Others. The Ordinary Precipitated Barium Sulfate segment dominated the market with an estimated 44.6% share in 2025, owing to its widespread use as a cost-effective filler and extender in coatings, plastics, and rubber applications. Its high whiteness, chemical inertness, and good dispersion properties make it suitable for large-volume industrial usage, particularly in construction and general-purpose coatings.

The Nanometre Precipitated Barium Sulfate segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for ultra-fine particle sizes, enhanced surface performance, and improved mechanical properties. Growing adoption in high-end coatings, automotive finishes, and specialty plastics is accelerating demand for nano-grade products.

- By Application

On the basis of application, the market is segmented into the Coating Industry, Rubber Industry, Plastic Industry, and Others. The Coating Industry segment dominated the market with a 41.8% share in 2025, supported by extensive use of precipitated barium sulfate as a functional filler to enhance brightness, corrosion resistance, weatherability, and film durability. Its role in reducing pigment costs while maintaining coating performance drives strong adoption across architectural, industrial, and automotive coatings.

The Plastic Industry segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for lightweight, high-strength, and dimensionally stable plastic products. Increasing usage in automotive components, consumer goods, and electrical applications is strengthening demand for high-purity and surface-modified precipitated barium sulfate grades.

Which Region Holds the Largest Share of the Precipitated Barium Sulfate Market?

- Asia-Pacific dominated the Precipitated Barium Sulfate market with a 41.8% revenue share in 2025, driven by strong growth in coatings, plastics, rubber, and chemical manufacturing across China, Japan, India, South Korea, and Southeast Asia. Rapid industrialization, large-scale infrastructure development, and expanding automotive and construction sectors continue to fuel demand for precipitated barium sulfate as a functional filler and extender. High-volume production capabilities, cost-efficient manufacturing, and strong domestic consumption further strengthen regional leadership

- Leading producers in Asia-Pacific are expanding capacity, improving particle size control, and introducing surface-modified and nano-grade products to meet evolving performance requirements in coatings and polymer applications. Continuous investment in specialty chemicals and materials science supports long-term market expansion

- Strong manufacturing ecosystems, availability of raw materials, and rising downstream demand reinforce Asia-Pacific’s dominant market position

China Precipitated Barium Sulfate Market Insight

China is the largest contributor in Asia-Pacific, supported by its massive chemical manufacturing base, strong coatings and plastics industries, and government-backed industrial development programs. Growing use in automotive coatings, architectural paints, plastics, and rubber products drives sustained demand. Competitive pricing and large export volumes further enhance China’s global market influence.

Japan Precipitated Barium Sulfate Market Insight

Japan shows steady growth due to demand for high-purity and specialty grades used in premium coatings, electronics materials, and advanced plastics. Strong emphasis on quality, consistency, and performance supports adoption in high-value industrial applications.

India Precipitated Barium Sulfate Market Insight

India is emerging as a key growth market, driven by rapid expansion of construction, paints & coatings, plastics, and automotive manufacturing. Increasing domestic production, infrastructure spending, and industrialization are accelerating market penetration.

North America Precipitated Barium Sulfate Market

North America is projected to register the fastest CAGR of 10.87% from 2026 to 2033, supported by rising demand for high-performance coatings, advanced polymer formulations, and specialty chemicals across the U.S. and Canada. Growing focus on lightweight materials, durability, and environmental compliance is boosting adoption of precipitated barium sulfate in coatings, plastics, and rubber applications.

U.S. Precipitated Barium Sulfate Market Insight

The U.S. leads regional growth, driven by strong demand from architectural and industrial coatings, automotive manufacturing, and specialty plastics. Investments in sustainable materials, advanced formulations, and domestic chemical production continue to support market expansion.

Canada Precipitated Barium Sulfate Market Insight

Canada contributes steadily through demand from construction coatings, rubber products, and industrial materials. Increasing infrastructure projects and adoption of high-quality fillers strengthen long-term market growth across the country.

Which are the Top Companies in Precipitated Barium Sulfate Market?

The precipitated barium sulfate industry is primarily led by well-established companies, including:

- Solvay (Belgium)

- Huntsman International LLC (U.S.)

- Cimbar Performance Minerals (U.S.)

- Nippon Chemical Industrial Co., Ltd. (Japan)

- Sakai Chemical Industry Co., Ltd. (Japan)

- Barium & Chemicals, Inc. (U.S.)

- SHENZHOU JIAXIN CHEMICAL CO., LTD. (China)

- Shaanxi Fuhua Chemical Co., Ltd. (China)

- China Nafine Group International Co., Ltd. (China)

- Hebei Xinji Chemical Group Co., Ltd. (China)

- Foshan Onmillion Nano Materials Co., Ltd. (China)

- Suns Chemical (China)

What are the Recent Developments in Global Precipitated Barium Sulfate Market?

- In May 2024, the Environmental Protection Agency revised regulations covering barium, calcium, manganese, and strontium oxides under the Toxic Substances Control Act, highlighting continued regulatory scrutiny on barium-containing compounds, including precipitated barium sulphate, and their industrial usage, which is expected to significantly shape compliance requirements and market dynamics in the coming years

- In July 2023, Vishnu Chemicals announced the successful completion of trials for its precipitated barium sulphate and sodium sulphide products and commenced commercial production at its Srikalahasti, Andhra Pradesh facility with an installed capacity of 30,000 TPA, strengthening its presence in pure white powder coating fillers and supporting growing demand for high-gloss industrial coating applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Precipitated Barium Sulfate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Precipitated Barium Sulfate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Precipitated Barium Sulfate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.